- Home

- »

- Medical Devices

- »

-

Cell And Gene Therapy Clinical Trials Market Report, 2033GVR Report cover

![Cell And Gene Therapy Clinical Trials Market Size, Share & Trends Report]()

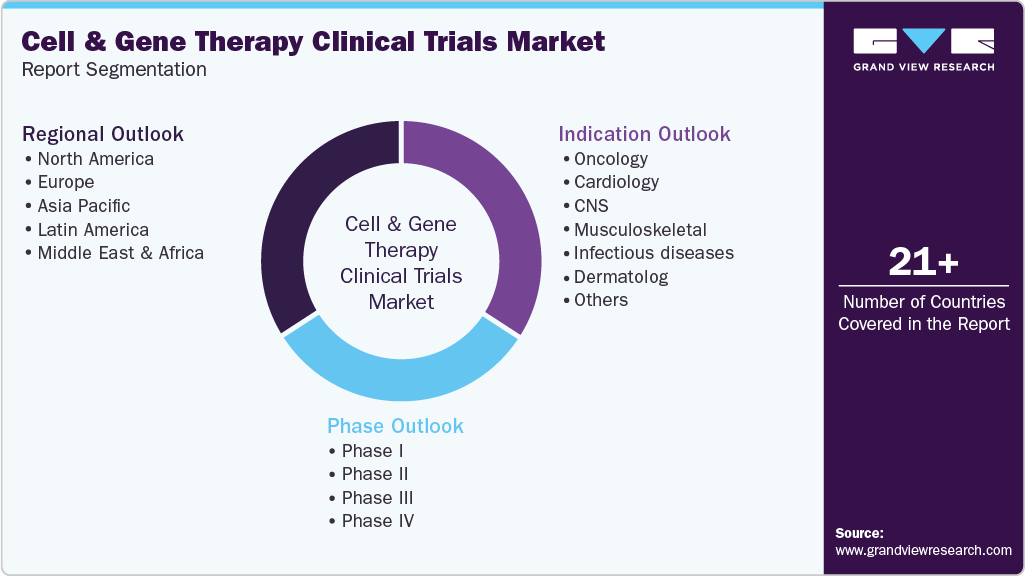

Cell And Gene Therapy Clinical Trials Market (2025 - 2033) Size, Share & Trends Analysis Report By Phase (Phase I, Phase II, Phase III), By Indication (Oncology, Cardiology, CNS, Musculoskeletal, Infectious Diseases), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-409-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cell And Gene Therapy Clinical Trials Market Summary

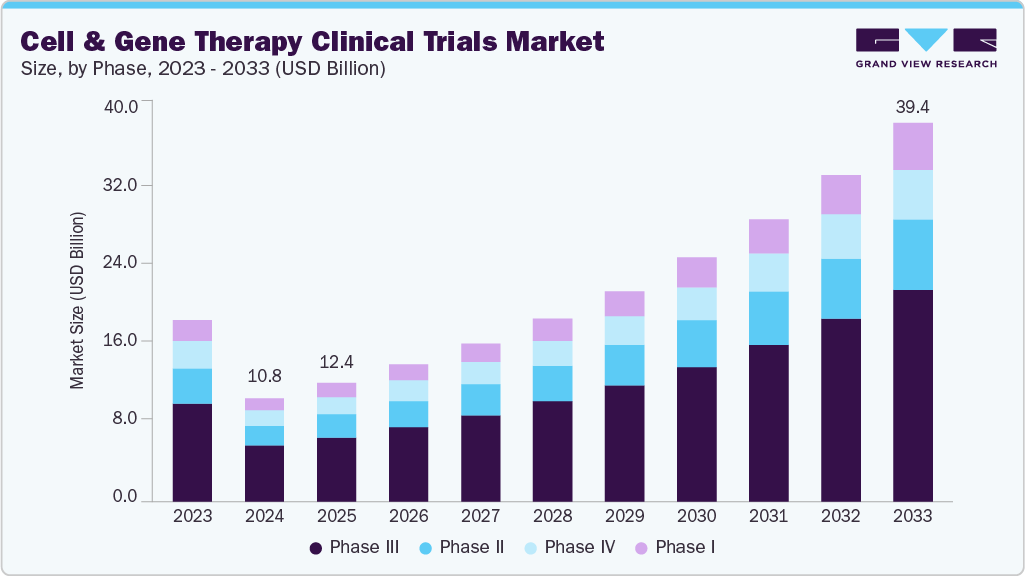

The global cell and gene therapy clinical trials market size was estimated at USD 10.75 billion in 2024 and is projected to reach USD 39.41 billion by 2033, growing at a CAGR of 15.58% from 2025 to 2033. The market is driven by an increase in R&D funding, rising patient demand for innovative therapies, growing interest in cell and gene therapies for cancer treatment, and a favorable regulatory environment.

Key Market Trends & Insights

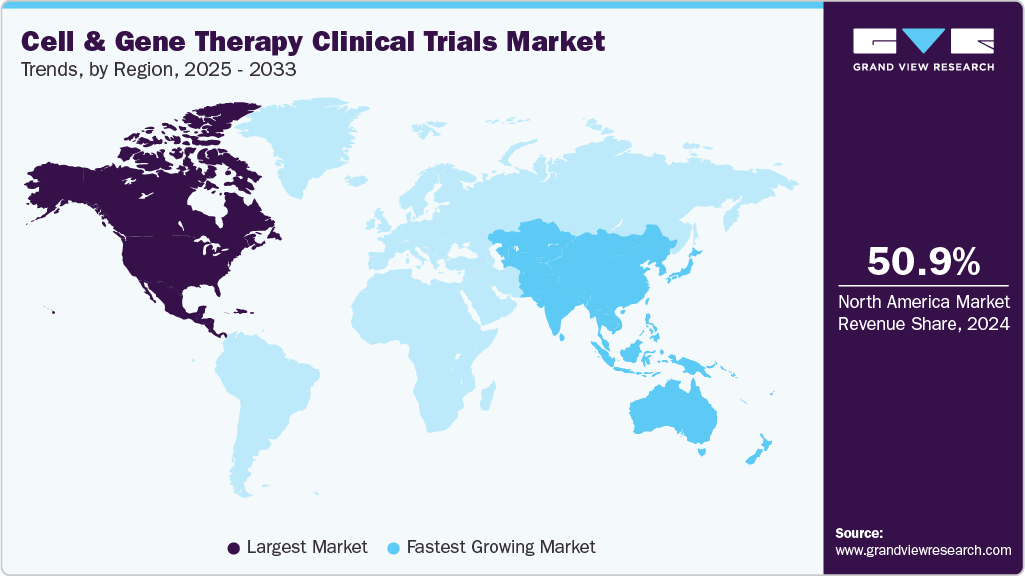

- North America cell and gene therapy clinical trials market held the largest share of 50.90% of the global market in 2024.

- The cell and gene therapy clinical trials industry in the U.S. is expected to grow significantly over the forecast period.

- By phase, the Phase III segment led the market with the largest revenue share of 54.3% in 2024.

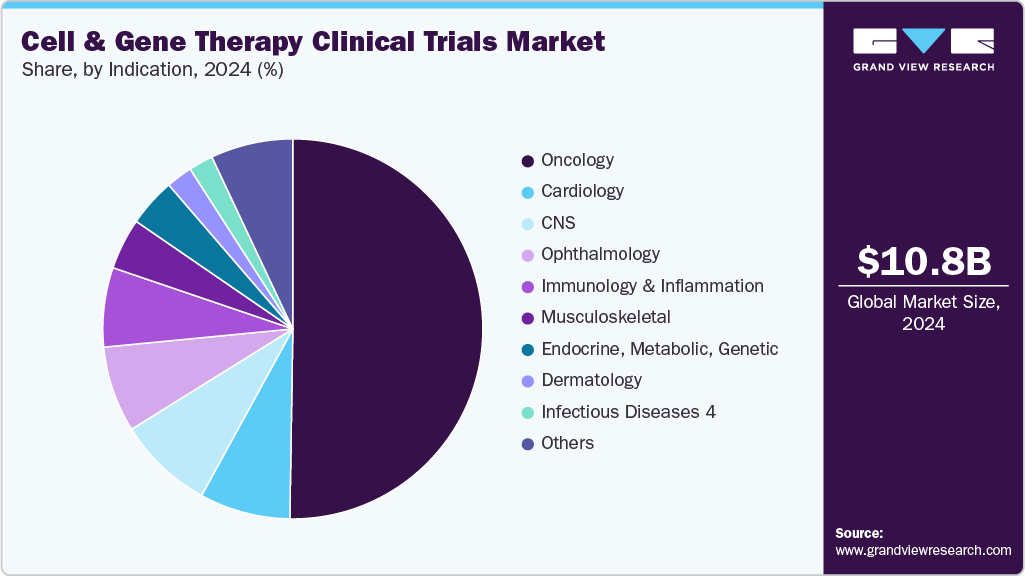

- By indication, the oncology segment led the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10.75 Billion

- 2033 Projected Market Size: USD 39.41 Billion

- CAGR (2025-2033): 15.58%

- North America: Largest market in 2024

- Asia-Pacific: Fastest growing market

The market is primarily driven by the accelerating pace of innovation in genetic medicine and increasing regulatory support for advanced therapies. Advancements in genome editing technologies such as CRISPR, as well as breakthroughs in viral and non-viral vector delivery systems, have enabled researchers to develop highly targeted therapeutic candidates for rare genetic disorders, cancers, and autoimmune diseases. Regulatory bodies, including the FDA and EMA, have introduced accelerated approval pathways, orphan drug designations, and RMAT (Regenerative Medicine Advanced Therapy) designations to support CGT development. These incentives have significantly reduced the time and cost burden for companies developing novel CGT products, encouraging the launch of early-phase trials.

Furthermore, the influx of funding and strategic partnerships between biotech firms, large pharmaceutical companies, and academic research centers focused on CGT development is driving the market growth. This financial momentum, especially from venture capital and public-private collaborations, is enabling clinical trial sponsors to scale up from pilot studies to multi-site international trials. Companies like Bluebird Bio, CRISPR Therapeutics, and Beam Therapeutics, numerous Phase I/II trials are being initiated in areas such as sickle cell disease, CAR-T therapies, and gene editing-based oncology pipelines.Moreover, the need to validate safety, dosing, and long-term efficacy of these therapies has increased demand for specialized CROs and trial infrastructure tailored to CGT studies.

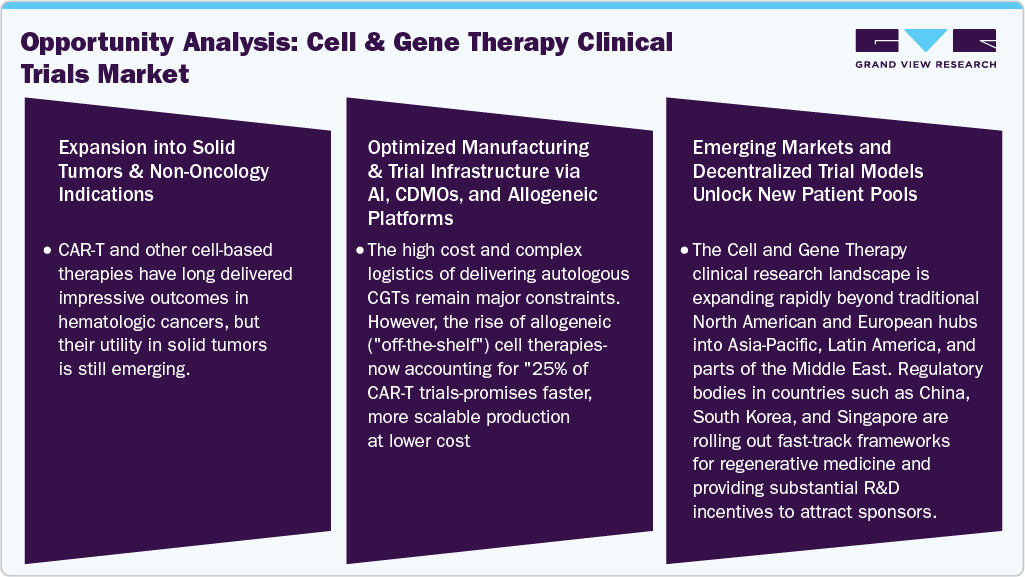

Opportunity Analysis

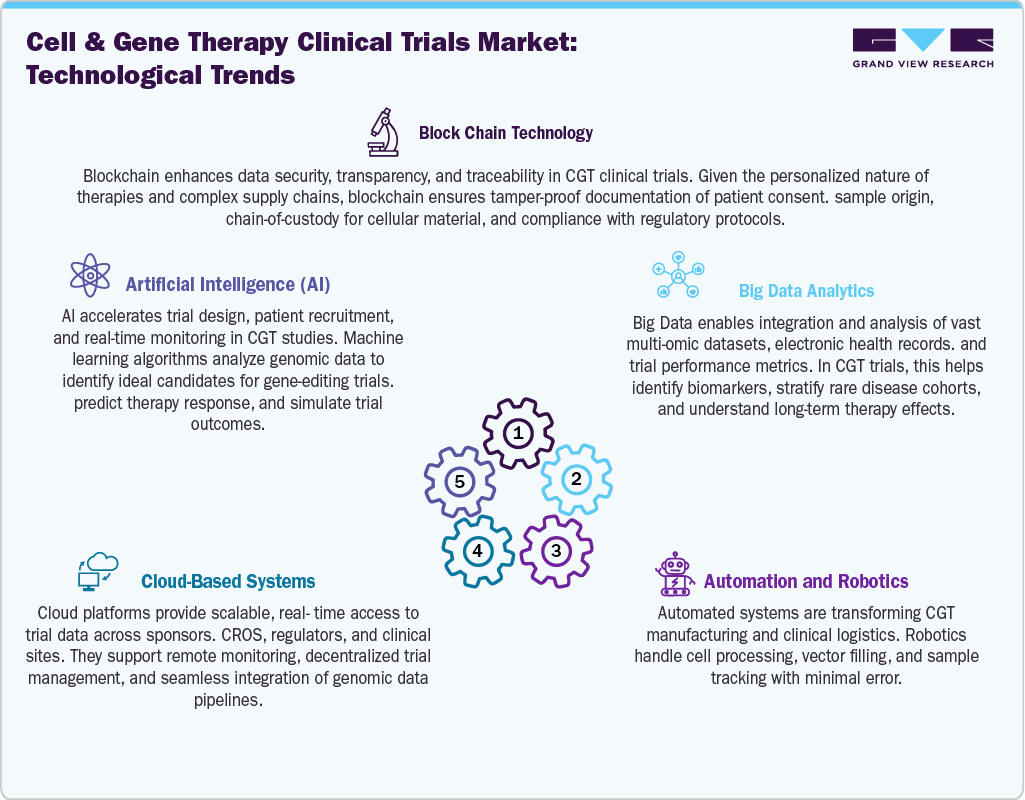

Technological Advancements

The refinement of gene editing technologies-particularly CRISPR-Cas9, base editors, and prime editing-is dramatically accelerating the CGT trial landscape. These tools offer precise gene correction with minimized off-target effects, enabling safer and more durable therapeutic responses. Companies like Beam Therapeutics and Editas Medicine are running clinical trials using next-gen base editors to treat conditions like sickle cell disease and Leber congenital amaurosis. In parallel, innovations in viral vector engineering (AAVs, lentiviruses) and non-viral delivery systems (lipid nanoparticles, electroporation) have enhanced transduction efficiency, payload capacity, and tissue specificity, expanding the types of diseases that CGTs can safely and effectively target.

Pricing Analysis

The pricing model landscape of the Cell and Gene Therapy Clinical Trials Market is shaped by the complexity of personalized treatment development, high per-patient costs, and growing pressure for value-based justification. Unlike traditional trials, CGT studies involve intricate processes such as autologous cell harvesting, genome manipulation, and cold chain logistics, which significantly increase operational expenditure. Consequently, pricing strategies are evolving from conventional fee-for-service models to more integrated, milestone-driven, or risk-sharing approaches that align with the therapeutic value and trial outcomes. Many service providers and CROs are now adopting modular pricing, offering scalable solutions based on trial phase, platform technology (e.g., AAV vs. CAR-T), and sponsor size.

Phase Insights

On the basis of phase, the market is classified into phase I, phase II, phase III, and phase IV. The Phase III segment accounted for the largest revenue share of 54.35% in 2024. The growth of the segment is due to the increasing number of late-stage pipeline candidates transitioning from early-phase success. As CGT therapies advance through regulatory pathways, Phase III trials serve as the critical stage for evaluating efficacy, long-term safety, and comparative effectiveness at scale.

The Phase I segment is anticipated to grow at the fastest CAGR during the forecast period. The segment growth is driven due to the rapid expansion of early-stage investigational programs in cell and gene therapies. As advancements in gene editing tools, viral vector technologies, and synthetic biology platforms accelerate, a growing number of biotech startups and academic institutions are initiating first-in-human studies to validate novel therapeutic mechanisms.

Indication Insights

On the basis of indication, the market is segregated into oncology, cardiology, CNS, musculoskeletal, infectious diseases, dermatology, endocrine, metabolic, genetic, immunology & inflammation, ophthalmology, hematology, gastroenterology, and others. The oncology segment held the largest market share in 2024 due to the high volume of pipeline candidates targeting hematologic malignancies and solid tumors. Cancer remains one of the most studied therapeutic areas in CGT, with a significant concentration of CAR-T cell therapies, tumor-infiltrating lymphocytes (TILs), and gene-edited immune cell products progressing through clinical development. The strong efficacy signals observed in refractory cancers, such as acute lymphoblastic leukemia, multiple myeloma, and non-Hodgkin lymphoma, have encouraged sponsors to initiate larger and more diversified oncology trials.

The cardiology segment is anticipated to grow at a lucrative CAGR over the forecast period. The growth of the segment is due to the expanding application of regenerative cell and gene therapies in treating cardiovascular disorders that are otherwise resistant to conventional interventions. Conditions such as heart failure, myocardial infarction, and inherited cardiomyopathies are increasingly being targeted with gene-editing tools, stem cell therapies, and gene delivery vectors aimed at restoring cardiac function and repairing damaged tissue.

Regional Insights

North America cell and gene therapy clinical trials market accounted for the largest revenue share of 50.90% in the cell and gene therapy clinical trials market in 2024. This is attributed to the region’s advanced clinical research infrastructure, high concentration of biotech and pharmaceutical companies, and strong regulatory support for innovative therapies. The United States, in particular, leads in the number of CGT clinical trials, driven by expedited approval pathways such as the FDA’s RMAT designation and Orphan Drug status, which incentivize early and mid-stage development.

U.S. Cell And Gene Therapy Clinical Trials Market Trends

The cell and gene therapy clinical trials market in the U.S. held the largest share in 2024. The country’s growth is due to its mature biopharmaceutical ecosystem, cutting-edge research capabilities, and proactive regulatory environment. The U.S. Food and Drug Administration (FDA) has played a pivotal role in accelerating CGT development through initiatives like the Regenerative Medicine Advanced Therapy (RMAT) designation, Fast Track, and Breakthrough Therapy designations, which streamline the clinical approval process for innovative treatments.

Europe Cell And Gene Therapy Clinical Trials Market Trends

The cell and gene therapy clinical trials market in Europe is expected to grow significantly due to the region’s increasing regulatory harmonization, supportive funding mechanisms, and growing infrastructure for advanced therapy research. The European Medicines Agency (EMA) has established the Committee for Advanced Therapies (CAT) to streamline the scientific evaluation of cell and gene therapies, while programs like PRIME (PRIority MEdicines) offer accelerated development support for promising candidates.

Germanycell and gene therapy clinical trials market held a significant share in 2024, owing to the country’s strong biomedical research ecosystem, favorable regulatory environment, and advanced clinical infrastructure. Germany hosts a high concentration of certified clinical trial centers, university hospitals, and GMP-compliant manufacturing facilities that are well-equipped to conduct complex CGT trials. The Paul-Ehrlich-Institut, Germany’s regulatory body for advanced therapies, has established clear guidelines and a supportive framework for the approval and oversight of ATMPs (Advanced Therapy Medicinal Products), fostering innovation and reducing administrative delays.

The cell and gene therapy clinical trials market in the UK held the largest share in 2024. The growth of the market is due to its pioneering regulatory framework, strong public investment, and world-class clinical research infrastructure. The Medicines and Healthcare products Regulatory Agency (MHRA) has introduced progressive approval pathways and early scientific advice programs specifically designed for Advanced Therapy Medicinal Products (ATMPs), enabling faster trial initiation.

Asia Pacific Cell And Gene Therapy Clinical Trials Market Trends

The cell and gene therapy clinical trials market in Asia Pacific is expected to be the fastest-growing industry due to the region’s rapidly evolving regulatory frameworks, increasing healthcare investments, and expanding biotech ecosystems. Countries like China, Japan, South Korea, and Singapore are actively streamlining approval processes and offering incentives such as priority review and expedited clinical trial authorizations specifically for advanced therapies.

Chinacell and gene therapy clinical trials market held the largest share in 2024. The growth is due to the country’s strong government support, evolving regulatory frameworks, and growing domestic biotech innovation. Regulatory agencies have introduced accelerated approval pathways and clearer guidelines that encourage early-phase trial initiation, reducing traditional barriers for advanced therapies. China’s large and diverse patient population offers significant advantages for recruiting participants, especially in rare genetic and oncology indications.

The cell and gene therapy clinical trials market in Japan is expected to grow over the forecast period. The country’s growth is due to the combination of supportive regulatory frameworks, robust research infrastructure, and increasing demand for innovative treatments. The Pharmaceuticals and Medical Devices Agency (PMDA) has implemented expedited approval processes, such as the Sakigake designation system, to accelerate the development and commercialization of advanced therapies. This regulatory support, coupled with substantial government funding and strategic partnerships between academic institutions and biotech companies, has fostered a conducive environment for clinical trials.

Indiacell and gene therapy clinical trials market is anticipated to grow at a lucrative CAGR over the forecast period. India's large and diverse patient population, cost-effective research capabilities, and supportive regulatory environment are driving the country’s growth. The Central Drugs Standard Control Organization (CDSCO) has implemented structured regulatory pathways and accelerated approval processes for orphan diseases and rare genetic disorders, facilitating the initiation and progression of clinical trials.

Key Cell And Gene Therapy Clinical Trials Company Insights

Key players operating in the cell and gene therapy clinical trials market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Cell And Gene Therapy Clinical Trials Companies:

The following are the leading companies in the cell and gene therapy clinical trials market. These companies collectively hold the largest market share and dictate industry trends.

- IQVIA

- ICON Plc

- LabCorp

- Charles River Laboratories

- PAREXEL International Corp.

- Syneos Health

- Medpace

- Thermo Fisher Scientific, Inc.

- Novotech

- Veristat, LLC

Recent Developments

-

In April 2024, Labcorp announced the expansion of its Precision Oncology portfolio to support biopharma, pharmaceutical, and clinical research in advancing drug development programs.

-

In February 2024, IQVIA entered into a partnership agreement with California Institute for Regenerative Medicine (CIRM), WuXi AppTec, City of Hope, and Charles River Laboratories to enhance cell and gene therapy clinical trial capabilities, accelerating patient recruitment and data analytics. This collaboration aims to streamline trial execution and improve therapy development timelines.

Cell And Gene Therapy Clinical Trials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.37 billion

Revenue forecast in 2033

USD 39.41 billion

Growth rate

CAGR of 15.58% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Phase, indication, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; Kuwait; UAE

Key companies profiled

IQVIA; ICON Plc; LabCorp; Charles River Laboratories; PAREXEL International Corp.; Syneos Health; Medpace; Thermo Fisher Scientific, Inc.; Novotech; Veristat, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cell And Gene Therapy Clinical Trials Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global cell and gene therapy clinical trials market report based on phase, indication, and region:

-

Phase Outlook (Revenue, USD Million, 2021 - 2033)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Oncology

-

Cardiology

-

CNS

-

Musculoskeletal

-

Infectious diseases

-

Dermatology

-

Endocrine, metabolic, genetic

-

Immunology & inflammation

-

Ophthalmology

-

Hematology

-

Gastroenterology

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cell and gene therapy clinical trials market size was estimated at USD 10.75 billion in 2024 and is expected to reach USD 12.37 billion in 2025.

b. The global cell and gene therapy clinical trials market is expected to grow at a compound annual growth rate of 15.58 % from 2025 to 2033 to reach USD 39.41 billion by 2033.

b. The Phase III segment led the global cell and gene therapy clinical trials market and accounted for more than 54.35% in 2023.The growth of the segment is due to the increasing number of late-stage pipeline candidates transitioning from early-phase success.

b. The oncology segment dominated the global cell & gene therapy clinical trials market with a share of 47.86% in 2024. The growth of the segment is due to the high volume of pipeline candidates targeting hematologic malignancies and solid tumors.

b. North America dominated the cell & gene therapy clinical trials market with a share of 50.9% in 2024. The U.S. FDA has established a collaborative regulatory procedure for CGTs with early & steady engagement with the sponsor, along with special regulatory designations useful for many CGTs.

b. Some key players operating in the cell and gene therapy clinical trials market include IQVIA; ICON Plc; Laboratory Corporation of America Holdings; Charles River Laboratories International, Inc.; PAREXEL International Corporation; Syneos Health; Medpace, Holdings, Inc.; PPD Inc.; Novotech; Veristat, LLC. Market players are undertaking numerous strategic initiatives such as acquisition, collaborations, & partnership to gain market share.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.