- Home

- »

- Renewable Chemicals

- »

-

Cellulose Esters And Ethers Market Size Report, 2030GVR Report cover

![Cellulose Esters And Ethers Market Size, Share & Trends Report]()

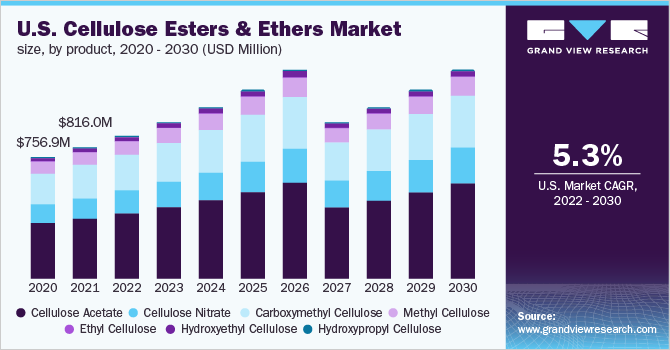

Cellulose Esters And Ethers Market (2022 - 2030) Size, Share & Trends Analysis Report By Product (Cellulose Acetate, Cellulose Nitrate, Ethyl Cellulose), By Process (Kraft, Sulfite), By Region (North America, Europe, APAC, CSA, MEA), And Segment Forecasts

- Report ID: GVR-3-68038-216-7

- Number of Report Pages: 211

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global cellulose esters and ethers market size was valued at USD 5.7 billion in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 5.2% from 2022 to 2030. The demand for the product is anticipated to be driven by growing demand from food and beverage, photographic films, cigarette filters, and the textile and apparel industry, especially in emerging countries of the Asia Pacific region. Cellulose acetate phthalate is an enteric polymer broadly used for the coating of pharmaceutical drugs, whose substitute is chitosan, which is cheap as well as available in abundance. Chitosan acetate phthalate exhibits several properties similar to that of cellulose acetate phthalate and is anticipated to hamper its market growth.

Carboxymethyl Cellulose (CMC) is extensively utilized by the food and beverage industry. It is employed as a thickener, emulsifier, and stabilizer, which enables food to maintain its uniform flavor, concentration, and texture. Mounting consumption of emulsifiers in frozen desserts, margarine, chocolates, peanut butter, baked products, and salad dressings has propelled the product demand. The packaged food market has witnessed considerable growth in the past few years on account of changing consumer perceptions toward their eating habits. This change is primarily driven by evolving consumer lifestyle that includes long working hours and quick access to packed foods available in a wide range of cuisines.

Cellulose is an organic polymer that is derived from wood and can be chemically modified to yield its derivatives such as ethers and esters. Raw materials used mostly include wood, caustic soda, and cotton. The costs of these raw materials are volatile in nature and are prone to increase extensively owing to various factors including changes in climatic conditions, lack of availability, and demand and supply considerations.

Generally, cellulose esters and ethers are used in various industries including paper and pulp, oil and gas, pharmaceuticals, food and beverage, construction, detergents, personal care, mining, and textiles. Finished products such as nitrocellulose, cellulose acetate, carboxymethyl, and methylcellulose are supplied to the aforementioned end-use industries through several distribution channels including distributors, wholesalers, and vendors.

Product Insights

The cellulose acetate product segment dominated the market for cellulose esters and ethers and accounted for the largest revenue share of over 45.0% in 2021. This is attributed to its wide usage in textile as well as in cigarette production. Factors like the ever-growing textile industry, rising number of cigarette consumers, and higher preference for low-tar cigarettes have a positive impact on the demand. Acetate is a non-flammable plastic produced from natural cellulose with a wide range of applications. In the primary form, it cannot be processed as a thermoplastic and can only be processed by dissolving in a solvent.

It has several physical properties including toughness, transparency, high dielectric constant, and high flexibility. Cellulose nitrate is extremely inflammable. It is widely used in military and civilian industries for manufacturing lacquers and propellants, and explosives. It is a fluffy white solid and is majorly used in paint and wood industries when produced from cotton.

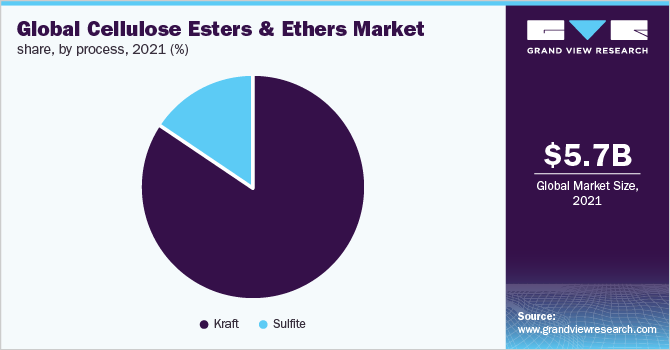

Process Insights

The kraft process segment dominated the market for cellulose esters and ethers and accounted for the highest revenue share of more than 84.0% in 2021. This high share is attributed to its characteristics such as reduction in cooking time and an efficient waste recovery system. Also, the growth in this process can be attributed to the increasing demand for cellulose.

The Kraft process is the most used process for mining cellulose, which is further employed in paper and pulp production. The purified product is mainly manufactured from the bleached wood pulp obtained during the kraft process, which removes most of the related hemicellulose, pectin, lignin, and other composites present in the pulp. This process is a method for the conversion of wood into wood pulp containing pure cellulose fibers, the key component of paper.

The sulfite process is a chemical pulping process for transforming wood chips into paper pulp. The main purpose of pulping is to reduce wood to cellulose fiber. The sulfite process is not as widely utilized as the kraft process. The sulfite process leads to the production of unadulterated cellulose fibers by using several salts of sulfurous acid to extract the lignin in huge pressure vessels. The combination of calcium bisulfite and sulfurous acid dissolves the lignin in wood, thereby releasing cellulose fibers.

Regional Insights

Asia Pacific dominated the market for cellulose esters and ethers and accounted for the highest revenue share of more than 56.0% in 2021. This is attributed to favorable government rules and regulations for promoting investment in the region’s manufacturing and production industry. These regulations will help in increasing the product demand for adhesives, paints, and coating applications.

Cosmetics, food and beverage, oil and gas, and pharmaceutical industries are the major market drivers of the product market in Europe. The increasing use of cosmetics and personal care products in major countries such as Germany, Italy, the U.K., and France is expected to have a positive impact on the growth of the market for cellulose esters and ethers. Also, the increasing use of synthetic and natural personal care products is also anticipated to boost the growth in the region.

In North America, the market for cellulose esters and ethers is projected to witness high consumption of coating binders such as cellulose for coated board and paper applications. Activities related to the recycling and recovery of paper in the U.S. are expected to boost the growth of the paper industry in the near future, followed by the oil and gas industry, which is also one of the emerging industries in the region. Technological advancements in hydraulic fracturing coupled with enhanced oil recovery have propelled the production of tight oil and shale gas in the region.

Key Companies & Market Share Insights

The competition in the market for cellulose esters and ethers is high. Manufacturing companies require significant capital investment owing to the presence of stringent regulations regarding the testing and labeling of a product, which discourages new players from entering the market for cellulose esters and ethers. Companies are heavily investing in R&D activities to meet regulatory guidelines, norms, and specifications. The product manufacturers include Georgia-Pacific, The Dow Chemical Company, Akzo Nobel, Eastman Chemical Corporation, Celanese Corporation, Lamberti S.p.A., Rayonier Advanced Materials, and Ashland Inc.

The manufacturers apply competitive pricing strategies to get a competitive advantage over others. In August 2018, Celanese announced an increase in the price of acetate flake, which is employed in various end-use applications such as textile filament, plastics, films, non-wovens, coatings, and medical. The price rise affected all long-term contracts of the supply of these products by Celanese Corporation. In January 2017, Ashland increased the prices of hydroxyethyl cellulose across the globe. This pricing strategy helped the company focus on minimizing the cost of raw materials, labor, and packaging. Some of the prominent players in the cellulose esters and ethers market include:

-

Lamberti S.p.A.

-

J.M. Huber Corporation

-

The Dow Chemical Company

-

Daicel Corporation

-

Ashland

-

AkzoNobel N.V.

-

Rhodia Acetow International GmbH

-

Eastman Chemical Company

-

Celanese Corporation

-

Rayonier Advanced Materials

-

Georgia-Pacific

-

Borregaard

Global Cellulose Esters And Ethers Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 5.9 billion

Revenue forecast in 2030

USD 9.0 billion

Growth Rate

CAGR of 5.2% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2022 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, process, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; Brazil; Saudi Arabia

Key companies profiled

Borregaard; Georgia-Pacific; Rayonier Advanced Materials; Celanese Corporation; Eastman Chemical Company; Rhodia Acetow International GmbH; AkzoNobel N.V.; Ashland; Daicel Corporation; The Dow Chemical Company; J.M. Huber Corporation; Lamberti S.p.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global cellulose esters and ethers market report on the basis of product, process, and region:

-

Product Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Cellulose Acetate

-

Cellulose Nitrate

-

Carboxymethyl Cellulose

-

Methyl Cellulose

-

Ethyl Cellulose

-

Hydroxyethyl Cellulose

-

Hydroxypropyl Cellulose

-

-

Process Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Kraft

-

Sulfite

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global cellulose esters and ethers market size was estimated at USD 5.7 billion in 2021and is expected to reach USD 5.9 billion in 2022

b. The global cellulose esters and ethers market is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2022 to 2030 and reach USD 9.0 billion by 2030

b. The Asia Pacific dominated the market with the highest revenue share of more than 56% in 2021. This is attributed to favorable government rules and regulations for promoting investment in the region’s manufacturing and production industry. These regulations will help in increasing the product demand for adhesives, paints, and coating applications.

b. Some prominent players in the global cellulose esters and ethers market include Borregaard, Georgia-Pacific, Rayonier Advanced Materials, Celanese Corporation, Eastman Chemical Company, Rhodia Acetow International GmbH, AkzoNobel N.V., Ashland, Daicel Corporation, The Dow Chemical Company, J.M. Huber Corporation, Lamberti S.p.A.

b. The cellulose esters and ethers market is driven by growing demand from food & beverage, photographic films, cigarette filters, and the textile & apparel industry, especially in emerging countries of the Asia Pacific region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.