- Home

- »

- Advanced Interior Materials

- »

-

Central And South America Geosynthetics Market Report, 2030GVR Report cover

![Central And South America Geosynthetics Market Size, Share & Trends Report]()

Central And South America Geosynthetics Market Size, Share & Trends Analysis Report By Application (Road & Pavements, Rail Roads, Drainage Systems, Soil Reinforcement & Erosion), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-056-8

- Number of Report Pages: 198

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Market Size & Trends

The Central and South America geosynthetics market size was estimated at USD 1.16 billion in 2024 and is projected to grow at a CAGR of 6.4% from 2025 to 2030. This growth is attributed to the growing applications of geosynthetics in infrastructural applications such as the construction of railroads and roadways. Geosynthetics are used for base reinforcement, separation, and stabilization of roads and pavements. These products also find applications in subsurface drainage systems for dewatering, road base, and structure drainage. Geotextiles strengthen industrial units, car parks, and new roadways. Incorporating geosynthetics entails sustainable development, a small volume of earthwork, a low carbon footprint, and an increased rate of construction.

Increasing infrastructural activities in Central & South America are likely to boost the use of geomembranes, geogrids, and geotextiles. Water and waste management are expected to remain the promising application segments for geomembranes in the region owing to the high prevalence of the offshore oil & gas industry in Brazil, Venezuela, and Argentina. In addition, the robust mining base in Chile, Brazil, Peru, and Colombia is likely to increase the need for wastewater treatment, thereby fueling the demand for geomembranes over the forecast period.

Brazil's rising developments in waste management, mining, transportation, and water resources will likely fuel the demand for geosynthetics over the forecast period. The growth in the Brazilian construction industry is likely to open new avenues for market growth in the next few years. A rise in hydraulic fracturing activities and a lack of proper waste management methods in the country are likely to promote the demand for geosynthetics, especially geotextiles and geomembranes, over the forecast period.

Application Insights

The soil reinforcement & erosion segment led the market with a revenue share of 27.0% in 2024. The segment is further forecasted to grow at a CAGR of 6.2% till 2030. Geogrids and geotextiles are used for soil reinforcement as they prevent the intermixing of the soil and piping. In addition, they help preserve the strength of the construction aggregate. Soil erosion is a significant problem as it leads to loss of land, slope instability, and reservoir capacity due to silting. Geocells and geogrids play an essential role in shore protection and vegetative growth. The growing construction industry in Argentina and Brazil will likely increase the demand for geosynthetics in soil reinforcement soon.

The railroads application segment is forecasted to grow at the fastest CAGR of 7.4% over the forecast period. Railroads use geotextiles as they act as separators & filters and help transmit water through lateral drainage. Geosynthetics are incorporated to reinforce tracks for stress reduction, which ensures long-term performance. Geosynthetic solutions are required for various applications such as track-bed separation, slope erosion control, structural drainage, embankment stabilization, tunnel drainage, and access road reinforcement in rail construction projects.

Country Insights

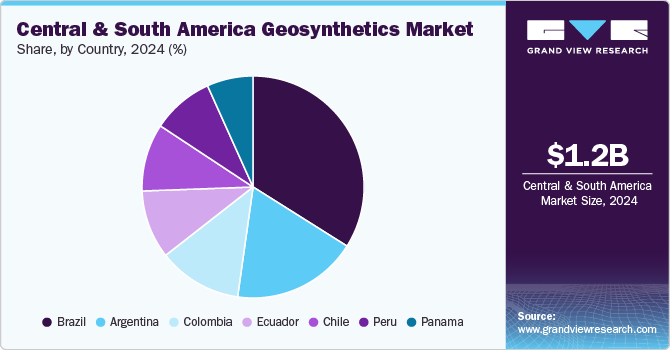

Central & South American countries such as Brazil, Peru, and Argentina have started economic revival as manufacturing net exports have returned to the pre-pandemic levels. Factors such as the influx of remittances, increasing food costs, and adequate governmental assistance in economic aid have helped economies improve their GDP growth.

Brazil Geosynthetics Market Trends

Brazil's geosynthetic market dominated the segment with the highest revenue share of 28.1% in 2024 and is expected to grow at a CAGR of 5.2% till 2030. Brazil is one of the major developing countries in the Central & South American region. Major industries contributing to the country’s economic growth include automobile, oil & gas, agriculture, construction, iron & steel, and machinery & equipment. The construction industry in Brazil is anticipated to witness significant growth due to increasing efforts taken by the government to revive the economy, followed by improvement in consumer and investor confidence.

Panama Geosynthetics Market Trends

Panama geosynthetics market is expected to be the fastest-growing market for geosynthetic in the Central & South American region, with a compound annual growth of 7.4% over the forecast period. Panama's strategic location as a global logistics hub, with the Panama Canal acting as a key trade artery, has led to an uptick in infrastructure activities such as road construction, port development, and the canal's expansion. Geosynthetics, including geotextiles, geomembranes, and geogrids, are essential for reinforcing soils, controlling erosion, and improving the durability of roads, dams, and drainage systems, making them a critical component of Panama's infrastructure projects.

Argentina Geosynthetic Market Trends

Argentina geosynthetic market held a significant market revenue share in 2024. Argentina is rich in mineral resources, particularly lithium, copper, and gold, and the mining industry has been a significant contributor to the country's economy. Geosynthetics are widely used in mining applications, including tailings management, heap leaching, and erosion control. The use of geosynthetic liners and other materials in these processes helps mitigate environmental risks and improve operational efficiency, thus driving demand for geosynthetic products within the mining sector.

Key Central And South America Geosynthetics Company Insights

Some of the key players operating in the market include AGRU America, Inc., SOLMAX, HUESKER Group, and others:

-

AGRU America, Inc. is a manufacturer in the geosynthetic market, specializing in high-performance polymer products designed for various applications in civil engineering and environmental protection. The company offers a comprehensive range of geosynthetic solutions, including geomembranes, geotextiles, and geocomposites in landfill liners, water containment systems, and erosion control projects.

-

SOLMAX is a global provider of geosynthetic solutions, specializing in designing, manufacturing, and supplying high-performance geosynthetic products for various industries, including construction, mining, environmental, and infrastructure projects.

Key Central And South America Geosynthetics Companies:

- AGRU America, Inc.

- SOLMAX

- HUESKER Group

- Minerals Technologies Inc.

- Concrete Canvas Ltd

- Officine Maccaferri SpA

- NAUE GmbH & Co. KG

- Raven Industries, Inc.

- Strata Systems, Inc.

- The Best Project Material Co., Ltd. (BPM)

Central And South America Geosynthetics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.22 billion

Revenue forecast in 2030

USD 1.67 billion

Growth rate

CAGR of 6.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million, Volume in million square meters, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Regional Scope

Central & South America

Country scope

Brazil; Argentina; Chile; Colombia; Ecuador; Peru; Panama

Segments covered

Application, country

Key companies profiled

AGRU America, Inc.; SOLMAX; HUESKER Group; Minerals Technologies Inc.; Concrete Canvas Ltd; Officine Maccaferri SpA; NAUE GmbH & Co. KG; Raven Industries Inc.; Strata Systems Inc., The Best Project Material Co., Ltd. (BPM)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Central & South America Geosynthetics Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Central & South America geosynthetics market report on application, and country:

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Road & Pavements

-

Rail Roads

-

Drainage Systems

-

Soil Reinforcements & Erosion

-

Containment & Waste Water

-

Others

-

-

Country Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Central & South America

-

Brazil

-

Argentina

-

Chile

-

Colombia

-

Ecuador

-

Peru

-

Panama

-

-

Frequently Asked Questions About This Report

b. The Central and South America geosynthetics market size was estimated at USD 1.16 billion in 2024 and is expected to reach USD 1.22 billion in 2025

b. The Central and South America geosynthetics market is expected to grow at a compound annual growth rate of 6.4% from 2025 to 2030, reaching USD 1.67 billion by 2030.

b. The soil reinforcement & erosion application segment led the market and accounted for a revenue share of 26.9% in 2024 due to the growing soil conservation projects in various countries across Latin America.

b. Some of the key players operating in the Central and South America geosynthetics market include AGRU America, Inc., SOLMAX, HUESKER Group, Minerals Technologies Inc., Concrete Canvas Ltd, Officine Maccaferri SpA, NAUE GmbH & Co. KG, Raven Industries, Inc., Strata Systems, Inc., and The Best Project Material Co., Ltd. (BPM).

b. Increasing infrastructural development and construction activities in Central & South America are propelling the demand for geosynthetics, including geomembranes, geogrids, and geotextiles.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."