- Home

- »

- Advanced Interior Materials

- »

-

Geosynthetics Market Size & Share, Industry Report, 2033GVR Report cover

![Geosynthetics Market Size, Share & Trends Report]()

Geosynthetics Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Geotextiles, Geomembranes, Geogrids, Geonets, Geocells), By Region (North America, Europe, Asia pacific, MEA, CSA), And Segment Forecasts

- Report ID: 978-1-68038-501-4

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Geosynthetics Market Summary

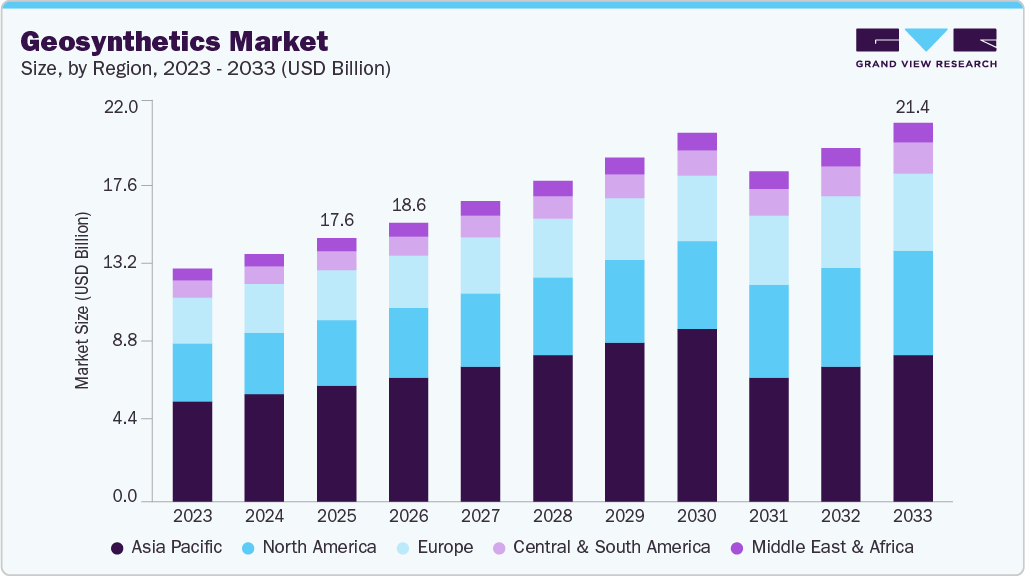

The global geosynthetics market size was estimated at USD 17.59 billion in 2025 and is projected to reach USD 21.40 billion by 2033, growing at a CAGR of 9.5% from 2026 to 2033. The market is being driven primarily by rising infrastructure development and the growing emphasis on sustainable construction practices.

Key Market Trends & Insights

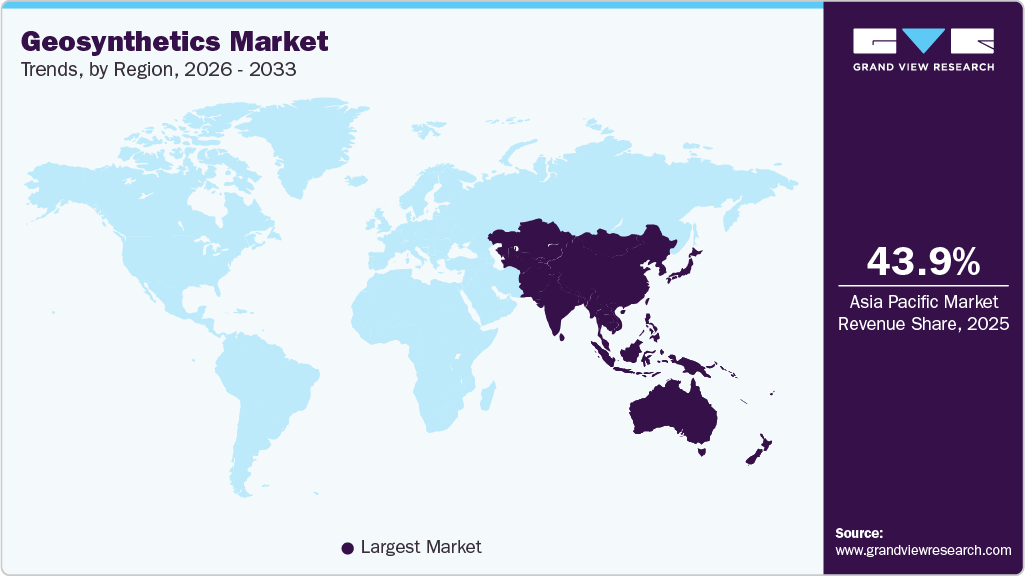

- Asia Pacific dominated the geosynthetics market with the largest revenue share of 43.9% in 2025.

- The geosynthetics market in China is propelled by massive government-led construction and land reclamation projects.

- By product, the geomembrane segment is expected to grow at the fastest CAGR of 9.5% over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 17.59 Billion

- 2033 Projected Market Size: USD 21.40 Billion

- CAGR (2025-2033): 9.5%

- Asia Pacific: Largest market in 2025

Governments and private developers are investing heavily in transportation networks, including highways, railways, and airports, where geotextiles, geomembranes, and geogrids play a critical role in soil stabilization, drainage, reinforcement, and erosion control. As urbanization accelerates, the need for durable and cost-effective civil engineering materials continues to expand, positioning geosynthetics as a preferred alternative to traditional construction materials.

Environmental regulations and an increasing focus on resource conservation are also major contributors to market growth. Geosynthetics support environmentally responsible engineering by reducing the use of natural aggregate, lowering carbon footprints, and enhancing the longevity of structures. Their use in waste management systems-particularly in landfills and mining operations-has become indispensable due to strict containment and leakage-prevention standards. This regulatory push has significantly increased the deployment of geomembranes and geosynthetic clay liners across industrial and municipal sectors.

Furthermore, the market is benefiting from technological advancements that have improved product performance, durability, and installation efficiency. Innovations in polymer science have enabled the development of geosynthetics with enhanced chemical resistance, temperature stability, and mechanical strength, broadening their application range. In addition, the expansion of research into biodegradable and recycled geosynthetic options reflects the industry’s shift toward circular-economy principles. As these advancements align with global sustainability priorities, they continue to reinforce the long-term adoption of geosynthetics across diverse geotechnical and environmental engineering projects.

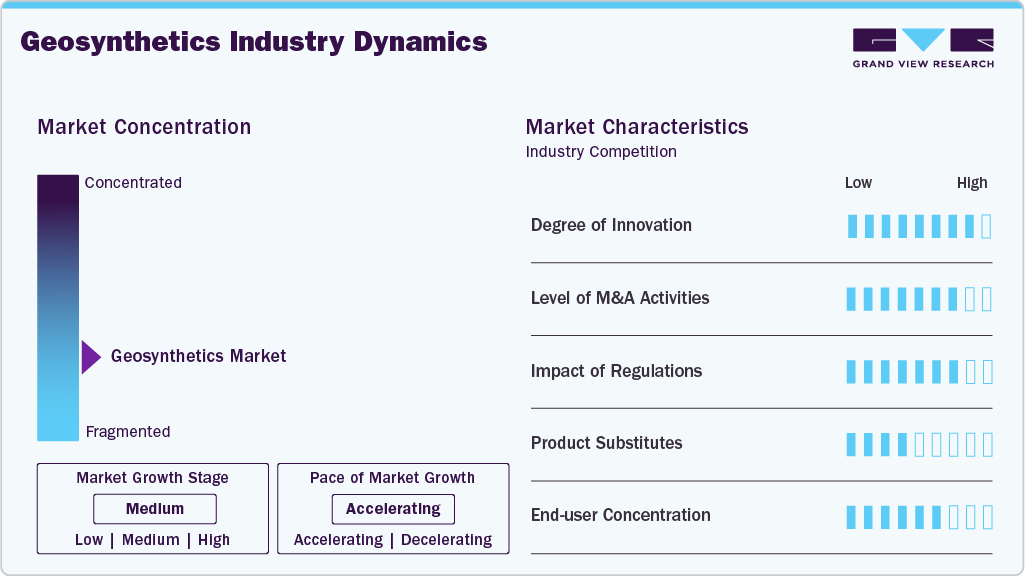

Market Concentration & Characteristics

The geosynthetics industry growth stage is medium, and the pace of growth is accelerating. The market is highly fragmented on account of the presence of a large number of manufacturers. These players compete based on product quality, product range, geographies catered to, strategic developments, operational capabilities, and pricing, which leads to high competition.

The geosynthetics industry is characterized by a high degree of innovation, as technologically advanced equipment is used for highly precise and accurate manufacturing as well as installation of geosynthetics. The majority of the equipment manufacturers are based in the European region, where they develop application-specific products such as extruders, beaming machines, looms, and pressing machinery.

The market is also characterized by a high level of merger and acquisition (M&A) activity by the players. The majority of the companies are engaged in mergers & acquisitions to increase their shares in the global market. For instance, in December 2025, Core & Main Inc. closed the acquisition of Granite Water Works Inc., a water, wastewater & storm drainage supplier in Minnesota, U.S.The market is also subject to increasing regulatory scrutiny. Organizations such as the Bureau of Indian Standards, the U.S. Environmental Protection Agency, and the European Union have set standards and directives for waste disposal, protection of the environment, and test methods. For instance, BIS standards are mainly for test methods, jute & coir geotextiles, and PVC/HDPE geomembrane for waterproof lining.

High dependency of civil engineers on conventional raw materials such as bricks, cement, steel, etc. has led to high costs of material for its transportation. As a result, geosynthetics have gained importance over the aforementioned materials. The incorporation of new technologies in soil erosion and the deployment of compacted clay liners are expected to reduce the application of geosynthetics. The threat of new substitutes is likely to be low to medium over the forecast period.

The market is marked by the presence of a large number of end-users, who use geosynthetics in applications such as construction, drainage, landfill, roads, and pavements. Growing demand for environmentally friendly products has prompted the use of these products in the construction industry. End-users are expected to opt for backward integration to ensure access to products for captive consumption.

Product Insights

Geotextiles led the market in 2025 with a revenue share of more than 48.2%. The segment dominated the market on account of its better performance and functional advantages over other materials. The synthetic fibers used in manufacturing geotextiles are made up of polypropylene, polyethylene, polyester, and polyamide. However, natural geotextiles are gaining importance for short-term use or as temporary reinforcement due to rising awareness regarding their eco-friendly benefits, thereby complementing market growth.

Geomembranes are estimated to expand at a CAGR of 9.5% in terms of revenue from 2026 to 2033, considering the rising awareness regarding the product’s application as floating covers for reservoirs to control evaporation, reduce Volatile Organic Compounds (VOCs) emissions, and minimize demand for drainage and cleaning. Polyvinyl chloride (PVC)-based geomembranes are witnessing increasing application on account of their properties, such as a high degree of flexibility, excellent elongation percentage, and reduced expansion coefficient.

Geogrids are increasingly used in railway and road infrastructure development for reinforcement of structural bases over soft soils on account of their exceptional bearing capacity. Moreover, geogrids are used in retaining walls for reinforcement of railway abutments and bridges. Thus, these factors are expected to bolster market growth over the forecast period.

Regional Insights

The geosynthetics market in the Asia Pacific is driven by rapid infrastructure expansion across transportation, energy, and urban development projects. Government investments in highways, railways, and large-scale civil engineering initiatives continue to boost product adoption. The region’s growing focus on erosion control and soil stabilization in areas prone to landslides also supports market growth. Increasing environmental awareness is encouraging the use of geosynthetics as sustainable alternatives in construction. In addition, population growth and industrialization fuel continuous demand for advanced ground reinforcement solutions.

China Geosynthetics Market Trends

The geosynthetics market in China is propelled by massive government-led construction and land reclamation projects. The country’s emphasis on strengthening its transportation network, including expressways and rail corridors, increases the need for soil reinforcement materials. Expansion in mining, waste management, and water containment applications further enhances product demand. Environmental regulations promoting safer and more efficient construction techniques also support the adoption. China’s accelerated urbanization and industrial growth ensure sustained consumption across multiple sectors.

Europe Geosynthetics Market Trends

The geosynthetics market in Europe is driven by stringent environmental regulations and strong emphasis on sustainable construction practices. The region’s aging infrastructure requires significant rehabilitation, increasing the use of geosynthetic materials for reinforcement and drainage. Climate adaptation efforts, such as flood management and coastal protection, also contribute to demand. The focus on reducing carbon footprints encourages the adoption of innovative geosynthetic solutions over conventional materials. In addition, investments in renewable energy projects, including wind farms, create new application opportunities.

Germany geosynthetics market benefits from the country’s commitment to high engineering standards and long-lasting construction solutions. Infrastructure modernization programs, particularly in transportation and public utilities, drive steady product demand. The push for environmentally responsible building materials strengthens the role of geosynthetics in soil stabilization and waste containment. Growth in the renewable energy sector, especially wind installations, supports applications in land preparation and foundation reinforcement. Germany’s strict regulatory environment continues to encourage the use of certified and technologically advanced materials.

North America Geosynthetics Market Trends

The geosynthetics market in North America is driven by large-scale infrastructure renewal and government funding for transportation upgrades. Increasing focus on environmental protection enhances adoption in landfill liners, water containment, and erosion control systems. The region experiences growing demand from the oil and gas industry for containment and separation applications. Severe weather events and climate-resilience planning also necessitate advanced reinforcement solutions. Furthermore, rising interest in sustainable construction fuels the development of high-performance geosynthetic products.

The U.S. geosynthetics market is supported by major federal and state investments in rebuilding highways, bridges, and flood control systems. Increased emphasis on regulatory compliance in waste management drives demand for geosynthetic liners and barriers. Construction of renewable energy facilities, such as solar farms, further expands the application scope. The country’s diverse climatic conditions require durable materials for erosion control and soil stabilization. In addition, a rising shift toward cost-effective and long-life construction solutions strengthens overall market adoption.

Latin America Geosynthetics Market Trends

The geosynthetics market in Latin America is influenced by growing infrastructure development in transportation, mining, and energy sectors. Expanding urban populations create demand for stronger and more durable civil engineering solutions. The region’s susceptibility to erosion, flooding, and slope instability encourages wider use of geosynthetics. Investments in mining operations, particularly in countries like Chile and Peru, boost demand for containment and separation systems. Despite occasional economic fluctuations, long-term development initiatives continue to support market growth.

Middle East & Africa Geosynthetics Market Trends

The geosynthetics market in the Middle East & Africa sees rising demand for geosynthetics due to large-scale infrastructure and land development projects. Harsh climatic conditions and soil instability make geosynthetics essential for road construction and foundation reinforcement. Water scarcity challenges drive the use of geosynthetic liners in desalination plants and water storage systems. Expanding oil and gas activities further increase the need for containment and environmental protection materials. Urban expansion and megaprojects across the Gulf region continue to strengthen market momentum.

Key Geosynthetics Company Insights

Key industry participants are entering into strategic agreements with raw material suppliers and equipment manufacturers to maintain an uninterrupted supply. Factors such as the expansion of manufacturing capacities in the developing economies of the Asia Pacific and the Middle East offer a competitive edge to the geosynthetics manufacturers.

Key players in the market are entering into agreements with emerging players to expand their distribution capacities, thereby increasing their market reach. In addition, companies are likely to establish partnerships with e-commerce portals to ensure that buyers have timely access to geosynthetic products.

Key Geosynthetics Companies:

The following are the leading companies in the geosynthetics market. These companies collectively hold the largest market share and dictate industry trends.

- GSE Holdings, Inc.

- Koninklijke Ten Cate N.V.

- Officine Maccaferri S.p.A.

- NAUE GmbH & Co. KG

- Propex Operating Company, LLC

- Low and Bonar PLC

- TENAX Group

- Fibertex Nonwovens A/S

- Global Synthetics

- AGRU America

- TYPAR

- HUESKER Group

- PRS Geo-Technologies

- Tensar International Corporation

- Solmax

Recent Developments

-

In September 2023, Titan Environmental Containment acquired Hewitt Geosynthetics, a geosynthetics company from the Greater Toronto Area, Canada. Titan Environmental Containment provides high-quality geosynthetic solutions and specialized civil engineering construction services to extend the service life of critical infrastructure while conserving valuable natural resources. Under the terms of the agreement, Titan absorbed Hewitt's current client base in Canada and the U.S.

Geosynthetics Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 18.59 billion

Revenue forecast in 2033

USD 21.40 billion

Growth rate

CAGR of 9.5% from 2026 to 2033

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Volume in million square meters, revenue in USD billion/million, and CAGR from 2026 to 2033

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; France; UK; Germany; Italy; Spain; China; India; Japan; New Zealand; Australia; Malaysia; Thailand; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

GSE Holdings, Inc.,; Koninklijke Ten Cate N.V.; Officine Maccaferri S.p.A.; NAUE GmbH & Co. KG; Propex Operating Company, LLC; Low and Bonar PLC; TENAX Group; Fibertex Nonwovens A/S; Global Synthetics; AGRU America; TYPAR; HUESKER Group; PRS Geo-Technologies; Tensar International; Solmax

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Geosynthetics Market Report Segmentation

This report forecasts market share and revenue growth at global, regional, and country levels and provides an analysis of industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global geosynthetics market report based on product and region:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2021 - 2033)

-

Geotextiles

-

Geomembranes

-

Geogrids

-

Geonets

-

Geocells

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

New Zealand

-

Australia

-

Malaysia

-

Thailand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global geosynthetics market was estimated at USD 17.59 billion in 2025 and is expected to reach USD 18.59 billion in 2026.

b. The global geosynthetics market is expected to grow at a compound annual growth rate (CAGR) of 9.5 % from 2026 to 2033 to reach USD 21.40 billion by 2033.

b. Geotextiles led the market in 2025 with a revenue share of more than 48.2%. The segment dominated the market on account of its better performance and functional advantages over other materials.

b. Some key players operating in the geosynthetics market include Koninklijke Ten Cate B.V., GSE Holdings, Inc., NAUE GmbH & Co. KG, Officine Maccaferri S.p.A., Low and Bonar PLC, Propex Operating Company, LLC, Fibertex Nonwovens A/S, TENAX Group, AGRU America, Global Synthetics, HUESKER Group, TYPAR, Machina-TST, and Gayatri Polymers & Geo-synthetics.

b. Key factors that are driving the market growth include the rapid infrastructure development in emerging economies, such as India and Brazil, which is anticipated to fuel the market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.