- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Ceramic Coating Market Size, Share & Growth Report, 2030GVR Report cover

![Ceramic Coating Market Size, Share & Trends Report]()

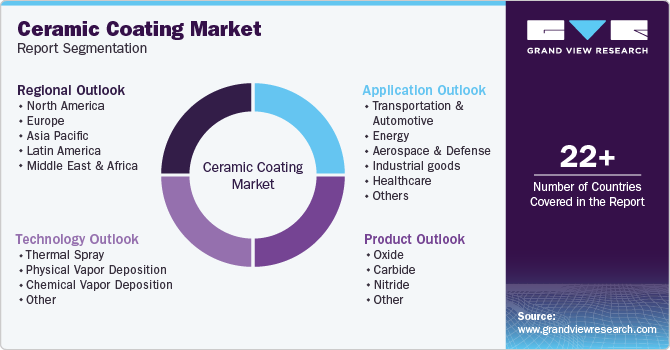

Ceramic Coating Market Size, Share & Trends Analysis Report, By Product (Oxide, Carbide), By Technology (Thermal Spray, Physical Vapor Deposition), By Application (Industrial Goods, Healthcare), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-589-2

- Number of Report Pages: 91

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Ceramic Coating Market Size & Trends

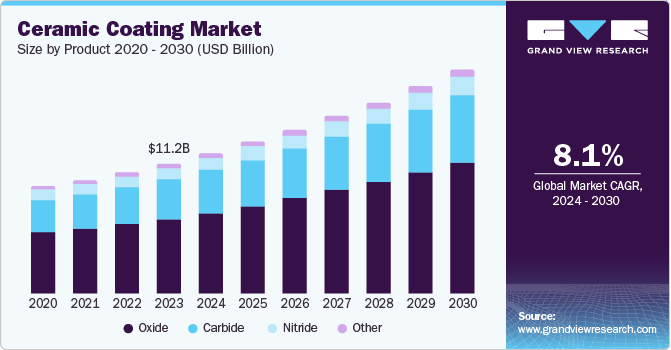

The global ceramic coating market size was estimated at USD 10.37 billion in 2023 and is expected to grow at a CAGR of 8.4% from 2024 to 2030. The market is expected to witness substantial growth over the forecast period owing to its increasing use in biomedical applications including biomedical plants as well as bone and hip implants. In addition, these products are also used in dental applications where ceramic coated teeth can be matched to a patient’s natural teeth for improving their smile.

Increasing demand for ceramic coating in manufacturing various automotive parts, including manifolds, piston skirts, pistons, and cylinder heads, among others, is expected to positively impact demand over the forecast period. For example, aircraft manufacturers use ceramic-coated rods to cast the fins for a turbine engine.

Automobile manufacturers, particularly in the U.S., employ ceramic-coated filters to remove particulates from molten metal, which in turn is used to form automotive bodies and components. However, manufacturers in the Asia Pacific region largely employ the product in the production of spark and glow plugs, oxygen sensors, knocking sensors, parking distance control systems, PTC heaters, and fuel injection systems.

Ceramic coatings are used in various application segments, including aerospace, defense, energy & power, etc. Established and proposed governmental regulations regarding the use of these materials in aircraft, automobile, and industrial equipment components are expected to augment ceramic coating demand in end-use industries. Despite the extraordinary benefits of ceramic coating, difficulty in processing and manufacturing these materials incurs high initial investment.

Ceramic coatings cost more than regular powder coatings. Their high prices have limited their use to high-performance applications such as jet fighters, spacecraft, racecars, missiles, aircraft engines, and similar high-temperature applications.

Market Concentration & Characteristics

The market is moderately fragmented with players aiming to achieve optimum business growth and strong market positioning through production capacity expansions, new product development, acquisition, collaboration, and partnership, and investments in research & development. For instance, in 2023 CeramTec, a German producer of ceramic ingredients and systems, has announced the expansion of a new manufacturing unit in China. The novel production unit manufactures ceramic plating for myriad applications, such as aerospace, automotive, and medical.

Manufacturers in the ceramic coating market focus on product durability, long-lasting shine, and protection against environmental hazards to stay competitive. The emphasis is on innovation and sustainability, as the industry faces challenges in meeting stricter environmental regulations and adopting sustainable practices. The market players are also investing in research and development to expand their product lines and cater to the growing demand for effective protective solutions.

Product Insights

Oxide form of the product dominated the market with a revenue share of 57.5% in 2023 Oxide product form is a type of industrial coating that offers a variety of benefits to the underlying surface. They are made from metal oxides, which are compounds of oxygen and metal. Oxide ceramic coatings such as aluminum (alumina), alumina-titania, zirconium, magnesium, titanium, and chromium oxide are among the coatings sprayed on industrial equipment such as refractory bricks, chimneys and hot rods in steel and power plants to combat corrosion and excess heat. They are used in various industries, including automotive, aerospace, oil & gas, power generation, medical devices, etc.

Chromium carbide, chromium carbide, nickel-chromium blends, chromium-nickel carbide, and chromium carbide MCrAlY blend are some of the most commonly used carbide coatings. They are used mainly in HVOF and gas plasma spraying methods. Carbide coatings help prevent against abrasion, adhesion, erosion, and fretting. Carbides are increasingly used as an excellent tool for hard chromium plating, particularly for hydraulic rods, landing gears, and oil field equipment

Nitride ceramic coating is a thin layer of ceramic material, primarily composed of nitrides, applied to the surface of a material to improve its properties. These coatings are made up of nitrogen and metal compounds, such as silicon nitride or titanium nitride. They are known for being extremely hard, water-resistant, and corrosion-resistant. They can also improve the thermal stability and lubricity of a material. They have a wide range of applications, including cutting tools, dies and molds, bearings, and biomedical implants, among others.

Technology Insights

Thermal spray coatings technology dominated the market with a revenue share of 74.9% in 2023. This method is particularly useful for enhancing the surface properties of various materials, making it a preferred choice in numerous industrial applications. Thermal spray coatings are widely preferred over hard chrome in various applications because of their biocompatible nature and compliance with VOC limits.

Stringent regulations in several regions, such as North America and Europe, characterize the thermal spray ceramic coating segment. There are numerous regulations governing thermal spray coatings and related raw materials. MIL-STD-1687A (SH) standard determines thermal-spray processes for machinery element repair of non-ferrous and ferrous substrates.

In addition, requirements for the qualification of thermal spray technology operator, procedures, guidance for the use of thermal spray material, quality assurance requirements, equipment, and descriptions of applicable qualification tests are also included in this code.

Application Insights

Industrial goods application segment dominated the market with a revenue share of 31.0% in 2023. Ceramic coatings offer a significant advantage in industrial settings due to their exceptional properties. They can withstand extremely high temperatures without degradation. This makes them ideal for components in engines, furnaces, turbines, transformers, capacitors, and other high-heat environments. It can also lower the friction coefficients, improving machinery's energy efficiency.

Ceramic coatings play a crucial role in the healthcare industry by improving various medical devices and implants' longevity, functionality, and biocompatibility. Biocompatible ceramic coatings are applied to hip and knee replacements. They also improve surgical instruments' wear resistance and sharpness, allowing for precise and efficient procedures with minimal tissue damage.

Moreover, increasing aircraft production, mainly in North America and Europe, further fuels the market's growth. The presence of leading manufacturers such as Beechcraft Corporation, Airbus Corporate Jets, Cessna Aircraft, Boeing Business Jets, Dassault Aviation, Bombardier Business Aircraft, Gulfstream Aerospace, and Embraer Executive Jets is propelling the product demand. Key Airbus customers include Acropolis Aviation, Comlux, and K5 Aviation. Thus, the increasing production of aircraft is potentially driving the growth of the market.

Region Insights

The market in North America is primarily driven by the development in manufacturing industries such as transportation & automotive, aerospace & defense, and others. North America, led by the U.S., was the largest aerospace & defense market globally. The growing U.S. aerospace industry and the emergence of major aerospace manufacturers in Mexico are expected to fuel the demand for ceramic coatings in North America. Furthermore, prominent manufacturers, including Boeing Business Jets, Beechcraft Corporation, Cessna Aircraft, Gulfstream Aerospace, and Airbus, are expected to further augment market growth. In addition, the growing automobile industry and increased oil exploration activities in Mexico are expected to drive the market demand for ceramic coatings in this region.

The U.S. Ceramic Coating Market Trends

The U.S.dominated the market for ceramic coating in North America in 2023 and is expected to continue its dominance over the forecast period. The demand for ceramic coatings in the U.S. is majorly derived from the growing demand from the transportation & automotive sector due to new product launches by Ford Motors and General Motors and automobile production growth. The aerospace sector in the U.S. has consistently been increasing over the past few years and is expected to continue this trend over the forecast period.

Asia Pacific Ceramic Coating Market Trends

Asia Pacific dominated the market with a revenue share of 41.5% in 2023 which is attributed to rising automobile production coupled with rapid economic growth in China, India, Japan, Indonesia, South Korea, and Thailand.

China ceramic coating market is expected to be one of the promising markets in Asia Pacific in the coming years due to the support of the government of the country for promoting investments in the manufacturing sector. Several companies are expanding their existing manufacturing facilities or setting up new ones owing to low labor costs and ease of raw material procurement in China. The growing manufacturing sector is expected to contribute to the demand for the product in the country owing to increasing construction of manufacturing units in China.

As per the ITA, China was the largest construction market in the world in 2023. The 14th Five-year Plan of the country focuses on developing new infrastructures related to transportation, energy, water systems, etc. According to the same organization, an estimated USD 4.2 trillion investment is expected in new infrastructure developments in the country between 2021 and 2025. Thus, the ongoing urbanization and the increasing infrastructure development projects are expected to boost the demand for the product in the country in the coming years.

Europe Ceramic Coating Market Trends

Europe was the third-largest revenue-generating region in the global market. The market is driven by rising demand from critical applications such as transportation & automotive, aircraft & defense, healthcare, and industrial goods. The automotive industry plays a significant role in the overall contribution to the European economy. Furthermore, the expansion of automobile production in Hungary, Austria, and Romania is expected to fuel the market growth over the forecast period.

Germany ceramic coating market was the most significant revenue-generating country in the European market, and this trend is expected to continue over the forecast period. It is among the leading automotive markets in Europe in terms of production and sales. Key automotive manufacturers operating in Germany include Audi AG, Volkswagen AG, BMW AG, and Daimler. Germany accounts for over 27% of the total passenger vehicles manufactured in Europe.

Central & South America Ceramic Coating Market Trends

The petrochemical and aerospace sectors are majorly driving the growth of the market in Central & South America. The growing demand for aluminum to protect steel in offshore structures is expected to upsurge industry growth. The increasing investments being made in the oil and gas industry in Brazil are expected to fuel the demand for the product market.

Brazil ceramic coating market is witnessing significant growth in product demand. Brazil is one of the five countries that manufacture commercial jets and is one of the top ten export destinations for U.S. aircraft and parts. The two major aerospace industry segments include OEMs and maintenance and repair operations. Since ceramic coatings are widely used in these segments, the market is expected to grow over the forecast period.

Middle East & Africa Ceramic Coating Market Trends

The Middle East & Africa market is anticipated to grow significantly over the forecast period. The market is supplemented by the growing economies of the UAE, Saudi Arabia, Iran, Egypt, and Oman. Increasing industrial manufacturing and rapid urbanization & industrialization in this region are expected to drive the demand for ceramic coating.

Saudi Arabia ceramic coating market demand has been experiencing a significant rise, due to several factors. The country's industrial goods sector has witnessed substantial growth, further increase in the consumption of product in the country.

Key Ceramic Coating Company Insights

Some of the key players operating in the market include Bodycote, Praxair Surface Technologies, Inc., Aremco Products, Inc., APS Materials, Inc., Cetek Ceramic Technologies, Keronite Group Ltd./ Curtiss-Wright Corporation, Saint-Gobain S.A., Element 119 and NanoShine Ltd., Ultramet, Inc. among others.

-

Cetek Ceramic Technologies provides coating and hot repair services. The company caters to different industries, including coal power, oil and gas, pulp and paper, biomass and waste energy, and metals and mining. Under its services portfolio, the company offers Cetek ceramic technologies, on-site thermal spray coatings, boiler maintenance, environmental products, and hot-tek online services

-

Bodycote provides heat treatment services to enhance material properties such as corrosion resistance, strength, and durability. It operates in five business segments: automotive, aerospace & defense, energy, general industries, and hot isostatic pressing. It also provides heat treatment, metal joining, surface technology, and hot isostatic pressing services. Furthermore, the company has a geographical presence in North America, Europe, Asia Pacific, and the Middle East.

Key Ceramic Coating Companies:

The following are the leading companies in the ceramic coating market. These companies collectively hold the largest market share and dictate industry trends.

- Bodycote

- Praxair Surface Technologies, Inc.

- Aremco Products, Inc.

- APS Materials, Inc.

- Cetek Ceramic Technologies

- Keronite Group Ltd./ Curtiss-Wright Corporation

- Saint-Gobain S.A.

- Element 119

- NanoShine Ltd.

- Ultramet, Inc.

Recent Developments

-

In June 2023, CeramTec, a German producer of ceramic ingredients and systems, has announced the expansion of a new manufacturing unit in China. The novel production unit manufactures ceramic plating for myriad applications, such as aerospace, automotive, and medical.

-

In November 2022, Curtiss-Wright Corporation acquired Keronite Group Limited (Keronite) for $35 million in cash. The acquisition shall benefit Curtiss in terms of product portfolio expansion and technological advancements.

Ceramic Coating Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.17 billion

Revenue forecast in 2030

USD 18.16 billion

Growth rate

CAGR of 8.4% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; Italy; France; Spain, China; India; Japan, South Korea; Brazil; Argentina; Saudi Arabia, South Africa

Key companies profiled

Bodycote; Praxair Surface Technologies, Inc.; Aremco Products, Inc.; APS Materials, Inc.; Cetek Ceramic Technologies; Keronite Group Ltd./ Curtiss-Wright Corporation; Saint-Gobain S.A.; Element 119

NanoShine Ltd.; Ultramet, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ceramic Coating Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ceramic coating market report based on product, technology, application, and region.

-

Product Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Oxide

-

Carbide

-

Nitride

-

Other

-

-

Technology Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Thermal Spray

-

Physical Vapor Deposition

-

Chemical Vapor Deposition

-

Other

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Transportation & Automobile

-

Energy

-

Aerospace & Defense

-

Industrial Goods

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ceramic coatings market size was estimated at USD 10.37 billion in 2023 and is expected to reach USD 11.17 billion in 2024.

b. The global ceramic coatings market is expected to grow at a compound annual growth rate of 8.4% from 2024 to 2030 to reach USD 18.16 billion by 2030.

b. The Asia Pacific dominated the ceramic coatings market with a share of more than 41.5% in 2023. This is attributable to rising demand from the automotive sector and industrial components owing to its properties of abrasion and heat resistance.

b. Some key players operating in the ceramic coatings market includeBodycote, Praxair Surface Technologies, Inc., Aremco Products, Inc., APS Materials, Inc., Cetek Cermaic Technologies Ltd., Keronite Group Ltd., Saint-Gobain S.A., Element 119, NanoShine Ltd., and Ultramet, Inc.

b. Key factors that are driving the ceramic coatings market growth include ceramic coatings application for surgical instruments, prosthetic limb & hip and personal hygiene products, and its application for abrasion and corrosion resistance in various end-use industries such as transportation & automotive, energy, and aerospace & defense.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."