- Home

- »

- Plastics, Polymers & Resins

- »

-

Thermal Spray Coatings Market Size, Industry Report, 2033GVR Report cover

![Thermal Spray Coatings Market Size, Share & Trends Report]()

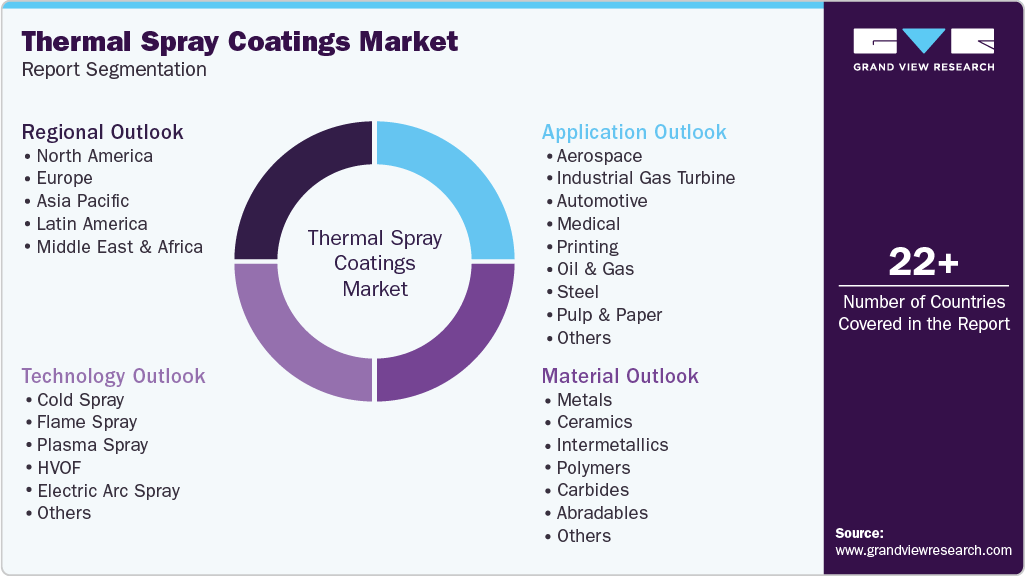

Thermal Spray Coatings Market (2026 - 2033) Size, Share & Trends Analysis Report By Technology (Coldspray, Flamespray, Plasma Spray, HVOF, Electric arc spray), By Material, By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-514-4

- Number of Report Pages: 128

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Thermal Spray Coatings Market Summary

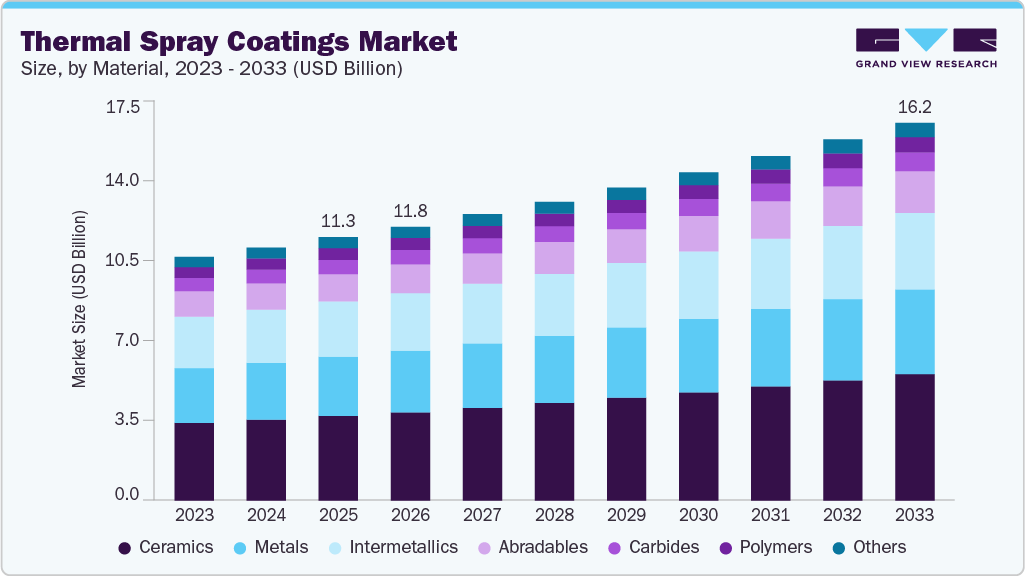

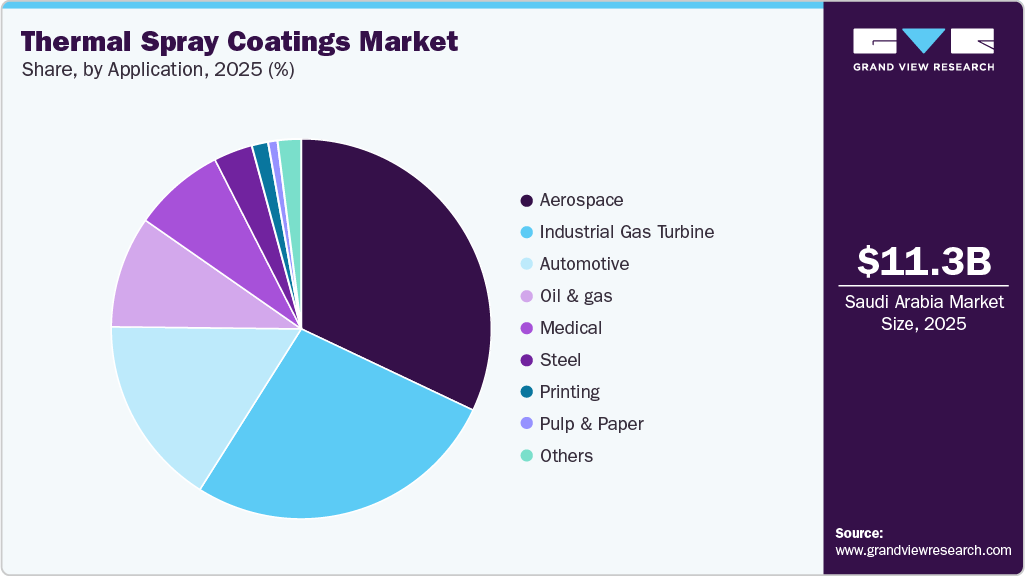

The global thermal spray coatings market size was estimated at USD 11.29 billion in 2025 and is projected to reach USD 16.22 billion by 2033, growing at a CAGR of 4.7% from 2026 to 2033. The market growth depends on the use of thermal spray coatings in various end-use industries, including automotive, aerospace, medical, industrial gas turbines, printing, steel, and pulp & paper.

Key Market Trends & Insights

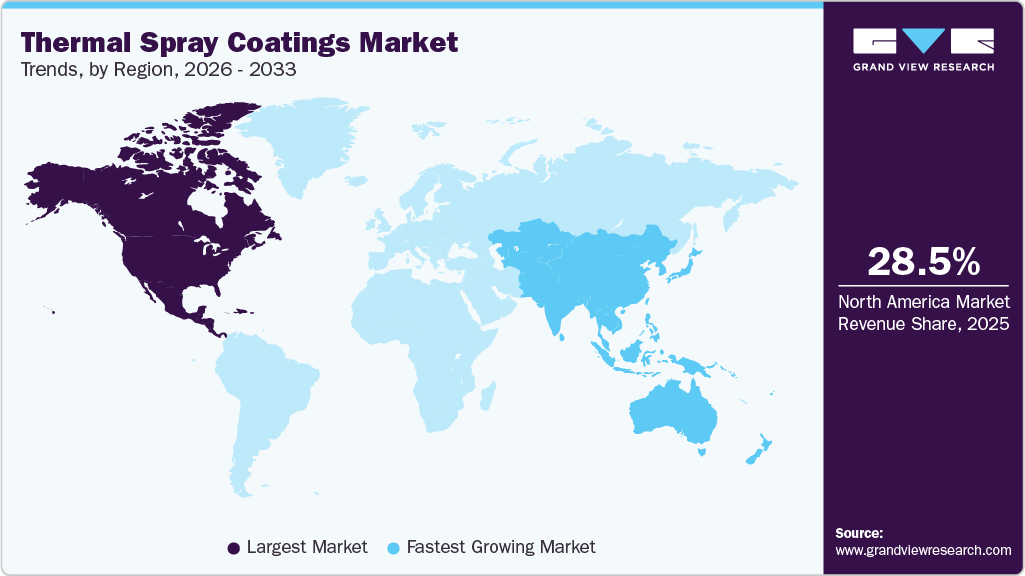

- North America dominated the thermal spray coatings market in 2025, accounting for the largest revenue share of 28.5%.

- The growth of the U.S. thermal spray coatings industry is driven by its strong aerospace, defense, and industrial manufacturing base.

- By material, the ceramics segment held the largest revenue share of 32.1% in 2025.

- By application, the medical segment is expected to grow at the fastest CAGR of 5.3% from 2025 to 2033.

- The aerospace application segment held the largest revenue share of 32.0% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 11.29 Billion

- 2033 Projected Market Size: USD 16.22 Billion

- CAGR (2026-2033): 4.7%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The rising use of gas turbines in helicopter engines, tanks, ships, and locomotives is expected to help augment the demand for thermal spray coatings due to their high temperature and corrosion resistance, which protects the parts against fire in high-temperature and moisture-laden conditions.The properties provided by thermal spray coatings include wear resistance against abrasion, cavitation, and erosive forces, as well as chemical resistance, electrical insulation, and improved adhesion between the substrate and the top layer of components. The stringent regulations by the U.S. EPA, REACH, and OSHA regarding the curtailment of hard chrome plating, which produces a byproduct recognized as a carcinogen, influence the coating manufacturers to adopt sustainable solutions that can further propel the market growth in various end-use industries.

This is attributed to the high demand from power generation plants for industrial gas turbines, which are expected to witness a surge in gas turbine demand due to the policy transition of the U.S. government toward replacing coal with natural gas for electricity generation. According to the Rural Health Information Hub, there are currently 46 million adults over the age of 65 years living in the U.S., which is expected to grow to 90 million by 2050. The rising geriatric population and improved healthcare services in the U.S. are expected to drive the market for orthopedic implants required in knee cap replacement surgery, and are anticipated to grow the market in the region.

Material Insights

The ceramic material segment dominated the thermal spray coatings industry, accounting for a revenue share of 32.1% in 2025. This is attributed to the fact that ceramic coatings possess excellent adhesion properties, which enable them to adhere to the surface and provide corrosion protection, thermal barrier, dielectric strength, and sliding wear resistance to the coated materials. Due to the thermal barrier properties, ceramics are often utilized in heat insulation applications to improve the operational efficiency of components in high-temperature environments and extend the service lifespan. Abradable materials tend to wear when rubbed against a highly abrasive material while protecting the underlying material and leaving it damage-free. It is used for coating gas turbine engines for clearance control, which helps prevent the change in dimensions that occur due to thermal expansion since the rotating assemblies and blades heat up and cool down during operation.

The abradables segment is expected to grow at the fastest CAGR of 5.4% from 2025 to 2033, due to increasing demand from aerospace and industrial gas turbine applications. These coatings enhance engine efficiency by enabling tighter clearances between rotating and stationary parts, thereby reducing fuel consumption and emissions. Rising aircraft production, expanding MRO activities, and the need for higher turbine performance and safety further support the strong growth of abradable thermal spray coatings.

Technology Insights

The plasma spray technology segment dominated the thermal spray coatings market, accounting for a 33.4% revenue share in 2025. This is attributed to the fact that this process provides the advantage of spraying metallic and ceramic materials onto various surfaces with excellent bond strength, while minimizing substrate distortion on both large and small components. It provides electrical conductivity, clearance control, wear resistance, and heat & oxidation resistance to the substrate surface. The plasma thermal spray coatings process is used on printing rolls, gas turbines, industrial diesel engine piston rings, and oil & gas machinery. Moreover, this process is adopted widely in coating orthopedic and dental implants due to its ability to produce a dense and porous surface layer, surface roughness, and microstructure of the coatings depending upon the requirement.

The growing incidence of orthopedic injuries and diseases, such as arthritis and osteoarthritis, combined with the rapid rise in the geriatric population, particularly in Europe and North America, is driving the demand for orthopedic implants, which in turn may fuel the growth of plasma thermal spray coatings technology. Cold spray technology utilizes thermal energy to soften or melt the feedstock, then impacts particles at high velocity onto a substrate. This technology finds use in corrosion protection, electronics, and the automotive industry due to its compatibility with various alloys, metals, composites, and refractory metals. The application of cold spray technology is driven by its expansion into other end-use sectors, contributing to its growth.

For instance, members of the 28th Maintenance Squadron’s Additive Manufacturing and Rapid Repair Facility conducted a cold spray repair to a B-1B Lancer Forward Equipment Bay (FEB) panel. This type of repair increases aircraft availability at a reduced operational cost through the sustainment of legacy aircraft components and can positively impact segment growth in the aerospace sector. High-velocity oxy-fuel (HVOF) was the subsequent dominating technology in the global market. It is used to restore or improve a component’s properties or geometry, enabling the extension of the equipment’s life.

The advantages of HVOF over other technologies, such as lower porosity due to greater particle impact velocities, higher strength bond to the underlying substrate, lower oxide content, smooth surface, better wear resistance, and improved corrosion resistance, drive the segment growth. However, HVOF-sprayed coatings can be highly complex, as their properties & microstructure depend on numerous processing variables. Additionally, the powder sizes are restricted to approximately 5-60µm, which further limits its application.

Application Insights

The aerospace application segment dominated the thermal spray coatings industry, accounting for a 32.0% revenue share in 2025. This is attributed to the high demand for products in aerospace applications, as parts in an aircraft are prone to degradation due to particle erosion, hot corrosion, metal-to-metal wear, and fretting. According to a report published by Deloitte in 2021, the pandemic-induced impact on customer demand and pricing pressure has led many aerospace manufacturers to seek new opportunities for aftermarket services revenue. This is expected to increase Maintenance, Repair, and Overhaul (MRO) work, which can boost product demand in the aerospace industry.

The medical segment is expected to grow at the fastest CAGR of 5.3% from 2025 to 2033, driven by the rising global demand for orthopedic and dental implants. Thermal spray coatings are widely used to enhance biocompatibility, corrosion resistance, and bone integration of implant surfaces. Factors such as an aging population, increasing incidence of joint disorders, higher surgical procedure volumes, and continuous advancements in implant materials and surface engineering technologies are strongly supporting the growth of thermal spray coatings in medical applications.

Regional Insights

North America dominated the thermal spray coatings market in 2025, accounting for the largest revenue share of 28.5%, driven by its robust aerospace, defense, and industrial manufacturing sectors. The region has a high concentration of aircraft OEMs, gas turbine manufacturers, and well-established MRO facilities, which drive consistent demand for advanced coating solutions. Additionally, the early adoption of surface engineering technologies, strong R&D investments, and stringent performance and safety standards further contribute to sustained market leadership.

U.S. Thermal Spray Coatings Market Trends

The growth of the U.S. thermal spray coatings industry is driven by its strong aerospace, defense, and industrial manufacturing base. The country hosts major aircraft OEMs, engine manufacturers, and one of the world’s largest MRO networks, creating steady demand for high-performance coatings. In addition, significant investments in defense modernization, power generation infrastructure, and advanced manufacturing technologies support continued adoption of thermal spray solutions across critical applications.

Asia Pacific Thermal Spray Coatings Market Trends

The Asia Pacific thermal spray coatings industry is expected to grow at the fastest CAGR of 5.5% from 2026 to 2033, driven by rapid industrialization, expanding aerospace and automotive manufacturing, and increasing energy infrastructure investments. Countries such as China, India, and Japan are witnessing increasing aircraft fleet sizes, expanding power generation capacity, and higher vehicle production. Additionally, cost-effective manufacturing, the increasing number of local coating service providers, and government support for industrial development are accelerating the adoption of thermal spray coatings across the region.

China’s thermal spray coatings market is supported by rapid industrial expansion, large-scale power generation projects, and the growth of aerospace and automotive manufacturing. The country’s focus on domestic aircraft programs, high-speed rail, and industrial gas turbines increases demand for wear- and heat-resistant coatings. Additionally, government initiatives promoting local manufacturing, infrastructure development, and energy efficiency are accelerating the use of thermal spray coatings in industrial and energy applications.

Europe Thermal Spray Coatings Market Trends

The growth of Europe’s thermal spray coatings industry is driven by a strong presence of aerospace OEMs, automotive manufacturers, and advanced engineering industries. Countries such as Germany, France, and the UK emphasize high-quality manufacturing, sustainability, and emissions reduction, supporting the adoption of advanced coating technologies. The region’s focus on extending equipment life, integrating renewable energy, and adhering to strict regulatory standards further sustains demand for thermal spray coatings across the aerospace, automotive, and industrial sectors.

Latin America Thermal Spray Coatings Market Trends

The Latin America thermal spray coatings industry is growing steadily due to expanding oil & gas operations, power generation activities, and automotive manufacturing, particularly in Brazil and Mexico. The region places a strong emphasis on equipment maintenance and life extension due to budget constraints, increasing the use of thermal spray coatings for repair and refurbishment. Growth in industrial infrastructure and localized manufacturing also supports market expansion.

Middle East & Africa Thermal Spray Coatings Market Trends

The growth of the Middle East & Africa thermal spray coatings industry is driven mainly by the oil & gas, power generation, and industrial processing sectors. Harsh operating environments, including high temperatures and corrosive conditions, create strong demand for protective coatings. In addition, ongoing investments in energy infrastructure, gas turbines, desalination plants, and industrial diversification initiatives are supporting increased adoption of thermal spray coatings across the region.

Key Thermal Spray Coatings Company Insights

The two key dominant manufacturers in the thermal spray coatings market are Oerlikon Metco and Linde plc.

-

Oerlikon Metco is a globally recognized leader in surface engineering technologies with a strong focus on thermal spray coatings. The company offers a broad portfolio of coating materials, equipment, and integrated coating solutions designed for high-performance applications. Its capabilities support demanding industries such as aerospace, automotive, energy, and medical, where durability, thermal resistance, and wear protection are critical. Oerlikon Metco is known for its strong emphasis on innovation, process control, and application-specific solutions, enabling customers to enhance component performance, extend service life, and meet strict quality and regulatory requirements.

-

Linde plc plays a significant role in the thermal spray coatings market through its advanced materials and process technologies supporting surface engineering applications. The company’s expertise spans high-purity gases, advanced materials, and engineered solutions that are essential for precise and controlled thermal spray processes. Linde’s strong technological foundation supports applications in aerospace, power generation, industrial manufacturing, and other high-temperature or high-performance environments. Its focus on operational efficiency, process optimization, and technological advancement enables consistent coating quality and supports the evolving performance requirements of modern industrial applications.

Key Thermal Spray Coatings Companies:

The following are the leading companies in the thermal spray coatings market. These companies collectively hold the largest market share and dictate industry trends.

- Linde PLC

- Höganäs AB

- H.C. Starck Inc.

- Castolin Eutectic

- Wall Colmonoy Corporation

- Powder Alloy Corporation

- MTC Industries and Research

- Fujimi Incorporated

- Oerlikon Metco

- Kennametal Stellite

- GTV Verschleißschutz GmbH

- Flame Spray Inc.

- HTS Coatings

- Cincinnati Thermal Spray, Inc.

- Bodycote

- Chromalloy

- Sulzer Ltd

- Hannecard

Recent Developments

-

In June 2024, Oerlikon established its Advanced Coating Technology Center in Westbury, NY, combining thermal spray and PVD capabilities to accelerate the development of high-performance coatings for the aerospace and gas turbine industries. The facility focuses on innovative solutions such as environmental barrier coatings for ceramic matrix components, enhancing durability, efficiency, and sustainability. This initiative strengthens collaboration with OEMs and sets new standards for advanced surface technologies.

-

In January 2024, Flame Spray announced a $2.5 million investment to expand its Fountain Inn, South Carolina, operations, adding advanced thermal spray coating technologies and creating 40 new jobs. The expansion enhances the company’s capability to serve industrial gas turbine and aerospace applications with enhanced coating services.

Thermal Spray Coatings Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 11.77 billion

Revenue forecast in 2033

USD 16.22 billion

Growth rate

CAGR of 4.7% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; Japan; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Linde plc; Höganäs AB; H.C. Starck Inc.; Castolin Eutectic; Wall Colmonoy Corporation; Powder Alloy Corporation; MTC Industries and Research; Fujimi Incorporated; Oerlikon Metco; Kennametal Stellite; GTV Verschleißschutz GmbH; Flame Spray Inc.; HTS Coatings; Cincinnati Thermal Spray, Inc.; Bodycote; Chromalloy; Sulzer Ltd.; Hannecard

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Thermal Spray Coatings Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global thermal spray coatings market report based on material, technology, application, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2033)

-

Metals

-

Ceramics

-

Intermetallics

-

Polymers

-

Carbides

-

Abradables

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2033)

-

Cold Spray

-

Flame Spray

-

Plasma Spray

-

HVOF

-

Electric Arc Spray

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2033)

-

Aerospace

-

Industrial Gas Turbine

-

Automotive

-

Medical

-

Printing

-

Oil & Gas

-

Steel

-

Pulp & Paper

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global thermal spray coatings market size was estimated at USD 11.29 billion in 2025 and is expected to reach USD 11.77 billion in 2026.

b. The global thermal spray coatings market is expected to grow at a compound annual growth rate of 4.7% from 2026 to 2033 to reach USD 16.22 billion by 2033.

b. The ceramics segment holds the largest revenue share of 32.1% in 2025, owing to their extensive use in thermal barrier coatings, electrical insulation, and high-temperature applications across aerospace, gas turbines, and industrial equipment, where superior heat resistance, oxidation protection, and durability are critical for improving component efficiency and operational lifespan.

b. The aerospace segment holds the largest revenue share of 32.0% in 2025. This dominance is driven by extensive use of thermal spray coatings on aircraft engines, airframes, and landing gear to meet stringent performance, safety, and durability requirements, as well as increasing aircraft production and maintenance activities across both commercial and defense aviation sectors.

b. Some of the key players operating in the market include Linde PLC, Höganäs AB, H.C. Starck Inc., Castolin Eutectic, Wall Colmonoy Corporation, Powder Alloy Corporation, MTC Industries and Research, Fujimi Incorporated, Oerlikon Metco, Kennametal Stellite, GTV Verschleißschutz GmbH, Flame Spray Inc., HTS Coatings, Cincinnati Thermal Spray, Inc., Bodycote, Chromalloy, Sulzer Ltd, Hannecard

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.