- Home

- »

- Consumer F&B

- »

-

Ceramic Cookware Market Size, Share, Industry Report 2030GVR Report cover

![Ceramic Cookware Market Size, Share & Trends Report]()

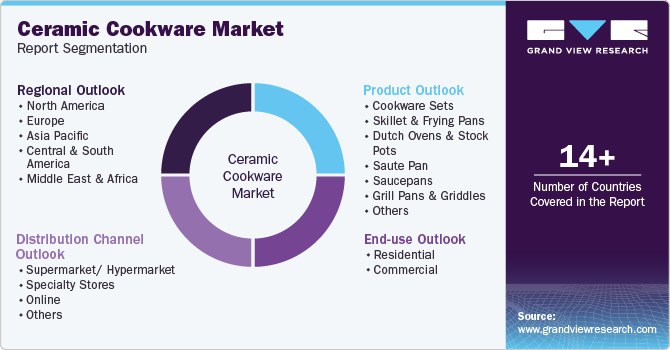

Ceramic Cookware Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Cookware Sets, Skillet & Frying Pans, Dutch Ovens & Stock Pots), By End-use (Residential, Commercial), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-525-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ceramic Cookware Market Summary

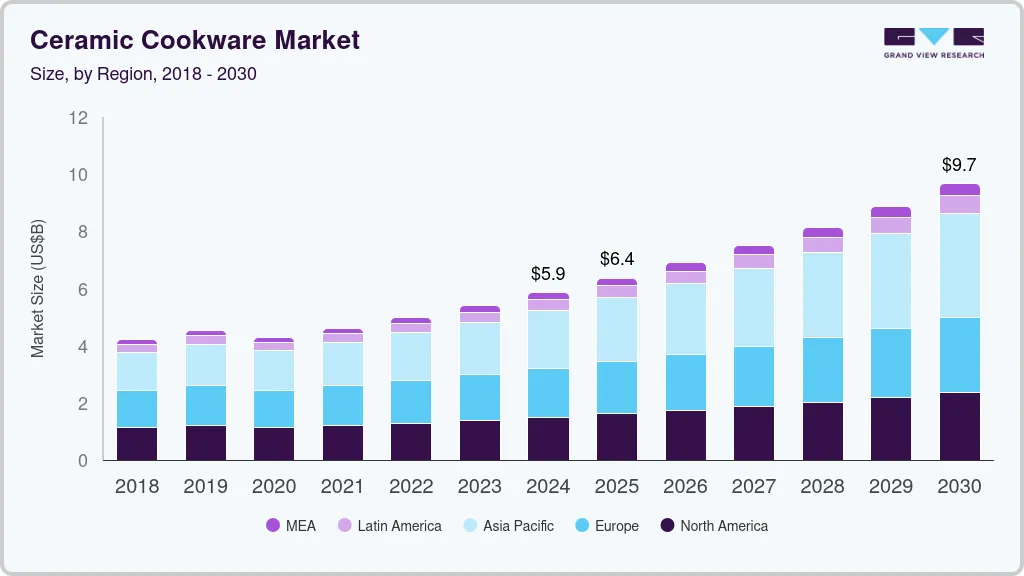

The global ceramic cookware market size was estimated at USD 5,855.5 million in 2024 and is projected to reach USD 9,671.4 million by 2030, growing at a CAGR of 8.8% from 2025 to 2030. The shift in cooking preferences and lifestyle choices has contributed to the increasing popularity of ceramic cookware.

Key Market Trends & Insights

- Asia Pacific dominated the ceramic cookware market with the largest revenue share of 34.7% of the global market revenue in 2024.

- The U.S. accounted for a significant revenue share in North America in 2024.

- By product, the skillet & frying pans segment led the market with the largest revenue share of 32.4% in 2024.

- Based on end use, the residential segment led the market with the largest revenue share of 83.36% in 2024.

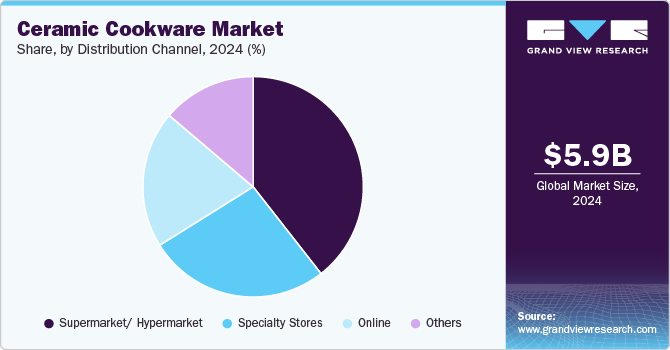

- Based on distribution channel, the supermarket/hypermarket segment led the market with the largest revenue share of 39.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5,855.5 Million

- 2030 Projected Market Size: USD 9,671.4 Million

- CAGR (2025 - 2030): 8.8%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market

Many people are embracing home cooking as a healthier and more cost-effective alternative to eating out, leading to a growing demand for high-quality cookware. Ceramic cookware is valued for its superior heat distribution, which ensures even cooking and enhances the overall culinary experience. In addition, its aesthetic appeal, with a variety of colors and designs, makes it a favorite among home chefs who want stylish and functional kitchen tools.Many conventional non-stick coatings contain harmful chemicals such as perfluorooctanoic acid (PFOA) and polytetrafluoroethylene (PTFE), which can release toxic fumes at high temperatures. Ceramic cookware, on the other hand, is made from natural materials and does not contain these chemicals, making it a safer and more eco-friendly option. As consumers become more conscious of the potential health risks associated with traditional cookware, they are actively seeking alternatives that provide a non-toxic cooking experience.

For instance, in October 2023, Kyocera introduced a new line of high-performance ceramic-coated non-stick cookware designed for eco-friendly and health-conscious cooking. The cookware features a durable, PFAS-free ceramic coating that resists scratches and enhances food release, reducing the need for excess oils or fats. The collection is made with energy-efficient production processes and recyclable materials. Kyocera aims to provide a safer, more environmentally responsible alternative to traditional non-stick cookware, aligning with growing consumer demand for healthier and more sustainable kitchen products.

Unlike conventional metal cookware, which is often plain or limited in color choices, ceramic cookware is available in various vibrant colors, sleek finishes, and elegant designs. This makes it a preferred choice for those who want cookware that not only functions well but also enhances the aesthetic appeal of their kitchen. With the rise of social media and food photography trends, many consumers are choosing cookware that looks good on camera, further increasing the demand for visually appealing options like ceramic cookware.

Furthermore, online marketplaces have made it easier for consumers to explore a wide range of options, read reviews, compare prices, and make informed purchasing decisions. In addition, influencers, chefs, and cooking enthusiasts on social media platforms have played a key role in promoting ceramic cookware by showcasing its benefits through cooking tutorials and product recommendations. As digital marketing continues to grow, the visibility and desirability of ceramic cookware are expected to increase, driving further market expansion.

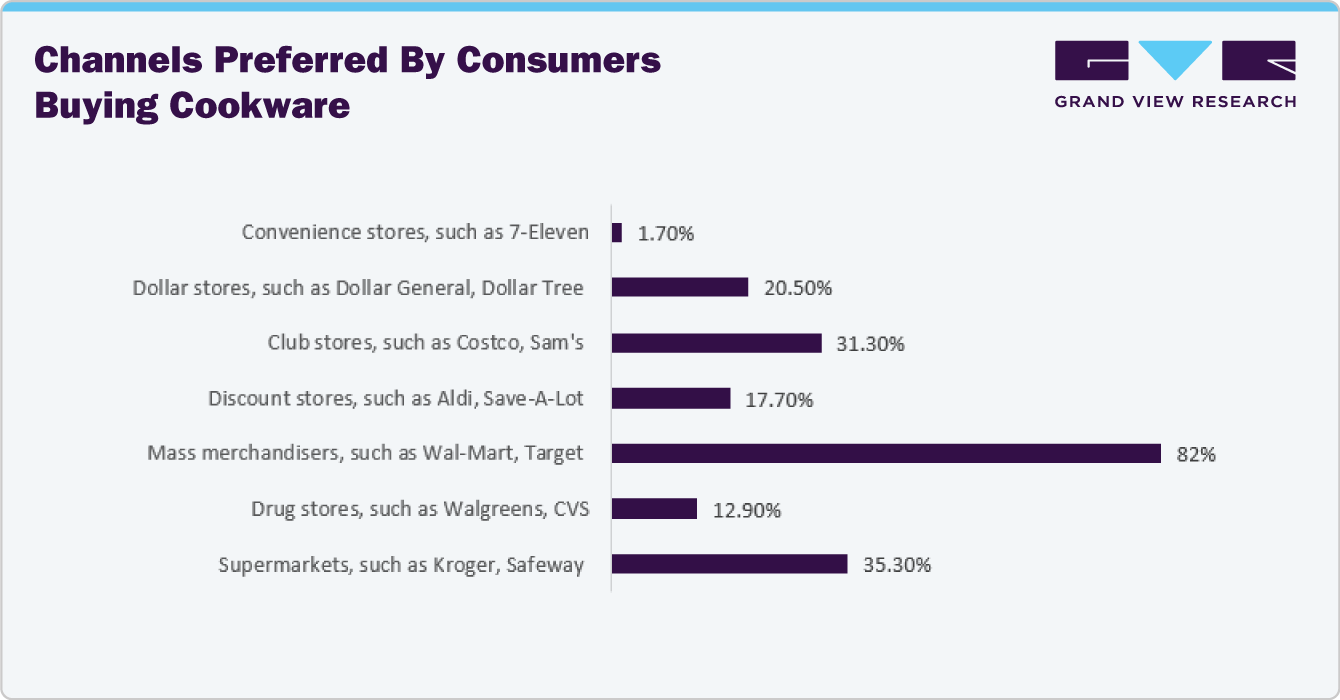

Consumer Insights

According to a consumer survey report by PLMA in 2019, mass merchandisers like Walmart and Target play a dominant role in shaping consumer purchasing behavior for kitchenware and cookware, including ceramic cookware. With 82% of shoppers choosing these retailers, it indicates that convenience, affordability, and product availability are key factors influencing consumer decisions. This trend suggests that ceramic cookware brands looking to expand their market presence should prioritize partnerships with mass merchandisers to reach a wider audience. Offering competitive pricing and strategic in-store placements can further enhance visibility and drive sales among budget-conscious and convenience-seeking shoppers.

The department stores attract 50% of buyers, while supermarkets (35%) and club stores (31%) cater to a smaller but significant portion of the market. This indicates that while department stores remain relevant for premium and branded cookware, supermarkets and club stores may be more effective for impulse purchases and bulk-buying consumers. Ceramic cookware brands can tap into these segments by offering value-driven promotions, bundling products, and leveraging seasonal demand. Overall, the data reflects a diverse shopping landscape where accessibility, affordability, and perceived quality influence consumer choices in the ceramic cookware market.

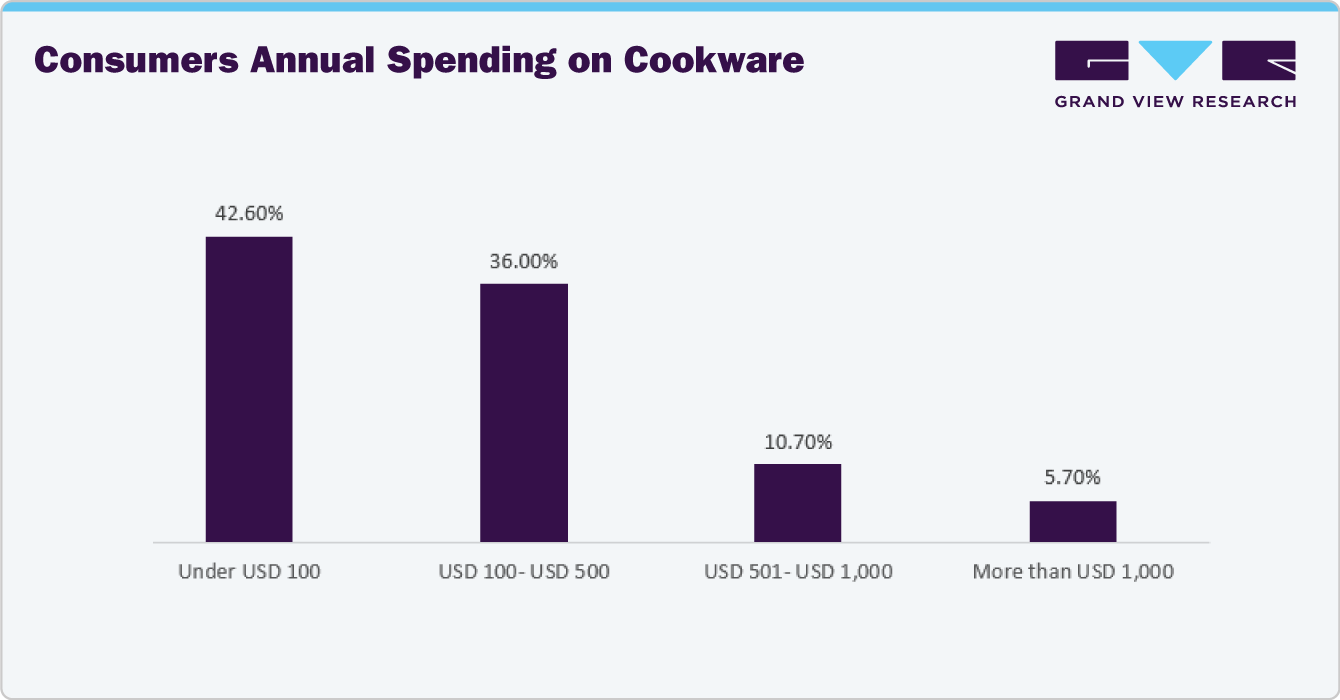

Furthermore, a significant portion of consumers prefer to spend under USD 100 on cookware annually, with 42.6% falling into this budget range. This suggests a strong demand for affordable and budget-friendly options, making mass-market and entry-level products highly competitive. Meanwhile, 36% of consumers allocate between USD 100 and USD 500 for cookware, highlighting a substantial segment willing to invest in mid-range, durable, and high-quality products, including premium ceramic cookware.

Higher spending categories decrease significantly, with only 10.7% spending between USD 501 and USD 1,000 and just 5.7% exceeding USD 1,000 annually. This reflects that while there is a niche market for luxury and professional-grade cookware, the majority of consumers prioritize cost-effective and practical solutions. Brands can use this insight to tailor their product offerings, ensuring a balance between affordability and quality to meet diverse consumer preferences.

Product Insights

The skillet & frying pans segment led the market with the largest revenue share of 32.4% in 2024. Ceramic-coated skillets & frying pans provide a non-toxic cooking surface that allows healthier, low-oil cooking without the risk of releasing toxic fumes. Their even heat distribution ensures consistent cooking results, making them ideal for a wide range of cooking techniques, from frying and sautéing to searing. In addition, modern consumers are increasingly drawn to sustainable kitchen products, and ceramic skillets & frying pans made from natural materials and designed for long-lasting use, align with this trend. The rise in home cooking, driven by health awareness, cost savings, and social media influence, has further fueled demand for aesthetically appealing and easy-to-maintain cookware.

The ceramic grill pans & griddles segment is expected to grow at the fastest CAGR of about 10.8% from 2025 to 2030. With the rise of health-conscious eating, many people are shifting towards grilling as a preferred cooking method because it requires minimal oil while preserving the natural flavors and nutrients of food. In addition, trends such as plant-based diets and high-protein meal plans have fueled interest in grilling vegetables, tofu, lean meats, and seafood, making grill pans an essential tool in modern kitchens. Consumers are also drawn to the ability of ceramic grill pans to create perfectly seared meats and visually appealing grill marks, replicating the experience of outdoor grilling indoors.

End-use Insights

Based on end use, the residential segment led the market with the largest revenue share of 83.36% in 2024. The shift toward home-cooked meals, driven by health-conscious lifestyles, cost savings, and the influence of social media, has led to greater investment in high-quality, durable kitchen essentials. Consumers appreciate the eco-friendly nature of ceramic cookware, as it is made from natural materials and offers long-lasting performance, reducing waste. The aesthetic appeal of ceramic cookware, available in various colors and stylish designs, further enhances its demand as homeowners seek cookware that complements modern kitchen interiors. As more people embrace home cooking as a daily habit, the residential sector continues to drive significant growth in the ceramic cookware market.

The commercial segment is expected to grow at the fastest CAGR of 9.5% from 2025 to 2030. The food service industry is increasingly prioritizing sustainability, and ceramic cookware, known for its long lifespan and environmentally friendly materials, aligns with this trend. As demand for healthier menu options rises, chefs and commercial kitchens are looking for cookware that supports low-oil cooking while maintaining superior heat distribution. The rise of open kitchens and live cooking experiences in restaurants also contributes to this demand, as ceramic cookware’s aesthetic appeal enhances presentation. With the expansion of the hospitality and food service industries, coupled with stricter health and environmental regulations, the adoption of ceramic cookware in commercial settings is expected to grow significantly.

Distribution Channel Insights

Based on distribution channel, the supermarket/hypermarket segment led the market with the largest revenue share of 39.4% in 2024. Supermarkets and hypermarkets offer competitive pricing, frequent discounts, and bundled deals, making them attractive shopping destinations for budget-conscious consumers. In addition, as more people prioritize healthier cooking and sustainable kitchenware, retailers have expanded their selection of ceramic cookware to meet growing demand. The increasing footfall in these stores, driven by one-stop shopping convenience, also contributes to higher sales, as customers can easily add cookware to their household purchases. With established brand trust and strong in-store promotions, supermarkets and hypermarkets remain a dominant distribution channel for ceramic cookware.

The online segment is projected to grow at the fastest CAGR of 9.8% from 2025 to 2030. Online retailers often offer exclusive discounts, seasonal promotions, and flexible return policies, further attracting consumers looking for affordability and convenience. With the expansion of fast and reliable delivery services, more people are opting for online shopping to access high-quality ceramic cookware from the comfort of their homes. As digital shopping habits continue to grow, supported by advancements in technology and secure payment options, the online sales segment is expected to witness significant expansion in the ceramic cookware market.

Regional Insights

The ceramic cookware market in North America is anticipated to grow at a significant CAGR during the forecast period. Many households are shifting toward premium-quality cookware that offers enhanced durability, resistance to scratches, and ease of maintenance, making ceramic cookware a favored choice. The rise of multifunctional kitchens, where cookware serves both practical and aesthetic purposes, has also driven demand for stylish ceramic cookware that seamlessly blends with modern kitchen designs. In addition, busy lifestyles have led consumers to seek cookware that simplifies meal preparation, as well as ceramic cookware’s quick heating capabilities and easy cleanup for those looking for convenience. Moreover, as North American consumers become more brand-conscious, the presence of well-established and emerging ceramic cookware brands offering innovative features has significantly contributed to the market’s growth.

U.S. Ceramic Cookware Market Trends

The ceramic cookware market in the U.S. accounted for a significant revenue share in North America in 2024. The rise of open-concept kitchens in modern American homes has driven demand for visually appealing cookware that complements kitchen aesthetics. Major U.S. retailers such as Walmart, Target, and specialty kitchen stores have expanded their ceramic cookware selections, making it more accessible to consumers nationwide. The convenience of online shopping through platforms like Amazon and direct-to-consumer brands has further fueled growth, as consumers can easily compare reviews and access a wide range of options. Moreover, as American households increasingly seek durable and easy-to-maintain cookware, the preference for ceramic cookware continues to grow, shaping the U.S. cookware market.

Asia Pacific Ceramic Cookware Market Trends

Asia Pacific dominated the ceramic cookware market with the largest revenue share of 34.7% of the global market revenue in 2024. The increasing influence of international cuisines, along with a rising interest in healthy home cooking, has driven consumers to invest in better cookware options, including ceramic cookware. Additionally, the expansion of e-commerce platforms such as Alibaba, Flipkart, and Shopee has made ceramic cookware more accessible, allowing consumers across countries like China, India, Japan, and Australia to explore a variety of brands and products. The popularity of cooking shows, social media influencers, and the influence of Western culinary trends have further fueled demand, making ceramic cookware a preferred choice for modern households in the Asia-Pacific region.

Europe Ceramic Cookware Market Trends

The ceramic cookware market in Europe is anticipated to grow at the fastest CAGR during the forecast period. The rise of modern kitchen designs, where cookware is often displayed, has also driven demand for stylish and aesthetically appealing ceramic cookware. In addition, the expansion of specialty cookware brands across major European markets, including Germany, France, and the UK, has made ceramic cookware more widely available in department stores, home goods retailers, and online marketplaces. The influence of European chefs, cooking shows, and food influencers has further contributed to consumer interest in high-performance cookware.

Key Ceramic Cookware Company Insights

Some of the key companies include Tramontina USA, Our Place, Williams-Sonoma Inc., Wayfair LLC

-

Tramontina USA is a cookware manufacturer known for producing high-quality, durable, and innovative kitchen products. As a subsidiary of the Brazilian brand Tramontina, the company has built a strong reputation in the U.S. market by offering a wide range of cookware, kitchen tools, and household products. In the ceramic cookware segment, the company provides a variety of options, including ceramic-coated frying pans, sauté pans, stockpots, and cookware sets designed for both home cooks and professional chefs. Their ceramic cookware is known for its superior heat distribution, non-stick properties, and easy-to-clean surfaces, making it a popular choice for consumers seeking convenience and performance.

-

Our Place is a modern cookware brand known for its minimalist design, multifunctional products, and commitment to innovation in the kitchenware industry. The company has gained popularity for creating stylish, space-saving cookware that caters to contemporary home cooking needs. In the ceramic cookware market, The company offers the highly popular Always Pan and Perfect Pot, both featuring a non-toxic ceramic coating designed for easy cooking and cleaning. These products are designed to replace multiple kitchen tools, promoting convenience and versatility in everyday cooking.

Key Ceramic Cookware Companies:

The following are the leading companies in the ceramic cookware market. These companies collectively hold the largest market share and dictate industry trends.

- Tramontina USA.

- Our Place

- Williams-Sonoma Inc.

- Wayfair LLC

- Sunbeam Products, Inc.

- Nordic Ware.

- The Cookware Company (USA), LLC.

- Meyer Group

- carawayhome.

- Fissler GmbH

Recent Developments

-

In September 2024, GreenPan announced an expansion to its TUCCI by GreenPan cookware collection, a collaboration with actor and author Stanley Tucci. This exclusive line, available in 34 new ceramic cookware pieces, featured key additions: a 4.5-quart Stanley Pan in six vibrant colors and a 9x13-inch Lasagna Pan designed for both baking and serving. The collection also offers stainless-steel cookware with both uncoated and ceramic nonstick options, ensuring professional-grade performance.

-

In April 2023, Our Place announced the launch of the Always Pan, a multifunctional ceramic cookware piece designed to replace several traditional kitchen tools. This all-in-one pan serves as a frying pan, sauté pan, skillet, saucepan, steamer, saucier, and nonstick pan while also featuring a built-in spatula and spoon rest.

Ceramic Cookware Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.36 billion

Revenue forecast in 2030

USD 9.67 billion

Growth rate

CAGR of 8.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; South Africa

Key companies profiled

Tramontina USA.; Our Place; Williams-Sonoma Inc.; Wayfair LLC; Sunbeam Products, Inc.; Nordic Ware.; The Cookware Company (USA), LLC.; Meyer Group; carawayhome.; Fissler GmbH

Customization

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ceramic Cookware Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ceramic cookware market report based on the product, end-use, distribution channel, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cookware Sets

-

Skillet & Frying Pans

-

Dutch Ovens & Stock Pots

-

Saute Pan

-

Saucepans

-

Grill Pans & Griddles

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supermarket/ Hypermarket

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ceramic cookware market was estimated at USD 5.86 billion in 2024 and is expected to reach USD 6.36 billion in 2025.

b. The global ceramic cookware market is expected to grow at a compound annual growth rate of 8.8% from 2025 to 2030, reaching USD 9.67 billion by 2030.

b. Skillet & frying pans in the ceramic cookware industry accounted for about 32.4% of the market in 2024, due to their versatility, ease of use, and growing consumer preference for healthier, non-toxic cooking solutions. Their ability to provide even heat distribution and require minimal oil makes them a popular choice for home cooks and professionals alike.

b. Some key players operating in the ceramic cookware market include Tramontina USA., Our Place, Williams-Sonoma Inc., Wayfair LLC, Sunbeam Products, Inc., Nordic Ware., The Cookware Company (USA), LLC., Meyer Group, carawayhome., Fissler GmbH

b. Key factors driving the ceramic cookware market include, increasing consumer demand for non-toxic, eco-friendly cookware and advancements in durable, high-performance ceramic coatings.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.