- Home

- »

- Plastics, Polymers & Resins

- »

-

Chemical Recycling Of Plastics Market Size Report, 2030GVR Report cover

![Chemical Recycling Of Plastics Market Size, Share & Trends Report]()

Chemical Recycling Of Plastics Market Size, Share & Trends Analysis Report By Type (Depolymerization, Dissolution), By Product (PE, PET), By End-use (Packaging, Automotive), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-166-8

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

The global chemical recycling of plastics market size was estimated at USD 14.82 billion in 2023 and is expected to grow at a CAGR of 9.4% from 2024 to 2030. The market is witnessing lucrative growth owing to growing global plastic waste crisis and the demand for more sustainable waste management solutions. Chemical recycling is a process of converting plastic waste into chemical feedstocks and other valuable goods using various chemical processes.

The market is predicted to witness significant growth over the forecast period, with several factors driving this expansion. Various government initiatives toward recycling of plastics coupled with high investments is likely to propel demand for chemical recycling of plastics, thus boosting the market growth. Moreover, changing consumer behavior towards sustainability is driving the market.

Increasing use of chemical recycled plastics in various industries such as automotive, electrical & electronics, packaging, textiles, and building and construction is anticipated to boost demand for chemical recycling of plastics. Additionally, increasing government investment in advanced plastics recycling technologies is anticipated to create lucrative opportunities for local market players. For instance, in September 2023, the U.S. Environmental Protection Agency announced an investment of over USD 100 million in grants to increase recycling and trash management, marking agency's first big effort in these areas in 30 years. This aims for a 50% recycling rate by 2030. Recycling rate for plastic garbage is only about 5%. These factors are creating opportunities for the growth of chemical recycling of plastics.

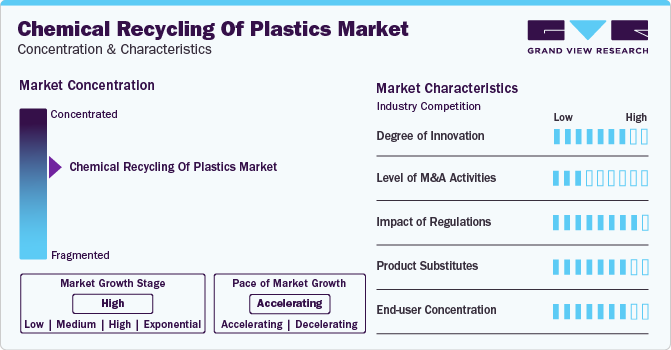

Market Concentration & Characteristics

The chemical recycling of plastics market is highly consolidated, with key participants involved in R&D and technological innovations. Notable companies include Agilyx, BASF SE, Veolia, SABIC, JEPLAN, INC, among others. Several players are engaged in framework development to improve their market share.

Regulations aimed at reducing single-use plastics are likely to drive innovation in the development of alternative materials, affecting the global market. Modifications and updates in the directives are done to increase and improve the process of recycling plastic waste and facilitate several incentives and plans to move toward a circular economy.

Chemically recycled plastics are mainly used as raw materials in production of new polymers, fuels, and other important items. Chemical recycling offers ability to process a larger range of plastic waste streams and generate high-quality feedstocks for production of new polymers. Furthermore, market is being driven by severe environmental regulations, increased consumer concerns about plastic pollution, and a desire for recycled plastic products.

Furthermore, ongoing R&D efforts are aimed at enhancing efficiency and scalability of chemical recycling processes. Advanced technologies such as pyrolysis, de-polymerization, and solvent-based recycling are gaining popularity in the market.

Product Insights

The polyethylene (PE) segment led the market and accounted for largest revenue share of 30.9% in 2023. Polyethylene compounds are widely used in various industries such as automotive, construction, electrical & electronics, and packaging. Construction is one of the major consumer markets for polyethylene compounds with a significant market share in global market.

Chemically recycled polyethylene provides a high moisture barrier, and cost-effectiveness to product making it suitable in production for prototype development in CNC (Computer Numerical Control) machines and 3D printers. Polyethylene offers high stiffness, making it suitable for industrial applications, primarily packing automotive and electrical replacement parts.

End-use Insights

The packaging end-use segment led the market and accounted for a significant revenue share in 2023. Expanding growth of key application industries including as medicines, personal & household care, food & drinks, and global perception of e-commerce are principally driving rise of plastic packaging.

Plastics are widely used due to their high performance, low cost, and long durability. Plastics are used in a variety of packaging materials, including food, beverage, and oil. Furthermore, designed plastic is resistant to extreme environmental conditions and does not degrade under high temperatures, keeping integrity of products such as cosmetics and food and beverages. Furthermore, low cost and high printability of plastic make it a profitable packaging material.

Automotive end-use segment is expected to grow at a significant growth rate in the coming years, owing to the wide usage of recycled plastics in several automotive applications. The growing trend of using eco-friendly and recyclable plastic solutions in vehicles to meet environmental regulations and consumer demand for environmentally friendly products is expected to drive the market growth over the forecast period.

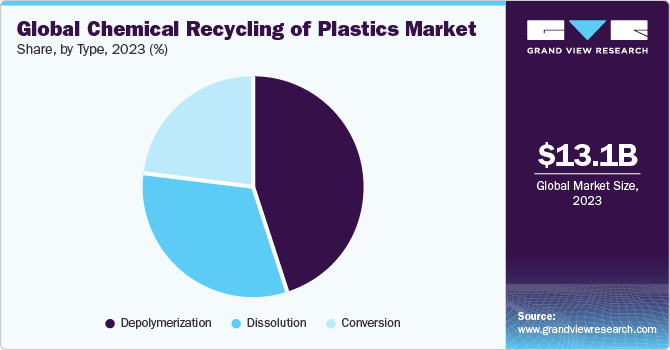

Type Insights

The depolymerization type segment accounted for a substantial revenue share in 2023. Depolymerization offers numerous advantages, including ability to recycle a wide range of plastics, a reduction in greenhouse gas emissions compared to manufacturing of plastics from fossil fuels, and a contribution to circular economy by encouraging reuse of plastic waste.

Plastic waste is depolymerized into oligomers or monomers using procedures such as hydrolysis, glycolysis, methanolysis, heat pyrolysis, among others. Monomers obtained are purified and depolymerized into a product. Demand for recycled materials is increasing in a variety of industries, including food and beverage and consumer goods. Consumption of recyclable polymers is increasing in several sector of economy due to high need for packaging materials that are safe for use in food and drinks.

Furthermore, growing concern about plastic waste, as well as crucial need for more environmentally friendly waste management solutions, are projected to fuel expansion of plastic chemical recycling market. The depolymerization need for plastics chemical recycling is likely to boost market growth.

Regional Insights

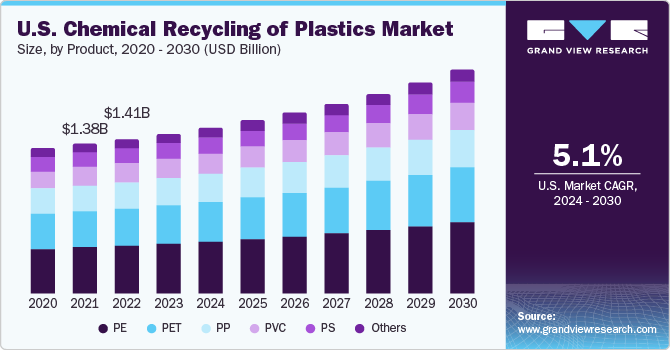

North America market is expected to grow significantly over the forecast period, with market share of 21.0% in 2023, owing to the high demand of chemically recycled plastics from the automotive, electrical & electronics, packaging, and construction sectors.

U.S. Chemical Recycling Of Plastics Market Trends

The U.S. market is expected to grow over the forecast period, due to rising awareness regarding sustainability. However, the plastic recycling rate in the U.S. is low as the plastic waste generated in the country is exported to other countries for recycling.

Asia Pacific Chemical Recycling Of Plastics Market Trends

Asia Pacific dominated the market and accounted for the largest revenue share in 2023. Asian countries such as China, Vietnam, Indonesia, India, and Thailand, Japan are expected to emerge as primary markets for chemical recycling of plastics. Rising demand from various industries such as building & construction, packaging, and automotive, which are more inclined toward adoption of recycled plastics, is expected to drive the market growth.

Chemical Recycling of Plastics Market in China is anticipated to grow at a substantial rate due to its substantial manufacturing sector and population. China has a robust and growing market for recycled plastics due to its substantial manufacturing sector and population. As the government emphasizes environmental sustainability and circular economy principles, there is increasing demand for recycled plastics in various industries.

India Chemical Recycling of Plastics Market is anticipated to grow at a notable CAGR over the forecast period. The introduction of the chemical-based plastic recycling technology to recycle plastic waste to promote sustainability and the circular economy is expected to drive the growth of chemical-based plastic recycling market in the country.

Europe Chemical Recycling Of Plastics Market Trends

Europe accounted for a notable revenue share in 2023 and is expected to grow at a significant rate. Rising adoption of sustainable economy by European Commission for reducing plastic waste is propelling market growth in the region. According to European Commission, the region recycles and manufactures recycled plastics for about 45% of its plastic waste. These recovered plastics are employed in a several industries, including building & construction, automotive, packaging, and electrical and electronics.

Chemical Recycling of Plastics Market in Germany held a significant share in the market in 2023. Germany has high plastic recycling rates compared to other European countries. This is due to the introduction of the Packaging Ordinance (VerpackV), which came into force in December 1991, and a new Packaging Law (VerpackG) that came into force in January 2019 (further amended in 2021).

UK Chemical Recycling of Plastics Market is anticipated to grow over the forecast period. Governmental initiatives such as the Plastic Pact 2025 are expected to positively influence the market in the country.

Central & South America Chemical Recycling Of Plastics Market Trends

Central & South America market is expected to witness significant growth over the forecast period. The region includes Argentina, Brazil, Chile, Colombia, Venezuela, Peru, Ecuador, and others. The emergence of construction companies in Chile and Peru is expected to create growth potential for the market over the forecast period.

Middle East & Africa Chemical Recycling Of Plastics Market Trends

Middle East & Africa market is expected to witness significant growth over the forecast period. A shift in focus toward the non-oil private sector in the region is predicted to boost manufacturing and other end-use industries, as well as diversify the economy of the region. The efforts taken by various governments in the region to support the growth of plastic recycling in the industrial sector and achieve sustainability goals are anticipated to contribute to the growth of the market in the forecast period.

Key Chemical Recycling Of Plastics Company Insights

Key companies are adopting several organic and inorganic growth strategies, such as new product development, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In April 2023, NextChem completed the acquisition of Biorenova's proprietary continuous chemical recycling technology, known as CATC. Biorenova transferred CatC patents, assets, including a demonstration plant, and contracts to MyRemono S.r.l., a newly formed business in which NextChem owns a controlling stake of 51%.

Key Chemical Recycling Of Plastics Companies:

The following are the leading companies in the chemical recycling of plastics market. These companies collectively hold the largest market share and dictate industry trends.

- Agilyx

- BASF SE

- MaireTecnimont S.p.A.

- INEOS AG

- Recycling Technologies

- Veolia Environnement SA

- JEPLAN, INC.

- Eastman Chemical Company

- SABIC

- LyondellBasell Industries Holdings B.V.

Chemical Recycling Of Plastics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.71 billion

Revenue forecast in 2030

USD 26.88 billion

Growth rate

CAGR of 9.4% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

Volume in Kilotons, Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Denmark; Norway; Sweden; China; India; Japan; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Agilyx; BASF SE; MaireTecnimont S.p.A.; INEOS AG; Recycling Technologies; Veolia Environnement SA; JEPLAN, INC.; Eastman Chemical Company; SABIC; LyondellBasell Industries Holdings B.V

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

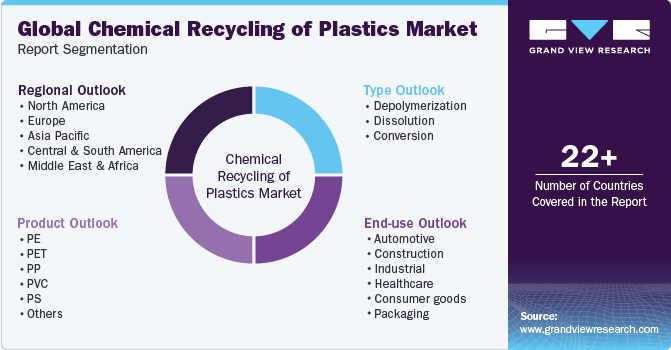

Global Chemical Recycling Of Plastics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global chemical recycling of plastics market report based on type, product, end-use, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Depolymerization

-

Dissolution

-

Conversion

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

PE

-

PET

-

PP

-

PVC

-

PS

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Automotive

-

Building & Construction

-

Electrical & electronics

-

Textiles

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global chemical recycling of plastics market size was estimated at USD 14.82 billion in 2023 and is expected to reach USD 15.71 billion in 2024.

b. The chemical recycling of plastics market is expected to grow at a compound annual growth rate of 9.4% from 2024 to 2030 to reach USD 26.88 billion by 2030.

b. The PE segment led the global chemical recycling of plastics market and accounted for the largest revenue share of more than 32.30% in 2023.

b. Some key players operating in the chemical recycling of plastics market include Agilyx, BASF SE, MaireTecnimont S.p.A., INEOS AG, Recycling Technologies, Veolia Environnement SA, JEPLAN, INC., and Eastman Chemical Company.

b. Key factors driving the chemical recycling of plastic market growth include the growing global plastic waste crisis and the demand for more sustainable waste management solutions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."