- Home

- »

- Consumer F&B

- »

-

Chilled And Deli Foods Market Size & Share Report, 2030GVR Report cover

![Chilled And Deli Foods Market Size, Share & Trends Report]()

Chilled And Deli Foods Market Size, Share & Trends Analysis Report By Product (Meat, Cheese, Prepared Products), By Nature (Conventional, Organic), By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-679-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

The global chilled and deli foods market size was estimated at USD 224.92 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.7% from 2023 to 2030.The popularity of delicatessen, specialty, and fine foods has grown enormously, as consumers’ tastes have become more sophisticated and adventurous. Increasing demand for prepared super foods which are organic, locally sourced, additive-free, and fair-trade products have complemented the overall market growth. According to a report published by Kerry Group in May 2020, 26% of consumers claimed that prepared foods are the most important consideration when they shop for fresh foods, while 66% of consumers buy prepared snacks, meals, and more from retail every month.

The outbreak of the Coronavirus (COVID-19) pandemic has affected the industry majorly with deli counters and supermarkets shutdowns globally. During this panic situation, consumers started buying prepared offerings owing to their higher shelf life and convenient low-temperature storage options leading to innovation in the retail sector. However, there was a shift from comfort foods with plenty of consumers trying to get back on the healthy track after weeks of comfort eating which prompted the demand for high-quality products including deli offerings. Thus, recent events globally are helping to shape the trends thus, driving market growth.

Consumers are on the lookout for better-for-health products with clean label attributes such as ‘all-natural, 100% natural’ and ‘made with real’, and ‘organic.’ These attributes have seemed to gain even more traction since the onset of the pandemic. Meanwhile, the rising pressure on brands to expand their portfolio continues to shift the overall concept of frozen deli offerings toward more plant-based, vegan, and organic ingredients. For instance, in February 2022 California-based startup Prime Roots launched a new line of vegan deli and charcuterie meats made from koji (a Japanese fungus). The new product line includes both classic deli meats such as cracked black pepper turkey, smokey ham, and pepperoni, along with delicacies such as meatless foie gras and pâté.

Prepared meals and superfoods have been a behemoth for supermarket delis in recent years. Ready-to-serve meals, sides, salads, pre-sliced meats and cheeses, and ready-to-heat-and-serve sides offer both familiarity and timesaving for consumers, which has propelled the market growth. According to the report of the International Dairy Deli Bakery Association (IDDBA) published for the year 2020, prepared meats witnessed significant sales increases during 2020 across the categories, including pre-sliced ham, beef, bologna, salami, and pepperoni. These increases in sales ranged from 23% to 95% for the year 2020.

As frozen food brands penetrate the market with new product launches, many of the established brands in the market are focusing on strategies such as online advertising campaigns, re-branding, packaging, and more to get a hold of a new set of consumers. For instance, in April 2021 Land O’Frost, one of the U.S. best-selling brands of pre-sliced deli meats and a producer of specialty meats, announced a brand re-design and three new flavors for its Bistro Favorites meat brand after witnessing Bistro Favorites brand reaching 42% growth in sales in 2020. The new brand design includes a uniquely crafted, hand-drawn Bistro Favorites logo, while ingredients and sandwich imagery provide inspiration and a reminder of the brand’s unique, handcrafted offerings. Such innovative marketing strategies are likely to provide artisanal, and unique engagement with the shoppers.

Growth trends such as mergers & acquisitions in the food & retail industry, especially by key players in the market, are likely to propel market growth. For instance, in December 2021, MamaMancini’s Holdings, Inc., a marketer of specialty pre-prepared, frozen, and refrigerated products announced agreements for the acquisitions of T&L Creative Salads, Inc. and Olive Branch, LLC, which are related premier gourmet food manufacturers based in New York. Both premium gourmet manufacturers sell their salads and prepared products to over 250 delis, bagel shops, smaller retail accounts, and distributors in the New York metropolitan area. Thus, the acquisition would help the company to generate more net income and expand its distribution network.

Product Insights

The prepared products segment dominated the market and held the largest revenue share of 53.5% in 2022 and is expected to maintain its dominance over the forecast period. The fast-paced lives of individuals in developed and developing countries are leading to a preferential shift among the working class from conventional prepared food products such as prepared meals & meats, salads, sandwiches, etc. covering the requirements of chilled & deli foods. Prepared meals ensure customers about high-quality food with good flavors and locally/organically sourced ingredients within an affordable range.

The inclination of consumers, especially millennials towards prepared meals due to hectic lifestyles is likely to bode well with the growing demand. Major brands operating in the segment are likely to capitalize on this product segment to obtain a larger market share by launching new prepared meals. For instance, in February 2021, Hormel Deli Solutions Group launched the Perfect Plate brand offering prepared meals.

The company aimed to capitalize on the prepared meals trend and thus launched five prepared options in the current launch including Brisket Mac & Cheese, Southwest Chicken and Rice, Beef and Broccoli Stir-Fry, Chicken Fettucine Alfredo, Cheese Ravioli in the main course, and four protein recipe starters−Flame Seared Chicken Breasts, Flame Seared Pulled Chicken, Sadler's Smokehouse Smoked Carved Turkey Breast, and Fontanini Italian Meatballs.

However, the spreads, dips, and sauces segment is projected to register the fastest CAGR from 2023 to 2030. Spreads, dips & sauces are likely to gain traction amongst consumers because of their convenience and longer shelf-life. Sauces, dips, and spreads offer convenience and versatility to consumers. They are ready-to-use products that enhance the flavor and enjoyment of various foods.

As consumers' lifestyles become more fast-paced, there is a growing demand for easy-to-use and ready-to-eat products, making sauces, dips, and spreads a popular choice. Consumers are becoming more adventurous in their food choices and seeking new flavors and taste experiences. Sauces, dips, and spreads provide a way to add unique and diverse flavors to meals, allowing consumers to explore different cuisines and culinary experiences.

Nature Insights

The conventional segment dominated the market and held the largest revenue share of 85.5% in 2022 and is expected to maintain its dominance over the forecast period. As demand for chilled and premium foods increases among consumers, the conventional segment is likely to dominate supermarket shelves in major countries such as the U.S. and the UK. Strategic partnerships, product launches, and expansion strategies in the conventional segment by major players are likely to bode well for future market growth. For instance, in March 2020, Target Corp. partnered with meat and condiments brand Boar’s Head to offer pre-packaged meals, conventional raps, premium deli meats, specialty cheeses, spreads such as hummus and condiments with prices ranging from USD 2.99 to USD 8.99 in its deli section.

However, the organic segment is projected to register significant growth during the forecast period. Millennials nowadays are becoming more conscious of their health and wellness and are willing to pay a reasonable price for organic ingredients. According to the YouGov report published in September 2019, in the U.S., one in two millennials, which is approximately 51%, indicated that they are buying more organic food products, while 60% of older millennials aged 33 to 37 years stated that they are buying organic more often. Such factors are likely to boost the demand for organic frozen foods in the near future.

Distribution Channel Insights

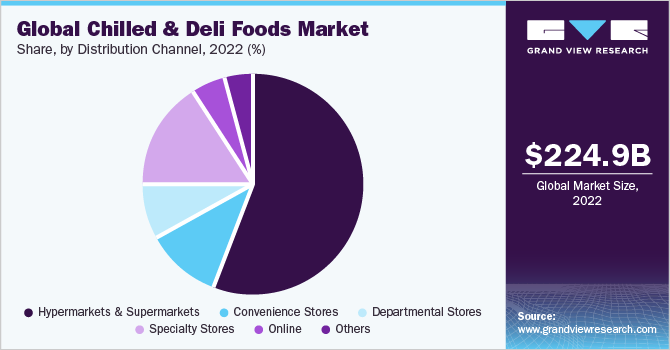

The hypermarkets and supermarkets segment dominated the market and accounted for a revenue share of 56.0% in 2022. Grab-and-go and prepackaged meals dominated the shelves in supermarkets, while some local restaurants and ghost kitchens collaborated with supermarkets to offer their wide range of products. For instance, in February 2021, Unreal Deli announced its supermarket retailers nationwide in the U.S. for chilled deli foods. The supermarket in the U.S. includes Wegman’s, Fresh Thyme, HEB, Whole Foods, Giant Food, Ralph’s stores, and more offering plant-based meats, deli sandwiches made from real vegetables, and protein-rich grains.

The sale of chilled and deli foods through online distribution channels is anticipated to grow at a higher rate during the forecast period. Delicatessen brands have embraced online distribution channels and many deli brands now sell products online. Many producers use e-commerce to sell their goods direct to consumers. For instance, in May 2020 Deliveroo-online food delivery company launched its new virtual brand called Deliveroo Deli to support its Australian restaurant partners as well as smaller grocery and businesses during the COVID-19 outbreak. The virtual platform provides offers groceries such as bread, ready meals, and delis helped consumers during the restrictions on retail and restaurants. Such initiatives are likely to bode well with future segment growth.

Regional Insights

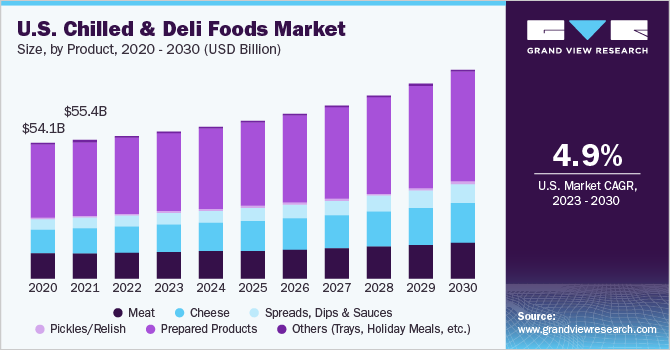

North America accounted for the largest revenue share of 29.0% in 2022. The rising consumption of convenient sources of food products that can be consumed on the go has been supporting the dominance in the region. Several customers supplement their regular meals with chilled products, such as prepackaged sandwiches and prepared salads, while some time-pressed consumers substitute their regular meals with the same. Thus, changing consumer lifestyles, especially in terms of eating habits, and the rising need for convenience meal options are estimated to augment the sales of such products in the region.

There has been a shift in consumer preferences for fresher and healthier food options. Chilled and deli foods are often associated with freshness, as they are made with perishable ingredients and have shorter shelf lives compared to non-perishable foods. Consumers are increasingly seeking out fresh, minimally processed, and high-quality food choices, propelling the growth of the U.S. chilled & deli foods market.

The demand for a wide range of ethnic and international flavors in Europe, driven by the diverse cultural backgrounds of the population, has contributed to the growth of the regional market. This segment incorporates these flavors into its products, offering consumers in Europe a taste of different cuisines. The availability of diverse flavors and the desire for culinary exploration have played a significant role in driving the growth of Europe’s chilled and deli foods market.

Furthermore, the increasing prevalence of on-the-go snacking habits in European countries such as the UK, Germany, and Italy has fueled the demand for convenient and portable food options. Chilled and deli foods, including snack packs, individual portions, and grab-and-go items, are well-positioned to cater to this snacking trend. These products provide a convenient snacking solution for European consumers who are seeking quick bites throughout the day.

In their continuous pursuit of innovation, manufacturers in the UK chilled and deli foods industry are dedicated to introducing new and exciting products. For instance, in 2022, Verdino Green Foods UK made a notable contribution by launching a new deli range consisting of three plant-based options. This exciting range includes mortadella with pistachios, dry-cured salami, and bacon, all crafted to cater to the growing demand for plant-based alternatives in the deli market. By expanding its product offerings with these plant-based options, Verdino Green Foods UK aims to provide consumers with a diverse and flavorful range of choices, aligning with the evolving preferences and dietary needs of consumers.

Asia Pacific is anticipated to be the fastest-growing region with a CAGR of 6.5% from 2023 to 2030. Sales of chilled and deli offerings are growing with the expansion of modern retailers in emerging economies, wherein companies are increasingly investing in cold chain infrastructure for fresh, chilled packaged products. The market is mainly driven by the need for convenience products that need less preparation or consumption time. Retail chains are significantly boosting the demand for savory appetizers.

Consumer preferences have shifted significantly towards ready-to-eat food options, owing to reasons such as busy lifestyles, urbanization, and more disposable income. As a result, there is a growing desire for convenient and quick meal alternatives. Manufacturers have recognized this trend and are capitalizing on it by launching novel chilled and deli food products that meet the special needs of Indian consumers. For example, in August 2022, Pescafresh, India's first direct-to-consumer seafood and meats brand, debuted a new portfolio of specifically made Chicken Deli meats as part of its SaSH22 ready-to-eat and ready-to-cook range.

The advent of modern retail formats like supermarkets, hypermarkets, and convenience stores has aided the expansion of China’s chilled and deli foods sector. These retail formats offer an excellent opportunity for producers to demonstrate and market their products. Australia has a vibrant food service sector, including restaurants, cafes, and takeaway outlets. Chilled and deli foods play a significant role in these establishments, providing ingredients for sandwiches, salads, and deli platters. The growth of the food service industry, coupled with consumer preferences for on-the-go meals, drives the demand for chilled and deli products.

Key Companies & Market Share Insights

The market holds immense potential for international as well as regional players. Emerging entrants, especially in developing countries, are expected to gain increased opportunities to enter the market. Rising establishment of government initiatives and increasing foreign investments in developing the sector, mainly in China and India, are expected to boost industry growth in the coming years. Overall, the global market is highly competitive and dependent on technological advancements along with product development. Industry players strive to achieve local taste and gain a competitive advantage over others. The presence of local players poses a significant threat to large multinational companies in terms of product quality and price offered to customers.

-

In June 2023, MamaMancini's Holdings, Inc, a prominent national marketer and manufacturer of fresh Deli prepared foods, announced its latest venture, Mama's Creations, a brand-new international deli foods platform.

-

In June 2023, Prime Roots made its debut in New York City with the launch of plant-based deli meat. Setting itself apart, Prime Roots is the first and only company that has successfully recreated the microscopic texture and umami taste of meat using plant-based ingredients. With this innovative product, Prime Roots is entering the deli market with a unique offering that caters to individuals seeking meat alternatives derived from plants.

-

In July 2021, Sweet Earth Foods-plant based innovator, announced the launch of its new heat-and-eat breakfast bowls and ready-to-eat deli slices.

-

In April 2021, a new plant-based deli meat company announced its launch in the U.S. after one year of product development. The company offers a wide range of products including plant-based cold cuts, sausages, pâtés created with green banana, golden linseed, grapeseed oil, protein from legumes and seeds, onion, garlic, herbs, and spices.

Some prominent players in the global chilled and deli foods market include:

-

General Mills, Inc.

-

PepsiCo

-

The Kraft Heinz Company

-

Nestlé

-

The Kellogg Company

-

Unilever

-

Calbee

-

Intersnack Group GmbH & Co. KG

-

Conagra Brands, Inc.

-

ITC Limited

Chilled And Deli Foods Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 233.48 billion

Revenue forecast in 2030

USD 350.9 billion

Growth rate

CAGR of 5.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

July 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, nature, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; China; Japan; India; Australia & New Zealand; Brazil; UAE

Key companies profiled

General Mills, Inc.; PepsiCo; The Kraft Heinz Company; Nestlé; The Kellogg Company; Unilever; Calbee; Intersnack Group GmbH & Co. KG; Conagra Brands, Inc.; ITC Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Chilled And Deli Foods Market Report Segmentation

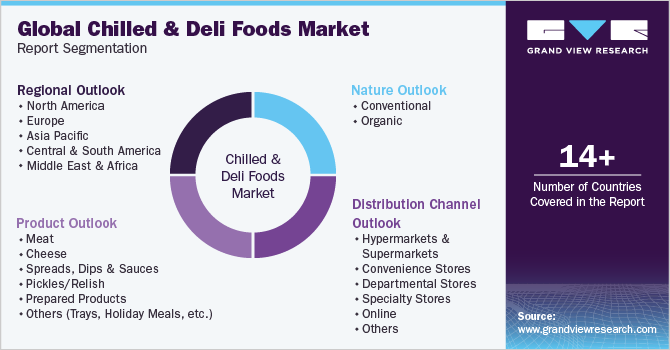

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented thechilled and deli foods market report based on product, nature, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Meat

-

Cheese

-

Spreads, Dips & Sauces

-

Pickles/Relish

-

Prepared Products

-

Prepared Meals & Meats

-

Salads

-

Sandwiches

-

Appetizers

-

Side Dishes

-

Soups

-

Pizza

-

Breakfast

-

Others (Holiday Combos, Desserts)

-

-

Others (Trays, Holiday Meals, etc.)

-

-

Nature Outlook (Revenue, USD Billion, 2017 - 2030)

-

Conventional

-

Organic

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Departmental Stores

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global chilled and deli foods market size was estimated at USD 224.92 billion in 2022 and is expected to reach USD 233.48 billion in 2023.

b. The global chilled and deli foods market is expected to grow at a compounded growth rate of 5.7% from 2023 to 2030 to reach USD 350.9 billion by 2030.

b. Prepared products dominated the global chilled and deli foods market with a share of 53.5% in 2022. This is attributed to the increased demand for prepared food products such as sandwiches, salads, and prepared meals from the working population.

b. Some key players operating in the chilled and deli foods market includes General Mills Inc., PepsiCo, Unilever, The Kellogg Company, Conagra Brands, Inc., Nestlé and ITC Limited.

b. Key factors that are driving the chilled and deli foods market growth include the increased consumer demand for better-for-health products with clean label attributes such as all-natural, 100% natural and organic.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."