- Home

- »

- Automotive & Transportation

- »

-

China Cold Chain Market Size, Share & Growth Report, 2030GVR Report cover

![China Cold Chain Market Size, Share & Trends Report]()

China Cold Chain Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Storage, Transportation), By Temperature Range (Chilled, Frozen), By Application, By City, And Segment Forecasts

- Report ID: GVR-2-68038-113-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

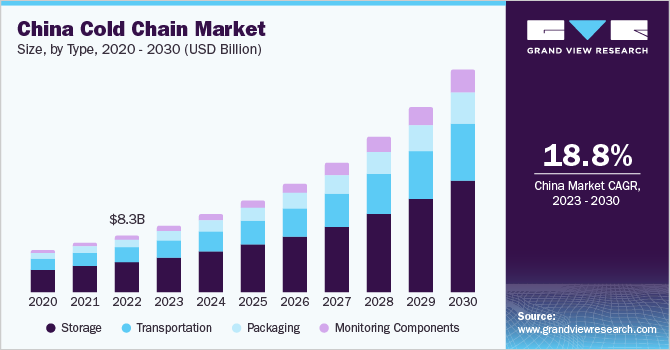

The China cold chain market size was estimated at USD 8.31 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 18.8% from 2023 to 2030. The market is witnessing a remarkable surge in demand, primarily fueled by the rapid expansion of the nation's food and pharmaceutical industries. As the country's population increases and urbanizes, there has been an escalating demand for fresh produce and temperature-sensitive goods. Consequently, this surge in demand has placed substantial pressure on the supply chain to uphold product quality and safety, thereby driving a greater reliance on efficient cold chain logistics. Furthermore, a key factor contributing to the market's expansion is heightened consumer awareness and emphasis on product quality and safety. After recognizing the significance of maintaining the integrity of their products throughout the supply chain, businesses have invested significantly in the development of a robust cold chain infrastructure to instill and preserve consumer trust and confidence.

The proactive role of the Chinese Government in implementing stringent regulations and food safety standards has played a pivotal role in stimulating the cold chain market's growth. For instance, in December 2019, the Chinese Government enacted new laws to bolster food safety standards and practices nationwide. These regulations signify a commitment by the government to improve the safety and quality of food products available to consumers. The authorities introduced more rigorous and comprehensive supervision measures to monitor the food supply chain. Through their concerted efforts to enhance food safety and reduce wastage, the government has fostered an environment conducive to the wider adoption of cold chain practices within the food sector.

RFID technology has emerged as a pivotal driver in the cold chain market, enhancing visibility and efficiency in the entire process. Maintaining optimal product temperatures during transportation and storage is a critical concern among the challenges encountered in the cold chain. In addition, the application of data analytics and AI in the cold chain has revolutionized supply chain management. The processing and analyzing of vast amounts of data collected from various sources enables companies to optimize their operations, forecast potential issues, and derive valuable insights to enhance overall efficiency. The convergence of these technological advancements in the market has revolutionized the landscape, enabling more efficient and reliable transportation and storage of temperature-sensitive goods.

COVID-19 Impact

The COVID-19 pandemic has significantly impacted the China cold chain market. This market encompasses the transportation, storage, and distribution of temperature-controlled food products. Due to the pandemic, there has been a notable shift in consumer behavior towards online grocery shopping and home delivery, resulting in an increased demand for cold chain logistics services. The food supply chain, a complex network involving farmers, processors, distributors, wholesalers, and retailers, has experienced disruptions at every stage, reducing demand for temperature-controlled goods.

Among the temperature-sensitive products, fruits and vegetables have been particularly affected, necessitating careful handling and transportation to maintain their freshness and safety. The closure of restaurants and reduced international trade due to travel restrictions have significantly diminished the demand for these perishable items. Consequently, many farmers have faced challenges selling their produce, incurring substantial losses in the agriculture industry. Moreover, the decreased demand for temperature-controlled products has resulted in increased food wastage, leading to additional economic and environmental concerns.

Type Insights

In terms of type, the storage segment led the market in 2022 and held a revenue share of more than 53%. By Type, the market is segmented into storage, transportation, packaging, and monitoring components. The storage component plays a critical role in the cold chain industry, providing specialized facilities and solutions to maintain perishable food products at optimal low temperatures throughout their journey from production to consumption. This segment is divided into two key categories: reefer containers and warehouses. Several factors, including evolving consumer preferences, population growth, and urbanization, drive the escalating demand for perishable food. In addition, technological advancements have significantly contributed to the increased efficiency and reliability of cold storage solutions, further solidifying their indispensable role in the industry. These temperature-controlled storage systems are paramount in preserving perishable goods' quality, safety, and freshness, such as fruits, vegetables, dairy products, meat, and seafood.

Various cold storage facilities are utilized within the storage segment, including refrigerated warehouses, walk-in coolers, freezers, and refrigerated containers for transportation. These sophisticated storage solutions are meticulously designed to maintain temperature-sensitive items within the required range, effectively preventing spoilage, bacterial growth, and degradation in product quality. As the demand for perishable food rises, the storage component's significance in the cold chain becomes even more pronounced. With the relentless pursuit of technological advancements, these temperature-controlled facilities and solutions continuously strive to optimize their capabilities, ensuring the safe and efficient preservation of perishable goods throughout the entire supply chain. This, in turn, reinforces the cold chain industry's ability to meet consumers' expectations for high-quality and fresh products, thereby driving its continued growth and prominence in the marketplace.

The monitoring components segment is anticipated to witness the fastest CAGR of 24.3% throughout the forecast period. Monitoring components in temperature-controlled food logistics is indispensable, ensuring that perishable goods consistently maintain the required temperature range throughout transportation, storage, and distribution processes. Several key drivers fuel the market for these monitoring components. One significant factor is the growing emphasis on food safety and quality regulations enforced by governments and regulatory bodies worldwide. In response to these stringent requirements, businesses are adopting advanced monitoring technologies to uphold the integrity of their products throughout the entire supply chain.

Essential components in this domain include advanced temperature sensors, data loggers, real-time tracking systems, and sophisticated software solutions. When integrated harmoniously, these components provide accurate and real-time information regarding temperature-sensitive products' storage and transportation conditions. By constantly monitoring temperature fluctuations and potential deviations, these components play a pivotal role in safeguarding perishable items' quality, safety, and freshness. The increasing adoption of these monitoring components is a strategic move by businesses to meet regulatory standards and gain a competitive edge in the market. Maintaining the desired temperature range is crucial to prevent product spoilage, bacterial growth, and deterioration in quality, all of which can harm consumer trust and brand reputation.

Temperature Range Insights

Based on temperature range, the frozen segment led the market in 2022 with a revenue share of more than 59%. Based on temperature range, the market is segmented into chilled, frozen, and deep frozen. The rapid expansion of e-commerce and online grocery platforms has further emphasized the need for reliable frozen temperature range services. The surge in online food purchases necessitates a seamless cold chain infrastructure to deliver frozen products to consumers' doorsteps while upholding the desired temperature throughout the supply chain. The demand for efficient frozen temperature range logistics is fueled by various factors, including the increasing popularity of frozen meat products due to their longer shelf life, convenience, and wider availability.

The growing trend of frozen bakery items as a convenient choice for consumers has led to a surge in demand for reliable cold chain solutions to ensure their quality and appeal upon delivery. The significance of this temperature range extends to the transportation of frozen bakery items such as cakes and bread. These perishable goods require stringent temperature control from production facilities to distribution centers and ultimately to consumers. Ensuring frozen meat products maintain their required low temperatures, typically below -18°C, is essential to preserve their quality, taste, and safety. The cold chain logistics for frozen meat necessitates specialized refrigerated transport vehicles with advanced temperature control systems. These vehicles maintain a consistently low temperature, safeguarding the meat from spoilage, bacterial growth, and degradation during transit.

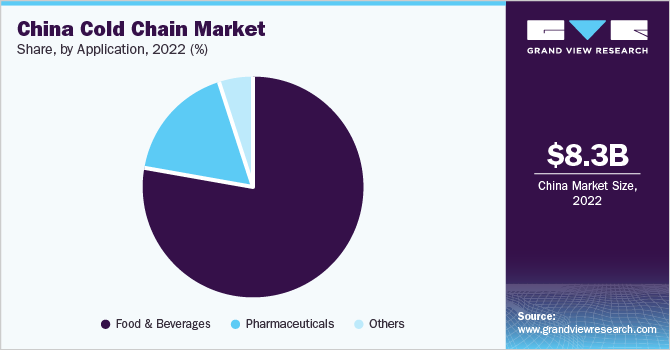

Application Insights

The food & beverages segment led the market in 2022 with a revenue share of more than 77%. Based on application, the market is segmented into fruits & vegetables, fruit pulp & concentrates, fish, meat, and seafood, bakery & confectionary, dairy products, processed food, and others. The market is primarily driven by the growing demand for fresh, high-quality, and safe protein sources that significantly influence the need for efficient cold-chain logistics. The expansion of the food service industry, including restaurants, hotels, and catering services, has escalated the demand for a steady and reliable supply of fish, meat, and seafood. The cold chain ensures these establishments receive a consistent stream of premium products, enabling them to cater to their discerning clientele with delectable and high-quality culinary offerings. Furthermore, China's growing appetite for international cuisine and exotic delicacies has intensified the demand for an efficient cold chain network. Importing and exporting fish, meat, and seafood products necessitate stringent temperature-controlled logistics to ensure the safe and timely delivery of these perishables, thereby expanding the sector's importance in trade.

The processed food segment is anticipated to grow at the fastest CAGR of 20.6% throughout the forecast period. The changing consumer lifestyle and preferences have increased demand for convenient, ready-to-eat food options. Processed food caters to these needs, offering a wide range of convenient and easy-to-prepare meals. Secondly, urbanization and busy schedules have resulted in a growing reliance on processed food products, as they provide a quick and accessible solution for consumers with limited time for cooking. In addition, the expansion of the population and the rise of disposable income have further fueled the demand for processed food, especially in emerging economies. Moreover, advancements in food processing technology and packaging techniques have contributed to the growth of the processed food market. These innovations have improved the quality and variety of processed food products, attracting more consumers to choose these convenient options.

City Insights

In the evolving landscape of the China cold chain market, segmentation based on cities has emerged as a significant approach. As major metropolitan hubs, Beijing and Shanghai have naturally become key players in this segment. These cities, along with other prominent ones like Shandong, Tianjin, Shenzhen, and Guangzhou, have witnessed substantial growth in the cold chain industry due to urbanization, rising consumer demand for perishable goods, and the presence of major industries and trade centers. Numerous international exhibitions and expos are conducted in these prominent cities to foster the growth and development of the cold chain market, serving as platforms for industry stakeholders to showcase their latest innovations, cutting-edge technologies, and logistics solutions. Among these, the Shanghai International Cold Chain Logistics Expo holds particular prominence, drawing participants from across the globe. These exhibitions focus on promoting advancements in the industry, launching new products and services, and demonstrating innovative applications that drive efficiency and sustainability within the cold chain logistics domain.

These exhibitions foster collaboration and knowledge exchange among industry professionals, logistics providers, suppliers, and government agencies. Participants gain insights into the latest trends and best practices, enabling them to make informed decisions and stay ahead in this competitive market. Moreover, these expos drive investments in cold chain infrastructure and technologies, leading to enhanced logistics capabilities and a more resilient supply chain. For businesses operating in the cold chain market, participation in these exhibitions offers unparalleled opportunities for networking, forging partnerships, and expanding their customer base. It enables them to showcase their expertise, products, and services to a diverse and highly targeted audience, propelling their growth and market reach.

Key Companies & Market Share Insights

The cold chain market in China is highly competitive. Major players invest in research & development (R&D) to drive innovation. Some prominent players in the market include John Swire & Sons (H.K.) Ltd., Arcticold Food., Gaishi Group, S.F. Express, Xianyi Holding Group, and Beijing Ershang Group Co. Ltd., among others. These key players in the market are adopting various development strategies such as mergers & acquisitions, product launches, and others to expand their presence and market share. Along with key strategies, these players are introducing new features to improve the customer experience.

In July 2022, Yum China Holdings, Inc. announced the construction of a 61,000 square meter for providing supply chain support to Yum China's restaurants in eastern China. The newly established facility will also serve as a crucial integrated cold chain transit hub for the entire region, bolstering the company's operations throughout the country. The facility's features will encompass ambient temperature storage, cold-chain storage, well-equipped office space, and other essential supporting facilities to ensure seamless and efficient logistics operations. Some of the prominent players in the China cold chain market include:

-

China Merchants Americold Logistics Company Ltd.

-

John Swire & Sons (H.K.) Ltd.

-

Arcticold Food

-

Gaishi Group

-

SF Express

-

Xianyi Holding Group

-

Beijing Ershang Group Co. Ltd.

-

Jinjiang International (Group) Co., Ltd.

-

NICHIREI CORPORATION

-

JD.com

China Cold Chain Market Report Scope

Report Attribute

Details

Revenue Forecast in 2030

USD 32.46 billion

Growth rate

CAGR of 18.8% from 2023 to 2030

Historical data

2017 - 2021

Base year for estimation

2022

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type, temperature range, application, city

Country Scope

China

City Scope

Beijing; Shanghai; Others

Key companies profiled

China Merchants Americold Logistics Company Ltd.; John Swire & Sons (H.K.) Ltd.; Arcticold Food.; Gaishi Group; SF Express; Xianyi Holding Group; Beijing Ershang Group Co. Ltd.; Jinjiang International (Group) Co., Ltd.; NICHIREI CORPORATION; JD.com

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

China Cold Chain Market Report Segmentation

This report forecasts revenue growth at country level and offers a qualitative and quantitative analysis of the market trends for each of the segments and sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the China cold chain market report based on type, temperature range, application, and city:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Storage

-

Facilities

-

Refrigerated Warehouse

-

Private & Semi-Private

-

Public

-

Cold Room

-

-

Equipment

-

Blast Freezer

-

Walk-in Cooler and Freezer

-

Deep Freezer

-

Others

-

-

-

Transportation

-

Transportation (By Mode)

-

Road

-

Sea

-

Rail

-

Air

-

-

Transportation (By Offering)

-

Refrigerated Vehicles

-

Refrigerated Containers

-

-

-

Packaging

-

Crates

-

Insulated Containers & Boxes

-

Large (32 to 66 liters)

-

Medium (21 to 29 liters)

-

Small (10 to 17 liters)

-

X-small (3 to 8 liters)

-

Petite (0.9 to 2.7 liters)

-

-

Cold Chain bags/vaccine bags

-

Ice Packs

-

Others

-

-

Monitoring Components

-

Hardware

-

Sensors

-

RFID Devices

-

Telematics

-

Networking Devices

-

-

Software

-

On-premise

-

Cloud-based

-

-

-

-

Temperature Range Outlook (Revenue, USD Million, 2017 - 2030)

-

Chilled

-

Frozen

-

Deep Frozen

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Food & Beverages

-

Fruits & Vegetables

-

Fruit Pulp & Concentrates

-

Dairy Products

-

Milk

-

Butter

-

Cheese

-

Ice Cream

-

Others

-

-

Fish, Meat, and Seafood

-

Processed Food

-

Bakery & Confectionary

-

Others

-

-

Pharmaceuticals

-

Vaccines

-

Blood Banking

-

Others

-

-

Others

-

- City Outlook (Revenue, USD Million, 2017 - 2030)

-

Beijing

-

Shanghai

-

Others

-

Frequently Asked Questions About This Report

b. The China cold chain market size was estimated at USD 8.31 billion in 2022 and is expected to reach USD 9.71 billion in 2023.

b. The China cold chain market is expected to grow at a compound annual growth rate of 18.8% from 2023 to 2030 to reach USD 32.46 billion by 2030.

b. The storage segment led the China cold chain market and accounted for more than 53% share of the revenue in 2022. Several factors, including evolving consumer preferences, population growth, and urbanization, drive the escalating demand for perishable food. Additionally, technological advancements have significantly contributed to the increased efficiency and reliability of cold storage solutions, further solidifying their indispensable role in the industry.

b. Some key players operating in the China cold chain market include SChina Merchants Americold Logistics Company Ltd., John Swire & Sons (H.K.) Ltd., Arcticold Food., Gaishi Group, SF Express, Xianyi Holding Group, Beijing Ershang Group Co. Ltd., Jinjiang International (Group) Co., Ltd., NICHIREI CORPORATION, JD.com

b. Key factors that are driving the market growth include increasing population and urbanization, escalating the demand for fresh produce and temperature-sensitive goods. Consequently, this surge in demand has placed substantial pressure on the supply chain to uphold product quality and safety, thereby driving a greater reliance on efficient cold chain logistics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.