- Home

- »

- Next Generation Technologies

- »

-

China Industrial Robotics Market Size, Industry Report, 2033GVR Report cover

![China Industrial Robotics Market Size, Share & Trends Report]()

China Industrial Robotics Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Handling, Welding & Soldering, Assembling & Disassembling, Processing, Cleanroom, Dispensing and Others), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-683-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

China Industrial Robotics Market Summary

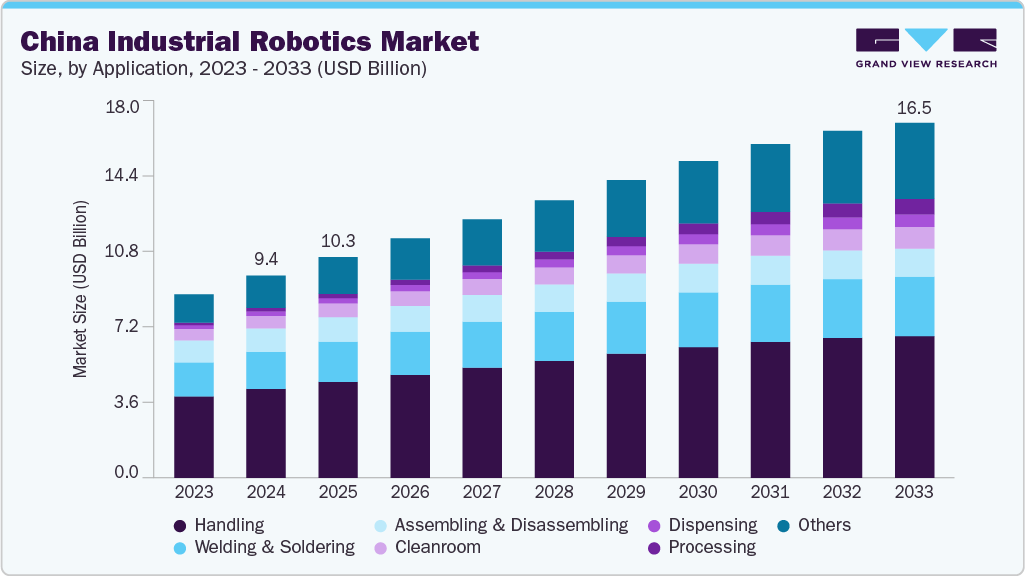

The China industrial robotics market size was estimated at USD 9,423.9 million in 2024 and is projected to reach USD 16,545.0 million by 2033, growing at a CAGR of 6.1% from 2025 to 2033. The rapid automation demand across key manufacturing industries such as electronics and automotive, fueled by rising labor costs and workforce aging in China, is significantly boosting the market growth. Additionally, the rising shift towards smart manufacturing is significantly enhancing productivity, quality control, and operational efficiency, thereby driving the rapid expansion of China’s industrial robotics industry.

China’s growing government initiatives and investments are significantly boosting market demand. For instance, in March 2025, the China National Development and Reform Commission announced the launch of a state-backed venture capital fund aimed at attracting nearly RMB 1 trillion over 20 years to support robotics, AI, and smart manufacturing, underscoring the government's deep commitment to scaling domestic deployment and innovation. By combining heavy investment, targeted policy incentives, and coordinated planning, the government is driving growth in the industrial automation and robotics industry.

Additionally, the rapid advancements in AI-powered industrial robots for various tasks such as floor cleaning, material handling, and assembly are significantly boosting the growth of China's industrial robotics industry. Using advanced AI technologies, these robots improve efficiency, accuracy, and automation across manufacturing and service sectors, lowering labor costs and increasing productivity. The country’s strong emphasis on innovation, expanding production capacity, and growing adoption in automotive, electronics, healthcare, and other industries is expected to propel rapid industry growth in the coming years.

Furthermore, the rise of collaborative robots (cobots) and regional industrial hubs is expanding robotics adoption in China, reaching beyond traditional large-scale manufacturers to include small and medium-sized enterprises (SMEs) and specialized sectors. Chinese cities such as Beijing, Shanghai, Shenzhen, and Guangzhou have become innovation centers focusing on AI, electronics, automotive, and aerospace robotics applications. These regional dynamics are accelerating customized automation solutions across China's vast industrial landscape, democratizing access, fostering innovation, and enabling deeper penetration of robotics nationwide, thereby advancing the Chinese industrial robotics industry.

Moreover, major companies operating in China’s industrial robotics sector are adopting multifaceted strategies to capitalize on the country’s rapid automation growth and government support. Many global leaders and domestic firms are heavily investing in local manufacturing and R&D facilities to customize robots for China’s diverse industrial needs while cutting costs and lead times. For example, in July 2025, ABB Ltd launched three new robot families produced at its Shanghai Mega Factory, integrating AI and cloud technologies to provide flexible, scalable solutions for mid-market and SME customers. Such strategies by leading companies are expected to propel market growth in the coming years.

Application Insights

The handling segment led the market, holding the largest share of over 43% in 2024. This growth is driven by the increasing need for automation in material movement, loading, and unloading processes across manufacturing industries to boost efficiency and decrease reliance on labor. Rising labor costs and workforce shortages in China are speeding up the adoption of robots for handling tasks, especially in electronics, automotive, and consumer goods sectors. Moreover, the deployment of collaborative robots (cobots) that work safely alongside humans, advanced sensor technologies for precise object manipulation, and integration with AI and IoT for real-time monitoring and optimization of handling operations are contributing to this trend.

The processing segment is projected to have the highest CAGR of over 17% from 2025 to 2033. This growth is fueled by advances in robotic technologies that improve precision and consistency in manufacturing processes like welding, machining, and assembly. The move toward smart manufacturing and Industry 4.0 initiatives in China is increasing demand for robots capable of performing complex processing tasks with high accuracy. Moreover, the integration of additive manufacturing (3D printing) and the use of AI-driven robots for adaptive process control are contributing to the segment's growth.

End Use Insights

The electrical/electronics segment captured the largest market share in 2024, driven by the need for high-precision, high-speed automation to meet increasing consumer electronics demand. The country’s role as a global electronics manufacturing hub and government initiatives promoting automation help maintain competitiveness. The use of compact, flexible robots for delicate assembly tasks, advanced AI and vision systems for quality control, and the growing adoption of collaborative robots in electronics manufacturing lines to boost efficiency and reduce human error are fueling the segment's growth.

The chemical, rubber & plastics segment is expected to experience the highest CAGR from 2025 to 2033. This growth is fueled by strict regulatory requirements for the safe handling of hazardous materials and the need to enhance operational safety and efficiency. The use of robots for precise dosing, mixing, and packaging processes, the integration of advanced sensors for real-time monitoring of chemical processes, and the deployment of robust robots capable of functioning in harsh chemical environments to meet safety standards are the main factors driving segment growth.

Key China Industrial Robotics Company Insights

Some of the key players operating in the market include ABB Ltd. and Mitsubishi Electric Corporation, among others

-

ABB Ltd. is a global robotics supplier with a strong foothold in China. The company focuses on mid-sized Chinese enterprises with AI-powered, cost-effective robots tailored for sectors such as electronics, food, and metals. Its localized manufacturing and R&D in China support rapid deployment and customization, aligning with government initiatives such as “Made in China 2025” to accelerate automation adoption among SMEs.

-

Mitsubishi Electric Corporation is a major Japanese multinational providing industrial automation and robotics solutions. The company’s robots are widely used in China’s automotive and electronics industries, supporting precision manufacturing and automation. The company emphasizes innovation in robot control systems and integration with factory automation to enhance productivity.

SIASUN Robot & Automation Co., Ltd and Omron Corporation are some of the emerging market participants in the China industrial robotics market.

-

SIASUN Robot & Automation Co., Ltd is a Chinese robotics manufacturer rapidly growing in the domestic market. The company offers a broad range of industrial robots, including articulated arms, AI-powered inspection systems, and autonomous mobile robots. The company benefits from strong government support and China’s push for indigenous innovation, targeting smart manufacturing and Industry 4.0 transformation across multiple sectors.

-

Omron Corporation is a Japanese automation specialist providing industrial robots, sensors, and control systems. Omron’s robotics solutions in China focus on collaborative robots and AI-driven automation for electronics, food processing, and logistics sectors, aligning with the rising demand for flexible and intelligent manufacturing.

Key China Industrial Robotics Companies:

- ABB Ltd.

- Changzhou Yuanchuan Robot Technology Co., Ltd.

- Comau Group

- DEEP Robotics

- Denso Corporation

- ECOVACS Robotics

- Epson Corporation

- Estun Automation Co., Ltd.

- Fanuc Corporation

- Flexiv Ltd.

- Hangzhou Unitree Robotics Co., Ltd.

- Mitsubishi Electric Corporation

- Nachi-Fujikoshi Corporation

- SIASUN Robot & Automation CO., Ltd

- Yaskawa Electric Corporation

Recent Developments

-

In July 2025, ABB Group announced the launch of three new robot familiesLite+, PoWa, and a redesigned IRB 1200, manufactured at its Shanghai Mega Factory to strengthen its leadership in China’s robotics market.

-

In May 2025, Estun Automation Co., Ltd. launched a 700 kg payload industrial robot aimed at the heavy machinery, automotive, and construction sectors. This development underscores China's growing capabilities in producing high-payload industrial robots.

-

In October 2024, SIASUN Robot & Automation CO., Ltd officially launched the iMRS 2.0 platform, a comprehensive mobile robotics solution designed to address the evolving needs of industries such as automotive manufacturing, new energy power batteries, semiconductors, and photovoltaics.

China Industrial Robotics Market Report Scope:

Report Attribute

Details

Market size value in 2025

USD 10,284.3 million

Revenue forecast in 2033

USD 16,545.0 million

Growth rate

CAGR of 6.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD Million; Volume in Thousand Units and CAGR from 2025 to 2033

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end use

Country scope

China

Key companies profiled

ABB Ltd.; Changzhou Yuanchuan Robot Technology Co., Ltd.; Comau Group; DEEP Robotics; Denso Corporation; ECOVACS Robotics; Epson Corporation; Estun Automation Co., Ltd.; Fanuc Corporation; Flexiv Ltd.; Hangzhou Unitree Robotics Co., Ltd.; Mitsubishi Electric Corporation; Nachi-Fujikoshi Corporation; SIASUN Robot & Automation Co., Ltd.; Yaskawa Electric Corporation.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

China Industrial Robotics Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest technology trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the China industrial robotics market report based on application and end use:

-

Application Outlook (Revenue, USD Million; Volume, Thousand Units; 2021 - 2033)

-

Handling

-

Assembling & Disassembling

-

Welding & Soldering

-

Cleanroom

-

Dispensing

-

Processing

-

Others

-

-

End Use Outlook (Revenue, USD Million; Volume, Thousand Units; 2021 - 2033)

-

Automotive

-

Electrical/Electronics

-

Metal/Heavy Machinery

-

Chemical, Rubber, & Plastics

-

Food

-

Others

-

Frequently Asked Questions About This Report

b. The China industrial robotics market size was estimated at USD 9,423.9 million in 2024 and is expected to reach USD 10,284.3 million in 2025.

b. The China industrial robotics market is expected to grow at a compound annual growth rate of 6.1% from 2025 to 2033 to reach USD 16,545.0 million by 2033.

b. The handling segment dominated the market with a share of over 43% in 2024, driven by the increasing need for automation in material movement, loading, and unloading processes across manufacturing industries to improve efficiency and reduce labor dependency.

b. Some of the key players operating in the China industrial robotics market include ABB Ltd., Mitsubishi Electric Corporation, Yaskawa Electric Corporation, Comau Group, DEEP Robotics, and Denso Corporation, among others.

b. The growing demand for automation, the rising shift towards smart manufacturing, the growing government initiatives and investments, and the rapid advancements in AI-powered industrial robots for diverse tasks such as floor cleaning, material handling, and assembly are the key factors driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.