- Home

- »

- Animal Health

- »

-

China Veterinary Medicine Market Size, Industry Report 2030GVR Report cover

![China Veterinary Medicine Market Size, Share & Trends Report]()

China Veterinary Medicine Market Size, Share & Trends Analysis Report By Product (Biologics, Pharmaceuticals), By Animal Type (Production Animals, Companion Animals), By Route Of Administration, By Distribution Channel, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-230-7

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

China Veterinary Medicine Market Trends

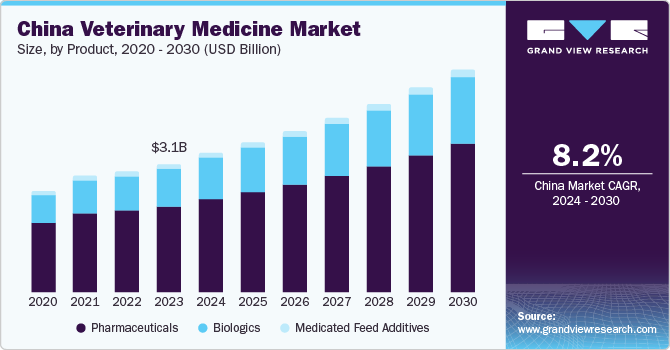

The China veterinary medicine market size was estimated at USD 3.12 billion in 2023 and is projected to grow at a CAGR of 8.2% from 2024 to 2030. Increasing trend of pet ownership, the growth of animal-related businesses, and the rising awareness about animal health are some of the major factors driving the market growth. The awareness campaigns and initiatives undertaken to encourage the adoption of pets in the country are contributing to the increased demand for veterinary medicines in China. In March 2022, Taobao, a Chinese e-commerce company, hosted a runway show that focused on stray animal adoption in the country. Such initiatives are anticipated to boost the animal adoption rate further driving market growth.

China accounted for 6.7% of the global veterinary medicine market in 2023. This can be attributed to the increasing pet ownership and awareness of the benefits of pet companions. Moreover, the growing internet connectivity and social media usage have made it easier for pet owners to share their pet lifestyle on platforms encouraging people to adopt pets. According to a Chinese pet industry website, petadoop.com, the number of urban pet owners in China reached 70.43 million in 2022, a 2.9% year-on-year increase. This rising pet adoption in urban areas, owing to the ability to afford pet expenses and veterinary care, is expected to increase the demand for veterinary medicine in the country and fuel market growth.

The growing pet adoption in the country is gaining the attention of several global market players, which has increased investments and veterinary services, thereby developing the country’s veterinary industry and driving market growth. For instance, in September 2020, Boehringer Ingelheim International GmbH announced that the company had acquired a stake in China-based New Ruipeng Group (NRP Group). The partnership aims to deliver quality care, better solutions, and professional assistance to the country's increasing number of pet owners. The increasing penetration of veterinary service providers increases awareness of pet adoption in the country and contributes to market growth.

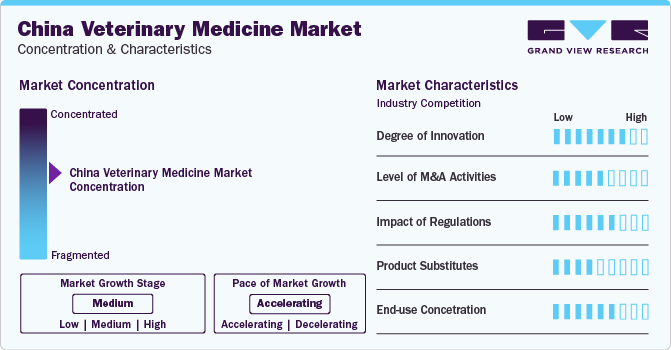

Market Concentration & Characteristics

The market growth stage is medium and the pace of growth is accelerating. The China veterinary medicine market is characterized by a high degree of innovation as the market players have to deal with the rise of new animal diseases and infections. Moreover, the players are focusing on developing accessible and effective ways of medicine delivery to ensure better results of the medicine on animal health.

The Chinese veterinary medicine market is characterized by a moderate level of merger and acquisition (M&A) activity as the market players are using several different strategies to get a competitive edge in the market, such as the development of new medicine, partnerships, and expansions to reach a more extensive customer base.

The regulatory framework plays a vital role in the market for veterinary medicine in China. The veterinary drugs in the country are primarily regulated by the Ministry of Agriculture and Rural Affairs (MARA) and the Institute of Veterinary Drug Control (IVCD) in China. These entities lay down the regulatory framework for using and commercializing veterinary drugs to ensure their safety and effectiveness. This regulatory control benefits the market by improving the quality of animal care in the country.

The product substitutes for medical devices are limited as veterinary medicines are crucial for disease prevention, treatment, and care of animal health. Moreover, veterinary doctors and animal owners can consider several factors before substituting medicines, such as safety, ingredients, regulatory compliance, and many others. These factors limit the substitute for the products in the market.

The end-user concentration of the China veterinary medicine market is moderately high due to the presence of dominant large-scale animal farms, dairy-related businesses, and an increasing number of pet owners. Moreover, the increasing government focus on the breeding industry can further influence the end-user concentration.

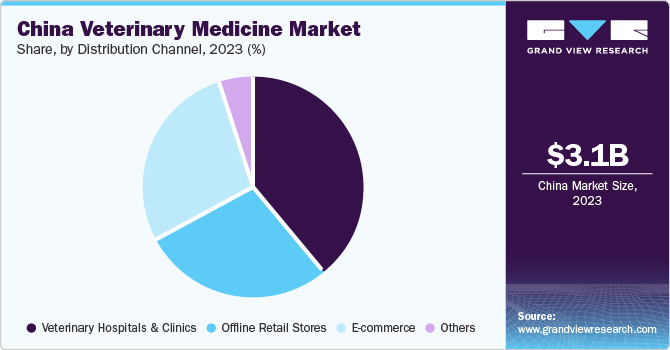

Distribution Channel Insights

The veterinary hospitals and clinics segment accounted for the largest revenue share in 2023. This can be attributed to the high penetration of veterinary hospitals and clinics in China. The increasing demand for veterinary services is increasing the investments and penetration of veterinary hospitals, thereby contributing to the segment’s growth. For instance, in September 2020, Tencent invested in the New Ruipeng Pet Healthcare Group. This group runs around 1400 pet hospitals in 80 cities in China, providing services such as medical treatment, vaccination, sterilization, and others. This increasing investment and wide presence of veterinary hospitals and clinics are contributing to the segment share.

The e-commerce segment is anticipated to grow at the fastest CAGR over the forecast period. This can be attributed to the growing pet ownership in the young generation, which has a larger preference for e-commerce than other distribution channels. Moreover, the offerings of e-commerce, such as the delivery of medicine to the door, a wide range of products, and the ability to choose among the best products at the best prices, are further attracting the attention of customers towards e-commerce. This ease of getting veterinary medicine through e-commerce is driving the segment growth.

Product Insights

The pharmaceutical segment accounted for the largest revenue share of over 65% in 2023, owing to the growing production of meat and milk products and the increasing demand for veterinary drugs. Pharmaceuticals account for the major veterinary medicine available in the market, boosting their demand. According to China’s Ministry of Agriculture and Rural Affairs, meat production in China is expected to rise to 93.1 metric tons in 2025 and 95.7 million metric tons in 2031 from 89 million metric tons in 2021. This increasing meat production increases the demand for pharmaceuticals to ensure better health of animals and protection from zoonotic diseases.

The biologics segment is expected to grow at the fastest CAGR of 9.2% over the forecast period, owing to the increasing R&D activities and government support for developing advanced biologic drugs. For instance, in May 2022, the Ministry of Agriculture and Rural Affairs (MARA) the number of animals used for clinical experimentation to develop biological products was reduced from a minimum of 200 to a minimum of 50 animals to simplify the requirement of clinical approvals of veterinary biological products. This increasing government support for the R&D activities associated with veterinary biologics is anticipated to drive market growth over the forecast period.

Animal Type Insights

The production animals segment accounted for the largest revenue share in 2023. This can be attributed to the increasing demand for dairy and the focus on better health of production animals. The country's gigantic population of production animals is attracting investment in the country's dairy industry, contributing to the segment’s growth. For instance, in April 2021, KKR, a global investment company, invested in Adopt A Cow, a Chinese direct-to-consumer company. This investment was used to construct smart production factories and modernize dairy farms in the country to bring high-quality dairy products to China. These increasing investments and growing focus on the businesses associated with production animals are contributing to the segment share.

The companion animals segment is expected to witness the fastest CAGR over the forecast period. This can be attributed to the rising adoption and care of companion animals and increasing pet care services. China is witnessing a surge in pet care providers, with the rise in the number of pets in the country. Moreover, the increasing telemedicine and e-commerce services are increasing the access of remote pet owners to pet healthcare services, contributing to this segment’s growth. For instance, in October 2021, JD Health, a tele-healthcare platform, announced an extension of its services to pets with the launch of JD Pet Hospital. This O2O platform covers the entire lifetime of pets, from diagnosis disease prevention to health management. This increasing pet owners' access to pet health services is anticipated to drive the segment’s growth.

Route of Administration Insights

The injectable segment accounted for the largest revenue share in 2023. This can be attributed to the supportive regulatory framework and advantages of delivering medicine to the animals through injectables, such as regulated dosage. Some injectables work as long-term doses for animal treatment, eliminating the need for regular monitoring and administration of animal health. In June 2020, Boehringer Ingelheim International GmbH. announced that the company's Ingelvac CSF MLV, a classical swine fever live vaccine, was approved by the Ministry of Agriculture and Rural Affairs of China. This vaccine provides a disease solution and immunization program to the country's pig farming industry. This vaccine /injectable development supportive regulatory framework and advantages of injectables are contributing to the segment's growth.

The topical segment is expected to witness a significant CAGR over the forecast period. The tropical route of administration is primarily used for the local treatment of skin and controlling external and internal parasites. The wide range of topical delivery solutions such as cream, ointment, paste, gel, lotion, and others offer a variety of topical administration alternatives for animal health monitoring. Moreover, the topical method provides a non-invasive way of medicine delivery and is easy to administer. These advantages of the topical method are expected to fuel the segment growth over the forecast period.

Key China Veterinary Medicine Company Insights

Some of the key market players include China Animal Husbandry Industry Co. Ltd.; Boehringer Ingelheim International GmbH; and Bimeda, Inc.

-

China Animal Husbandry Industry Co. Ltd. is a “National Agricultural Industrialization Initiative” flagship company. The company has rich technical experience in treating and preventing animal diseases and has cultivated in the field of animal healthcare and biotechnology.

-

Boehringer Ingelheim International GmbH is active in China since 1994. The company is expanding in the Chinese market with acquisitions, partnerships, and the launch of veterinary medicines to improve animal health in the country.

Zoetis Services LLC, Virbac SA, and Vetoquinol are some of the emerging market participants.

Key China Veterinary Medicine Companies:

- China Animal Husbandry Industry Co. Ltd.

- Boehringer Ingelheim International GmbH

- Bimeda, Inc.

- Merck & Co., Inc.

- Ceva

- Zoetis Services LLC

- Virbac SA

- Vetoquinol

Recent Developments

-

In November 2023, Bimeda, Inc., an Irish animal health company, announced the opening of its state-of-the-art sterile injectable manufacturing facility in China. This facility is expected to increase the company’s portfolio for a growing consumer base in both China and the AMEA-ANZ region.

-

In May 2023, Kuehne+Nagel announced a partnership with Elanco, an animal healthcare company in China. The company opened a manufacturing warehouse and a distribution center for Elanco's finished goods. This partnership is expected to increase Elanco’s footprint in China’s fast-growing animal healthcare market.

-

In August 2018, Boehringer Ingelheim International GmbH launched NexGard Spectra, an oral endectocide for dogs. This product can assist the owners in treating six common types of ecto and endo parasites simultaneously.

-

In April 2018, Zoetis Inc. started the construction of a vaccine manufacturing and R&D facility in China. The facility focuses on the development of vaccines for cattle, swine, fish and companion animals to protect them from prevalence diseases in China.

China Veterinary Medicine Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 5.39 billion

Growth rate

CAGR of 8.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, animal type, route of administration, distribution channel

Key companies profiled

China Animal Husbandry Industry Co. Ltd.; Boehringer Ingelheim International GmbH; Bimeda, Inc.; Merck & Co., Inc.; Ceva; Zoetis Services LLC; Virbac SA; Vetoquinol

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

China Veterinary Medicine Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the China veterinary medicine market report based on product, animal type, route of administration, and distribution channel:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Biologics

-

Vaccines

-

Modified/Attenuated Live

-

Inactivated (Killed)

-

Other Vaccines

-

-

Other Biologics

-

-

Pharmaceuticals

-

Parasiticides

-

Anti-infectives

-

Anti-inflammatory

-

Analgesics

-

Others

-

-

Medicated Feed Additives

-

-

Animal Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Production Animals

-

Poultry

-

Pigs

-

Cattle

-

Sheep & Goats

-

Others

-

-

Companion Animals

-

Dogs

-

Cats

-

Horses

-

Others

-

-

-

Route of Administration Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oral

-

Injectable

-

Topical

-

Other Routes

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

E-commerce

-

Offline Retail Stores

-

Others

-

Frequently Asked Questions About This Report

b. The China veterinary medicine market size was estimated at USD 3.12 billion in 2023 and is expected to reach USD 3.35 billion in 2024.

b. The China veterinary medicine market is expected to grow at a compound annual growth rate (CAGR) of 8.2% from 2024 to 2030 to reach USD 5.39 billion by 2030.

b. The production animals segment dominated the market with the largest market share of 59.0% in 2023. This high share is attributable to the increasing focus on the health of production animals and the rising demand for the dairy industry in the country.

b. Some of the key players operating in the China veterinary medicine market include China Animal Husbandry Industry Co. Ltd., Boehringer Ingelheim International GmbH, Bimeda, Inc., Merck & Co., Inc., Ceva, Zoetis Services LLC, Virbac SA, Vetoquinol, among others.

b. Key factors driving the market growth include increasing pet ownership, rising livestock production, the emergence of new animal diseases, and increasing animal health awareness.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."