- Home

- »

- Consumer F&B

- »

-

Chocolate Confectionery Market Share Report, 2030GVR Report cover

![Chocolate Confectionery Market Size, Share & Trends Report]()

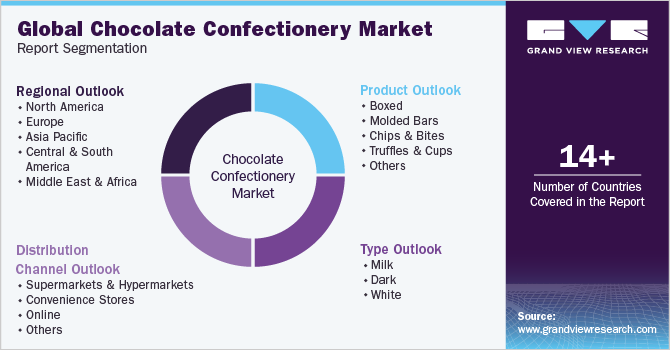

Chocolate Confectionery Market Size, Share & Trends Analysis Report By Product (Boxed, Molded Bars), By Type (Milk, Dark), By Distribution Channel (Supermarkets & Hypermarkets, Online), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-294-5

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Report Overview

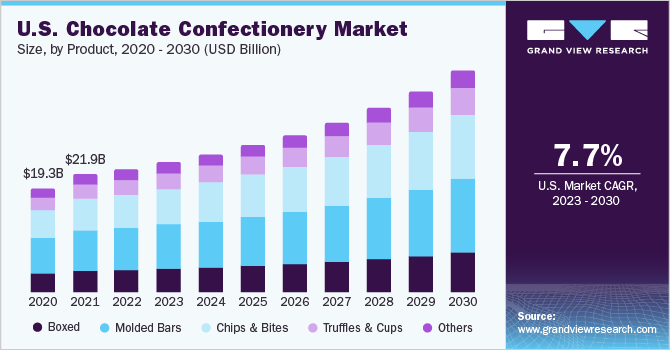

The global chocolate confectionery market size was valued at USD 186.32 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.7% from 2023 to 2030. According to the National Confectioners Association (NCA), sales of chocolate confectionery products through supermarkets increased by 17.9% between March 2020 to August 2020 as compared to the same period last year. Furthermore, demand for high-quality products is getting stronger among the consumers, which is likely to propel market growth. According to the survey conducted by Cargill’s North America Cocoa & Chocolate team of 600 U.S. grocery shoppers in February 2021, approximately one-third of the Americans in the country increased chocolate consumption during the pandemic. Approximately 72% of surveyed consumers claimed that chocolate uplifted their moods, while 59% stated it supports their energy while working from home during the lockdown. Such facts are likely to bode well for future market growth.

Consumers in the market are looking out for premium confectionery products, which include a wide range of textures and premium quality. According to a report by Barry Callebaut proprietary study 2019, approximately 55% of consumers globally are willing to pay for products with multiple flavors, textures, and premium quality. The key brands in the market are capitalizing on such demands. For instance, in September 2021, premium brand Baron Chocolatier launched a product line of bars exclusively at Dollar Stores in the U.S. The product range consists of five bars in three flavors such as peanut butter, milk mousse, and creamy caramel. These bars are certified Kosher, trans-fat-free, and non-GMO.

Furthermore, an increasing number of consumers globally are following healthy eating lifestyles that have specialized needs and demand “better-for-me” alternatives, as health & wellbeing have become a top priority. According to Cargill’s ChocoLogic research in February 2021, 52% of consumers in the U.S. purchase dark chocolate confectionery products due to the perception of health benefits associated with it. Such factors are likely to complement the overall market growth for healthier products.

Consumers consider a variety of factors when shopping for confectionery products, with many purchasing premium items. The premium confectionery products in the chocolate segment have been growing in recent years as brands launch products with label claims such as vegan, cruelty-free, organic, and paleo, aimed at differentiating their offerings with healthier titles. For instance, in October 2021, Cadbury announced the launch of a vegan milk bar in Britain in two flavors such as Cadbury Plant Bar Smooth Chocolate and Cadbury Plant Bar Smooth Chocolate with Salted Caramel pieces.

Many key companies have been acquiring premium chocolate brands to expand their brand portfolio. For instance, in January 2021, MondelÄ“z International acquired Hu Master Holdings, a manufacturer of premium snacks made from simple ingredients, at USD 340 million. The brand is paleo-friendly and clean-label, which would further expand the company’s product offerings in the U.S.

Product Insights

Molded bars chocolate confectionery accounted for the largest share of 35.5% in 2022 and is expected to maintain its dominance during the forecast period. Bar chocolates are the most consumed chocolate form in the world. They are popular among consumers owing to their convenient size. Product launches in this segment by key players are driving the segment growth. For instance, in January 2020, Hershey India Private Ltd, the Indian subsidiary of the American confectionery manufacturer, launched molded bars in India under its flagship Hershey’s brand. The product is available in grocery stores, supermarkets, and e-commerce platforms, such as Amazon.

However, the chips & bites chocolate confectionery is expected to grow at the fastest CAGR of 7.9% from 2023 to 2030. With the rising demand for premium products for various festivals and small occasions, the demand for chips & bites is also rising. The trend of home cooking and preparing uncommon dishes, especially bakery items, while all the bakeries and restaurants were shut, was observed across the globe. The adoption of the product is increasing remarkably among millennials and centennials.

Type Insights

Milk chocolate confectionery accounted for the largest share of 56.6% in 2022. According to a survey published by YouGov PLC in February 2021, stated that approximately 49% of Americans in the U.S. are partial to milk chocolates. With a rising preference for milk type category, many companies have been launching new products with clean labels such as organic, vegan, and certified Kosher to expand the existing product portfolio. For instance, in October 2020, Hershey launched a new "Oat Made" line of bars, which is organic and contains less sugar.

However, the dark type segment is projected to register the highest growth during the forecast period. In the past few years, the popularity of the product among consumers, especially in Asian countries, has increased with shifting taste preferences and growing awareness about the many health benefits of dark chocolate. Citing these trends, numerous product manufacturers are launching various products ranging from vegan to organic in the market. For instance, in March 2021, Nestlé launched Incoa in France and the Netherlands. It is a 70% dark chocolate bar made of cocoa fruit under its Les Recettes de L’Atelier brand.

Distribution Channel Insights

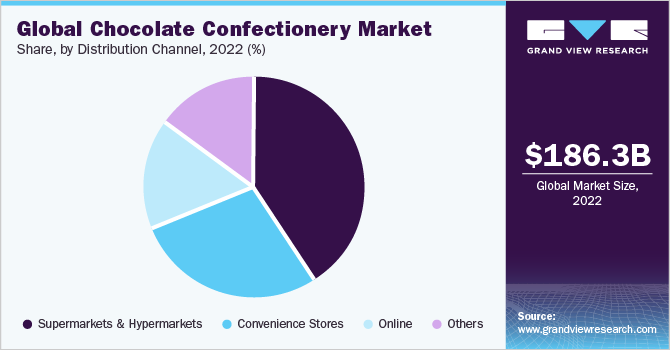

The hypermarkets and supermarkets accounted for the largest market share of 41.4% in 2022 in the chocolate confectionery industry. The segment is projected to retain its dominance throughout the forecast period, owing to the high consumer inclination toward shopping for grocery products from supermarkets. Most of the products launched by companies are debuted at big supermarkets & hypermarkets, such as Walmart, Tesco, and Kroger, due to their larger customer base. Furthermore, the availability of both premium and private label brands at these stores boost sales through these distribution channels.

The online distribution channel is anticipated to be the fastest-growing segment during the forecast period. The shift in consumers’ shopping behavior is one of the major factors driving product sales through online channels. Growing consumer preference for online platforms has prompted companies to offer products through this channel. Many brands have been penetrating through online platforms globally as they provide fewer entry barriers, and products can be shipped by online companies or third-party distributors, such as Amazon.

Regional Insights

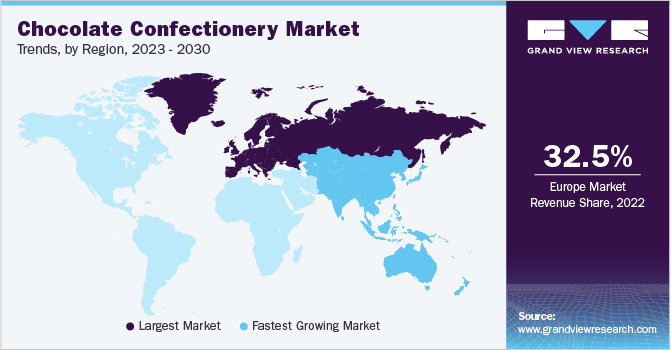

Europe accounted for the largest share with 32.5% in 2022. France and Belgium have witnessed considerable growth in the recent past. The regional market growth is driven by increased production of artisanal chocolates, constant innovations in terms of flavors, and in-store promotions. Consumers are looking for high-quality products that are good for their health and the environment. The robust food & drinks industry in Europe is likely to boost the market growth in this region as well during the forecast period. Several prominent market players such as Barry Callebaut, Chocoladefabriken Lindt & Sprüngli AG, Nestlé (all based in Switzerland), and Ferrero (Italy) are also present in the European region.

Asia Pacific is anticipated to be the fastest-growing region from 2023 to 2030. This growth is attributed to the increasing target young and millennial population in the region. Moreover, the growing population, increasing consumer disposable income, and rising awareness about such products are contributing to the regional market growth. Furthermore, new product launches in the region by international players are likely to bode well with the regional growth.

Key Companies & Market Share Insights

The market is competitive, owing to the presence of many global and domestic companies. Various strategies, such as introducing innovative product offerings into the market and marketing & promotions, are being adopted by these key market players to increase the outreach of their products and expand their presence into emerging markets.

-

In May 2023, Ferrero USA, the renowned Italian confectionery brand, has announced that Kinder Chocolate will be available in the U.S. for the first time, starting in August 2023.

-

In September 2022, Ferrero has introduced its new Rocher Premium Chocolate Bars, which is made available in four diiferent flavors: Original Milk Hazelnut, 55% Dark Hazelnut, White Hazelnut, and Hazelnut & Almond.

-

In July 2021, Barry Callebaut announced the acquisition of Europe Chocolate Company (ECC), a Belgian-based private B2B chocolate specialties manufacturer.

Some of the key players operating in the global chocolate confectionery market are:

-

The Hershey Company

-

Ferrero

-

Chocoladefabriken Lindt & Sprüngli AG

-

Mars, Incorporated

-

Mondelēz International

-

Nestlé

-

CEMOI Group

-

Barry Callebaut

-

Lake Champlain Chocolates

- LOTTE

Chocolate Confectionery Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 194.96 billion

Revenue forecast in 2030

USD 312.65 billion

Growth rate

CAGR of 6.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America and Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; Saudi Arabia

Key companies profiled

The Hershey Company; Ferrero; Chocoladefabriken Lindt & Sprüngli AG; Mars, Incorporated; MondelÄ“z International; Nestlé; CEMOI Group; Barry Callebaut; Lake Champlain Chocolates; LOTTE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chocolate Confectionery Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global chocolate confectionery market based on product, type, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Boxed

-

Molded Bars

-

Chips & Bites

-

Truffles & Cups

-

Others

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Milk

-

Dark

-

White

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global chocolate confectionery market size was estimated at USD 186.32 billion in 2022 and is expected to reach USD 194.96 billion in 2023

b. The global chocolate confectionery market is expected to grow at a compound annual growth rate of 6.7% from 2023 to 2030 to reach USD 312.65 billion by 2030.

b. Europe dominated the chocolate confectionery market with a share of 32.5% in 2022. This is attributable to the increased production of artisanal chocolates and constant innovations in terms of flavors, and in-store promotions.

b. Some key players operating in the chocolate confectionery market include The Hershey Company; Ferrero; Chocoladefabriken Lindt & Sprüngli AG; Mars, Incorporated; Mondelēz International; Nestlé; CEMOI Group; Barry Callebaut; Lake Champlain Chocolates; LOTTE

b. Key factors that are driving the chocolate confectionery market growth include increasing demand for premium chocolates with claims such as vegan, gluten-free, organic, etc. Moreover, the role of chocolate consumption in the upliftment of mood is also expected to boost the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."