- Home

- »

- Alcohol & Tobacco

- »

-

Cider Market Size, Share And Growth, Industry Report, 2030GVR Report cover

![Cider Market Size, Share & Trends Report]()

Cider Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Sparkling, Still, Apple Wine), By Source (Apple, Fruit Flavored, Perry, Other Vegan Sources), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-2-68038-877-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cider Market Summary

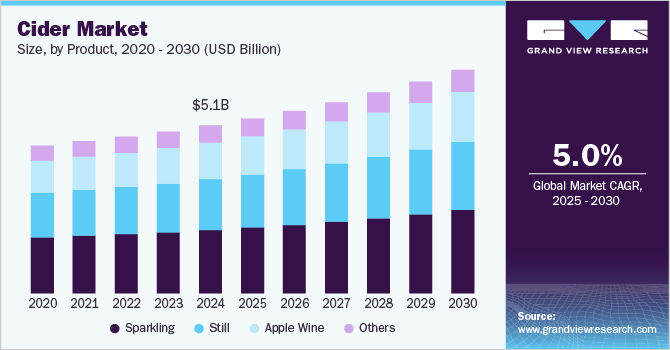

The global cider market size was estimated at USD 5.15 billion in 2024 and is anticipated to reach USD 6.86 billion by 2030, growing at a CAGR of 5.0% from 2025 to 2030. This growth is attributed to the increasing consumer preference for alcoholic beverages with unique flavors and lower-calorie options.

Key Market Trends & Insights

- Europe cider market held the largest revenue share of 37.0% in 2024.

- The Asia Pacific cider market is expected to grow at the fastest CAGR of 5.9% over the forecast period.

- By product, the sparkling segment held the largest revenue share of 37.6% in the cider industry in 2024.

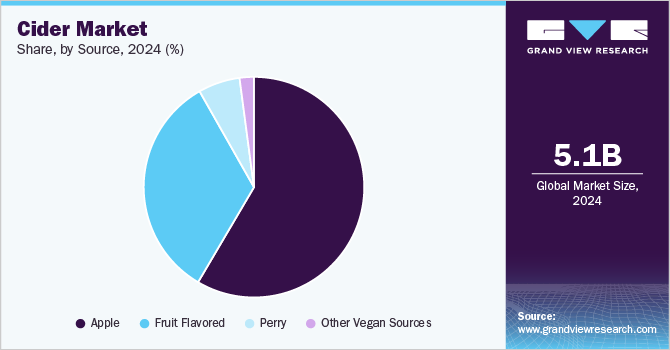

- By source, the apple segment held the largest revenue share in the cider industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.15 Billion

- 2030 Projected Market Size: USD 6.86 Billion

- CAGR (2025-2030): 5.0%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Cider, often perceived as a gluten-free and fruit-based option, has gained popularity as health-conscious consumers seek alternatives to traditional beers and spirits. For instance, brands such as Angry Orchard have successfully captured market share by offering a variety of flavor profiles that appeal to diverse consumer tastes. The rise of craft and artisanal producers who focus on quality and innovation has contributed to the growth of the cider industry. These players create unique blends and flavors that cater to niche markets, enhancing consumer interest in cider as a premium beverage choice. The craft beer movement has paved the way for similar trends in cider, encouraging experimentation with ingredients such as spices and other fruits. This trend attracts new consumers and fosters brand loyalty among those seeking distinctive taste experiences.

The expansion of distribution channels has also played a crucial role in the growth of the cider market. Availability in supermarkets, liquor stores, and online platforms has made cider more accessible to consumers. In addition, promotional efforts by brands to educate consumers about the versatility of ciders in cocktails and food pairings further enhance its appeal. For instance, cider is increasingly featured in mixology, where bartenders create innovative cocktails that showcase its refreshing qualities.

The geographic expansion of key players into emerging markets presents significant opportunities for growth in the cider sector. Regions such as Asia Pacific are witnessing rising disposable income and changing drinking habits, leading to increased demand for alcoholic beverages. As producers aim to tap into these new markets, they are likely to introduce localized flavors and marketing strategies tailored to regional preferences. This strategic focus on international expansion is expected to be instrumental in driving the overall growth of the global cider market over the forecast period.

Product Insights

The sparkling segment held the largest revenue share of 37.6% in the cider industry in 2024 due to the widespread appeal of sparkling ciders among consumers seeking refreshing and flavorful alcoholic beverages. These ciders are often perceived as a lighter and more effervescent alternative to traditional beers and wines, making them particularly attractive for social occasions and casual drinking. For instance, brands such as Angry Orchard have capitalized on this trend by offering a range of sparkling ciders infused with various fruit flavors, enhancing taste and catering to diverse consumer preferences.

The apple wine segment is expected to grow at the fastest CAGR over the forecast period due to increasing consumer interest in healthy and more diverse beverage options. As health-conscious individuals seek alternatives to traditional wines, apple wine offers a natural and flavorful choice that aligns with current clean eating and wellness trends. Apple wine's lower alcohol content and the use of high-quality, pesticide-free apples make it an appealing option for those looking to enjoy a refreshing drink without compromising their health goals.

Source Insights

The apple segment held the largest revenue share in the cider industry in 2024, owing to its strong consumer preference for traditional apple-based flavors, which are widely recognized and enjoyed. Apples are the primary ingredient in cider production, and their versatility allows for a range of flavor profiles, from sweet to tart, appealing to diverse consumer tastes. For instance, Woodchuck Cidery has successfully marketed various apple cider styles, including classic, spiced, and fruit-infused options, attracting a broad customer base.

The fruit-flavored segment is expected to grow at the fastest CAGR over the forecast period due to the increasing demand for diverse and innovative beverage options. Fruit-flavored ciders offer a refreshing and flavorful choice that aligns with current trends toward natural ingredients and lower-calorie options. The rise of premium products and the growing popularity of craft beverages have further fueled interest in fruit-flavored ciders, as consumers are willing to explore new flavors and support artisanal producers.

Regional Insights

The North America cider market is expected to witness significant growth over the forecast period due to rising consumer preference for craft beverages, particularly among millennials and Gen Z, who favor unique and artisanal products over mass-produced options. This demographic shift encourages innovation in cider flavors, with producers experimenting beyond traditional apple and pear varieties to include diverse fruit infusions. In addition, the increasing demand for gluten-free and lower-alcohol alternatives contributes to the popularity of cider as a healthier choice compared to other alcoholic drinks. Events such as cider festivals also play a crucial role in promoting cider culture and expanding consumer awareness.

Mexico Cider Market Trends

Mexico accounted for the highest regional cider market revenue share in 2024. The rise of craft cider producers in regions like Chihuahua, Puebla, and Mexico City adds unique flavors and premium products to the market. Regional consumers are increasingly seeking alternatives to traditional beverages, with cider offering a refreshing and potentially healthier option. Additionally, cultural events such as the Festival Internacional de la Sidra and Feria de la Sidra promote cider and foster community engagement, contributing to the industry's growth.

Europe Cider Market Trends

The Europe cider market held the largest revenue share of 37.0% in 2024 with an increase in consumer interest in craft beverages, which has led to a surge in cider production. This trend is fueled by a growing preference for natural and locally sourced ingredients, aligning with health-conscious consumer behavior. In addition, the introduction of innovative flavors and styles has attracted a younger demographic, enhancing cider's appeal as an alternative to traditional alcoholic beverages. For instance, brands such as Kopparberg have successfully marketed flavored ciders that resonate with younger consumers.

The UK cider market held the largest revenue share in the European market in 2024, driven by strong consumer preference for premium and craft ciders. The cider industry benefits from a long history of cider production that began in Roman times. This heritage has made cider a traditional drink in British culture, especially in areas like Herefordshire and Somerset, which are famous for their apple orchards. The country is also home to brands such as Thatchers Cider, which leads innovation in flavor and quality and thereby favors the cider industry's growth.

Asia Pacific Cider Market Trends

The Asia Pacific cider market is expected to grow at the fastest CAGR of 5.9% over the forecast period due to the growing consumer interest in craft beverages, particularly among younger demographics who seek unique and artisanal products. This trend is evident in countries such as China and India, where local cider producers are innovating with flavors derived from regional fruits, such as lychee and Asian pears, creating distinct offerings that appeal to local tastes. In addition, increased disposable income and urbanization are contributing to a shift from traditional alcoholic beverages, such as beer, to cider, which is perceived as a lighter and more refreshing option.

The China cider market held the largest revenue share in the APAC market in 2024, driven by the rapidly growing middle class, which has increased disposable income and a willingness to explore diverse alcoholic beverages. Young consumers, particularly those in their 20s and 30s, increasingly favor craft and premium ciders, leading to a demand for innovative flavors. In addition, the expansion of e-commerce platforms has made cider more accessible to consumers, allowing for greater experimentation with different brands and styles. For instance, cider producers in China are introducing unique offerings such as baijiu cider, which blends traditional Chinese liquor flavors with cider, appealing to local tastes.

Key Cider Company Insights

Some of the key players in the cider market are Carlsberg Breweries A/S, Halewood Sales, AB InBev, and Heineken N.V. These companies in the cider industry employ various strategies, such as launching innovative products that cater to evolving consumer preferences for unique flavors and lower-alcohol options, to maintain a competitive edge. They focus on sustainability by utilizing eco-friendly ingredients and packaging to meet the growing demand for clean and responsible drinking.

-

Heineken focuses on product innovation by introducing new flavor profiles and low-calorie options. The company also prioritizes sustainability in its production processes, aligning with the increasing demand for eco-friendly products.

-

AB InBev specializes in expanding its cider offerings through strategic acquisitions and innovative product development. The company creates diverse cider brands catering to various consumer preferences, including craft and premium options.

Key Cider Companies:

The following are the leading companies in the cider market. These companies collectively hold the largest market share and dictate industry trends.

- Diageo

- Aston Manor.

- C&C Group PLC.

- Carlsberg Breweries A/S

- Halewood Sales

- Heineken N.V.

- AB InBev

- Thatchers Cider

- KOPPARBERGS BRYGGERI AB

- The Boston Beer Company, Inc.

Recent Developments

-

In May 2024, Budweiser Brewing Group launched the Brutal Fruit Cider, a premium cider aimed at revitalizing the UK cider category. This fruit cider is a blend of citrus, ruby apple, and subtle spice notes, presented in a light pink liquid resembling cocktails. The brand has partnered with British musician Pixie Lott to enhance its appeal and engage with younger audiences through events and digital campaigns.

-

In March 2024, Heineken announced the launch of Strongbow Zest cider, a new product designed to attract younger consumers and strengthen its presence in the cider market. This cider has a refreshing blend of flavors, including zesty citrus and apple notes, that delivers a vibrant drinking experience. Heineken's strategy focuses on appealing to health-conscious consumers by offering a lower-calorie option without compromising taste.

Cider Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.37 billion

Revenue forecast in 2030

USD 6.86 billion

Growth rate

CAGR of 5.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, source, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, South Africa

Key companies profiled

Carlsberg Breweries A/S; Halewood Sales; Heineken N.V.; AB InBev; Diageo; Aston Manor.; C&C Group PLC.; Thatchers Cider; KOPPARBERGS BRYGGERI AB; The Boston Beer Company, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

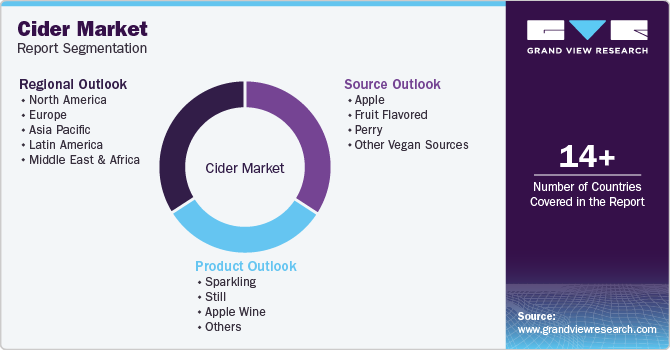

Global Cider Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cider market report based on product, source, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sparkling

-

Still

-

Apple Wine

-

Others

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Apple

-

Fruit Flavored

-

Perry

-

Other Vegan Sources

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.