- Home

- »

- HVAC & Construction

- »

-

Cleanroom Lighting Market Size, Industry Report, 2030GVR Report cover

![Cleanroom Lighting Market Size, Share & Trends Report]()

Cleanroom Lighting Market (2025 - 2030) Size, Share & Trends Analysis Report By Offering (Hardware, Software, Services), By Type (LED, Fluorescent), By Mounting Type, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-574-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cleanroom Lighting Market Summary

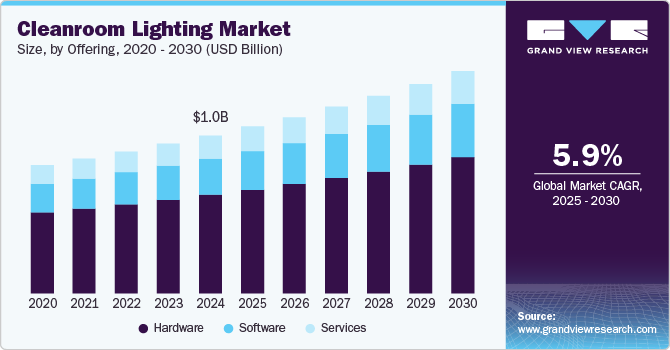

The global cleanroom lighting market size was estimated at USD 1.01 billion in 2024 and is projected to reach USD 1.42 billion by 2030, growing at a CAGR of 5.9% from 2025 to 2030. The growing demand in the pharmaceutical and biotechnology sectors is driving market growth.

Key Market Trends & Insights

- Asia Pacific held the major share of over 40.0% of the cleanroom lighting industry in 2024.

- Based on offering, the hardware segment dominated the market and accounted for a revenue share of over 62.0% in 2024.

- Based on type, the LED segment accounted for the largest market share of over 70.0% in 2024.

- Based on mounting type, the surface-mounted segment dominated the market and accounted for a revenue share of over 50.0% in 2024.

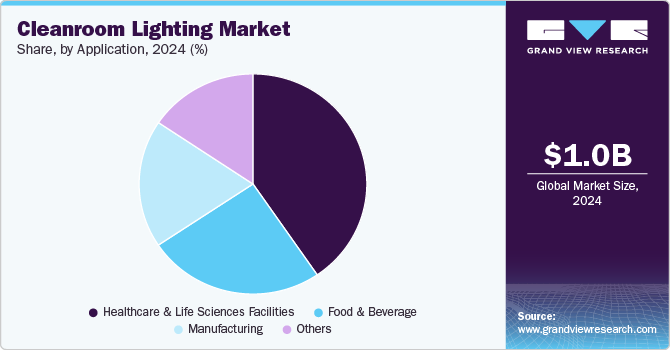

- Based on application, the healthcare & life sciences facilities segment accounted for the largest market share of over 40.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.01 Billion

- 2030 Projected Market Size: USD 1.42 Billion

- CAGR (2025-2030): 5.9%

- Asia Pacific: Largest market in 2024

These industries require strict adherence to contamination control protocols during manufacturing processes, particularly in areas such as drug formulation, packaging, and vaccine production. As global pharmaceutical production expands, fueled by aging populations, rising chronic diseases, and recent pandemic responses, the need for high-quality cleanroom facilities has increased significantly.

Cleanroom lighting systems, particularly those that are sealed, dust-proof, and easy to clean, are essential in maintaining a sterile environment. In addition, the rise in biopharmaceuticals and research in genetic therapies requires advanced lighting that supports both compliance and visibility for precision tasks.

The transition to energy-efficient LED lighting solutions is another key factor influencing the cleanroom lighting market. Traditional fluorescent lighting is being increasingly replaced by LED technology due to its longer lifespan, lower energy consumption, and reduced maintenance requirements. In cleanroom environments where lighting must be constantly operational, energy efficiency and reliability are critical. LEDs also emit less heat, which helps maintain stable ambient temperatures in cleanrooms, reducing the burden on HVAC systems. Furthermore, advanced LED lighting systems can be designed to be completely sealed and flicker-free, minimizing particulate shedding and electromagnetic interference, both of which are essential for cleanroom compliance.

The growing adoption of automation and Industry 4.0 technologies in cleanroom-intensive sectors is driving market growth. Smart lighting systems that can be integrated with building management systems (BMS) or cleanroom automation platforms are gaining popularity. These systems offer controllable illumination, remote monitoring, dimming capabilities, and real-time performance data. As cleanrooms become more digitized and interconnected, intelligent lighting solutions that improve operational efficiency and support data-driven facility management are becoming increasingly important, especially in high-tech and life sciences applications.

In addition, hospitals and healthcare facilities are emerging as key applications of cleanroom lighting. With the rising focus on infection control and sterile environments in critical care units, operating rooms, and isolation wards, cleanroom-compliant lighting is being integrated into healthcare infrastructure. These lighting systems help minimize contamination risks, support stringent hygiene protocols, and enhance visibility during medical procedures. The COVID-19 pandemic accelerated this trend, leading to increased investments in modular cleanroom construction within hospitals and laboratories, thereby expanding the scope of cleanroom lighting in the healthcare segment.

Furthermore, the growth of the food and beverage industry with an emphasis on hygiene and contamination prevention is also supporting the demand for cleanroom lighting. Food processing and packaging facilities are implementing cleanroom technologies to ensure product safety, especially for ready-to-eat and sterile foods. Cleanroom lighting that is waterproof, corrosion-resistant, and easy to sterilize is becoming increasingly essential in these settings. Regulatory frameworks around food safety, such as HACCP (Hazard Analysis and Critical Control Point), are encouraging food manufacturers to invest in cleanroom-compatible lighting to maintain stringent hygiene standards.

Offering Insights

The hardware segment dominated the market and accounted for a revenue share of over 62.0% in 2024 in the cleanroom lighting market. The miniaturization and customization of hardware for specialized cleanroom layouts is also a significant growth factor. Cleanroom facilities often have unique structural designs and space constraints, requiring custom-shaped lighting fixtures, adjustable mounting systems, and modular configurations. Hardware that can be easily integrated into ceilings, walls, or suspended structures while maintaining sterile conditions is in high demand. This customization extends to the hardware’s ability to interface with HVAC systems and other cleanroom infrastructure. This creates opportunities for vendors to offer flexible and scalable lighting solutions tailored to specific cleanroom environments.

The software segment is anticipated to grow at the highest CAGR during the forecast period. The increasing adoption of smart and IoT-enabled lighting solutions in cleanroom settings is also propelling the software segment forward. With the advent of Internet of Things (IoT) technology, lighting fixtures are being embedded with sensors and connectivity features that communicate real-time data to centralized platforms. These software systems can track performance metrics such as luminaire status, power consumption, failure alerts, and environmental compatibility. Predictive maintenance and diagnostics made possible through these platforms help prevent costly downtime in mission-critical environments such as semiconductor fabs or pharmaceutical labs. The ability to leverage data for decision-making and continuous improvement makes lighting software a strategic investment for cleanroom operators.

Type Insights

The LED segment accounted for the largest market share of over 70.0% in 2024 in the cleanroom lighting market. The growing demand for smart and connected lighting solutions is further boosting the LED segment. LEDs are inherently compatible with digital controls, making them ideal for integration with lighting management systems and building automation platforms. This enables advanced functionalities such as occupancy sensing, daylight harvesting, real-time energy monitoring, and predictive maintenance. These smart capabilities are particularly valuable in high-tech and regulated environments, where lighting systems must be both responsive and efficient. The move toward Industry 4.0 and smart cleanroom technologies continues to drive demand for LED solutions that support data-driven facility management.

The fluorescent segment is anticipated to expand at a highest compound annual growth rate from 2025 to 2030. The stability of light output over time in high-quality fluorescent fixtures also contributes to their continued appeal. In cleanrooms, uniform and consistent illumination is critical to prevent errors in inspection, assembly, or lab work. While LEDs are generally more efficient, low-cost, or poorly manufactured, LED fixtures may exhibit lumen depreciation or color shifting over time. Fluorescent lighting, when sourced from reputable manufacturers, provides a stable and predictable light output that is well-understood by cleanroom operators. This consistency can be especially important in environments where process repeatability and visual clarity are paramount.

Mounting Type Insights

The surface-mounted segment dominated the market and accounted for a revenue share of over 50.0% in 2024 in the cleanroom lighting industry. The demand for quick turnaround and expansion in cleanroom construction projects also supports the surface-mounted segment. Facilities that need to scale quickly or adapt to changing production demands often prefer surface-mounted lighting due to its quick installation process. As new cleanroom projects emerge in industries such as pharmaceuticals, biotechnology, and food processing, the need for rapid type and system flexibility drives the preference for surface-mounted fixtures. These lights can be installed more quickly compared to recessed options, helping businesses meet tight construction timelines while still adhering to cleanliness standards.

The recessed segment is anticipated to grow at a CAGR of 6.4% during the forecast period. The growing demand for modular and pre-fabricated cleanroom systems is also fueling interest in recessed lighting solutions. Modular cleanrooms, which are rapidly deployed and customized to specific industry needs, often incorporate recessed lighting as part of the ceiling panel system. This pre-integration allows for faster installation, better sealing, and greater design flexibility. As modular cleanrooms gain popularity across pharmaceutical, electronics, and food processing sectors, the demand for compatible recessed lighting continues to rise.

Application Insights

The healthcare & life sciences facilities segment accounted for the largest market share of over 40.0% in 2024 in the cleanroom lighting market. The rapid expansion of healthcare infrastructure, particularly in emerging markets and developing economies, is also driving the demand for cleanroom lighting in healthcare and life sciences facilities. As the global healthcare industry grows to meet the needs of a larger and aging population, the construction of new hospitals, research labs, and pharmaceutical manufacturing plants is increasing. These new facilities are designed with advanced cleanroom technologies, which include specialized lighting systems that meet international standards for sterility and functionality. The expansion of healthcare infrastructure in regions such as Asia-Pacific and Latin America is creating significant opportunities for cleanroom lighting providers to cater to these growing markets.

The manufacturing segment is anticipated to grow at the highest CAGR from 2025 to 2030. Advancements in smart lighting technology are driving the growth of cleanroom lighting in manufacturing facilities. Smart lighting systems, which include features such as occupancy sensors, daylight harvesting, and centralized control, enable manufacturers to optimize lighting use and reduce energy waste. In cleanrooms, where specific light intensity and uniformity are essential for maintaining production quality, smart lighting solutions allow for precise control of illumination levels. These systems also integrate with building automation systems, enabling manufacturers to manage lighting alongside other environmental factors such as temperature and humidity. The shift towards intelligent, connected lighting solutions is a key driver for cleanroom lighting adoption in manufacturing environments, enhancing operational efficiency and ensuring compliance with cleanroom standards.

Regional Insights

Asia Pacific Cleanroom Lighting Market Trends

Asia Pacific held the major share of over 40.0% of the cleanroom lighting industry in 2024. The semiconductor manufacturing sector in Asia Pacific is another significant driver for the cleanroom lighting market. Countries such as Taiwan, South Korea, and Japan are global leaders in semiconductor production, and the need for highly controlled environments to manufacture these sensitive components is critical. Cleanrooms in semiconductor fabrication plants require advanced lighting systems that provide uniform, high-intensity light without generating heat or contributing to contamination. The shift towards more advanced manufacturing techniques, such as the production of smaller, more intricate semiconductor devices, is pushing the demand for specialized cleanroom lighting systems designed to maintain precise illumination conditions. These lighting systems are essential in creating an environment where particles, dust, and other contaminants are kept to an absolute minimum, ensuring product quality and manufacturing efficiency.

The China cleanroom lighting industry is projected to grow during the forecast period. The expansion of the digital economy in China is also playing a significant role in the growth of cleanroom lighting. The country’s e-commerce giants, financial technology companies, and digital entertainment platforms generate enormous amounts of data that require the rapid growth of manufacturing and infrastructure projects in China is another key factor driving the demand for cleanroom lighting. China’s robust manufacturing industry continues to expand, with the country being a global leader in electronics, automotive, and food processing. These industries require cleanroom environments to meet production standards and maintain high levels of hygiene. As China modernizes its manufacturing infrastructure, particularly in industries such as electronics and medical device production, the demand for specialized cleanroom lighting systems that meet international cleanliness and performance standards grows. The expansion of manufacturing capabilities, along with a focus on technological innovation and automation, ensures continued demand for cleanroom lighting solutions.

Europe Cleanroom Lighting Market Trends

The demand for cleanroom lighting in the Europe is growing at a CAGR of 5.7% from 2025 to 2030. The rising focus on patient safety and medical research is another significant driver for the cleanroom lighting market in Europe. With healthcare becoming a central focus across the continent, particularly as the population ages, the demand for cleanroom environments to support the production of medical devices, sterile equipment, and pharmaceuticals is increasing. Medical research facilities, in particular, require cleanroom environments to maintain sterility and ensure the safety of products that directly affect patient well-being. This growth in healthcare infrastructure and research initiatives contributes directly to the demand for specialized lighting solutions that meet the stringent requirements of these high-stakes environments.

The cleanroom lighting industry in the UK is expected to grow during the forecast period. The growth of healthcare and life sciences research is a significant driver for the cleanroom lighting market in the UK The country has long been a leader in medical research, with a wealth of universities, research institutions, and healthcare organizations dedicated to advancing healthcare technologies. Many of these research facilities require cleanroom environments to carry out sensitive medical research and produce new treatments. As the UK government continues to invest in healthcare innovation and research, the need for cleanroom environments to support these activities will increase, driving further demand for specialized lighting solutions.

North America Cleanroom Lighting Market Trends

The cleanroom lighting market in North America is growing significantly during the forecast period. The expansion of the aerospace and automotive industries in North America also plays a role in the growing demand for cleanroom lighting. Cleanroom environments are essential in the production of high-precision components, such as those used in aerospace systems and advanced automotive technologies. Similarly, the aerospace sector requires cleanrooms for the assembly of sensitive components that must meet exacting standards for cleanliness and precision. As these industries continue to innovate and grow, the need for advanced cleanroom lighting systems that can support the production of these high-tech components will continue to rise.

U.S. Cleanroom Lighting Market Trends

The U.S. cleanroom lighting market is projected to grow during the forecast period. The growing adoption of modular cleanroom solutions in the U.S. is contributing to the growing demand for specialized cleanroom lighting. Modular cleanrooms, which are flexible and easily adaptable to changing manufacturing needs, are becoming more popular, particularly in industries such as pharmaceuticals, food processing, and biotechnology. These cleanrooms often come with integrated lighting solutions, making it easier for companies to set up and modify their facilities as needed. The increasing adoption of modular cleanroom systems is expected to drive the demand for cleanroom lighting solutions that are customizable and compatible with these flexible environments.

Key Cleanroom Lighting Company Insights

Some of the key companies operating in the market Signify Holding, Eaton Corporation Inc., and Wipro Enterprises., among others are some of the leading participants in the cleanroom lighting market.

-

Signify Holding is a global lighting solutions company operating in over 70 countries. Signify offers specialized cleanroom lighting solutions designed to meet the stringent requirements of environments such as laboratories, hospitals, and pharmaceutical manufacturing facilities. One of the key products in this category is the Kleenseal 100 Recessed Cleanroom LED. This luminaire is suitable for Class 100 to 100,000 cleanrooms and is designed to resist corrosion, ensuring durability in demanding environments.

-

Eaton Corporation Inc. is a global power management company. Eaton operates in over 175 countries. Eaton offers a range of cleanroom lighting solutions designed to meet the stringent requirements of environments such as pharmaceutical manufacturing, laboratories, and semiconductor facilities. One of Eaton's notable products in this category is the CEAG RLF Recessed Mount Hazardous Area Linear LED Fixture. Part of Eaton's Crouse-Hinds series, this fixture is designed for flush and surface mounting in hazardous areas, including Zones 1, 2, 21, and 22. It features white-painted sheet steel or polished stainless steel housing, providing excellent resistance to corrosion and contaminants.

Thorlux Lighting, CleanAir Solutions and LEDspan Ltd are some of the emerging market participants in the cleanroom lighting market.

-

Thorlux Lighting is a UK-based designer, manufacturer, and supplier of professional lighting systems. As a division of the FW Thorpe Plc group, Thorlux offers a comprehensive range of lighting solutions tailored for various applications, including architectural, commercial, industrial, hazardous areas, floodlighting, and tunnel environments. Thorlux offers a diverse portfolio of lighting products designed to meet the specific needs of different sectors. The company's product range includes LED luminaires, emergency lighting systems, and specialized lighting solutions for challenging environments.

-

CleanAir Solutions specializes in providing cleanroom technology and services, focusing on the design, implementation, and maintenance of cleanroom facilities. The company offers technical assistance to end-users and contractors, ensuring optimal cleanroom performance and compliance with industry standards. CAS's product portfolio includes cleanroom lights, filters, monitoring systems, and accessories, catering to various industries such as pharmaceuticals, biotechnology, and semiconductor manufacturing.

Key Cleanroom Lighting Companies:

The following are the leading companies in the cleanroom lighting market. These companies collectively hold the largest market share and dictate industry trends.

- CleanAir Solutions

- Crompton Greaves Consumer Electricals Ltd.

- Eaton Corporation Inc.

- Havells India Ltd

- Jansen Cleanrooms & Labs

- Kenall Manufacturing

- LEDspan Ltd

- LUG Light Factory Sp. z o.o.

- Signify Holding

- Terra Universal Inc.

- Thorlux Lighting

- Total Clean Air

- Wipro Enterprises

Recent Developments

-

In February 2025, Jansen Cleanrooms & Labs announced the launch of cleanroom construction products. This new line includes an interlock system, lighting, a hinged door system, a wall system, and a pass box. These products are designed to maintain a contamination-free environment for critical operations.

-

In August 2024, Total Clean Air launched Modulab, a new modular cleanroom solution built from robust aircraft-grade structural aluminum. Modulab delivers exceptional strength, efficiency, and a significantly reduced carbon footprint. Engineered for durability and full customization, it supports rapid type and seamless modifications. Modulab is suited for diverse sectors, including pharmaceuticals, medical devices, electronics, engineering, and aerospace.

-

In November 2023, Kenall Manufacturing launched the CSSGI series. The CSSDI series is a low-profile plenum troffer specifically engineered for cleanrooms and controlled environments, including food processing plants, pharmacies, pharmaceutical manufacturing facilities, and research centers. This low-profile luminaire is compatible with ISO Class 3 to 9 and BSL 1 to 4 cleanrooms, providing a cost-effective lighting solution. The CSSGI is the latest addition to Kendall’s trusted SimpleSeal line of sealed enclosure lighting, reflecting the company’s specialized expertise in IP-rated lighting for clean and controlled spaces.

Cleanroom Lighting Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.06 billion

Revenue forecast in 2030

USD 1.42 billion

Growth rate

CAGR of 5.9% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Offering, type, mounting type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Signify Holding; Wipro Enterprises; Crompton Greaves Consumer Electricals Ltd.; Eaton Corporation Inc.; LUG Light Factory Sp. z o.o.; Terra Universal Inc.; Kenall Manufacturing; LEDspan Ltd; Havells India Ltd; Thorlux Lighting; CleanAir Solutions; Total Clean Air; Jansen Cleanrooms & Labs

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cleanroom Lighting Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the cleanroom lighting market report based on offering, type, mounting type, application, and region.

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

LED

-

Fluorescent

-

-

Mounting Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Recessed

-

Surface-Mounted

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare & Life Sciences Facilities

-

Manufacturing

-

Food & Beverage

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cleanroom lighting market size was estimated at USD 1.01 billion in 2024 and is expected to reach USD 1.06 billion in 2025

b. The global cleanroom lighting market is expected to grow at a compound annual growth rate of 5.9% from 2025 to 2030 to reach USD 1.42 billion by 2030

b. Asia Pacific held the major share of 40.0% of the cleanroom lighting industry in 2024. The semiconductor manufacturing sector in Asia Pacific is a significant driver for the cleanroom lighting market.

b. Some key players operating in the market include Signify Holding, Wipro Enterprises, Crompton Greaves Consumer Electricals Ltd. , Eaton Corporation Inc., LUG Light Factory Sp. z o.o., Terra Universal Inc., Kenall Manufacturing, LEDspan Ltd, Havells India Ltd, Thorlux Lighting, CleanAir Solutions, Total Clean Air, Jansen Cleanrooms & Labs

b. The growing demand in the pharmaceutical and biotechnology sectors and The transition to energy-efficient LED lighting solutions are driving cleanroom lighting market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.