- Home

- »

- Plastics, Polymers & Resins

- »

-

Cling Films Market Size And Share, Industry Report, 2030GVR Report cover

![Cling Films Market Size, Share & Trends Report]()

Cling Films Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Polyvinyl Chloride, Polyethylene, Polypropylene, Polyvinylidene Chloride), By End-use (Food & Beverage, Automotive, Healthcare), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-595-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cling Films Market Summary

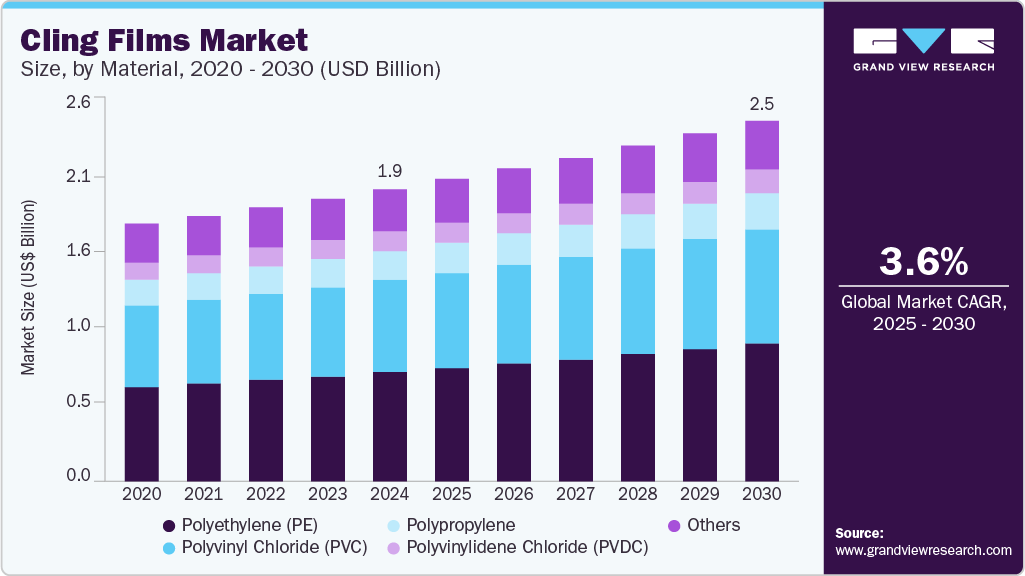

The global cling films market size was estimated at USD 1980.0 million in 2024 and is projected to reach USD 2445.7 million by 2030, growing at a CAGR of 3.6% from 2025 to 2030. The cling film industry is driven by growing demand for convenient and hygienic food packaging, especially in households and the foodservice industry.

Key Market Trends & Insights

- Asia Pacific dominated the cling films market with the largest revenue share of 40.64% in 2024 and is anticipated to grow at the fastest CAGR of 4.0% during the forecast period.

- The cling films market in Europe is anticipated to grow at a rapid CAGR during the forecast period.

- Based on material, the polyethylene (PE) segment led the market with the largest revenue share of 37.28% in 2024 and is projected to grow at the fastest CAGR of 4.0% during the forecast period.

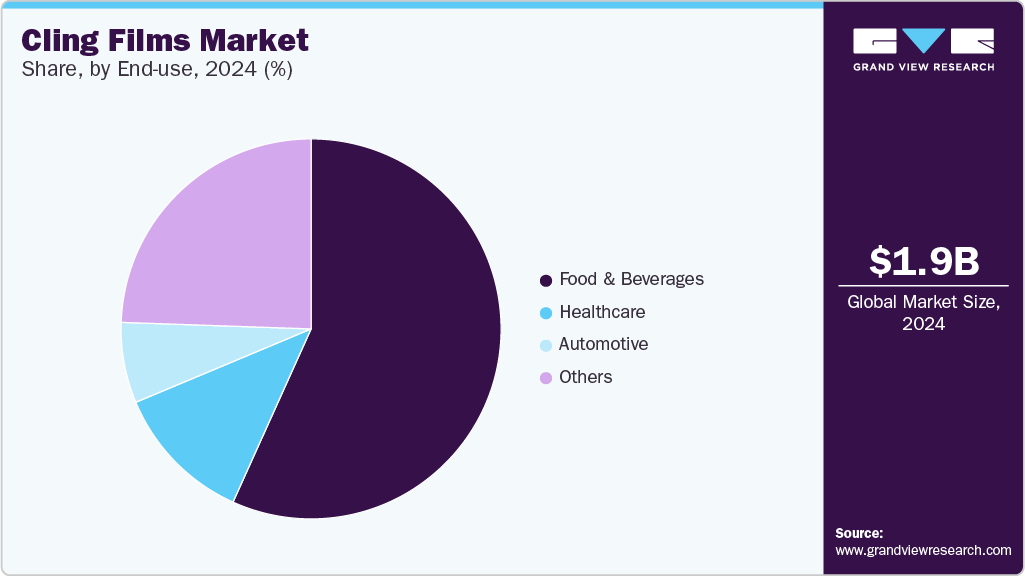

- Based on end-use, the food & beverages segment led the market with the largest revenue share of 56.74% in 2024 and is projected to grow at the fastest CAGR of 4.0% during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 1980.0 Million

- 2030 Projected Market Size: USD 2445.7 Million

- CAGR (2025-2030): 3.6%

- Asia Pacific: Largest market in 2024

In addition, rising awareness of food preservation and shelf-life extension is fueling market growth. The cling film industry is primarily driven by the growing demand for packaged and ready-to-eat foods, especially in urban areas where busy lifestyles have led to increased consumption of convenience foods.

Cling films are widely used in both industrial and household applications to wrap fruits, vegetables, meat, and bakery products to preserve freshness, reduce contamination, and extend shelf life. The expansion of supermarkets, hypermarkets, and online grocery platforms has further contributed to the widespread use of cling films for food packaging. For example, food delivery and takeaway services use cling film as a practical solution to keep items fresh during transportation.

Another key driver is the increased awareness of hygiene and food safety, especially after the COVID-19 pandemic, which significantly altered consumer behavior. Consumers and foodservice providers have become more conscious of preventing contamination and ensuring food safety. Cling films, with their moisture retention properties and ability to provide a protective barrier, are increasingly viewed as essential tools in food packaging. For example, delis and restaurants use cling film to seal food trays and portions, ensuring the product is untouched and visibly secure, which builds customer confidence.

The rising demand from the food processing and hospitality industries also plays a pivotal role in market growth. Commercial kitchens, hotels, catering services, and food processing companies require large volumes of cling film for daily operations. These industries prioritize packaging materials that are flexible, easy to use, and effective in preserving food. The increasing number of QSRs (quick service restaurants) and cloud kitchens in emerging economies, such as India, Indonesia, and Brazil, is further fueling this demand. In such regions, cling film offers an affordable and efficient means of food protection and storage in both hot and cold conditions.

Market Characteristics & Concentration

The cling film industry is heavily reliant on petroleum-based raw materials such as polyethylene (PE), polyvinyl chloride (PVC), and polypropylene (PP). Fluctuations in crude oil prices significantly impact production costs and profit margins for manufacturers. While PVC is traditionally dominant due to its superior stretch and cling properties, increasing regulatory scrutiny over its environmental and health impact is encouraging a shift toward polyethylene-based and biodegradable alternatives. This cost sensitivity makes the market vulnerable to supply chain disruptions and price volatility in raw materials.

Environmental regulations and plastic waste management laws are shaping the industry’s evolution. Governments worldwide, particularly in Europe and parts of North America, are implementing restrictions on single-use plastics, prompting manufacturers to invest in sustainable materials and recycling technologies. Compliance with food safety regulations, such as FDA (U.S.), EFSA (EU), and others, is also a critical requirement, especially for films used in direct food contact. These regulatory demands are pushing the industry toward innovation in eco-friendly cling films, such as compostable and bio-based alternatives.

The market serves industrial/commercial users and household consumers. Industrial users such as food processing companies, hospitality, and retail, demand high-performance films with better tensile strength and barrier properties, often in bulk rolls, while household users prioritize ease of use, safety, and affordability. Seasonal trends, such as festive seasons or increased online food deliveries during lockdowns, can cause spikes in demand, particularly in the household consumer’s segment. This dual nature of demand requires manufacturers to tailor their products for a wide range of application environments and price points.

Material Insights

The polyethylene (PE) segment led the market with the largest revenue share of 37.28% in 2024 and is projected to grow at the fastest CAGR of 4.0% during the forecast period. PE cling films, especially LDPE, are widely used due to their non-toxic nature and recyclability. These films are less elastic than PVC but are more chemically stable and are gaining popularity due to fewer health risks. PE films are also resistant to moisture and are increasingly used for wrapping food in households and commercial establishments. PE cling films also benefit from strong government support for recyclable plastics and an expanding eco-conscious consumer base.

PVC cling films are widely used due to their excellent transparency, elasticity, and self-clinging properties. These films offer superior stretchability and are commonly used in food packaging, especially for wrapping fruits, vegetables, meat, and dairy. The key drivers for PVC cling films include their cost-effectiveness, high clarity, and ability to tightly seal products without adhesives. However, increasing environmental concerns and regulatory pressure on chlorinated plastics may affect growth in some regions.

The others segment includes materials such as biodegradable films, polyolefin blends, and coextruded multilayer films. These materials are gaining attention as sustainable alternatives to conventional plastic cling films and are often targeted at eco-conscious consumers and regulatory-driven markets. This segment is primarily driven by increasing environmental regulations and consumer demand for sustainable packaging.

End-use Insights

The food & beverages segment led the market with the largest revenue share of 56.74% in 2024 and is projected to grow at the fastest CAGR of 4.0% during the forecast period. Cling films are extensively used in the food and beverage sector for packaging fresh produce, meat, bakery products, and ready-to-eat meals. Their ability to preserve freshness, prevent contamination, and extend shelf life makes them essential in both commercial and household kitchens. They are commonly used in supermarkets, restaurants, and catering services for wrapping perishable goods and covering containers. The growth of the food service industry, rise in online food delivery platforms, increasing preference for convenience foods, and the demand for hygienic packaging solutions are major drivers.

In the automotive industry, cling films are used primarily for surface protection during manufacturing, assembly, and transportation. These films help safeguard components and vehicle surfaces from scratches, dust, and chemical damage. They are often applied on dashboards, trims, screens, and painted surfaces. The expansion of automotive production globally, rising focus on quality control and aesthetic preservation during shipping, and growing aftermarket services are propelling the demand for cling films.

In the healthcare sector, cling films are employed for packaging medical devices, laboratory equipment, and pharmaceuticals. Their sterile and protective nature helps in maintaining hygiene and preventing contamination. They are also used in wound care and as a barrier in certain medical applications. The increasing need for disposable and protective packaging materials in hospitals and laboratories continues to drive market demand.

Region Insights

The cling films market in North America is anticipated to grow at a significant CAGR during the forecast period, due to high consumer awareness about food waste reduction and the widespread use of cling film in both households and food service industries. The U.S. and Canada have a strong culture of bulk shopping and meal prepping, which increases cling film usage. The food service sector, including restaurants and catering businesses, also contributes significantly to demand, especially for heavy-duty commercial-grade cling films. Furthermore, the growth of e-commerce and grocery delivery services such as Amazon Fresh and Instacart has further boosted cling film consumption for packaging.

Asia Pacific Cling Films Market Trends

Asia Pacific dominated the cling films market with the largest revenue share of 40.64% in 2024 and is anticipated to grow at the fastest CAGR of 4.0% during the forecast period. This dominance can be attributed to rapid urbanization, a growing food processing industry, and increasing demand for convenience packaging. Countries such as China, India, and Japan are witnessing a surge in supermarket culture and online food delivery services, which rely heavily on cling film for food preservation. In addition, the rise of dual-income households has boosted the demand for ready-to-eat meals, further propelling market growth.

The cling films market in China accounted for the largest market revenue share in Asia Pacific in 2024, driven by its massive food industry, booming e-commerce sector, and increasing household consumption. The country’s expanding middle class prefers packaged and preserved foods, leading to higher cling film usage. The food delivery market, dominated by platforms such as Meituan and Ele.me, also contributes significantly, as vendors use cling film to ensure hygiene and freshness. Government policies promoting food safety standards are further boosting market growth.

Europe Cling Films Market Trends

The cling films market in Europe is anticipated to grow at a rapid CAGR during the forecast period, driven by stringent food safety regulations and strong emphasis on sustainable packaging solutions. Countries such as Germany, France, and the UK are leading due to high consumer preference for convenience and food preservation. The region’s well-established retail sector, including supermarkets such as Tesco and Carrefour, relies on cling film for in-store food packaging. In addition, the growing trend of home meal kits and pre-packaged fresh produce is further accelerating demand.

Key Cling Films Company Insights

The competitive environment of the cling film industry is moderately fragmented, with a mix of global and regional players competing based on factors such as product quality, pricing, sustainability, and innovation. Key companies such as Berry Global Inc., Reynolds Consumer Products, and Mitsubishi Chemical Group Corporation dominate through broad distribution networks and strong brand recognition. However, increasing demand for biodegradable and recyclable alternatives has intensified competition, pushing companies to invest in R&D for eco-friendly materials. Additionally, private label brands and regional manufacturers are gaining market share by offering cost-effective and localized solutions, further intensifying price-based competition.

Key Cling Films Companies:

The following are the leading companies in the cling films market. These companies collectively hold the largest market share and dictate industry trends.

- Berry Global Inc.

- Mitsubishi Chemical Group Corporation

- Amcor plc

- Sealed Air

- Sigma Plastics Group

- Anchor Packaging LLC

- IPG

- POLIFILM

- Reynolds Consumer Products

- Greendot Biopak

- Zhengzhou Eming Aluminium Industry Co., Ltd.

- PRAGYA FLEXIFILM INDUSTRIES

- Megaplast India Pvt Ltd

- Tilak Polypack

Recent Development

-

In April 2024, Berry Global released a white paper introducing its breakthrough Omni Xtra+ polyethylene (PE) cling film technology as a recyclable, high-performance alternative to traditional polyvinyl chloride (PVC) cling films used in fresh food packaging. This new PE film replicates key benefits of PVC such as uniform stretch, clarity, and elastic recovery while offering superior puncture resistance and a 25% reduction in material weight. Certified recyclable by RecyClass and Interseroh, Omni Xtra+ complies with emerging European regulations requiring packaging designed for recyclability by 2030.

-

In July 2021, DKSH partnered with Reynolds Consumer Products to promote and distribute aluminum foil and cling wrap products under the Diamond brand across Cambodia. As a strategic partner, DKSH Cambodia provided full-agency services including distribution, logistics, marketing, and sales to help Reynolds grow their business in the country.

Cling Films Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2047.7 million

Revenue forecast in 2030

USD 2445.7 million

Growth rate

CAGR of 3.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Berry Global Inc.; Mitsubishi Chemical Group Corporation; Amcor plc; Sealed Air; Sigma Plastics Group; Anchor Packaging LLC; IPG; POLIFILM; Reynolds Consumer Products; Greendot Biopak; Zhengzhou Eming Aluminium Industry Co., Ltd.; PRAGYA FLEXIFILM INDUSTRIES; Megaplast India Pvt Ltd; Tilak Polypack

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cling Films Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cling films market report based on material, end-use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyvinyl Chloride (PVC)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polyvinylidene Chloride (PVDC)

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Automotive

-

Healthcare

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global cling films market was estimated at around USD 1.98 billion in the year 2024 and is expected to reach around USD 2.05 billion in 2025.

b. The global cling films market is expected to grow at a compound annual growth rate of 3.6% from 2025 to 2030 to reach around USD 2.45 billion by 2030.

b. Food & beverages emerged as the dominating end use segment in the cling film market due to the rising demand for convenient, hygienic, and shelf-life-extending packaging solutions for fresh produce, meat, dairy, and ready-to-eat meals.

b. The key players in the cling film market include Berry Global Inc.; Mitsubishi Chemical Group Corporation; Amcor plc; Sealed Air; Sigma Plastics Group; Anchor Packaging LLC; IPG; POLIFILM; Reynolds Consumer Products; Greendot Biopak; Zhengzhou Eming Aluminium Industry Co., Ltd.; PRAGYA FLEXIFILM INDUSTRIES; Megaplast India Pvt Ltd; and Tilak Polypack.

b. The cling film market is driven by rising demand for hygienic and tamper-evident food packaging, growth in ready-to-eat and on-the-go food consumption, and increasing adoption in the pharmaceutical and personal care sectors for protective wrapping.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.