- Home

- »

- Clinical Diagnostics

- »

-

Clinical Laboratory Services Market, Industry Report, 2033GVR Report cover

![Clinical Laboratory Services Market Size, Share & Trends Report]()

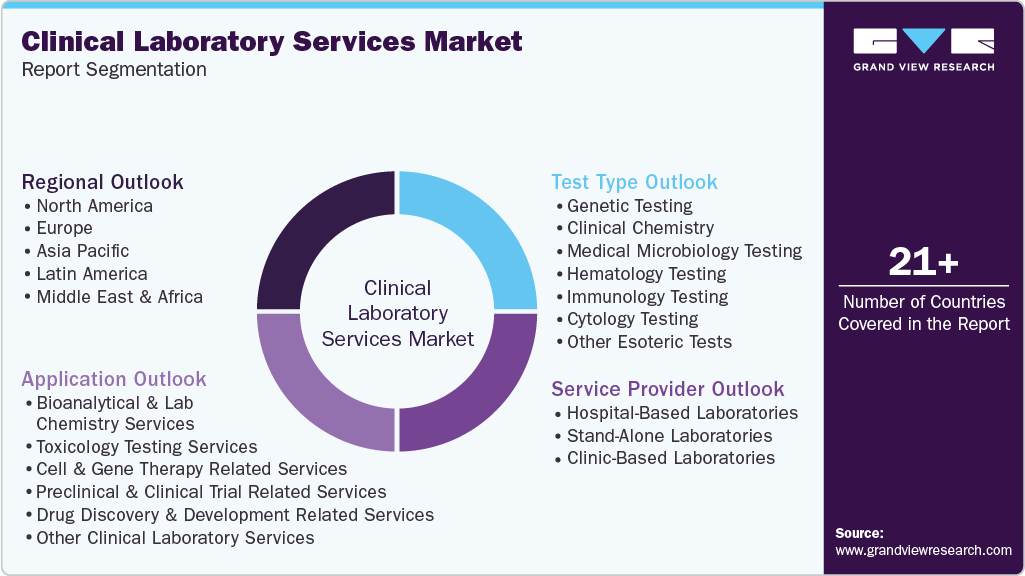

Clinical Laboratory Services Market (2026 - 2033) Size, Share & Trends Analysis Report By Test Type (Hematology Testing, Immunology Testing, Cytology Testing), By Service Provider (Hospital-Based Laboratories, Stand-Alone Laboratories), By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-250-1

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Clinical Laboratory Services Market Summary

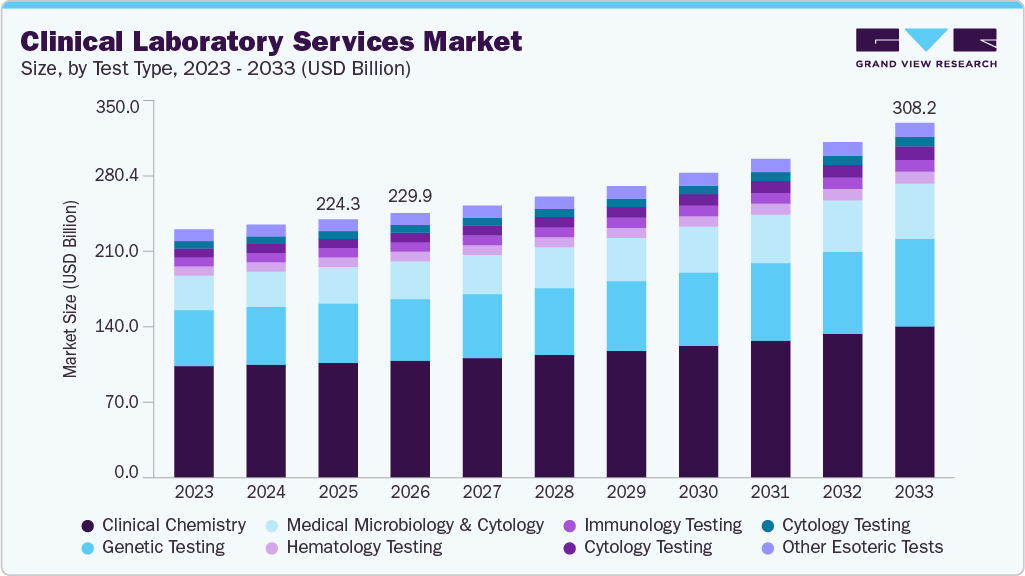

The global clinical laboratory services market size was valued at USD 224.35 billion in 2025 and is expected to reach USD 308.24 billion by 2033, expanding at a CAGR of 4.28% from 2026 to 2033. The market is witnessing growth due to factors such as the increasing burden of chronic diseases and the growing demand for early diagnostic tests.

Key Market Trends & Insights

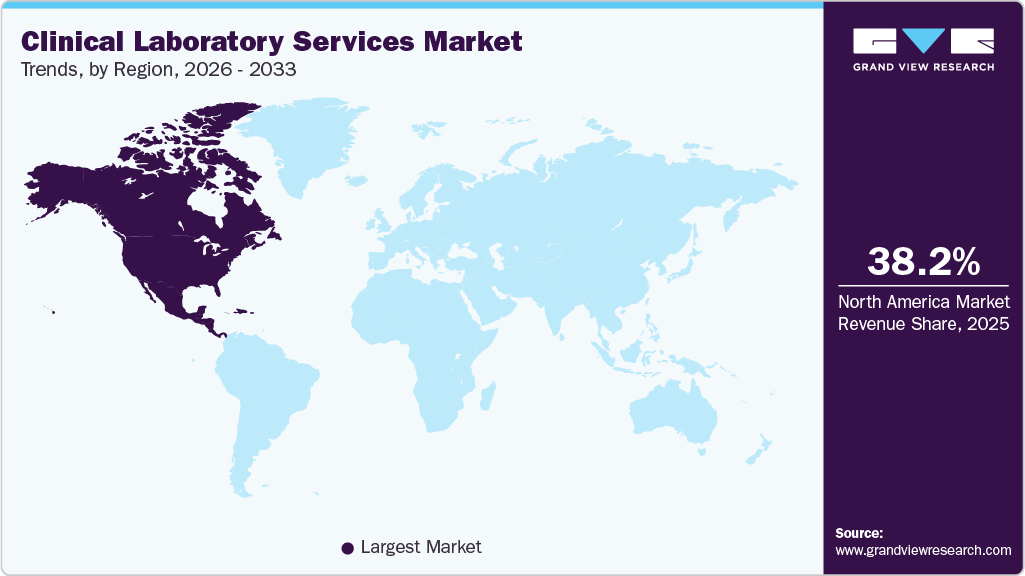

- North America clinical laboratory services market dominated the global market and accounted for the largest revenue share of 38.23% in 2025.

- The U.S. led the North American market and held the largest revenue share in 2025.

- Based on test type, the clinical chemistry segment held the largest revenue share of 44.46% in 2025.

- Based on service provider, the hospital-based laboratories segment dominated the clinical laboratory services market and accounted for the largest revenue share of 56.88% in 2025.

- On the basis of application, the bioanalytical & lab chemistry services segment held the largest revenue share of 40.80% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 224.35 Billion

- 2033 Projected Market Size: USD 308.24 Billion

- CAGR (2026-2033): 4.28%

- North America: Largest Market in 2025

For instance, the rising incidence of diabetes and cardiovascular disease is driving the demand for frequent blood glucose and lipid profile screenings, while early cancer detection activities are rapidly expanding. According to the International Diabetes Federation 2024, diabetes affected 589 million adults aged 20 to 79 worldwide, accounting for one in every nine. Rapid advancements in data handling and sample preparation, such as the adoption of automated laboratory information management systems (LIMS) and high-throughput sample processing platforms, are projected to drive market expansion throughout the projection period.

Clinical lab services are widely used for various applications, primarily for detecting and quantifying different biological substances. Variations in biomolecular concentrations can indicate various abnormal metabolic activities, infections, infectious and non-infectious diseases, and inflammatory conditions. To ensure optimal clinical results and overall public health, it's vital to rapidly and accurately diagnose severe illnesses and administer appropriate treatment.

Automation in clinical settings has significantly improved the data management process in laboratories. Growing adoption of laboratory automation systems is expected to boost the market during the forecast period. Furthermore, database management tools, patient test records, and integrated workflow management systems have received significant consideration in the healthcare industry. This can be attributed mainly to companies that process nearly 100 to 150 billion samples per year. Hence, the improvement and implementation of informatics and automated data management solutions to perform seamless operations are anticipated to drive the market.

An increase in disease prevalence and high demand for early disease diagnosis are expected to boost the market in the coming years. These factors have prompted market players to introduce innovative services to address the growing demand. The introduction of accurate and technologically advanced products, such as companion diagnostics, biochips, & microarrays, has increased the demand for early disease detection. Products such as companion diagnostics also reduce the overall healthcare cost by helping physicians identify the most suitable treatment option based on a patient's genetic makeup. Furthermore, the growing prevalence of target diseases, such as cardiovascular diseases and diabetes, is a high-impact market driver over the forecast period. Cardiovascular disease has become the most dominant cause of mortality and morbidity in the world over the past three decades. According to the WHO, by 2030, cardiovascular diseases are estimated to cause approximately 23.6 million deaths, mainly due to heart disease and stroke. Moreover, the global prevalence of diabetes is constantly increasing, creating a large patient pool for the industry.

The global market for clinical laboratory services is expanding rapidly, driven by the increased adoption of cutting-edge diagnostic technology and enhanced healthcare infrastructure. The South America clinical laboratory services market is expanding rapidly as a result of rising healthcare spending, improved insurance coverage, and increased demand for specialty tests. Digital laboratory platforms, automated sample processing, and cloud-based data management systems are helping to optimize operations and reduce turnaround times. Furthermore, the use of molecular diagnostics, genetic testing, and biomarker-based assays enables more precise and individualized illness identification and monitoring. The shift to decentralized and point-of-care testing is increasing access in remote and underprivileged locations. These technical advancements and structural improvements, considered together, will promote the continued global rise of the industry.

Market Concentration & Characteristics

The industry demonstrates a high degree of innovation, driven by a moderate degree of innovation. This can be attributed to the advanced technologies and methodologies for transforming diagnostic practices. From novel testing approaches to automation, the sector continually evolves, enhancing accuracy and efficiency in healthcare diagnostics. For instance, in January 2023, QIAGEN released EZ2 Connect MDx, an in-vitro diagnostics platform for automated sample processing for diagnostic laboratories. The device allows labs to purify RNA and DNA samples in 30 minutes.

The industry witnesses a notable M&A activity by the leading players. Leading players are strategically joining forces to expand and enhance their services, gain access to new technologies, consolidate in the rapidly growing market, and address the increasing strategic importance of clinical laboratory services. For example, in August 2024, Labcorp acquired Invitae, a prominent company in medical genetics, which improves Labcorp's genetic-testing abilities in oncology and rare diseases. This transaction indicates how consolidation is being used to rapidly increase service offerings and improve competitiveness in the global industry.

The industry is highly regulated because regulations ensure safety standards, quality control, and fair competition. Countries have designated regulatory bodies that regulate clinical laboratory services. In the U.S., the application and safety aspects of laboratory tests and services are regulated and reviewed by the federal government through the Clinical Laboratory Improvement Amendments (CLIA). In addition to CLIA, the U.S. FDA is also involved in the regulations for the industry.

The clinical laboratory services industry is undergoing a significant transformation with the continuous expansion of service offerings to meet the growing and evolving needs of modern healthcare. This expansion is being driven by several key factors, including the rising global disease burden, increased demand for precision diagnostics, and advancements in medical technology. Laboratories are broadening their scope beyond traditional routine tests to include specialized services such as genetic and molecular diagnostics, companion diagnostics, pharmacogenomics, and next-generation sequencing (NGS). These services play a crucial role in the early detection and personalized treatment of complex diseases like cancer, neurological disorders, and infectious diseases.

The industry is witnessing a growing number of geographical expansion strategies, with key players such as Quest Diagnostics and LabCorp employing this approach to broaden their service reach. This strategy enhances service availability across diverse geographic areas, ensuring a more extensive market presence. Along with opening additional labs and diagnostic facilities, firms are forming strategic agreements with local healthcare practitioners and hospitals to expand their distribution channels. Investments in developing countries, particularly in Latin America and Southeast Asia, enable these enterprises to reach previously underserved people. Digital platforms and telemedicine connections are also helping to improve regional access by allowing for remote testing and faster result delivery.

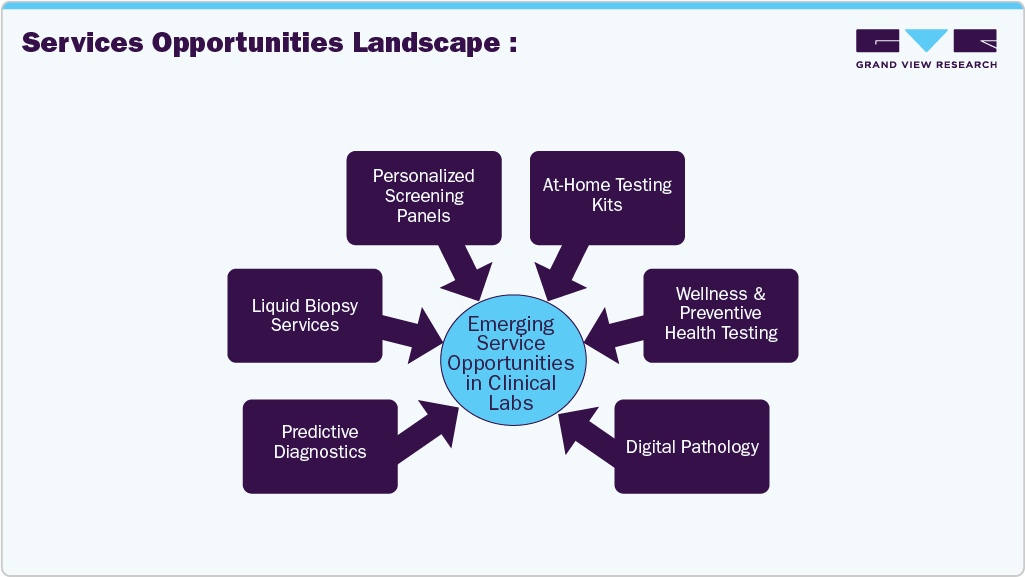

Services Opportunities Landscape

The industry is transforming strategically, fueled by emerging service opportunities that align with technological advancements and evolving patient needs. Key growth areas include liquid biopsy services, which are revolutionizing cancer diagnostics through minimally invasive testing, and at-home testing kits that offer convenience and accessibility for chronic disease monitoring and preventive care. Digital pathology is enhancing diagnostic accuracy and speed by enabling remote slide analysis and AI integration, while machine learning technologies are streamlining operations and delivering predictive insights across lab workflows.

The industry is expanding rapidly as laboratories throughout the world adopt new technologies and expand their service offerings. The growing demand for rapid, decentralized testing, such as point-of-care molecular diagnostics, enables more access and convenience. For instance, in 2025, LabCorp opened a new cutting-edge diagnostic facility in Chantilly, Virginia, which expanded specimen processing capacities and included sophisticated cytology and histology services, thereby enhancing testing efficiency and service availability. In addition, advancements such as next-generation sequencing, AI-driven diagnostics, and biomarker-based testing give more accurate and personalized diagnostics, opening up new options for growth. With the growing demand for customized, quick, and precise tests, the industry is poised for continued expansion.

Test Type Insights

The clinical chemistry segment accounted for the largest revenue share of 44.46% in 2025. The segment's dominance is attributed to numerous clinical chemistry tests involved in pathology analysis of body fluids, including analysis of urine, plasma, serum, and other body fluids. Clinical chemistry or biochemistry tests are integral to basic level diagnosis and laboratory testing. Some of the common tests for clinical chemistry include glucose, creatinine, urea, total protein, globulins, albumin, bilirubin, alanine transaminase (ALT), aspartate transaminase (AST), alkaline phosphatase (ALP), and gamma-glutamyl transpeptidase (GGT), among others. Techniques such as spectrophotometry, immunoassay, and electrophoresis are used to measure the concentration of different types of molecules present in the collected sample. Increasing automation to enhance customer experience is gaining traction in the segment.

The genetics testing segment is projected to show lucrative growth during the forecast period. This can be attributed to an increase in intensive research activities on genetic and proteomic studies, in the context of hereditary & gene-mutation-related disorders. Moreover, there is an increasing demand for personalized care, with accurate and early diagnosis in oncology is expected to fuel segment growth. The rising need for efficient tests in the early diagnosis of major infections and cancer is anticipated to boost the segment growth.

Service Provider Insights

Hospital-based laboratories held the largest market share of 56.88% in 2025. This dominance is attributable to the high turnaround number of patients’ tests, mainly for complex and severe disease conditions that are comparatively more cost-intensive. It is expected to maintain its dominance owing to the increasing number of hospitals integrating laboratories into their premises. The expansion of outreach programs initiated by hospitals, along with the quick turnaround of patients grappling with severe and major diseases, is projected to propel the segment's growth. For instance, in February 2023, Tenaris, along with San Jose Municipal Hospital in Campana, launched a new laboratory in Argentina to improve the capability of testing in the country.

The stand-alone laboratories segment is expected to show lucrative growth over the forecast period. The growth of the market is owing to efforts to improve patient outcomes by providing diagnostic facilities at the retail level. Moreover, the ability of standalone labs to handle large volumes of diagnostic tests at an expedited rate and provide better results at comparatively lower prices is anticipated to offer economies of scale to service providers. There has been an increasing growth of the standalone market since the outbreak of the COVID-19 pandemic. In addition, emerging players providing standalone clinical lab testing services are expected to make a significant contribution to the segment’s rapid growth.

Application Insights

The bioanalytical & lab chemistry services segment accounted for the largest revenue share of 40.80% in 2025. Bioanalytical & lab chemistry laboratories use a wide range of techniques and technology platforms to fulfill diagnostic needs. ELISA, chromatography, immunochemistry, mass spectroscopy, and molecular biology are the most commonly used technologies in bioanalytical & lab chemistry applications. Bioanalytical services are an essential tool in drug discovery and development for determining the concentration of drugs and their metabolites. For instance, in November 2021, Labcorp launched a bioanalytical laboratory in Singapore, expanding its bioanalytical presence in Asia Pacific.

The toxicology testing services segment is expected to register a lucrative growth rate. Toxicology testing services include the identification of chemicals, drugs, and other toxic elements that affect patients and help clinicians in predicting future toxic effects, confirming a different diagnosis, or guiding therapy. Moreover, market players are adopting various strategies, including mergers and acquisitions, contributing to segment growth. For instance, in January 2023, Aegis Sciences Corporation acquired HealthTrackRx's Toxicology business unit, strengthening Aegis's toxicology portfolio. This allows Aegis to provide comprehensive clinical toxicology testing, while HealthTrackRx concentrates on expanding its capabilities in PCR infectious disease testing.

Regional Insights

North America clinical laboratory services market dominated the global market and accounted for 38.23% share in 2025. Major factors contributing to the largest share include high prevalence of chronic diseases, well established healthcare infrastructure, and rising geriatric population. The region shows the presence of a well-established healthcare system and reimbursement framework for clinical laboratory services. Moreover, new players are entering the market owing to the lucrative nature of the business in the country. For instance, in February 2023, Dutch biotech company Detact Diagnostics announced setting up a new laboratory in the Keene State College (U.S.) with a 2-year rental contract. Moreover, leading clinical laboratories that offer patients and healthcare professionals with crucial diagnostic information are represented by the American Clinical Laboratory, a national trade group.

U.S. Clinical Laboratory Services Market Trends

The clinical laboratory services market in the U.S. is growing as the FDA has proposed regulations to oversee laboratory-developed tests (LDTs), aiming to ensure their safety and effectiveness. For instance, in April 2024, the U.S. Food and Drug Administration (FDA) issued a final regulation aiming at reclassifying Laboratory-Developed Tests (LDTs) as medical devices, subjecting them to stricter oversight and device regulation criteria. Even though a court overturned the law in March 2025, the regulatory endeavor emphasized the growing strategic importance of accuracy and compliance in lab testing within the clinical diagnostics business. At the same time, the integration of digital health platforms, molecular diagnostics, and cutting-edge genomic testing is constantly improving service capabilities, allowing for more accurate and tailored patient care while also offering prospects for expansion in laboratories across the U.S., thereby increasing the growth of the market.

Europe Clinical Laboratory Services Market Trends

The clinical laboratory services market in Europe is rapidly evolving due to significant investments in research and development, leading to advancements in diagnostic technologies such as chemiluminescence immunoassays and real-time PCR. For instance, the UK government allocated USD 2 billion to establish over 155 Community Diagnostic Centers, delivering more than 7 million tests by March 2023. These initiatives enhance early disease detection and streamline patient pathways. Opportunities lie in the continued adoption of high-throughput assays and the expansion of personalized medicine approaches. However, the market faces challenges, including the need for standardized regulations across countries and addressing disparities in access to advanced diagnostic services. Furthermore, the European market is expanding due to greater collaboration between private labs and public health systems, which broadens service availability and improves access to cutting-edge diagnostics. The combination of digital health technologies, AI-driven analytics, and automated lab procedures is strengthening the market by boosting accuracy, lowering turnaround times, and promoting the advancement of precision medicine across the region.

The UK clinical laboratory services market is expected to grow over the forecast period due to the establishment of Community Diagnostic Centers has expanded access to testing, reducing waiting times and improving patient outcomes. The NHS's commitment to integrating advanced technologies, such as mass spectrometry and flow cytometry, enhances diagnostic accuracy and efficiency. Additionally, collaborations between public and private sectors are fostering innovation in laboratory services. Opportunities exist in the expansion of personalized medicine, requiring sophisticated diagnostic capabilities. The market also benefits from a skilled workforce and a strong regulatory framework. However, challenges include managing the increasing demand for services and ensuring equitable access across regions.

The clinical laboratory services market in Germany is supported by a robust healthcare system and a focus on technological innovation. German healthcare providers are increasingly adopting automated and high-throughput testing solutions to enhance efficiency and accuracy. Major players are forming partnerships to introduce new lab testing services, expanding their offerings and market reach. The country's emphasis on quality standards and regulatory compliance ensures reliable diagnostic outcomes. Opportunities abound in the integration of digital health tools and the expansion of molecular diagnostics. However, the market must navigate challenges such as workforce shortages and the need for continuous investment in infrastructure and training.

Asia Pacific Clinical Laboratory Services Market Trends

The clinical laboratory services market in Asia Pacific is anticipated to witness the fastest growth of 5.77% CAGR over the forecast period. The growth of the region is largely due to escalating scientific research, unmet medical needs, economic growth, and improvements in healthcare infrastructure and regulations. Increasing public awareness and the availability of advanced medical treatments are anticipated to bolster the region's growth. Clinical laboratory services have gained significant importance during the COVID-19 pandemic due to heightened demand for testing. Major players are focusing on partnerships to introduce new lab testing services. Furthermore, the APAC Clinical Laboratory Services Market is expanding as a result of the increased use of next-generation sequencing, AI-assisted diagnostic tools, and automated lab processes, which improve testing precision and reduce turnaround time. Moreover, expanding into developing countries such as India, China, and Southeast Asia creates significant opportunities for service providers to reach underserved people and strengthen their regional footprint.

China clinical laboratory services market is expected to grow over the forecast period due to driven by healthcare reforms, a large and aging population, and increased government investments in diagnostics. The rising prevalence of chronic diseases and urbanization contributes to the growing demand for laboratory services. Technological advancements, including the adoption of next-generation sequencing and automation, are enhancing diagnostic capabilities. Opportunities exist in the development of personalized medicine and the integration of artificial intelligence in diagnostics.

The clinical laboratory services market in Japan is expanding rapidly, driven by an aging population and a focus on early disease detection. The country's healthcare system emphasizes preventive care, increasing the demand for diagnostic testing. Technological innovations, such as advanced imaging and molecular diagnostics, are being integrated into laboratory services. Opportunities lie in the expansion of personalized medicine and the use of digital health solutions to streamline processes. Challenges include addressing workforce shortages and ensuring the sustainability of healthcare funding amidst demographic changes.

India clinical laboratory services market is rapidly expanding, driven by increasing access to healthcare, higher health awareness, and increased investment in diagnostic infrastructure. For instance, during Fiscal Year 2024-25, Dr. Lal PathLabs opened 18 new laboratories and hundreds of collecting centers across the country to expand their reach beyond large cities. Innovations like next-generation sequencing (NGS), automation, and digital laboratory information systems are improving diagnosis accuracy and efficiency. Major elements driving this expansion include increased demand for specialist testing, an increase in preventative health checkups, and an increase in organized diagnostics in tier III and tier IV cities. These advancements position the India clinical laboratory services market for further expansion throughout the forecast period.

Latin America Clinical Laboratory Services Market Trends

The clinical laboratory services market in Latin America is driven by the rising burden of chronic diseases and the adoption of advanced diagnostic technologies. Laboratories are investing in digitalization initiatives, such as laboratory information management systems (LIMS) and electronic health records (EHRs), to streamline processes. Opportunities exist in the integration of telemedicine platforms, enhancing access to diagnostic services. However, the market faces challenges like unclear regulatory frameworks and the need for workforce development.

Brazil clinical laboratory services market is witnessing substantial growth, supported by increased private investment and government reforms. The implementation of an electronic submission system for ethical approvals accelerates the process of test assessment and clinical trials. Opportunities lie in the expansion of genetic testing services and collaborations with international partners. Challenges include addressing ethical concerns and improving infrastructure in underserved regions.

Middle East and Africa Clinical Laboratory Services Market Trends

The clinical laboratory services market in the Middle East and Africa is poised for growth driven by the increasing prevalence of chronic diseases, advancements in diagnostic technology, and rising healthcare expenditure. The region is witnessing substantial investments in healthcare infrastructure, enhancing access to quality diagnostic services. Opportunities exist in the adoption of personalized medicine and the expansion into emerging markets with untapped potential. However, challenges such as limited accessibility in remote areas and cost constraints for advanced tests need to be addressed to ensure equitable healthcare delivery.

The Saudi Arabia clinical laboratory services market is experiencing steady growth, supported by government-led healthcare initiatives and the expansion of hospital infrastructure. The launch of the Seha Virtual Hospital, the largest virtual hospital globally, exemplifies the country's commitment to integrating digital health solutions. This initiative connects 224 hospitals and offers 44 specialized services, enhancing access to diagnostic care. Opportunities lie in the adoption of artificial intelligence and the development of personalized medicine. Challenges include ensuring the sustainability of healthcare funding and addressing workforce training needs to support the evolving landscape.

Key Clinical Laboratory Services Companies Insights

Key players operating in the clinical laboratory services market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Clinical Laboratory Services Companies:

The following are the leading companies in the clinical laboratory services market. These companies collectively hold the largest market share and dictate industry trends.

- Laboratory Corporation of America Holdings (LabCorp)

- QIAGEN

- Eurofins Scientific

- Quest Diagnostics Incorporated

- OPKO Health, Inc.

- Siemens Healthineers AG

- NeoGenomics Laboratories.

- Fresenius Medical Care.

- ARUP Laboratories.

- Sonic Healthcare Limited

- Charles River Laboratories.

- SYNLAB International

- Mayo Clinic Laboratories

- Unilabs

Recent Developments

-

In August 2025, C2N Diagnostics, LLC, a diagnostics company committed to delivering Clarity Through Innovation, will expand its reach to additional healthcare providers worldwide who are interested in utilizing its PrecivityAD2 blood test for the diagnosis of Alzheimer's disease. The PrecivityAD2 blood test helps healthcare providers detect amyloid pathology, a hallmark of Alzheimer's disease, in individuals with cognitive difficulties using a simple, non-invasive blood sample.

-

In August 2025, BioMark Diagnostics Inc., a well-known developer of liquid biopsy tests for early cancer detection, announces the successful completion of a strategic lease agreement for laboratory equipment, effectively doubling BioMark's testing capacity and preparing the company for the upcoming commercial launch of its lung cancer assay. This significant improvement in its operational capabilities supports the expansion of its diagnostic and research services, establishing the Company as a key hub for innovation, high-throughput diagnostics, and collaborative efforts.

-

In August 2023, Laboratory Corporation of America Holdings entered into an agreement with Tufts Medicine. Under the agreement, Labcorp will acquire Tufts Medicine Outreach Laboratory Business to expand its diagnostic testing and laboratory services.

-

In July 2023, DiaCarta, Ltd. partnered with Hopkins MedTech Lab Services and Hopkins MedTech Compliance to support the development and validation of laboratory developed tests in the U.S.

-

In February 2023, Dutch biotech company Detact Diagnostics announced setting up a new laboratory in the Keene State College (U.S.) with a 2-year rental contract.

Clinical Laboratory Services Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 229.87 billion

Revenue forecast in 2033

USD 308.24 billion

Growth rate

CAGR of 4.28% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2023

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test type, service provider, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark, Sweden, Norway, China; Japan; India; Australia; Thailand, South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait; Peru; Colombia

Key companies profiled

Laboratory Corporation of America Holdings (LabCorp); QIAGEN; Eurofins Scientific; Quest Diagnostics Incorporated; OPKO Health, Inc.; Siemens Healthineers AG; NeoGenomics Laboratories.; Fresenius Medical Care.; ARUP Laboratories.; Sonic Healthcare Limited; Charles River Laboratories.; SYNLAB International; Mayo Clinic Laboratories; Unilabs

Customization scope

Free report customization (equivalent to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Clinical Laboratory Services Market Report Segmentation

This report forecasts revenue growth at the global, regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global clinical laboratory services market report on the basis of test type, service provider, application, and region:

-

Test Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Genetic Testing

-

Clinical Chemistry

-

Routine Chemistry Testing

-

Therapeutic Drug Monitoring Testing

-

Endocrinology Chemistry Testing

-

Specialized Chemistry Testing

-

Other Clinical Chemistry Testing

-

-

Medical Microbiology Testing

-

Infectious Disease Testing

-

Transplant Diagnostic Testing

-

Other Microbiology Testing

-

-

Hematology Testing

-

Immunology Testing

-

Cytology Testing

-

Drug of Abuse Testing

-

Other Esoteric Tests

-

-

Service Provider Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital-Based Laboratories

-

Stand-Alone Laboratories

-

Clinic-Based Laboratories

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Bioanalytical & Lab Chemistry Services

-

Toxicology Testing Services

-

Cell & Gene Therapy Related Services

-

Preclinical & Clinical Trial Related Services

-

Drug Discovery & Development Related Services

-

Other Clinical Laboratory Services

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Colombia

-

Peru

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global clinical laboratory services market size was estimated at USD 224.35 billion in 2025 and is expected to reach USD 229.87 billion in 2026.

b. The global clinical laboratory service market is expected to grow at a compound annual growth rate of 4.28% from 2026 to 2033 to reach USD 308.24 billion by 2033.

b. Clinical chemistry dominated the clinical laboratory service market with a share of 44.46% in 2025 owing to the wide usage of tests related to urine, plasma, serum, and other body fluids for disease screening.

b. Some of the key service providers in the market include QIAGEN, ARUP Laboratories., Quest Diagnostics Incorporated, OPKO Health, Inc., Abbott, Siemens Medical Solutions USA, Inc., NeoGenomics Laboratories., Fresenius Medical Care., Sonic Healthcare., Laboratory Corporation of America Holdings (LabCorp).

b. Key factors that are driving the clinical laboratory service market growth include the increasing burden of chronic disease prevalence coupled with consequent demand for the early diagnostic tests and rapid advances in data management & sample preparation due to growing volumes of testing samples.

b. North America led the clinical laboratory service market for clinical laboratory services and accounted for the largest revenue share of 38.23% in 2025, owing to the high burden of chronic diseases in the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.