- Home

- »

- Biotechnology

- »

-

Clinical Oncology Next Generation Sequencing Market ReportGVR Report cover

![Clinical Oncology Next Generation Sequencing Market Size, Share & Trends Report]()

Clinical Oncology Next Generation Sequencing Market Size, Share & Trends Analysis Report By Workflow (NGS Pre-sequencing, NGS Data Analysis), By Technology, By Application, By End Use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-791-9

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global clinical oncology next generation sequencing market size was valued at USD 370.0 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 15.7% from 2023 to 2030. The key drivers are responsible for clinical oncology next-generation Sequencing (NGS) market growth are increasing technological advancements, growing competition among players, increasing healthcare spending, and the rise in the prevalence of cancer. In addition, augmenting research & development activities to invent solutions is expected to fuel the market growth over the forecast period. The COVID-19 pandemic has significantly impacted the market. The regulations and guidelines mandated by various countries' governments for cancer treatment have fueled the market during the pandemic. For instance, the Scottish Government's National Cancer Treatment Response Group allowed continuing essential cancer treatment by altering the treatment pathways in December 2020.

Moreover, the NGS diagnostic technology has the potential edge to determine a virus's genetic sequence and enables scientists to understand the mutations. During the COVID-19 pandemic, private players and government authorities worked to bring NGS technology as a diagnostic tool into the market. For instance, the U.S. Centers for Medicare & Medicaid Services expanded coverage of FDA-approved laboratory diagnostic tests using NGS in January 2020 for breast or ovarian cancer patients. These factors pushed the market demand during COVID-19 pandemic.

The increase in clinical applications of NGS in precision oncology has compelled key companies to invent novel platforms that can be utilized for genomic insights. For instance, in August 2022, Thermo Fisher Scientific, a key player in the market, introduced NGS Analysis and Test Software CE-IVD (IVDD) to extend access to precision oncology biomarker testing. This software enables healthcare providers to evaluate genomic test results quickly. The software compares the variant data to relevant evidence, including supported guidelines, therapies, clinical trials, and peer-reviewed literature. Such inventions in clinical applications of NGS can augment the market demand.

Moreover, the rising prevalence of cancer worldwide is the prominent factor driving the market. According to the article published by WebMD in June 2022, every year, more than 600,000 deaths are caused by cancer in the U.S. and around 80,000 in Canada. In addition, the International Agency for Research on Cancer (IARC) estimated nearly 27.5 million new cancer cases by 2040. NGS is useful for identifying rare and novel cancer mutations, detecting familial cancer mutation carriers, and giving a molecular rationale for suitable targeted treatment. As a result, it is projected that the increase in cancer incidences across the world can propel the demand for clinical oncology in next generation sequencing market.

Technological advancements in next-generation sequencing (NGS) and the growing adoption of companion diagnostics and personalized medicine are expected to propel market growth. Moreover, the rising usage of NGS for liquid biopsy is anticipated to drive revenue generation. The technological advances in NGS are useful in sequencing circulating tumor DNA for liquid biopsy sample analysis, which helps in effectively profiling cancers and facilitating real-time, non-invasive monitoring of cancer.

In addition, increasing market competition and the rising research & development activities to invent solutions can boost market demand. For instance, in May 2022, Berry Oncology, a company of early screening and genetic testing of tumors, introduced HIFI System, a novel self-iterative liquid biopsy technology. This technology enables early screening for cancer and delivers timely treatment to patients.

Next-generation technology facilitates cost- and time-effective sequencing of cancer DNA, transforming cancer treatment research. The wide application of NGS and bioinformatics tools can revolutionize cancer research, diagnosis, and therapy.NGS is an advanced technology that has rapidly developed. The adoption of NGS technology, particularly in the cancer field, regarding the genetic aspects of the disorder, is anticipated to influence the market growth positively. The sensitivity, speed, and lowered cost per sample are some of the aspects that contribute to the increased adoption of NGS technology for research purposes.

Technology Insights

The targeted sequencing and resequencing segment held the largest market share of 72.7% in 2022 in terms of revenue, owing to the various benefits associated with this technology, such as decreased time, cost, and quantity of data analyzed during the tumor samples sequencing Furthermore, the clinical utility of targeted panels is increased due to their efficiency in detecting malignant tumors. According to a study published by the JCO Precision Oncology in September 2020, it was found that NGS panels are clinically helpful in 64% of cancer cases.

Whole-Genome Sequencing (WGS) is anticipated to be the fastest-growing segment with 17.5% CAGR from 2023 to 2030, owing to the usage of this technology to compare and differentiate tumor tissues from normal tissues. In addition, WGS of cancer patients enables the identification of treatments for current mutations, and aids target mutations in advance. This also supports analyzing cancer prognosis.

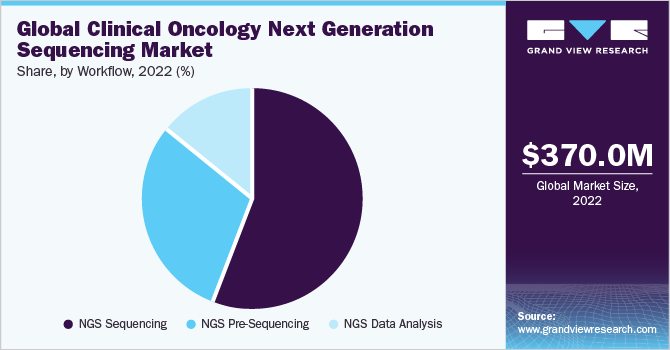

Workflow Insights

The NGS sequencing segment accounted for the largest revenue share of 56% in 2022 in workflow segment and it is expected to expand at the fastest CAGR over the forecast period. Sequencing includes the use of cutting-edge platforms and is a critical step of the complete workflow. The rise in cancer sequencing projects also expands segment growth. For instance, according to the study published by the National Library of Medicine in February 2020, the Pan-Cancer Analysis of Whole Genomes Consortium analyzed 38 cancer types by sequencing over 2,600 tumor samples.

NGS data analysis is expected to grow at a substantial rate. Efforts taken by key market players and scientists to invent advanced computational tools propel the segment growth. For instance, in May 2023, Researchers at the University of California, Los Angeles (UCLA) and the Children’s Hospital of Philadelphia (CHOP) invented a computational tool-Isoform peptide from RNA splicing for Immunotherapy target Screening (IRIS) capable of finding tumor antigens stemmed from alternative RNA splicing, extending the pool of cancer immunotherapy targets.

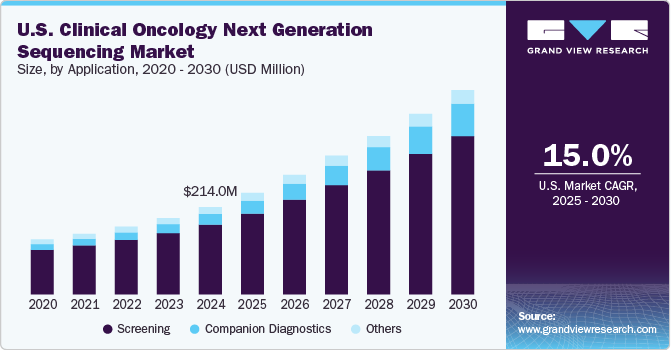

Application Insights

Screening held the largest market share of 80.1% in 2022, owing to the wide use of NGS in cancer screening programs across the world. Nowadays, NGS-based testing is considered the most efficient technique for identifying genetic alterations that can be targeted for clinical benefit in cancer patients. This technology enables clinicians to assess multiple gene alterations simultaneously.

The companion diagnostics segment is anticipated to witness the fastest CAGR of 20.8% from 2023 to 2030. Continuous product developments, partnerships & collaborations among the key participants are projected to increase the adoption of NGS for companion diagnostics.For instance, F. Hoffmann-La Roche Ltd expanded its partnership with Janssen Biotech Inc. (Janssen) in February 2023 to develop companion diagnostics for targeted treatments and to incorporate a broad range of companion diagnostics, comprising tissue and blood-based biomarkers, digital and sequencing pathology.

End-use Insights

The laboratories segment held the largest market share of 64.1% in 2022. Setting up complex workflows is a time-consuming process for laboratories. Therefore, most of the developed laboratories have created pre-existing workflows that are set according to standard procedures.

Moreover, with the enormous development and release of NGS assays for clinical purposes, detailed guidelines have been produced for NGS testing procedures. Thus, many FDA-approved tests come with specified standards, controls, and performance characteristics to verify the validity of the results. Several governing bodies in the U.S. regulate clinical laboratories. The CMS’s control laboratory testing via Clinical Laboratory Improvement Amendments (CLIA). These are also governed by state-level bodies that may have stricter regulations than CLIA. In addition, several organizations, such as the American College of Medical Genetics and Genomics (ACMG), the Association of Molecular Pathology (AMP), and the College of American Pathologists (CAP), have further developed the best guidelines for clinical laboratories.

As an end-user, clinics are anticipated to register the fastest CAGR of 18.1% from 2023 to 2030. Owing to the rising prevalence of cancer across the globe and increasing research and development activities in the market. According to the article published by JAMA Network in October 2020, next-generation sequencing has revolutionized over the past five years from research to clinical use. A minimum of 14 countries have undertaken initiatives to sequence large populations, and it is estimated that over 60 million people have their genomes sequenced by 2025. These statistics highlight the demand for the market over the forecast period.

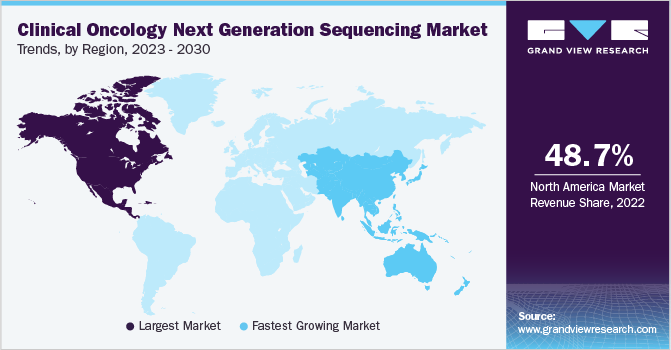

Regional Insights

North America dominated the market in 2022 with a share of 48.68% owing to the measures taken by regulatory bodies to boost cancer screening diagnosis in the U.S., increasing R&D investment, and the presence of key players in the region.North America dominated the market in 2022 with a share of xx% owing to the measures taken by regulatory bodies to boost cancer screening diagnosis in the U.S., increasing R&D investment, and the presence of key players in the region. Key players in the region are focusing on technological advancements to strengthen the market position and provide the best solutions. For instance, Illumina Inc., a company of DNA sequencing and array-based technologies, introduced an artificial intelligence algorithm- PrimateAI-3D, in June 2023 that predicts disease-causing hereditary mutations in patients with unprecedented accuracy.

The Asia Pacific region is expected to expand at the fastest CAGR of 17.3% during 2023-2030 due to decreased sequencing costs, favorable government policies, rising R&D investments, and competitive pricing by key players. China has witnessed a huge drop in sequencing costs compared to earlier years. The prominent players in the country provide NGS services and products at a highly competitive price compared to other countries. Encouraging government policies and high investment by key market players are driving the market's growth.

Key Companies & Market Share Insights

Several small and mid-sized players are operating in the market. Companies involved in the market are adopting various strategies, such as the launch of innovative products, partnerships & collaborations, to maintain their market presence. For instance, in May 2023, Thermo Fisher Scientific collaborated with Pfizer to improve regional access to next-generation sequencing-based testing for breast and lung cancer patients in over 30 countries across Africa, the Middle East, Latin America, and Asia where developed genomic testing has earlier been confined or inaccessible. Some of the key players in the global clinical oncology next generation sequencing market include:

-

Illumina, Inc.

-

Thermo Fisher Scientific

-

F. Hoffmann-La Roche Ltd.

-

Agilent Technologies

-

Myriad Genetics

-

Beijing Genomics Institute (BGI)

-

Perkin Elmer

-

Foundation Medicine

-

Pacific Bioscience

-

Oxford Nanopore Technologies Ltd.

-

Paradigm Diagnostics

-

Caris Life Sciences

-

Partek, Inc.

-

Eurofins Scientific S.E.

-

Qiagen N.V.

Clinical Oncology Next Generation Sequencing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 419.6 million

Revenue forecast in 2030

USD 1.16 billion

Growth rate

CAGR of 15.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, workflow, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Illumina, Inc.; Thermo Fisher Scientific; F. Hoffmann-La Roche Ltd.; Agilent Technologies; Myriad Genetics; Beijing Genomics Institute (BGI); Perkin Elmer; Foundation Medicine; Pacific Bioscience; Oxford Nanopore Technologies Ltd.; Paradigm Diagnostics; Caris Life Sciences; Partek, Inc.; Eurofins Scientific S.E.; Qiagen N.V.

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clinical Oncology Next Generation Sequencing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global clinical oncology next generation sequencing (NGS) market report based on technology, workflow, application, end-use, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Whole Genome Sequencing

-

Whole Exome Sequencing

-

Targeted Sequencing & Resequencing

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

NGS Pre-Sequencing

-

NGS Sequencing

-

NGS Data Analysis

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Screening

-

Sporadic Cancer

-

Inherited Cancer

-

-

Companion Diagnostics

-

Other Diagnostics

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Laboratories

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global clinical oncology NGS market size was estimated at USD 370.0 million in 2022 and is expected to reach USD 419.6 million in 2023.

b. Some key players operating in the clinical oncology NGS market include Illumina, Roche, Agilent; Thermo Fisher Scientific; Myriad Genetics; Beijing Genomics Institute (BGI); Perkin Elmer, Inc.; Qiagen NV; Partek, Inc.; Pacific Bioscience, Inc.; Foundation Medicine; Oxford Nanopore Technologies Ltd.; Paradigm Diagnostics, Inc.; Caris Life Sciences; and Eurofins Scientific.

b. Key factors that are driving the clinical oncology NGS market growth include a decrease in costs for genetic sequencing, advancements in the field of personalized medicine, growing adoption of NGS over single gene testing, and others.

b. The global clinical oncology NGS market is expected to grow at a compound annual growth rate of 15.7% from 2023 to 2030 to reach USD 1.16 billion by 2030.

b. Government support to conduct large-scale sequencing, and analysis of NGS data through BigData are some of the key factors that provide growth opportunities to the clinical oncology NGS market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."