- Home

- »

- Healthcare IT

- »

-

Clinical Workflow Solutions Market Size, Share Report, 2030GVR Report cover

![Clinical Workflow Solutions Market Size, Share & Trends Report]()

Clinical Workflow Solutions Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Data Integration Solutions, Workflow Automation Solutions), By End-use (Hospitals, Ambulatory Care Centers), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-152-8

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global clinical workflow solutions market size was estimated at USD 9.56 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 12.4% from 2023 to 2030. The increasing initiatives undertaken by public and private organizations, increasing demand for standardization of clinical workflow in developed nations such as the U.S., and the need for providing clinicians remote access to data insights and scalability are some of the key factors that have fueled demand for quality healthcare systems.

For instance, in January 2023, CenTrak launched WorkflowRT, an adaptable and cloud-based platform that optimizes clinical care communications and workflow and lessens reliance on human documentation. By enhancing patient flow metrics and identifying irregularities or obstructions, these advances are anticipated to propel market expansion.

Furthermore, hospitals are increasingly using technology-driven frameworks to upgrade their healthcare facilities and meet the increasing demands of both patients and clinicians. This trend is expected to further fuel the expansion of the market during the forecast period.Healthcare providers encountered substantial hurdles during the COVID-19 pandemic, emphasizing the need for remote access to data insights and effective clinical processes.

For instance, patients with diabetes and end-stage renal disease (ESRD) are particularly at risk; however, clinical workflow and solutions allow medical professionals to intervene in patients' care journeys and remotely access patient data. During the COVID-19 pandemic, this fueled market expansion and boosted acquisition activity as companies looked to diversify and combine their product portfolios. For instance, in September 2020, Health Catalyst, Inc. announced the purchase of healthfinch, Inc., a clinical workflow optimization system, to improve their EMR Embedded Insights package, which includes programs for refills, care gap closure, and visit planning.

Market players have taken further steps, such as creating new platforms and integrating their electronic health record (EHR) systems, to assist healthcare practitioners in managing COVID-19 patients. For instance, in April 2020, Hillrom and AgileMD collaborated to provide COVID-19 clinical paths at no cost for a full year. AgileMD delivers an EHR-integrated software platform with rapid access to cutting-edge clinical pathways and predictive analytics for use in the surgeon and nursing workflows. Similarly, in December 2020, Canon Medical unveiled the "AUTOStroke solution," a deep-learning AI-driven platform for clinical process automation.

Furthermore, government initiatives are expected to drive the demand for clinical workflow management systems in the coming years. For instance, the policy paper "The Future of UK Clinical Research Delivery: 2021 to 2022 implementation plan" highlights the strong collaboration within the UK clinical research environment. The implementation will be overseen by the UK-wide Clinical Research, Resilience, Recovery, and Growth (RRG) program, which collaborates with industry-government, the NHS, partners, academia, universities, regulators, medical research charities, patients, and the public.

The plan includes measures to expedite ethical approval and study setup and investments in digitizing clinical research delivery, enhancing the UK's capacity and capability for cutting-edge clinical research. These initiatives are anticipated to promote research, encourage funding, spur economic expansion, address health disparities, and enhance overall health outcomes throughout the UK, boosting market expansion over the forecast period.

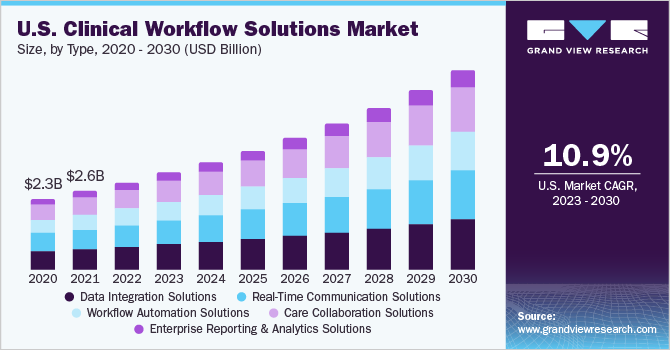

Type Insights

In 2022, the data integration solutions segment held the largest market share at 26.5%. Due to increasing data quantities and economic integration requirements, healthcare providers choose data integration technologies. The demand for integrated systems that provide access to patient data throughout the continuum of care is increasing. The adoption of electronic medical records, interoperability solutions, regulatory changes, and the transition to value-based services are the factors driving the growth of this market.

Due to the increasing emphasis on patient-centric services, the sector for care collaboration solutions is anticipated to develop at the fastest CAGR of 12.9%, over the forecast period. Integrated solutions are being used by payers, employer groups, and government entities to fulfill their management demands. In addition to improving patient care while reducing time and expenses, care management solutions offer effective workflow approaches.

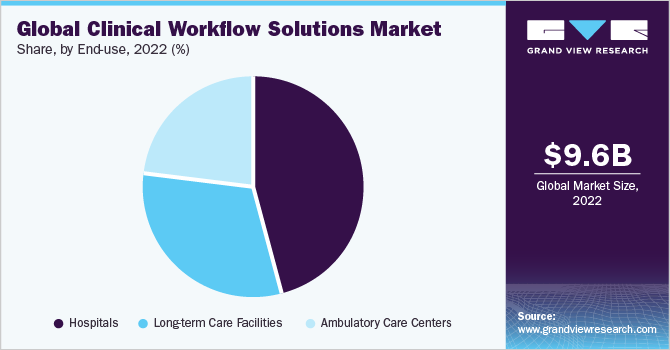

End-use Insights

The hospitals segment dominated the market with a revenue share of 44.9% in 2022 owing to the applicability and rising number of healthcare facilities clubbed with associated data that required proper management and privacy. In addition, government initiatives to support the healthcare sector and simplify the complexity of a huge amount of data in hospitals are further expected to drive market growth. Furthermore, rising workflow demand and the ongoing trend for connected hospitals will drive segment growth over the forecast period. The high demand for collaborative & integrated care delivery unified critical clinical communications and streamlined process for call scheduling are the factors contributing towards its largest revenue share.

With a CAGR of 12.9% during the projection period, the ambulatory care centers segment is anticipated to develop at the fastest pace. An increase in outpatient admissions is fueling this growth. Using IT solutions, these facilities can minimize medical errors and enhance communication between the nursing staff, doctors, pharmacists, and residents' relatives. The high adoption rates of cutting-edge technology in outpatient facilities result in quicker recovery and economical treatments.

Home healthcare is in greater demand, which has led to the introduction of new software and technology by service providers to improve the quality of their offerings. Over the forecast period, the adoption of clinical workflow management systems in long-term care institutions will be driven by the rising need for value-based care models and increased provider-payer cooperation.

Regional Insights

North America dominated the global clinical workflow solutions industry with a revenue share of 41.8% in 2022. This can be attributed to the growing number of R&D activities and hospital patient admissions, resulting in a large volume of generated data. In addition, increasing government initiatives to promote the effective use of interoperability, EHR, and other solutions, as well as a focus on patient care and rising healthcare spending on digitization for secure data exchange within organizations, contribute to North America's leading revenue share.

The Asia Pacific region is expected to be the fastest-growing market, with a projected CAGR of 13.8% during the forecast period. This growth is driven by the significant demand for healthcare information technology solutions in the medical sector. Supportive government initiatives promoting the implementation of eHealth, improving healthcare infrastructure, the rise in medical tourism, and the high demand for quality healthcare services also contribute to the growth of the clinical workflow solutions industry in the Asia Pacific region.

Key Companies & Market Share Insights

To sustain a high level of competitive rivalry, market participants are investing an extensive amount of funds in the development and launch of new products. For instance, at the American Society of Nephrology's Kidney Week 2022 in Orlando in November 2022, Magnifi was unveiled by Modulim, a health technology business that provides point-of-care microvascular and data analytics. Magnifi is a software program that improves clinical workflow effectiveness across multiple healthcare organizations by enabling doctors to obtain data insights remotely. These initiatives support the market's continuing competitiveness.

Furthermore, companies collaborate to encourage innovation in workflow solutions. For instance, in January 2023, the collaboration between VieCure and LabCorp intends to improve healthcare providers' access to complete genetic testing, enhancing the clinical workflow overall. Such collaborative initiatives are anticipated to promote the adoption of clinical workflow solutions over the forecast period. Some prominent players in the global clinical workflow solutions market include:

-

Veradigm Inc. (formerly Allscripts Healthcare Solutions, Inc.)

-

Cerner Corporation (acquired by Oracle Corporation)

-

NXGN Management, LLC

-

McKesson Corporation

-

Koninklijke Philips N.V.

-

Cisco Systems, Inc.

-

Getinge AB.

-

Vocera Communications, Inc.

-

Spok Inc.

-

AMETEK, Inc.

Clinical Workflow Solutions Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 10.7 billion

Revenue forecast in 2030

USD 24.37 billion

Growth rate

CAGR of 12.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

July 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Veradigm Inc. (formerly Allscripts Healthcare Solutions, Inc.); Cerner Corporation (acquired by Oracle Corporation); NXGN Management, LLC; McKesson Corporation; Koninklijke Philips N.V.; Cisco Systems, Inc.; Getinge AB.; Vocera Communications, Inc.; Spok Inc.; AMETEK, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clinical Workflow Solutions Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global clinical workflow solutions market report on type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Data Integration Solutions

-

EMR Integration Solutions

-

Medical Image Integration Solutions

-

-

Real-time Communication Solutions

-

Nurse Call Alert Systems

-

Unified Communication Solutions

-

-

Workflow Automation Solutions

-

Patient Flow Management Solutions

-

Nursing & Staff Scheduling Solutions

-

-

Care Collaboration Solutions

-

Medication Administration Solutions

-

Perinatal Care Management Solutions

-

Rounding Solutions

-

Other Care Collaboration Solutions (Specimen Collection Solutions and Blood Products Administration Solutions)

-

-

Enterprise Reporting & Analytics Solutions

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Long-term Care Facilities

-

Ambulatory Care Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global clinical workflow solutions market size was estimated at USD 9.56 billion in 2022 and is expected to reach USD 10.7 billion in 2023.

b. The global clinical workflow solutions market is expected to grow at a compound annual growth rate of 12.4% from 2023 to 2030 to reach USD 24.37 billion by 2030.

b. North America dominated the clinical workflow solutions market with a share of 41.8% in 2022. This is attributable to increasing number of R&D activities and patient admission in the hospitals leading to high volume of data generated.

b. Some key players operating in the clinical workflow solutions market include Veradigm Inc. (formerly Allscripts Healthcare Solutions, Inc.); Cerner Corporation (acquired by Oracle Corporation); NXGN Management, LLC; McKesson Corporation; Koninklijke Philips N.V.; Cisco Systems, Inc.; Getinge AB.; Vocera Communications, Inc.; Spok Inc.; AMETEK, Inc.

b. Key factors that are driving the market growth include growing initiatives by public and private organizations, increasing demand for standardization of clinical workflow in developed nations such as the U.S., and the need for providing clinicians remote access to data insights and scalability.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.