- Home

- »

- Next Generation Technologies

- »

-

Cloud AI Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Cloud AI Market Size, Share & Trends Report]()

Cloud AI Market (2026 - 2033) Size, Share & Trends Analysis Report By Technology (Machine Learning, Deep Learning, Natural Language Processing), By Type (Solution, Services), By Verticals (BFSI, Government, Healthcare), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-055-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cloud AI Market Summary

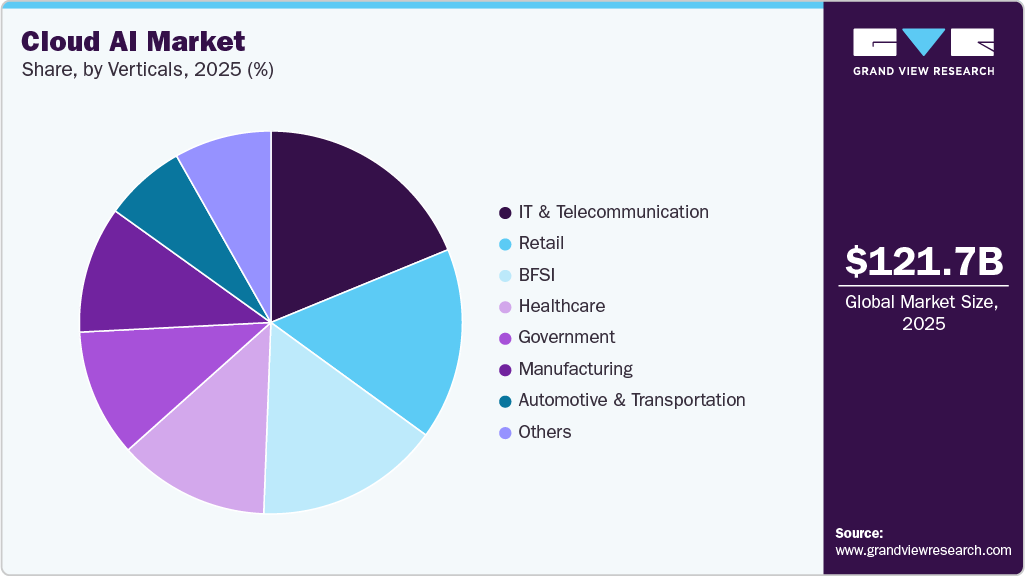

The global cloud AI market size was estimated at USD 121.74 billion in 2025 and is projected to reach USD 1,728.40 billion by 2033, growing at a CAGR of 39.3% from 2026 to 2033. The increasing demand for cloud AI integrates the capabilities of cloud computing with artificial intelligence algorithms to deliver various benefits, including faster processing, enhanced efficiency, and cost savings for businesses.

Key Market Trends & Insights

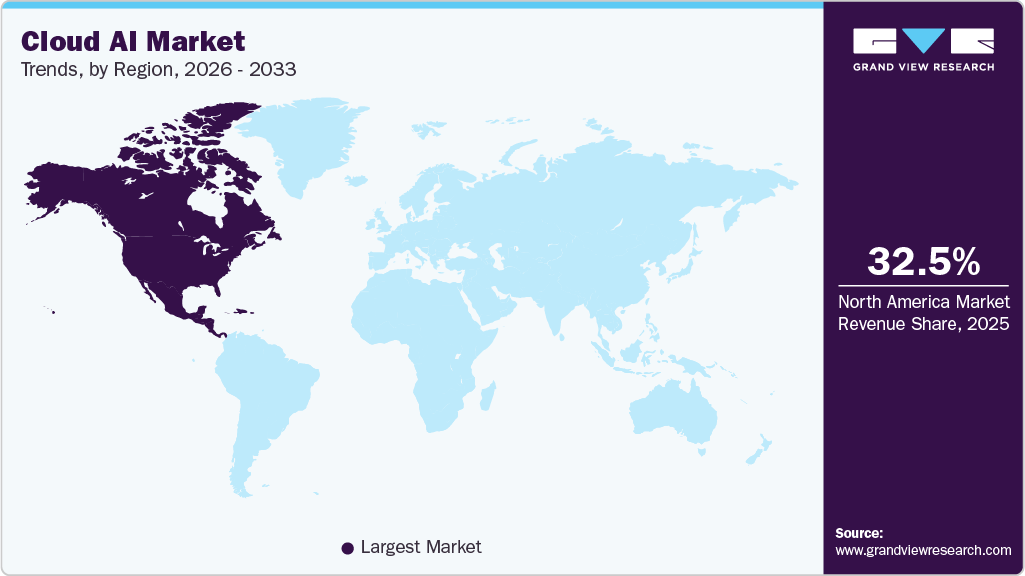

- North America dominated the global cloud AI industry with the largest revenue share of 32.5% in 2025.

- The cloud AI industry in the U.S. led the North America market and held the largest revenue share in 2025.

- By technology, the deep learning segment led the market and held the largest revenue share of 33.7% in 2025.

- By type, the solution segment held the dominant position in the market and accounted for the leading revenue share of 62.5% in 2025.

- By verticals, the government segment is expected to grow at the fastest CAGR of 41.3% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 121.74 Billion

- 2033 Projected Market Size: USD 1,728.40 Billion

- CAGR (2026-2033): 39.3%

- North America: Largest Market in 2025

One of the primary factors driving the expansion of the cloud AI industry is the growing adoption of artificial intelligence and machine learning technologies across multiple industries. As these technologies become more widely used, organizations are exploring ways to harness their potential for gaining a competitive edge. Cloud AI offers a scalable and accessible platform, making it a practical choice for implementing these advanced solutions effectively. Major technology companies, including Microsoft and Google LLC, are driving this growth by offering sophisticated AI platforms that cater to diverse business needs. These platforms provide tools for natural language processing, image recognition, predictive analytics, and other AI functionalities. The market is experiencing rapid growth due to increasing demand from businesses across various industries seeking to optimize their operations and enhance decision-making. Cloud AI integrates artificial intelligence algorithms with the scalability and flexibility of cloud computing, enabling organizations to deploy advanced technologies without requiring significant capital investment. This ease of access is encouraging more businesses to experiment with AI-driven solutions, contributing to widespread adoption. Consequently, the market continues to expand, supported by ongoing advancements in AI capabilities and cloud infrastructure.

The proliferation of data across industries is another crucial factor propelling the growth of the market. As businesses generate and collect vast amounts of data, the need for efficient processing, analysis, and actionable insights has become paramount. Cloud AI platforms address these challenges by offering scalable solutions that can handle large datasets while ensuring real-time processing. Furthermore, they enable seamless integration with existing enterprise systems, making them highly adaptable for businesses of all sizes. This growing reliance on data-driven decision-making is fueling the adoption of cloud AI solutions, ensuring sustained cloud AI industry growth.

Technology Insights

The deep learning segment led the market and accounted for 33.7% of the global revenue in 2025, driven by the demand for handling unstructured data volumes through scalable neural architectures. Deep Learning-accelerated infrastructure supports intensive model training and low-latency inference essential for complex pattern recognition. Advancements in federated learning enable privacy-preserving computation across distributed datasets. Hybrid deployment models facilitate seamless integration of on-premises and cloud resources for optimized performance.

The natural language processing segment is predicted to foresee significant growth over the forecast period. Natural language processing in the market advances via integration of large language models into user interfaces for language comprehension tasks. Cloud-native platforms deliver computational resources for response analysis and translation at enterprise scale. Expansion of model-as-a-service offerings accelerates deployment of hyper-personalized interaction systems. Multimodal processing capabilities enhance handling of combined text and voice inputs.

Type Insights

The solution segment accounted for the largest market revenue share in 2025. Solutions integrate agentic AI frameworks that autonomously execute multi-step tasks, such as generating personalized project recommendations from natural language inputs. These frameworks combine multimodal processing with real-time data synthesis to deliver actionable outcomes, including inventory-linked guidance and workflow automation.

The services segment is predicted to foresee significant growth over the forecast period. Cloud AI services deploy conversational interfaces that interpret project descriptions via voice, text, or image inputs to produce comprehensive materials lists. Backend automation handles intent resolution and issue mitigation through integrated chat, SMS, and voice channels. Route optimization incorporates external variables like access constraints for precise delivery execution.

Verticals Insights

The IT & telecommunication segment holds the largest market share of the global revenue in 2025. This sector extensively uses AI to optimize network management, improve customer natural language processing, and enhance data security. The integration of AI in telecommunications supports innovations such as 5G technology, predictive maintenance, and automated support systems. For instance, in August 2025, Xtelify launched Airtel Cloud, an independent telco-grade platform. The cloud offering provides IaaS, PaaS, advanced connectivity, secure migration, scaling capabilities, cost efficiencies, and vendor lock-in avoidance, managed by certified cloud experts.

The government segment is predicted to foresee significant growth over the forecast period. This sector is growing due to the adoption of AI as it seeks to improve efficiency and modernize public services. AI is being used to enhance security, streamline administrative processes, and optimize resource allocation. For instance, in December 2025, India's Ministry of Electronics and Information Technology introduced MeghRaj, the GI Cloud platform as part of the Digital India program. It offers secure, flexible, and expandable cloud services for e-Governance, with features like on-demand scaling, pay-as-you-go billing, easy self-service setup, and quick app deployment.

Regional Insights

North America cloud AI industry dominated the global market with a 32.5% revenue share in 2025. The cloud AI industry in North America is highly advanced, driven by the presence of major technology companies and early adoption of AI solutions. Businesses across industries are leveraging cloud AI to enhance efficiency and innovation. Significant investments in AI research and development further bolster the region's leadership in this cloud AI industry. Regulatory frameworks and strong digital infrastructure support widespread adoption of cloud-based AI services.

U.S. Cloud AI Market Trends

The U.S. cloud AI industry dominated the global market in 2025, with leading companies such as Microsoft and Google LLC driving innovation. The country’s diverse industries, including healthcare, finance, and retail, are rapidly adopting AI to gain a competitive edge. Government initiatives and private sector investments in AI research further accelerate cloud AI industry growth. The strong digital infrastructure and talent pool make the U.S. a global leader in cloud AI adoption. The increasing demand for scalable AI solutions positions the U.S. as a cornerstone of the global cloud AI industry.

Europe Cloud AI Market Trends

The Europe cloud AI industry is expanding as businesses and governments adopt AI to drive digital transformation. Key markets such as Germany, the UK, and France are investing heavily in AI infrastructure and innovation. The European Union’s focus on ethical AI and data privacy influences the development of cloud-based AI solutions. Industries such as manufacturing, automotive, and banking are integrating AI to improve efficiency and competitiveness. This growing adoption reflects Europe’s strategic approach to advancing cloud AI technologies while addressing regulatory concerns.

Asia Pacific Cloud AI Market Trends

The cloud AI industry in Asia-Pacific is growing rapidly, fueled by increasing digitalization and AI adoption across industries. Countries such as China, Japan, and India are leading this growth through significant investments in cloud infrastructure and AI research. Businesses in e-commerce, healthcare, and finance are leveraging cloud AI to optimize operations and enhance customer experiences. Government initiatives promoting AI adoption, along with a large and tech-savvy consumer base, contribute to the Cloud AI industry’s expansion. Asia-Pacific is emerging as a key region for cloud AI innovation and application on a global scale.

Key Cloud AI Company Insights

Some key companies in the cloud AI industry are Apple Inc., Intel Corporation, NVIDIA, and ZTE Corp.

-

Apple Inc. is using AI to improve its devices and services, such as Siri and facial recognition. While the company focuses more on Services, it’s expanding its AI capabilities through services such as iCloud. Apple’s AI-powered features help with things like personalized recommendations and smarter photo management. The company is also enhancing its Solution with AI tools. Apple Inc. is gradually growing its role in cloud AI to improve the user experience.

-

Google LLC is a major player in cloud AI, offering powerful AI tools such as TensorFlow and AutoML. Google Cloud uses AI for machine learning, language processing, and image recognition. The company’s AI services help businesses in industries such as healthcare and finance. Google continues to innovate and expand its AI offerings, making cloud AI more accessible. Google’s advancements in AI are helping businesses make smarter, data-driven decisions.

Key Cloud AI Companies:

The following key companies have been profiled for this study on the cloud AI market.

- Apple Inc.

- Google, Inc.

- IBM Corporation

- Intel Corporation

- Microsoft

- MicroStrategy, Inc.

- NVIDIA Corporation

- Oracle Corporation

- Qlik Technologies, Inc.

- Salesforce.com Inc.

- ZTE Corp.

Recent Developments

-

In January 2026, Google launched MedASR and MedGemma 1.5, open-source AI models for healthcare, accessible on Hugging Face and Google Cloud's Vertex AI under the Health AI Developer Foundations initiative. MedGemma 1.5 handles intricate 3D medical scans such as CTs, MRIs, and pathology slides, plus electronic health record processing with DICOM integration.

-

In December 2024, Amazon Web services (AWS), Inc., introduced new AI servers powered by its Trainium2 chips, with Apple joining as a customer to use them. These servers, designed for advanced generative AI workloads, will be used by AI startup Anthropic and offer greater chip connectivity than existing alternatives.

-

In October 2024, Intel collaborated with Inflection AI to launch inflection for enterprise, a ready-to-use AI system running on Intel's Gaudi 3 chips and Tiber AI Cloud. It offers chat-based AI that's customized to a company's own data, rules, and ways of working, helping employees get more done whether on local servers, in the cloud, or a mix of both.

Cloud AI Market Report Scope

Report Attribute

Details

Market size in 2026

USD 169.85 billion

Revenue forecast in 2033

USD 1,728.40 billion

Growth rate

CAGR of 39.3% from 2026 to 2033

Base year for estimation

2025

Actual data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, type, verticals, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Europe; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa; Mexico

Key companies profiled

Apple Inc.; Google Inc.; IBM Corporation; Intel Corporation; Microsoft; MicroStrategy Inc.; NVIDIA Corporation; Oracle Corporation; Qlik Technologies Inc.; Salesforce.com Inc.; ZTE Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

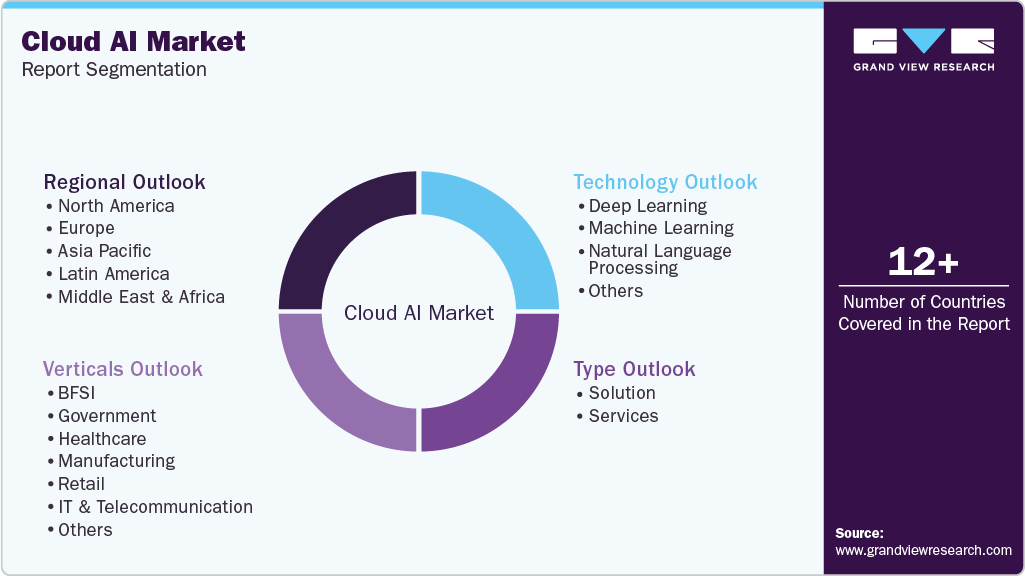

Global Cloud AI Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global cloud AI market report based on technology, type, verticals, and region:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Deep Learning

-

Machine Learning

-

Natural Language Processing

-

Others

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Solution

-

Services

-

-

Verticals Outlook (Revenue, USD Million, 2021 - 2033)

-

BFSI

-

Government

-

Healthcare

-

Manufacturing

-

Retail

-

IT & Telecommunication

-

Automotive & Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cloud AI market size was estimated at USD 121.74 billion in 2025 and is expected to reach USD 169.85 billion in 2026.

b. The global cloud AI market is expected to grow at a compound annual growth rate of 39.3% from 2026 to 2033 to reach USD 1,728.40 billion by 2033.

b. North America dominated the cloud AI market with a share of 32.53% in 2025. This is driven by the presence of major technology companies and early adoption of AI solutions as businesses across industries are using cloud AI to enhance efficiency and innovation.

b. Some key players operating in the cloud AI market include Apple Inc; Google Inc.; IBM Corporation; Intel Corporation; Microsoft Corporation; MicroStrategy Inc; NVIDIA Corporation; Oracle Inc.; Qlik Technologies Inc.; Salesforce Inc.; and ZTE Corp.

b. Key factors that are driving the market growth include the increasing demand for cloud AI integrates the capabilities of cloud computing with artificial intelligence algorithms to deliver various benefits, including faster processing, enhanced efficiency, and cost savings for businesses

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.