- Home

- »

- Next Generation Technologies

- »

-

Cloud Logistics Market Size & Share, Industry Report, 2030GVR Report cover

![Cloud Logistics Market Size, Share & Trends Report]()

Cloud Logistics Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Public, Private, Hybrid), By OS Type, By Enterprise Size, By Industry Vertical (Retail, Consumer Electronics, Healthcare, Automotive), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-112-7

- Number of Report Pages: 134

- Format: PDF

- Historical Range: 2017 -2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cloud Logistics Market Summary

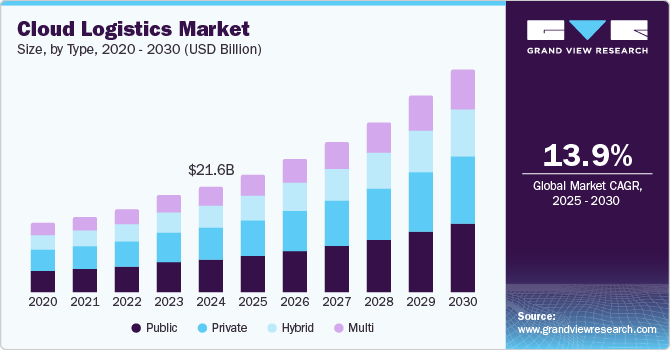

The global cloud logistics market size was estimated at USD 21,550.4 million in 2024 and is projected to reach USD 46,313.9 million by 2030, growing at a CAGR of 13.9% from 2025 to 2030. The global acceleration in adopting cloud-based business operations has led to the digitalization of the supply chain industry, thereby driving the market.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, Saudi Arabia is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, public accounted for a revenue of USD 6,455.9 million in 2024.

- Private is the most lucrative type segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 21,550.4 Million

- 2030 Projected Market Size: USD 46,313.9 Million

- CAGR (2025-2030): 13.9%

- North America: Largest market in 2024

This transformation enables the industry to handle fluctuations and fast-paced demands while improving responsiveness to disruptions in the supply chain. Companies are now restructuring their supply chains into digital networks, seamlessly integrating physical product and service flows. These digital supply networks offer cost-effective, efficient, secure, and highly scalable solutions that can easily integrate with existing systems.

Furthermore, the rapid growth of cloud computing facilitates expanding collaborative transportation management solutions (TMS) and other facets of transportation management. These include sourcing network capacity, achieving comprehensive visibility and event management, and handling ancillary functions like freight pay and audit.

Moreover, cloud computing offers enhanced disaster recovery capabilities in the logistics industry, enabling logistics firms to swiftly rebound from unforeseen events like system failures or natural tragedy. Cloud technology provides disaster recovery options, including backup and restore replication and failover solutions. These features ensure the resilience and continuity of logistics operations during challenging situations. Moreover, adopting cloud computing in the logistics industry offers several crucial benefits, including minimizing downtime, ensuring business continuity, and mitigating the risk of data loss. These advantages are essential as downtime can result in substantial revenue losses and harm a company's reputation. Consequently, numerous logistics companies are embracing cloud logistics to leverage the advantages that cloud computing brings to their operations.

Limited structural control and unauthorized uses are major factors hindering the growth of the cloud logistics industry. Moreover, the primary cause of the breach lies in the employees' irresponsibility, as they may be utilizing untested and unauthorized methods to access the cloud servers, damaging the entire logistics and supply chain system. However, implementing artificial intelligence (AI) with cloud logistics is anticipated to provide opportunities for market growth over the forecast period. Additionally, the rising number of AI-based innovations and the escalating cost of manual labor drive AI adoption in logistics industry. This trend is fueling the optimization of integrated operations.

AI and Machine Learning (ML) are increasingly being integrated into cloud logistics platforms to optimize supply chain management. These technologies enable real-time decision-making, predictive analytics, and automation, allowing companies to better forecast demand, optimize routes, and improve inventory management. AI algorithms can predict disruptions, automate decision-making, and even suggest the most efficient delivery routes based on historical data and real-time conditions, minimizing delays and costs.

Companies are launching AI-powered cloud logistics solutions. In March 2023, Alibaba Cloud announced the launch of its AI-driven logistics solution, EasyDispatch, in Malaysia to boost the local logistics sector through innovative, real-time dispatch capabilities powered by advanced cloud-based technology. Partnering with Malaysia’s Global Track and EasyParcel, Alibaba Cloud aims to enhance productivity and efficiency across Southeast Asia’s logistics landscape, supporting local businesses in digital transformation with solutions that improve operational speed, cost-effectiveness, and customer experiences.

Collaborative logistics platforms are significantly driving the growth of the cloud logistics market by enabling enhanced cooperation and information-sharing among all stakeholders in the logistics value chain, which results in improved operational efficiency, cost savings, and more agile responses to market demands. Collaborative platforms allow shippers, carriers, suppliers, and third-party logistics providers (3PLs) to share real-time data and updates about shipments, inventory levels, and delivery statuses. This seamless communication reduces delays, minimizes errors, and enhances coordination across various functions, leading to smoother logistics operations.

Type Insights

The public dominated the market with a revenue share of 29.9% in 2024. A public-based cloud is an IT framework where a third-party provider manages and offers on-demand computing resources and infrastructure over the Internet. These services are accessible to various companies and individuals, who can rent them on a flexible basis, including options like Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS). Payments can be made either on a monthly or pay-per-use model. Furthermore, a public-based cloud offers various benefits, including lower cost, high reliability, and near-unlimited scalability. Such benefits associated with public clouds are anticipated to propel the segment growth over the forecast period.

The private segment is anticipated to register the fastest CAGR from 2025 to 2030. The segment is anticipated to be driven by an increased focus on data security. Furthermore, the growing adoption of private clouds has led to the emergence of various vendors offering private cloud solutions to government agencies. For instance, Microsoft Corp. provides Azure Government, a specialized cloud computing service that caters to US government agencies and their partners, ensuring top-notch security and protection. This offering utilizes hyper-scale cloud capabilities and emphasizes threat detection through machine learning. As a result, Azure Government enables seamless data transfer between devices and data centers for US government agencies.

OS Type Insights

The web-based OS segment dominated the market with a revenue share of 52.5% in 2024. Web-based software is accessed and operated through the internet using a web browser. It is purposely built to expedite and improve many areas of logistics management, such as transportation, inventory control, order monitoring, and supply chain coordination. This sort of software enables users to view and control logistics data and operations from any place with internet connectivity, allowing for more ease and flexibility in logistics management. Furthermore, web-based logistics software frequently provides real-time tracking and reporting capabilities, allowing for more effective decision-making and overall logistics efficiency.

The native OS is another crucial segment in the cloud logistics industry. The segment is anticipated to register the fastest growth over the forecast period. Native OS is a logistics software developed and constructed for deployment and operation on cloud computing platforms. Native logistics software, as opposed to traditional software that has been retrofitted for cloud use, is designed from the ground up to leverage the advantages of cloud computing fully. Furthermore, such software is designed to leverage these technologies such as scalability, adaptability, and robustness. Furthermore, native logistics software can automatically adjust its computing resources in response to changing workloads, ensuring efficient handling of varying demands. This software can be accessed from any location with an internet connection and a web browser, enabling seamless remote management and user collaboration.

Enterprise Size Insights

The large enterprise segment dominated the market with a revenue share of 66.4% in 2024. It is anticipated to remain prevalent over the forecast period owing to its heavy utilization. Logistics cloud is becoming a more popular option for large enterprises as they want to streamline their supply chain and logistics operations. Furthermore, such solutions enable major organizations to grow their logistics operations as needed. Cloud-based solutions can rapidly and efficiently adapt to changing requirements, whether handling increasing demand during peak seasons or expanding into new areas. Advanced analytics and machine learning are used in supply chain systems to estimate demand, optimize routes, and identify possible supply chain issues. These insights allow large enterprises to make more informed decisions and improve operational efficiency.

The small & medium enterprises segment is expected to grow at a significant CAGR from 2025 to 2030. Cloud-based solutions provide SMEs with resources and capabilities that were previously only available to bigger organizations. Cloud based supply chain is an appealing alternative for SMEs trying to optimize their logistics operations and stay competitive in a quickly expanding market because of its cost-effectiveness, scalability, real-time visibility, security, and innovation. Additionally, it offers significant cost-saving benefits for small and medium-sized businesses (SMEs). One of the most notable advantages is reducing hardware, software, and maintenance expenses, freeing up financial resources for other purposes. Moreover, cloud servers consume less electricity, resulting in lower energy costs. Additionally, SMEs can opt for a pay-as-you-go model, paying only for their specific services, eliminating the need for upfront investments in hardware or software. This cost-effective approach makes cloud platforms an attractive option for SMEs seeking to optimize their IT budgets and focus on core business operations.

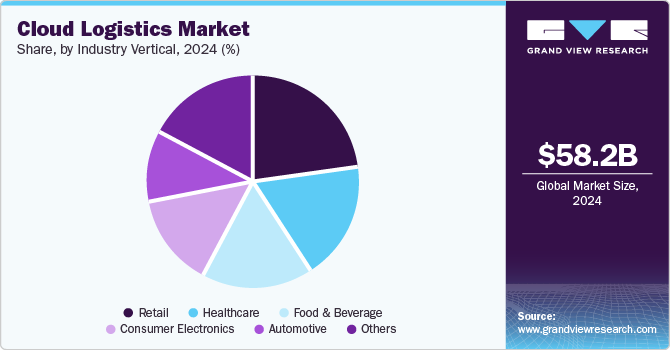

Industry Vertical Insights

The retail segment dominated the market with a revenue share of 23.0% in 2024. Cloud logistics are bringing significant benefits to the retail industry across multiple fronts. These advantages encompass cost reduction by minimizing infrastructure, storage, and computing expenses while providing immediate access to crucial operational and inventory data. As a result, cloud logistics is causing a comprehensive transformation in the retail sector, leading to more efficient inventory management, improved data security, enhanced user experiences, increased profitability, and better disaster management capabilities. Additionally, in November 2021, WPP, a UK-based creative transformation business, purchased Cloud Commerce Group. This UK-based firm supplies merchants with multi-channel e-commerce software for an undisclosed sum. This purchase demonstrates WPP's ongoing commitment to growing its client commerce offering.

The healthcare segment has emerged as a lucrative segment for the market, accounting for a market share of 18.2% in 2024. These solutions provide real-time visibility into the healthcare supply chain, allowing medical institutions to manage medical equipment, medications, and other supplies and monitor inventory levels. This improved visibility aids in preventing stockouts and shortages, guaranteeing a steady supply of vital medical commodities. In addition, cloud platforms are especially beneficial for handling medicines and cold chain logistics, ensuring that temperature-sensitive drugs and vaccines are properly kept and transferred.

Regional Insights

North America dominated the cloud logistics industry and accounted for the highest share of 30.7% in 2024. The regional growth can be attributed to major platform providers such as IBM Corporation, Bwise, and Microsoft Corporation, among others. Additionally, in April 2022, Synkrato, a California-based firm, introduced a logistics platform at MODEX 2022. This platform seamlessly integrates the metaverse, augmented reality (AR), artificial intelligence (AI), mobility, and the Internet of Things (IoT) into a comprehensive solution for supply-chain professionals. This holistic platform allows logistics experts to manage and optimize their logistics processes efficiently.

U.S. Cloud Logistics Market Trends

The U.S. cloud logistics industry is advancing rapidly due to increased demand for real-time visibility, efficient last-mile delivery, and AI-driven optimization. Companies are adopting cloud-based solutions to gain flexibility, cost savings, and enhanced sustainability through streamlined operations and collaborative platforms. These trends are central to digital transformation in logistics, enabling U.S. businesses to meet high consumer expectations and competitive pressures effectively.

Asia Pacific Cloud Logistics Market Trends

Asia Pacific is anticipated to register the fastest growth from 2025 to 2030. Cloud logistics industry has witnessed rapid growth in Asia Pacific, altering the supply chain and warehouse management environment for firms in various industries. Asia Pacific, being a dynamic and diversified market, has used cloud-based solutions to handle difficulties and profit from the benefits of the cloud supply chain. Furthermore, the Asia Pacific region has substantially increased e-commerce and digital transformation. Cloud platforms has played a critical part in e-commerce business growth, allowing for smooth order processing, fulfillment, and last-mile delivery.

Key Cloud Logistics Company Insights

Some of the key players operating in the market include IBM, Microsoft, and Oracle.

-

Microsoft is a global technology company headquartered in the U.S., specializing in software, devices, services, and solutions. Founded in 1975, Microsoft has grown into one of the world's biggest and most influential technology companies, known primarily for its Windows operating system, Microsoft Office productivity suite, and Azure cloud computing platform. In recent years, Microsoft has strategically expanded its business in cloud computing, artificial intelligence, and enterprise services.

ShipBob, Inc. and CargoSmart Limited are some of the emerging participants in the target market.

-

ShipBob, Inc. is a leading global fulfillment platform headquartered in in the U.S., specializing in e-commerce logistics and order fulfillment for direct-to-consumer brands. Founded in 2014, the company provides warehousing, packaging, shipping, and returns management through a technology-driven platform that integrates with popular e-commerce platforms such as Shopify, Amazon, and BigCommerce.

Key Cloud Logistics Companies:

The following are the leading companies in the cloud logistics market. These companies collectively hold the largest market share and dictate industry trends.

- BWISE

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP

- Thomson Reuters

- Trimble

- Uber Freight

- The Descartes Systems Group Inc

- C.H. Robinson Worldwide, Inc.

- MetricStream

- 3Gtms, LLC

- CargoSmart Limited

- e2open, LLC

- ShipBob, Inc.

- orderful

- Paccurate, Inc.

- Cleo

- Fleetio (Rarestep, Inc.)

Recent Developments

-

In September 2024, Rose Rocket, Inc., a Canada-based provider of cloud-based transportation software, announced a partnership with CartonCloud to introduce its logistics solutions to Australia and New Zealand. This collaboration combines Rose Rocket, Inc.'s customizable, scalable platform with CartonCloud's expertise in warehouse and transport management, offering a comprehensive, user-friendly solution tailored to local needs, launching in early 2025.

-

In December 2023, Fujitsu announced a new cloud-based logistics data standardization and visualization service aimed at enhancing sustainability and addressing challenges like driver shortages, emissions reduction, and regulatory compliance. Available on Amazon Web Services, Inc. (AWS), this service will enable shippers, logistics firms, and vendors to securely share standardized data across the supply chain, fostering collaboration and streamlined logistics planning while optimizing complex operations.

-

In November 2022, Microsoft Corporation revealed the Microsoft Supply Chain Platform, an innovative design approach focused on enhancing supply chain agility, automation, and sustainability. This new platform aims to revolutionize supply chain operations, enabling businesses to become more flexible, efficient, and environmentally sustainable in their logistics and supply chain practices.

-

In February 2022, Oracle Corporation unveiled enhanced logistics capabilities empower to its customers to boost supply chain efficiency and overall value. These new capabilities are designed to optimize supply chain operations, resulting in improved performance and cost-effectiveness within the supply chain. By leveraging these innovations, Oracle's clients can achieve higher levels of operational efficiency, cost savings, and increased value in managing their logistics and supply chain processes.

Cloud Logistics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 24.18 billion

Revenue forecast in 2030

USD 46.31 billion

Growth rate

CAGR of 13.9% from 2025 to 2030

Actual data

2017 - 2024

Forecast period

2025 - 2030

Market representation

Revenue in USD billion/million, and CAGR from 2025 to 2030

Market segmentation

Type, OS type, enterprise size, industry vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil;United Arab Emirates (UAE); Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

BWISE; IBM Corporation; Microsoft Corporation; Oracle Corporation; SAP; Thomson Reuters; Trimble; Uber Freight; The Descartes Systems Group Inc.; C.H. Robinson Worldwide, Inc.; MetricStream; 3Gtms, LLC; CargoSmart Limited; e2open, LLC; ShipBob, Inc.; orderful; Paccurate, Inc.; Cleo; Fleetio (Rarestep, Inc.)

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analysts working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Global Cloud Logistics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global cloud logistics market report based on type, OS type, enterprise size, industry vertical, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Public

-

Private

-

Hybrid

-

Multi

-

-

OS Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Native

-

Web-based

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprise

-

SMEs

-

-

Industry Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail

-

Consumer Electronics

-

Healthcare

-

Automotive

-

Food & Beverage

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

United Arab Emirates (UAE)

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cloud logistics market size was estimated at USD 21.55 billion in 2024 and is expected to reach USD 24.18 billion in 2025.

b. The global cloud logistics market is expected to grow at a compound annual growth rate of 13.9% from 2025 to 2030 to reach USD 46.31 billion by 2030.

b. North America dominated the cloud logistics market with a share of 30% in 2024. This is attributable to the presence of major cloud logistics platform providers operating in the region.

b. Some key players operating in the cloud logistics market include BWise, IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, Thomson Reuters Corporation, Trimble Transportation, Transplace (an Uber Freight Co.), Descartes Systems Group, C. H. Robinson, MetricStream, Inc., 3GTMSCargoSmart Limited BluJay Solutions, ShipBob, Inc., Orderful, Paccurate, Cleo, Fleetio.

b. Key factors that are driving the cloud logistics market growth include growing digitalization across supply chain industry, and rapid adoption of cloud computing across industry verticals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.