- Home

- »

- Automotive & Transportation

- »

-

CNG Powertrain Market Size, Share & Trends Report, 2030GVR Report cover

![CNG Powertrain Market Size, Share & Trends Report]()

CNG Powertrain Market (2022 - 2030) Size, Share & Trends Analysis Report By Drive Type (All Wheel, Rear Wheel, Front Wheel), By Fuel Type, By Vehicle Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-946-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global CNG powertrain market size was valued at USD 71.99 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 17.2% from 2022 to 2030. A growing need for an alternative transitional fuel leads toward the net-zero carbon emissions goal. Compressed Natural Gas (CNG) produces lesser carbon emissions and is free from particulate matter, which is a prominent source of vehicular pollution, thus CNG is expected to become a dominant energy source over other fuels such as diesel, petrol, and LPG. Governments worldwide are taking strategic initiatives to provide tax rebates, subsidies, and other benefits to CNG vehicle purchasers, which are expected to create high demand for CNG powertrain vehicles during the forecast period.

However, government initiatives and the rise in consumers’ inclination toward less carbon-emitting vehicles have increased the demand for CNG powertrain. COVID-19 negatively impacted its market sales. Thus, the new CNG powertrain vehicle production halted, leading to sluggish sales between 2019 and 2020. For instance, Volvo Group, a prominent automobile manufacturer, has sold 661,713 cars in 2020 and faced a decline in sales by 6.2% compared to 2019. The pandemic stalled manufacturing and production activities across the world. Post-pandemic, high demand for personal fuel-efficient vehicles was observed majorly from the developing nations of the Asia Pacific region, thus fueling the market growth.

The CNG powertrain manufacturers are majorly focusing on improving the vehicle's engine efficiency. They are investing in enhancing the engine performance by working on reducing the volumetric efficiency loss, increasing the flame propagation speed, and decreasing the fuel evaporation in engines. Additionally, prominent automobile manufacturers are implementing advanced technologies in CNG vehicles.

For instance, S-CNG technology is incorporated in passenger cars to enhance fuel economy by regulating the fuel and air ratio and synchronizing between the electric control units and intelligent fuel injection system. Besides, through technology integration, there is a better calibration of the CNG system with the powertrain, suspension, and braking system, thus the S-CNG technology improves the overall efficiency of the vehicle.

Moreover, the sales of CNG powertrain vehicles are hindered due to the limited number of fulling stations across the globe. According to the U.S Department of Energy, in 2021, about 900 CNG stations are available in the U.S., which is far less than the petrol and diesel station. Thus, to boost the sales of CNG powertrain vehicles, there is a need for the development of CNG refilling stations across various countries.

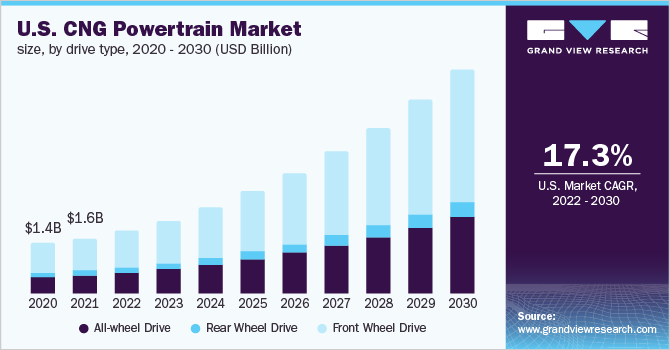

Drive Type Insights

The front wheel drive segment dominated the overall market in 2021 and accounted for a revenue share of over 50.0%. The segment growth is attributed to the advantageous features of front wheel drive vehicles such as lightweight, better fuel economy, and vehicle weight distribution balance, which enhances the overall stability of the automobile in difficult terrains. Additionally, a front wheel drive is a cost-effective option for consumers because drivetrains require lesser maintenance, and the engine offers extra vehicle mileage; these lucrative features are contributing to the significant segment growth.

The all-wheel drive segment is estimated to expand at the highest CAGR of 18.3% over the forecast period. The all-wheel drivetrain distributes power to each corner of the car, which increases the grip capacity of the vehicle, provides better acceleration, and offers smooth handling. The superior traction forces eliminate the possibility of a vehicle slipping on icy, wet, and sloppy roads, thus making all-wheel drive CNG powertrain a widely preferred option over others.

Fuel Type Insights

The bi-fuel dominated the overall market in 2021 and accounted for a revenue share of over 80.0%. The segment growth is attributed to the higher adoption of advanced technologies such as S-CNG technology, which offers easy switching between the gasoline and CNG without affecting the engine performance. The development of fuel injection technology that allows direct injection of CNG into the existing combustion chamber has further increased the sales of bi-fuel CNG powertrain.

The mono-fuel segment is estimated to expand at a lucrative CAGR of 19.2% from 2022 to 2030. The use of CNG as a fuel offers significant advantages such as reduction of primary and tailpipe emissions. Further, the petrol and diesel prices are highly fluctuating while the cost of CNG per gallon is low, which provides relief to CNG vehicle owners. Therefore, the economic nature of CNG is expected to create high demand for a mono-fuel CNG powertrain vehicle.

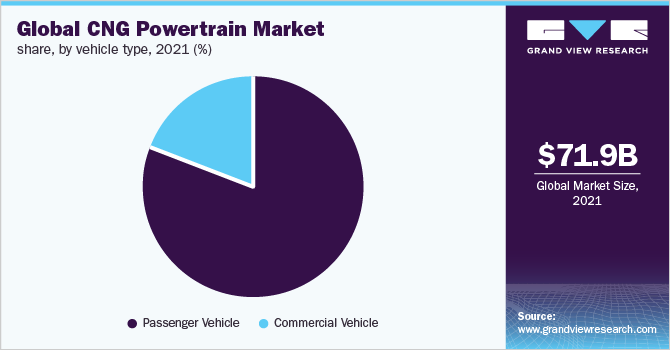

Vehicle Type Insights

The passenger vehicle segment accounted for more than 75.0% share of the overall revenue in 2021. The segment growth is majorly due to the lower initial cost of the CNG powertrain vehicle over other environment-friendly substitutes such as electric powertrain vehicles. Based on vehicle type, the market is bifurcated into passenger vehicles and commercial vehicles.

The commercial vehicle segment is anticipated to expand at a lucrative CAGR of 18.9% over the forecast period. There is increasing adoption of CNG-powered buses for school and public transportation to reduce environmental degradation. For instance, in March 2022, the Indian government has planned to introduce 100 CNG powertrain A.C buses to the country’s capital. These buses are environmentally friendly and are expected to reduce the vehicular pollution level of the city at large. Thus, such initiatives of the government of emerging nations will increase the penetration of CNG commercial vehicles and are anticipated to create the demand for CNG powertrain in the market.

Regional Insights

Asia Pacific dominated the market in 2021 and accounted for over 65.0% share owing to the rapid growth in the automobile sector in countries such as China and India. Asia Pacific is undergoing numerous technological advancements, along with ever-developing CNG infrastructure. Prominent players in the region, such as Maruti Suzuki, are incorporating S-CNG technology into passenger vehicles, such as cars. The cars offered by the company are equipped with an intelligent fuel injection system and the CNG powertrain is calibrated to deliver optimum performance and improve the drivability for all terrains.

Latin America is anticipated to expand at the highest CAGR of 18.6% from 2022 to 2030. The growing per capita income of consumers based in Argentina, Brazil, and Colombia has resulted in increased expenditure on automobiles. Consumers are majorly investing in buying a personal vehicle as compressed natural gas powertrain vehicles are viable, cost-effective, and environmentally friendly, thus they are widely preferred in the region. Additionally, the government in Argentina is actively taking steps to increase the adoption of the CNG powertrain vehicles by launching the ‘Conectar Gas Industria’ program. Under this program, the government has planned to invest USD 517,000 to build CNG infrastructure and install a new 25 CNG station in the country.

Key Companies & Market Share Insights

Prominent players are adopting strategies such as expansion, mergers & acquisitions, and partnerships to strengthen their market presence in various regions. Organic growth remains the key strategy for most of the market's incumbents. As such, C.N.G. powertrain manufacturers are focused on enhancing their existing product offerings and brand awareness to gain a competitive edge in the market.

In October 2021, Cummins announced a launch of the X15N engine, a 15-liter natural engine for heavy-duty trucks, which is a specially modified bi-fuel engine and can run on diesel and CNG. Additionally, the X15N engine model is incorporated with Eaton automated transmission technologies and Cummins fuel delivery system to ensure the development of a fully integrated natural gas powertrain. The Cummins manufactured engine is a vital part of the company’s strategy toward zero-emission goals as the engine will deliver excellent performance and reduce the total cost of ownership, coupled with the carbon-neutral powertrain option. Some prominent players in the global CNG powertrain market include:

-

Cummins Inc.

-

AB Volvo

-

Robert Bosch GmbH.

-

FPT Industrial S.P.A.

-

Ford Motor Company

-

Maruti Suzuki India Limited

-

Volkswagen AG

-

Hyundai Motor Company

-

Nissan Motor Co., Ltd.

-

Honda Motor Company

CNG Powertrain Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 81.64 billion

Revenue forecast in 2030

USD 290.09 billion

Growth rate

CAGR of 17.2% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drive type, fuel type, vehicle type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; Italy; China; India; Japan; Brazil; Argentina; Cambodia

Key companies profiled

Cummins Inc.; AB Volvo; Robert Bosch GmbH; FPT Industrial S.P.A.; Ford Motor Company

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global CNG powertrain market report on the basis of drive type, fuel type, vehicle type, and region:

-

Drive Type Outlook (Revenue, USD Million, 2018 - 2030)

-

All-wheel Drive

-

Rear Wheel Drive

-

Front Wheel Drive

-

-

Fuel Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mono Fuel

-

Bi-fuel

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Vehicle

-

Commercial Vehicle

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Argentina

-

Cambodia

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.