- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Coated Glass Market Size And Share, Industry Report, 2033GVR Report cover

![Coated Glass Market Size, Share & Trend Report]()

Coated Glass Market (2026 - 2033) Size, Share & Trend Analysis Report By Coating (Hard, Soft), By Application (Architecture, Automotive, Optical), By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-3-68038-144-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Coated Glass Market Summary

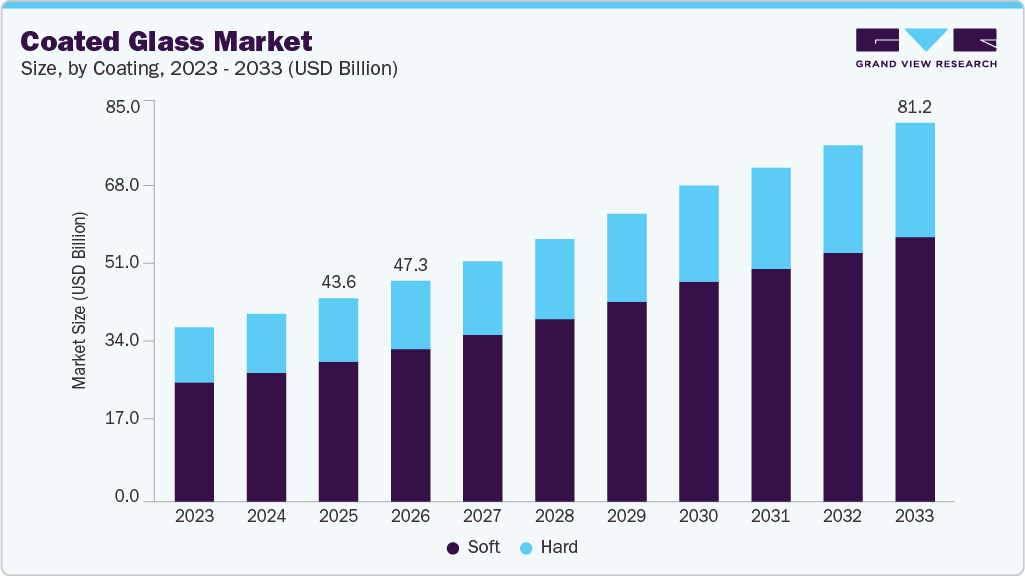

The global coated glass market size was valued at USD 43.61 billion in 2025 and is projected to reach USD 81.25 billion by 2033, at a CAGR of 8.0% from 2026 to 2033. The coated glass market is witnessing strong growth primarily due to the rising focus on energy-efficient buildings and green construction standards.

Key Market Trends & Insights

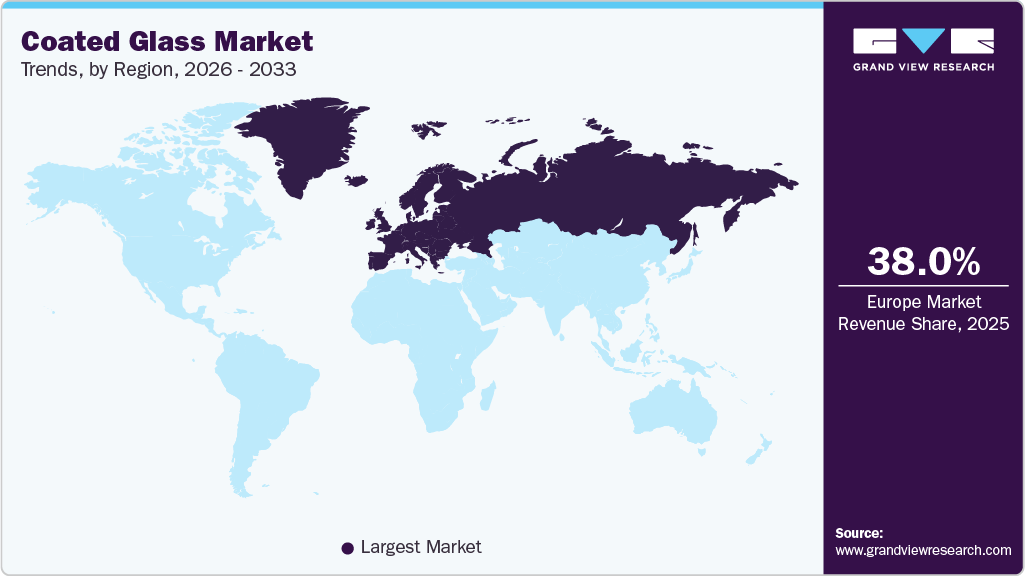

- Europe dominated the coated glass market with the largest market revenue share of over 38% in 2025.

- By coating, soft coated glass accounted for the largest market revenue share of over 68.0% in 2025.

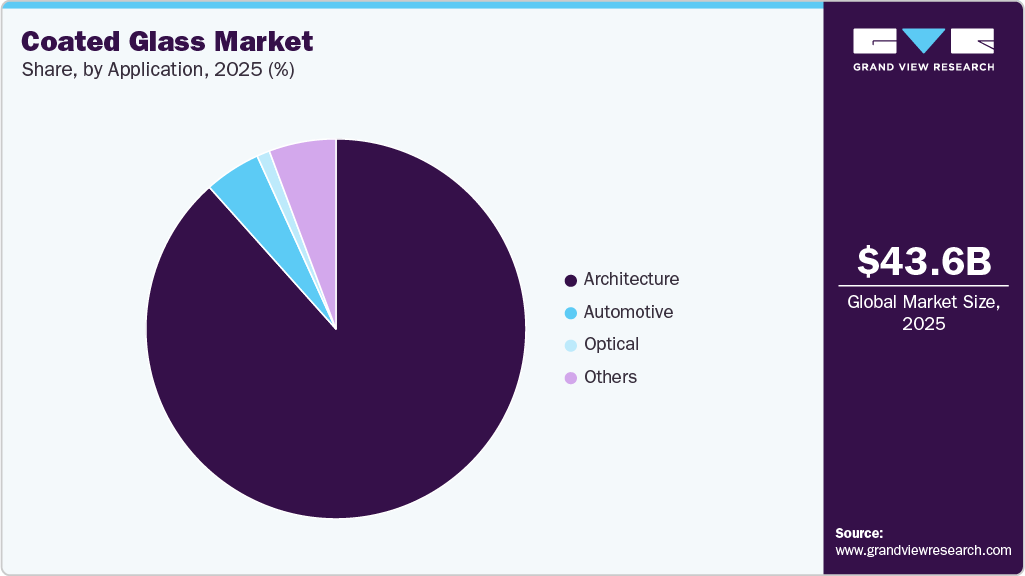

- By application, optical is anticipated to grow at the fastest CAGR over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 43.61 Billion

- 2033 Projected Market Size: USD 81.25 Billion

- CAGR (2026-2033): 8.0%

- Europe: Largest market in 2025

Governments across major economies are enforcing stricter building codes to reduce energy consumption, encouraging the adoption of low-emissivity and solar-control coated glass. These coatings help minimize heat transfer and lower HVAC costs, making them highly preferred for modern residential and commercial infrastructure projects. Rapid urbanization and large-scale infrastructure development, particularly in emerging economies, are another key driver boosting demand. The increasing construction of high-rise buildings, airports, shopping malls, and office complexes is significantly expanding the use of coated glass in façades and curtain wall applications. As architectural trends continue to shift toward premium glass exteriors, demand for aesthetically appealing, functional coated glass products is growing steadily.

The automotive sector is also playing an important role in driving market expansion. Vehicle manufacturers are increasingly using coated glass to enhance thermal insulation, reduce glare, and improve passenger comfort. With the growth of electric vehicles, demand for coated glass is increasing further, as thermal management has become critical for improving battery performance and reducing air conditioning loads inside vehicles.

Technological advancements in coating processes are further supporting market growth. Improved sputtering and deposition techniques have enabled manufacturers to produce high-performance coatings with better durability, clarity, and solar control properties. These innovations are expanding coated glass applications into specialized segments such as soundproof glazing, anti-reflective glass, and smart glass solutions for high-end commercial buildings.

Rising consumer preference for comfort, energy savings, and modern aesthetics is further fueling coated glass adoption. Homeowners and businesses are increasingly investing in insulated and coated glass windows to improve indoor temperature control and reduce electricity bills. Additionally, increasing awareness of sustainable construction practices and long-term cost savings is strengthening the demand outlook, supporting consistent growth for the coated glass market globally.

Drivers, Opportunities & Restraints

The coated glass market is primarily driven by rising demand for energy-efficient buildings and increasing adoption of green construction practices. Coated glass products, such as low-emissivity and solar control glass, help reduce heat transfer, improve indoor comfort, and lower cooling and heating costs, making them highly preferred in commercial and residential infrastructure. Additionally, growth in automotive production and the rising use of coated glass in vehicle glazing for thermal insulation and glare reduction are further supporting market expansion.

Key opportunities in the market are emerging from rapid urbanization, large-scale infrastructure projects, and increasing investments in smart buildings. Growing demand for advanced glazing solutions such as anti-reflective coatings, self-cleaning glass, and smart-coated glass is expected to create strong growth potential, especially in premium construction projects. Moreover, the expansion of solar energy installations is creating new opportunities for coated glass in photovoltaic panels and energy generation applications, supporting long-term market growth.

However, the market faces restraints due to high production costs and the requirement for advanced coating technologies, which increase the overall price of coated glass compared to conventional glass. Volatility in raw material prices and energy costs can also impact profitability for manufacturers.

Coating Insights

Soft coated glass held the largest revenue share of over 68% in 2025. The soft coating segment in the coated glass market is gaining strong traction due to its superior thermal insulation and solar control performance compared to hard coatings. Soft-coated glass, typically produced using magnetron sputtering vacuum deposition technology, offers enhanced low-emissivity properties, enabling a significant reduction in heat loss during winter and limiting heat gain during summer.

Hard coated glass is expected to grow at a CAGR of 7.7% over the forecast period, driven by its high durability, scratch resistance, and ability to withstand harsh environmental conditions. Hard-coated glass is typically manufactured using pyrolytic coating technology, where the coating is applied directly during the float glass production process, resulting in a strong bond with the glass surface. This makes it suitable for applications requiring long service life and mechanical strength, such as exterior glazing, windows, and commercial building installations exposed to extreme temperatures and weather conditions.

Application Insights

Architecture segment held the largest revenue share of over 88% in 2025. Coated glass is widely adopted in architectural applications such as façades, curtain walls, skylights, and windows as it helps control solar heat gain, improves insulation, and reduces overall energy consumption. With increasing emphasis on sustainable construction and compliance with green building standards, demand for low-emissivity and solar control coated glass is expanding rapidly across developed and emerging economies.

The optical segment in the market is gaining momentum due to the rising demand for high-precision glass used in advanced electronics, display panels, and optical instruments. Coated glass is widely used in applications such as camera lenses, microscopes, telescopes, and laser systems, as coatings help enhance light transmission, minimize reflection, and improve image clarity. The growing production of consumer electronics, including smartphones, tablets, and high-resolution display devices, is significantly supporting demand for anti-reflective and protective-coated optical glass.

Regional Insights

Europe held over 38% revenue share of the global coated glass market. In Europe, strict energy performance targets for buildings are a key force driving coated glass demand because regulations such as the Energy Performance of Buildings Directive require improved thermal efficiency. Architects and builders increasingly specify low-emissivity, solar control, and insulating coated glass to meet these standards while enhancing occupant comfort and reducing heating and cooling costs.

North America Coated Glass Market Trends

In North America, the market is largely driven by stringent energy-efficiency regulations and sustainability goals in the building sector. Federal and state-level codes increasingly require high-performance glazing to meet thermal insulation and daylighting targets, which drives demand for low-emissivity, solar control, and insulating coated glass products. Growth in commercial construction, particularly in office parks, retail complexes, and institutional buildings, further supports this trend. Residential renovation activity and an emphasis on modern energy-efficient homes also contribute to the steady uptake of advanced coated glass options.

The U.S. coated glass market strongly emphasis on energy efficiency and strict building performance standards are major forces driving demand for coated glass in the country. Federal regulations and state codes increasingly require glazing systems that improve thermal insulation and reduce energy consumption in commercial and residential buildings. This increases the use of low-emissivity and solar control coated glass in curtain walls, storefronts, and high-performance windows, as developers and architects seek solutions that help achieve green building certifications and lower operational costs over the building lifecycle.

Asia Pacific Coated Glass Market Trends

The Asia Pacific market is being driven by rapid urbanization and strong construction activity across major economies such as China, India, Indonesia, and Vietnam. Large scale investments in commercial complexes, high rise residential buildings, airports, and metro rail projects are boosting demand for high performance glazing materials. In addition, increasing focus on green buildings and energy efficient infrastructure is accelerating the adoption of coated glass, particularly low emissivity and solar control coated variants, as they help reduce heat gain and lower air conditioning costs in warmer climates.

Middle East & Africa Coated Glass Market Trends

In the Middle East and Africa region, rapid infrastructure development and large construction programs in countries such as the UAE, Saudi Arabia, and South Africa are fueling demand for coated glass, particularly in commercial towers, luxury residential projects, and hospitality developments. Harsh climatic conditions and high temperatures make energy-efficient glazing solutions especially attractive, because coated glass helps lower cooling costs and enhances indoor comfort.

Key Coated Glass Company Insights

Some of the key players operating in the market include Central Glass Co. Ltd., AGC Inc., and others.

-

AGC Inc. is a glass manufacturer headquartered in Japan, with a strong global footprint across architectural, automotive, and specialty glass segments. The company has a well-established presence in the coated glass market through its advanced architectural glazing solutions designed for energy efficiency, thermal insulation, and solar control applications.

-

Central Glass Co. Ltd. is a chemical and glass manufacturer known for its diversified operations in glass products, electronic materials, and fine chemicals. In the coated glass segment, the company focuses on providing high-quality coated and functional glass solutions catering to industrial and architectural applications. Central Glass offers coated glass products that support enhanced optical performance, durability, and heat control, making them suitable for modern building envelopes and specialized glazing needs.

Key Coated Glass Companies:

The following key companies have been profiled for this study on the coated glass market.

- AGC Inc.

- Central Glass Co. Ltd.

- CEVITAL GROUP

- China Glass Holding, Ltd.

- Euroglas

- Fuyao Glass Industry Group Co., Ltd.

- Guardian Industries

- Nippon Sheet Glass Co., Ltd.

- Saint-Gobain

- SCHOTT AG

Recent Developments

-

In September 2025, Guardian Glass launched its new triple silver low-E coated glass, SunGuard SNX 60+, in North America, featuring advanced coating technology that delivers a consistently neutral reflected color from any viewing angle and a Light to Solar Gain (LSG) ratio of 2.41. This product offers 60% visible light transmission with low external (14%) and internal (15%) light reflection, a Solar Heat Gain Coefficient (SHGC) of 0.25, and a U-value of 0.29, helping reduce cooling loads and meet energy codes while maintaining neutral transmitted colors for true interior views.

Coated Glass Market Report Scope

Report Attribute

Details

Market definition

The market size represent annual sales value of coated glass used in different applications.

Market size value in 2026

USD 47.33 billion

Revenue forecast in 2033

USD 81.25 billion

Growth rate

CAGR of 8.0% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative Units

Volume in Kilotons, Revenue in USD million, and CAGR from 2026 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Coating, Application, and Region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Russia; China; Japan; India; Brazil; Saudi Arabia; UAE

Key companies profiled

AGC Inc.; Central Glass Co. Ltd.; CEVITAL GROUP; China Glass Holding, Ltd.; Euroglas; Fuyao Glass Industry Group Co., Ltd.; Guardian Industries; Nippon Sheet Glass Co., Ltd.; Saint-Gobain; SCHOTT AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Coated Glass Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global coated glass market report on the basis of coating, application, and region.

-

Coating Outlook (Volume, Kil0tons; Revenue, USD Million; 2021 - 2033)

-

Hard

-

Soft

-

-

Application Outlook (Volume, Kil0tons; Revenue, USD Million; 2021 - 2033)

-

Architecture

-

Automotive

-

Optical

-

Others

-

-

Regional Outlook (Volume, Kil0tons; Revenue, USD Million; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. Rising awareness to improve energy efficiency and increasing government expenditure on infrastructure is projected to drive the coated glass market growth over the coming years.

b. The global coated glass market was estimated at USD 43.61 billion in 2025 and is expected to reach USD 47.33 billion in 2026.

b. The global coated glass market is expected to grow at a compound annual growth rate of 8.0% from 2026 to 2033 to reach USD 81.25 billion by 2033.

b. Architectural was the key application segment of the market with a revenue share of about 88.0% of the market in 2025.

b. Some of the key players operating in the coated glass market are AGC Inc.; Central Glass Co. Ltd.; CEVITAL GROUP; China Glass Holding, Ltd.; Euroglas; Fuyao Glass Industry Group Co., Ltd.; Guardian Industries; Nippon Sheet Glass Co., Ltd.; Saint-Gobain; SCHOTT AG

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.