- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Coated Glass Market Size, Share And Growth Report, 2030GVR Report cover

![Coated Glass Market Size, Share & Trends Report]()

Coated Glass Market (2024 - 2030) Size, Share & Trends Analysis Report By Coating (Hard, Soft), By Application (Architectural, Automotive, Optical), By Region (NA, Europe, APAC, CSA, MEA), And Segment Forecasts

- Report ID: GVR-3-68038-144-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Coated Glass Market Summary

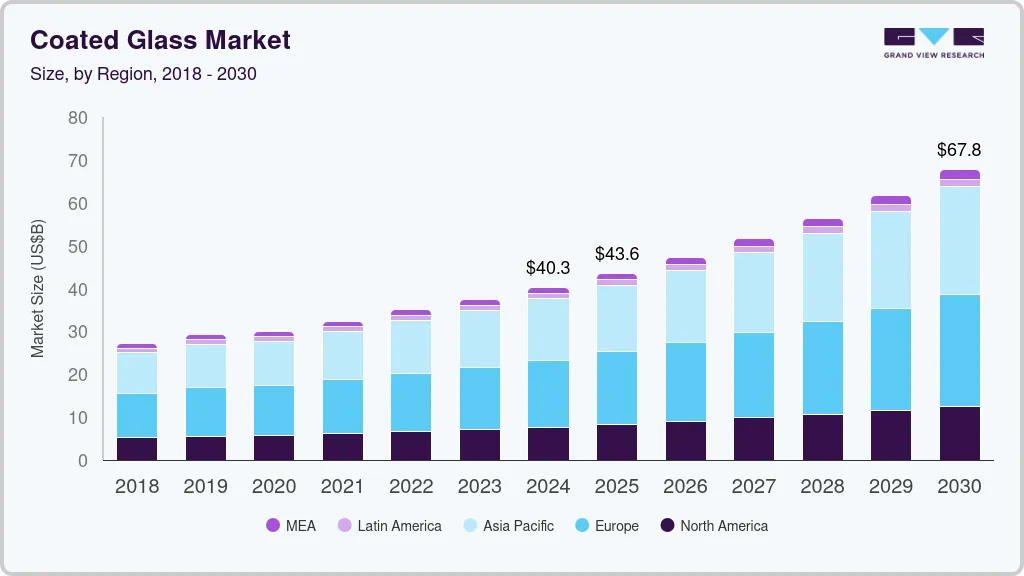

The global coated glass market size was estimated at USD 38.01 billion in 2023 and is projected to reach USD 71.71 billion by 2030, growing at a CAGR of 9.6% from 2024 to 2030. Rising penetration of green buildings and increasing emphasis on improving energy efficiency are projected to benefit market growth over the coming years.

Key Market Trends & Insights

- Asia Pacific held a revenue share of 35.0% in 2023, of the global market.

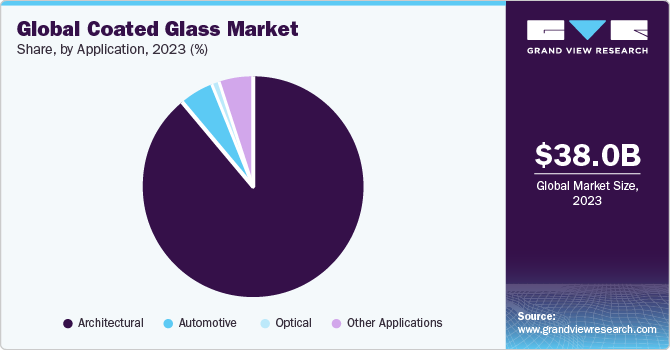

- By application, architectural applications accounted for the largest revenue share of over 89.0% in 2023.

- By coating, soft coating segment accounted for a maximum revenue share of more than 69.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 38.01 Billion

- 2030 Projected Market Size: USD 71.71 Billion

- CAGR (2024-2030): 9.6%

- Asia Pacific: Largest market in 2023

Coated glass is used in residential and commercial buildings to cool rooms and allow maximum visible light. By reflecting infrared energy, temperature inside building is cooler, reducing dependence on air conditioning systems. This product is also used in colder regions to maintain a warm temperature in the room. In the building & construction industry, coated glass is generally used as insulated glazing units in façades and windows. As a result, the growth of the construction industry in the US is predicted to benefit the coated glass industry.The US's USD 1.2 trillion Bipartisan Infrastructure Bill is expected to prove fruitful for market growth. This bill is projected to drive the structure value for transportation infrastructure at a standard rate of 8.9% from 2020 to 2025, which is anticipated to benefit the expansion of rails, ports, bridges, telecommunications, water transport, EVs, broadband, and energy. Construction industry recovered well in 2021 as COVID-19 cases were reduced. However, it witnessed subdued demand in 2022 due to tighter and aggressive monetary policy and higher borrowing rates. The industry outlook remained uncertain throughout 2023 owing to looming recessionary fears and soaring energy prices.

Jumbo-coated architectural glass is a significant trend in the global market. As a result, companies are establishing jumbo coaters to serve their demand. For instance, in December 2023, Emirates Glass LLC, a leading glass industry company, continued to focus on innovation and quality standards with investment in new machinery & equipment to install a Jumbo Series production line with Vortex Pro Convection technology. This latest production line can manufacture coated glass with high and low emissivity levels of 8cm and 0.02cm, respectively.

Market Concentration & Characteristics

Market growth stage is moderate, and pace of market growth is accelerating. The market is characterized by rising demand and growing adoption of coated glass owing to awareness regarding green buildings, increased energy efficiency, and reduced solar radiation penetration. The industry is significantly driven by construction and automotive sectors and impacted by a degree of innovation and regulation amendments.

A high merger and acquisition activity level and expansion of manufacturing facilities by leading industry manufacturers also characterize the market. Emerging companies in the market are teaming up and making long-term deals with technology partners to succeed in a competitive market. They want to gain market share and consolidate their position in a growing market.

The market is also subject to increasing end-user concentration. Governments around the world are formulating regulations to enhance application of sustainable components and energy-efficient materials in infrastructure sector. Furthermore, supportive government regulations are expected to play a key role in driving the growth of coated glass in automotive sector.

There are a limited number of direct product substitutes for coated glass products owing to its unique characteristics such as reduced solar radiation penetration, energy efficiency, sustainable initiative, among others. However, there are a variety of technologies that can be used to achieve unique characteristics and launch an innovative product to gain market share. These production technologies can be used as methods of coating and achieve certain characteristics and improve performance of coated glass products.

Application Insights

Architectural applications accounted for the largest revenue share of over 89.0% in 2023. Coated glass facilitates very low energy utilization and reduces air conditioning costs in architecture. This is done by reflecting heat coming from outside the building in warmer climates. Therefore, it is perceived as an innovative product that enhances energy efficiency of buildings by reducing AC costs and lowering CO2 emissions.

Various governments around the world are setting new building codes to minimize energy utilization in buildings. This represents a lucrative opportunity for key market players. Low-e glass is a critical technology owing to its ability to minimize emissions of UV and infrared radiation. This helps in cooling the temperature inside buildings and different architectures.

The automotive segment is expected to grow at a rate of 7.0% from 2024 to 2030, in terms of revenue. Coated products, particularly Low-e coated glass, are used in the windshield of automobiles. Use of such products in automobiles helps minimize utilization of AC, reduces carbon efficiency, and boosts fuel efficiency.

Regional Insights

Asia Pacific held a revenue share of 35.0% in 2023, of the global market. China, Japan, and South Korea are significant markets in the Asia Pacific. Also, developing economies such as India and Southeast countries, including Indonesia and Thailand have huge potential. Rising economic growth, disposable income, and subsequent increases in investments in EVs, housing construction, and solar installations in these countries are benefitting market growth.

High-volume production of automobiles in Asia Pacific is likely to benefit the industry to some extent. Although there is no significant adoption of coated glass products in the automotive industry, automakers are beginning to integrate these products into vehicles, especially luxury vehicles. Asian countries have significant cost advantages, which help to boost the production of vehicles.

Europe coated glass market is expected to grow at a CAGR of 9.4% from 2024 to 2030, in terms of revenue. Special emphasis on green construction in Europe is anticipated to augment growth of the market. Heating & cooling, insulation, lighting, and self-powered building are key areas of focus in green construction industry. In high efficiency buildings that reflect heat, and radiations from windows, leaving cold air for ventilation during summers, use Low-E coated solar control glass.

Coating Insights

Soft coating segment accounted for a maximum revenue share of more than 69.0% in 2023. A significant factor driving the growth of this segment is its ultra-low emissivity, which enables it to reflect considerably more heat than hard-coated products. Furthermore, soft-coated products are characterized by more visible light transmission and higher optical clarity as compared to hard-coated products.

In colder regions, to retain heat inside the room, sputtered coating is applied to outside face to re-radiate heat inside the room. This type is typically employed in double-glazed units and can be used in all climates. Also, since soft-coated product is typically used in a double-glazed unit, air gap in unit facilitates better heat insulation properties as compared to single hard-coated single-pane windows.

For hard coated glass, special handling procedures and equipment are not required. This type of product is shipped and handled using the same equipment as that for non-value-added float glass. A significant factor contributing to growth of this segment is durability of hard-coated products. This glass can be laminated, heat-strengthened, tempered and can be used in glazing applications without fear of losing the coating.

Key Companies & Market Share Insights

Some of the key players operating in the market include Euroglas, AGC Inc., China Glass Holding, Ltd., and Guardian Industries, among others.

-

AGC Inc. announced the launch of a new range of low-carbon glass with reduced environmental impact. The new production line will enable AGC to ensure a sustainable future and reduce carbon footprints. Such an initiative will enable AGC to reduce carbon emissions by overall more than 40%. Leading players invest in R&D and new range of products with innovation to sustain their market share

-

China Glass Holdings, Ltd. agreed to the acquisition of Orda Glass Ltd LLP for a value of USD 67.5 million in December 2021. The acquisition was completed in January 2022, after the transfer of ownership from Global Expansion Investment II Limited and Belt and Road Glass Management Limited

-

Riou Glass, Central Glass Co., Ltd., SCHOTT AG, and Vitro Architectural Glass are some of the emerging market participants.

-

Riou Glass acquired Vidresif, a Spain-based glazing manufacturer in November 2023. The acquisition will reinforce its high performance technical as part of a strategic initiative to expand its business portfolio in laminated, tempered, and coated glass and spread its presence across Spanish market.

-

Emerging players resort to merger & acquisitions to increase market share and sustain in a highly competitive market.

Key Coated Glass Companies:

- AGC Inc.

- Central Glass Co. Ltd.

- CEVITAL GROUP

- China Glass Holding, Ltd.

- Euroglas

- Fuyao Glass Industry Group Co., Ltd.

- Guardian Industries

- Nippon Sheet Glass Co., Ltd.

- Saint-Gobain

- SCHOTT AG

Recent Developments

-

In November 2023, Nippon Sheet Glass Co., Ltd. announced a new production line for solar glass in Malaysia as it started operations. Existing production line was converted into a TCO glass (transparent conductive oxide) production line. The coated solar glass is a part of company’s strategy to shift towards renewable energy and solve global environmental issues.

-

In January 2023, Guardian Glass, a leading coated and fabricated glass manufacturer announced acquisition of Vortex Glass with signing of an agreement. Guardian Glass will acquire the fabrication business assets of Vortex Glass in California, Miami, and Florida and expand its operations to cater to rising demand for coated glass in the US.

Coated Glass Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 41.38 billion

Revenue forecast in 2030

USD 71.71 billion

Growth rate

CAGR of 9.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD million/billion, volume in kilotons and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Coating, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; UK; France; Russia; China; Japan; India; Brazil

Key companies profiled

AGC Inc.; Central Glass Co. Ltd.; CEVITAL GROUP; China Glass Holding, Ltd.; Euroglas; Fuyao Glass Industry Group Co., Ltd.; Guardian Industries; Nippon Sheet Glass Co., Ltd.; Saint-Gobain; SCHOTT AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Coated Glass Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global coated glass market report based on coating, application, and region.

-

Coating Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Hard Coating

-

Soft Coating

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Architectural

-

Automotive

-

Optical

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global coated glass market was estimated at USD 38.01 billion in 2023 and is expected to reach USD 41.38 billion in 2024.

b. The coated glass market is expected to grow at a compound annual growth rate of 9.6% from 2024 to 2030 to reach USD 71.71 billion by 2030.

b. Architectural was the key application segment of the market with a revenue share of about 89.0% of the market in 2023.

b. Some of the key players operating in the coated glass market are AGC Inc., Central Glass Co. Ltd., CEVITAL GROUP, China Glass Holding, Ltd., Euroglas, Fuyao Glass Industry Group Co., Ltd., Guardian Industries, Nippon Sheet Glass Co., Ltd., Saint-Gobain, and SCHOTT AG.

b. Rising awareness to improve energy efficiency and increasing government expenditure on infrastructure is projected to drive the coated glass market growth over the coming years.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.