- Home

- »

- Specialty & Chemicals

- »

-

Coatings Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Coatings Market Size, Share & Trends Report]()

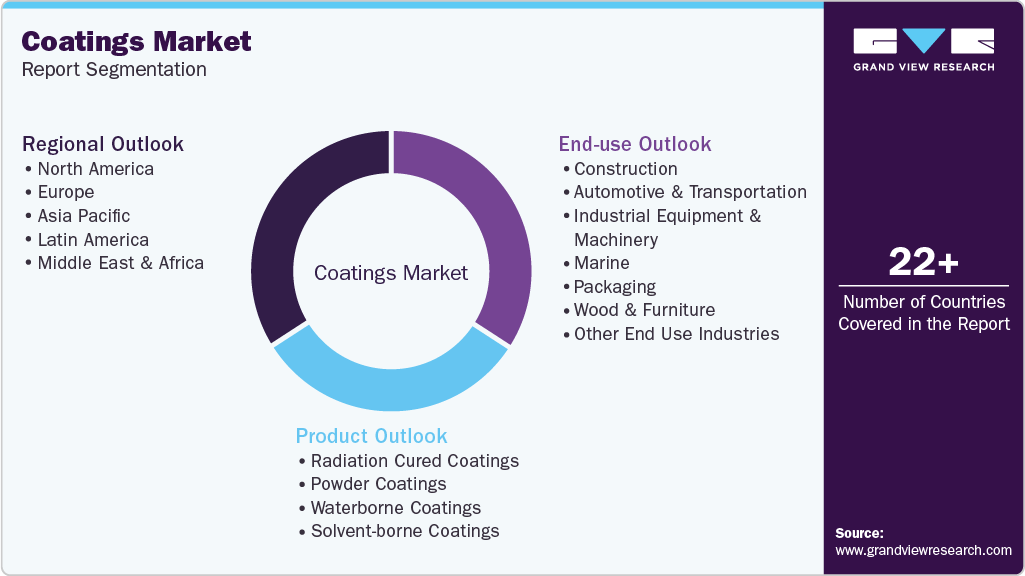

Coatings Market (2026 - 2033) Size, Share & Trends Analysis Report Product (Radiation Cured Coatings, Powder Coatings), By End Use Industry (Construction, Automotive & Transportation, Industrial Equipment & Machinery) By Region, And Segment Forecasts

- Report ID: GVR-4-68040-848-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2025

- Forecast Period: 2026 - 2033

- Industry: Research

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Coatings Market Summary

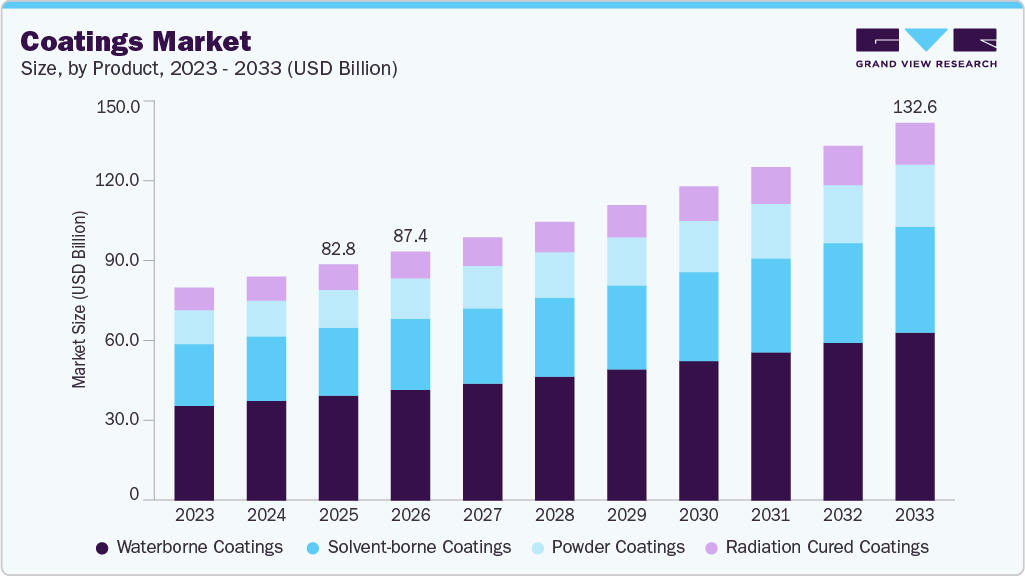

The global coatings market size was estimated at USD 82.80 billion in 2025 and is projected to reach USD 132.64 billion by 2033, growing at a CAGR of 6.1% from 2026 to 2033. The market is driven by sustained growth in construction, automotive, and industrial manufacturing activity, coupled with increasing demand for corrosion protection, surface durability, and asset life extension across infrastructure and equipment applications.

Key Market Trends & Insights

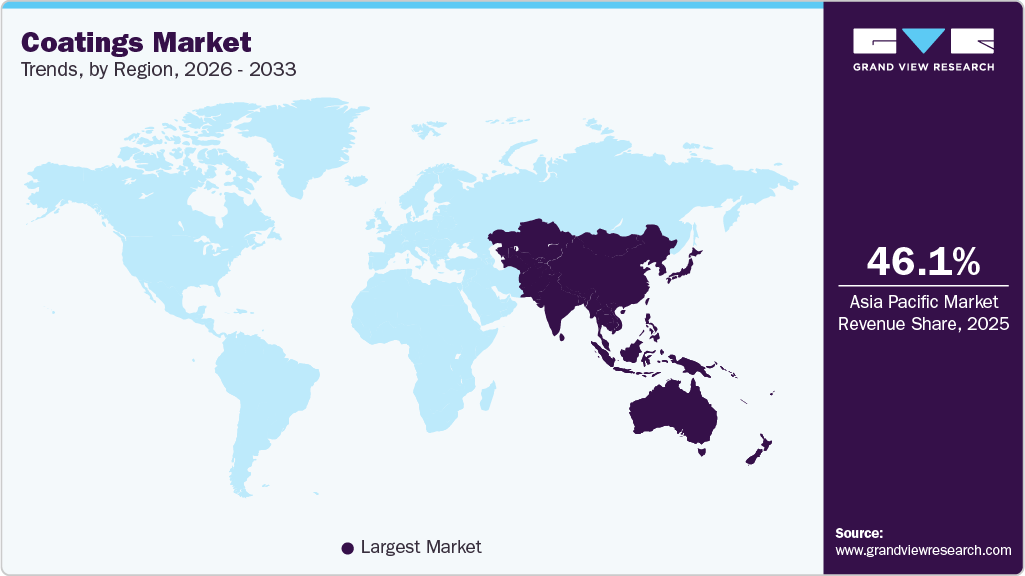

- Asia Pacific dominated the coatings market with the largest revenue share of 46.1% in 2025.

- The market in China is expected to grow at the fastest CAGR of 6.4% from 2026 to 2033 in terms of revenue.

- By product, the radiation cured coatings segment is expected to grow at the fastest CAGR of 6.6% from 2026 to 2033 in terms of revenue.

- By product, the waterborne coatings segment held the largest revenue share of 44.5% in 2025 in terms of value.

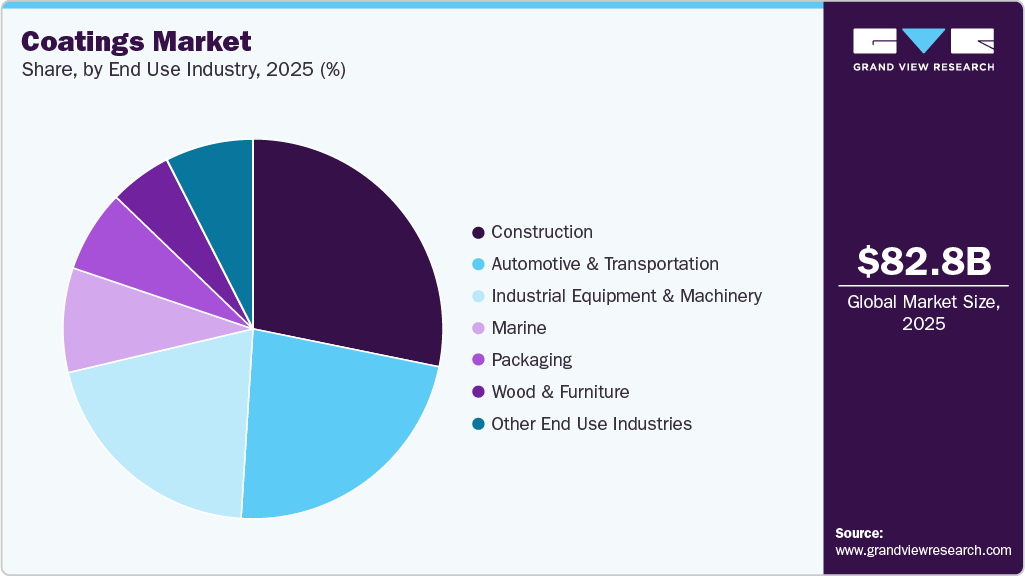

- By end use industry, the construction segment held the largest revenue share of 28.2% in 2025 in terms of value.

Market Size & Forecast

- 2025 Market Size: USD 82.80 billion

- 2033 Projected Market Size: USD 132.64 billion

- CAGR (2026-2033): - 6.1%

- Asia Pacific: Largest market in 2025

Stricter environmental and VOC emission regulations in North America and Europe are accelerating the adoption of waterborne, powder, and radiation-cured coatings, while rapid urbanization and industrial expansion in Asia Pacific continue to underpin volume growth.Significant opportunities exist in the development and commercialization of low-VOC, solvent-free, and energy-efficient coating technologies, particularly powder and radiation-cured coatings, as end users prioritize sustainability and regulatory compliance. Additionally, rising investments in infrastructure, renewable energy assets, electric vehicles, and advanced manufacturing across emerging economies are creating demand for high-performance, application-specific coatings, enabling manufacturers to expand margins through differentiated product offerings.

The market faces challenges from volatile raw material prices, especially petrochemical-based resins and additives, which impact production costs and pricing stability. Furthermore, high R&D and compliance costs, combined with the technical complexity of transitioning from solvent-borne to environmentally compliant technologies without compromising performance, pose barriers for manufacturers, particularly in cost-sensitive and heavy-duty industrial applications.

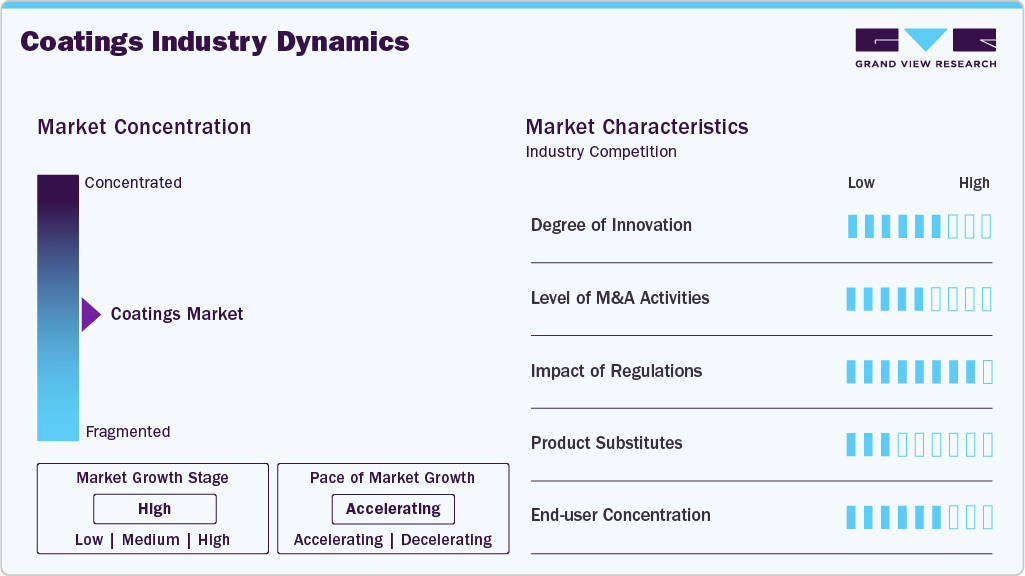

Market Concentration & Characteristics

The global coatings market is moderately consolidated, characterized by a mix of large multinational corporations and specialized regional players competing across advanced technologies and end-use segments. Leading companies such as The Sherwin-Williams Company, PPG Industries, Inc., Akzo Nobel N.V., BASF SE, Henkel AG & Co. KGaA, Jotun, Axalta Coating Systems, RPM International, Inc., Hempel A/S, and 3M maintain significant market presence through diversified product portfolios spanning waterborne, solvent-borne, powder, and radiation-cured coatings. Competitive differentiation is increasingly driven by technological innovation, regulatory compliance, sustainability leadership, and application expertise, with firms leveraging robust R&D pipelines to meet performance demands across the automotive, industrial equipment, and infrastructure sectors.

Market incumbents are pursuing strategic initiatives including capacity expansions in high-growth regions (notably Asia Pacific), targeted acquisitions to bolster specialty coatings offerings, and partnerships that enhance distribution reach and technical service capabilities. Sustainability imperatives and regulatory constraints have intensified competition for low-VOC, environmentally compliant formulations, prompting investment in advanced coating systems that deliver performance without compromising environmental standards. Smaller and niche players continue to carve out segments in specialized coatings applications. Still, the competitive advantage remains with established players that combine global scale, portfolio breadth, and deep application engineering capabilities to meet the evolving needs of diverse end-use industries.

Product Insights

Waterborne coatings dominated the global coatings market in 2025, capturing the largest revenue share of 44.5%, driven by stringent environmental regulations, particularly on VOC emissions, and increasing adoption across construction, automotive, and industrial applications. These coatings offer a balanced combination of performance, cost efficiency, and sustainability, making them highly preferred by end users seeking regulatory compliance without compromising on durability or aesthetic quality. Growth in this segment is further supported by rapid urbanization in the Asia Pacific, the expansion of industrial manufacturing, and the growing trend toward eco-friendly building materials and industrial processes.

Powder coatings and radiation-cured coatings are emerging as high-growth segments, fueled by demand for energy-efficient, high-performance, and low-emission solutions in automotive components, appliances, packaging, and electronics. Powder coatings are valued for their near-zero VOC emissions and superior durability, while radiation-cured coatings offer rapid curing times and high throughput, particularly in specialized industrial applications. Solvent-borne coatings, while still significant in revenue due to their superior performance in harsh environments, are gradually losing share to environmentally compliant alternatives. Together, these product segments highlight a technology-driven market shift toward sustainable, application-specific coatings that meet evolving end-user and regulatory demands.

End Use Industry Insights

The construction segment held the largest revenue share of 28.2% in 2025, driven by rapid urbanization, infrastructure development, and residential and commercial building expansion, particularly in Asia Pacific and North America. The demand for protective, weather-resistant, and aesthetically appealing coatings in buildings, bridges, and other infrastructure projects has fueled consistent growth. The increasing adoption of eco-friendly, low-VOC, and durable coating solutions in construction has further strengthened the segment, positioning it as the largest contributor to the global coatings market by value.

The automotive & transportation, industrial equipment & machinery, and marine segments represent significant revenue contributors, driven by OEM and aftermarket demand, asset protection, and regulatory compliance. Automotive coatings are expanding due to vehicle production volumes, electrification, and lightweighting trends, while industrial equipment and machinery coatings are supported by manufacturing modernization and demand for corrosion-resistant solutions. Marine coatings continue to grow steadily due to antifouling and protective requirements. Packaging, wood & furniture, and other end-use industries, including electronics, aerospace, oil & gas, and power generation, are witnessing niche yet high-value growth, propelled by specialized coatings applications that require functional performance, durability, and regulatory compliance.

Regional Insights

Asia Pacific dominated the global coatings market in 2025, capturing 46.1% of the total revenue, driven by rapid urbanization, robust industrial growth, and escalating demand from construction, automotive, and industrial equipment sectors. Key markets such as China, India, and Southeast Asia are witnessing sustained infrastructure development, manufacturing expansion, and export-oriented industrial activity, positioning Asia Pacific as the largest and fastest-growing regional market.

China Coatings Market Trends

China accounted for 57.2% of the Asia Pacific coatings market in 2025, making it the largest single-country contributor in the region. Growth is fueled by massive construction projects, automotive production, industrial equipment manufacturing, and packaging demand, alongside strong government initiatives to promote environmentally friendly and low-VOC coating technologies. China’s dominance underscores its critical role in shaping regional and global market trends.

North America Coatings Market Trends

North America held 24.3% of the global coatings market in 2025, with growth driven by the United States, Canada, and Mexico. The market benefits from advanced industrial and automotive sectors, robust construction and infrastructure projects, and stringent environmental regulations, which have accelerated adoption of waterborne, powder, and radiation-cured coatings. North America remains a mature but technologically sophisticated market.

The U.S. coatings market contributed approximately 80.3% of North America’s coatings market in 2025, reflecting its position as the dominant regional player. Growth is supported by high-value automotive OEM and refinish applications, industrial equipment demand, and construction activity, as well as ongoing investments in environmentally compliant and high-performance coating solutions. The U.S. market combines scale, innovation, and regulatory-driven adoption, reinforcing its global significance.

Europe Coatings Market Trends

Europe accounted for 20.8% of the global coatings market in 2025, characterized by mature demand, strict environmental regulations, and advanced industrial applications. Growth is concentrated in Germany, France, and the UK, where industrial equipment, automotive, and construction coatings benefit from technology adoption, sustainability initiatives, and end-user emphasis on high-performance and low-emission coatings.

The Germany coatings market is the largest contributor within Europe, benefiting from a strong automotive industry, industrial machinery production, and infrastructure projects. The market emphasizes innovation, sustainability, and high-performance coatings, with widespread adoption of waterborne, powder, and specialty coatings. Germany’s market is considered technology-driven and highly influential in setting European standards.

Middle East & Africa Coatings Market Trends

Middle East & Africa contributed a modest share to the global coatings market in 2025, driven by infrastructure, construction, and oil & gas projects across countries such as Saudi Arabia, UAE, and South Africa. Protective and corrosion-resistant coatings dominate demand, while market growth is supported by increasing industrialization, urban development, and investment in sustainable coating technologies.

Latin America Coatings Market Trends

Latin America accounted for a smaller share of the global coatings market, with growth led by Brazil, Mexico, and Argentina. The region is experiencing rising construction, automotive, and industrial equipment demand, along with gradual adoption of environmentally compliant coatings. Despite being a modest contributor in global terms, Latin America represents a high-growth opportunity relative to market maturity, particularly in urban infrastructure and industrial expansion projects.

Key Coatings Company Insights

Key players, such as Jotun, The Sherwin-Williams Company, Axalta Coating Systems, PPG Industries, Inc., RPM INTERNATIONAL, INC, and BASF SE ,are dominating the market.

Jotun

-

Jotun is a leading global coatings manufacturer headquartered in Norway, specializing in decorative paints, protective coatings, and marine coatings across industrial, construction, and marine sectors. The company has a strong presence in Europe, Asia Pacific, and the Middle East, leveraging a diversified product portfolio that includes waterborne, solvent-borne, powder, and specialty coatings. Jotun emphasizes sustainability, high-performance formulations, and innovative coating technologies, with a focus on corrosion protection, durability, and environmentally compliant solutions. Through strategic regional expansions, R&D investment, and targeted partnerships, Jotun has established itself as a trusted supplier for industrial, decorative, and marine applications worldwide, consistently maintaining a robust competitive position in the global coatings market.

Key Coatings Companies:

The following key companies have been profiled for this study on the coatings market.

- Jotun

- The Sherwin-Williams Company

- Axalta Coating Systems

- PPG Industries, Inc.

- RPM INTERNATIONAL, INC

- BASF SE

- Henkel AG & Company, KGaA

- Hempel A/S

- 3M

- Akzo Nobel N.V.

Recent Developments

-

In May 2025, Sherwin‑Williams launched Repacor SW‑1000, a 100% solids, VOC‑free single‑coat maintenance and repair coating that simplifies corrosion protection for steel structures, particularly in offshore and industrial applications.

-

In January 2025, Axalta announced a strategic partnership with Dürr Systems AG to integrate NextJet precision paint application technology with Dürr’s robotics, aiming to commercialize digital, overspray‑free automotive coating processes that enhance production efficiency and reduce waste.

Coatings Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 87.36 billion

Revenue forecast in 2033

USD 132.64 billion

Growth rate

CAGR of 6.1% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million, Volume in Kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, End Use Industry, and Region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Jotun; The Sherwin-Williams Company; Axalta Coating Systems; PPG Industries, Inc.; RPM INTERNATIONAL, INC; BASF SE; Henkel AG & Company, KGaA; Hempel A/S; 3M; Akzo Nobel N.V.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Coatings Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global coatings market report based on product, end use industry, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2033)

-

Radiation Cured Coatings

-

Powder Coatings

-

Waterborne Coatings

-

Solvent-borne Coatings

-

-

-

End Use Industry Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2033)

-

Construction

-

Automotive & Transportation

-

Industrial Equipment & Machinery

-

Marine

-

Packaging

-

Wood & Furniture

-

Other End Use Industries

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.