- Home

- »

- Consumer F&B

- »

-

Roasted Coffee Market Size, Share & Growth Report, 2030GVR Report cover

![Roasted Coffee Market Size, Share & Trends Report]()

Roasted Coffee Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Arabica, Robusta), By Distribution Channel (B2B, B2C), By Region (North America, Europe, Asia Pacific, Central & South America, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-015-6

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Roasted Coffee Market Summary

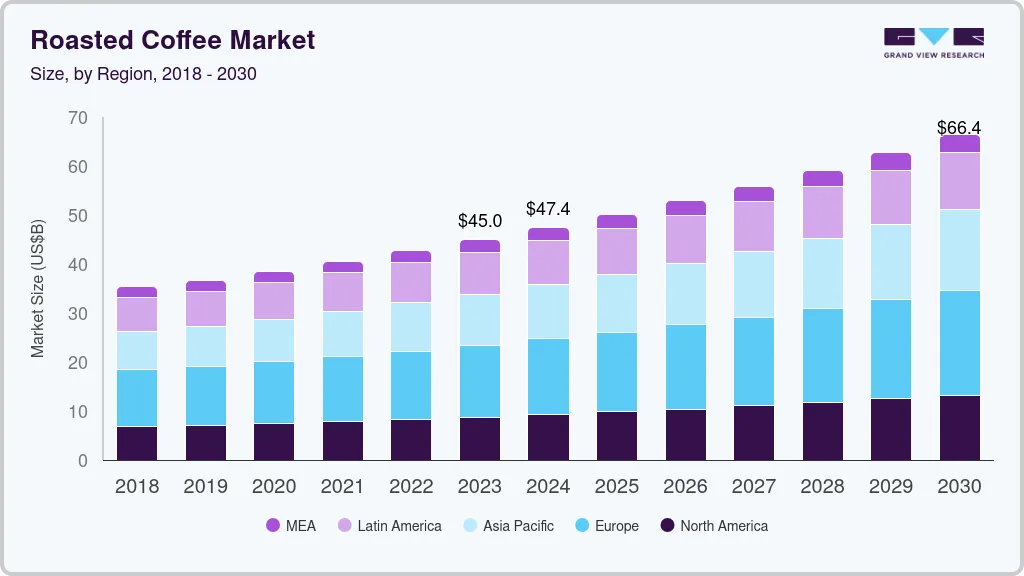

The global roasted coffee market size was estimated at USD 44,984.1 million in 2023 and is projected to reach USD 66,413.0 million by 2030, growing at a CAGR of 5.8% from 2024 to 2030. Increasing global coffee consumption, growing consumer preference for specialty and premium coffee, innovations in packaging and distribution, and the rise of online retail platforms are driving the market.

Key Market Trends & Insights

- In terms of region, Europe was the largest revenue generating market in 2023.

- Country-wise, Brazil is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, arabica accounted for a revenue of USD 25,909.0 million in 2023.

- Robusta is the most lucrative type segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 44,984.1 Million

- 2030 Projected Market Size: USD 66,413.0 Million

- CAGR (2024-2030): 5.8%

- Europe: Largest market in 2023

Moreover, the increasing popularity of coffee shops and cafes, coupled with the rise of coffee culture, has further boosted market demand. As per the World Coffee Portal, the U.S. branded coffee shop market has experienced steady growth of 4% in 2023, with over 40,000 outlets operating and an anticipated expansion to 45,200 by 2028.

Consumers are seeking out third-wave coffee experiences, characterized by artisanal roasting, unique brewing techniques, and a focus on sustainability and ethical sourcing. This trend has fostered a vibrant market for specialty roasts and high-quality beans, driving innovation and pushing the boundaries of coffee flavor profiles. Younger generations are increasing their coffee intake, which is the primary reason for the growth in coffee consumption in developed countries. As per the data published by the National Coffee Association in 2023, 66% of consumers aged 25-39 and 47% of consumers aged 18-24 drank coffee in the past day. Coffee consumption among this demographic is being driven by product innovation, shifting work patterns, and consuming coffee as a social activity.

Technology plays a pivotal role in shaping the roasted coffee market. The advent of online platforms and e-commerce has streamlined the distribution of coffee beans, offering consumers a wider selection and convenience. Subscription services, where consumers receive regular shipments of freshly roasted coffee, have gained traction, further enhancing consumer access and bolstering market growth. Additionally, advancements in roasting technology, such as precision roasting equipment and innovative bean processing methods, have allowed roasters to achieve greater control and consistency in their products, elevating the overall coffee experience. This technological innovation is driving demand for premium roasted coffee, as consumers seek out exceptional flavor and quality.

Health consciousness is also influencing coffee consumption trends. Studies have shown that moderate coffee intake can offer health benefits, including improved cognitive function and reduced risk of certain diseases. This awareness has contributed to a rise in demand for 'healthier' coffee options, such as decaffeinated coffee, cold brew, and organic beans. Furthermore, the increasing focus on sustainability and ethical sourcing is driving consumers towards coffee brands that prioritize environmental responsibility and fair trade practices. This shift in consumer preferences is shaping the market, as roasters and retailers respond to the demand for ethically sourced and environmentally friendly coffee products.

The rising global population, particularly in coffee-consuming regions, presents a significant demographic advantage. Furthermore, the ongoing urbanization and increasing disposable incomes in emerging economies will further fuel demand for coffee. The market is also expected to benefit from the growing popularity of specialty coffee experiences, driven by the pursuit of unique flavors and innovative brewing methods. To maintain their competitive edge, coffee roasters will need to embrace technological advancements, prioritize sustainability, and continuously innovate to meet the evolving tastes and preferences of discerning coffee consumers.

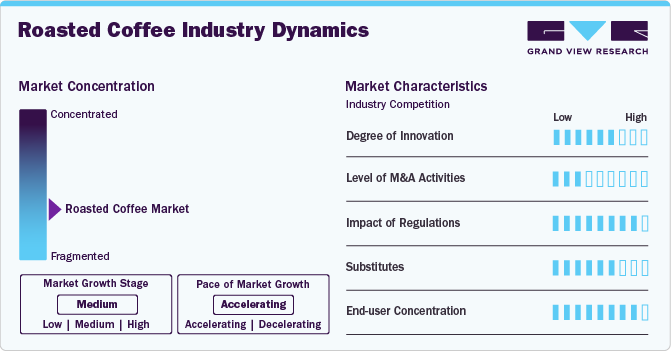

Market Concentration & Characteristics

The market is characterized by continuous product and process innovation, driven by growing consumer demand for premium and differentiated coffee experiences. Coffee roasters strive to develop innovative roasting techniques, flavor profiles, and packaging solutions to cater to evolving consumer preferences and stay ahead of the competition.

The roasted coffee industry has witnessed a surge in merger and acquisition (M&A) activities in recent years. Large incumbents seek to expand their market share, gain access to specialized capabilities, and respond to changing consumer trends through strategic acquisitions. These consolidations have led to the emergence of dominant players and an increasingly concentrated market landscape.

Government regulations play a significant role in the roasted coffee industry. Regulations regarding food safety, labeling, and fair trade practices impact production, distribution, and marketing practices. Compliance with these regulations ensures consumer safety and promotes ethical and sustainable coffee sourcing. The roasted coffee market faces competition from a range of substitutes, including tea, energy drinks, and cold beverages.

Consumer preferences and the availability of alternative caffeine sources influence market dynamics. Innovation in substitute products and marketing strategies can impact coffee consumption patterns. Moreover, the market is characterized by a relatively high degree of end-user concentration, with a significant portion of revenue generated from a small number of large retail chains and coffeehouse operators.

Product Insights

The roasted Arabica coffee segment led the market and accounted for a revenue share of 57.60% in 2023. Arabica coffee is particularly favored by coffee enthusiasts and experts due to its superior flavor profile. The beans are known for being the most flavorful and sweet among all coffee varieties. The moderate and subtle taste of Arabica coffee is another factor that contributes to its popularity. Moreover, Arabica beans have a relatively low caffeine content compared to other coffee varieties, making them a preferred choice for individuals who prefer milder caffeine levels. Additionally, major coffee shop chains, including Starbucks, prioritize the use of Arabica coffee beans to focus on providing a premium and distinctive coffee experience to their customers.

The roasted robusta coffee segment is anticipated to witness the highest CAGR of 5.9% from 2024 to 2030. Robusta coffee beans are known for their distinctive flavor profile characterized by boldness, strong body, and nutty or chocolatey notes. This unique taste appeals to consumers seeking a robust and intense coffee experience. Additionally, robusta beans are commonly used in espresso blends due to their ability to provide a rich crema, making them versatile for various brewing methods. Robusta coffee beans are generally more resilient and easier to cultivate than Arabica beans. They are often grown at lower altitudes and are less susceptible to pests and diseases. In August 2022, Robusta constituted 37% of global green coffee exports, as per International Coffee Organization data.

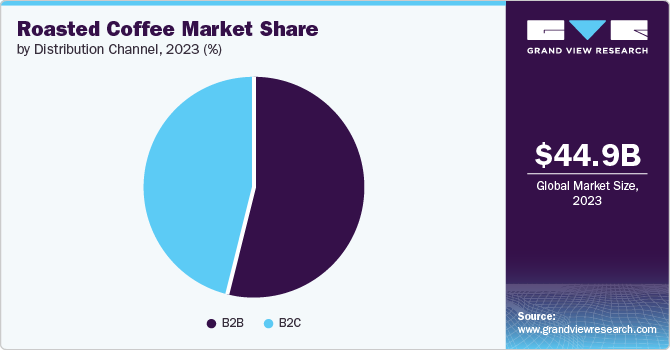

Distribution Channel Insights

The B2B segment led the market and accounted for a revenue share of 54.17% in 2023. The escalating demand from a spectrum of commercial establishments, including cafes, restaurants, and corporate offices, is driving the segment growth. These enterprises necessitate a steady and consistent supply of high-quality coffee, prompting them to rely on B2B distributors to meet their requirements effectively. The specialization and expertise inherent in the B2B distribution network play a pivotal role. B2B distributors possess an in-depth understanding of the nuanced preferences and diverse tastes of different business clientele. This enables them to offer customized blends, roast profiles, and sourcing options, catering precisely to the distinct demands of each establishment.

The B2C segment is estimated to grow at a CAGR of 6.0% from 2024 to 2030. B2C channels, such as online stores and retail outlets, offer consumers convenience and accessibility. These channels provide a diverse range of roasted coffee bean options, including different origins, blends, and roast profiles. Moreover, B2C channels facilitate direct interactions between consumers and coffee brands. This engagement creates opportunities for brands to showcase their unique selling propositions, share stories about their coffee sourcing and roasting processes, and build a loyal customer base through brand loyalty and affinity. Besides, online stores offer consumers a platform to explore and purchase various coffee products with ease. This trend is particularly evident in the rise of subscription services that deliver freshly roasted beans to consumers' doorsteps regularly.

Regional Insights

The North America roasted coffee market held over 19.44% of the global revenue in 2023. The growing popularity and consumption of roasted coffee in the region are driving the market. The introduction of coffee chains like Starbucks in North America has made roasted coffee increasingly sought-after, from light roast to dark roast. These chains offer roasted coffee based on customers’ varying individual tastes and preferences, thus fueling the market growth. As per National Coffee Data Trends (NCDT), about 63% of Americans consume coffee daily. This factor supports the demand for roasted coffee among consumers.

U.S. Roasted Coffee Market Trends

The roasted coffee market in the U.S. is expected to grow at a CAGR of 6.1% from 2024 to 2030, driven by the growing number of coffee retail chains, coupled with their expanding global reach. The presence of a large number of small local cafes, baristas, coffee bars, and even large coffee chains like Starbucks and Dunkin Donuts is driving the market growth in the U.S. As per National Coffee Data, as of 2022, there are about 65,410 coffee shops in the U.S., with Seattle, New York, Los Angeles, and San Francisco reporting the highest concentration of cafes.

Canada roasted coffee market is expected to grow at a CAGR of 6.5% from 2024 to 2030. Canada has a rich coffee culture, and there has been a growing appreciation for high-quality, specialty, and artisanal coffee. This trend could lead to increased demand for roasted coffee products that offer unique flavors and experiences. Tim Hortons is Canada's largest coffee chain, serving over 5 million cups of coffee every day, with 80% of Canadians visiting the chain at least once a month, resulting in a significant demand for coffee.

Europe Roasted Coffee Market Trends

The roasted coffee market in Europe held over 32% of the global revenue in 2023. The increasing disposable incomes and changing consumer consumption patterns are accelerating the demand for coffee in the region. According to forecasts by the World Coffee Portal, the European market for branded coffee shops is projected to surpass 44,100 establishments by March 2024 and is expected to reach 49,600 outlets by March 2028.

Germany roasted coffee market is set to grow at a CAGR of about 5.5% from 2024 to 2030. Germany has the second-largest coffee roasting sector in Europe after Italy, producing roasted coffee to satisfy both domestic consumption and international export. Companies are investing in building or upgrading production facilities to increase capacity and efficiency. In March 2022, Schwarz Produktion, a part of the Schwarz Group, successfully launched a state-of-the-art coffee roasting plant in Rheine, Germany, just 18 months after commencing construction.

Asia Pacific Roasted Coffee Market Trends

The roasted coffee market in Asia Pacific is set to grow at a CAGR of about 6.7% from 2024 to 2030. The growth of the middle-income population keen to try out new trends is driving the demand for coffee consumption across Asia Pacific, which is traditionally a tea-drinking region. Social media platforms like Instagram and TikTok have been pushing coffee ahead of tea, giving rise to a rapidly growing coffee-drinking culture. This cultural phenomenon, supported by Westernized lifestyles, urbanization, and rising disposable incomes, has fueled consumers' demand for coffee. Asia Pacific has witnessed the highest annual growth rate in coffee consumption in the last few years. According to the International Coffee Organization report published in April 2023, coffee production in the Asia Pacific increased by 8.7% during 2021-2022 to 52.1 million bags, from 47.9 million bags in 2020 - 2021, increasing its market share of the world’s output to 30.9% from 28.0% during 2020 - 2021.

Central & South America Roasted Coffee Market Trends

The roasted coffee market in Central & South America is set to grow at a CAGR of about 4.6% from 2024 to 2030. The demand for roasted coffee is expected to increase in Central & South America owing to a combination of factors such as the region’s rich coffee-growing heritage coupled with the growing demand for specialty coffee which has placed the region as a prime source of high-quality beans. Moreover, the rise of café culture and increasing urbanization further fuel the need for roasted coffee. As South American countries increasingly focus on sustainable practices and premium offerings will boost the industry growth.

Middle East & Africa Roasted Coffee Market Trends

The roasted coffee market in the Middle East & Africa is set to grow at a CAGR of about 5.1% from 2024 to 2030. Coffee consumption in Africa is extremely concentrated with the top 6 countries including Ethiopia, Algeria, Egypt, Morocco, South Africa, and Tunisia holding 74% of the market share in the region according to statistics published by International Coffee Organization in April 2023.

Key Roasted Coffee Company Insights

Nestlé S.A., JDE Peet’s, Starbucks Corporation, The J.M. Smucker Company, Luigi Lavazza SPA, STRAUSS Coffee B.V. (Straus Group), Melitta Group, Tchibo, Massimo Zanetti Beverage Group, and Farmer Bros. Co. are some of the dominant players operating in the roasted coffee market. The global roasted coffee market is characterized by intense competition. Many leading companies control the entire supply chain, from coffee bean cultivation to retail, allowing for greater control over quality, cost, and sustainability practices. Companies have been implementing various strategic initiatives, such as expansions, strengthening of online presence, and launching new products, to gain a competitive advantage over others. Moreover, players are trying to increase their brand recognition through various forms of media, the internet, and social networking sites.

Key Roasted Coffee Companies:

The following are the leading companies in the roasted coffee market. These companies collectively hold the largest market share and dictate industry trends.

- Nestlé S.A.

- JDE Peet’s

- Starbucks Corporation

- The J.M. Smucker Company

- Luigi Lavazza SPA

- STRAUSS Coffee B.V. (Straus Group)

- Melitta Group

- Tchibo

- Massimo Zanetti Beverage Group

- Farmer Bros. Co.

Recent Developments

-

In June 2024, Farmer Bros, based in Texas, moved its headquarters to a new 25,000 sq. ft. location in Fort Worth, Texas. This relocation comes after the sale of its former 540,000 sq ft headquarters in Northlake, Texas, to TreeHouse Foods for USD 100 million in June 2023, which included its shipping and roasting operations. Farmer Bros has now centralized its roasting activities in Portland, Oregon.

-

In May 2024, Nescafé, a Nestlé coffee brand, announced that it is expanding its offerings to include roasted, ground, and espresso capsules. Nestlé will increase production capacity by 50% at its Araras factory in Brazil, investing R$1 billion (USD 184 million) over four years. This will also boost the number of professional Nescafé machines in retail and corporate locations by 25%, up from the current 22,000 machines.

-

In May 2024, Melitta Group acquired a majority stake in Caturra, a coffee roaster and service provider based in Cape Town, South Africa. The transaction, whose financial details were not disclosed, is aimed at expanding Melitta's market reach in Africa. Operations will be overseen by Melitta Europe - Coffee Division, headquartered in Bremen, Germany.

-

In March 2024, JDE Peet’s obtained a long-term global license to manufacture, sell, and market Caribou foodservice and consumer coffee products, excluding Caribou coffeehouses. This boosts JDE Peet’s premium coffee portfolio in the U.S., which already includes Stumptown, Intelligentsia, Peet’s Coffee, and L’OR. The deal also involves JDE Peet’s acquisition of Caribou’s coffee roasting operations in Minneapolis and a strategic partnership to supply coffee and coffee products to Caribou coffeehouses.

Roasted Coffee Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 47.44 billion

Revenue forecast in 2030

USD 66.41 billion

Growth rate (Revenue)

CAGR of 5.8% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India;Brazil; Ethiopia

Key companies profiled

Nestlé S.A.; JDE Peet’s; Starbucks Corporation; The J.M. Smucker Company; Luigi Lavazza SPA; STRAUSS Coffee B.V. (Straus Group); Melitta Group; Tchibo; Massimo Zanetti Beverage Group; Farmer Bros. Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Roasted Coffee Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global roasted coffee market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Arabica

-

Robusta

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

B2C

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Ethiopia

-

-

Frequently Asked Questions About This Report

b. The global roasted coffee market was estimated at USD 44.98 billion in 2023 and is expected to reach USD 47.44 billion in 2024.

b. The roasted coffee market is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030 to reach USD 66.41 billion by 2030.

b. Europe dominated the roasted coffee market with a share of 32.66% in 2023. This whopping market share is mainly attributed to rising disposable incomes and a growing preference for premium and specialty coffee. Moreover, the burgeoning coffee culture across Europe, characterized by a proliferation of independent coffee shops, cafes, and roasteries, is contributing to increased consumption

b. Some of the key market players in the roasted coffee market are Nestlé S.A.; JDE Peet’s, Starbucks Corporation; The J.M. Smucker Company; Luigi Lavazza SPA; STRAUSS Coffee B.V. (Straus Group); Melitta Group; Tchibo; Massimo Zanetti Beverage Group; and Farmer Bros. Co.

b. The roasted coffee market has experienced significant growth in recent years, driven by several health benefits associated with coffee consumption, such as its potential to enhance cognitive function and reduce the risk of certain diseases, are boosting roasted coffee consumption. Moreover, the expansion of coffee shops and cafes is creating new avenues for consumers to experience different roasts and blends, thereby fostering a culture of coffee appreciation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.