- Home

- »

- Next Generation Technologies

- »

-

Cold Chain Equipment Market Size, Industry Report, 2030GVR Report cover

![Cold Chain Equipment Market Size, Share & Trends Report]()

Cold Chain Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Equipment Type (Storage Equipment, Transportation Equipment), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-787-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cold Chain Equipment Market Size & Trends

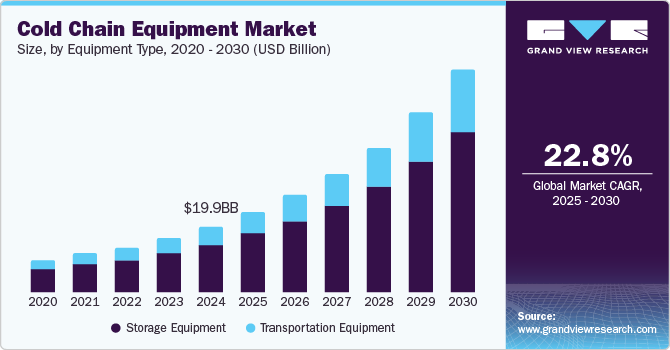

The global cold chain equipment market size was estimated at USD 19.87 billion in 2024 and is projected to grow at a CAGR of 22.8% from 2025 to 2030. It consists of a wide range of devices, including freezers, refrigerators, cold rooms, temperature sensors, data loggers, and monitoring systems. These devices are designed to maintain a constant temperature within a predetermined range and to offer real-time information regarding temperature variations, which is essential for making sure that items continue to be secure and efficient. Effective cold chain equipment is required to preserve the quality and safety of these perishable goods due to the rising demand for fresh produce, seafood, meat, and dairy products. Similar to the food and beverage industry, the pharmaceutical and healthcare industry relies significantly on cold chain equipment to store and ship temperature-sensitive medical supplies including vaccines and medications.

Companies are using IoT and cloud computing to monitor and manage temperature and humidity levels in real time, allowing them to swiftly address any issues. Data loggers and sensors are used in the pharmaceutical industry, among others, to track the temperature and humidity of goods as they are transported. Effective cold chain equipment is required due to the rising demand for perishable foods. For instance, businesses in the seafood sector must make sure that fish and other seafood items are transported safely and in good condition. Companies are making investments in cutting-edge refrigeration and monitoring gear, including temperature sensors, data loggers, and monitoring systems, to meet this demand.

Also, there is a huge need for cold chain equipment due to the expansion of the pharmaceutical and healthcare sectors. For instance, the COVID-19 pandemic has increased the need for efficient vaccine distribution and storage, and businesses are investing in cutting-edge cold chain technology to guarantee the vaccines' continued safety and efficacy. To address the demand for ultra-low temperature storage of the COVID-19 vaccine from Pfizer-BioNTech, businesses are investing in cutting-edge freezers and refrigeration equipment. The market for cold chain equipment is expanding as a result of the aforementioned issues, and businesses are spending money on cutting-edge machinery to fulfill the rising need for temperature-controlled storage and transportation.

The emergence of portable and modular cold chain systems addresses the growing demand for flexible, cost-effective, and scalable temperature-controlled solutions across industries. These systems support last-mile delivery, seasonal storage needs, and operations in underserved regions, with innovations such as IoT-enabled monitoring and solar-powered units enhancing their efficiency. This trend is reshaping the market by improving accessibility, reducing operational costs, and enabling businesses to adapt to dynamic logistics requirements.

The rising demand for perishable goods is driving the global cold chain equipment industry, driven by the expansion of e-commerce, urbanization, and changing consumer preferences for fresh and frozen products. Global food trade and stringent food safety standards further necessitate advanced cold chain solutions to ensure product quality and minimize waste. This growth is prompting investments in innovative refrigeration technologies and efficient storage and transportation systems.

Equipment Type Insights

In terms of equipment type, the market is bifurcated into storage equipment and transportation equipment. The storage equipment segment dominated the overall market, gaining a market share of 74.2% in 2024. The storage equipment is created to maintain a particular temperature range that is suitable for the product being stored. For some goods, such as vaccines, this temperature range can vary from below freezing to just above freezing, and above freezing for other products, such as fruits and vegetables. Throughout the cold chain process, it is essential to keep the products' quality, safety, and efficacy, which calls for appropriate storage equipment and temperature control. The products could spoil, lose their efficacy, or even become dangerous to use or consume without the right storage equipment.

The transportation equipment segment is anticipated to grow at a significant growth rate from 2025 to 2030. Depending on the method of transportation and the particular requirements of the product being carried out, different types of transportation equipment are used in the cold chain system. Refrigerated trucks, vans, and containers, as well as air cargo containers, and ships with refrigeration units, are a few instances of transportation tools used in the cold chain system. To guarantee that the product maintains the required temperature throughout the entire journey, from loading to unloading, the transportation equipment must keep a specified temperature range. This is accomplished by utilizing specialized heating or cooling systems that can keep a constant temperature independent of the outside environment. In order to prevent product damage during transit, temperature control and transportation equipment are both essential. To protect against damage from factors such as vibrations, shocks, and humidity fluctuations, the equipment must be built to provide adequate insulation, airflow, and humidity control.

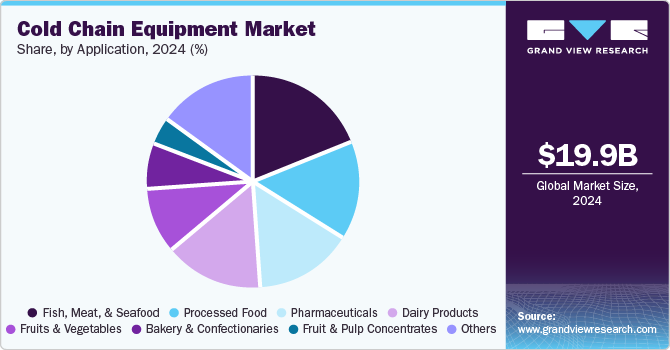

Application Insights

In terms of application, the market is segmented into fish, meat, & seafood, fruits & vegetables, dairy products, processed food, fruit & pulp concentrates, bakery & confectionaries, pharmaceuticals, and others. The fish, meat, & seafood segment dominated the market in 2024, with a market share of over 19.0%. The refrigerated storage of fish, meat, and seafood is crucial as harmful bacteria can grow on the meat when the animal is slaughtered. Food, meat, and seafood are among the high-risk products in terms of food poisoning. Hence, refrigerated storage solutions are vital to maintaining their quality and shelf life. Bacteria can multiply rapidly in meat when stored between 5°C and 63°C. The optimal temperature to store fish, meat, and seafood products is between 0°C and 5°C.

The processed food segment is anticipated to witness the fastest growth from 2025 to 2030. Processed foods are food items that have undergone various chemical or mechanical processes from their raw agricultural state, such as heating, cooking, canning, and dehydrating. They include ready-to-eat meals, frozen pizzas, and foods with added ingredients such as spices, oils, and sweeteners, among others. According to the U.S. Department of Agriculture and Foreign Agricultural Service (FAS), the total U.S. processed food export was valued at USD 34.24 billion in 2021. Cold chain solutions help maintain the quality of processed foods and increase their shelf life.

Regional Insights

North America led the overall market in 2024, with a market share of 43.6%. The cold chain equipment industry in North America is a mature and established industry that serves a wide range of sectors, including food, pharmaceuticals, and chemicals. There are several prominent companies that provide cold chain equipment solutions in the region. One example is Lineage Logistics, which is the world's largest temperature-controlled warehousing and logistics company. Lineage Logistics operates over 300 facilities across North America and provides a wide range of services, including blast freezing, cross-docking, and import/export services. Another example is Carrier, which is a global leader in heating, air conditioning, and refrigeration solutions. Carrier offers a range of cold chain equipment solutions, including refrigerated transport vehicles, storage solutions, and refrigeration systems. In addition, Americold is a leading provider of temperature-controlled warehousing and logistics services, with a focus on sustainability and energy efficiency.

U.S. Cold Chain Equipment Market Trends

The U.S. cold chain equipment industry is growing due to rising e-commerce sales of perishable goods, the expanding pharmaceutical industry, and increasing consumer demand for fresh and organic products. Strict regulations on food safety and pharmaceutical distribution, coupled with advancements in IoT-enabled and energy-efficient solutions, are further driving adoption. In addition, investments in infrastructure and efforts to reduce food waste are strengthening the market's growth trajectory.

Asia Pacific Cold Chain Equipment Market Trends

Asia Pacific market is anticipated to witness the fastest growth from 2025 to 2030. The cold chain equipment industry in the Asia Pacific region is rapidly expanding due to the increasing demand for fresh and frozen food, pharmaceuticals, and other perishable products. The region is home to some of the world's largest population centers, and there is a growing awareness of the importance of maintaining product quality and safety during transport and storage. Many companies in the Asia Pacific region provide cold chain equipment solutions. One example is Haier, a Chinese company that offers a range of refrigerators and freezers, including medical refrigerators and vaccine freezers. Another example is Daikin Industries, a Japanese company that provides air conditioning and refrigeration equipment, including refrigerated transport trucks and trailers. In addition, Nichirei Logistics, a Japanese company, specializes in temperature-controlled warehousing and transportation solutions for food and pharmaceutical products.

Key Cold Chain Equipment Company Insights

Some of the key players operating in the market include Thermo King (Trane Technologies plc), Carrier, and Schmitz Cargobull, among others.

- Thermo King is a brand of Trane Technologies plc. Trane Technologies plc reports business in three segments, namely, Americas, EMEA, and Asia Pacific. Thermo King provides temperature-controlled solutions for transporting perishable goods such as medicines and food. Thermo King offers a wide range of refrigeration units for trailers, trucks, railcars, and other cold storage applications. Their product line includes both diesel-powered and electric refrigeration units, with an increasing focus on energy-efficient, eco-friendly technologies.

Rivacold srl and Intertecnica (IK Interklimat S.p.A.) are some of the emerging market participants in the target market.

- CAREL INDUSTRIES S.p.A. provides components and solutions, both software and hardware, which can help in achieving energy-efficient control, and regulation instruments for HVAC and refrigeration markets. As such, the company offers control and humidification solutions for refrigeration, humidification, heating, air conditioning, and IoT application segments. The group operates through 49 companies with 15 production sites in Germany, China, Croatia, Italy, the U.S., Poland, and Brazil.

Key Cold Chain Equipment Companies:

The following are the leading companies in the cold chain equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo King (Trane Technologies plc)

- Carrier

- Zanotti S.p.A.

- Viessmann Group

- Schmitz Cargobull

- Fermod

- Intertecnica (IK Interklimat S.p.A.)

- ebm-papst

- CAREL INDUSTRIES S.p.A.

- BITZER Group

- Kelvion Holding GmbH

- ARNEG S.p.A.

- Rivacold srl

- Kason Industries, Inc.

- Component Hardware Group, Inc.

Recent Development

-

In October 2024, Carrier Transicold launched its next-generation Supra A and Citimax D series refrigeration units at REFCOLD 2024 in Kolkata, India, showcasing cutting-edge technology and efficiency for the cold chain industry. The Supra A series offers enhanced efficiency, compactness, and reliability in high ambient temperatures, while the Citimax D series features improved performance, faster pull-down speeds, lighter design, and an intelligent controller, supporting the growing demands of the cold chain sector.

-

In August 2024, Trane Technologies plc, through its Thermo King brand, completed the acquisition of Klinge Corporation, enhancing its sustainable transport temperature control offerings. Klinge Corporation, a company specializing in ISO refrigerated containers, complements Thermo King's portfolio of innovative solutions for transporting temperature-sensitive goods, aligning with the company's growth strategy and commitment to global efficiency in delivering critical goods.

Cold Chain Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 24.08 billion

Revenue forecast in 2030

USD 67.27 billion

Growth rate

CAGR of 22.8% from 2025 to 2030

Historic year

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; Poland; Sweden; Finland; Norway; Croatia; Greece; Turkey; India; China; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Thermo King (Trane Technologies plc); Carrier; Zanotti S.p.A.; Viessmann Group; Schmitz Cargobull; Fermod; Intertecnica (IK Interklimat S.p.A.); ebm-papst; CAREL INDUSTRIES S.p.A.; BITZER Group; Kelvion Holding GmbH; ARNEG S.p.A.; Rivacold srl; Kason Industries, Inc.; Component Hardware Group, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cold Chain Equipment Market Report Segmentation

This report forecasts revenue growths at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global cold chain equipment market based on equipment type, application, and region.

-

Equipment Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Storage Equipment

-

On-grid

-

Walk-in coolers

-

Walk-in freezers

-

Ice-lined refrigerators

-

Deep freezers

-

-

Off-grid

-

Solar Chillers

-

Milk Coolers

-

Solar powered cold boxes

-

Others

-

-

Others

-

-

Transportation Equipment

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Fruits & Vegetables

-

Fruit & pulp concentrates

-

Dairy Products

-

Fish, Meat, & Seafood

-

Processed Food

-

Pharmaceuticals

-

Bakery & Confectionaries

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Poland

-

Sweden

-

Finland

-

Norway

-

Croatia

-

Greece

-

Turkey

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cold chain equipment market size was estimated at USD 19.87 billion in 2024 and is expected to reach USD 24.08 billion in 2025.

b. The global cold chain equipment market is expected to grow at a compound annual growth rate of 22.8% from 2025 to 2030 to reach USD 67.27 billion by 2030.

b. North America dominated the cold chain equipment market with a share of 43.6% in 2024. This is attributable to the significant fragmentation of cold storage and cold chain equipment companies in the region. Also, factors such as rising disposable income, increasing population, and regulatory initiatives towards food safety during storage and transportation are expected to drive the regional market.

b. Some key players operating in the cold chain equipment market include Thermo King, Carrier Transicold, Zanotti SpA, Viessmann, Schmitz Cargobull, Fermod, Intertecnica, ebm-papst Group, CAREL, Bitzer, Kelvion, Incold S.p.A., Rivacold srl, Kason Industries, Inc., and CHG Europe BV.

b. Key factors that are driving the market growth include growing demand for frozen food across the globe, increasing demand for processed food in developing economies, coupled with the focus on reducing wastage of food in African countries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.