- Home

- »

- Plastics, Polymers & Resins

- »

-

Cold Chain Packaging Market Size And Share Report, 2030GVR Report cover

![Cold Chain Packaging Market Size, Share & Trends Report]()

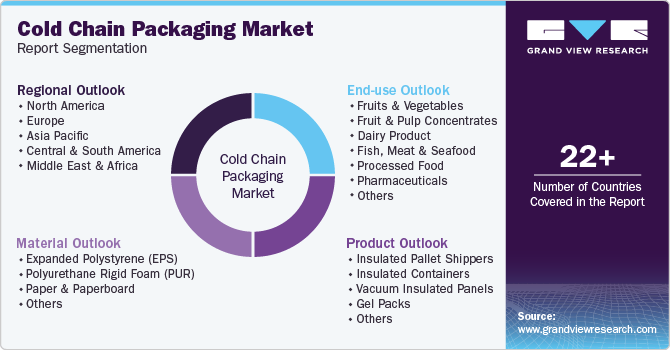

Cold Chain Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (EPS, PUR, Paper & Paperboard), By Type, By Product, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-135-9

- Number of Report Pages: 220

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cold Chain Packaging Market Summary

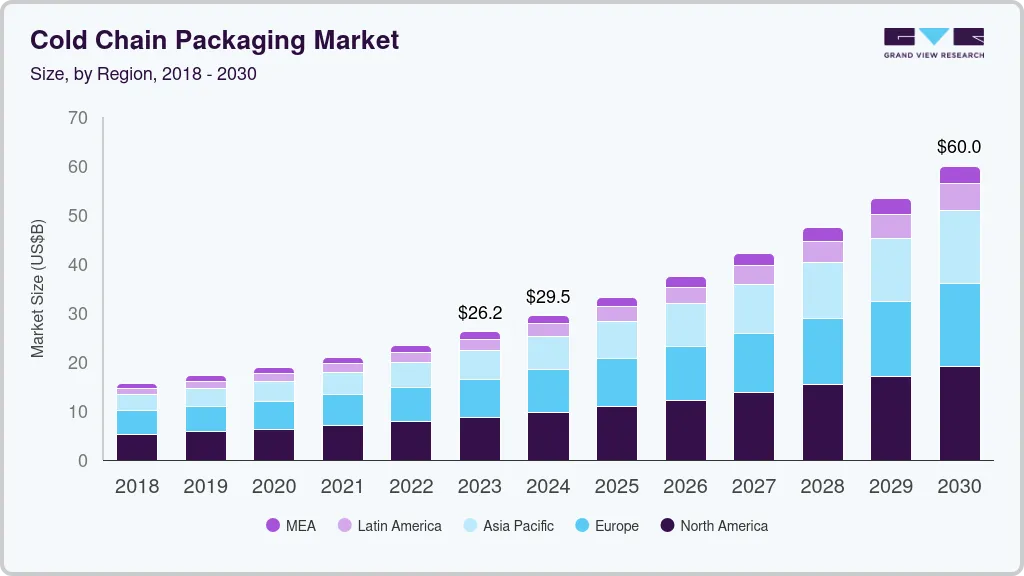

The global cold chain packaging market size was estimated at USD 26.17 billion in 2023 and is projected to reach USD 59.95 billion by 2030, growing at a CAGR of 12.6% from 2024 to 2030. Its growth can be attributed to rising demand for packaging solutions from the global food processing industry.

Key Market Trends & Insights

- North America dominated the global cold chain packaging market and accounted for the largest revenue share of 33.10% in 2023.

- The cold chain packaging market in the U.S. held the largest share in the North America region.

- Based on material, EPS segment dominated the cold chain packaging industry with a share of 38.90% in 2023.

- Based on product, insulated containers segment dominated the market in 2023 and accounted for a share of 41.29%.

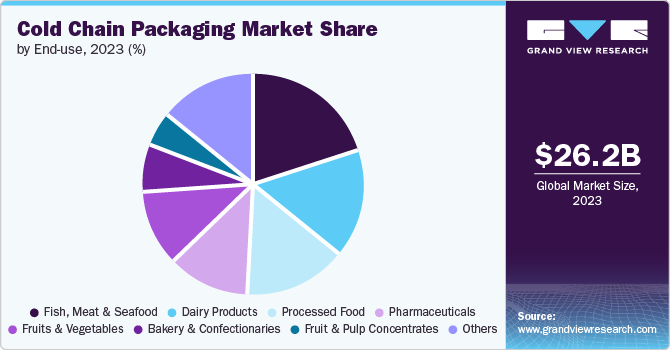

- Based on end-use, fish, meat & seafood segment dominated the market in 2023 and accounted for a share of 20.26%.

Market Size & Forecast

- 2023 Market Size: USD 26.17 Billion

- 2030 Projected Market Size: USD 59.95 Billion

- CAGR (2024-2030): 12.6%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Key factors driving this demand are changing lifestyle of people, growing population, and rapid urbanization, which has triggered demand for food products as changing lifestyles are prompting consumers to opt for processed and easy-to-eat food items. Processed food items such as frozen fruits and vegetables, dairy products, seafood, and meat have high demand globally. Such food items require efficient packaging in transit and storage. The different food and safety regulations globally have a significant impact on future of temperature-controlled packaging industry. Governments across regions have drafted various rules and guidelines for storage and transportation of refrigerated products. Various regulations across countries related to food packaging include the Food and Drug Administration’s regulations for frozen food in the U.S., India’s Food Safety and Standards (Packaging) Regulations (2018), China’s Food Safety Law, and Canada’s Food and Drugs Act, among others. Companies need to adhere to various standards that meet all regulations regarding temperature-controlled packaging solutions.

According to the Food and Agriculture Organization, 1.3 billion metric tons of food is wasted globally. The fact that several governments have adopted cold chain packaging shows how important it is and how it helps expand the industry. For instance, the Indian government funds investments in cold chains, including processing, according to the "Scheme of Cold Chain, Value Addition and Preservation Infrastructure" plan. Under this scheme, the Indian government is focused on building cold chain infrastructure at farm level. Furthermore, under the Government of India's integrated cold chain and value-addition infrastructure initiative, eligible parties can receive a grant or subsidy between 35% and 50% of the project cost, depending on previously set cost parameters, thus contributing to the market.

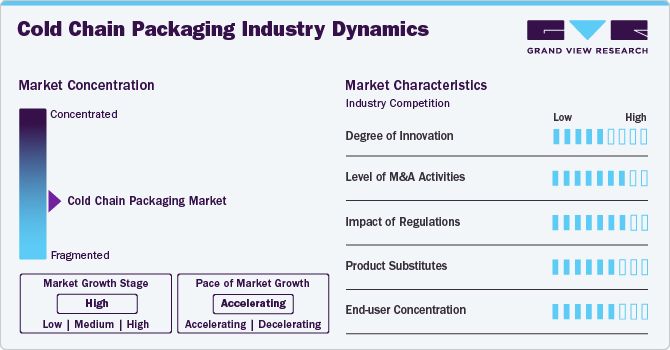

Industry Dynamics

Prominent cold chain packaging companies operating in the market include Cold Chain Technologies, Cryopak, Sonoco Thermosafe, SOFRIGAM, Softbox Systems Ltd, Pelican Products, Inc., CSafe, TOWER Cold Chain Solutions, Sealed Air Corporation, CoolPac, Nordic Cold Chain Solutions, Global Cooling Inc., Inmark LLC, Envirotainer AB, DGP Intelsius LLC, Vericool, Inc., Emballages Cre-O-Pack Intl, and TemperPack Technologies, Inc.

Companies increasingly focus on developing new products related to the market to increase their market penetration. For instance, in April 2024, CSafe introduced Silverpod MAX RE, its newest reusable shipping option, intended to assist clients in reaching their environmental goals. The highly resilient Silverpod MAX RE pallet shipper, composed of reusable parts, advances CSafe's original Silverpod technology. It offers more than 120 hours of approved thermal protection and employs high-performing, recyclable PCM coolants to enable safe storage prior to and during transportation.

In November 2023,Cryopak introduced Eco Gel, manufactured from a patented blend of natural, biodegradable components. This gel is designed for optimal performance in diverse weather conditions and is resilient to withstand repeated use and maintain consistent temperature control. Eco Gel is recyclable and biodegradable, it has a lower environmental impact than traditional refrigerant gels used in gel packs, demonstrating more sustainability.

Material Insights

Based on material, the market has been segmented into expanded polystyrene (EPS), polyurethane rigid foam (PUR), paper & paperboard, and others. Among these, EPS dominated the cold chain packaging industry with a share of 38.90% in 2023. EPS is relatively inexpensive to produce compared to other insulating materials. Its cost-effectiveness makes it an attractive option for companies looking to balance performance with budget constraints, thus contributing to its high market share.

Paper & paperboard is expected to progress with the fastest CAGR of 13.8% from 2024 to 2030. Increasing environmental concerns and the push for sustainable packaging solutions are driving adoption of paper and paperboard materials. These materials are biodegradable, recyclable, and have a lower environmental impact than traditional plastics like EPS. Laminated or multi-layer paperboard can provide effective thermal barriers to maintain the required temperatures for cold chain products. Paperboard, created by Dura-Fibre, is utilized in packaging of COVID vaccines. This paperboard exhibits excellent freeze/thaw characteristics that are useful in cold chain packing.

Product Insights

Based on product, the market is segmented into insulated pallet shippers, insulated containers, vacuum insulated panels (VIPs), gel packs, and others. Insulated containers dominated the market in 2023 and accounted for a share of 41.29%. Insulated containers are typically robust and durable, providing excellent protection against physical damage during transit. This ensures that contents are kept at the right temperature and safeguarded from external impacts and environmental factors.

Vacuum insulated panels (VIP) are expected to grow at the fastest CAGR of 13.2% over the forecast period. VIPs provide high insulation performance with a thinner profile, maximizing usable space inside the packaging. This is particularly beneficial for transporting larger quantities of products without increasing a package's overall size and weight.

End Use Insights

Based on end use, the market is segmented into fruits & vegetables, fruit & pulp concentrates, dairy products, fish, meat & seafood, processed food, pharmaceuticals, bakery & confectionaries, and others. Among these, fish, meat & seafood dominated the market in 2023 and accounted for a share of 20.26%. This high share is attributable to rising volumes of meat products, including beef and chicken, increasingly being exported from the U.S. and Brazil. As meat products are prone to natural, continuous, and irreversible bio-physiochemical changes, they must be stored at a suitable frozen temperature range during transit and storage.

Pharmaceuticals is expected to progress with a CAGR of 15.2% over the forecast period. Many pharmaceutical products, such as vaccines, biologics, and certain medications, are highly sensitive to temperature variations. Maintaining correct temperature range is critical to preserving their efficacy, safety, and shelf life. Cold chain packaging solutions are essential to ensure these products remain within specified temperature limits throughout supply chain.

Regional Insights

North America dominated the global cold chain packaging market and accounted for the largest revenue share of 33.10% in 2023. North America, particularly the U.S., has a highly developed healthcare and pharmaceutical industry. According to the European Federation of Pharmaceutical Industries and Association (EFPIA) 2023 report, North America accounted for 52.3% of world pharmaceutical sales, thus presenting a positive market drive for cold chain packaging from pharmaceutical end-use segment.

U.S. Cold Chain Packaging Market Trends

The cold chain packaging market in the U.S. held the largest share in the North America region. According to NOAA Fisheries, the U.S. harvests seafood of USD 6.3 billion dockside value annually. In August 2023, the National Seafood Strategy was released by the NOAA Fisheries. Under this strategy, NOAA Fisheries will partner with Interstate Commissions, Regional Fisheries Management Councils, National Sea Grant College Program, seafood farmers, harvesters, non-government organizations, and other partners or stakeholders to address challenges faced by seafood sector, especially when resources are limited. Such initiatives aimed at boosting domestic seafood industry can drive demand for cold chain packaging solutions for seafood packaging.

Cold chain packaging market in Canada is primarily driven by growing agricultural sector. The government of Canada is heavily investing in the development of agricultural production, thus presenting growth opportunities for the market. For instance, in 2023 Grow Ontario Market Initiative was launched to provide cost-sharing funding to food and industry organizations and primary producers. Under this initiative, the governments of Ontario and Canada are investing more than USD 7.0 million to help food and agriculture businesses increase their sales in foreign and domestic markets.

Europe Cold Chain Packaging Market Trends

The cold chain packaging market in Europe is driven by growing developments in cold chain logistics market. According to A.P. Moller-Maersk, the cold chain industry in Europe is facing challenges such as proper handling (63%), product packaging (31%), and adequate storage (31%). These prevailing issues have attracted investments targeted toward the development of cold chain infrastructure in Europe, which can positively influence market growth. For instance, in May 2023, UK’s one of the leading cold storage providers, Cold Chain Federation Magnavale announced to invest USD 161.3 million (GBP 130 million) to construct a 101,000-pallet cold store.

Germany cold chain packaging market accounted for the largest share of 17.87% in 2023. High share can be attributed to growing dairy production in Germany. According to Statistisches Bundesamt (Destatis), Germany is largest milk producer in Europe. Storage of milk and other dairy products is sensitive. In general, dairy products contain microorganisms that make long-term use of these products almost impossible without proper storage and temperature conditions. Hence these products require continuous and excellent protection to prevent any degradation of product quality, thus increasing demand for cold chain packaging.

The cold chain packaging market in Spain is expected to progress with a CAGR of 12.1% over the forecast period. According to United States Department of Agriculture (USDA), Spain has largest fish processing industry in Europe with a high per capita consumption and high per capita expenditure on fish and seafood products. However, Spain’s domestic seafood production is not sufficient to fulfill local demand, thus driving the import of seafood from the U.S., Morocco, Ecuador, and Sweden, among others. Thus, growing seafood consumption in Spain can positively influence market growth.

Asia Pacific Cold Chain Packaging Market Trends

The cold chain packaging market in Asia Pacific is projected to grow with the fastest CAGR owing to growing pharmaceutical production in the region. According to United Nations ESCAP, Asia-Pacific accounts for largest share of global research and development spending and large shares in patents and publications on vaccine research and development. Countries in the Asia Pacific have incentivized investments in vaccine research and development, thus driving global pharmaceutical firms to not only offshore part of their production but also transfer some of their research and development activities to the region. For instance, in September 2023, Bio Farma and Coalition for Epidemic Preparedness Innovations (CEPI) entered into a 10-year agreement to manufacture vaccines to tackle future outbreaks and pandemics, which can drive demand for cold chain packaging products.

China cold chain packaging market held a significant share in 2023. China’s growing population has escalated demand for fresh produce and temperature-sensitive products. For instance, the health benefits of blueberries have resulted in the growing demand for blueberries as a viable option among Chinese consumers. Even U.S.-based Driscoll has estimated that the volume of blueberries harvested in China can grow significantly in coming years, which can drive demand for cold chain packaging in China.

Cold chain packaging market in South Korea is expected to progress with a CAGR of 14.5% over the forecast period. The surge in online shopping in South Korea is driving demand for fresh food delivery, thus positively influencing demand for cold chain packaging to maintain food safety and quality during the last-mile delivery stage. Also, in December 2023, South Korea announced the construction of a cold chain logistics center in the Dutch port city of Rotterdam by 2027. The growing interest in Korean food in Europe is expected to be the driving factor behind the construction of this center, which can facilitate fresh food exports from South Korea, thus contributing to the market.

Central & South America Cold Chain Packaging Market Trends

The cold chain packaging market in Central & South America is projected to grow significantly over the forecast period. The climate in this region is tropical, with high temperatures and humidity. This necessitates efficient cold chain packaging to maintain the integrity and efficacy of temperature-sensitive products like pharmaceuticals, food items, and biologics during transportation and storage. Without proper insulation and temperature control, these products can spoil or lose effectiveness.

Brazil cold chain packaging market accounted for the largest share of 26.02% in 2023 in Central & South America. Brazil is a major agricultural producer and exporter of products like meat, poultry, fruits, and vegetables. Efficient cold chain packaging is crucial for maintaining product quality during transportation over long distances, both domestically and for export, thus contributing to its high market share.

Middle East & Africa Cold Chain Packaging Market Trends

The cold chain packaging market in the Middle East & Africa is experiencing growth on account of the growing pharmaceutical sector. The overall pharmaceutical market in the region is heavily reliant on imports. The COVID-19 pandemic significantly impacted pharmaceutical sector in Middle East & Africa, highlighting need to increase localization of pharmaceutical products. In line with this requirement, various country governments in this region are focusing on reducing reliance on imports of pharmaceutical products. For instance, based on the “Bottom-Up Economic Transformation Agenda”, the Kenya government is prioritizing local manufacturing of pharmaceuticals which can drive demand for cold chain packaging products used for packaging vaccines and other temperature-sensitive pharmaceutical products

Saudi Arabia cold chain packaging market growth can be attributed to growing imports of pharmaceutical products. This is driving shipping companies operating in Saudi Arabia to source temperature-controlled containers for shipping life science, biotech, and pharmaceutical products. For instance, in April 2023, Saudi Cargo approved temperature-controlled containers manufactured byTower Cold Chain to be used in the shipping of life science and pharmaceutical products.

Key Cold Chain Packaging Company Insights

This market is fragmented, with a number of players having a significant global presence. Regional players cater to specific countries or regions. These manufacturers have a wide range of products, strong distribution networks, and extensive customer bases.

Key Cold Chain Packaging Companies:

The following are the leading companies in the cold chain packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Cold chain Technologies

- Cryopak

- Sonoco Thermosafe

- SOFRIGAM

- Softbox Systems Ltd

- Pelican Products, Inc.

- CSafe

- TOWER Cold Chain Solutions

- Sealed Air Corporation

- CoolPac

- Nordic Cold Chain Solutions

- Global Cooling Inc.

- Inmark LLC

- Envirotainer AB

- DGP Intelsius LLC

- Vericool, Inc.

- Emballages Cre-O-Pack Intl

- TemperPack Technologies, Inc.

Recent Developments

-

In March 2023, Ranpak introduced RecyCold climaliner solution, a thermal liner made from paper for cold chain packaging. RecyCold climaliner ensures products stay within their ideal temperature range for up to 48 hours while simultaneously ensuring sustainability and recyclability.

-

In October 2023, Exeltainer, a global provider of life sciences thermal packaging solutions with manufacturing facilities in Brazil and Spain, was acquired by Cold Chain Technologies. This acquisition will help Cold Chain Technologies expand its sustainable cold chain packaging products portfolio.

Cold Chain Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 29.48 billion

Revenue forecast in 2030

USD 59.95 billion

Growth rate

CAGR of 12.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in million units, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, product, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Cold chain Technologies; Cryopak; Sonoco Thermosafe; SOFRIGAM; Softbox Systems Ltd; Pelican Products, Inc.; CSafe; TOWER Cold Chain Solutions; Sealed Air Corporation; CoolPac; Nordic Cold Chain Solutions; Global Cooling Inc.; Inmark LLC; Envirotainer AB; DGP Intelsius LLC; Vericool, Inc.; Emballages Cre-O-Pack Intl; TemperPack Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cold Chain Packaging Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the cold chain packaging market report based on material, product, end use, and region:

-

Material Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Expanded Polystyrene (EPS)

-

Polyurethane Rigid Foam (PUR)

-

Paper & Paperboard

-

Others

-

-

Product Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Insulated Pallet Shippers

-

Insulated Containers

-

Vacuum Insulated Panels

-

Gel Packs

-

Others

-

-

End Use Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Fruits & Vegetables

-

Fruit & Pulp Concentrates

-

Dairy Products

-

Milk

-

Butter

-

Cheese

-

Ice Cream

-

-

Fish, Meat & Seafood

-

Processed Food

-

Pharmaceuticals

-

Vaccines

-

Blood Banking

-

-

Bakery & Confectionaries

-

Others

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cold chain packaging market size was estimated at USD 26.17 billion in 2023 and is expected to reach USD 29.48 billion in 2024.

b. The global cold chain packaging market is expected to grow at a compound annual growth rate of 12.6% from 2024 to 2030 to reach USD 59.95 billion by 2030.

b. North America dominated the cold chain packaging market with a share of more than 33.10% in 2023. This is attributable to the growing demand for processed and frozen foods as a result of the growing population, as well as the changing lifestyles of people in the region.

b. Some key players operating in the cold chain packaging market include Cascades inc.; Cold Chain Technologies; Creopack; Cryopak A TCP Company; Intelsius; Pelican Products, Inc.; Softbox; Sofrigam; Sonoco ThermoSafe; and va-Q-tec.

b. Key factors that are driving the cold chain packaging market growth include growing emphasis on regulatory compliance of pharmaceutical products and increased demand for frozen food products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.