- Home

- »

- Automotive & Transportation

- »

-

Cold Storage Market Size, Share & Growth Report, 2030GVR Report cover

![Cold Storage Market Size, Share & Trends Report]()

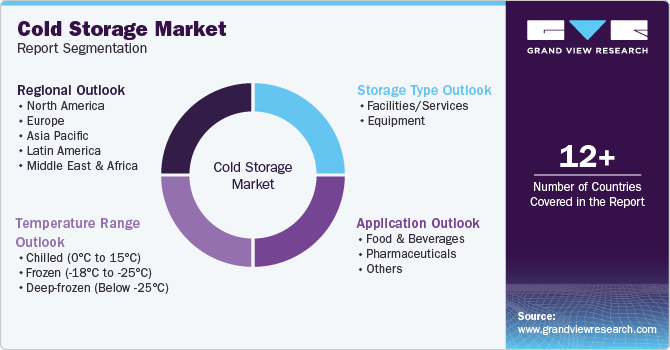

Cold Storage Market Size, Share & Trends Analysis Report By Storage Type (Facilities/Services, Equipment), By Temperature Range (Chilled, Frozen), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-225-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2023 - 2030

- Industry: Technology

Cold Storage Market Size & Trends

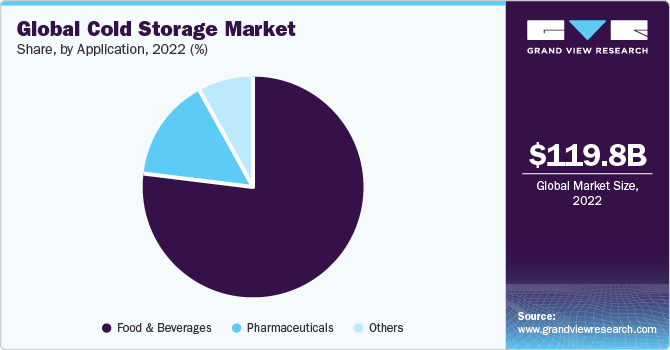

The global cold storage market size was estimated at USD 119.8 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 17.5% from 2023 to 2030. The market has benefitted significantly from the strict regulations governing the supply and production of temperature-sensitive products. The industry is expected to grow significantly over the forecast period owing to growing organized retail sectors in developing economies. Moreover, rising automation in refrigerated warehouses is projected to boost demand further. Warehouse automation includes cloud technology, conveyor belts, robots, energy management, and truck-loading automation. Refrigerated storage has become integral to supply chains when storing and transporting temperature-sensitive products. In addition, the growing perishable product trade is also expected to boost the demand for refrigerated storage solutions over the next few years.

Players in the cold storage market are adopting low-carbon designs and investing in environmental auditing and innovative construction methods. A low-carbon design that minimizes energy consumption can lead to more sustainable and environment-friendly warehouses. Using energy-efficient technologies, such as intelligent automation and control systems, can reduce energy costs and lower the carbon footprint of these facilities.

The need for a high initial investment to establish a cold storage facility is among the key factors hampering the growth of the cold storage industry. Cold storage facilities require significant investment to construct the unit, install the necessary equipment, and maintain and repair the infrastructure. This cost can be especially high for companies just starting in the market, as they need to invest in high-quality infrastructure, refrigeration systems, and insulation to ensure proper temperature control and energy efficiency.

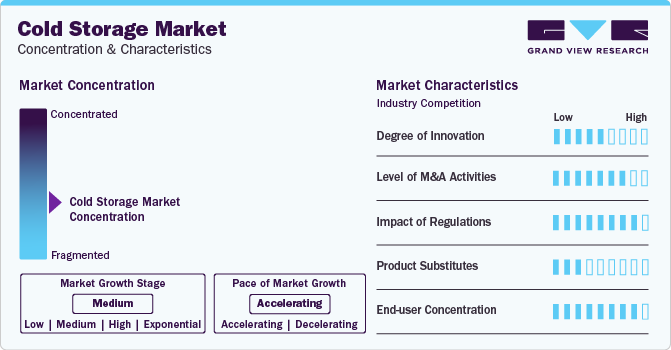

Market Concentration & Characteristics

The cold storage market growth stage is high. Globalization of the food supply chain, changing customer preferences, and the growing need to preserve medications and other temperature-sensitive goods have altogether contributed to an increase in the demand for cold storage facilities.The industry's adaptability to shifting consumer preferences and dietary trends is one prominent attribute. The increasing preference of consumers for fresh and perishable commodities has led to a surge in the need for cold storage facilities to maintain the integrity and quality of these goods. Not only are industrialized nations like North America and Europe observing this trend, but emerging markets are as well, as increased wealth and urbanization are causing a change in consumer behavior.

The target market is also characterized by a high level of mergers & acquisitions by the leading players. The high level of mergers and acquisitions (M&A) in the cold storage market is driven by the pursuit of market consolidation and strategic expansion. Cold storage operators are engaging into such growth strategies to constantly upgrade their technology and stay ahead of the competition. To expand their services and offer end-to-end solutions, players also collaborate with logistics suppliers, transportation corporations, or technology organizations. Through these partnerships, participants can improve their skills and maintain their competitive edge in a market that is evolving constantly.

The complex regulatory environment around cold storage is essential to guaranteeing security, excellence, and adherence to standards of temperature-controlled storage facilities. Policies differ from region to region and are intended to handle the particular difficulties that come with storing medications, perishable commodities, and other items that are sensitive to temperature. Aspects including equipment standards, facility design, and environmental considerations are all covered under the regulatory framework. Strict regulations are imposed on the distribution and storage of pharmaceutical items by regulatory bodies including the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA). Good Distribution Practice (GDP) compliance is essential to preserving the safety and effectiveness of pharmaceuticals, and cold storage facilities need to follow these guidelines to guarantee the integrity of the pharmaceutical supply chain. Refrigerant usage is also regulated by organizations like the US Environmental Protection Agency (EPA) and the EU F-Gas Regulation, which promote the use of greener alternatives and the decrease of greenhouse gas emissions.

A few alternatives and substitutes have emerged in the constantly evolving cold storage industry, providing innovative solutions to concerns related to perishable goods preservation and storage. Hybrid cooling systems provide an innovative way to improve energy efficiency by fusing conventional refrigeration with alternative technologies like thermal energy storage or phase change materials. By optimizing cooling operations in response to variables like demand and energy prices, these systems help lessen the need for constant electrical refrigeration. Insulated containers and pallets equipped with advanced insulation materials and designs offer another option for cold storage consumers. When fitted with heating or cooling components, these containers can regulate temperature during transit and offer an alternate method of product preservation without requiring centralized cold storage facilities.

In many different markets and industries, end-user concentration plays a vital role in shaping pricing strategies, supply and demand dynamics, and overall business stability. This concentration describes the degree to which a company's revenue is largely derived from a small number of clients or customers. End-user concentration can have a significant influence and is frequently evaluated in terms of both opportunities and hazards. Businesses largely depend on a limited number of critical consumers for their revenue in marketplaces where end-user concentration is strong. Businesses frequently adopt tactics like customer diversification, market expansion, and product or service portfolio development to mitigate risks associated with end-user concentration.

Storage Type Insights

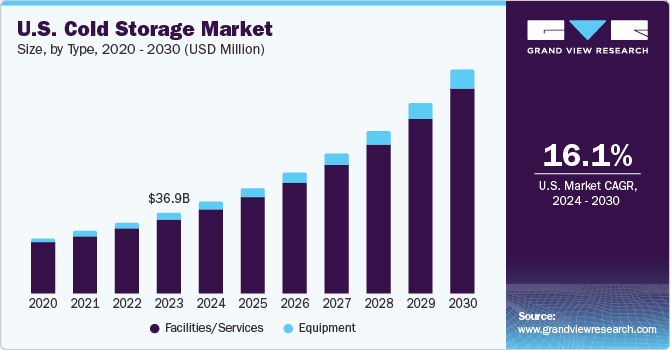

Based on storage type, the market is segmented into facilities/services and equipment. The facilities/services segment dominated the overall market, gaining a revenue share of 89.8% in 2022. It is expected to grow at a CAGR of 17.3% from 2023 to 2030 throughout the forecast period. Based on facilities/services, the cold storage industry has been segmented into refrigerated warehouses and cold rooms.

According to the United States Department of Agriculture, in October 2021, the public warehouse capacity held approximately 71% of the gross refrigerated storage capacity in the U.S. A public warehouse is operated as an independent business that offers various services, such as transportation, storage, and handling for a variable or fixed fee. The growing availability and automation of refrigerated warehouse facilities by numerous market players drive the segment's growth.

The equipment segment is anticipated to grow at the fastest CAGR of 19.3% from 2023 to 2030. Factors such as changing food preferences, changing lifestyles, and growing online food delivery services are driving the demand for frozen food globally. Cold storage equipment stores various perishable food items within the specified temperature ranges to avoid spoilage and increase shelf life. The use of such equipment aids in reducing food wastage as the equipment can store food for a longer duration, driving segment growth.

Temperature Range Insights

Based on temperature range, the market has been segmented into chilled (0°C to 15°C), frozen (-18°C to -25°C), and deep-frozen (below -25°C). The frozen (-18°C to -25°C) segment dominated the overall market, gaining a revenue share of more than 61% in 2022. It is expected to grow at a CAGR of 18.7% throughout the forecast period. Rising consumption of frozen foods in emerging markets, such as China and India, is driving segment growth.

Warehouses under this segment are used to store frozen fruits, vegetables, fish, meat, seafood, and other products. Changing consumer preferences as well as the growing consumption of ready-to-cook meals due to convenience will boost the frozen (-18°C to -25°C) segment growth. The proliferation of organized retail chains, including supermarkets and hypermarkets, is also triggering the demand for such products in emerging economies.

The chilled (0°C to 15°C) segment is anticipated to grow at a considerable CAGR of 15.7% throughout the forecast period. Warehouses under the chilled segment store fresh fruits & vegetables, eggs, dairy products, dry fruits, and dehydrated foods, among others. The chilled temperature range is that of a standard refrigerator and prevents the growth of harmful bacteria on perishable food products, preventing decomposition. The need to store and extend the shelf life of temperature-sensitive products is driving segment growth.

Application Insight

Based on application, the market is segmented into pharmaceuticals, food & beverages, and others. The food & beverages segment dominated the overall cold storage industry, gaining a revenue share of more than 77% in 2022. It is expected to grow at a CAGR of 17.3% throughout the forecast period. Refrigerated storage solutions remain vital for safeguarding food items, such as milk and dairy products, against spoilage. Hence, principles governing the deterioration of food substances due to bacterial growth need to be adhered to while storing dairy products in refrigerated warehouses. The need to maintain food quality and simultaneously prevent deterioration is driving the growth of the food & beverages segment.

The pharmaceuticals segment is expected to grow at the fastest CAGR of 19.4% over the forecast period. Strict government regulations regarding the manufacturing and distribution of pharmaceutical products are driving the adoption of cold storage solutions. Pharmaceutical products must be preserved in a specific temperature range to maintain efficacy and adhere to temperature regulations. Therefore, the demand for cold chain storage & equipment is rising in the pharmaceutical industry. The optimum temperature range to store and transport vaccines is 2°C to 8°C. Equipment facilitating this optimum temperature range includes cold boxes, ice packs, and refrigerators.

Regional Insight

The North America region led the market with a 34.1% revenue share globally in 2022. The proliferation of connected devices and the presence of a large consumer base are the major factors propelling the region’s growth. The presence of prominent market players, including U.S.-based LINEAGE LOGISTICS HOLDING, LLC; Americold Logistics, Inc.; United States Cold Storage; Canada-based CONESTOGA COLD STORAGE; is aiding the market growth in the region. According to the United States Department of Agriculture, in October 2021, the gross refrigerated warehouse capacity was 3.73 billion cubic feet in the U.S.

Asia Pacific region is expected to grow at the fastest CAGR of 20.0% over the forecast period. Advances in warehouse management and refrigerated transportation coupled with government subsidies to develop the cold chain industry has enabled service providers to tap these emerging markets by leveraging innovative solutions that can overcome complexities associated with transportation. Developing technological infrastructure and the presence of market players such as India-based Blue Star Limited and Japan-based NICHIREI CORPORATION is driving the segment growth. According to Global Cold Chain Alliance (GCCA), in March 2023, NICHIREI CORPORATION was ranked fifth in temperature-controlled space operated among GCCA members.

Key Companies & Market Share Insights

Some of the key players operating in the market include Americold Logistics, Inc. and Preferred Freeze among others.

-

Americold Logistics, Inc. is a temperature-controlled warehousing and transportation company. The company operates its business through three segments, namely warehouse, third-party managed, and transportation. Its offerings include producer solution and retailer solution. In December 2020, Americold Logistics, Inc. acquired Agro Merchants Group from an investor group for USD 1.59 billion.

-

Preferred Freezer Services, LLC is engaged in the warehousing, cold storage, distribution, and logistics industry. The company offers full-service, temperature controlled warehouse in the U.S. to provide services to retail and food service companies. It also offers public refrigerated warehouse services in China, North America, and Vietnam. In addition, the company provides less-than-truckload/truckload, intermodal, and drayage services. Preferred Freezer has its cold storage facilities in Florida, New Jersey, Georgia, California, Illinois, Massachusetts, Texas, Pennsylvania Virginia, China, and Vietnam. Preferred Freezer Services, LLC is BRC (British Retail Consortium) certified company.

RSA Logistics and LINEAGE LOGISTICS HOLDING, LLC are some of the emerging market participants in the target market.

-

RSA Logistics is a Dubai-based third party logistics company. It provides logistic services, contract logistics, freight operations, distribution, and supply chain management. The company caters to a variety of industries including chemical, automotive, project logistics, and others. Its major services include warehousing, on-site logistics, customs clearance, supply chain distribution, transportation, and freight services.

-

LINEAGE LOGISTICS HOLDING, LLC provides warehousing and logistics solutions to users in various industries. The company’s solutions consist of temperature-controlled public warehousing facilities for storing multiple food commodities, including pork, beef, poultry, bakery products, fruits & vegetables, seafood, ice creams, and vegetables. It also provides port-centric cold chain facilities on the East and West Coasts to serve containerized markets and break bulk.

Key Cold Storage Companies:

- Americold Logistics, Inc.

- Al Rai Logistica K.S.C

- Agro Merchants Group

- Burris Logistics

- Barloworld Limited

- Cloverleaf Cold Storage

- Gulf Drug LLC

- Henningsen Cold Storage Company

- Kloosterboer

- LINEAGE LOGISTICS HOLDING, LLC

- Nordic Logistics

- Oxford Logistics Group

- Oceana Group Limited

- Preferred Freezer

- RSA Logistics

- Swire Group

- VersaCold Logistics Services

- United States Cold Storage

- Wared Logistics

- Wabash National Corporation

Recent Developments

-

In March 2023, Americold announced a strategic investment in the Dubai-based RSA Cold Chain, an established regional cold storage operator which begun operating in 2017. Americold’s minority ownership will help realize the company’s plans to expand locally, pursue strategic development avenues in the Middle East and neighboring markets, and connect RSA Cold Chain to its global network

-

In February 2023, Lineage Logistics introduced its ‘Lineage Fresh’ service in Europe, which offers storage solutions for leading grocers, producers, and importers of fresh fruit and produce, at the Fruit Logistica trade show in Berlin. The service, which launched in the U.S. in November 2022, will allow products with a short shelf-life to face fewer obstacles and less risk & spoilage with Lineage’s cold storage technology and strong logistics network

-

In January 2023, GulfDrug inaugurated an advanced supply chain management and training facility in Abu Dhabi for making its medical and pharmaceutical management and distribution more robust and well-connected across the country. The facility has a significantly large cold chain service for storage and distribution, accredited by DAC and certified by Dickson, along with a smart delivery fleet for safe and timely product delivery

-

In November 2022, Lineage Logistics announced the official opening of its fully-automated Cool Port II cold storage facility in the Port of Rotterdam, Netherlands. This deep-freeze high bay warehouse features 60,000 pallet locations, three automated truck unloading systems, as well as a complete range of services for the safe storage and distribution of food products. The facility adds a major European port location to Lineage’s global network of advanced cold storage facilities

-

In October 2022, Oceana Group announced that it was selling its Commercial Cold Storage (CCS) business for 760 million South African rand, as part of a deal to allow the company to invest in and expand its core fishing business. At the time of the agreement, CCS had six cold stores, with five being in South Africa and one in Namibia; of these, three were long-term leases and three were owned. The total storage capacity was around 100,000 pallet spaces

-

In July 2022, RSA Global announced that Seafood Souq (SFS) had selected it as the company’s exclusive global digital freight and supply chain partner. SFS has developed a digital ecosystem to enable procurement of traceable seafood products directly from the source, in support of the UN’s Sustainable Development Goals. RSA Global will be responsible for handling local storage requirements, B2B distribution, and SFS’s global sea and air freight operations

-

In June 2022, Americold announced the opening of its newest facility in Dunkirk, New York. The facility is LEED-certified, has 181,000 square feet of cold storage and operational space, and features 25,000 pallet positions for supporting the cold storage demands in western New York. This made it the company’s first facility in this region and added it to Americold’s portfolio of 250 locations globally at the time

-

In April 2022, United States Cold Storage (USCS) announced the sale of three public refrigerated warehouses in Medley, Florida; Marshville, North Carolina; and La Vista, Nebraska, to Vertical Cold Storage based in South Dakota. The sale enabled USCS to reinvest the proceeds and focus on the further expansion of its Tulare, California facility, as well as the purchase of an additional 39 acres in Turlock for future expansion.

Cold Storage Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,38,026.0 million

Revenue forecast in 2030

USD 4,27,626.3 million

Growth Rate

CAGR of 17.5% from 2023 to 2030

Actual Data

2017 - 2023

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Storage type, temperature range, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Netherlands; Switzerland; Japan; China; India; South Korea; Singapore; Australia; Brazil; Mexico

Key companies profiled

Americold Logistics, Inc., Al Rai Logistica K.S.C, Agro Merchants Group, Burris Logistics, Barloworld Limited, Cloverleaf Cold Storage, Gulf Drug LLC, Henningsen Cold Storage Company, Kloosterboer, LINEAGE LOGISTICS HOLDING, LLC, Nordic Logistics, Oxford Logistics Group, Oceana Group Limited, Preferred Freezer, RSA Logistics, Swire Group, VersaCold Logistics Services, United States Cold Storage, Wared Logistics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cold Storage Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global cold storage market report based on storage type, temperature range, application, and region.

-

Storage Type Outlook (Revenue, USD Million; 2017 - 2030)

-

Facilities/Services

-

Refrigerated Warehouse

-

Private & Semi-Private

-

Public

-

-

Cold Room

-

-

Equipment

-

Blast freezer

-

Walk-in Cooler and Freezer

-

Deep Freezer

-

Others

-

-

-

Temperature Range Outlook (Revenue, USD Million; 2017 - 2030)

-

Chilled (0°C to 15°C)

-

Frozen (-18°C to -25°C)

-

Deep-frozen (Below -25°C)

-

Application Outlook (Revenue, USD Million; 2017 - 2030)

-

Food & Beverages

-

Fruits & Vegetables

-

Fruit Pulp & Concentrates

-

Dairy Products

-

Milk

-

Butter

-

Cheese

-

Ice cream

-

Others

-

-

Fish, Meat, and Seafood

-

Processed Food

-

Bakery & Confectionary

-

Others

-

-

Pharmaceuticals

-

Vaccines

-

Blood Banking

-

Others

-

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

Norway

-

Netherlands

-

Switzerland

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Singapore

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cold storage market size was estimated at USD 119.8 billion in 2022 and is expected to reach USD 138.0 billion in 2023.

b. The global cold storage market is expected to grow at a compound annual growth rate of 17.5% from 2023 to 2030 to reach USD 427.6 billion by 2030.

b. North America dominated the cold storage market with a share of 34.1% in 2022. This is attributable to the strengthening network of warehouses and rising investments in the development of the logistics infrastructure in the region.

b. Some key players operating in the cold storage market include Cloverleaf Cold Storage (U.S.), Agro Merchants Group (U.S.), Burris Logistics (U.S.), Americold Logistics LLC (U.S.), and Wabash National Corporation (U.S.).

b. Key factors that are driving the cold storage market growth include low-carbon design, environmental auditing, and crafty construction of cold storage warehouses.

b. The public warehouse segment led the global cold storage market and accounted for more than 64.4% share of the global revenue in 2022.

Table of Contents

Chapter 1. Cold Storage Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definitions

1.3. Research Methodology

1.4. Research Assumptions

1.5. List of Data Sources

1.5.1. Secondary Sources

1.5.2. Primary Sources

Chapter 2. Cold Storage Market: Executive Summary

2.1. Market Snapshot

2.2. Segmental Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Cold Storage Market: Variables, Trends, & Scope Outlook

3.1. Market Lineage Outlook

3.2. Cold Storage Market Value Chain Analysis

3.3. Cold Storage Market Dynamics

3.3.1. Market Driver Analysis

3.3.2. Market Restraint/Challenge Analysis

3.3.3. Market Opportunity Analysis

3.4. Industry Analysis - Porter’s Five Forces Analysis

3.4.1. Supplier Power

3.4.2. Buyer Power

3.4.3. Substitution Threat

3.4.4. Threat of New Entrants

3.4.5. Competitive Rivalry

3.5. Cold Storage Market PESTEL Analysis

3.5.1. Political Landscape

3.5.2. Economic Landscape

3.5.3. Social Landscape

3.5.4. Technology Landscape

3.5.5. Environmental Landscape

3.5.6. Legal Landscape

3.6. Impact of COVID-19 on the Cold Storage Market

Chapter 4. Cold Storage Market Storage Type Outlook

4.1. Cold Storage Market, By Type Analysis & Market Share, 2022 & 2030

4.2. Facilities/Services

4.2.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

4.2.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million)

4.2.3. Refrigerated warehouse

4.2.3.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

4.2.3.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million)

4.2.4. Cold room

4.2.4.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

4.2.4.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million)

4.3. Equipment

4.3.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

4.3.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million)

4.3.3. Blast freezer

4.3.3.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

4.3.3.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million)

4.3.4. Walk-in cooler and freezer

4.3.4.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

4.3.4.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million)

4.3.5. Deep freezer

4.3.5.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

4.3.5.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million)

4.3.6. Others

4.3.6.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

4.3.6.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million)

Chapter 5. Cold Storage Market Temperature Range Outlook

5.1. Cold Storage Market, By Temperature Range Analysis & Market Share, 2022 & 2030

5.2. Chilled (0°C to 15°C)

5.2.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

5.2.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million)

5.3. Frozen (-18°C to -25°C)

5.3.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

5.3.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million)

5.4. Deep-frozen (Below -25°C)

5.4.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

5.4.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million)

Chapter 6. Cold Storage Market Application Outlook

6.1. Cold Storage Market, By Application Analysis & Market Share, 2022 & 2030

6.2. Food & Beverages

6.2.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

6.2.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million)

6.2.3. Fruits & Vegetables

6.2.3.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

6.2.3.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million)

6.2.4. Fruit Pulp & Concentrates

6.2.4.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

6.2.4.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million)

6.2.5. Dairy products

6.2.5.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

6.2.5.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million)

6.2.6. Fish, meat, and Seafood

6.2.6.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

6.2.6.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million)

6.2.7. Processed Food

6.2.7.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

6.2.7.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million)

6.2.8. Bakery & Confectionary

6.2.8.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

6.2.8.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million)

6.2.9. Others

6.2.9.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

6.2.9.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million)

6.3. Pharmaceuticals

6.3.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

6.3.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million)

6.3.3. Vaccines

6.3.3.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

6.3.3.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million)

6.3.4. Blood Banking

6.3.4.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

6.3.4.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million)

6.3.5. Others

6.3.5.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

6.3.5.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million)

6.4. Others

6.4.1. Market estimates and forecasts, 2017 - 2030 (USD Million)

6.4.2. Market estimates and forecasts, By Region, 2017 - 2030 (USD Million)

Chapter 7. Cold Storage Market: Regional Estimates & Trend Analysis

7.1. Cold Storage Market Share by Region, 2022 & 2030

7.2. North America

7.2.1. Market estimates and forecasts, 2017 - 2030

7.2.2. Market estimates and forecasts, By Storage Type, 2017 - 2030 (USD Million)

7.2.3. Market estimates and forecasts, By Temperature Range, 2017 - 2030 (USD Million)

7.2.4. Market estimates and forecasts, By Application, 2017 - 2030 (USD Million)

7.2.5. U.S.

7.2.5.1. Market estimates and forecasts, By Storage Type, 2017 - 2030 (USD Million)

7.2.5.2. Market estimates and forecasts, By Temperature Range, 2017 - 2030 (USD Million)

7.2.5.3. Market estimates and forecasts, By Application, 2017 - 2030 (USD Million)

7.2.6. Canada

7.2.6.1. Market estimates and forecasts, By Storage Type, 2017 - 2030 (USD Million)

7.2.6.2. Market estimates and forecasts, By Temperature Range, 2017 - 2030 (USD Million)

7.2.6.3. Market estimates and forecasts, By Application, 2017 - 2030 (USD Million)

7.3. Europe

7.3.1. Market estimates and forecasts, 2017 - 2030

7.3.2. Market estimates and forecasts, By Storage Type, 2017 - 2030 (USD Million)

7.3.3. Market estimates and forecasts, By Temperature Range, 2017 - 2030 (USD Million)

7.3.4. Market estimates and forecasts, By Application, 2017 - 2030 (USD Million)

7.3.5. Germany

7.3.5.1. Market estimates and forecasts, By Storage Type, 2017 - 2030 (USD Million)

7.3.5.2. Market estimates and forecasts, By Temperature Range, 2017 - 2030 (USD Million)

7.3.5.3. Market estimates and forecasts, By Application, 2017 - 2030 (USD Million)

7.3.6. U.K.

7.3.6.1. Market estimates and forecasts, By Storage Type, 2017 - 2030 (USD Million)

7.3.6.2. Market estimates and forecasts, By Temperature Range, 2017 - 2030 (USD Million)

7.3.6.3. Market estimates and forecasts, By Application, 2017 - 2030 (USD Million)

7.3.7. France

7.3.7.1. Market estimates and forecasts, By Storage Type, 2017 - 2030 (USD Million)

7.3.7.2. Market estimates and forecasts, By Temperature Range, 2017 - 2030 (USD Million)

7.3.7.3. Market estimates and forecasts, By Application, 2017 - 2030 (USD Million)

7.3.8. Spain

7.3.8.1. Market estimates and forecasts, By Storage Type, 2017 - 2030 (USD Million)

7.3.8.2. Market estimates and forecasts, By Temperature Range, 2017 - 2030 (USD Million)

7.3.8.3. Market estimates and forecasts, By Application, 2017 - 2030 (USD Million)

7.3.9. Italy

7.3.9.1. Market estimates and forecasts, By Storage Type, 2017 - 2030 (USD Million)

7.3.9.2. Market estimates and forecasts, By Temperature Range, 2017 - 2030 (USD Million)

7.3.9.3. Market estimates and forecasts, By Application, 2017 - 2030 (USD Million)

7.3.10. Norway

7.3.10.1. Market estimates and forecasts, By Storage Type, 2017 - 2030 (USD Million)

7.3.10.2. Market estimates and forecasts, By Temperature Range, 2017 - 2030 (USD Million)

7.3.10.3. Market estimates and forecasts, By Application, 2017 - 2030 (USD Million)

7.3.11. Netherlands

7.3.11.1. Market estimates and forecasts, By Storage Type, 2017 - 2030 (USD Million)

7.3.11.2. Market estimates and forecasts, By Temperature Range, 2017 - 2030 (USD Million)

7.3.11.3. Market estimates and forecasts, By Application, 2017 - 2030 (USD Million)

7.3.12. Switzerland

7.3.12.1. Market estimates and forecasts, By Storage Type, 2017 - 2030 (USD Million)

7.3.12.2. Market estimates and forecasts, By Temperature Range, 2017 - 2030 (USD Million)

7.3.12.3. Market estimates and forecasts, By Application, 2017 - 2030 (USD Million)

7.3.13. Russia

7.3.13.1. Market estimates and forecasts, By Storage Type, 2017 - 2030 (USD Million)

7.3.13.2. Market estimates and forecasts, By Temperature Range, 2017 - 2030 (USD Million)

7.3.13.3. Market estimates and forecasts, By Application, 2017 - 2030 (USD Million)

7.4. Asia Pacific

7.4.1. Market estimates and forecasts, 2017 - 2030

7.4.2. Market estimates and forecasts, By Storage Type, 2017 - 2030 (USD Million)

7.4.3. Market estimates and forecasts, By Temperature Range, 2017 - 2030 (USD Million)

7.4.4. Market estimates and forecasts, By Application, 2017 - 2030 (USD Million)

7.4.5. China

7.4.5.1. Market estimates and forecasts, By Storage Type, 2017 - 2030 (USD Million)

7.4.5.2. Market estimates and forecasts, By Temperature Range, 2017 - 2030 (USD Million)

7.4.5.3. Market estimates and forecasts, By Application, 2017 - 2030 (USD Million)

7.4.6. Japan

7.4.6.1. Market estimates and forecasts, By Storage Type, 2017 - 2030 (USD Million)

7.4.6.2. Market estimates and forecasts, By Temperature Range, 2017 - 2030 (USD Million)

7.4.6.3. Market estimates and forecasts, By Application, 2017 - 2030 (USD Million)

7.4.7. India

7.4.7.1. Market estimates and forecasts, By Storage Type, 2017 - 2030 (USD Million)

7.4.7.2. Market estimates and forecasts, By Temperature Range, 2017 - 2030 (USD Million)

7.4.7.3. Market estimates and forecasts, By Application, 2017 - 2030 (USD Million)

7.4.8. Singapore

7.4.8.1. Market estimates and forecasts, By Storage Type, 2017 - 2030 (USD Million)

7.4.8.2. Market estimates and forecasts, By Temperature Range, 2017 - 2030 (USD Million)

7.4.8.3. Market estimates and forecasts, By Application, 2017 - 2030 (USD Million)

7.4.9. South Korea

7.4.9.1. Market estimates and forecasts, By Storage Type, 2017 - 2030 (USD Million)

7.4.9.2. Market estimates and forecasts, By Temperature Range, 2017 - 2030 (USD Million)

7.4.9.3. Market estimates and forecasts, By Application, 2017 - 2030 (USD Million)

7.4.10. Australia

7.4.10.1. Market estimates and forecasts, By Storage Type, 2017 - 2030 (USD Million)

7.4.10.2. Market estimates and forecasts, By Temperature Range, 2017 - 2030 (USD Million)

7.4.10.3. Market estimates and forecasts, By Application, 2017 - 2030 (USD Million)

7.5. Latin America

7.5.1. Market estimates and forecasts, 2017 - 2030

7.5.2. Market estimates and forecasts, By Storage Type, 2017 - 2030 (USD Million)

7.5.3. Market estimates and forecasts, By Temperature Range, 2017 - 2030 (USD Million)

7.5.4. Market estimates and forecasts, By Application, 2017 - 2030 (USD Million)

7.5.5. Brazil

7.5.5.1. Market estimates and forecasts, By Storage Type, 2017 - 2030 (USD Million)

7.5.5.2. Market estimates and forecasts, By Temperature Range, 2017 - 2030 (USD Million)

7.5.5.3. Market estimates and forecasts, By Application, 2017 - 2030 (USD Million)

7.5.6. Mexico

7.5.6.1. Market estimates and forecasts, By Storage Type, 2017 - 2030 (USD Million)

7.5.6.2. Market estimates and forecasts, By Temperature Range, 2017 - 2030 (USD Million)

7.5.6.3. Market estimates and forecasts, By Application, 2017 - 2030 (USD Million)

7.6. Middle East & Africa

7.6.1. Market estimates and forecasts, 2017 - 2030

7.6.2. Market estimates and forecasts, By Storage Type, 2017 - 2030 (USD Million)

7.6.3. Market estimates and forecasts, By Temperature Range, 2017 - 2030 (USD Million)

7.6.4. Market estimates and forecasts, By Application, 2017 - 2030 (USD Million)

7.6.5. Kingdom of Saudi Arabia (KSA)

7.6.5.1. Market estimates and forecasts, By Storage Type, 2017 - 2030 (USD Million)

7.6.5.2. Market estimates and forecasts, By Temperature Range, 2017 - 2030 (USD Million)

7.6.5.3. Market estimates and forecasts, By Application, 2017 - 2030 (USD Million)

7.6.6. UAE

7.6.6.1. Market estimates and forecasts, By Storage Type, 2017 - 2030 (USD Million)

7.6.6.2. Market estimates and forecasts, By Temperature Range, 2017 - 2030 (USD Million)

7.6.6.3. Market estimates and forecasts, By Application, 2017 - 2030 (USD Million)

7.6.7. South Africa

7.6.7.1. Market estimates and forecasts, By Storage Type, 2017 - 2030 (USD Million)

7.6.7.2. Market estimates and forecasts, By Temperature Range, 2017 - 2030 (USD Million)

7.6.7.3. Market estimates and forecasts, By Application, 2017 - 2030 (USD Million)

Chapter 8. Cold Storage Market Competitive Landscape

8.1. Key Market Participants

8.1.1. Americold Logistics, Inc.

8.1.2. Al Rai Logistica K.S.C

8.1.3. Agro Merchants Group

8.1.4. Burris Logistics

8.1.5. Barloworld Limited

8.1.6. Cloverleaf Cold Storage

8.1.7. Gulf Drug LLC

8.1.8. Henningsen Cold Storage Company

8.1.9. Kloosterboer

8.1.10. LINEAGE LOGISTICS HOLDING, LLC

8.1.11. Nordic Logistics

8.1.12. Oxford Logistics Group

8.1.13. Oceana Group Limited

8.1.14. Preferred Freezer

8.1.15. RSA Logistics

8.1.16. Swire Group

8.1.17. VersaCold Logistics Services

8.1.18. United States Cold Storage

8.1.19. Wared Logistics

8.1.20. Wabash National Corporation

8.2. Key Company Market Share Analysis, 2022

8.3. Company Categorization/Position Analysis, 2022

8.4. Strategic Mapping

8.4.1. Expansion

8.4.2. Acquisition

8.4.3. Collaborations

8.4.4. Product/service launch

8.4.5. Partnerships

8.4.6. Others

List of Tables

Table 1 Global cold storage market revenue estimates and forecast, by Storage Type, 2017 - 2030 (USD Million)

Table 2 Global cold storage market revenue estimates and forecast, by Facilities/Services, 2017 - 2030 (USD Million)

Table 3 Global cold storage market revenue estimates and forecast, by Refrigerated Warehouse, 2017 - 2030 (USD Million)

Table 4 Global cold storage market revenue estimates and forecast, by Equipment, 2017 - 2030 (USD Million)

Table 5 Global cold storage market revenue estimates and forecast, by Temperature Range, 2017 - 2030 (USD Million)

Table 6 Global cold storage market revenue estimates and forecast, by Application, 2017 - 2030 (USD Million)

Table 7 Global cold storage market revenue estimates and forecast, by Food & Beverages, 2017 - 2030 (USD Million)

Table 8 Global cold storage market revenue estimates and forecast, by Dairy Products, 2017 - 2030 (USD Million)

Table 9 Global cold storage market revenue estimates and forecast, by Pharmaceuticals, 2017 - 2030 (USD Million)

Table 10 Global cold storage market revenue estimates and forecast, by region, 2017 - 2030 (USD Million)

Table 11 Company heat map analysis

Table 12 Key companies undertaking partnerships and collaboration

Table 13 Key companies launching new product

List of Figures

Fig. 1 Cold storage market segmentation

Fig. 2 Information procurement

Fig. 3 Data analysis models

Fig. 4 Market formulation and validation

Fig. 5 Data validating & publishing

Fig. 6 Market snapshot

Fig. 7 Segment snapshot (1/2)

Fig. 8 Segment snapshot (2/2)

Fig. 9 Competitive landscape snapshot

Fig. 10 Cold storage market value, 2017 - 2030 (USD Million)

Fig. 11 Cold storage market - Industry value chain analysis

Fig. 12 Cold storage market - Market trends

Fig. 13 Cold storage market: Porter’s analysis

Fig. 14 Cold storage market: PESTEL analysis

Fig. 15 Cold storage market, by storage type: Key takeaways

Fig. 16 Cold storage market, by storage type: Market share, 2022 & 2030

Fig. 17 Facilities/services cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 18 Equipment cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 19 Cold storage market, by temperature range: Key takeaways

Fig. 20 Cold storage market, by temperature range: Market share, 2022 & 2030

Fig. 21 Chilled (0°C to 15°C) cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 22 Frozen (-18°C to -25°C) cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 23 Deep-frozen (Below -25°C) cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 24 Cold storage market, by application: Key takeaways

Fig. 25 Cold storage market, by application: Market share, 2022 & 2030

Fig. 26 Food & beverages cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 27 Pharmaceuticals cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 28 Others cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 29 North America cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 30 U.S. cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 31 Canada cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 32 Europe cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 33 Germany cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 34 U.K. cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 35 France cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 36 Spain cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 37 Italy cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 38 Norway cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 39 Netherlands cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 40 Switzerland cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 41 Russia cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 42 Asia Pacific cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 43 India cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 44 China cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 45 Japan cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 46 India cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 47 Singapore cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 48 South Korea cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 49 Australia cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 50 Latin America cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 51 Brazil cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 52 Mexico cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 53 Middle East & Africa cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 54 Kingdom of Saudi Arabia (KSA) cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 55 UAE cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 56 South Africa cold storage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 57 Key company categorization

Fig. 58 Cold storage market - Key company market share analysis, 2022.

Fig. 59 Strategic frameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Cold Storage Market Storage Type Outlook (Revenue, USD Million; 2017 - 2030)

- Facilities/Services

- Refrigerated Warehouse

- Private & Semi-Private

- Public

- Cold Room

- Refrigerated Warehouse

- Equipment

- Blast freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Facilities/Services

- Cold Storage Market Temperature Range Outlook (Revenue, USD Million; 2017 - 2030)

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

- Cold Storage Market Application Outlook (Revenue, USD Million; 2017 - 2030)

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

- Food & Beverages

- Cold Storage Market Regional Outlook (Revenue, USD Million; 2017 - 2030)

- North America

- North America Cold Storage Market by Storage Type

- Facilities/Services

- Refrigerated Warehouse

- Private & Semi-Private

- Public

- Cold Room

- Refrigerated Warehouse

- Equipment

- Blast freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- North America Cold Storage Market by Temperature Range

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

- North America Cold Storage Market by Application

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

- Food & Beverages

- U.S.

- U.S. Cold Storage Market by Storage Type

- Facilities/Services

- Refrigerated Warehouse

- Private & Semi-Private

- Public

- Cold Room

- Refrigerated Warehouse

- Equipment

- Blast freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Facilities/Services

- U.S. Cold Storage Market by Temperature Range

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

- U.S. Cold Storage Market by Application

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

- Food & Beverages

- U.S. Cold Storage Market by Storage Type

- Canada

- Canada Cold Storage Market by Storage Type

- Facilities/Services

- Refrigerated Warehouse

- Private & Semi-Private

- Public

- Cold Room

- Refrigerated Warehouse

- Equipment

- Blast freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Facilities/Services

- Canada Cold Storage Market by Temperature Range

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

- Canada Cold Storage Market by Application

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

- Food & Beverages

- Canada Cold Storage Market by Storage Type

- Facilities/Services

- North America Cold Storage Market by Storage Type

- Europe

- Europe Cold Storage Market by Storage Type

- Facilities/Services

- Refrigerated Warehouse

- Private & Semi-Private

- Public

- Cold Room

- Refrigerated Warehouse

- Equipment

- Blast freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Facilities/Services

- Europe Cold Storage Market by Temperature Range

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

- Europe Cold Storage Market by Application

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

- Food & Beverages

- Germany

- Germany Cold Storage Market by Storage Type

- Facilities/Services

- Refrigerated Warehouse

- Private & Semi-Private

- Public

- Cold Room

- Refrigerated Warehouse

- Equipment

- Blast freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Facilities/Services

- Germany Cold Storage Market by Temperature Range

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

- Germany Cold Storage Market by Application

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

- Food & Beverages

- Germany Cold Storage Market by Storage Type

- U.K.

- U.K. Cold Storage Market by Storage Type

- Facilities/Services

- Refrigerated Warehouse

- Private & Semi-Private

- Public

- Cold Room

- Refrigerated Warehouse

- Equipment

- Blast freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Facilities/Services

- U.K. Cold Storage Market by Temperature Range

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

- U.K. Cold Storage Market by Application

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

- Food & Beverages

- U.K. Cold Storage Market by Storage Type

- France

- France Cold Storage Market by Storage Type

- Facilities/Services

- Refrigerated Warehouse

- Private & Semi-Private

- Public

- Cold Room

- Refrigerated Warehouse

- Equipment

- Blast freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Facilities/Services

- France Cold Storage Market by Temperature Range

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

- France Cold Storage Market by Application

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

- Food & Beverages

- France Cold Storage Market by Storage Type

- Spain

- Spain Cold Storage Market by Storage Type

- Facilities/Services

- Refrigerated Warehouse

- Private & Semi-Private

- Public

- Cold Room

- Refrigerated Warehouse

- Equipment

- Blast freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Facilities/Services

- Spain Cold Storage Market by Temperature Range

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

- Spain Cold Storage Market by Application

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

- Food & Beverages

- Spain Cold Storage Market by Storage Type

- Italy

- Italy Cold Storage Market by Storage Type

- Facilities/Services

- Refrigerated Warehouse

- Private & Semi-Private

- Public

- Cold Room

- Refrigerated Warehouse

- Equipment

- Blast freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Facilities/Services

- Italy Cold Storage Market by Temperature Range

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

- Italy Cold Storage Market by Application

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

- Food & Beverages

- Italy Cold Storage Market by Storage Type

- Norway

- Norway Cold Storage Market by Storage Type

- Facilities/Services

- Refrigerated Warehouse

- Private & Semi-Private

- Public

- Cold Room

- Refrigerated Warehouse

- Equipment

- Blast freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Facilities/Services

- Norway Cold Storage Market by Temperature Range

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

- Norway Cold Storage Market by Application

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

- Food & Beverages

- Norway Cold Storage Market by Storage Type

- Netherlands

- Netherlands Cold Storage Market by Storage Type

- Facilities/Services

- Refrigerated Warehouse

- Private & Semi-Private

- Public

- Cold Room

- Refrigerated Warehouse

- Equipment

- Blast freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Facilities/Services

- Netherlands Cold Storage Market by Temperature Range

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

- Netherlands Cold Storage Market by Application

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

- Food & Beverages

- Netherlands Cold Storage Market by Storage Type

- Switzerland

- Switzerland Cold Storage Market by Storage Type

- Facilities/Services

- Refrigerated Warehouse

- Private & Semi-Private

- Public

- Cold Room

- Refrigerated Warehouse

- Equipment

- Blast freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Facilities/Services

- Switzerland Cold Storage Market by Temperature Range

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

- Switzerland Cold Storage Market by Application

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

- Food & Beverages

- Switzerland Cold Storage Market by Storage Type

- Russia

- Russia Cold Storage Market by Storage Type

- Facilities/Services

- Refrigerated Warehouse

- Private & Semi-Private

- Public

- Cold Room

- Refrigerated Warehouse

- Equipment

- Blast freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Facilities/Services

- Russia Cold Storage Market by Temperature Range

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

- Russia Cold Storage Market by Application

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

- Food & Beverages

- Russia Cold Storage Market by Storage Type

- Europe Cold Storage Market by Storage Type

- Asia Pacific

- Asia Pacific

- Asia Pacific Cold Storage Market by Storage Type

- Facilities/Services

- Refrigerated Warehouse

- Private & Semi-Private

- Public

- Cold Room

- Refrigerated Warehouse

- Equipment

- Blast freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Facilities/Services

- Asia Pacific Cold Storage Market by Temperature Range

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

- Asia Pacific Cold Storage Market by Application

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

- Food & Beverages

- China

- China Cold Storage Market by Storage Type

- Facilities/Services

- Refrigerated Warehouse

- Private & Semi-Private

- Public

- Cold Room

- Refrigerated Warehouse

- Equipment

- Blast freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Facilities/Services

- China Cold Storage Market by Temperature Range

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

- China Cold Storage Market by Application

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

- Food & Beverages

- China Cold Storage Market by Storage Type

- Japan

- Japan Cold Storage Market by Storage Type

- Facilities/Services

- Refrigerated Warehouse

- Private & Semi-Private

- Public

- Cold Room

- Refrigerated Warehouse

- Equipment

- Blast freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Facilities/Services

- Japan Cold Storage Market by Temperature Range

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

- Japan Cold Storage Market by Application

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

- Food & Beverages

- Japan Cold Storage Market by Storage Type

- India

- India Cold Storage Market by Storage Type

- Facilities/Services

- Refrigerated Warehouse

- Private & Semi-Private

- Public

- Cold Room

- Refrigerated Warehouse

- Equipment

- Blast freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Facilities/Services

- India Cold Storage Market by Temperature Range

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

- India Cold Storage Market by Application

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

- Food & Beverages

- India Cold Storage Market by Storage Type

- Singapore

- Singapore Cold Storage Market by Storage Type

- Facilities/Services

- Refrigerated Warehouse

- Private & Semi-Private

- Public

- Cold Room

- Refrigerated Warehouse

- Equipment

- Blast freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Facilities/Services

- Singapore Cold Storage Market by Temperature Range

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

- Singapore Cold Storage Market by Application

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

- Food & Beverages

- Singapore Cold Storage Market by Storage Type

- South Korea

- South Korea Cold Storage Market by Storage Type

- Facilities/Services

- Refrigerated Warehouse

- Private & Semi-Private

- Public

- Cold Room

- Refrigerated Warehouse

- Equipment

- Blast freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Facilities/Services

- South Korea Cold Storage Market by Temperature Range

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

- South Korea Cold Storage Market by Application

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

- Food & Beverages

- South Korea Cold Storage Market by Storage Type

- Australia

- Australia Cold Storage Market by Storage Type

- Facilities/Services

- Refrigerated Warehouse

- Private & Semi-Private

- Public

- Cold Room

- Refrigerated Warehouse

- Equipment

- Blast freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Facilities/Services

- Australia Cold Storage Market by Temperature Range

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

- Australia Cold Storage Market by Application

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

- Food & Beverages

- Australia Cold Storage Market by Storage Type

- Asia Pacific Cold Storage Market by Storage Type

- Asia Pacific

- Latin America

- Latin America Cold Storage Market by Storage Type

- Facilities/Services

- Refrigerated Warehouse

- Private & Semi-Private

- Public

- Cold Room

- Refrigerated Warehouse

- Equipment

- Blast freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Facilities/Services

- Latin America Cold Storage Market by Temperature Range

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

- Latin America Cold Storage Market by Application

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

- Food & Beverages

- Brazil

- Brazil Cold Storage Market by Storage Type

- Facilities/Services

- Refrigerated Warehouse

- Private & Semi-Private

- Public

- Cold Room

- Refrigerated Warehouse

- Equipment

- Blast freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Facilities/Services

- Brazil Cold Storage Market by Temperature Range

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

- Brazil Cold Storage Market by Application

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

- Food & Beverages

- Brazil Cold Storage Market by Storage Type

- Mexico

- Mexico Cold Storage Market by Storage Type

- Facilities/Services

- Refrigerated Warehouse

- Private & Semi-Private

- Public

- Cold Room

- Refrigerated Warehouse

- Equipment

- Blast freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Facilities/Services

- Mexico Cold Storage Market by Temperature Range

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

- Mexico Cold Storage Market by Application

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

- Food & Beverages

- Mexico Cold Storage Market by Storage Type

- Latin America Cold Storage Market by Storage Type

- Middle East & Africa

- Middle East & Africa Cold Storage Market by Storage Type

- Facilities/Services

- Refrigerated Warehouse

- Private & Semi-Private

- Public

- Cold Room

- Refrigerated Warehouse

- Equipment

- Blast freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Facilities/Services

- Middle East & Africa Cold Storage Market by Temperature Range

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

- Middle East & Africa Cold Storage Market by Application

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

- Food & Beverages

- Kingdom of Saudi Arabia (KSA)

- Kingdom of Saudi Arabia (KSA) Cold Storage Market by Storage Type

- Facilities/Services

- Refrigerated Warehouse

- Private & Semi-Private

- Public

- Cold Room

- Refrigerated Warehouse

- Equipment

- Blast freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Facilities/Services

- Kingdom of Saudi Arabia (KSA) Cold Storage Market by Temperature Range

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

- Kingdom of Saudi Arabia (KSA) Cold Storage Market by Application

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

- Food & Beverages

- Kingdom of Saudi Arabia (KSA) Cold Storage Market by Storage Type

- UAE

- UAE Cold Storage Market by Storage Type

- Facilities/Services

- Refrigerated Warehouse

- Private & Semi-Private

- Public

- Cold Room

- Refrigerated Warehouse

- Equipment

- Blast freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Facilities/Services

- UAE Cold Storage Market by Temperature Range

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

- UAE Cold Storage Market by Application

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

- Food & Beverages

- UAE Cold Storage Market by Storage Type

- South Africa

- South Africa Cold Storage Market by Storage Type

- Facilities/Services

- Refrigerated Warehouse

- Private & Semi-Private

- Public

- Cold Room

- Refrigerated Warehouse

- Equipment

- Blast freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Facilities/Services

- South Africa Cold Storage Market by Temperature Range

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

- South Africa Cold Storage Market by Application

- Food & Beverages

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

- Food & Beverages

- South Africa Cold Storage Market by Storage Type

- Middle East & Africa Cold Storage Market by Storage Type

- North America

Cold Storage Market Dynamics

Drivers: Low-Carbon Design, Environmental Auditing, And Crafty Construction Of Cold Storage Warehouses

Cold storage companies are embracing low-carbon designs, environmental audits, and innovative construction techniques. Low-carbon designs aim to minimize energy use, leading to more sustainable and eco-friendly warehouses. Energy-efficient technologies like intelligent automation and control systems can decrease energy expenses and reduce the facilities’ carbon footprint. Environmental audits, using standards like LEED or BREEAM, assess a building’s design sustainability and operational efficiency. This ensures environmentally responsible design and operation, providing a competitive edge by attracting eco-aware consumers and stakeholders. Innovative construction methods, such as single-envelope technology, provide cost and time savings and more flexibility in building usage. In conclusion, the integration of low-carbon designs, environmental audits, and innovative construction methods in the cold storage industry offers numerous benefits. These include enhanced sustainability, cost savings, and increased competitiveness, serving as a significant growth and development driver in this sector.

Increasing It Spending In Cold Storage Logistics

The growth of the cold storage market is driven by increased IT spending, which enhances inventory management and overall system efficiency. Investments in advanced technologies like cloud computing, IoT, and RFID allow real-time inventory tracking, reducing food waste, spoilage, and product recalls. The demand for temperature-sensitive products underscores the need for real-time monitoring. IT investments also help companies better manage energy consumption and reduce their carbon footprint. Smart sensors and real-time monitoring systems can optimize temperature settings and minimize energy waste, leading to cost savings, improved operational efficiency, and reduced environmental impact. The burgeoning e-commerce industry, growing demand for food delivery services, and increased consumption of perishable goods like fruits and vegetables have spurred the cold storage market’s growth, promoting the adoption of IT solutions and services. Strict regulations in several countries govern the transportation and storage of perishable food products to ensure food safety and quality. Compliance often requires a robust cold chain system, achievable with IT systems that provide real-time temperature and humidity monitoring, location tracking, and data analytics. Devices like data loggers, sensors, and RFID tags collect and transmit temperature data for compliance analysis. Regulations like the US FDA’s Food Safety Modernization Act (FSMA) and the European Union Food Hygiene Regulations mandate temperature-controlled transportation and storage of all food products, with temperature data collection and analysis to ensure regulatory adherence.

Restrains: High Initial Investment