- Home

- »

- Beauty & Personal Care

- »

-

Colostrum Market Size, Share, Growth, Industry Report, 2030GVR Report cover

![Colostrum Market Size, Share & Trends Report]()

Colostrum Market (2025 - 2030) Size, Share & Trends Analysis Report By Nature (Organic, Conventional), By Source (Cow, Buffalo, Goat), By Form, By Distribution Channel (B2B, B2C), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-919-7

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Colostrum Market Summary

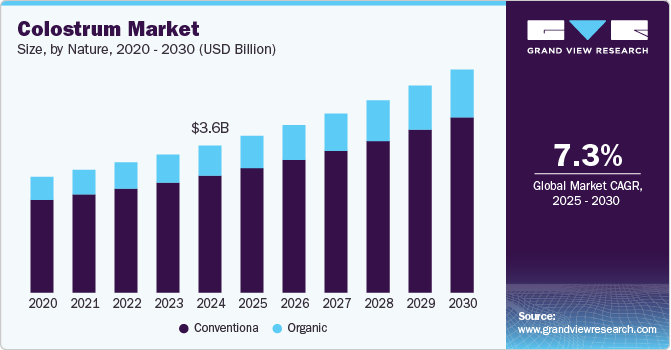

The global colostrum market size was estimated at USD 3,577.1 million in 2024 and is projected to reach USD 5,430.4 million by 2030, growing at a CAGR of 7.2% from 2025 to 2030. The demand for colostrum is rising due to several key factors that align with growing consumer interest in natural health solutions and preventive wellness.

Key Market Trends & Insights

- North America dominated the colostrum market with the largest revenue share of 33.80% in 2024.

- U.S. is projected to grow at the fastest CAGR of 7.7% from 2025 to 2030.

- Based on nature, the conventional colostrum segment led the market with the largest revenue share of 79.6% in 2024.

- Based on source, the cow colostrum segment led the market with the largest revenue share of 88.13% in 2024.

- Based on form, the capsules segment led the market with the largest revenue share of 43.18% in 2024.

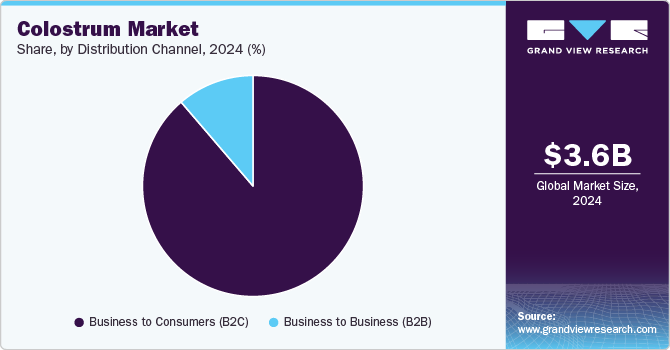

- Based on distribution channel, the B2C segment led the market with the largest revenue share of 88.73% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3,577.1 Million

- 2030 Projected Market Size: USD 5,430.4 Million

- CAGR (2025-2030): 7.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

One of the primary drivers of this demand is the increasing awareness of colostrum’s immune-boosting properties. Colostrum is rich in immunoglobulins, antibodies, and growth factors that help strengthen the immune system.

In addition to its immune benefits, colostrum is also recognized for its positive effects on gut health, as it helps repair the intestinal lining and promotes a healthy microbiome. This has made colostrum especially popular among individuals seeking to improve digestive health or those dealing with gut-related conditions like leaky gut syndrome.

Another significant factor behind the rise in colostrum consumption is the increasing shift toward preventive health and holistic wellness. As consumers become more proactive about their well-being, they are turning to natural supplements that can provide long-term health benefits. Colostrum is viewed as a multi-benefit supplement—supporting everything from immune health to anti-aging and muscle recovery. This holistic approach fits into the larger trend of seeking out foods and supplements that offer a wide range of health benefits, without relying on pharmaceuticals or synthetic products. Colostrum is especially appealing to athletes and fitness enthusiasts because of its rich protein content and growth factors, which promote muscle recovery, support physical endurance, and enhance overall athletic performance. This has led to greater adoption of colostrum in sports nutrition.

The growing demand for natural, clean-label products is another key factor driving the popularity of colostrum. As more consumers opt for natural, minimally processed products with fewer additives, colostrum fits neatly into this trend. It is a natural superfood that is often marketed as free from artificial ingredients and preservatives. Colostrum’s status as a whole-food supplement has helped it gain favor among those seeking natural alternatives to synthetic health products. Moreover, colostrum’s role in the anti-aging market is also contributing to its rising consumption. The growth factors in colostrum, such as IGF-1 (Insulin-like Growth Factor 1), are believed to help regenerate cells, improve skin elasticity, and reduce the appearance of wrinkles, making it increasingly popular in both wellness supplements and high-end skincare products.

Nature Insights

Based on nature, the conventional colostrum segment led the market with the largest revenue share of 79.6% in 2024. Conventional colostrum is derived from cows raised using traditional farming methods, which may include the use of synthetic pesticides, hormones, and antibiotics in farming practices. Conventional colostrum-based forms cater to consumers looking for more affordable options without the emphasis on organic or sustainable farming practices. These forms are still rich in essential nutrients and bioactive compounds, making them a viable choice for those seeking the benefits of colostrum at a lower price point.

The organic colostrum segment is projected to grow at the fastest CAGR of 8.2% from 2025 to 2030. Organic colostrum is characterized by a focus on sustainable, environmentally friendly practices and high-quality forms derived from organically raised animals. Organic colostrum is sourced from animals raised on organic farms, where they are fed organic diets free from synthetic pesticides, hormones, and antibiotics. The organic market is projected to grow owing to the rising trend of organic and clean-label forms in the health and wellness industry, catering to health-conscious consumers who prioritize purity, transparency, and authenticity.

Source Insights

Based on source, the cow colostrum segment led the market with the largest revenue share of 88.13% in 2024. Cow colostrum is gaining popularity compared to other sources due to several key benefits, such as its rich nutritional profile, bioavailability, absorption, immune-boosting properties, and gentleness on the digestive system. Cow colostrum is filled with essential nutrients, growth factors, antibodies, and immune-boosting compounds, making it a comprehensive source of health-promoting substances. This nutrient density sets cow colostrum apart from other sources, appealing to individuals looking for a holistic health supplement.

The goat segment is projected to grow at the fastest CAGR of 6.8% from 2025 to 2030. The increasing popularity of goat colostrum in infant formula applications is anticipated to drive market expansion. Goat colostrum is a potent source of immunoglobulins, offering essential passive immunity to newborns and supporting immune system health in individuals of all ages. Moreover, it boasts elevated concentrations of protein, fat, vitamins, and minerals compared to regular milk, guaranteeing a robust foundation for the baby's early growth and well-being.

Form Insights

Based on form, the capsules segment led the market with the largest revenue share of 43.18% in 2024. Colostrum capsules offer a convenient and easily manageable way to consume colostrum, providing a precise dosage without the need for measuring powders or liquids. This convenience appeals to individuals seeking a hassle-free supplement regimen. For instance, NutriNoche's Colostrum Capsules provide a pure and potent source of colostrum, encapsulated for convenience and easy consumption.

The chewable tablets segment is projected to grow at the fastest CAGR of 8.3% from 2025 to 2030. Chewable tablets offer a pleasant and convenient way to consume colostrum, enhancing the overall palatability of the supplement. Factors such as flavor variety, sweetness, and the absence of an undesirable aftertaste contribute to the demand among consumers who seek enjoyable supplementation experiences. For instance, Kirkman Labs offers colostrum chewable tablets that contain pure colostrum sourced from bovine colostrum. These tablets provide immune support and digestive health benefits in a convenient and tasty format, meeting the demand for high-quality colostrum supplements.

Distribution Channel Insights

Based on distribution channel, the B2C segment led the market with the largest revenue share of 88.73% in 2024. The B2C segment consists of hypermarkets & supermarkets, convenience stores, pharmacies & drugstores, and online stores. The presence of colostrum forms in hypermarkets and supermarkets increases visibility and accessibility for a wide consumer base, leading to higher sales. Colostrum forms in convenient formats like single-dose sachets or ready-to-drink options appeal to busy consumers who frequent convenience stores, leading to increased sales.

The B2B segment is projected to grow at the fastest CAGR of 6.5% from 2025 to 2030.The demand for colostrum in B2B end-use applications is primarily driven by its versatile bioactive properties. This demand is met by leading colostrum suppliers and manufacturers who play a crucial role in providing high-quality colostrum-based ingredients, formulations, and forms to businesses across various industries, fueling innovation and growth in the global market.

Regional Insights

North America dominated the colostrum market with the largest revenue share of 33.80% in 2024. The growing number of dairy farms in North America contributes to the increased availability of colostrum, the first milk produced by mammals after giving birth, including cows. This availability serves as a driving factor for the market growth. An increased demand has been witnessed for colostrum-based forms such as dietary supplements and functional foods.

U.S. Colostrum Market Trends

The colostrum market in the U.S. is projected to grow at the fastest CAGR of 7.7% from 2025 to 2030. There has been increasing awareness about the health benefits of colostrum, including its immune-boosting properties and potential to improve gut health. This increased awareness drives the demand for colostrum-based forms in the region.

Europe Colostrum Market Trends

The colostrum market in Europe is projected to grow at a significant CAGR of 7.1% from 2025 to 2030. The European market has been witnessing a surge in demand for a variety of colostrum-based forms, including capsules, powders, and drinks. This is due to increasing awareness about the health benefits of colostrum, such as boosting the immune system, improving gut health, and supporting athletic performance. As a result, manufacturers are constantly innovating and introducing new forms to cater to the diverse needs of consumers.

Asia Pacific Colostrum Market Trends

The colostrum market in the Asia Pacific is projected to grow at the fastest CAGR of 7.9% from 2025 to 2030. The large population of dairy cattle in the Asia Pacific (APAC) region has contributed to the significant formation of colostrum. With a considerable number of dairy farms across countries like India, China, Australia, and New Zealand, APAC has emerged as a major supplier of colostrum globally. This abundance of colostrum has led to opportunities for innovation in colostrum-based forms, including the manufacturing of new collagen forms.

Key Colostrum Company Insights

The competitive landscape of the global market is characterized by the presence of well-established brands, niche market players, and emerging companies, each vying for market share through innovation, brand loyalty, and strategic collaborations. Market players are focusing on increasing investments in R&D, expanding distribution channels, and implementing targeted marketing campaigns to grow in the market.

Key Colostrum Companies:

The following are the leading companies in the colostrum market. These companies collectively hold the largest market share and dictate industry trends

- Colostrum BioTec GmbH

- Zuche Pharmaceuticals

- NOW Foods

- Agati Healthcare

- Vivesa holding s.r.o.

- Cure Nutraceutical Pvt. Ltd.

- INGREDIA s.r.o.

- Glanbia PLC

- Biotaris

- Deep Blue Health NZ.

Recent Developments

-

In January 2024, Nuchev, a company specializing in infant forms, expanded its offerings to include bovine forms targeting immunity and digestion, inspired by consumer research in Australia and China. The new Oli6 Immunity+ full cream milk powder contains colostrum, vitamins A and D, and lactoferrin to support immunity and overall health. The form is available in Australia and China through various distribution channels, with plans to explore markets in Southeast Asia.

-

In April 2023, PanTheryx introduced a new form line tailored for healthcare practitioners, known as Life’s First Naturals PRO ColostrumOne Extra Strength. This innovative line is specifically crafted to bolster immune and digestive health in both adults and children. The supplement is engineered using high-grade bovine colostrum and proprietary technology to enhance immune bioactives.

Colostrum Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.81 billion

Revenue forecast in 2030

USD 5.43 billion

Growth rate

CAGR of 7.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Nature, source, form, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; Spain; Italy; France; China; India; Japan; South Korea; Australia; New Zealand; Brazil; Argentina; South Africa

Key companies profiled

Colostrum BioTec GmbH; Zuche Pharmaceuticals; NOW Foods; Agati Healthcare; Vivesa holding s.r.o.; Cure Nutraceutical Pvt. Ltd.; INGREDIA s.r.o.; Glanbia PLC; Biotaris; Deep Blue Health NZ.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Colostrum Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global colostrum market report based on the nature, source, form, distribution channel, and region.

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Cow

-

Buffalo

-

Goat

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder

-

Whole Colostrum Powder

-

Skim Colostrum Powder

- Specialty Colostrum Powder

-

-

Capsules

-

Chewable Tablets

-

Liquid

-

Stick

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

Functional Foods & Dietary Supplements

-

Animal Nutrition

-

Cosmetics

-

Infant Formula

-

Pharmaceuticals

-

-

B2C

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Pharmacy & Drugstores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global colostrum market size was estimated at USD 3.58 billion in 2024 and is expected to reach USD 3.81 billion in 2025.

b. The global colostrum market is expected to grow at a compounded growth rate of 7.3% from 2025 to 2030 to reach USD 5.43 billion by 2030.

b. Cow is expected to experience a 6.4% compound annual growth rate (CAGR) in colostrum usage from 2025 to 2030. Cow colostrum is gaining popularity compared to other sources due to several key benefits, such as its rich nutritional profile, bioavailability, absorption, immune-boosting properties, and gentleness on the digestive system.

b. Some key players operating in colostrum market include Colostrum BioTec GmbH, Zuche Pharmaceuticals, NOW Foods, and others.

b. Key factors that are driving the market growth include growing use of colostrum in functional foods and rising health consciousness.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.