- Home

- »

- Homecare & Decor

- »

-

Comic Book Market Size And Share, Industry Report, 2033GVR Report cover

![Comic Book Market Size, Share & Trends Report]()

Comic Book Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Digital, Non-Digital), By Format (Hard Copy, E-Book, Audiobooks), By Genre (Science-Fiction, Superhero, Manga, Non-Fiction), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-999-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Comic Book Market Summary

The global comic book market size was estimated at USD 17.62 billion in 2024 and is projected to reach USD 37.15 billion by 2033, growing at a CAGR of 8.7% from 2025 to 2033. The market is gaining momentum as audiences seek stories that reflect a wider range of voices and cultures.

Key Market Trends & Insights

- The Asia Pacific comic book market held the largest share of 58.99% of the global market in 2024.

- The comic book industry in Europe is expected to grow steadily over the forecast period.

- By type, non-digital comic books held the largest market share of 65.90% in 2024.

- By format, hard copy comic books held the largest market share in 2024.

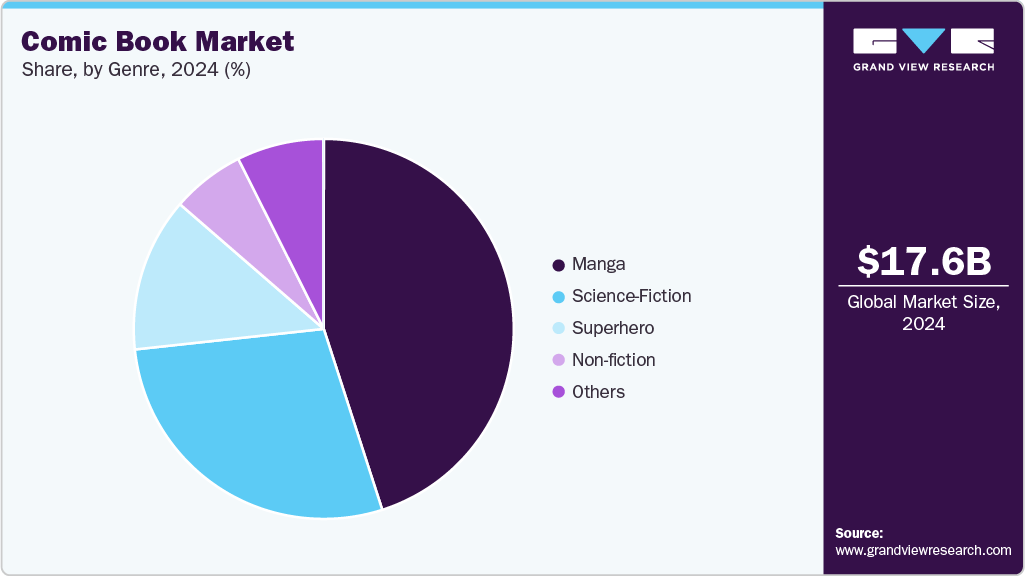

- By genre, the manga comics segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 17.62 Billion

- 2033 Projected Market Size: USD 37.15 Billion

- CAGR (2025-2033): 8.7%

- Asia Pacific: Largest market in 2024

Readers are moving beyond traditional Western superhero templates and gravitating toward characters with authentic multicultural identities and socially relevant themes. Marvel’s Ms. Marvel, with its South Asian Muslim lead, and the global resonance of Black Panther show how representation can expand readership across markets. Japanese manga remains a cornerstone of the industry, with One Piece alone circulating more than 500 million copies worldwide, demonstrating the universal pull of long-form storytelling.Shifting consumer habits are reshaping demand. Genres such as fantasy, horror, and slice-of-life have become mainstream choices alongside caped heroes. South Korea’s WEBTOON platform has built a massive international audience through mobile-first, vertically formatted comics designed for younger readers. At the same time, print editions continue to hold their ground among collectors and long-time fans, with deluxe reprints and anniversary editions selling strongly. This balance between the immediacy of digital access and the permanence of physical ownership reflects how readers are consuming comics in complementary ways rather than abandoning one format for the other.

Publishers are adapting with greater creative risk-taking. Image Comics and Boom! Studios have developed global followings through titles such as Saga and Something Is Killing the Children, showing that creator-owned works can achieve both critical recognition and commercial viability. Dark Horse has extended its reach by linking print titles such as Hellboy with film and streaming adaptations. Regional publishers are also shaping the international landscape: India’s Amar Chitra Katha continues to retell mythological epics for new generations, while African studio Kugali Media partnered with Disney to bring Iwájú to audiences far beyond its home market.

Distribution strategies are now inseparable from digital ecosystems. Platforms such as WEBTOON and Tapas provide direct global reach for independent creators, bypassing traditional gatekeepers. Major manga houses such as Shueisha and Kodansha have strengthened their digital distribution pipelines, offering simultaneous releases in multiple regions to counter piracy and serve international demand. Together with the momentum from screen adaptations, this blending of print, digital, and media tie-ins has transformed comics into a global entertainment format, where a locally conceived story can reach worldwide audiences within months.

Film, television, and streaming adaptations have pushed comics into the cultural mainstream, often reviving interest in the original works. Marvel and DC remain the most visible drivers, but the influence of Japanese manga is equally significant. Demon Slayer set box-office records in Asia, while Attack on Titan carried its momentum from page to screen with worldwide reach. These projects demonstrate how adaptations create powerful entry points for audiences unfamiliar with comics, widening the consumer base and reinforcing brand value across formats.

Digital access has become an equally important force. Subscription services such as Marvel Unlimited or Shueisha’s MANGA Plus offer instant access to catalogues spanning decades, while WEBTOON has shown how mobile-first, serialized content can build global readership. Lore Olympus, for example, became a global hit through its app-based distribution. The pandemic underscored this shift, as digital platforms kept readers engaged during retail closures, showing that online consumption is no longer an alternative channel but a permanent part of the market.

Fan events continue to anchor the industry. San Diego Comic-Con and New York Comic-Con remain headline gatherings, but regional festivals such as Angoulême in France and Comiket in Japan attract hundreds of thousands of attendees. These forums serve as commercial and cultural platforms. Exclusive editions, previews, and merchandise routinely sell out, while announcements tied to film or streaming projects generate global media buzz and fuel pre-orders.

Physical comics, meanwhile, have held their ground. Collectors still place value on the tangible and the rare: anniversary editions, signed prints, and limited variants regularly command premium prices. In 2022, a copy of Superman #1 sold at auction for more than USD 5 million, a reminder of the asset-like quality of rare comics. This interplay between mass accessibility through digital and the exclusivity of print illustrates why comics remain commercially resilient and culturally central worldwide.

Consumer Survey & Insights

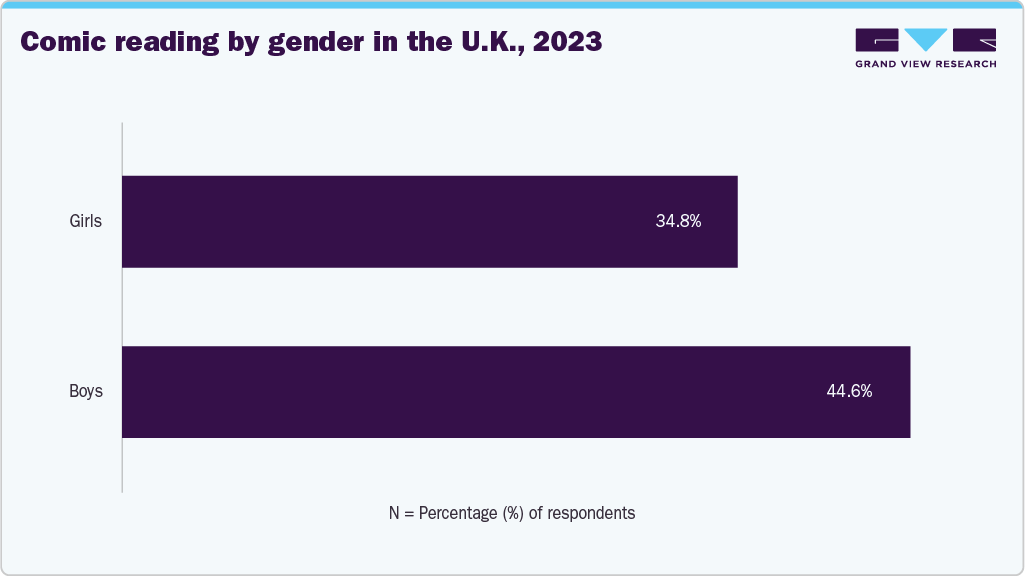

According to the Annual Literacy Survey 2023, gender-based readership trends indicate that boys engage with comics more frequently than girls, with 44.6% of boys reading comics at least once a month compared to 34.8% of girls.

This gap reflects longstanding consumer preferences, where traditional superhero comics and action-driven narratives have historically been marketed more toward male audiences. However, the rise of diverse storytelling, inclusive characters, and graphic novels aimed at young adult and female readers has contributed to a gradual shift.

The rise of manga, which often features a wide range of genres appealing to both male and female readers, has contributed significantly to this shift. For instance, Shojo manga, designed for young female readers, has seen strong sales, and franchises such as Sailor Moon and Fruits Basket have played a major role in attracting more female comic enthusiasts.

The emergence of graphic novels addressing female-centric themes and experiences has also broadened readership. Titles such as "Ms. Marvel" (Marvel Comics), "Lumberjanes" (BOOM! Studios), and "Nimona" (ND Stevenson) showcase strong female protagonists and narratives beyond traditional superhero tropes, appealing to a wider demographic. As a result, while male readership still leads, the growing presence of female voices in comics is driving a shift in consumer behavior, making the market more balanced and diverse.

Type Insights

Non-digital comic books accounted for a revenue share of 65.90% in the overall comic book industry in 2024, as collectors and long-time readers remain loyal to physical editions. Print comics retain a strong appeal due to nostalgia, artistic craftsmanship, and the cultural value of tangible ownership. The success of franchises such as Marvel and DC has driven many new fans to explore the source material in its original form, while Japanese manga volumes like One Piece and Demon Slayer have sustained massive print circulation worldwide, underscoring the resilience of physical comics despite the rapid growth of digital channels.

The demand for digital comic books is expected to grow at a CAGR of 9.3% from 2025 to 2033, as smartphones, tablets, and online platforms reshape how readers access content. Digital comics provide instant libraries without the need for storage, making them especially attractive to audiences in regions with limited access to bookstores. Platforms such as WEBTOON, Tapas, and Shueisha’s MANGA Plus have built international followings by offering mobile-first experiences, while subscription models such as Marvel Unlimited continue to drive consistent engagement among global fans.

Format Insights

Hard-copy comic books accounted for a revenue share of 65.90% in the overall comic book industry in 2024. Collectors and long-time fans place high value on the physical experience, the artwork on glossy pages, the feel of a bound edition, and the permanence of owning a tangible product. Nostalgia also plays a central role, as many readers associate print comics with childhood or tradition. Beyond sentiment, physical editions serve as prized collectibles, with limited variants, signed copies, and anniversary reprints commanding premium demand in both retail and auctions.

The demand for e-books is expected to grow at a CAGR of 10.0% from 2025 to 2033. Growing smartphone and tablet penetration allows readers to carry entire libraries in one device, while online platforms and subscription services provide instant access to a wide variety of titles. This portability appeals particularly to younger, tech-savvy consumers and readers in regions with limited bookstore infrastructure. In addition, features such as adjustable fonts, integrated dictionaries, and cross-device syncing enhance the overall reading experience, reinforcing e-books’ long-term growth potential.

Genre Insights

The demand for manga comic books accounted for a revenue share of 45.02% in the overall comic book industry in 2024. Unlike traditional Western comics that often concentrate on superhero themes, manga spans genres ranging from action and fantasy to romance, sports, and slice-of-life, ensuring relevance across demographics. Japanese publishers have also built powerful global distribution networks, with titles such as One Piece and Demon Slayer achieving record circulation well beyond their domestic market. The success of anime adaptations has reinforced readership internationally, creating a cycle where on-screen popularity drives consistent demand for print and digital manga volumes.

The demand for superhero comic books is expected to grow at a CAGR of 8.6% from 2025 to 2033. Film and television adaptations within the Marvel and DC universes continue to attract new audiences who often turn to the original comics to deepen their engagement with the storylines. Superhero narratives also benefit from strong merchandising, gaming tie-ins, and collectible editions that extend their cultural presence beyond the page. The genre’s ability to combine action-driven plots with contemporary themes such as identity, justice, and social responsibility ensures relevance for both long-standing fans and newer generations of readers.

Regional Insights

The comic book industry in North America held 13.84% of the global revenue in 2024, due to its long-standing publishing heritage, strong consumer base, and integration of comics into mainstream entertainment. The region is home to major players such as Marvel and DC, whose franchises dominate both publishing and cross-media adaptations, reinforcing demand for print and digital editions. Well-developed retail channels, including specialty comic shops, large bookstore chains, and online platforms, ensure wide accessibility. In addition, a strong culture of conventions, collectibles, and fan communities has kept engagement levels high, supporting steady revenue generation across the market.

U.S. Comic Book Market Trends

The comic book industry in the U.S. held 80.09% of the global revenue in 2024, owing to its position as the industry’s cultural and commercial hub. The country is home to powerhouse publishers such as Marvel, DC, and Image Comics, whose titles not only drive domestic sales but also set global trends through film, television, and gaming adaptations. A highly developed distribution network, ranging from specialty comic shops and nationwide bookstore chains to robust e-commerce platforms, ensures wide accessibility for readers. A strong collector culture further strengthens the U.S. market, with record-breaking auctions of rare issues and large-scale fan conventions that continually stimulate both sales and engagement.

Europe Comic Book Market Trends

Europe comic book industry accounted for a revenue share of 21.14% in the year 2024, supported by its rich artistic heritage, diverse publishing traditions, and strong readership culture. Countries such as France, Belgium, and Italy have long histories of comic book production, with titles like Asterix and Tintin continuing to attract multi-generational audiences. The region also benefits from internationally renowned events such as the Angoulême International Comics Festival, which highlights both mainstream and independent creators. Well-established publishing houses, widespread bookstore networks, and the growing popularity of translated Japanese manga further reinforced Europe’s position as a leading contributor to global comic book revenues.

Asia Pacific Comic Book Market Trends

The Asia Pacific comic book industry is projected to grow at a CAGR of 9.8% from 2025 to 2033, supported by the region’s deep-rooted storytelling traditions and rapidly growing youth population. Japan remains the epicenter, with manga shaping global reading habits through blockbuster titles such as One Piece and Demon Slayer, while South Korea’s WEBTOON platform has revolutionized mobile-first comics and built a global audience.

China and India are also emerging as important markets, where rising internet penetration and increased translation of international titles are broadening access. With expanding digital infrastructure, strong domestic production, and growing global influence, the Asia Pacific continues to drive the comic book industry’s long-term growth.

Key Comic Book Company Insights

The comic book market is fragmented primarily due to the presence of several globally recognized players as well as regional players. Some prominent companies in the comic book industry are Disney, Image Comics, IDW Publishing, Dark Horse Comic, and others.

- Disney Books, a division of Disney Publishing Worldwide, is a publisher of children's and young adult literature, bringing beloved Disney characters and stories to life in print and digital formats. The company offers a diverse range of books, including picture books, storybooks, early readers, middle-grade novels, and young adult fiction.

- Image Comics is a leading independent comic book publisher known for its creator-owned model, allowing writers and artists to retain full rights to their work. Since its founding in 1992, Image has established itself as a key player in the industry. It offers a diverse portfolio that includes best-selling titles like Spawn, Saga, The Walking Dead, and Invincible. Unlike traditional publishers, Image does not impose editorial control, fostering innovation and genre diversity across science fiction, fantasy, horror, and superhero narratives.

Key Comic Book Companies:

The following are the leading companies in the comic book market. These companies collectively hold the largest market share and dictate industry trends.

- Disney

- Image Comics

- IDW Publishing

- Dark Horse Comic

- TOKYOPOP

- DC Comics

- Archie Comics

- DMG Entertainment

- Shogakukan Inc.

- KODANSHA USA PUBLISHING

Recent Developments

-

In March 2025, IDW Publishing announced the release of three new limited comic series, expanding the Star Trek universe. Star Trek: Red Shirts likely to focus on the often-overlooked red-shirted crew members following their mission on the U.S.S. Warren. Star Trek: Strange New Worlds - The Seeds of Destruction is anticipated to explore Captain Pike and the crew of the U.S.S. Enterprise as they face a new threat to a distant colony. Meanwhile, Star Trek: Voyager - Homecoming picks up after the events of the Voyager TV series, following Captain Janeway and her crew as they navigate life back in the Alpha Quadrant. This series is expected to offer fresh stories for fans, delving into both familiar and uncharted territories in the Star Trek universe.

-

In February 2025, Image Comics partnered with the upcoming digital comics platform Sweet Shop to make nearly 400 of its creator-owned titles available upon the app's launch later this summer. This collaboration is expected to feature new series such as "Exquisite Corpses" by James Tynion IV and Michael Walsh and "We're Taking Everyone Down With Us" by Matthew Rosenberg and Stefano Landini, alongside popular titles such as "Transformers," "Spawn," "Invincible," and "The Walking Dead." Sweet Shop aims to enhance the digital comics reading experience by offering features like vertical scrolling, support for both right-to-left and left-to-right reading orientations, and availability on both Apple and Android devices. In addition, users likely to have the option to purchase comics either in-app or as DRM-free downloads. Readers can sign up on Sweet Shop's pre-launch site to receive updates on the launch and new features.

Comic Book Market Report Scope

Report Attribute

Details

Market revenue in 2025

USD 19.05 billion

Revenue forecast in 2033

USD 37.15 billion

Growth rate (Revenue)

CAGR of 8.7% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, format, genre, region

Regional Scope

North America; Europe; Asia Pacific; Central and South America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; South Africa

Key companies profiled

Disney; Image Comics; IDW Publishing; Dark Horse Comic; TOKYOPOP; DC Comics; Archie Comics; DMG Entertainment; Shogakukan Inc.; KODANSHA USA PUBLISHING

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Comic Book Market Report Segmentation

This report forecasts revenue growth at the global and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the comic book market based on type, format, genre, and region:

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Digital

-

Non-Digital

-

-

Format Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hard Copy

-

E-Books

-

Audiobook

-

-

Genre Outlook (Revenue, USD Billion, 2021 - 2033)

-

Science-Fiction

-

Manga

-

Superhero

-

Non-fiction

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global comic book market was estimated at USD 17.62 billion in 2024 and is expected to reach USD 19.05 billion in 2025.

b. The global comic book market is expected to grow at a compound annual growth rate of 8.7% from 2025 to 2030 to reach USD 37.15 billion by 2030.

b. Asia Pacific dominated the comic book market with a share of 58.99% in 2024. The regional growth is driven by the expanding readership, fueled by younger demographics and a growing adult audience, which has strengthened market demand across diverse genres and formats.

b. Some of the key players operating in the comic book market include Disney; DC Comics; Shueisha Inc.; PANINI S.P.A.; Shogakukan Inc.; Dark Horse Comic; Image Comics; IDW Publishing; HAKUSENSHA; TOKYOPOP.

b. Growth of the global comic book market is majorly driven on account of The increasing prevalence of graphic novels in literary spaces and the growing recognition of comics as a sophisticated storytelling medium has attracted adult readers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.