- Home

- »

- Next Generation Technologies

- »

-

Commercial Refrigeration Equipment Market Report, 2030GVR Report cover

![Commercial Refrigeration Equipment Market Size, Share & Trends Report]()

Commercial Refrigeration Equipment Market Size, Share & Trends Analysis Report By Product, By System Type, By Capacity, By Application, By Refrigerant, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-531-1

- Number of Report Pages: 127

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

The global commercial refrigeration equipment market size was valued at USD 40.82 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2030. The rapid expansion of the hospitality and tourism sector and the growing preference among end-consumers for takeaway meals are expected to drive market growth over the forecast period. In addition, increasing regulatory implications resulting in the adoption of lower global warming potential (GWP) commercial refrigerants coupled with ongoing technological breakthroughs will also provide growth prospects for the market.

A considerable rise in the international food trade has also boosted the demand for commercial refrigeration systems for frozen foods, processed foods, and seafood required for to storage and transportation. The continual innovations and rapid improvements in technologies, including liquid-vapor compression and ammonia absorption systems, are driving the product demand further. Various leading manufacturers are focusing on R&D activities to enhance the design and temperature control of their products to gain a competitive edge in the industry. The increasing need to control and monitor the environment of a commercial kitchen is expected to provide ample growth opportunities for the refrigeration industry over the forecast period.

Products equipped with automated or smart refrigeration controls are gaining massive traction in the market. As per the Federal Energy Management Program, commercial refrigerators with ENERGY STAR certification consume 1.89 kWh energy per day on an average, while refrigerators with lesser efficiency consume energy of around 4.44 kWh per day. The increasing demand for energy-efficient commercial refrigeration units driven by the rising awareness about their environment-friendly and cost-effective nature is encouraging the market players to develop innovative designs.

Climate concerns related to high GWP refrigerants, such as global warming and ozone depletion, are urging manufacturers to produce alternatives. The rising demand for technologies that can address hazardous gas emissions has urged market participants to equip their products with advanced magnetic refrigeration systems. These systems also improve the energy efficiency of refrigeration equipment, thereby minimizing operational costs. As per the U.S. Department of Energy statistics, these systems are highly energy-efficient and can help in energy saving of up to 30%.

The worldwide outbreak of the COVID-19 crisis led to the establishment of stringent containment measures, resulting in a temporary halt in the manufacturing and shipment of commercial refrigeration equipment. However, the pandemic created a strong demand for vaccine production and storage, which triggered the demand for cold storage solutions to support the mass immunization program against the coronavirus. The accelerating usage of vaccine storage units is likely to propel the demand for transportation refrigeration equipment in the subsequent years.

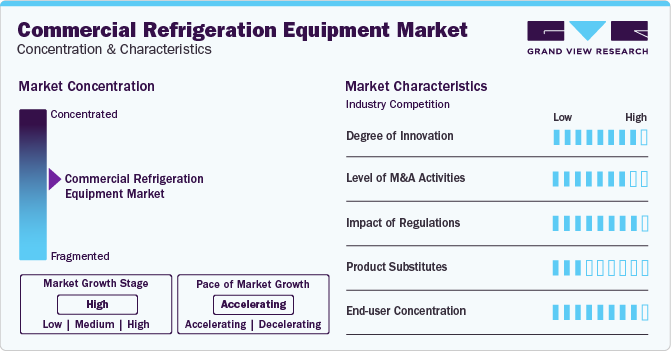

Market Concentration & Characteristics

The market growth stage is moderate to high, and the pace of the market growth is accelerating. The commercial refrigeration equipment market is driven by a high degree of innovation, owing to the increased demand for improved energy efficiency and reduced operating costs along with regulatory compliant commercial refrigerators. The commercial sector is demand refrigerating solutions that reduce their energy consumption and lower their carbon footprint. For instance, hydrocarbon-based refrigerants and natural alternatives are witnessing higher demand owing to their lower impact on the environment.

In addition, the industry is witnessing moderate to high merger and acquisition activities by the leading market players, which further accelerates market growth. These strategies by commercial refrigeration industry players are aimed at expanding their market share and increase existing product portfolio. In December 2023, Haier announced the acquisition of the commercial refrigeration business from Carrier. This acquisition is expected to help Haier Smart Home business establish its commercial refrigeration platform.

The commercial refrigeration equipment market is also subject to increasing regulatory scrutiny owing to an increasing number of regulations aimed at reducing the usage of refrigerants with high global warming potential. Implementation of stringent regulations by various governments authorities globally is compelling manufacturers to develop new technologies and products that using natural refrigerants including carbon dioxide (CO2) and ammonia (NH3). For instance, the American Innovation and Manufacturing (AIM) Act was enacted in December 2020, which mandates about 85% reduction in the consumption and production of high-GWP HFCs by 2036.

End-user concentration is high in the commercial refrigeration equipment market owing to rapid demand for refrigeration equipment from end users such as supermarkets, restaurants, convenience stores, and hospitality businesses.

Product Insights

The refrigerators and freezers segment accounted for the largest revenue share of more than 22.0% in 2022. This can be attributed to the worldwide expansion of the travel and tourism industry, leading to the opening of various food joints and restaurants. The segment also covers blast chillers that are mainly used for prompt freezing or cooling of items at lower temperatures and stopping bacteria growth in the stored item. Besides, the wide adoption of chillers by healthcare professionals to store tissue samples of vaccines, controlled tests, and critical medicines is also contributing to the segment's growth.

The beverage refrigeration segment is expected to grow at a CAGR of more than 6.0% from 2023 to 2030, owing to the increased deployment of medium-capacity beverage coolers for travelers and vacationers. Moreover, the emerging trend of ‘grab and go’ and ‘sip and shop’ across the retail chains to offer a better shopping experience to their consumers is expected to drive the demand for beverage commercial refrigerators in the forthcoming years.

System Type Insights

The self-contained segment held major revenue share of the global commercial refrigeration equipment market in 2022 on account of the rising product demand driven by easy and cost-effective installation and low maintenance and relocation costs of the appliances. As per the Environmental Protection Agency (EPA) statistics, in 2020, self-contained commercial refrigeration equipment produced around 26% of the overall HFC emissions globally. The stringent HFC emission norms are compelling the manufacturers to replace R-404A refrigerant with R-448A, minimizing the GWP of refrigeration equipment by around 70%.

The remotely operated refrigerators segment is expected to grow at a notable CAGR from 2023 to 2030, with increasing adoption across restaurants with limited kitchen space to reduce the heat produced by the refrigerators. These refrigerators offer less resonating noise than the self-contained refrigerators as the compressor unit is deployed outside the kitchen. However, they are less energy-efficient, and their installation requires professionals, which further increases the already high installation cost.

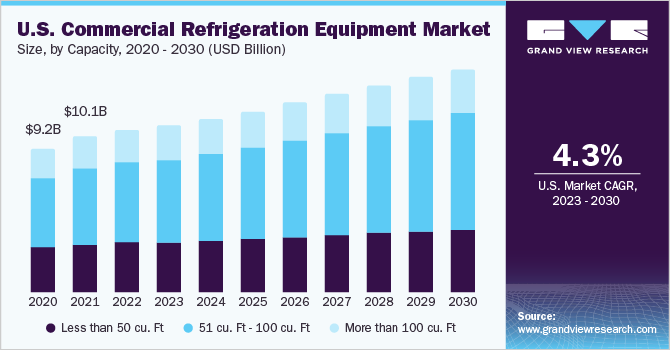

Capacity Insights

The 51 cu. Ft. to 100 cu. Ft. segment held the largest revenue share in 2022, owing to the rising number of specialty food stores, hypermarkets, and supermarkets across the globe. These retail chains have a wide range of products that require ample refrigeration, such as fresh produce, dairy, meat, and frozen foods. Their expansion is propelling the demand for commercial refrigerators in this capacity range to accommodate their growing inventory. Moreover, they are also required to comply with the regulations pertaining to food quality, which, in turn, leads to increased product demand.

The less than 50 cu. Ft. segment is anticipated to grow at a fastest from 2023 to 2030. This can be majorly credited to the increasing need for various refrigeration equipment in this capacity range for highly concentrated application areas such as cold channel logistics and food service. Moreover, they are also in high demand across smaller businesses with limited space as they are more compact, energy-efficient, cost-effective and can store perishable items without taking extra space. They are commonly used in convenience stores, cafes, smaller restaurants, etc.

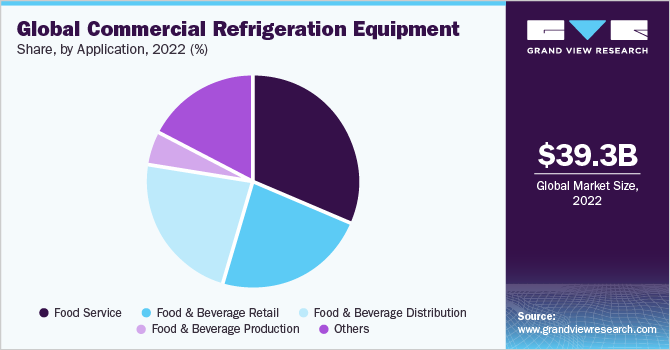

Application Insights

The food & beverage retail segment is estimated to record a substantial CAGR from 2023 to 2030. The ongoing developments in cold channel logistics for transporting temperature-sensitive items are positively impacting segmental growth. Moreover, the demand for high-end temperature-controlled refrigerators for various transport vehicles for reliable distribution of beverages, liquor, fish, biopharmaceuticals, and other perishable products is also favoring the business growth. Besides, the growing inclination of capital-intensive customers in the food & beverage distribution industry toward the sectional refrigerated trailers will drive the segment’s growth in the upcoming years.

The food service segment captured a revenue share of around 32.0% of the overall market in 2022. The sizable revenue share can be credited to the increasing trend of quick-service restaurants (QSRs) and food trucks in the food service industry. According to the National Restaurant Association (NRA), there were more than 1 million restaurant locations in the U.S. in 2022, including QSRs, FSRs, bars, and taverns, which have a considerable demand for refrigeration equipment. Furthermore, the expansion of various prominent food and beverage chains, such as McDonald's, Subway IP LLC, and Starbucks Coffee Company is expected to impel the demand for commercial refrigeration equipment further.

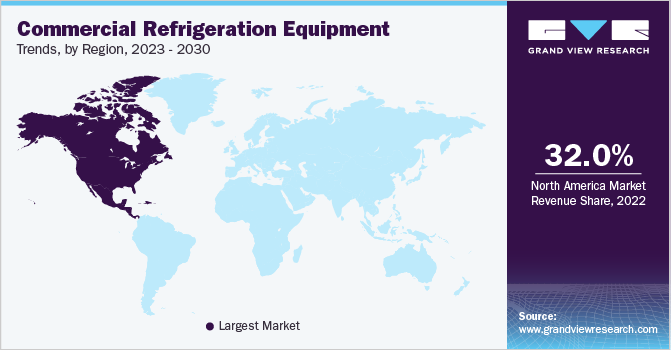

Regional Insights

North America accounted for a dominant revenue share of over 32% in 2022 in the global commercial refrigeration equipment market. The significant growth can be attributed to the mature retail industry and the availability of major supermarket chains, such as Walmart, Costco, Kroger, Publix, etc., in the region. Besides, the strong presence of various leading manufacturers of commercial refrigeration equipment coupled with the early adoption of smart equipment across the commercial kitchens is favoring the expansion of the regional market further.

Europe commercial refrigeration equipment market is expected to witness a CAGR of over 4% from 2023 to 2030. This can be attributed to the high demand for commercial refrigeration equipment from food, drinks, medicines, and chemicals industries. High growth in consumption of convenience foods in Europe region is boosting the market’s growth.

Asia Pacific is expected to witness a growth at CAGR of over 6.0% from 2023 to 2030, owing to increasing product demand driven by the improving economic conditions, steady employment rates, growing gross disposable income, and rising expenditure on leisure activities, including traveling, and dining out. The flourishing travel & tourism industry in the countries, such as Malaysia, Indonesia, and Singapore, is further contributing to the segmental growth.

Middle East & Africa is expected to witness a growth at CAGR of over 6.0% from 2023 to 2030, owing to expansion of the cold storage sector. In addition, the region is seeing rapid growth in demand for smart and connected refrigeration, further contributing to the market’s growth.

U.S. Commercial Refrigeration Equipment Market Trends

The commercial refrigeration equipment market in U.S. is anticipated to grow at a CAGR of 4.3% from 2023 to 2030. The expansion of retail chains, convenience stores, and grocery stores, along with increasing demand for fresh and frozen food products in the U.S. region, is expected to drive market growth in upcoming years. Technological innovation aimed at reducing energy consumption and reducing the impact on the environment by focusing on the application of natural refrigerants is expected to strengthen the market growth in the near future.

U.K. Commercial Refrigeration Equipment Market Trends

The commercial refrigeration equipment market in U.K. accounted for over 15% revenue share of the European market in 2022. Ongoing trend of using eco-friendly refrigerants in the U.K. along with the integration of artificial intelligence (AI) is projected to drive market’s growth in upcoming years.

Germany Commercial Refrigeration Equipment Market Trends

The commercial refrigeration equipment market in Germany accounted for over 25% revenue share of the European market in 2022. Continuous development of efficient and reliable refrigeration systems in Germany is driving the growth of the market.

France Commercial Refrigeration Equipment Market Trends

The commercial refrigeration equipment market in France is driven by its booming food industry with consumer demand for high-quality bakery, dairy, and meat products. This leads to the continuous demand for efficient and reliable commercial refrigeration equipment in the country.

China Commercial Refrigeration Equipment Market Trends

The commercial refrigeration equipment market in China is expected to witness a growth at CAGR of nearly 6.0% from 2023 to 2030. High-quality and fresh food products in China drives demand for commercial refrigeration equipment. In addition, high adoption rate of vaccine storage units across research institutions and biopharmaceutical companies in the country drives growth of the market.

India Commercial Refrigeration Equipment Market Trends

The commercial refrigeration equipment market in India is expected to witness a growth at CAGR of over 8.0% from 2023 to 2030. High growth in number of cafes, restaurants, supermarkets, and convenience stores in India fuels demand for the commercial refrigeration equipment.

Japan Commercial Refrigeration Equipment Market Trends

The commercial refrigeration equipment market in Japan accounted for over 20% revenue share of the Asia Pacific market in 2022. Rising demand for efficient and space-saving refrigeration solutions owing to the limited space availability and high population density is supporting the growth of commercial refrigeration equipment market in Japan.

Saudi Arabia Commercial Refrigeration Equipment Market Trends

The commercial refrigeration equipment market in Saudi Arabia accounted for highest revenue share of the Middle East & Africa market in 2022. High prevalence of prevalence of packaged and frozen food & beverages due to hot and dry climate of the country drives commercial refrigeration equipment market growth.

Key Companies & Market Share Insights

The market players are focusing on implementing various strategic initiatives such as capacity expansion, collaborations, mergers, and acquisitions to strengthen their foothold in the market. For instance, in June 2023, Johnson Controls acquired M&M Carnot, a prominent company involved in the development of natural refrigeration solutions with ultra-low global warming potential. This strategic initiative is aimed at broadening the former’s portfolio of sustainable solutions to help customers achieve net zero emissions.

The increased adoption of sustainable technology equipment has urged the major market players to launch new and enhanced product offerings to cater to consumer demands effectively. For instance, in January 2024, Hussmann Corporation, a retail refrigeration systems company, launched Evolve Technologies, a new offering focused on the development of technologies that facilitate the use of environmentally friendly refrigerants. As part of this strategy, the company also expanded its production capacity for transcritical CO2 refrigeration systems in the Suwanee, Georgia, facility.

In January 2022, Carrier Commercial Refrigeration installed its PowerCO2OL refrigeration system at a COVID-19 vaccine storage warehouse in Spain. This system uses carbon dioxide, a natural refrigerant, and serves as a sustainable and low global warming potential refrigerant to help preserve critical vaccines in Spain.

Key Commercial Refrigeration Equipment Companies:

- AHT Cooling Systems GmbH

- Ali Group S.r.l. a Socio Unico

- Carrier

- Daikin Industries Ltd.

- Dover Corporation

- Electrolux AB

- Hussmann Corporation

- Illinois Tool Works Inc.

- Johnson Control

- Lennox International Inc.

- Panasonic Corporation

- Whirlpool Corporation

Recent Developments

-

In November 2023, Whirlpool Corporation introduced SlimTech insulation, the vacuum-insulated structure (VIS) technology, in a refrigerator. According to the company, this technology signifies a substantial transformation in refrigeration technologies.

-

In September 2023, Carrier partnered with Relayr, Inc., an industrial Internet of Things (IIoT) technology company, an innovative Refrigeration-as-a-Service (RaaS) offering for customers. This collaboration will help food retailers avoid the upfront investment required for refrigeration equipment and infrastructure.

-

In March 2023, Carrier launched the Transicold EverFRESH active controlled atmosphere system for refrigerated containers. This software development helped transporters to carry a wide range of perishable goods, including high value products.

-

In February 2023, Carrier launched a Carbon Air Purifier with UV in their Healthy Homes portfolio. This product delivers air purification to help in the reduction of unwanted odor, volatile organic compounds, and common household gases from indoor air.

-

In January 2023, Daikin Industries, Ltd. invested in Atomis Co., Ltd., a company originating from Kyoto University. Atomis is involved in the development of innovative functional materials using "metal-organic frameworks (MOFs)." This investment from Daikin is aimed at developing next-generation refrigerants and equipment that are environmentally friendly.

Commercial Refrigeration Equipment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 40.82 billion

Revenue forecast in 2030

USD 58.31 billion

Growth Rate

CAGR of 5.2% from 2023 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, system type, refrigerant, capacity, application, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Germany, U.K., France, Italy, Spain, China, Japan, India, Australia, South Korea, Mexico, Brazil, Saudi Arabia, South Africa.

Key companies profiled

AHT Cooling Systems GmbH; Ali Group S.r.l. a Socio Unico; Carrier; Dover Corporation; DAIKIN Industries, Ltd.; Carrier; Electrolux AB; Hussmann Corporation; Illinois Tool Works Inc.; Johnson Control; Lennox International Inc.; Panasonic Corporation; and Whirlpool Corporation

Customization scope Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Commercial Refrigeration Equipment Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels in addition to providing an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global commercial refrigeration equipment market report based on the product, application, system type, refrigerant, capacity, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Transportation Refrigeration Equipment

-

Trailers

-

Trucks

-

Shipping Containers

-

-

Refrigerators & Freezers

-

Walk-in-Refrigerators

-

Reach-in Refrigerators

-

Chest

-

-

Beverage Refrigeration

-

Display Showcases

-

Ice Cream Cabinets

-

Bakery/Deli Display

-

Others

-

-

Ice Merchandisers & Ice Vending Equipment

-

Other Equipment

-

-

System Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Self-contained

-

Remotely Operated

-

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Less than 50 cu. Ft

-

50 to 100 cu. Ft

-

More than 100 cu. Ft

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food Service

-

Food & Beverage Retail

-

Hypermarkets

-

Supermarkets

-

Convenience Store

-

Specialty Food Store

-

Others

-

-

Hotels and Hospitality

-

Pharmaceuticals

-

Healthcare

-

Biotechnology

-

Chemicals

-

Others

-

-

Refrigerant Outlook (Revenue, USD Million, 2018 - 2030)

-

Synthetic Refrigerants (HFCs, HCFCs)

-

Natural Refrigerants

-

Carbon Dioxide (CO2)

-

Ammonia (NH3)

-

Others

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

OEMs (Original Equipment Manufacturers)

-

Distributors and Wholesalers

-

Retailers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global commercial refrigeration equipment market size was estimated at USD 39.31 billion in 2022 and is expected to reach USD 40.8 billion in 2023.

b. The global commercial refrigeration equipment market is expected to grow at a compound annual growth rate of 5.2% from 2023 to 2030 to reach USD 58.3 billion by 2030.

b. North America dominated the commercial refrigeration equipment market with a share of 32.3% in 2022. This is attributable to the presence of well-established distribution channels for all categories of retail companies.

b. Some key players operating in the commercial refrigeration equipment market include Dover Corporation, DAIKIN Industries, Ltd., Carrier AB Electrolux, and Ali S.p.A.

b. Key factors that are driving the commercial refrigeration equipment market growth include rising demand for vaccine storage units during the cold supply chain activities to retain the immunization levels.

b. The refrigerators and freezers segment dominated the global commercial refrigeration equipment market and accounted for the highest revenue share of above 24.7% in 2022.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definitions

1.3. Information Procurement

1.3.1. Information analysis

1.3.2. Market formulation & data visualization

1.3.3. Data validation & publishing

1.4. 1.4 Research Scope and Assumptions

1.4.1. List to Data Sources

Chapter 2. Executive Summary

2.1. Commercial Refrigeration Equipment Market Snapshot

2.2. Commercial Refrigeration Equipment Market- Segment Snapshot

2.3. Commercial Refrigeration Equipment Market- Competitive Landscape Snapshot

Chapter 3. Commercial Refrigeration Equipment Market - Industry Outlook

3.1. Market Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Driver Analysis

3.3.1.1. Technological advancements and need for energy efficient refrigerators

3.3.1.2. Shifting trend in food consumption habits

3.3.2. Market Restraint Analysis

3.3.2.1. High maintenance cost of contemporary devices

3.3.2.2. Increasing fuel costs

3.3.3. Industry Opportunities

3.3.3.1. Adoption of data driven technology

3.3.3.2. Growing significance on online retail

3.4. Industry Analysis Tools

3.4.1. Porter’s analysis

3.4.2. Macroeconomic analysis

3.5. Distributor Landscape

3.6. Regulatory Landscape

3.7. COVID-19 Impact on Commercial Refrigeration Equipment Market

Chapter 4. Commercial Refrigeration Equipment Market: Product Estimates & Trend Analysis

4.1. Product Movement Analysis & Market Share, 2022 & 2030

4.2. Commercial Refrigeration Equipment Market Estimates & Forecast, By Product (USD Million)

4.2.1. Transportation Refrigeration Equipment

4.2.1.1. Trailers

4.2.1.2. Trucks

4.2.1.3. Shipping Containers

4.2.2. Refrigerators & Freezers

4.2.2.1. Walk-in-Refrigerators

4.2.2.2. Reach-in Refrigerators

4.2.2.3. Chest

4.2.3. Beverage Refrigeration

4.2.3.1. Refrigerated Vending Machine

4.2.3.2. Ice Machine

4.2.3.3. Ice Cream Machine

4.2.4. Display Showcases

4.2.5. Ice Merchandisers & Ice Vending Equipment

4.2.6. Other Equipment

Chapter 5. Commercial Refrigeration Equipment Market: System Type Estimates & Trend Analysis

5.1. System Type Movement Analysis & Market Share, 2022 & 2030

5.2. Commercial Refrigeration Equipment Market Estimates & Forecast, By System Type (USD Million)

5.2.1. Self-contained

5.2.2. Remotely Operated

Chapter 6. Commercial Refrigeration Equipment Market: Capacity Estimates & Trend Analysis

6.1. Capacity Movement Analysis & Market Share, 2022 & 2030

6.2. Commercial Refrigeration Equipment Market Estimates & Forecast, By Capacity (USD Million)

6.2.1. Less than 50 cu. Ft

6.2.2. 50 to 100 cu. Ft

6.2.3. More than 100 cu. Ft

Chapter 7. Commercial Refrigeration Equipment Market: Application Estimates & Trend Analysis

7.1. Application Movement Analysis & Market Share, 2022 & 2030

7.2. Commercial Refrigeration Equipment Market Estimates & Forecast, By Application (USD Million)

7.2.1. Food Service

7.2.2. Food & Beverage Retail

7.2.2.1. Hypermarkets

7.2.2.2. Supermarkets

7.2.2.3. Convenience Store

7.2.2.4. Specialty Food Store

7.2.2.5. Others

7.2.3. Hotels and Hospitality

7.2.4. Pharmaceuticals

7.2.5. Healthcare

7.2.6. Biotechnology

7.2.7. Chemicals

7.2.8. Others

Chapter 8. Refrigerant Estimates & Trend Analysis

8.1. Refrigerant Movement Analysis & Market Share, 2022 & 2030

8.2. Commercial Refrigeration Equipment Market by Refrigerant, 2022 & 2030

8.2.1. Synthetic Refrigerants (HFCs, HCFCs)

8.2.2. Natural Refrigerants

8.2.2.1. Carbon Dioxide (CO2)

8.2.2.2. Ammonia (NH3)

8.2.2.3. Others

Chapter 9. Distribution Channel Estimates & Trend Analysis

9.1. Distribution Channel Movement Analysis & Market Share, 2022 & 2030

9.2. Commercial Refrigeration Equipment Market by Distribution Channel, 2022 & 2030

9.2.1. OEMs (Original Equipment Manufacturers)

9.2.2. Distributors and Wholesalers

9.2.3. Retailers

Chapter 10. Regional Estimates & Trend Analysis

10.1. Commercial Refrigeration Equipment Market by Region, 2022 & 2030

10.2. North America

10.2.1. North America Commercial Refrigeration Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

10.2.2. U.S.

10.2.3. Canada

10.3. Europe

10.3.1. Europe Commercial Refrigeration Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

10.3.2. Germany

10.3.3. U.K.

10.3.4. France

10.3.5. Italy

10.3.6. Spain

10.4. Asia Pacific

10.4.1. Asia Pacific Commercial Refrigeration Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

10.4.2. Japan

10.4.3. China

10.4.4. India

10.4.5. South Korea

10.4.6. Australia

10.5. Latin America

10.5.1. Latin America Commercial Refrigeration Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

10.5.2. Brazil

10.5.3. Mexico

10.6. Middle East & Africa (MEA)

10.6.1. MEA Commercial Refrigeration Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Million)

10.6.2. Saudi Arabia

10.6.3. South Africa

Chapter 11. Commercial Refrigeration Equipment Market - Competitive Landscape

11.1. Recent Developments & Impact Analysis, By Key Market Participants

11.2. Company Categorization

11.3. Participant’s Overview

11.4. Financial Performance

11.5. Product Benchmarking

11.6. Company Market Share Analysis, 2022

11.7. Company Heat Map Analysis

11.8. Strategy Mapping

11.8.1. Expansion/Divestiture

11.8.2. Collaborations/Partnerships

11.8.3. New Product Launches

11.8.4. Contract

11.9. Company Profiles

11.9.1. AHT Cooling Systems GmbH

11.9.1.1. Participant’s Overview

11.9.1.2. Financial Performance

11.9.1.3. Product Benchmarking

11.9.1.4. Recent Developments

11.9.2. Ali Group S.r.l. a Socio Unico

11.9.2.1. Participant’s Overview

11.9.2.2. Financial Performance

11.9.2.3. Product Benchmarking

11.9.2.4. Recent Developments

11.9.3. Carrier

11.9.3.1. Participant’s Overview

11.9.3.2. Financial Performance

11.9.3.3. Product Benchmarking

11.9.3.4. Recent Developments

11.9.4. Daikin Industries Ltd.

11.9.4.1. Participant’s Overview

11.9.4.2. Financial Performance

11.9.4.3. Product Benchmarking

11.9.4.4. Recent Developments

11.9.5. Dover Corporation

11.9.5.1. Participant’s Overview

11.9.5.2. Financial Performance

11.9.5.3. Product Benchmarking

11.9.5.4. Recent Developments

11.9.6. Electrolux AB

11.9.6.1. Participant’s Overview

11.9.6.2. Financial Performance

11.9.6.3. Product Benchmarking

11.9.6.4. Recent Developments

11.9.7. Hussmann Corporation

11.9.7.1. Participant’s Overview

11.9.7.2. Financial Performance

11.9.7.3. Product Benchmarking

11.9.7.4. Recent Developments

11.9.8. Illinois Tool Works Inc.

11.9.8.1. Participant’s Overview

11.9.8.2. Financial Performance

11.9.8.3. Product Benchmarking

11.9.8.4. Recent Developments

11.9.9. Johnson Control

11.9.9.1. Participant’s Overview

11.9.9.2. Financial Performance

11.9.9.3. Product Benchmarking

11.9.9.4. Recent Developments

11.9.10. Lennox International Inc.

11.9.10.1. Participant’s Overview

11.9.10.2. Financial Performance

11.9.10.3. Product Benchmarking

11.9.10.4. Recent Developments

11.9.11. Panasonic Corporation

11.9.11.1. Participant’s Overview

11.9.11.2. Financial Performance

11.9.11.3. Product Benchmarking

11.9.11.4. Recent Developments

11.9.12. Whirlpool Corporation

11.9.12.1. Participant’s Overview

11.9.12.2. Financial Performance

11.9.12.3. Product Benchmarking

11.9.12.4. Recent Developments

List of Tables

Table 1 Commercial Refrigeration Equipment Market - Key market driver impact

Table 2 Commercial Refrigeration Equipment Market - Key market restraint impact

Table 3 Commercial Refrigeration Equipment Market Revenue Estimates and Forecast, By Product, 2018 - 2030 (USD Million)

Table 4 Commercial Refrigeration Equipment Market Revenue Estimates and Forecast, By System Type, 2018 - 2030 (USD Million)

Table 5 Commercial Refrigeration Equipment Market Revenue Estimates and Forecast, By Capacity, 2018 - 2030 (USD Million)

Table 6 Commercial Refrigeration Equipment Market Revenue Estimates and Forecast, By Application, 2018 - 2030 (USD Million)

Table 7 Commercial Refrigeration Equipment Market Revenue Estimates and Forecast, By Refrigerant, 2018 - 2030 (USD Million)

Table 8 Commercial Refrigeration Equipment Market Revenue Estimates and Forecast, By Distribution Channel, 2018 - 2030 (USD Million)

Table 9 Recent Developments & Impact Analysis, By Key Market Participants

Table 10 Company Heat Map Analysis

Table 11 Key companies undergoing expansions/divestitures

Table 12 Key Companies undergoing collaborations

Table 13 Key companies launching new products

List of Figures

Fig. 1 Commercial Refrigeration Equipment Market Segmentation

Fig. 2 Information Procurement

Fig. 3 Data Analysis Models

Fig. 4 Market Formulation and Validation

Fig. 5 Data Validating & Publishing

Fig. 6 Market Snapshot

Fig. 7 Segment Snapshot (1/2)

Fig. 8 Segment Snapshot (2/2)

Fig. 9 Competitive Landscape Snapshot

Fig. 10 Commercial Refrigeration Equipment Market Value, 2022 - 2030 (USD Million)

Fig. 11 Commercial Refrigeration Equipment Market - Industry Value Chain Analysis

Fig. 12 Market Dynamics

Fig. 13 Key Market Driver Impact

Fig. 14 Key Market Restraint Impact

Fig. 15 Key Market Opportunity Impact

Fig. 16 Commercial Refrigeration Equipment Market: PORTER’s Analysis

Fig. 17 Commercial Refrigeration Equipment Market: PESTEL Analysis

Fig. 18 Commercial Refrigeration Equipment Market, by Product: Key Takeaways

Fig. 19 Commercial Refrigeration Equipment Market, by Product: Market Share, 2022 & 2030

Fig. 20 Commercial Refrigeration Equipment Market, by System Type: Key Takeaways

Fig. 21 Commercial Refrigeration Equipment Market, by System Type: Market Share, 2022 & 2030

Fig. 22 Commercial Refrigeration Equipment Market, by Capacity: Key Takeaways

Fig. 23 Commercial Refrigeration Equipment Market, by Capacity: Market Share, 2022 & 2030

Fig. 24 Commercial Refrigeration Equipment Market, by Application: Key Takeaways

Fig. 25 Commercial Refrigeration Equipment Market, by Application: Market Share, 2022 & 2030

Fig. 26 Commercial Refrigeration Equipment Market, by Refrigerant: Key Takeaways

Fig. 27 Commercial Refrigeration Equipment Market, by Refrigerant: Market Share, 2022 & 2030

Fig. 28 Commercial Refrigeration Equipment Market, by Distribution Channel: Key Takeaways

Fig. 29 Commercial Refrigeration Equipment Market, by Distribution Channel: Market Share, 2022 & 2030

Fig. 30 Commercial Refrigeration Equipment Market, by Region: Key takeaways

Fig. 31 Commercial refrigeration equipment market by region, 2022 & 2030 Revenue (USD Million)

Fig. 32 North America commercial refrigeration equipment market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 33 U.S. commercial refrigeration equipment market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 34 Canada commercial refrigeration equipment market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 35 Europe commercial refrigeration equipment market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 35 Germany commercial refrigeration equipment market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 37 U.K. commercial refrigeration equipment market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 38 France commercial refrigeration equipment market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 39 Italy commercial refrigeration equipment market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 40 Spain commercial refrigeration equipment market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 41 Asia Pacific commercial refrigeration equipment market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 42 China commercial refrigeration equipment market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 43 India commercial refrigeration equipment market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 44 Japan commercial refrigeration equipment market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 45 South Korea commercial refrigeration equipment market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 46 Australia commercial refrigeration equipment market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 47 Latin America commercial refrigeration equipment market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 48 Brazil commercial refrigeration equipment market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 49 Mexico commercial refrigeration equipment market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 50 MEA commercial refrigeration equipment market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 51 Saudi Arabia commercial refrigeration equipment market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 52 South Africa commercial refrigeration equipment market estimates & forecast, 2018 - 2030 (USD Million)

Fig. 53 Key Company Categorization

Fig. 54 Company Market Share Analysis, 2022

Fig. 55 Strategic frameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Commercial Refrigeration Equipment Product Outlook (Revenue, USD Million, 2018 - 2030)

- Transportation Refrigeration Equipment

- Trailers

- Trucks

- Shipping Containers

- Refrigerators & Freezers

- Walk-in-Refrigerators

- Reach-in Refrigerators

- Chest

- Beverage Refrigeration

- Display Showcases

- Ice Cream Cabinets

- Bakery/Deli Display

- Others

- Ice Merchandisers & Ice Vending Equipment

- Other Equipment

- Transportation Refrigeration Equipment

- Commercial Refrigeration Equipment System Type Outlook (Revenue, USD Million, 2018 - 2030)

- Self-contained

- Remotely Operated

- Commercial Refrigeration Equipment Capacity Outlook (Revenue, USD Million, 2018 - 2030)

- Less than 50 cu. Ft

- 50 to 100 cu. Ft

- More than 100 cu. Ft

- Others

- Commercial Refrigeration Equipment Application Outlook (Revenue, USD Million, 2018 - 2030)

- Food Service

- Food & Beverage Retail

- Hypermarkets

- Supermarkets

- Convenience Store

- Specialty Food Store

- Others

- Hotels and Hospitality

- Pharmaceuticals

- Healthcare

- Biotechnology

- Chemicals

- Others

- Commercial Refrigeration Equipment Market, By Refrigerant Revenue, USD Million, 2018 - 2030)

- Synthetic Refrigerants (HFCs, HCFCs)

- Natural Refrigerants

- Carbon Dioxide (CO2)

- Ammonia (NH3)

- Others

- Commercial Refrigeration Equipment Market, By Distribution Channel Revenue, USD Million, 2018 - 2030)

- Distributors and Wholesalers

- Retailers

- Commercial Refrigeration Equipment Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Commercial Refrigeration Equipment Market, By Product

- Transportation Refrigeration Equipment

- Trailers

- Trucks

- Shipping Containers

- Refrigerators & Freezers

- Walk-in-Refrigerators

- Reach-in Refrigerators

- Chest

- Beverage Refrigeration

- Display Showcases

- Ice Cream Cabinets

- Bakery/Deli Display

- Others

- Ice Merchandisers & Ice Vending Equipment

- Other Equipment

- North America Commercial Refrigeration Equipment Market, By System Type

- Self-contained

- Remotely Operated

- North America Commercial Refrigeration Equipment Market, By Capacity

- Less than 50 cu. Ft

- 50 to 100 cu. Ft

- More than 100 cu. Ft

- North America Commercial Refrigeration Equipment Market, By Application

- Food Service

- Food & Beverage Retail

- Hypermarkets

- Supermarkets

- Convenience Store

- Specialty Food Store

- Others

- Hotels and Hospitality

- Pharmaceuticals

- Healthcare

- Biotechnology

- Chemicals

- Others

- North America Commercial Refrigeration Equipment Market, By Refrigerant

- Synthetic Refrigerants (HFCs, HCFCs)

- Natural Refrigerants

- Carbon Dioxide (CO2)

- Ammonia (NH3)

- Others

- North America Commercial Refrigeration Equipment Market, By Distribution Channel

- OEMs (Original Equipment Manufacturers)

- Distributors and Wholesalers

- Retailers

- U.S.

- U.S. Commercial Refrigeration Equipment Market, By Product

- Transportation Refrigeration Equipment

- Trailers

- Trucks

- Shipping Containers

- Refrigerators & Freezers

- Walk-in-Refrigerators

- Reach-in Refrigerators

- Chest

- Beverage Refrigeration

- Display Showcases

- Ice Cream Cabinets

- Bakery/Deli Display

- Others

- Ice Merchandisers & Ice Vending Equipment

- Other Equipment

- U.S. Commercial Refrigeration Equipment Market, By System Type

- Self-contained

- Remotely Operated

- U.S. Commercial Refrigeration Equipment Market, By Capacity

- Less than 50 cu. Ft

- 50 to 100 cu. Ft

- More than 100 cu. Ft

- U.S. Commercial Refrigeration Equipment Market, By Application

- Food Service

- Food & Beverage Retail

- Hypermarkets

- Supermarkets

- Convenience Store

- Specialty Food Store

- Others

- Hotels and Hospitality

- Pharmaceuticals

- Healthcare

- Biotechnology

- Chemicals

- Others

- U.S. Commercial Refrigeration Equipment Market, By Refrigerant

- Synthetic Refrigerants (HFCs, HCFCs)

- Natural Refrigerants

- Carbon Dioxide (CO2)

- Ammonia (NH3)

- Others

- U.S. Commercial Refrigeration Equipment Market, By Distribution Channel

- OEMs (Original Equipment Manufacturers)

- Distributors and Wholesalers

- Retailers

- Canada

- Canada Commercial Refrigeration Equipment Market, By Product

- Transportation Refrigeration Equipment

- Trailers

- Trucks

- Shipping Containers

- Refrigerators & Freezers

- Walk-in-Refrigerators

- Reach-in Refrigerators

- Chest

- Beverage Refrigeration

- Display Showcases

- Ice Cream Cabinets

- Bakery/Deli Display

- Others

- Ice Merchandisers & Ice Vending Equipment

- Other Equipment

- Canada Commercial Refrigeration Equipment Market, By System Type

- Self-contained

- Remotely Operated

- Canada Commercial Refrigeration Equipment Market, By Capacity

- Less than 50 cu. Ft

- 50 to 100 cu. Ft

- More than 100 cu. Ft

- Canada Commercial Refrigeration Equipment Market, By Application

- Food Service

- Food & Beverage Retail

- Hypermarkets

- Supermarkets

- Convenience Store

- Specialty Food Store

- Others

- Hotels and Hospitality

- Pharmaceuticals

- Healthcare

- Biotechnology

- Chemicals

- Others

- Canada Commercial Refrigeration Equipment Market, By Refrigerant

- Synthetic Refrigerants (HFCs, HCFCs)

- Natural Refrigerants

- Carbon Dioxide (CO2)

- Ammonia (NH3)

- Others

- Canada Commercial Refrigeration Equipment Market, By Distribution Channel

- OEMs (Original Equipment Manufacturers)

- Distributors and Wholesalers

- Retailers

- Europe

- Europe Commercial Refrigeration Equipment Market, By Product

- Transportation Refrigeration Equipment

- Trailers

- Trucks

- Shipping Containers

- Refrigerators & Freezers

- Walk-in-Refrigerators

- Reach-in Refrigerators

- Chest

- Beverage Refrigeration

- Display Showcases

- Ice Cream Cabinets

- Bakery/Deli Display

- Others

- Ice Merchandisers & Ice Vending Equipment

- Other Equipment

- Europe Commercial Refrigeration Equipment Market, By System Type

- Self-contained

- Remotely Operated

- Europe Commercial Refrigeration Equipment Market, By Capacity

- Less than 50 cu. Ft

- 50 to 100 cu. Ft

- More than 100 cu. Ft

- Europe Commercial Refrigeration Equipment Market, By Application

- Food Service

- Food & Beverage Retail

- Hypermarkets

- Supermarkets

- Convenience Store

- Specialty Food Store

- Others

- Hotels and Hospitality

- Pharmaceuticals

- Healthcare

- Biotechnology

- Chemicals

- Others

- Europe Commercial Refrigeration Equipment Market, By Refrigerant

- Synthetic Refrigerants (HFCs, HCFCs)

- Natural Refrigerants

- Carbon Dioxide (CO2)

- Ammonia (NH3)

- Others

- Europe Commercial Refrigeration Equipment Market, By Distribution Channel

- OEMs (Original Equipment Manufacturers)

- Distributors and Wholesalers

- Retailers

- Germany

- Germany Commercial Refrigeration Equipment Market, By Product

- Transportation Refrigeration Equipment

- Trailers

- Trucks

- Shipping Containers

- Refrigerators & Freezers

- Walk-in-Refrigerators

- Reach-in Refrigerators

- Chest

- Beverage Refrigeration

- Display Showcases

- Ice Cream Cabinets

- Bakery/Deli Display

- Others

- Ice Merchandisers & Ice Vending Equipment

- Other Equipment

- Germany Commercial Refrigeration Equipment Market, By System Type

- Self-contained

- Remotely Operated

- Germany Commercial Refrigeration Equipment Market, By Capacity

- Less than 50 cu. Ft

- 50 to 100 cu. Ft

- More than 100 cu. Ft

- Germany Commercial Refrigeration Equipment Market, By Application

- Food Service

- Food & Beverage Retail

- Hypermarkets

- Supermarkets

- Convenience Store

- Specialty Food Store

- Others

- Hotels and Hospitality

- Pharmaceuticals

- Healthcare

- Biotechnology

- Chemicals

- Others

- Germany Commercial Refrigeration Equipment Market, By Refrigerant

- Synthetic Refrigerants (HFCs, HCFCs)

- Natural Refrigerants

- Carbon Dioxide (CO2)

- Ammonia (NH3)

- Others

- Germany Commercial Refrigeration Equipment Market, By Distribution Channel

- OEMs (Original Equipment Manufacturers)

- Distributors and Wholesalers

- Retailers

- U.K.

- U.K. Commercial Refrigeration Equipment Market, By Product

- Transportation Refrigeration Equipment

- Trailers

- Trucks

- Shipping Containers

- Refrigerators & Freezers

- Walk-in-Refrigerators

- Reach-in Refrigerators

- Chest

- Beverage Refrigeration

- Display Showcases

- Ice Cream Cabinets

- Bakery/Deli Display

- Others

- Ice Merchandisers & Ice Vending Equipment

- Other Equipment

- U.K. Commercial Refrigeration Equipment Market, By System Type

- Self-contained

- Remotely Operated

- U.K. Commercial Refrigeration Equipment Market, By Capacity

- Less than 50 cu. Ft

- 50 to 100 cu. Ft

- More than 100 cu. Ft

- U.K. Commercial Refrigeration Equipment Market, By Application

- Food Service

- Food & Beverage Retail

- Hypermarkets

- Supermarkets

- Convenience Store

- Specialty Food Store

- Others

- Hotels and Hospitality

- Pharmaceuticals

- Healthcare

- Biotechnology

- Chemicals

- Others

- U.K. Commercial Refrigeration Equipment Market, By Refrigerant

- Synthetic Refrigerants (HFCs, HCFCs)

- Natural Refrigerants

- Carbon Dioxide (CO2)

- Ammonia (NH3)

- Others

- U.K. Commercial Refrigeration Equipment Market, By Distribution Channel

- OEMs (Original Equipment Manufacturers)

- Distributors and Wholesalers

- Retailers

- France

- France Commercial Refrigeration Equipment Market, By Product

- Transportation Refrigeration Equipment

- Trailers

- Trucks

- Shipping Containers

- Refrigerators & Freezers

- Walk-in-Refrigerators

- Reach-in Refrigerators

- Chest

- Beverage Refrigeration

- Display Showcases

- Ice Cream Cabinets

- Bakery/Deli Display

- Others

- Ice Merchandisers & Ice Vending Equipment

- Other Equipment

- France Commercial Refrigeration Equipment Market, By System Type

- Self-contained

- Remotely Operated

- France Commercial Refrigeration Equipment Market, By Capacity

- Less than 50 cu. Ft

- 50 to 100 cu. Ft

- More than 100 cu. Ft

- France Commercial Refrigeration Equipment Market, By Application

- Food Service

- Food & Beverage Retail

- Hypermarkets

- Supermarkets

- Convenience Store

- Specialty Food Store

- Others

- Hotels and Hospitality

- Pharmaceuticals

- Healthcare

- Biotechnology

- Chemicals

- Others

- France Commercial Refrigeration Equipment Market, By Refrigerant

- Synthetic Refrigerants (HFCs, HCFCs)

- Natural Refrigerants

- Carbon Dioxide (CO2)

- Ammonia (NH3)

- Others

- France Commercial Refrigeration Equipment Market, By Distribution Channel

- OEMs (Original Equipment Manufacturers)

- Distributors and Wholesalers

- Retailers

- Italy

- Italy Commercial Refrigeration Equipment Market, By Product

- Transportation Refrigeration Equipment

- Trailers

- Trucks

- Shipping Containers

- Refrigerators & Freezers

- Walk-in-Refrigerators

- Reach-in Refrigerators

- Chest

- Beverage Refrigeration

- Display Showcases

- Ice Cream Cabinets

- Bakery/Deli Display

- Others

- Ice Merchandisers & Ice Vending Equipment

- Other Equipment

- Italy Commercial Refrigeration Equipment Market, By System Type

- Self-contained

- Remotely Operated

- Italy Commercial Refrigeration Equipment Market, By Capacity

- Less than 50 cu. Ft

- 50 to 100 cu. Ft

- More than 100 cu. Ft

- Italy Commercial Refrigeration Equipment Market, By Application

- Food Service

- Food & Beverage Retail

- Hypermarkets

- Supermarkets

- Convenience Store

- Specialty Food Store

- Others

- Hotels and Hospitality

- Pharmaceuticals

- Healthcare

- Biotechnology

- Chemicals

- Others

- Italy Commercial Refrigeration Equipment Market, By Refrigerant

- Synthetic Refrigerants (HFCs, HCFCs)

- Natural Refrigerants

- Carbon Dioxide (CO2)

- Ammonia (NH3)

- Others

- Italy Commercial Refrigeration Equipment Market, By Distribution Channel

- OEMs (Original Equipment Manufacturers)

- Distributors and Wholesalers

- Retailers

- Spain

- Spain Commercial Refrigeration Equipment Market, By Product

- Transportation Refrigeration Equipment

- Trailers

- Trucks

- Shipping Containers

- Refrigerators & Freezers

- Walk-in-Refrigerators

- Reach-in Refrigerators

- Chest

- Beverage Refrigeration

- Display Showcases

- Ice Cream Cabinets

- Bakery/Deli Display

- Others

- Ice Merchandisers & Ice Vending Equipment

- Other Equipment

- Spain Commercial Refrigeration Equipment Market, By System Type

- Self-contained

- Remotely Operated

- Spain Commercial Refrigeration Equipment Market, By Capacity

- Less than 50 cu. Ft

- 50 to 100 cu. Ft

- More than 100 cu. Ft

- Spain Commercial Refrigeration Equipment Market, By Application

- Food Service

- Food & Beverage Retail

- Hypermarkets

- Supermarkets

- Convenience Store

- Specialty Food Store

- Others

- Hotels and Hospitality

- Pharmaceuticals

- Healthcare

- Biotechnology

- Chemicals

- Others

- Spain Commercial Refrigeration Equipment Market, By Refrigerant

- Synthetic Refrigerants (HFCs, HCFCs)

- Natural Refrigerants

- Carbon Dioxide (CO2)

- Ammonia (NH3)

- Others

- Spain Commercial Refrigeration Equipment Market, By Distribution Channel

- OEMs (Original Equipment Manufacturers)

- Distributors and Wholesalers

- Retailers

- Asia Pacific

- Asia Pacific Commercial Refrigeration Equipment Market, By Product

- Transportation Refrigeration Equipment

- Trailers

- Trucks

- Shipping Containers

- Refrigerators & Freezers

- Walk-in-Refrigerators

- Reach-in Refrigerators

- Chest

- Beverage Refrigeration

- Display Showcases

- Ice Cream Cabinets

- Bakery/Deli Display

- Others

- Ice Merchandisers & Ice Vending Equipment

- Other Equipment

- Asia Pacific Commercial Refrigeration Equipment Market, By System Type

- Self-contained

- Remotely Operated

- Asia Pacific Commercial Refrigeration Equipment Market, By Capacity

- Less than 50 cu. Ft

- 50 to 100 cu. Ft

- More than 100 cu. Ft

- Asia Pacific Commercial Refrigeration Equipment Market, By Application

- Food Service

- Food & Beverage Retail

- Hypermarkets

- Supermarkets

- Convenience Store

- Specialty Food Store

- Others

- Hotels and Hospitality

- Pharmaceuticals

- Healthcare

- Biotechnology

- Chemicals

- Others

- Asia Pacific Commercial Refrigeration Equipment Market, By Refrigerant

- Synthetic Refrigerants (HFCs, HCFCs)

- Natural Refrigerants

- Carbon Dioxide (CO2)

- Ammonia (NH3)

- Others

- Asia Pacific Commercial Refrigeration Equipment Market, By Distribution Channel

- OEMs (Original Equipment Manufacturers)

- Distributors and Wholesalers

- Retailers

- China

- China Commercial Refrigeration Equipment Market, By Product

- Transportation Refrigeration Equipment

- Trailers

- Trucks

- Shipping Containers

- Refrigerators & Freezers

- Walk-in-Refrigerators

- Reach-in Refrigerators

- Chest

- Beverage Refrigeration

- Display Showcases

- Ice Cream Cabinets

- Bakery/Deli Display

- Others

- Ice Merchandisers & Ice Vending Equipment

- Other Equipment

- China Commercial Refrigeration Equipment Market, By System Type

- Self-contained

- Remotely Operated

- China Commercial Refrigeration Equipment Market, By Capacity

- Less than 50 cu. Ft

- 50 to 100 cu. Ft

- More than 100 cu. Ft

- China Commercial Refrigeration Equipment Market, By Application

- Food Service

- Food & Beverage Retail

- Hypermarkets

- Supermarkets

- Convenience Store

- Specialty Food Store

- Others

- Hotels and Hospitality

- Pharmaceuticals

- Healthcare

- Biotechnology

- Chemicals

- Others

- China Commercial Refrigeration Equipment Market, By Refrigerant

- Synthetic Refrigerants (HFCs, HCFCs)

- Natural Refrigerants

- Carbon Dioxide (CO2)

- Ammonia (NH3)

- Others

- China Commercial Refrigeration Equipment Market, By Distribution Channel

- OEMs (Original Equipment Manufacturers)

- Distributors and Wholesalers

- Retailers

- Japan

- Japan Commercial Refrigeration Equipment Market, By Product

- Transportation Refrigeration Equipment

- Trailers

- Trucks

- Shipping Containers

- Refrigerators & Freezers

- Walk-in-Refrigerators

- Reach-in Refrigerators

- Chest

- Beverage Refrigeration

- Display Showcases

- Ice Cream Cabinets

- Bakery/Deli Display

- Others

- Ice Merchandisers & Ice Vending Equipment

- Other Equipment

- Japan Commercial Refrigeration Equipment Market, By System Type

- Self-contained

- Remotely Operated

- Japan Commercial Refrigeration Equipment Market, By Capacity

- Less than 50 cu. Ft

- 50 to 100 cu. Ft

- More than 100 cu. Ft

- Japan Commercial Refrigeration Equipment Market, By Application

- Food Service

- Food & Beverage Retail

- Hypermarkets

- Supermarkets

- Convenience Store

- Specialty Food Store

- Others

- Hotels and Hospitality

- Pharmaceuticals

- Healthcare

- Biotechnology

- Chemicals

- Others

- Japan Commercial Refrigeration Equipment Market, By Refrigerant

- Synthetic Refrigerants (HFCs, HCFCs)

- Natural Refrigerants

- Carbon Dioxide (CO2)

- Ammonia (NH3)

- Others

- Japan Commercial Refrigeration Equipment Market, By Distribution Channel

- OEMs (Original Equipment Manufacturers)

- Distributors and Wholesalers

- Retailers

- India

- India Commercial Refrigeration Equipment Market, By Product

- Transportation Refrigeration Equipment

- Trailers

- Trucks

- Shipping Containers

- Refrigerators & Freezers

- Walk-in-Refrigerators

- Reach-in Refrigerators

- Chest

- Beverage Refrigeration

- Display Showcases

- Ice Cream Cabinets

- Bakery/Deli Display

- Others

- Ice Merchandisers & Ice Vending Equipment

- Other Equipment

- India Commercial Refrigeration Equipment Market, By System Type

- Self-contained

- Remotely Operated

- India Commercial Refrigeration Equipment Market, By Capacity

- Less than 50 cu. Ft

- 50 to 100 cu. Ft

- More than 100 cu. Ft

- India Commercial Refrigeration Equipment Market, By Application

- Food Service

- Food & Beverage Retail

- Hypermarkets

- Supermarkets

- Convenience Store

- Specialty Food Store

- Others

- Hotels and Hospitality

- Pharmaceuticals

- Healthcare

- Biotechnology

- Chemicals

- Others

- India Commercial Refrigeration Equipment Market, By Refrigerant

- Synthetic Refrigerants (HFCs, HCFCs)

- Natural Refrigerants

- Carbon Dioxide (CO2)

- Ammonia (NH3)

- Others

- India Commercial Refrigeration Equipment Market, By Distribution Channel

- OEMs (Original Equipment Manufacturers)

- Distributors and Wholesalers

- Retailers

- Australia

- Australia Commercial Refrigeration Equipment Market, By Product

- Transportation Refrigeration Equipment

- Trailers

- Trucks

- Shipping Containers

- Refrigerators & Freezers

- Walk-in-Refrigerators

- Reach-in Refrigerators

- Chest

- Beverage Refrigeration

- Display Showcases

- Ice Cream Cabinets

- Bakery/Deli Display

- Others

- Ice Merchandisers & Ice Vending Equipment

- Other Equipment

- Australia Commercial Refrigeration Equipment Market, By System Type

- Self-contained

- Remotely Operated

- Australia Commercial Refrigeration Equipment Market, By Capacity

- Less than 50 cu. Ft

- 50 to 100 cu. Ft

- More than 100 cu. Ft

- Australia Commercial Refrigeration Equipment Market, By Application

- Food Service

- Food & Beverage Retail

- Hypermarkets

- Supermarkets

- Convenience Store

- Specialty Food Store

- Others

- Hotels and Hospitality

- Pharmaceuticals

- Healthcare

- Biotechnology

- Chemicals

- Others

- Australia Commercial Refrigeration Equipment Market, By Refrigerant

- Synthetic Refrigerants (HFCs, HCFCs)

- Natural Refrigerants

- Carbon Dioxide (CO2)

- Ammonia (NH3)

- Others

- Australia Commercial Refrigeration Equipment Market, By Distribution Channel

- OEMs (Original Equipment Manufacturers)

- Distributors and Wholesalers

- Retailers

- South Korea

- South Korea Commercial Refrigeration Equipment Market, By Product

- Transportation Refrigeration Equipment

- Trailers

- Trucks

- Shipping Containers

- Refrigerators & Freezers

- Walk-in-Refrigerators

- Reach-in Refrigerators

- Chest

- Beverage Refrigeration

- Display Showcases

- Ice Cream Cabinets

- Bakery/Deli Display

- Others

- Ice Merchandisers & Ice Vending Equipment

- Other Equipment

- South Korea Commercial Refrigeration Equipment Market, By System Type

- Self-contained

- Remotely Operated

- South Korea Commercial Refrigeration Equipment Market, By Capacity

- Less than 50 cu. Ft

- 50 to 100 cu. Ft

- More than 100 cu. Ft

- South Korea Commercial Refrigeration Equipment Market, By Application

- Food Service

- Food & Beverage Retail

- Hypermarkets

- Supermarkets

- Convenience Store

- Specialty Food Store

- Others

- Hotels and Hospitality

- Pharmaceuticals

- Healthcare

- Biotechnology

- Chemicals

- Others

- South Korea Commercial Refrigeration Equipment Market, By Refrigerant

- Synthetic Refrigerants (HFCs, HCFCs)

- Natural Refrigerants

- Carbon Dioxide (CO2)

- Ammonia (NH3)

- Others

- South Korea Commercial Refrigeration Equipment Market, By Distribution Channel

- OEMs (Original Equipment Manufacturers)

- Distributors and Wholesalers

- Retailers

- Latin America

- Latin America Commercial Refrigeration Equipment Market, By Product

- Transportation Refrigeration Equipment

- Trailers

- Trucks

- Shipping Containers

- Refrigerators & Freezers

- Walk-in-Refrigerators

- Reach-in Refrigerators

- Chest

- Beverage Refrigeration

- Display Showcases

- Ice Cream Cabinets

- Bakery/Deli Display

- Others

- Ice Merchandisers & Ice Vending Equipment

- Other Equipment

- Latin America Commercial Refrigeration Equipment Market, By System Type

- Self-contained

- Remotely Operated

- Latin America Commercial Refrigeration Equipment Market, By Capacity

- Less than 50 cu. Ft

- 50 to 100 cu. Ft

- More than 100 cu. Ft

- Latin America Commercial Refrigeration Equipment Market, By Application

- Food Service

- Food & Beverage Retail

- Hypermarkets

- Supermarkets

- Convenience Store

- Specialty Food Store

- Others

- Hotels and Hospitality

- Pharmaceuticals

- Healthcare

- Biotechnology

- Chemicals

- Others

- Latin America Commercial Refrigeration Equipment Market, By Refrigerant

- Synthetic Refrigerants (HFCs, HCFCs)

- Natural Refrigerants

- Carbon Dioxide (CO2)

- Ammonia (NH3)

- Others

- Latin America Commercial Refrigeration Equipment Market, By Distribution Channel

- OEMs (Original Equipment Manufacturers)

- Distributors and Wholesalers

- Retailers

- Brazil

- Brazil Commercial Refrigeration Equipment Market, By Product

- Transportation Refrigeration Equipment

- Trailers

- Trucks

- Shipping Containers

- Refrigerators & Freezers

- Walk-in-Refrigerators

- Reach-in Refrigerators

- Chest

- Beverage Refrigeration

- Display Showcases

- Ice Cream Cabinets

- Bakery/Deli Display

- Others

- Ice Merchandisers & Ice Vending Equipment

- Other Equipment

- Brazil Commercial Refrigeration Equipment Market, By System Type

- Self-contained

- Remotely Operated

- Brazil Commercial Refrigeration Equipment Market, By Capacity

- Less than 50 cu. Ft

- 50 to 100 cu. Ft

- More than 100 cu. Ft

- Brazil Commercial Refrigeration Equipment Market, By Application

- Food Service

- Food & Beverage Retail

- Hypermarkets

- Supermarkets

- Convenience Store

- Specialty Food Store

- Others

- Hotels and Hospitality

- Pharmaceuticals

- Healthcare

- Biotechnology

- Chemicals

- Others

- Brazil Commercial Refrigeration Equipment Market, By Refrigerant

- Synthetic Refrigerants (HFCs, HCFCs)

- Natural Refrigerants

- Carbon Dioxide (CO2)

- Ammonia (NH3)

- Others

- Brazil Commercial Refrigeration Equipment Market, By Distribution Channel

- OEMs (Original Equipment Manufacturers)

- Distributors and Wholesalers

- Retailers

- Mexico

- Mexico Commercial Refrigeration Equipment Market, By Product

- Transportation Refrigeration Equipment

- Trailers

- Trucks

- Shipping Containers

- Refrigerators & Freezers

- Walk-in-Refrigerators

- Reach-in Refrigerators

- Chest

- Beverage Refrigeration

- Display Showcases

- Ice Cream Cabinets

- Bakery/Deli Display

- Others

- Ice Merchandisers & Ice Vending Equipment

- Other Equipment

- Mexico Commercial Refrigeration Equipment Market, By System Type

- Self-contained

- Remotely Operated

- Mexico Commercial Refrigeration Equipment Market, By Capacity

- Less than 50 cu. Ft

- 50 to 100 cu. Ft

- More than 100 cu. Ft

- Mexico Commercial Refrigeration Equipment Market, By Application

- Food Service

- Food & Beverage Retail

- Hypermarkets

- Supermarkets

- Convenience Store

- Specialty Food Store

- Others

- Hotels and Hospitality

- Pharmaceuticals

- Healthcare

- Biotechnology

- Chemicals

- Others

- Mexico Commercial Refrigeration Equipment Market, By Refrigerant

- Synthetic Refrigerants (HFCs, HCFCs)

- Natural Refrigerants

- Carbon Dioxide (CO2)

- Ammonia (NH3)

- Others

- Mexico Commercial Refrigeration Equipment Market, By Distribution Channel

- OEMs (Original Equipment Manufacturers)

- Distributors and Wholesalers

- Retailers

- Middle East & Africa

- Middle East & Africa Commercial Refrigeration Equipment Market, By Product

- Transportation Refrigeration Equipment

- Trailers

- Trucks

- Shipping Containers

- Refrigerators & Freezers

- Walk-in-Refrigerators

- Reach-in Refrigerators

- Chest

- Beverage Refrigeration

- Display Showcases

- Ice Cream Cabinets

- Bakery/Deli Display

- Others

- Ice Merchandisers & Ice Vending Equipment

- Other Equipment

- Middle East & Africa Commercial Refrigeration Equipment Market, By System Type

- Self-contained

- Remotely Operated

- Middle East & Africa Commercial Refrigeration Equipment Market, By Capacity

- Less than 50 cu. Ft

- 50 to 100 cu. Ft

- More than 100 cu. Ft

- Middle East & Africa Commercial Refrigeration Equipment Market, By Application

- Food Service

- Food & Beverage Retail

- Hypermarkets

- Supermarkets

- Convenience Store

- Specialty Food Store

- Others

- Hotels and Hospitality

- Pharmaceuticals

- Healthcare

- Biotechnology

- Chemicals

- Others

- Middle East & Africa Commercial Refrigeration Equipment Market, By Refrigerant

- Synthetic Refrigerants (HFCs, HCFCs)

- Natural Refrigerants

- Carbon Dioxide (CO2)

- Ammonia (NH3)

- Others

- Middle East & Africa Commercial Refrigeration Equipment Market, By Distribution Channel

- OEMs (Original Equipment Manufacturers)

- Distributors and Wholesalers

- Retailers

- Saudi Arabia

- Saudi Arabia Commercial Refrigeration Equipment Market, By Product

- Transportation Refrigeration Equipment

- Trailers

- Trucks

- Shipping Containers

- Refrigerators & Freezers

- Walk-in-Refrigerators

- Reach-in Refrigerators

- Chest

- Beverage Refrigeration

- Display Showcases

- Ice Cream Cabinets

- Bakery/Deli Display

- Others

- Ice Merchandisers & Ice Vending Equipment

- Other Equipment

- Saudi Arabia Commercial Refrigeration Equipment Market, By System Type

- Self-contained

- Remotely Operated

- Saudi Arabia Commercial Refrigeration Equipment Market, By Capacity

- Less than 50 cu. Ft

- 50 to 100 cu. Ft

- More than 100 cu. Ft

- Saudi Arabia Commercial Refrigeration Equipment Market, By Application

- Food Service

- Food & Beverage Retail

- Hypermarkets

- Supermarkets

- Convenience Store

- Specialty Food Store

- Others

- Hotels and Hospitality

- Pharmaceuticals

- Healthcare

- Biotechnology

- Chemicals

- Others

- Saudi Arabia Commercial Refrigeration Equipment Market, By Refrigerant

- Synthetic Refrigerants (HFCs, HCFCs)

- Natural Refrigerants

- Carbon Dioxide (CO2)

- Ammonia (NH3)

- Others

- Saudi Arabia Commercial Refrigeration Equipment Market, By Distribution Channel

- OEMs (Original Equipment Manufacturers)

- Distributors and Wholesalers

- Retailers

- South Africa

- South Africa Commercial Refrigeration Equipment Market, By Product

- Transportation Refrigeration Equipment

- Trailers

- Trucks

- Shipping Containers

- Refrigerators & Freezers

- Walk-in-Refrigerators

- Reach-in Refrigerators

- Chest

- Beverage Refrigeration

- Display Showcases

- Ice Cream Cabinets

- Bakery/Deli Display

- Others

- Ice Merchandisers & Ice Vending Equipment

- Other Equipment

- South Africa Commercial Refrigeration Equipment Market, By System Type

- Self-contained

- Remotely Operated

- South Africa Commercial Refrigeration Equipment Market, By Capacity

- Less than 50 cu. Ft

- 50 to 100 cu. Ft

- More than 100 cu. Ft

- South Africa Commercial Refrigeration Equipment Market, By Application

- Food Service

- Food & Beverage Retail

- Hypermarkets

- Supermarkets

- Convenience Store

- Specialty Food Store

- Others

- Hotels and Hospitality

- Pharmaceuticals

- Healthcare

- Biotechnology

- Chemicals

- Others

- South Africa Commercial Refrigeration Equipment Market, By Refrigerant

- Synthetic Refrigerants (HFCs, HCFCs)

- Natural Refrigerants

- Carbon Dioxide (CO2)

- Ammonia (NH3)

- Others

- South Africa Commercial Refrigeration Equipment Market, By Distribution Channel

- OEMs (Original Equipment Manufacturers)

- Distributors and Wholesalers

- Retailers

- North America

Commercial Refrigeration Equipment Market Dynamics

Driver: Technological Advancements And Need For Energy Efficient Refrigerators

Improvements in technology has allowed manufacturers to build energy-efficient commercial refrigerators. Regulations regarding low energy consumption is driving the adoption of such smart equipment as they allow comprehensive computation of energy consumption. The emergence of low-voltage equipment that consumes minimal electricity is anticipated to drive the market for commercial refrigerators globally. Incorporating refrigerants in the refrigeration systems with high global warming potential has become a matter of concern for the manufacturers. Reduced emission of hazardous gases and decreased operational costs are certain other factors propelling such green technologies' demand over conventional cooling systems.

Driver: Shifting Trend In Food Consumption Habits

Shifting trend in food consumption habits have resulted in considerable changes in food consumption over the past few years. Improvement in the food supply chain accompanied by economic development and gradual elimination of dietary deficiencies have drastically changed consumption patterns. The rapidly growing frozen foods market is also expected to fuel the commercial refrigeration demand. Consumers today are adopting quick meals as an alternative to cooking at home and dining out, due to which, fast food restaurants are anticipated to substantially grow over the forecast period. This is further expected to favorably impact market demand for commercial refrigeration equipment over the forecast period.

Restraint: High Maintenance Cost Of Contemporary Devices

Major companies invest heavily in technological advancements and research & development of the product, which increases the prices of the appliances equipped with advanced technology. High maintenance cost of contemporary devices is major challenge to the market. Internet of Things (IoT) enabled commercial refrigerators are more expensive than the conventional ones. These refrigerators require frequent maintenance and replacement of worn-out parts. The investment cost, which includes purchase, installation, and accessories, is also higher, which may inhibit the consumers, with a low budget, from buying them. High initial and maintenance costs of these appliances may restrict the market growth over the forecast period.

What Does This Report Include?

This section will provide insights into the contents included in this commercial refrigeration equipment market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Commercial refrigeration equipment market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Commercial refrigeration equipment market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the commercial refrigeration equipment market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for commercial refrigeration equipment market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of commercial refrigeration equipment market data depending on the type of information we’re trying to uncover in our research.

-