- Home

- »

- Electronic & Electrical

- »

-

Commercial Vacuum Cleaner Market Size Report, 2030GVR Report cover

![Commercial Vacuum Cleaner Market Size, Share & Trends Report]()

Commercial Vacuum Cleaner Market (2025 - 2030) Size, Share & Trends Analysis Report By Power Source (Corded, Cordless), By Product (Upright, Canister, Robotic), By End Use, By Distribution, By Region, Segment Forecasts

- Report ID: GVR-4-68040-577-4

- Number of Report Pages: 378

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Commercial Vacuum Cleaner Market Trends

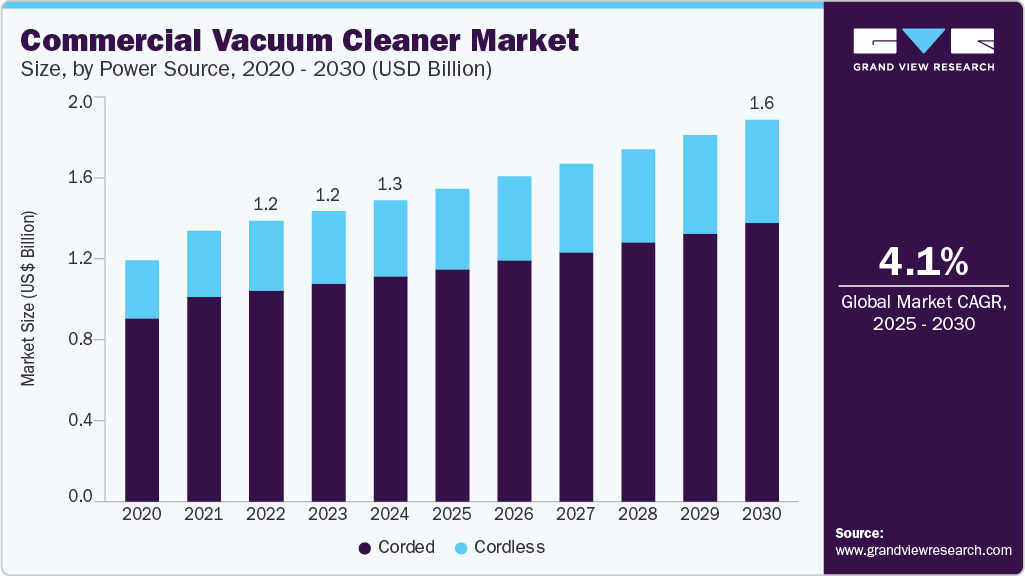

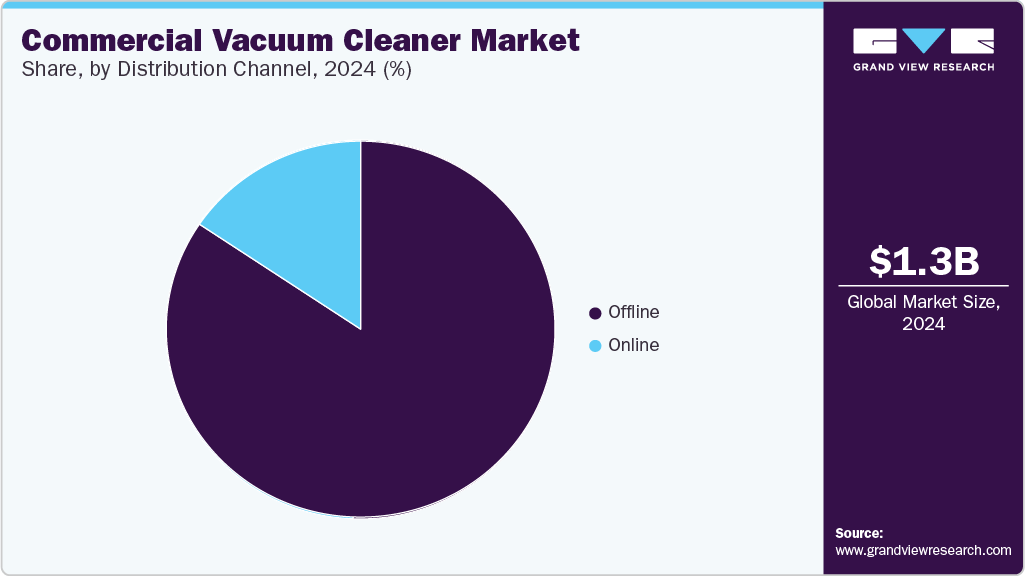

The global commercial vacuum cleaner market size was estimated at USD 1.30 billion in 2024 and is projected to grow at a CAGR of 4.1% from 2025 to 2030. As businesses increasingly focus on maintaining clean and hygienic environments, the need for advanced, high-performance vacuum cleaners continues to rise.

Key Highlights:

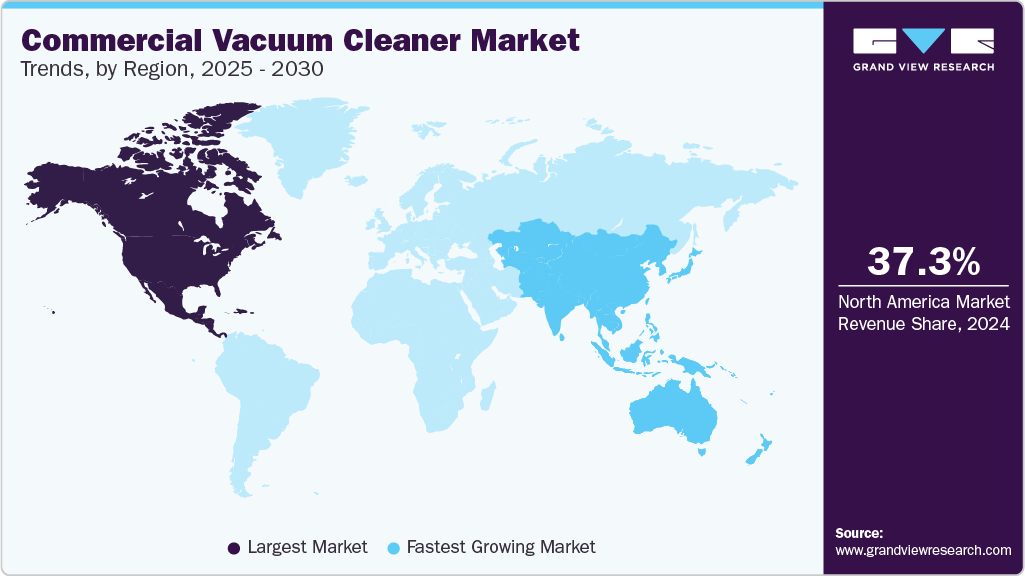

- North America dominated the commercial vacuum cleaner market with the largest revenue share of 37.3% in 2024.

- The commercial vacuum cleaner market in the U.S. accounted for the largest market revenue share of 89.4% in North America in 2024.

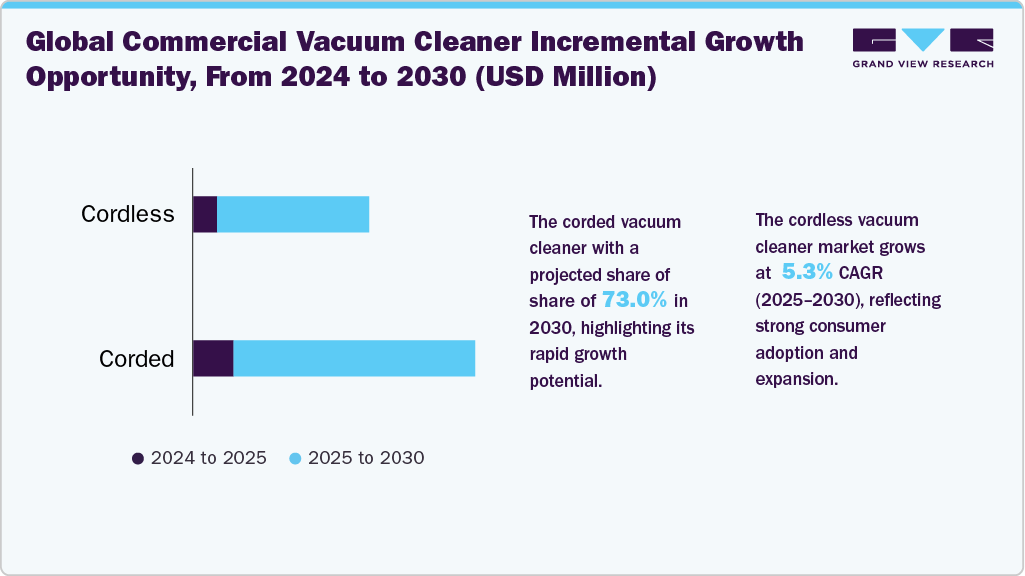

- By power source, the corded segment led the market with the largest revenue share of 74.7% in 2024.

- By product, the upright vacuum cleaners market led the market with the largest revenue share of 26.9% in 2024.

- By end use, the cleaning service providers segment led the market with the largest revenue share of 33.4% in 2024.

The expansion of the contract cleaning industry, rapid infrastructure development in emerging economies, and growing e-commerce adoption for B2B procurement also significantly contribute to market growth.

The commercial cleaner industry is being propelled by the expansion of sectors such as hospitality, healthcare, retail, and transportation, where maintaining cleanliness and hygiene standards is critical. Increasing regulations and compliance requirements related to sanitation in commercial spaces have further intensified demand. Moreover, the rise of outsourcing cleaning services and the need for specialized solutions for large-scale or high-traffic areas have created opportunities for innovation and product diversification in the commercial cleaning industry.

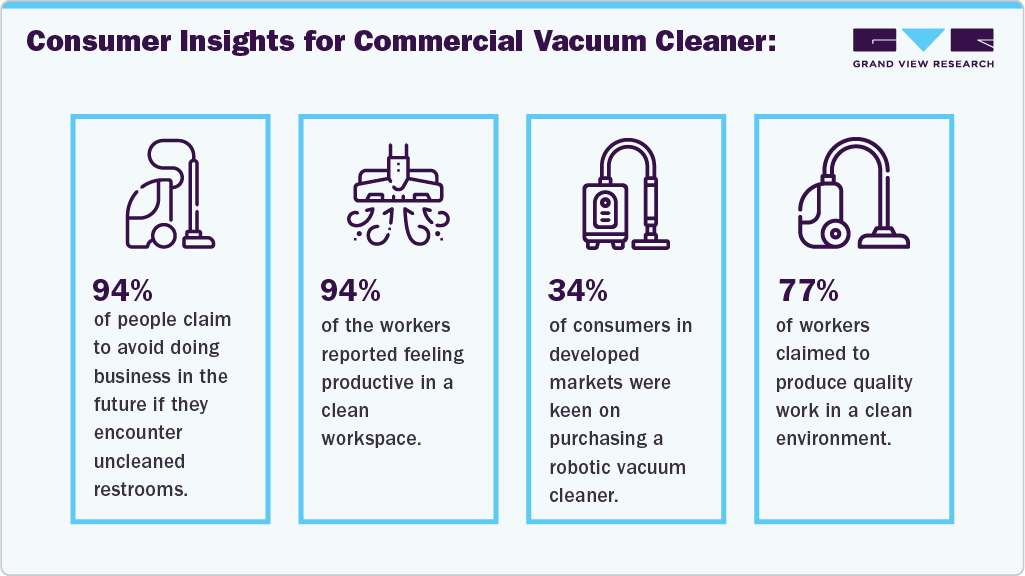

Source: International Sanitary Supply Association (ISSA) and Staples survey data

According to the data published in January 2025, entertainment & leisure facilities prefer using backpack dry & wet vacuum cleaners as they offer versatility, portability, and convenience to clean each row of the cinema hall, ensuring mobility to the staff while cleaning the space. In these sectors, backpack vacuums, canister vacuums, and upright models with HEPA filters and multi-surface compatibility are typically the most effective solutions.

According to the data published in September 2024, commercial space cleaning has a direct impact on employees, boosting their productivity. Regular maintenance and cleanliness improve the office environment, assure zero allergens, boost employee morale, enhance work satisfaction, and reduce stress. According to a study by the University of Arizona, observed cleanliness in workspaces enhanced productivity by 15% by curtailing absenteeism. Companies such as Alfred Kärcher SE & Co. KG offer powerful vacuum cleaners such as Industrial vacuum IVR 40/30 Sc, and IVR 40/30 Sc M ACD, suitable for fine and combustible dusts in non-explosive production areas.

According to the data published in December 2022, out of over 5,000 consumers surveyed in Europe and North America, 28% indicated a preference for a high-quality refurbished item over a brand-new product of lower quality.

Moreover, according to the data published in October 2022, O2 Telefónica equipped Nexaro robotic commercial cleaners with IoT connectivity for every NR 1500 model of robot vacuum cleaners.

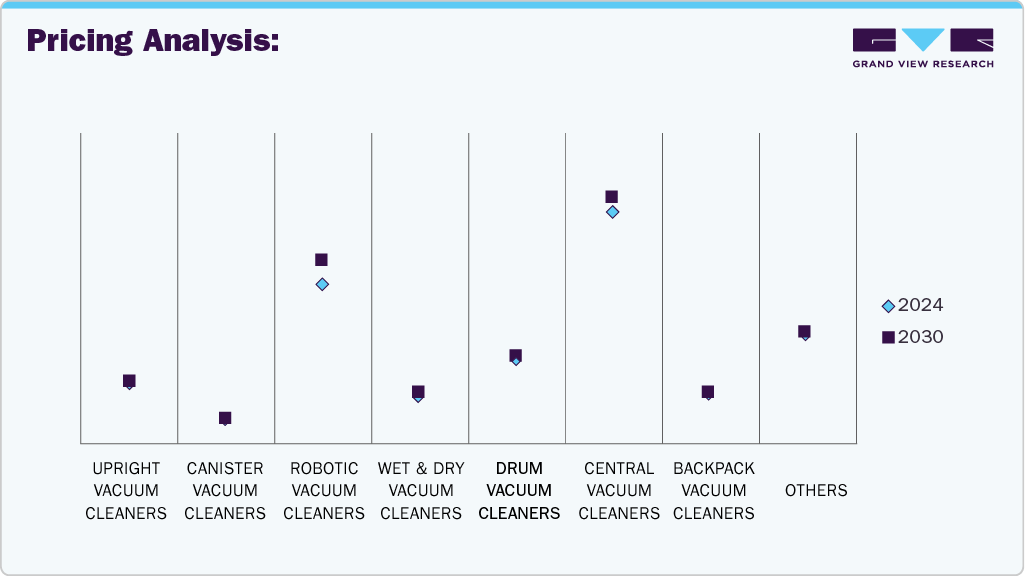

The global commercial vacuum cleaner industry is expected to experience steady growth across all major product segments between 2024 and 2030. Central vacuum cleaners hold the largest market value, reflecting their widespread use in large commercial and industrial facilities due to their powerful suction and convenience. Robotic vacuum cleaners are also projected to see significant growth, driven by increasing adoption of automation and smart technologies that reduce labor costs and improve cleaning efficiency. Other segments, such as upright, drum, wet & dry, backpack, and canister vacuum cleaners, are expected to grow moderately, supported by demand for versatile and specialized cleaning solutions in various commercial environments.

The “others” category, which includes handheld and stick vacuums, maintains a substantial market presence due to their portability and ease of use for spot cleaning. Overall, technological advancements, rising hygiene standards, and expanding commercial infrastructure globally are key factors fueling the gradual increase in market value across all product types.

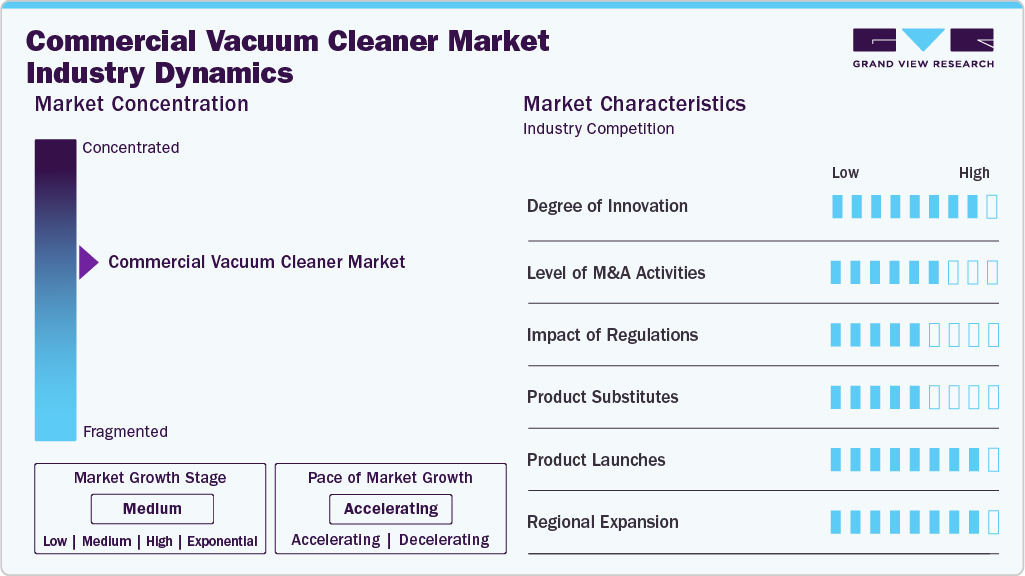

Market Concentration & Characteristics

The commercial vacuum cleaner industry is experiencing significant innovation driven by demand for efficient, technologically advanced cleaning solutions across industries such as healthcare, hospitality, manufacturing, and retail. Leading companies focus on integrating smart technologies like AI, IoT, and advanced filtration systems, including HEPA filters, to improve cleaning performance, indoor air quality, and user convenience. For example, robotic vacuum cleaners equipped with LIDAR technology enable precise, autonomous cleaning in complex environments, enhancing operational efficiency.

Mergers and acquisitions are moderately active in this market as major players seek to broaden product portfolios, enhance manufacturing capabilities, and enter emerging markets. Strategic partnerships between equipment manufacturers and distributors help companies expand their reach and offer comprehensive solutions tailored to specific industrial needs. These consolidation efforts also accelerate innovation by combining technological expertise and resources.

Regulatory frameworks vary by region but generally emphasize safety, energy efficiency, and environmental sustainability. Compliance with noise standards and eco-friendly material use is increasingly important, prompting manufacturers to develop lightweight, low-noise, and energy-saving vacuum cleaners. Certifications such as HEPA filtration performance are critical for applications in sensitive sectors like pharmaceuticals and healthcare.

Competition arises from substitutes such as automated floor scrubbers and manual cleaning tools, but commercial vacuum cleaners remain preferred for their versatility and effectiveness. End Uses include hospitals, manufacturing plants, offices, and public facilities, with growing demand for cordless, robotic, and multi-surface models that reduce labor costs and improve hygiene standards. This diverse customer base drives continuous product innovation and market growth.

Power Source Insights

The corded segment led the market with the largest revenue share of 74.7% in 2024. The market for corded (AC power) commercial vacuum cleaners is growing steadily, largely due to their reliability and suitability for large-scale cleaning tasks. One of the primary drivers of this demand is the uninterrupted power supply offered by corded models, which makes them ideal for extended use in environments such as hotels, hospitals, schools, and airports. Unlike battery-powered alternatives, corded vacuum cleaners do not require recharging, allowing for continuous operation and eliminating downtime, a crucial advantage for cleaning crews working within tight schedules.

The cordless commercial vacuum cleaner segment is projected to grow at the fastest CAGR of 5.3% from 2025 to 2030. A major driver behind their adoption is the increased focus on safety and reduced workplace hazards. Cordless vacuums eliminate the risk of people tripping over cords, which is especially important in public or high-traffic venues such as healthcare facilities, schools, and shopping centres. This has made them a go-to choice for businesses prioritising both operational effectiveness and employee/public safety. Technological advancements in lithium-ion batteries have also made a significant impact. Modern cordless commercial vacuums now offer improved battery life, stronger suction power, and faster charging. As a result, the performance gap between cordless and corded models has narrowed considerably, making cordless vacuums a practical solution for deep and daily cleaning needs.

Product Insights

The upright vacuum cleaners market led the market with the largest revenue share of 26.9% in 2024. The increasing demand for efficient and versatile cleaning solutions in commercial spaces such as offices, hotels, retail outlets, and healthcare facilities is leading to the demand for commercial upright vacuum cleaners. Upright vacuum cleaners are valued for their strong suction power, ease of use, and ability to handle large carpeted areas, making them a preferred choice for maintaining cleanliness in high-traffic environments. In addition, advancements in vacuum cleaner technology, such as lightweight designs, enhanced maneuverability, and energy efficiency, are making upright models more appealing. Features like HEPA filtration systems, which address concerns about air quality and allergens, are also influencing purchasing decisions, especially in sectors like healthcare and hospitality.

The robotic vacuum cleaners market is projected to grow at the fastest CAGR of 11.1% from 2025 to 2030, due to advancements in technology, increasing operational efficiency needs, and the rising demand for automation in commercial spaces. Businesses, particularly in sectors such as hospitality, retail, healthcare, and office spaces, are adopting robotic vacuum cleaners to streamline cleaning processes and reduce manual labor costs. These devices are equipped with features like AI-driven navigation, multi-surface cleaning, and remote operation, making them highly efficient and attractive for commercial use. The integration of smart technologies such as IoT, AI, and machine learning into robotic vacuum cleaners is also fueling their adoption. These technologies enable features like real-time mapping, adaptive learning, and scheduled cleaning, which are particularly beneficial for large commercial spaces.

End Use Insights

The cleaning service providers segment led the market with the largest revenue share of 33.4% in 2024. Commercial vacuum cleaners are available in various types (e.g., upright, canister, backpack, robotic), each suited for different cleaning environments. This versatility allows cleaning service providers to select the right type of vacuum cleaner based on the specific needs of the space they are cleaning. In April 2024, Makita launched a new backpack vacuum cleaner designed for commercial use. This model features a lightweight design for easy maneuverability, making it suitable for various cleaning tasks in large spaces. Key highlights include a powerful motor for efficient suction, a high-efficiency filter that captures allergens, and a user-friendly design with adjustable straps for comfort during extended use. The new vacuum is aimed at enhancing productivity and convenience for professional cleaning staff in commercial environments.

The offices and commercial buildings segment is projected to grow at the fastest CAGR of 5.3% from 2025 to 2030. Vacuum cleaners are indispensable in office and commercial building environments due to their ability to provide fast, efficient, and thorough cleaning. In office spaces with high foot traffic, vacuum cleaners are ideal for maintaining cleanliness across large areas, such as hallways, meeting rooms, and workstations. Their ability to quickly remove dirt, dust, and debris ensures that the workspace remains neat without significant disruptions. With advanced models, cleaning staff can cover more ground in less time, allowing employees to focus on their tasks while the space stays clean.

Distribution Channel Insights

The offline segment led the market with the largest revenue share of 86.1% in 2024, due to the hands-on experience, personalized service, and trust that brick-and-mortar outlets, distributors, and specialist suppliers provide. Many commercial buyers, especially in sectors like hospitality, healthcare, and facilities management prefer purchasing high-investment equipment offline, where they can physically inspect the machines, test functionality, and evaluate build quality before making a decision. In addition, strong after-sales support and servicing options available through offline retailers and distributors are a major draw. These channels often provide product training, on-site demonstrations, installation assistance, and long-term service contracts, which are highly attractive to businesses seeking reliability and minimal downtime.

The online segment is projected to grow at the fastest CAGR of 6.7% from 2025 to 2030, driven by evolving buyer behavior, convenience, and broader access to product options and information. One of the primary reasons for this growth is the shift toward digital procurement in commercial and institutional sectors. Facilities managers, cleaning service providers, and business owners increasingly prefer to shop online to compare brands, features, and prices quickly, saving time and reducing the need for in-person visits to suppliers or showrooms. In April 2023, Inalsa, an Indian brand in home and kitchen appliances, announced the launch of its new range of wet and dry vacuum cleaners. This product line aims to cater to the diverse cleaning needs of Indian households and commercial spaces, offering versatile solutions for both wet and dry cleaning tasks.

Regional Insights

North America dominated the commercial vacuum cleaner market with the largest revenue share of 37.3% in 2024. In North America, the market is driven by stringent hygiene regulations, advanced facility management practices, and widespread adoption of commercial cleaning services. High demand exists across a variety of segments, particularly for upright vacuum cleaners in large office buildings, retail chains, and hospitality venues where carpeted flooring is common. Canister vacuum cleaners remain a staple in healthcare, education, and smaller commercial facilities due to their flexibility and ease of maneuverability. Robotic vacuum cleaners are increasingly popular, especially among small businesses and facilities managers seeking labor-efficient solutions. Wet & dry and drum vacuum cleaners are preferred in industrial, warehouse, and automotive settings that require robust equipment for heavier messes.

U.S. Commercial Vacuum Cleaner Market Trends

The commercial vacuum cleaner market in the U.S. accounted for the largest market revenue share of 89.4% in North America in 2024, primarily due to strong demand from diverse industries like hospitality, healthcare, manufacturing, and retail that require specialized, high-performance cleaning solutions to maintain hygiene and safety standards. Commercial settings prioritize efficient, durable vacuum cleaners such as versatile backpack models and wet/dry units that can handle large areas, wet and dry debris, and tight spaces, improving productivity and compliance with sanitation regulations. The U.S. market’s size is also driven by strict regulatory frameworks (e.g., OSHA) and growing awareness of indoor air quality, which push businesses to invest in advanced cleaning equipment.

The Canada commercial vacuum cleaner market is projected to grow at the fastest CAGR of 5.1% from 2025 to 2030, due to increasing demand for advanced cleaning solutions driven by rising hygiene awareness in commercial spaces such as hospitals, malls, and offices. The growth is supported by expanding outsourcing of cleaning services, where businesses prefer professional providers using efficient vacuum cleaners to maintain high sanitation standards and reduce operational burdens. For instance, hospitals rely on powerful vacuum cleaners with HEPA filtration to ensure sterile environments for patients and staff. In addition, technological innovations like cordless, lightweight, and eco-friendly vacuum models are gaining popularity, aligning with Canada’s sustainability goals.

Europe Commercial Vacuum Cleaner Market Trends

The commercial vacuum cleaner market in Europe is projected to grow at a significant CAGR of 4.0% from 2025 to 2030, due to increasing industrial automation, stricter workplace hygiene regulations, and a strong focus on sustainability. Industries such as manufacturing, pharmaceuticals, and food processing are adopting advanced vacuum cleaners with smart features and energy-efficient designs to meet stringent environmental and safety standards. In addition, the rise of automated and robotic cleaning technologies helps reduce labor costs and improve cleaning efficiency in large commercial spaces like airports and shopping centers. Europe’s commitment to reducing carbon footprints and adopting eco-friendly cleaning solutions further drives demand for energy-saving vacuum cleaners.

The UK commercial vacuum cleaner market is projected to grow at a substantial CAGR of 4.4% from 2025 to 2030, due to increasing demand for efficient cleaning solutions across sectors like healthcare, retail, and manufacturing, driven by heightened hygiene standards and regulatory requirements. The rise in commercial construction and refurbishment projects also fuels demand for advanced vacuum cleaners, including canister and drum types, which offer powerful suction and versatility for large spaces. These factors, combined with innovations from key players like Dyson and Nilfisk, contribute to steady market growth.

The commercial vacuum cleaner market in Germany is projected to grow at a significant CAGR of 3.8% from 2025 to 2030, due to increasing demand for energy-efficient, high-quality cleaning equipment driven by strict environmental regulations like the EU Ecodesign Directive and rising awareness of indoor air quality. German businesses across the healthcare, manufacturing, and hospitality sectors prioritize durable vacuum cleaners with advanced features such as HEPA filtration to meet stringent hygiene standards. Hospitals extensively use canister vacuum cleaners that provide powerful suction while minimizing noise, ensuring patient comfort and infection control. In addition, the growing adoption of cordless and robotic vacuum cleaners enhances cleaning efficiency and convenience in commercial spaces. Urbanization and expansion of commercial infrastructure in cities such as Berlin and Munich also boost demand for compact, versatile models suited for diverse environments.

Asia Pacific Commercial Vacuum Cleaner Market Trends

The commercial vacuum cleaner market in Asia Pacific is projected to grow at the fastest CAGR of 5.1% from 2025 to 2030, due to rapid urbanization, rising disposable incomes, and increasing awareness about hygiene in commercial spaces such as hospitals, malls, and offices. Countries like China, India, and Japan lead the market with growing demand for advanced, energy-efficient vacuum cleaners equipped with features like HEPA filtration to maintain clean and healthy environments. For instance, hospitals in India increasingly use high-suction vacuum cleaners to ensure sterile conditions for patients and staff. In addition, the expanding industrial sector in the region, including manufacturing and pharmaceuticals, drives demand for durable vacuum cleaners that improve workplace safety by controlling dust and contaminants.

The China commercial vacuum cleaner market accounted for the largest market revenue share of 29.9% in Asia Pacific in 2024, due to rapid urbanization, rising disposable incomes, and growing consumer awareness about hygiene and cleanliness in both residential and commercial spaces. In addition, the rise of e-commerce platforms in China facilitates easy access to a wide range of vacuum cleaner models, boosting sales. Strong competition between international brands such as Dyson and local players such as Haier and Midea encourages continuous innovation tailored to Chinese consumers’ preferences.

The commercial vacuum cleaner market in India is projected to grow at a significant CAGR of 6.5% from 2025 to 2030, due to rapid urbanization, rising disposable incomes, and increasing awareness about hygiene and cleanliness in commercial and industrial spaces. Growing sectors such as healthcare, hospitality, and manufacturing are driving demand for advanced vacuum cleaners with features to maintain sanitation and comply with safety standards. In addition, the expansion of organized retail and commercial infrastructure fuels the need for efficient cleaning solutions. The rising middle-class population and evolving lifestyles also encourage the adoption of premium and technologically advanced products. Furthermore, government initiatives promoting cleanliness and workplace safety enhance market growth. These factors, combined with the entry of international and domestic brands offering innovative, affordable products, make India one of the fastest-growing commercial vacuum cleaner industries globally.

Central & South America Commercial Vacuum Cleaner Market Trends

The commercial vacuum cleaner market in Central & South America is projected to grow at a significant CAGR of 3.3% from 2025 to 2030, due to rising urbanization, expanding commercial infrastructure, and increasing awareness of hygiene and cleanliness in workplaces such as offices, hospitals, and retail spaces. Brazil, as the largest market in the region, drives growth with a growing middle class demanding advanced cleaning technologies like canister and robotic vacuum cleaners that offer efficiency and improved indoor air quality. Brazil increasingly uses HEPA-filtered vacuum cleaners to control dust and allergens, ensuring safer environments for patients.

In addition, the rise of e-commerce platforms like MercadoLibre facilitates easier access to a variety of vacuum cleaner models, boosting adoption even in smaller cities. Government initiatives promoting energy-efficient appliances and environmental sustainability also encourage the use of modern, eco-friendly vacuum cleaners. Despite challenges such as high costs and infrastructure gaps in some areas, these factors collectively support steady market expansion across Central and South America.

Middle East & Africa Commercial Vacuum Cleaner Market Trends

The commercial vacuum cleaner market in the Middle East & Africa is projected to grow at a substantial CAGR of 2.7% from 2025 to 2030, due to increasing urbanization, rising hygiene awareness, and expanding commercial infrastructure across key countries like Saudi Arabia, UAE, and South Africa. Although the residential sector dominates the overall vacuum cleaner industry, the commercial segment is growing steadily as offices, hospitals, and educational institutions invest in advanced cleaning equipment to meet stricter health and safety standards. The growing trend of automation and smart cleaning technologies also enhances operational efficiency in large facilities.

Key Commercial Vacuum Cleaner Company Insight

Key companies in the commercial vacuum cleaner industry adopt strategies focused on innovation and sustainability to maintain competitiveness. They develop advanced products featuring smart technologies, energy efficiency, and enhanced filtration systems to meet increasing hygiene and environmental standards across commercial sectors. Emphasis on ergonomic designs and cordless or robotic models improves user convenience and cleaning efficiency. Companies also invest in expanding distribution through online and offline channels to reach diverse markets.

Key Commercial Vacuum Cleaner Companies:

The following are the leading companies in the commercial vacuum cleaner market. These companies collectively hold the largest market share and dictate industry trends.

- Nilfisk Group

- Alfred Kärcher SE & Co. KG

- Makita Corporation

- Tennant Company

- Dyson Limited

- Hako Group

- Techtronic Industries Co. Ltd.

- Numatic International Ltd.

- Tacony Corporation

- Solenis LLC

- BISSEL Group

- ProTeam, Inc.

- SEBO America, LLC

- Pacvac Pty. Ltd.

- SPRiNTUS GmbH

Recent Developments

-

In April 2024, Nilfisk launched an upgraded version of its popular VP300 vacuum, now made from 30% post-consumer recycled (PCR) plastic. This initiative aims to divert consumer waste from landfills and marks Nilfisk's first product utilizing recycled materials. The vacuum is equipped with a certified HEPA filter that effectively removes airborne particles, weighs only 5.5 kg, and operates at a sound level comparable to a quiet refrigerator. It is suitable for daytime cleaning in various settings, such as offices and retail spaces.

-

In April 2024, Makita launched a new backpack vacuum cleaner designed for commercial use. This model features a lightweight design for easy maneuverability, making it suitable for various cleaning tasks in large spaces. Key highlights include a powerful motor for efficient suction, a high-efficiency filter that captures allergens, and a user-friendly design with adjustable straps for comfort during extended use. The new vacuum is aimed at enhancing productivity and convenience for professional cleaning staff in commercial environments.

Commercial Vacuum Cleaner Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.35 billion

Revenue Forecast in 2030

USD 1.65 billion

Growth rate

CAGR of 4.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Power source, product, end use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Netherland; Russia; Poland China; Japan; India; South Korea; Vietnam; Indonesia; Philippines; Australia & New Zealand; Brazil; Argentina; South Africa; Saudi Arabia; Turkey

UAE

Key companies profiled

Nilfisk Group; Alfred Kärcher SE & Co. KG; Makita Corporation; Tennant Company; Dyson Limited; Hako Group; Techtronic Industries Co. Ltd.; Numatic International Ltd.; Tacony Corporation; Solenis LLC; BISSEL Group; ProTeam, Inc.; SEBO America, LLC; Pacvac Pty. Ltd.; SPRiNTUS GmbH

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Commercial Vacuum Cleaner Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global commercial vacuum cleaner market based on the power source, product, end use, distribution channel, and region.

-

Power Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Corded

-

Cordless

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Upright Vacuum Cleaners

-

Canister Vacuum Cleaners

-

Robotic Vacuum Cleaners

-

Wet & Dry Vacuum Cleaners

-

Drum Vacuum Cleaners

-

Central Vacuum Cleaners

-

Backpack Vacuum Cleaners

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare Facilities

-

Hospitality and Lodging

-

Retail Stores

-

Shopping Malls

-

Educational Institutions

-

Offices and Commercial Buildings

-

Cleaning Service Providers

-

Car Detailing Services

-

Entertainment and Leisure Facilities

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherland

-

Russia

-

Poland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

Vietnam

-

Indonesia

-

Philippines

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Turkey

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global commercial vacuum cleaner market size was estimated at USD 1.30 billion in 2024 and is expected to reach USD 1.35 billion in 2025.

b. The global commercial vacuum cleaner market is expected to grow at a compounded growth rate of 4.1% from 2025 to 2030 to reach USD 1.65 billion by 2030.

b. The corded commercial vacuum cleaners market accounted for a share of 74.7% of the global revenue in 2024. The market for corded (AC power) commercial vacuum cleaners is growing steadily, largely due to their reliability and suitability for large-scale cleaning tasks.

b. Some key players operating in the commercial vacuum cleaner market include Nilfisk Group; Alfred Kärcher SE & Co. KG; Makita Corporation; Tennant Company; Dyson Limited; Hako Group; Techtronic Industries Co. Ltd.; Numatic International Ltd.; Tacony Corporation; Solenis LLC and others

b. Key factors that are driving the market growth include the expansion of the contract cleaning industry, rapid infrastructure development in emerging economies, and growing e-commerce adoption for B2B procurement

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.