- Home

- »

- Animal Health

- »

-

Companion Animal Diagnostic Services Market Report, 2030GVR Report cover

![Companion Animal Diagnostic Services Market Size, Share & Trends Report]()

Companion Animal Diagnostic Services Market Size, Share & Trends Analysis Report By Testing Category (Clinical Chemistry, Cytopathology), By Type, By Animal Type, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-115-1

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

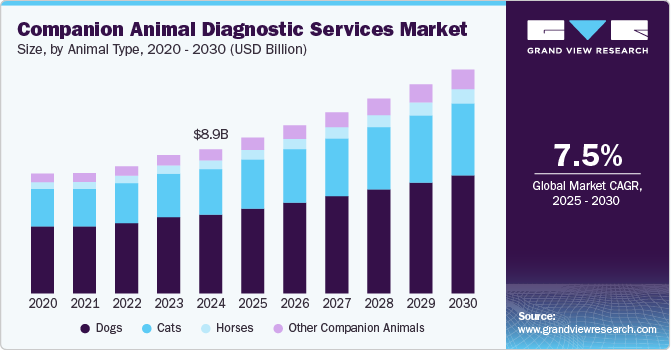

The global companion animal diagnostic services market size was estimated at USD 8.98 billion in 2024 and is projected to grow at a CAGR of 7.51% from 2025 to 2030. Some of the key drivers of the market include the increasing humanization of pets, technological advancements, uptake of point-of-care diagnostics, medicalization rate, and initiatives by key market stakeholders. For instance, Mars, Inc. provides a wide range of pet diagnostic services through its businesses, including Antech Diagnostics, SOUND, AniCura, Banfield, BluePearl, and VCA Animal Hospitals. In September 2024, it acquired SYNLAB Vet, further expanding its veterinary diagnostics capabilities across Europe with advanced diagnostics, imaging, and telemedicine solutions.

According to the American Pet Products Association (APPA) study conducted between 2023 and 2024, approximately 66% of households in the U.S. have at least one pet, totaling around 86.9 million households. Most insured pets are dogs, accounting for about 80% of the insured population, while cats comprise 20%. The pet population, expenditure on pets, pet humanization, medicalization rate, and uptake of pet insurance are expected to continue increasing in the near future, thus propelling the market growth. As more people adopt pets and consider them part of their families, they are more likely to seek medical attention and diagnostic services for their animals. This demand extends beyond essential vaccinations and routine check-ups to more advanced diagnostic procedures, including imaging, blood tests, and genetic testing. This trend is also associated with the desire to provide pets with the best quality of life, leading to early disease detection and proactive management.

Rapid advancements in diagnostic technologies have transformed the landscape of veterinary medicine and played a crucial role in market growth. Innovations in imaging techniques, laboratory testing methods, genetic analysis, and point-of-care devices have significantly improved the accuracy, speed, and range of diagnostic services available for companion animals. For instance, in November 2024, Primerdesign, part of the Novacyt Group, launched the genesigPLEX multiplex PCR assays for canine and feline gastrointestinal diseases at the 2024 London Vet Show. These tests detect six key pathogens in a single sample within three hours, offering faster, cost-effective diagnostics for companion animals while enhancing efficiency for veterinary labs.

The availability of advanced diagnostic tools allows veterinarians to diagnose conditions with higher precision and efficiency. For example, sophisticated imaging technologies such as MRI, CT scans, and ultrasounds allow detailed visualization of internal structures, supporting the diagnosis of complex issues. Genetic testing helps identify hereditary diseases and customized treatment plans. Point-of-care diagnostic devices provide rapid results, allowing veterinarians to make prompt treatment decisions. These technological advancements attract both pet owners and veterinary professionals, driving the market growth.

Animal Type Insights

Based on animal type, the dog segment led the market with the market with the largest revenue share of 54.69% in 2024. This is due to initiatives by key market players, a high pet dog population, and the availability of various diagnostic services specific to canine patients. In September 2024, Cancan Diagnostics signed a partnership agreement with Poland-based Vet Planet Ltd. to distribute its innovative canine cancer diagnostic products and services, such as K9-LiquiDX, across 47 territories in Europe, APAC, the Middle East, and South America. This collaboration aims to enhance early cancer detection and monitoring in dogs, advancing global veterinary care through cutting-edge diagnostic solutions.

The companion animals segment is anticipated to grow at the fastest CAGR of 9.86% from 2025 to 2030.The popularity of small mammals, birds, and exotic pets such as reptiles has grown in recent years, leading to increased pet health concerns. Pet owners are becoming more aware of the importance of regular check-ups and early disease detection, driving the demand for diagnostic services for other companion animals. For instance, the Ohana Animal Hospital in the U.S. is one of the many service providers in the country that offer laboratory testing, digital imaging, and other critical diagnostic services to exotic pets.

Testing Category Insights

Based on the testing category, the clinical chemistry segment led the market with the largest revenue share of 23.67% in 2024. The segment includes testing the chemical composition of body fluids such as serum or plasma, urine, joint fluid, etc. It includes applications such as organ function testing for the kidney, liver, pancreas, and more. The high segment share can be attributed to a wide range of clinical chemistry testing services offered by key companies, increasing uptake of these services, and growing advancements in the sector.

The cytopathology segment is projected to grow at the fastest CAGR of 10.26% during the forecast period. Zoetis Reference Laboratories is one of the many key players offering pet cytopathology testing. This includes Cytopathology Simple/Single Site and Cytopathology Complex tests for cats and dogs. In addition, animal health companies contribute to segment growth by increasing product and service offerings. For instance, in October 2024, Zomedica launched the Ear Cytology Quick Scan protocol for its TRUVIEW digital microscope, improving the workflow and diagnostic speed of ear cytology in veterinary practices. This feature allows veterinarians to complete ear cytology slide preparation and analysis in four minutes, streamlining the diagnosis of common ear infections and enhancing clinic efficiency. The innovation supports rapid, accurate diagnostics for better patient outcomes in companion animal care.

Type Insights

Based on type, the Point-of-Care (POC) segment led the market with the largest revenue share of 58.93% in 2024. The segment includes testing services provided at point-of-care (i.e., where the pet receives care), such as at home or a veterinary hospital/ clinic. Results are provided within minutes or a few hours (more quickly than send-out lab results), thus enabling veterinarians to provide efficient diagnoses and decide the next steps (such as more testing or treatment), preferably in the same visit. In January 2024, Zoetis expanded its Vetscan Imagyst platform with AI-driven Urine Sediment analysis, allowing in-clinic, point-of-care diagnostics for accurate, quick sediment analysis of fresh urine. This new feature enhances veterinarians' ability to make timely treatment decisions for pets by providing consistent, high-quality results within minutes, improving workflow and patient care. Such initiatives account for the high segment share.

The laboratory-based segment is estimated to witness at the fastest CAGR of 7.85% during the forecast period. The segment includes laboratories (owned and run by companies or public bodies) where customers (mostly vet hospitals & clinics) avail services by submitting samples by courier or overnight delivery and receiving results same-day or within a few days. In June 2024, IDEXX expanded its Catalyst platform by launching the Catalyst Pancreatic Lipase Test, providing veterinary professionals with rapid, quantitative results for diagnosing pancreatitis in dogs and cats. This test, available globally by late 2024, offers a fast and efficient way to confirm or rule out pancreatitis during patient visits, improving patient outcomes. IDEXX's innovative tools, such as the Catalyst SmartQC Control, further enhance diagnostic workflows, driving efficiency in veterinary labs and advancing companion animal diagnostics.

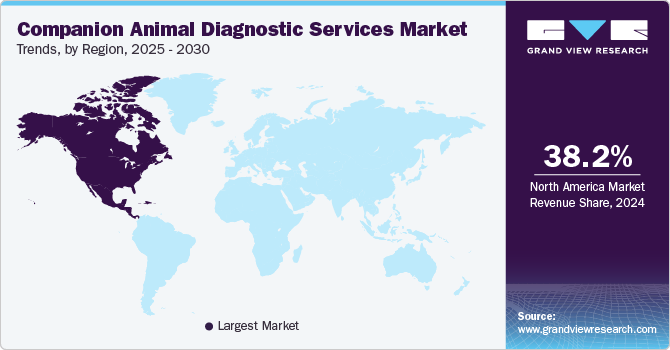

Regional Insights

North America companion animal diagnostic services market dominated the market with the largest revenue share of 38.25% in 2024. This is due to the fact that there are many pet diagnostic service providers, a high medicalization rate, and growing pet expenditure. In addition, increasing investment in veterinary diagnostics drives market growth in North America. For instance, in August 2024, The New York State Veterinary Diagnostic Laboratory (NYSVDL) at Cornell University was granted $19.5 million to expand its facilities and enhance its capacity to manage a growing caseload. The expansion will add 26,000 square feet, including more laboratories and workstations, to support the increasing demand for diagnostic services in veterinary care.

U.S. Companion Animal Diagnostic Services Market Trends

The companion animal diagnostic services market in the U.S. is growing rapidly due to the rise in technological advancements to enhance early disease detection and personalized treatment options for pets, along with the presence of key market players engaged in strategic alliances to expand service offerings.

Europe Companion Animal Diagnostic Services Market Trends

The companion animal diagnostic services market in Europe is influenced by several trends, driven by rising pet ownership, advanced diagnostic technologies, and the increasing demand for preventive healthcare. Innovations in AI-powered diagnostics and DNA testing, alongside the expansion of diagnostic service providers, are enhancing the market. For instance, in July 2024, Mars acquired Cerba HealthCare's stake in Cerba Vet and ANTAGENE, enhancing its veterinary diagnostics portfolio in Europe. This acquisition strengthens Mars Petcare's Science & Diagnostics division, which includes Antech, Wisdom Panel, and other diagnostic services.

The Germany companion animal diagnostic services market is anticipated to grow at a constant CAGR during the forecast period, due to increased pet ownership and awareness of animal health. The demand for advanced diagnostic technologies like imaging, molecular diagnostics, and AI-based tools is rising. With a robust veterinary infrastructure and high spending on pet care, Germany is becoming a hub for innovative diagnostic services, offering solutions such as rapid diagnostic tests and cloud-based platforms.

The companion animal diagnostic services market in the UK is expected to grow at a significant CAGR during the forecast period, due to rising pet ownership and increased awareness of preventive care. Pets are commonly found in homes everywhere in the UK. A 2024 article published by Pet Keen stated that the pet population in the UK in 2021 was estimated to be 12.5 million dogs & 12.2 million cats.

Asia Pacific Companion Animal Diagnostic Services Market Trends

The companion animal diagnostic services market in Asia Pacific is driven by increasing pet ownership, rising awareness about pet health, and the growing demand for advanced diagnostic technologies. Innovations like AI-assisted diagnostic tools and rapid diagnostic testing are enhancing veterinary care efficiency. For instance, in May 2024, SK Telecom (SKT) and ATX Solutions launched the AI-based diagnostic service X Caliber in Australia to enhance veterinary care for companion animals.

The India companion animal diagnostic services market is witnessing notable growth, driven by increasing pet ownership, rising awareness about animal health, and growing demand for advanced diagnostic services.

Latin America Companion Animal Diagnostic Services Market Trends

The companion animal diagnostic services market in Latin America is driven by increasing pet ownership, rising demand for advanced veterinary care, and growing awareness of pet health. The expanding middle-class population and a shift towards preventive care boost the demand for diagnostic services.

The Brazil companion animal diagnostic services market is witnessing significant growth owing to an increase in the number of healthcare reforms & expenditures. Increasing demand for better healthcare facilities is anticipated to boost market growth. In addition, the rising adoption of companion animals and growing pet spending are likely to boost market growth.

Middle East & Africa Companion Animal Diagnostic Services Market Trends

The companion animal diagnostic services market in the Middle East & Africa is witnessing significant growth, driven by rising pet adoption rates and increasing awareness about animal health; growing investment in veterinary healthcare infrastructure and the adoption of advanced diagnostic technologies are also expected to boost market growth. For instance, countries like South Africa and the UAE are leading the adoption with increased spending on veterinary services and diagnostic tools, reflecting the region's evolving healthcare landscape.

The South Africa companion animal diagnostic services market is witnessing significant growth driven by increased product launches from domestic players. Companies are introducing innovative testing solutions designed to meet local pet owners' needs. For example, the launch of breed identification and health screening tests by local firms like EasyDNA South Africa and International Biosciences South Africa has expanded consumer access to affordable genetic testing options.

Key Companion Animal Diagnostic Services Company Insights

The market is fragmented due to several small to large service providers that intensify the market competition. Market players implement various strategies to increase their market presence and share. These include offering a broad portfolio of services, technological innovations, enhancing turnaround time and speed, competitive pricing, partnerships & collaborations, mergers & acquisitions, and more. In April 2024, VolitionRx launched its Nu.Q Vet Cancer Test in U.S. and European veterinary clinics through Antech, enabling rapid, in-clinic canine cancer screening. The test, available on the Element i+ Analyzer, provides results in about six minutes, making it a cost-effective and efficient tool for early cancer detection, particularly in high-risk breeds and senior dogs. This innovation enhances companion animal diagnostic services by integrating cutting-edge technology for improved cancer care decision-making.

Key Companion Animal Diagnostic Services Companies:

The following are the leading companies in the companion animal diagnostic services market. These companies collectively hold the largest market share and dictate industry trends.

- Zoetis Services LLC

- IDEXX Laboratories, Inc.

- Mars Inc.

- The Animal Medical Center

- Embark Veterinary, Inc.

- SYNLAB

- NationWide Laboratories

- IVC Evidensia

- CVS Group Plc

- Greencross Vets

View a comprehensive list of companies in the Companion Animal Diagnostic Services Market

Recent Developments

-

In September 2024, Zoetis Inc. introduced Vetscan OptiCell, a new cartridge-based hematology analyzer that employs AI-powered technology to deliver precise Complete Blood Count (CBC) analysis at the point of care, offering lab-quality results with time, cost, and space efficiencies for veterinary clinics.

-

In July 2024, EKF Diagnostics launched the Biosen C-Line, an advanced glucose and lactate analyzer designed for enhanced usability. It features a touch screen and advanced connectivity options to integrate seamlessly with hospital and lab IT systems via EKF Link. This benchtop analyzer provides highly precise glucose and lactate measurements and is used in clinical settings for diabetes management and by elite sports teams to track lactate production during training.

-

In February 2024, MiDOG Animal Diagnostics introduced an advanced All-in-One Diagnostic Test capable of rapidly detecting bacterial and fungal infections, including antibiotic resistance, across various animal species. This innovation aims to enhance veterinary care by replacing traditional testing methods with efficient molecular-based diagnostics, supporting comprehensive treatment strategies for diverse animals, from pets to exotic species.

Companion Animal Diagnostics Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.71 billion

Revenue forecast in 2030

USD 13.95 billion

Growth rate

CAGR of 7.51% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Animal Type, testing category, type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain; Denmark; Netherlands; Sweden; Japan; China; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia.

Key companies profiled

Zoetis Services LLC; IDEXX Laboratories, Inc.; Mars Inc.; The Animal Medical Center; Embark Veterinary, Inc.; SYNLAB; NationWide Laboratories; IVC Evidensia; CVS Group Plc; Greencross Vets

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Companion Animal Diagnostic Services Market Report Segmentation

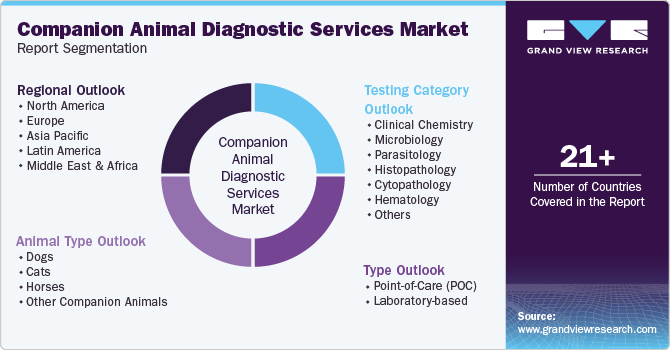

This report forecasts revenue growth at the regional & country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global companion animal diagnostic services market report based on the testing category, type, animal type, and region:

-

Testing Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Chemistry

-

Microbiology

-

Parasitology

-

Histopathology

-

Cytopathology

-

Hematology

-

Immunology & Serology

-

Imaging

-

Molecular Diagnostics

-

Other Categories

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Point-of-Care (POC)

-

By Testing Category

-

Clinical Chemistry

-

Microbiology

-

Parasitology

-

Histopathology

-

Cytopathology

-

Hematology

-

Immunology & Serology

-

Imaging

-

Molecular Diagnostics

-

Other Categories

-

-

-

Laboratory-based

-

By Testing Category

-

Clinical Chemistry

-

Microbiology

-

Parasitology

-

Histopathology

-

Cytopathology

-

Hematology

-

Immunology & Serology

-

Imaging

-

Molecular Diagnostics

-

Other Categories

-

-

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Horses

-

Other Companion Animals

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

Sweden

-

Denmark

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global companion animal diagnostic services market size was estimated at USD 8.98 billion in 2024 and is expected to reach USD 9.71 billion in 2025.

b. The global companion animal diagnostic services market is expected to grow at a compound annual growth rate of 7.51% from 2025 to 2030 to reach USD 13.95 billion by 2030.

b. By region, North America dominated the market with a share of 38.25% in 2024. This is owing to the presence of a large number of pet diagnostic service providers, high medicalization rate, and growing pet expenditure.

b. Some key players operating in the companion animal diagnostic services market include Zoetis Services LLC; IDEXX Laboratories, Inc.; Mars Inc.; The Animal Medical Center; Embark Veterinary, Inc.; SYNLAB; NationWide Laboratories; IVC Evidensia; CVS Group Plc; Greencross Vets

b. Some of the key drivers of the market include the increasing humanization of pets, technological advancements, uptake of point-of-care diagnostics, the medicalization rate, and initiatives by key market stakeholders.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."