- Home

- »

- Medical Devices

- »

-

Compound Management Market Size & Share Report, 2030GVR Report cover

![Compound Management Market Size, Share & Trends Report]()

Compound Management Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Products, Service), By Sample Type, By Application (Drug Discovery, Gene Synthesis), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-031-6

- Number of Report Pages: 187

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global compound management market size was valued at USD 466.3 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 15.8% from 2023 to 2030. Increasing drug discovery activities; growth in the pharmaceutical and biotechnology industries; and increasing demand for outsourcing these services are some of the key factors driving the market. The drug pipeline has seen a promising surge in recent years. According to Pharma R&D annual review 2022, the R&D pipeline consisted of 17,737 drugs in 2020, while in 2022, the number of drugs in the pipeline rose to 20,109.

The growing drug pipeline is expected to create opportunities for the market. During the COVID-19 pandemic, the majority of COVID-19 vaccines and drugs were in the pipeline. However, in 2022, biotechnology and anticancer drugs were the major drugs in the pipeline, as per Pharma R & D annual review 2022. The pipeline for these drugs is expected to improve in the coming years due to the high demand for biotechnology and anticancer drugs globally. This is expected to increase the demand for compound management of biotechnology and anticancer drugs in the post-pandemic period.

Automated storage solutions make it easier to manage compound collections, ensure sample integrity, and shorten sample turnaround times. Furthermore, new automated sample management technology has resulted in the introduction of innovations that support unique approaches to high-throughput screening. Preparation of the assay plate, weighing and dissolution of the molecule, and library management are all fully automated methods that drastically improve drug development workflows by removing time-consuming and error-prone procedures.

Companies are collaborating and leveraging expertise more frequently, which is expected to drive the market. To support drug discovery, organizations are forming and expanding existing strategic alliances with numerous academic institutions, venture capitalists, and other private or public companies. Growing drug discovery collaborations between public and private entities are expected to boost global demand for compound management services. For instance, in January 2022, pharmaceutical company AstraZeneca expanded its (AI)-powered drug discovery partnership with BenevolentAI to discover drugs for diseases such as systemic lupus erythematosus and heart failure. Such partnerships are likely to be profitable for the market.

COVID-19 vaccines have gained noteworthy importance even after the decline in COVID-19 cases. The fear of the emergence of new variants is increasing the demand for these vaccines. Hence, a significant number of drug manufacturers are developing new vaccines. On 31st May 2022, over 1,112 vaccines were under development, according to Clinicaltrials.gov. This is likely to drive the demand for compound management for COVID-19 vaccines.

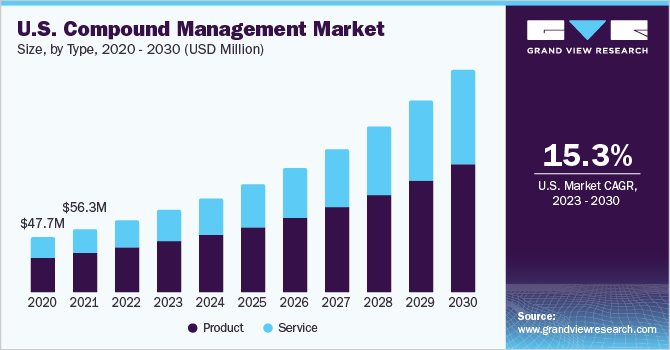

Type Insights

The products segment dominated the market with a revenue share of over 62.1% in 2022. The product segment is segmented into automated compound/sample storage systems, automated liquid handling systems, and other compounds/sample storage systems. The growing demand for automation to manage the compound and libraries is expected to propel the segment growth. Plate stamping, compound tracking, and reformatting can all be accomplished with the use of an automated liquid handler and automated compound store equipment.

Automated storage systems improve overall efficiency and reliability, allowing users to focus on high-value activities. Many updated processes include the complete integration of storage systems with sample processing workstations that include pipetting robots. Smaller businesses can also benefit from system integration thanks to novel systems. The Verso automated storage system, for example, offers a variety of adjustable configurations to meet the changing needs of compound storage.

The service segment is expected to expand at the fastest rate of 17.3% across the forecast period. The rise in drug discovery activities, the growing need to manage compound management services, and the increasing need to save costs associated with drug discovery are some of the key factors fueling the growth of the service segment.

Over the years, the demand for outsourcing compound management services has improved as the pharma and biotech industries are focusing on core competencies and outsourcing non-core functions. A significant number of small and medium-sized companies lacking infrastructure for compound management is further expected to improve the demand for compound management outsourcing services and thus is likely to have a positive impact on segment growth.

Application Insights

Drug discovery held the largest revenue share of over 35.7% in 2022 and is projected to grow significantly over the forecast period. Developing a drug is a costly, lengthy, and complicated process and requires various advanced techniques to check its process. High throughput screening is used to screen a large number of compounds with a biological target. The data on activity against the target is collected from a broad library.

Drug discovery is used to identify more active compounds. Hence, an increase in the activity of drug discovery is anticipated to create a large demand. Based on application, the market for compound management is segmented into drug discovery, gene synthesis, biobanking, and others, which include forensic science.

The biobanking segment is anticipated to register a lucrative CAGR of 17.3% across the forecast period owing to the increasing number of organizations involved in the collection and storage of biomaterials. In addition, an increasing emphasis on personalized medicine is driving the need for biobanking. Besides, the need for quality bio-specimens that are used to support research is expected to increase. Thus, the abovementioned factors are anticipated to support the growth of the segment.

End-use insights

The pharmaceutical companies segment held the largest revenue share of over 34.3% in 2022 owing to the increasing drug discovery activity that is leading to an increased demand for the compounds, thereby positively affecting the market growth. Based on end-use, the global market is segmented into biopharmaceutical companies, contract research organizations (CROs), pharmaceutical companies, and others, which include government, research, and academic institutes.

The biopharmaceutical companies segment is anticipated to exhibit the highest CAGR of 16.4% over the forecast period. Increased biologic production and the emergence of biosimilars are anticipated to propel the segment growth over the forecast period. In addition, rising R&D investments in biopharmaceutical companies and the growing prevalence of chronic diseases will drive the segment.

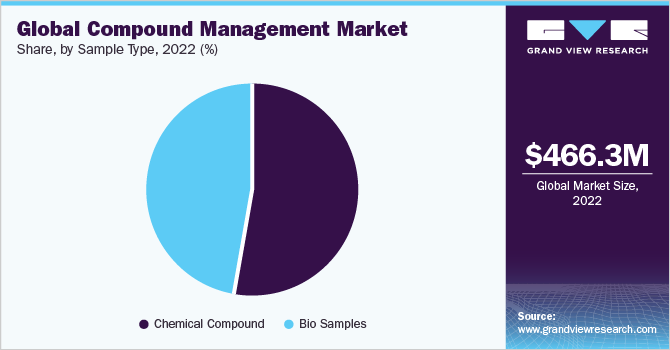

Sample Type Insights

The chemical compounds segment held the largest revenue share of over 52.5% in 2022. This is largely due to a large number of small molecule compounds being screened and assayed during the process of drug discovery. Apart from this, there are a high number of chemicals used in drug discovery, which are required to be stored and managed throughout the drug discovery process, further promoting segment growth. Based on sample type, the market is divided into chemical compounds and biosamples.

The biosamples segment is anticipated to exhibit the fastest CAGR of 16.1% over the forecast period. The increasing demand for personalized medicines is fueling the market growth. Biological samples are vital assets of medical research. Different biospecimens stored at biobanks are registering significant demand due to the developments in cell-based research activities. As per the FDA recommendations, the discovery and development of biomarkers are essential for biotechnology and pharmaceutical companies in the process of R&D.

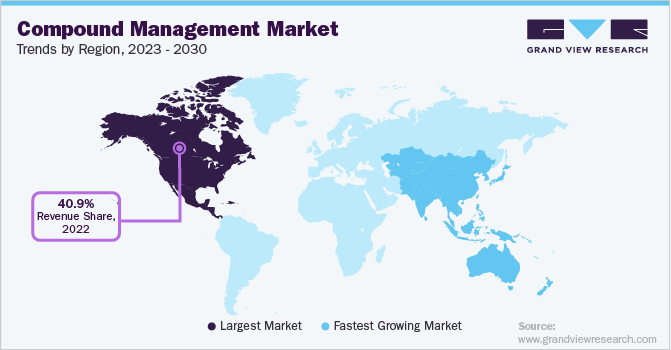

Regional Insights

North America dominated the market for compound management with a revenue share of over 40.9% in 2022. This is since a large number of pharmaceutical and biotechnology firms are involved in drug discovery in the region. As a result, there is an increasing demand for services in this region. Furthermore, the rise in disease-related morbidity and mortality has resulted in the identification of more drug candidates, fueling growth in this region. Favorable initiatives by public organizations for drug discovery and research are further promoting the regional market growth.

Asia Pacific is expected to register the fastest growth rate of 18.0% over the forecast period. Factors that are likely to propel regional market growth include ongoing drug discovery research, private-public collaborations, and government initiatives. Because of favorable government support, Japan contributed significantly to the market growth. The revised pharmaceutical affairs law in Japan supports research activities in tissue diagnostics and cancer, which is expected to drive the market in this country in the near future. Furthermore, the low cost of outsourcing compound management services in Asia Pacific countries and the high prevalence of chronic and infectious diseases in the region are driving the demand for research, thus contributing to regional growth.

Key Companies & Market Share Insights

The market is highly competitive and market players are undertaking numerous strategic initiatives, such as acquisitions, collaborations, and partnerships, to gain a greater market share. In February 2021, SPT Labtech announced the acquisition of BioMicroLab, a robotics automation provider, to strengthen its capabilities in automatic sample management. Some prominent players in the global compound management market include:

-

Azenta US, Inc.

-

Tecan Trading AG

-

Hamilton Company

-

BioAscent

-

Titian Service Limited

-

Evotec

-

Beckman Coulter Inc.

-

LiCONiC AG

-

AXXAM S.p.A.

-

SPT Labtech LTD.

Compound Management Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 533.3 million

Revenue forecast in 2030

USD 1.5 billion

Growth Rate

CAGR of 15.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, sample type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Colombia; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Azenta US, Inc.; Tecan Trading AG; Hamilton Company; BioAscent; Titian Service Limited; Evotec; Beckman Coulter, Inc.; LiCONiC AG; AXXAM S.p.A.; SPT Labtech LTD.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Compound Management Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global compound management market report based on type, sample type, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Product

-

Automated Compound/ Sample Storage System

-

Automated Liquid Handling Systems

-

Other Compound/ sample storage systems

-

-

Service

-

-

Sample Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemical compound

-

Bio samples

-

-

Application Outlook(Revenue, USD Million, 2018 - 2030)

-

Drug Discovery

-

Gene Synthesis

-

Bio Banking

-

Others

-

-

End-use Outlook(Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical

-

Biopharmaceutical

-

Contract Research Organizations

-

Others (Research and Institutes)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

Italy

-

France

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global compound management market size was estimated at USD 466.3 million in 2022 and is expected to reach USD 533.3 million in 2023.

b. The global compound management market is expected to grow at a compound annual growth rate of 15.8% from 2023 to 2030 to reach USD 1.5 billion by 2030.

b. The chemical compound segment dominated the market with a share of 52.6% in 2022 This is largely due to the large number of small molecule compounds being screened and assayed during the process of drug discovery.

b. Some of the players operating in compound management market are Azenta US, Inc.; Tecan; Hamilton Company; BioAscent; Titian Service Limited; Evotec; Beckman Coulter, Inc.; LiCONiC AG; AXXAM S.p.A.; and SPT Labtech Ltd.

b. Key factors that are driving the compound management market growth include increasing drug discovery activities, growth in the pharmaceutical and biotechnology industry as well as increasing demand for outsourcing these services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.