- Home

- »

- Electronic Devices

- »

-

Connected Living Room Market Size, Industry Report, 2030GVR Report cover

![Connected Living Room Market Size, Share & Trends Report]()

Connected Living Room Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Application (New Construction, Retrofit), By End-use (Home Entertainment & Media Streaming, Gaming & E-sports, Home Automation & Control), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-976-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Connected Living Room Market Summary

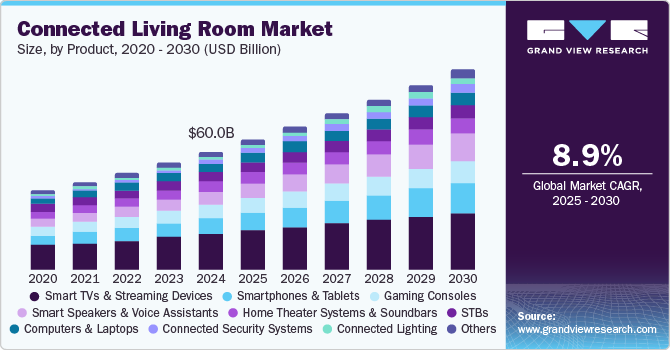

The global connected living room market size was valued at USD 60.03 billion in 2024 and is projected to grow at a CAGR of 8.9% from 2025 to 2030. The growing sales of products such as smart TVs, gaming consoles, laptops, smartphones, and connected lighting technologies are driving the demand for connected living rooms.

Key Market Trends & Insights

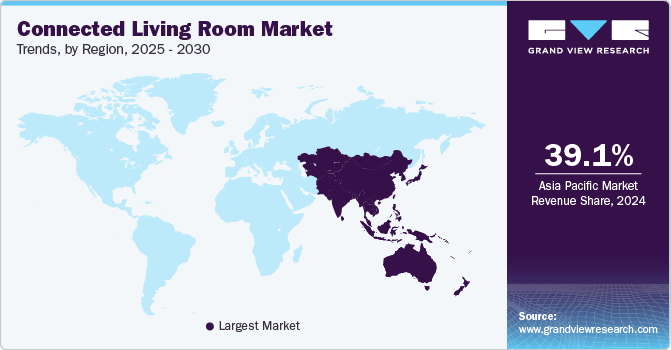

- Asia Pacific connected living room market accounted for a leading global revenue share of 39.1% in 2024.

- By product, the smart TVs and streaming devices segment accounted for the largest revenue share of 29.9% in 2024.

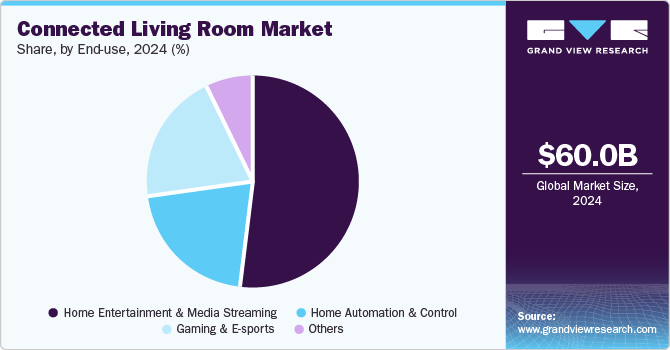

- By end use, the home entertainment & media streaming segment accounted for the largest revenue share in 2024.

- By application, the retrofit segment accounted for a larger revenue share in the global market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 60.03 Billion

- 2030 Projected Market Size: USD 101.42 Billion

- CAGR (2025-2030): 8.9%

- Asia Pacific: Largest market in 2024

Smart TVs allow users to access content directly from applications such as Netflix, Disney+, and YouTube without requiring additional devices. The rising demand for video and audio streaming platforms has led to increased sales of devices such as Amazon Fire TV, Chromecast, and Roku. These popular solutions offer easy access to streaming content and are a hub for connected living room ecosystems. Continued developments to advance the availability of 5G Internet present another avenue for industry expansion, as connected devices can seamlessly stream high-definition content and support multiple devices simultaneously through high-speed internet connectivity.

Globally, consumer interest has steadily increased in adopting integrated systems that control everything in a household, from entertainment and lighting to security. The emergence of the smart home concept, where different devices work together seamlessly, is a key driver for this trend. For instance, controlling the TV, lights, thermostat, and security system from a single application or voice command is becoming popular among modern consumers. With increasing concerns regarding home security, connected devices such as smart doorbells, surveillance cameras, and motion sensors are being integrated into the living room ecosystem, with these solutions providing convenience and security in a unified setup. Devices such as Ring and Google Nest Cam are increasingly being integrated into connected living rooms, as they offer video surveillance features, allowing users to monitor their home security from their TVs, smartphones, or voice-controlled assistants.

Advancements in technology and growing disposable income levels have led to substantial sales of modern gaming consoles such as the PlayStation 5, the Xbox Series X, and the Nintendo Switch. These products play a vital role in developing and adopting connected living rooms, driving demand for smart TVs, voice-controlled systems, high-quality audio setups, and integrated home entertainment hubs. The growing integration of gaming consoles with smart home devices enhances the overall user experience, making the living room a center for entertainment and gaming. In addition to playing games, these consoles can also provide access to streaming platforms such as Netflix and Hulu and support media playback capabilities. Smart TV manufacturers are optimizing their products to work seamlessly with gaming consoles. For example, 4K resolution, HDR, and low latency gaming modes in TVs are designed to complement next-generation gaming consoles, providing an exceptional gaming experience while proving reliable for streaming content.

The steadily rising use of smartphones and tablets presents another notable growth opportunity for the global connected living room industry. These devices have become essential components in the connected technologies category, functioning as control centers, entertainment hubs, and communication devices that integrate with various smart home solutions. Users can control devices such as smart lights, thermostats, security cameras, and smart locks via mobile apps. Moreover, they can conveniently adjust settings, check the status of devices, or control the operation of various appliances, creating a seamless experience. Governments across the world are increasingly investing in smart city initiatives. These large-scale projects often aim to integrate IoT (Internet of Things) technologies into urban infrastructure, including homes, creating a foundation for connected living rooms by promoting smart devices such as connected thermostats, lighting, and security systems. Many governments have initiated programs to support energy-efficient technologies, such as smart thermostats, LED lighting, and smart appliances. These programs often include grants or tax breaks for installing connected devices that reduce energy consumption, enabling households to improve the energy efficiency of their connected living spaces while reducing utility costs. These factors are expected to create more awareness regarding smart devices and help shape industry advancements in the coming years.

Product Insights

The smart TVs and streaming devices segment accounted for the largest revenue share of 29.9% in the connected living room industry in 2024. Improving living standards of the global population has resulted in an increased demand for premium home entertainment products, including smart TVs. These devices come with built-in Wi-Fi and Ethernet ports, enabling their easy connection to the Internet for streaming services, web browsing, and software updates. Moreover, integration with voice-controlled assistants such as Amazon Alexa and Google Assistant allows users to control their TV with voice commands for tasks such as changing channels, adjusting volume, or searching for content. Consumers increasingly prefer to watch content on streaming services such as Netflix, Hulu, and Disney+ on their TVs due to the availability of movies and shows in HD and ultra HD resolutions and various accessibility settings. As a result, smart TVs have become an important part of the connected living room setup.

The connected security systems segment is expected to advance at the fastest CAGR from 2025 to 2030 in the global market. Modern households are increasingly witnessing the integration of security systems with smart home technologies, providing consumers with more convenient, efficient, and intuitive ways to monitor and protect their homes. For instance, smart cameras can be placed in living rooms to monitor activities, record video footage, and alert homeowners of unusual motion or sounds. These cameras can be integrated with other devices in the home, such as lights or alarms. Moreover, cameras with motion sensors can automatically record footage when movement is detected and send instant notifications to the homeowner’s smartphone or connected device. Including innovative technologies in security appliances has generated substantial traction in this segment. For instance, in January 2025, eufy introduced the eufyCam S3 Pro outdoor security camera, which leverages the MaxColor Vision technology to provide sharp image quality and full colors even in complete darkness.

Application Insights

The retrofit segment accounted for a larger revenue share in the global market in 2024. Retrofitting connected technologies into existing living rooms is a popular way to transform traditional homes into smart homes without requiring complete renovations. The growing popularity of smart home devices has made homeowners more inclined to incorporate them into their homes. People are increasingly becoming aware of the benefits of technologies such as smart lighting, security systems, and voice assistants and their comfort and convenience. Connected lighting solutions have been considered to improve household energy efficiency and aid sustainability initiatives. According to Connected Places Catapult, more than one million properties in the UK are expected to undertake retrofitting efforts each year to achieve the target of retrofitting over 27 million households by 2050 and attain net-zero emission targets. Such developments are expected to increase the adoption of connected technologies that save energy, strengthening segment growth.

The new construction segment, meanwhile, is expected to advance at the highest CAGR in the global connected living room industry during the forecast period. The increasing pace of construction of modern building structures that provide the option to integrate devices such as smart lighting, advanced security, and smart home entertainment systems aids segment expansion. New home construction offers a simpler and more cost-effective approach to deploying connected technologies compared to retrofitting. The advanced design of new building infrastructure allows seamless integration of these systems while enabling buyers to customize their homes according to their interests and needs. For instance, features such as built-in speakers, recessed lighting, or smart thermostats can be incorporated into the architecture, maintaining the home’s aesthetic while ensuring functionality. Governments globally are advancing their smart city initiatives by encouraging builders and developers to offer modern and technology-oriented designs in their projects, which helps shape the demand for connected living rooms among homeowners.

End-use Insights

The home entertainment & media streaming segment accounted for the largest revenue share in the global market for connected living rooms in 2024, owing to the widespread popularity of video and music streaming platforms among consumers. Devices such as smart TVs, smart speakers, voice assistants, home theater systems, and smart set-top-boxes have witnessed substantial growth in sales over the past decade, enabled by the increasing disposable income of consumers and the demand for a premium viewing experience among homeowners. According to data provided by Hub Entertainment Research, in the U.S., the ownership of smart TVs grew to around 80% of households during the first quarter of 2024. The report further stated that over 60% of households availed of streaming services in this period, a significant increase from 47% in 2021. Connected living rooms provide the advantage of controlling all of the user's entertainment systems through a unified interface, either using voice commands, a remote, or a mobile application. This provides substantial convenience to users, thus boosting the appeal of connected solutions in living rooms.

The home automation & control segment is expected to grow at the fastest CAGR from 2025 to 2030 in the connected living room industry. The rapidly rising demand among homeowners to control various functions of their homes, such as lighting, security, and temperature, through their smartphones or other devices has led to the growing adoption of connected technologies. For instance, brands such as Philips Hue, LIFX, and Sengled offer Wi-Fi-enabled light bulbs that can be controlled remotely or through voice commands, allowing users to change color, dim, or brighten them based on their requirements. Meanwhile, smart motion sensors can automatically turn the lights on when someone enters the room and turn them off after a set period of inactivity, thus improving energy efficiency. Devices such as the Nest Thermostat and Ecobee enable users to set temperature preferences, monitor energy usage, and program heating and cooling schedules from their smartphones or voice assistants. This range of solutions is expected to create a strong demand for connected living rooms among modern consumers.

Regional Insights

North America accounted for a substantial revenue share in the global market in 2024, owing to the well-established digitalization initiatives in the region and the extensive presence of various major market players. The widespread popularity of over-the-top (OTT) streaming services such as Netflix, Hulu, Disney+, and Apple TV+ has transformed the content consumption patterns of people in North America. This shift has increased the demand for smart TVs, streaming devices, and sound systems as consumers increasingly demand seamless access to high-quality content directly in their living rooms. The rollout of 5G technology in this region has further made it easier to stream high-definition (HD) and 4K (ultra-HD) content, play online games, and use connected devices with minimal latency. This significantly enhances the performance of connected living room products such as smart TVs, gaming consoles, and voice-controlled assistants.

U.S. Connected Living Room Market Trends

The U.S. accounted for a dominant revenue share in the regional market in 2024, aided by the popularity and extensive adoption of music and video streaming services to take advantage of the strengthening 5G infrastructure in the economy. Video gaming continues to be a dominant form of entertainment in the country, owing to substantial sales of consoles such as PlayStation 5, Xbox, and Nintendo Switch and the rise of cloud gaming services. This has made connected living rooms a notable hub for immersive gaming and entertainment experiences. The demand for high-resolution smart screens, high-performance audio systems, and VR/AR devices has grown substantially among gaming enthusiasts, creating growth avenues for product manufacturers. The popularity of smart homes among American consumers is another notable market driver. The Smart Home Dashboard by Parks Associates, which provides reports featuring surveys among Internet households, published its findings in April 2024. As per the survey, 45% of households in the country had at least one smart home device, while 18% had at least six such devices. This showcases extensive awareness regarding technologically advanced products across households in the country.

Asia Pacific Connected Living Room Market Trends

The Asia Pacific connected living room market accounted for a leading global revenue share of 39.1% in 2024. The increasing regional population and development of modern housing projects, coupled with higher disposable income levels of consumers, have led to the widespread adoption of smart home solutions. Consumers in regional economies such as India, China, and Japan are increasingly adopting devices such as smart speakers, smart TVs, lighting, thermostats, and security cameras, creating an extensively connected and automated living room environment. Furthermore, the steadily growing presence of several regional and international manufacturers of these products to take advantage of rising awareness among modern buyers is anticipated to result in the launch of cutting-edge solutions. The emergence and popularity of streaming platforms in the region have significantly increased the demand for smart TVs and other connected devices.

China accounted for the largest revenue share in the regional market for connected living rooms in 2024. The Chinese government has been actively promoting the development of smart cities and smart homes as part of its broader digital economy strategy. Policies and subsidies promoting IoT (Internet of Things) adoption, smart appliances, and home automation systems have contributed to the demand for connected living rooms. According to Omdia, China is expected to account for 20-30% of worldwide shipments of smart home devices in the near future, making it the largest market by 2028. This highlights growing awareness regarding connected technologies among end users in the country. Moreover, the accelerated deployment of 5G networks across major cities and regions has enabled high-speed and low-latency connectivity, essential for the smooth operation of connected household devices. 5G helps enhance the capabilities of smart home devices, including in connected living rooms, supporting stable and seamless streaming, gaming, and remote work functionalities.

Middle East & Africa Connected Living Room Market Trends

The Middle East & Africa region is anticipated to grow at a significant CAGR from 2025 to 2030. Highly urbanized and fast-growing economies, such as the UAE, Saudi Arabia, and South Africa, have a substantial technologically-aware population that is eager to adopt the latest digital trends. This demographic presents a major customer base for companies developing smart technologies, including connected living room systems. The increasing pace of development of high-tech, modern homes with smart features in UAE, Saudi Arabia, and Qatar is another major factor aiding market expansion. In urban centers, where space is often limited, consumers are seeking efficient, multi-functional solutions that provide high-quality entertainment and convenience in their living rooms. Moreover, the high smartphone penetration rate in the region has made it easier to manage entertainment and smart devices remotely, creating further positive advancements in the regional market.

UAE accounted for a leading revenue share in the regional market in 2024 due to the fast pace of residential development initiatives by the country’s authorities that involve the integration of smart technologies. The affluent consumer demographic is more likely to invest in premium smart home devices, including smart TVs, home theater systems, and voice assistants, contributing to an elevated living room experience. Furthermore, the extensive use of voice assistants such as Amazon Alexa, Google Assistant, and Apple Siri is transforming living rooms into interactive, voice-controlled environments. Consumers strongly prefer the convenience of hands-free control over their entertainment and smart home devices, generating significant traction in this segment. The UAE’s real estate market, especially in cities such as Dubai and Abu Dhabi, is increasingly focused on smart homes that incorporate advanced technologies. These homes often come equipped with integrated smart living room solutions, providing residents with connected entertainment and home automation systems.

Key Connected Living Room Company Insights

Some major companies involved in the global connected living room industry include Apple, Samsung, and LG Electronics, among others.

-

Apple is a U.S.-based multinational technology organization specializing in providing consumers with consumer electronics, software, and online services. The company designs and manufactures a wide range of products, including smartphones, personal computers, tablets, and wearable devices. It distributes digital content and applications through platforms such as the App Store, Apple TV+, and Apple Music. Apple has developed various smart home solutions, including HomePod and HomePod Mini smart speakers and the Apple Home platform, which allows the configuration and control of smart appliances using Apple devices.

-

Samsung Electronics is a South Korean consumer electronics and appliance company that manufactures televisions, smartphones, personal computers, semiconductors, and home appliances, among other types of equipment. Samsung SmartThings is the company's proprietary platform designed to connect, monitor, and control smart devices within a household through a single application. SmartThings can be used through smartphones to control devices, cast select applications on TV, and monitor and control the user's home. SmartThings on Samsung TV enhances the entertainment experience by controlling the TV and other smart devices, changing settings, and monitoring security cameras.

Key Connected Living Room Companies:

The following are the leading companies in the connected living room market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Amazon.com, Inc.

- Apple Inc.

- ASSA ABLOY

- Google LLC

- Honeywell International Inc.

- Legrand SA

- LG Electronics

- Signify Holding

- Robert Bosch GmbH

- SAMSUNG

- Schneider Electric

- Siemens

- Sony Corporation

Recent Developments

-

In January 2025, ASSA ABLOY announced the acquisition of Uhlmann & Zacher GmbH, a Germany-based supplier of access-control knobs and handles and their complementary software. The acquisition aims to strengthen ASSA ABLOY's market positioning and product offerings in Germany. Uhlmann & Zacher GmbH offers products including electronic locking cylinders, door handles and knobs, wall-mounted readers, OEM products, and furniture locks. The company caters to various sectors, including hospitals, private homes, offices, and industrial plants.

-

In December 2024, Samsung announced the collaboration of its SmartThings platform with YouTube Music, allowing the former to effectively customize the Music Sync experience as per users' requirements. This partnership aims to provide options to users of YouTube Music Premium to synchronize the light of Philips Hue bulbs while listening to songs, creating customized ambiances such as 'Relax,' 'Party,' and 'Workout.' Samsung expects to partner with more companies in 2025 to improve the Music Sync experience further.

Connected Living Room Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 66.16 billion

Revenue forecast in 2030

USD 101.42 billion

Growth rate

CAGR of 8.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, UAE, Saudi Arabia, South Africa

Key companies profiled

ABB; Amazon.com, Inc.; Apple Inc.; ASSA ABLOY; Google LLC; Honeywell International Inc.; Legrand SA; LG Electronics; Signify Holding; Robert Bosch GmbH; SAMSUNG; Schneider Electric; Siemens; Sony Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Connected Living Room Market Report Segmentation

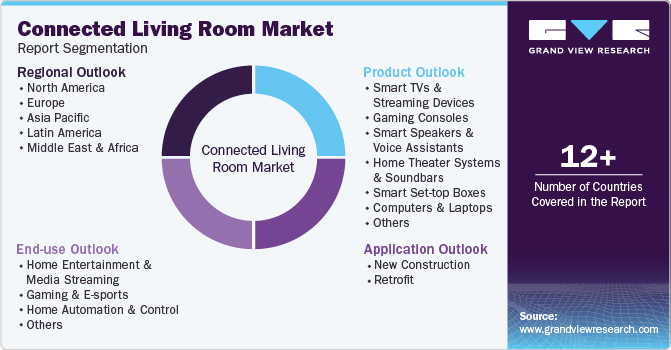

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global connected living room market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Smart TVs & Streaming Devices

-

Gaming Consoles

-

Smart Speakers & Voice Assistants

-

Home Theater Systems & Soundbars

-

Smart Set-top Boxes (STBs)

-

Computers and Laptops

-

Smartphones and Tablets

-

Connected Security Systems

-

Connected Lighting

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

New Construction

-

Retrofit

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Home Entertainment & Media Streaming

-

Gaming & E-sports

-

Home Automation & Control

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.