- Home

- »

- Electronic & Electrical

- »

-

Connected TV Market Size & Share, Industry Report, 2030GVR Report cover

![Connected TV Market Size, Share & Trends Report]()

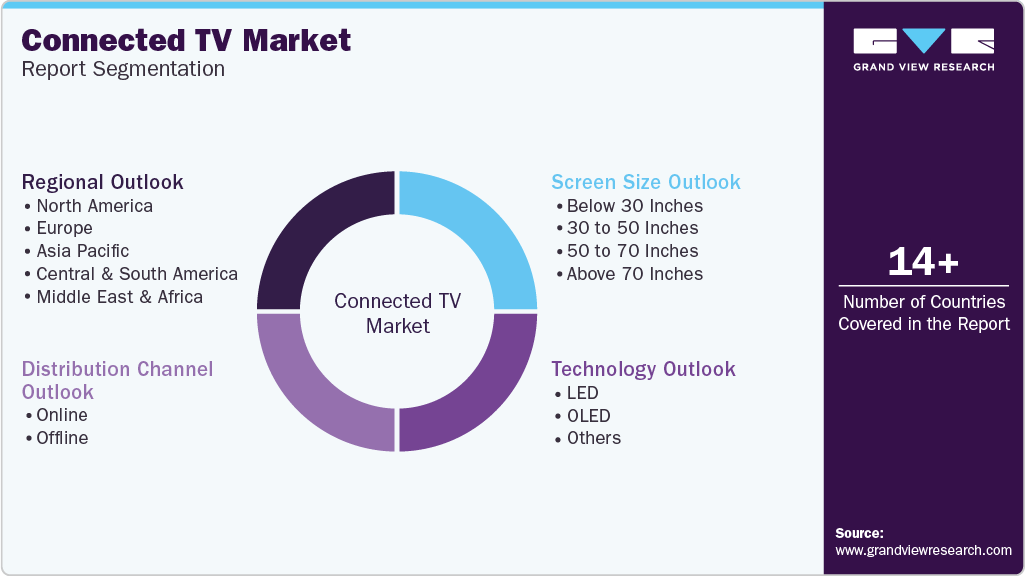

Connected TV Market (2025 - 2030) Size, Share & Trends Analysis Report By Screen Size (Less than 30 inches, 30 to 50 inches, 50 to 70 inches, above 70 inches), By Distribution, By Technology (LED, OLED), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-587-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Connected TV Market Summary

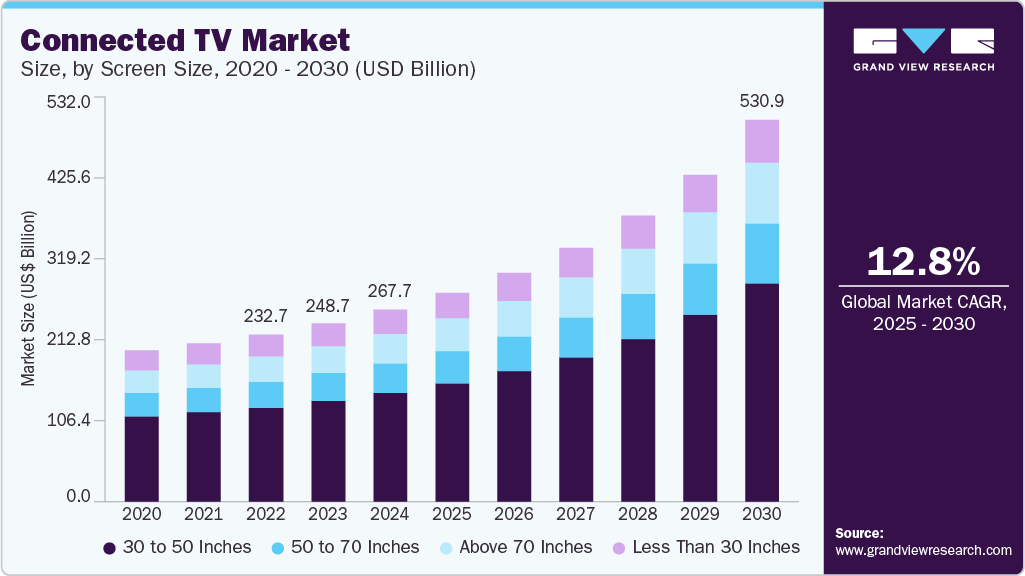

The global connected TV market size was estimated at USD 267.67 billion in 2024 and is expected to reach USD 530.90 billion by 2030, growing at a CAGR of 12.80% from 2025 to 2030. This expansion is primarily driven by the widespread adoption of streaming services, which offer consumers a vast array of on-demand content at competitive prices.

Key Market Trends & Insights

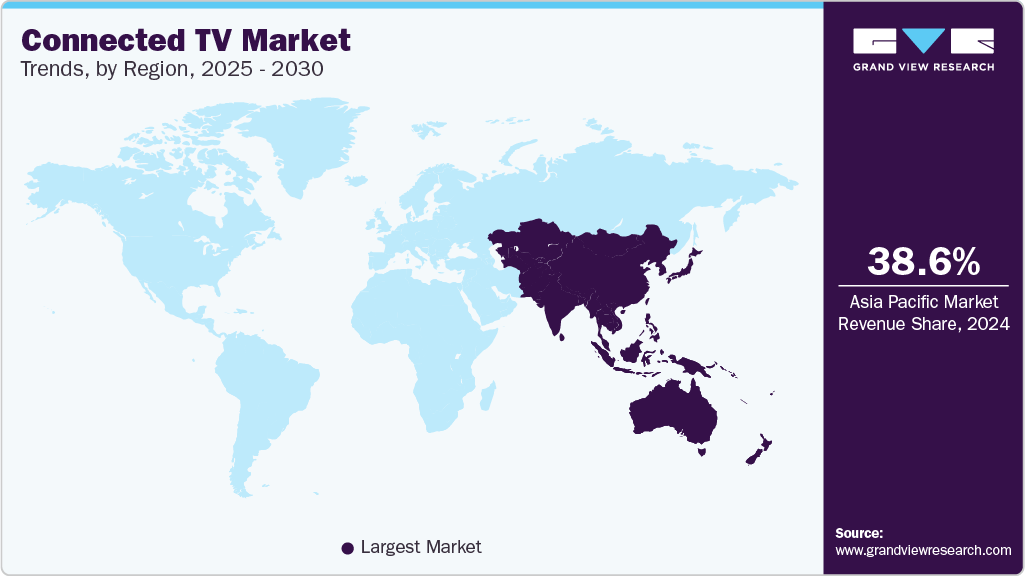

- Asia Pacific leads the global market with the revenue share of 38.57% in 2024.

- By screen size, the 30 to 50-inch segment led the market with revenue around USD 150 billion in 2024.

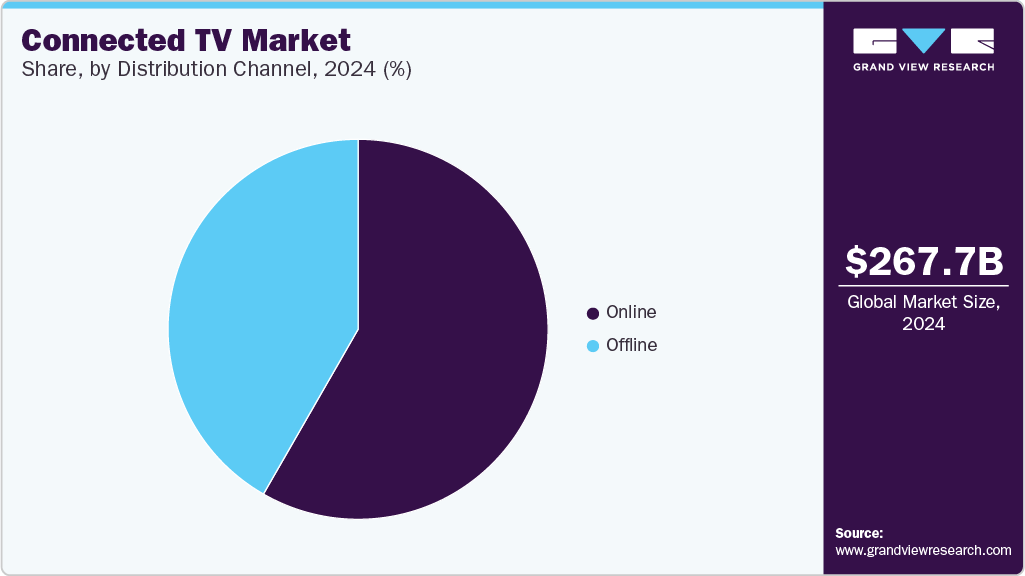

- By distribution channel, online segment held the dominated revenue share in 2024.

- By technology, LED segment is expected to grow at a CAGR of 12.6% from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 267.67 Billion

- 2030 Projected Market Size: USD 530.90 Billion

- CAGR (2025-2030): 12.80%

- Asia Pacific: Largest market in 2024

As viewers increasingly shift from traditional cable and satellite TV to platforms like Netflix, Disney+, and Amazon Prime Video, the demand for connected TV devices has surged, making them the preferred medium for modern home entertainment. Technological advancements play a crucial role in fueling this growth. Manufacturers are integrating cutting-edge features such as 4K and 8K resolution, HDR, OLED, and QLED displays, and AI-powered content recommendations. These innovations significantly enhance the viewing experience, attracting consumers seeking premium entertainment solutions. Voice control, smart home integration, and personalized user interfaces further differentiate connected TVs from conventional televisions, driving higher adoption rates.

The proliferation of high-speed internet and the expansion of smart home ecosystems have also accelerated connected TV market growth. Improved broadband infrastructure enables seamless streaming and supports advanced features like cloud gaming and AI-driven suggestions. As smart homes become more prevalent, consumers increasingly expect their TVs to function as central hubs for entertainment, communication, and home automation, reinforcing the appeal of connected TVs.

Regional market dynamics further contribute to the sector’s expansion. North America and Europe hold substantial market shares due to high disposable incomes, advanced internet infrastructure, and a strong appetite for the latest technology. However, the Asia Pacific region, particularly China and India, is expected to witness the fastest growth, fueled by rising incomes, rapid urbanization, and the deployment of 5G networks, which enhance streaming quality and accessibility.

Another significant growth driver is the rise of over-the-top (OTT) platforms and advertising-supported video on demand (AVOD) models. These services offer flexible, affordable alternatives to traditional TV, catering to the evolving preferences of younger demographics and cord-cutters. The availability of exclusive and localized content on various streaming platforms further incentivizes consumers to invest in connected TVs, solidifying their dominance in the entertainment sector.

The competitive landscape, featuring established electronics manufacturers like Samsung, LG, and Sony alongside tech giants like Amazon, Apple, and Google, ensures continuous innovation and market evolution. Strategic partnerships, mergers, and technological advancements are expected to propel the market further, making connected TVs an integral part of the digital home and entertainment ecosystem for years to come.

Despite its rapid growth, the connected TV (CTV) market faces several challenges. One major issue is market concentration, where a few large tech firms like Google and Amazon dominate the operating system landscape. This concentration can lead to reduced competition, higher prices, limited innovation, and less consumer choice, as these companies may engage in self-preferencing by promoting their content over competitors’ offerings.

Another challenge is the high cost associated with connected TVs compared to traditional TVs. This price premium can deter some consumers from adopting CTVs, especially in regions with lower disposable incomes. Additionally, resistance to change and conventional TV-watching habits slow down market penetration.

Screen Size Insights

The 30 to 50-inch screen size connected TV led the market with revenue around USD 150 billion in 2024 and is projected to exceed USD 300 billion by 2030, as it is the most preferred choice for households. These mid-sized TVs fit well in urban homes with space constraints, offering a compact yet high-quality entertainment solution. The surge in 4K Ultra HD content availability further fuels demand in this segment, as consumers seek better picture quality without paying premium prices for larger screens.

The 50 to 70-inch segment is gaining traction among consumers looking for a more cinematic and immersive viewing experience. This size range is favored in larger living rooms and home theaters, where viewers want to enjoy premium content such as 4K and HDR movies or gaming with greater visual impact. The growth in this category is driven by increasing consumer interest in high-end entertainment systems and the availability of advanced display technologies like OLED, which offer superior contrast and color accuracy.

Screens above 70 inches represent the premium segment of the CTV market, appealing to enthusiasts and luxury buyers. These very large TVs provide an immersive experience akin to a cinema, often integrated with the latest display technologies such as 8K resolution and advanced HDR formats. The growth in this category is supported by rising disposable incomes, especially in developed markets, and a desire for the ultimate home entertainment experience. However, their high price and space requirements limit mass adoption.

Distribution Channel Insights

The connected TV (CTV) market is distributed primarily through two main channels: offline and online. Offline channels include traditional retail stores, electronics outlets, and specialty shops where consumers physically purchase connected TV sets. Online channels consist of e-commerce platforms, brand websites, and digital marketplaces that allow consumers to buy CTVs remotely.

CTV's online distribution held the dominated revenue share in 2024 and is expected to grow at a CAGR of 12.9% from 2025 to 2030. This growth is driven by increasing internet penetration, convenience, and competitive pricing. E-commerce platforms offer a wider variety of models, user reviews, and easy price comparisons, which attract tech-savvy and younger consumers. The COVID-19 pandemic accelerated online shopping adoption, and ongoing logistics and payment options improvements further support this trend. Online channels also enable direct-to-consumer sales by brands, reducing costs and allowing personalized marketing.

The offline distribution market is expected to exceed USD 220 billion by 2030. Offline distribution remains strong due to consumers’ preference to see and experience the product before purchase, especially for high-value items like TVs. Retail stores provide hands-on demonstrations, expert advice, and immediate product availability, which builds consumer confidence. Additionally, offline channels benefit from bundled offers with service providers and seasonal promotions. In many emerging markets, offline retail is still the dominant channel due to limited internet penetration and consumer habits favoring in-person shopping.

Technology Insights

LED technology was the most preferred technology in the CTV market and is expected to grow at a CAGR of 12.6% from 2025 to 2030. LED technology drives growth through its affordability, energy efficiency, and widespread availability across various price points and screen sizes. LED TVs, which are LCDs with LED backlighting, offer improved brightness and thinner designs compared to traditional LCDs, making smart LED TVs accessible to a broad consumer base. The combination of cost-effectiveness and enhanced picture quality attracts budget-conscious buyers and those upgrading from non-smart TVs. Moreover, LED technology supports a wide ecosystem of smart TV operating systems and streaming services, fueling demand in both developed and emerging markets. Its dominance is reinforced by continuous improvements and mass production economies that keep prices competitive and features attractive.

The growth of OLED technology in the connected TV market is driven by its superior display qualities, such as perfect blacks, vibrant colors, wide viewing angles, and energy efficiency. Continuous technological innovations, like higher resolution (4K and 8K), improved brightness, and longer lifespan, enhance the viewing experience, making OLED TVs highly desirable for premium segments. Declining production costs and increasing availability of larger OLED screens are expanding adoption beyond early adopters to mainstream consumers. Additionally, rising disposable incomes and the surge in streaming content requiring high-quality displays further propel OLED market growth globally, especially in regions like North America and Asia Pacific, where major manufacturers invest heavily in R&D and production capacity.

Regional Insights

The North America connected TV market was estimated at USD 80 billion in 2024. North America remains a significant market due to high consumer spending power, widespread broadband availability, and early adoption of advanced technologies. The region benefits from a mature OTT ecosystem with numerous content providers and streaming services driving demand for connected TVs. Innovations like 4K/8K resolution, AI-powered recommendations, and voice control enhance user experience. The presence of major manufacturers and tech companies investing in smart TV platforms also sustains growth. North America’s market is characterized by intense competition and continuous technological advancements, supporting steady expansion.

U.S. Connected TV Market Trends

The U.S. connected TV market is expected to exceed USD 125 billion by 2030 and grow at a CAGR of 11.1% from 2025 to 2030. Advanced features such as 4K and 8K resolution, AI-powered voice control, personalized content recommendations, and integration with smart home ecosystems further boost the appeal of connected TVs in the U.S. market. The presence of major tech companies like Google, Amazon, Samsung, and LG fosters innovation and competitive product offerings. The rise of online gaming platforms requiring high-performance, low-latency displays also contributes to increased CTV adoption. A tech-savvy consumer base with a high affinity for cutting-edge entertainment technologies is expected to sustain strong market growth.

Europe Connected TV Market Trends

Europe connected TV market experiences steady growth driven by increasing consumer preference for smart home integration and high-quality entertainment systems. Countries like the UK, Germany, and France show rising adoption due to improved internet infrastructure and the availability of diverse streaming content. Environmental concerns and demand for energy-efficient TVs also influence purchasing decisions, encouraging manufacturers to innovate. The region’s regulatory environment and digital transformation initiatives support the uptake of connected TVs, especially in urban areas.

Asia Pacific Connected TV Market Trends

Asia Pacific connected TV market leads the global CTV market with the revenue share of 38.57% in 2024 and expected to grow at a CAGR of 14.4% over the forecast period. This growth is fueled by rising disposable incomes, rapid urbanization, and expanding middle-class populations in countries like China and India. The proliferation of affordable smart TVs, increasing internet penetration, and the rollout of 5G networks enable seamless streaming experiences. Additionally, the popularity of OTT platforms offering localized and diverse content further accelerates adoption. Government digital initiatives and growing demand for premium display technologies such as OLED and QLED also contribute to market expansion in this region.

Key Connected TV Company Insights

The connected TV (CTV) market is highly competitive and dominated by a mix of global electronics giants and specialized streaming device manufacturers. Leading companies like Samsung Electronics, LG Electronics, Sony, Panasonic, and Philips hold significant market shares, collectively accounting for a lion's share of the market. These Tier 1 players leverage extensive R&D capabilities, wide product portfolios, and robust global distribution networks to maintain their leadership. They focus on integrating advanced technologies such as UHD displays, AI-driven content recommendations, and seamless smart home integration, which provide them a competitive edge.

Alongside these leaders, Tier 2 companies, including TCL, Hisense, Vizio, and Roku, compete by targeting value-conscious consumers with affordable yet feature-rich connected TVs and streaming devices. These companies often capitalize on regional manufacturing strengths and local content partnerships to penetrate specific markets effectively. Roku, for example, leads in the U.S. connected TV device market with a substantial share due to its popular streaming platforms. The competitive landscape is also shaped by innovation in display technologies like OLED, QLED, and mini-LED, as well as by strategic moves such as partnerships with content providers and adoption of programmatic advertising models. Sustainability and energy-efficient designs are emerging as essential differentiators influencing consumer choices and innovation trajectories across the industry.

Key Connected TV Companies:

The following are the leading companies in the connected TV market. These companies collectively hold the largest market share and dictate industry trends.

- Samsung Electronics

- LG Electronics

- Sony Corporation

- Panasonic Corporation

- Philips

- TCL Technology

- Xiaomi Corporation

- Hisense Group

- Sharp Electronics

- Roku

- Skyworth

- Haier Group

Connected TV Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 290.54 billion

Revenue forecast in 2030

USD 530.90 billion

Growth rate

CAGR of 12.80% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Screen size, technology, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; UAE

Key companies profiled

Samsung Electronics; LG Electronics; Sony Corporation; Panasonic Corporation; Philips; TCL Technology; Xiaomi Corporation; Hisense Group; Vizio Inc.; Sharp Electronics; Roku; Skyworth; Haier Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Connected TV Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends and opportunities in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global connected TV market report based on screen size, distribution channel, technology, and region:

-

Screen Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Below 30 inches

-

30 to 50 inches

-

50 to 70 inches

-

Above 70 inches

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

LED

-

OLED

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global connected TV market was valued at USD 267.67 billion in 2024 and is expected to reach USD 290.54 billion in 2025.

b. The global connected TV market expected to grow at a CAGR of 12.80% from 2025 to 2030 to reach USD 530.90 billion by 2030.

b. LED technology was the most preferred technology in the CVT market and is expected to grow at a CAGR of 12.6% from 2025 to 2030. LED technology drives growth through its affordability, energy efficiency, and widespread availability across various price points and screen sizes. LED TVs, which are LCDs with LED backlighting, offer improved brightness and thinner designs compared to traditional LCDs, making smart LED TVs accessible to a broad consumer base. The combination of cost-effectiveness and enhanced picture quality attracts budget-conscious buyers and those upgrading from non-smart TVs. Moreover, LED technology supports a wide ecosystem of smart TV operating systems and streaming services, fueling demand in both developed and emerging markets. Its dominance is reinforced by continuous improvements and mass production economies that keep prices competitive and features attractive.

b. Some of the key players operating in the market include Samsung Electronics; LG Electronics; Sony Corporation; Panasonic Corporation; Philips; TCL Technology; Xiaomi Corporation; Hisense Group; Vizio Inc.; Sharp Electronics; Roku; Skyworth; Haier Group

b. The growth is primarily driven by the widespread adoption of streaming services, which offer consumers a vast array of on-demand content at competitive prices. As viewers increasingly shift from traditional cable and satellite TV to platforms like Netflix, Disney+, and Amazon Prime Video, the demand for connected TV devices has surged, making them the preferred medium for modern home entertainment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.