- Home

- »

- Advanced Interior Materials

- »

-

Construction Adhesives Market Size & Share Report, 2030GVR Report cover

![Construction Adhesives Market Size, Share & Trends Report]()

Construction Adhesives Market (2024 - 2030) Size, Share & Trends Analysis Report By Resin Type (Acrylic, Polyurethanes, Epoxy), By Technology (Water-based, Solvent-based), By Application (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-684-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Construction Adhesives Market Trends

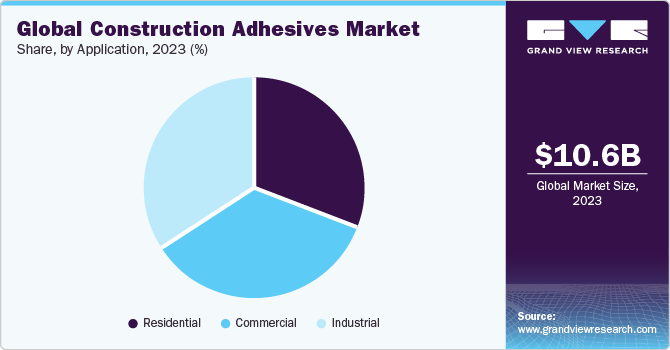

The global construction adhesives market size was estimated at USD 10.58 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.9% from 2024 to 2030. Growing investments in infrastructure sector worldwide are likely to push the demand for construction adhesives during the forecast period. As per the United Nations report on infrastructure in 2021, increasing investments in the infrastructure segment can add up to 0.6% to the global GDP. This addition can be more in some countries, including the U.S. and Brazil where it is up to 1.3% and 1.5%, respectively. Emerging economies are expected to remain key markets for construction adhesives demand, as 60% of infrastructure investment is projected to be attracted by these countries.

In June 2021, the U.S. government announced a USD 1.2 trillion infrastructure plan to support the country’s economic growth. This plan makes investments in transportation, water management, broadband, telecommunications, energy, and others. The funding is planned through a combination of federal investment that is expected to encourage private entities. Much of the incentivized non-federal investments are anticipated to originate from public-private partnerships. Such policies are predicted to facilitate the growth of the U.S. construction adhesives industry.

Commercial construction is anticipated to remain a key driver for the long-term growth of the U.S. market. It accounted for over 34.0% of revenue share in 2023 and is likely to grow at a moderate CAGR during the forecast period. Adhesives are widely utilized in commercial and residential buildings for bonding insulation foams, plastics, wood-based panels, plasterboard panels, and other synthetic raw materials.

The non-residential sector spending remained low for most of the year 2021. Spending across offices, healthcare, education, transportation, and commercial settings witnessed the largest y-o-y decline in July 2021. The overall spending declined by 11% in July 2021, compared to pre-pandemic levels. However, additional funding for infrastructure is likely to boost the spending over the next few years.

Regardless of the challenges associated with the supply chain, such as higher costs for raw materials and building materials, non-availability of materials, and the lack of skilled labor, residential sector in the country is likely to witness stable growth in the near future. The residential construction sector is mainly supported by strong demand for bigger houses, low mortgage rates, and low housing inventory in the U.S.

Market Dynamics

Adhesives designed for construction find application in infrastructure projects, including repair and construction of bridges, road development, and tunnel installations. Furthermore, these adhesives play a crucial role in bonding diverse materials like concrete, wood, metal, plastic, and more. In residential housing sector, they are utilized for tasks such as securing flooring, attaching baseboards, affixing crown molding, and installing drywall.

Driven by an increased focus on sustainability and environmental considerations, there is a rising need for adhesives that are eco-friendly and devoid of harmful chemicals. In 2022, many companies introduced VC shield technology, renowned in construction sector for its durability and resistance to abrasion. For instance, One Belt, One Road initiative undertaken by the Chinese government is anticipated to further elevate the demand for construction adhesive products.

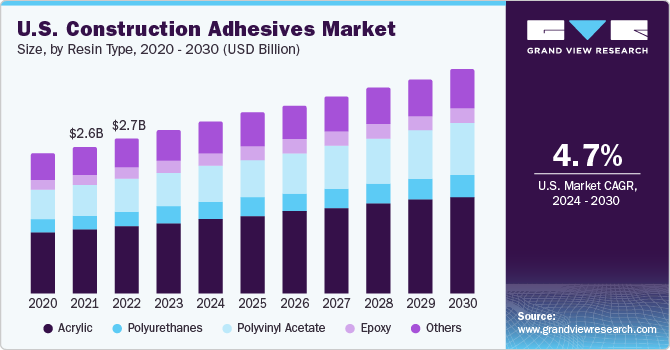

Resin Type Insights

The acrylic adhesive resin segment dominated the market with the highest revenue share of over 44.69% in 2023. The preference for acrylic adhesives is increasing in construction sector mainly due to exceptional bonding properties, good impact strength, and excellent water resistance. This segment is projected to witness a growth rate of 4.8% from 2024 to 2030.

Epoxies are structural adhesives and are likely to observe a growth rate of 4.4%, in terms of revenue, during the forecast period. These adhesives can be used on various substrates in construction industry, wherein a strong bond is required. They are used in laminated woods for roofs, decks, walls, and other applications. These have high heat and chemical resistance and are used to bond stone, glass, metal, wood, and some plastics.

The polyurethanes segment accounted for a volume share of over 11.0% in 2023 and is likely to grow at a lucrative pace. Polyurethane adhesives are paintable, have water resistance, low odor, low VOC content, and the ability to work in cold and hot environments. They are used in interior as well as exterior construction applications.

Technology Insights

The water-based technology segment dominated the market with the highest revenue share of over 44.65% in 2023. Products made using this technology have higher moisture resistance compared to other adhesives, which is likely to contribute to the growth of the segment. New product development along with an increase in R&D spending is likely to offer new avenues for vendors of water-based construction adhesives.

Solvent-based products are used in high-performance applications in construction industry and are likely to witness lucrative growth during the projection period. Demand from structural and non-structural applications is projected to keep a positive momentum for this segment. Key players are focusing on the development of advanced solutions to increase their market share through R&D investments. Reactive adhesives are projected to witness healthy growth on account of their high bond strength and excellent durability in harsh environmental circumstances.

Application Insights

The commercial application segment dominated the market with the highest revenue share of over 34.87% in 2023. Incentives for first-time house buyers are projected to assist residential construction sector around the globe. For instance, in 2022 budget, the Canadian government introduced Tax-Free First Home Savings Account. This will assist first-home buyers to save up to USD 40,000.

The commercial segment is likely to observe a growth rate of 5.4%, in terms of revenue, from 2024 to 2030. Government packages and incentives are projected to boost infrastructure and residential sectors, thereby positively influencing the growth of construction adhesive industry. For instance, the Mexican government is preparing a multi-billion infrastructure package for investment in highways, ports, energy, and telecommunications.

The industrial segment accounted for a revenue share of over 30.0% in 2023. Increasing FDIs in emerging countries, particularly for manufacturing industries, is likely to bolster market growth of industrial segment. For instance, in December 2021, Maharashtra government in India signed MoUs worth around USD 659.7 million for various sectors such as steel, electric vehicles, space research, biofuel, food processing, and ethanol production, etc.

Regional Insights

Asia Pacific region dominated the market with the highest revenue share of 39.39% in 2023. China is the leading consumer of construction adhesives and accounted for a volume share of over 20.0% of the global market in 2023. Massive investments in infrastructure sector of the country are projected to promote the use of construction adhesives. For instance, in August 2020, the state railway operator of China announced its plans to double the high-speed railway network over the next 15 years.

Europe’s infrastructure spending was flat in 2020; however, it observed a y-o-y growth of 1.5% in November 2021, compared to the same period from 2020. As per the latest EU Construction Outlook Report, construction sector is poised to grow by 2.5% in 2022, compared to 2021. the construction sector of North America is one of the leading sectors and contributes significantly to the global GDP. Strong economic growth, an increase in household formation, and low mortgage rates are expected to be key factors aiding the growth in residential construction. However, the demand for multi-family housing is expected to decline during the forecast period, which may have a moderate effect on residential construction.

Key Companies & Market Share Insights

Construction adhesive players in the market are focusing on new product developments, which are eco-friendly and have low VOC emissions. They are also focusing on the development of products with the ability to join different types of substrates, high bonding strength, and consistent performance. Companies are also undertaking other strategic initiatives such as mergers & acquisitions, collaborations, and partnerships, among others to establish their dominance in market. In July 2023, H.B. Fuller completed the acquisition of XCHEM International, a UAE-based adhesives manufacturer for construction industry in the Middle East and Northern Africa region.

Key Construction Adhesives Companies:

- H.B. Fuller Company

- 3M

- Sika AG

- Dow Inc.

- Bostik (Arkema Group)

- Henkel AG & Co. KGaA

- Franklin International, Inc.

- Avery Dennison Corporation

- Illinois Tool Works Incorporation

- DAP Products Inc.

Construction Adhesives Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.14 billion

Revenue forecast in 2030

USD 14.76 billion

Growth rate

CAGR of 4.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Resin type, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Brazil; South Africa; Saudi Arabia

Key companies profiled

H.B. Fuller Company; 3M; Sika AG; Dow; Bostik SA; Henkel AG & Co. KGaA; Franklin International, Inc; Avery Dennison Corporation; Illinois Tool Works Incorporation; DAP Products, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Construction Adhesives Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global construction adhesives market report based on resin type, technology, application, and region:

-

Resin Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Acrylic

-

Polyurethanes

-

Polyvinyl Acetate

-

Epoxy

-

Others

-

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Water-based

-

Solvent-based

-

Reactive & Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global construction adhesives market size was estimated at USD 10.58 billion in 2023 and is expected to reach USD 11.14 billion in 2024.

b. The global construction adhesives market is expected to grow at a compound annual growth rate of 4.9% from 2024 to 2030 to reach USD 14.76 billion by 2030.

b. The Asia Pacific dominated the construction adhesives market with a volume share of over 39.39% in 2023, owing to consistent demand in the real estate sector and housing needs for the increasing population.

b. Some of the key players operating in the construction adhesives market include H.B. Fuller, 3M, Sika AG, Dow, Bostik SA, Henkel AG & Co. KGaA, DAP Products, Inc.

b. The key factors that are driving the construction adhesives market include government funding for infrastructure projects toward economic recovery and increasing FDIs in emerging economies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.