- Home

- »

- Advanced Interior Materials

- »

-

Construction & Demolition Waste Management Market Report 2030GVR Report cover

![Construction & Demolition Waste Management Market Size, Share & Trends Report]()

Construction & Demolition Waste Management Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Soil, Sand, & Gravel), By Waste Type (Hazardous, Non-Hazardous), By Service, By Source, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-214-7

- Number of Report Pages: 114

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Construction & Demolition Waste Management Market Summary

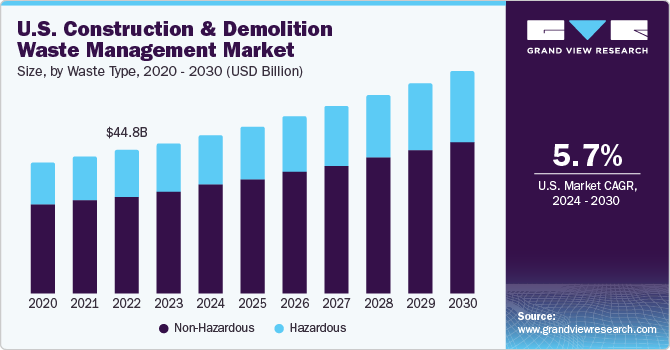

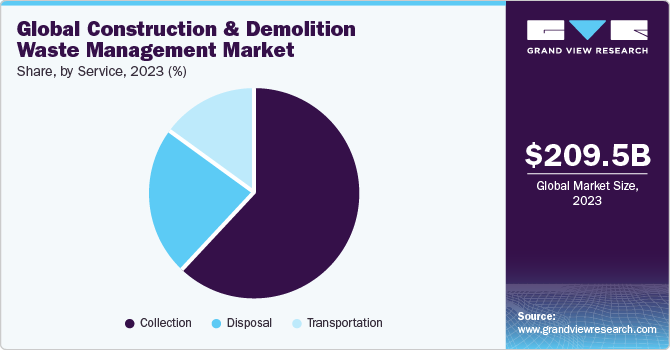

The global construction & demolition waste management market size was estimated at USD 209.5 billion in 2023 and is projected to reach USD 308.5 Billion by 2030, growing at a CAGR of 5.7% from 2024 to 2030.The market is significantly driven by the growth in construction projects and renovation activities across the world.

Key Market Trends & Insights

- Asia Pacific dominated the construction & demolition waste management market and accounted for the largest revenue share of more than 34.2% in 2023.

- The construction & demolition waste management market in China is driven by the increasing industrial expansion strategies.

- By service, the collection service segment is estimated to dominate the global construction & demolition waste management market with a 61.7% market share on the basis of revenue share in 2023.

- By waste type, the non-hazardous waste type segment dominated the market in 2023 owing to the large number of waste generated.

- By material, the soil, sand, & gravel segment dominated the market on the basis of revenue in 2023.

Market Size & Forecast

- 2023 Market Size: USD 209.5 Billion

- 2030 Projected Market Size: USD 308.5 Billion

- CAGR (2024-2030): 5.7%

- Asia Pacific: Largest market in 2023

Construction and demolition activities generate huge amounts of waste material such as wood, metal, concrete, sand, soil, bricks, etc. The rising initiatives by various governments to manage this waste in an environmentally sound way are expected to increase the potential of construction and demolition waste recycling and reuse.

In the U.S., the Environmental Protection Agency (EPA) has established a set of rules and guidelines to efficiently manage construction and demolition waste. EPA promotes a sustainable approach known as Sustainable Materials Management (SMM) that can identify construction and demolition (C&D) debris, which has the potential to be reused in building materials in new construction projects.

Further, new technological advancements in the sustainable recycling of construction and demolition waste are likely to positively impact C&D waste management. For instance, in April 2023, Holcim launched ECOCycle, a proprietary circular technology platform used for recycling construction and demolition waste materials. This platform sustainably processes construction and demolition waste using efficient distribution, grinding, processing, and recycling.

Construction & demolition waste management market is also propelled by the growth of the construction and demolition projects owing to the increase in the population. According to the U.S. Census Bureau, in December 2023 total of 1.5 million housing permits were granted in the U.S., and 1.6 million housing projects were completed. The total housing permits in December 2023 increased by 1.9% compared to November 2023 and 6.1% growth compared to December 2022. Thus, rising construction projects in the U.S. is expected to increase the demand for C&D waste management over the forecast period.

Further, strategies and initiatives by the leading key players and authorities in the market are expected to facilitate the efficient management of construction and demolition waste over the forecast period. For instance, in Lancaster, New Hampshire, U.S., a pilot program was conducted from May 30 to July 2023 to divert C&D waste from landfill to residential reuse. The program was conducted with technical assistance from the Northeast Resource Recovery Association. Such initiatives are expected to drive the growth of the C&D waste management market over the forecast period.

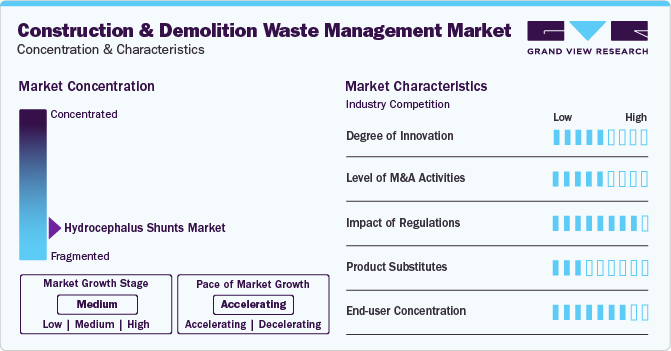

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The competitive rivalry is high in this market owing to the presence of a large number of international and regional players operating in it. The construction & demolition waste management market comprises different processes, including collection, transportation, and disposal. The disposal of the waste is carried out via recycling, landfilling, incinerating, etc.

Various rules and regulations impact the growth of the construction & demolition waste management market. The environmental concerns over the illegal dumping of construction and demolition waste are driving the demand for proper waste management. C&D debris consists of hazardous and non-hazardous waste materials. Asbestos and lead are the most hazardous C&D debris that can cause serious harm if not managed via proper guidelines. Hence, compliance with the regulatory guidelines is becoming mandatory as published by the various government authorities.

Manufacturers of construction & demolition waste management adopt several strategies, including mergers, acquisitions, joint ventures, new product developments, and geographical expansions, to enhance their market penetration. Merger and acquisition activities also impact market direction. Leading key players are making efforts to increase their presence across the value chains and different stages of waste, such as waste hauling/collection, waste transport stations, waste transporting vehicles, and waste processing.

For instance, in February 2024, Interstate Waste Services, Inc. announced the acquisition of Oak Ridge Waste & Recycling, based in Connecticut, U.S., which deals with waste collection, transfer, and recycling services.

The end user concentration is high in the construction and demolition waste management, which comprises the residential, commercial, and industrial sectors. The construction and demolition waste is generated from several projects of single-family houses, apartment buildings, commercial offices, resorts & hotels, educational institutes, public buildings, manufacturing facilities, warehouses, etc.

Service Insights

The collection service segment is estimated to dominate the global construction & demolition waste management market with a 61.7% market share on the basis of revenue share in 2023. The collection of construction & demolition waste from the origin to the transport stations requires a proper vessel and vehicle. It requires door-to-door collection or site-to-site collection, which marks it as one of the largest contributors to total waste management in terms of expenditure.

The disposal service segment is expected to register the fastest growth rate over the forecast period. The disposal techniques that are used for C&D waste management commonly include landfill, incineration, reuse, and recycling. The increasing efforts to divert C&D debris from landfills to recycling are expected to facilitate new opportunities in the market.

Waste Type Insights

The non-hazardous waste type segment dominated the market in 2023 owing to the large number of waste generated. The C&D debris consists of various non-hazardous waste materials according to the industry classification, such as concrete, bricks, tiles, ceramics, wood, glass, plastic, etc. Certain metallic wastes, such as iron, steel, tin, aluminum, etc., are considered non-hazardous waste types. The growing construction and demolition waste are driving the growth of the segment over the forecast period.

Hazardous waste type segment is expected to grow at a lucrative growth rate over the forecast period. Hazardous waste materials consist of insulation materials containing asbestos, a bituminous mixture containing coal tar, coal tar, tarred products, paints and varnishes, and adhesives and sealants. The rising disposal techniques for handling C&D hazardous debris are expected to positively impact the growth of the market.

Material Insights

The soil, sand, & gravel segment dominated the market on the basis of revenue in 2023. Construction activities require a large amount of soil, sand, & gravel used as a filling material in the construction of various different parts such as ground, foundation, underfloor filling, trenches, etc. The leftover materials from construction activities and waste generated from the demolition activities lead to a large amount of such waste materials, which are mostly recovered and reused.

The concrete segment is expected to witness lucrative growth over the forecast period owing to the increasing demolition activities across the world. In the U.S., around 600 million tons of construction and demolition debris are generated annually, as per the 2018 statistics from EPA. Also, new demolition projects across the country are expected to generate concrete and drive the growth of the segment. For instance, in June 2023, a USD 1.5 billion plan was announced to tear down two New York City Housing Authority complexes in Manhattan, the Fulton and Elliot-Chelsea Houses in Chelsea. A new high-rise apartment will replace the existing building. Such demolition activities are expected to increase concrete waste generation.

Source Insights

The industrial source segment held the largest market revenue share in 2023 in the global construction & demolition waste management market. The rising manufacturing output and increasing expansion of the industrial facilities across the developing economies are likely to significantly boost the growth of the industrial segment over the forecast period.

The commercial segment is expected to witness lucrative growth over the forecast period owing to the construction and demolition projects in the commercial sectors. The rising travel and tourism sector is creating a huge demand for new construction projects in hotel and hospitality buildings. Moreover, to provide an easy and convenient travel experience, the airport's construction projects are increasing in number rapidly. Such construction projects are likely to have a positive impact on the growth of the segment over the forecast period.

Regional Insights

North America construction & demolition waste management market is anticipated to grow during the forecast period. The expanding population and rise in construction activities across the region have led to an increase in the volume of construction waste. With an increase in awareness around sustainability and resource management, countries in North America have started to look for options to minimize the impact of construction.

U.S. Construction & Demolition Waste Management Market Trends

The construction & demolition waste management market in the U.S. is anticipated to grow owing to the rise in population and subsequent growth of construction projects. According to the Associated General Contractors of America, construction is a major contributor to the country's GDP. As per the data, more than 919,000 construction establishments were done in 1st quarter of 2023.

Europe Construction & Demolition Waste Management Market Trends

Europe construction & demolition waste management market is expanding at a moderate growth rate. The construction & demolition waste accounts for one-third of the total waste generated in the region. Due to high interest rates and soaring business costs is expected to slow down the construction industry in the region. However, the renovation of buildings, roads, and other transportation infrastructure is expected to contribute to the market.

The construction & demolition waste management market in Germany is poised to grow at a lucrative growth, attributed to the increasing investment in infrastructure development across the country. For instance, in September 2023, Germany introduced a renovation plan for the country’s rail network with a total investment worth USD 43.29 billion (Euro 40 billion). The investment will be made available through 2027 and strengthen the country’s rail infrastructure.

Asia Pacific Construction & Demolition Waste Management Market Trends

Asia Pacific dominated the construction & demolition waste management market and accounted for the largest revenue share of more than 34.2% in 2023, which is significantly attributed to the large construction projects in the developing economies and the huge amount of waste generation across the region. The growing population in the region is stressing the real estate sector to cater to the increasing requirements for residential and commercial places. The rising construction and renovation projects are expected to positively impact the growth of the market.

The construction & demolition waste management market in China is driven by the increasing industrial expansion strategies. The country is entering a new era of industrial expansion with several new expansion projects lined up. For instance, in September 2023, Arkema announced the expansion of the organic peroxide site in Changsu, China. The expansion will lead to a two-and-a-half increase in the total production capacity of the peroxide production facility. The investment is expected to be worth USD 50 million. Further, in July 2023, the second phase of the smart factory for the manufacturing of the equipment commenced. The project is owned by the China National Offshore Oil and Corporation (CNOOC). Such projects are likely to have a positive impact on the growth of the construction & demolition waste management market over the forecast period.

Central & South America Construction & Demolition Waste Management Market Trends

Central & South America construction & demolition waste management market is driven by high urbanization in the region. In South & Central America, over 80% of the population lives in cities, contributing to the vast construction industry in the region.

The construction & demolition waste management market in Brazil is expected to witness lucrative growth attributed to the rising urbanization. Owing to urbanization, rapid growth in the commercial sector and residential sectors is witnessed. The renovation, demolition, and construction projects are being introduced. For instance, in August 2023, the Growth Acceleration Program (PAC) was launched by the federal government for the construction of a new regional airport terminal in the State of Minas Gerais.

Middle East & Africa Construction & Demolition Waste Management Market Trends

Middle East & Africa construction & demolition waste management market driven by increasing awareness towards sustainable advantages and benefits of waste management and recycling. However, the lack of adequate infrastructure for the collection and recycling of C&D waste in many African regions is resulting in illegal landfill sites, thereby hampering the market growth.

The construction & demolition waste management market in Saudi Arabia is expected to grow at a lucrative growth rate owing to the rising efforts to strengthen the country’s waste management sector. The local governments are adopting sustainability and efficient waste management technology to handle the C&D debris. Such developments in the country are expected to drive market growth over the forecast period.

Key Construction & Demolition Waste Management Company Insights

The industry is extremely competitive due to the presence of various large numbers of waste management companies across the verticals. Waste collection, waste transportation, and waste disposal comprise various shareholders focusing on different activities. Some of the key players are integrated across the value chain and provide services from collection to disposal. Construction & demolition waste management companies use various strategies to increase their service offerings, such as expansions, mergers & acquisitions, research & development, and joint collaborations.

For instance, in February 2024, Capital Waste Services LLC, a South Carolina-based company, announced the acquisition of Herrington Industries LLC, based in Florida. Herrington Industries LLC is a provider of roll-off dumpster and landfill services, and it is one of the prominent service providers for construction and demolition materials.

Key Construction & Demolition Waste Management Companies:

The following are the leading companies in the construction & demolition waste management market. These companies collectively hold the largest market share and dictate industry trends.

- Veolia Environment S.A.

- Waste Connections

- Clean Harbors, Inc.

- Remondis

- Republic Services

- FCC Environment Limited

- WM Intellectual Property Holdings, LLC

- Kiverco

- Daiseki Co., Ltd.

- Windsor Waste

- Casella Waste Systems, Inc.

- Renewi plc

- GFL Environmental Inc.

- Metso Corporation

- Cleanaway Waster Management Limited

Recent Developments

-

In February 2024, Vermeer Corp., an Iowa-based company, launched the LS3600TX low-speed shredder. The new shredder offers excellent processing capabilities for processing light construction and demolition waste.

-

In April 2022, CRH subsidiary Eqiom announced the successful commissioning of the construction waste recycling pilot plant in Gennevilliers, France. The plant aimed to process 50,000 tons of construction waste in 2022.

Construction & Demolition Waste Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 221.38 billion

Revenue forecast in 2030

USD 308.5 billion

Growth Rate

CAGR of 5.7% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Waste type, material, source, service, region

Regional Scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Veolia Environment S.A; Waste Connections; Clean Harbors, Inc.; Remondis; Republic Services; FCC Environment Limited; WM Intellectual Property Holdings, LLC; Kiverco; Daiseki Co., Ltd.; Windsor Waste; Casella Waste Systems, Inc.; Renewi plc; GFL Environmental Inc.; Metso Corporation; Cleanaway Waste Management Limited

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Construction & Demolition Waste Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the construction & demolition waste management market report based on waste type, material, source, service, and region.

-

Waste Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hazardous

-

Non-Hazardous

-

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Soil, Sand, & Gravel

-

Concrete

-

Bricks & Masonry

-

Wood

-

Metal

-

Others

-

-

Source Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Collection

-

Transportation

-

Disposal

-

-

Region Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The construction & demolition waste management market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.7% from 2024 to 2030 to reach USD 308.50 billion by 2030.

b. Asia Pacific dominated the construction & demolition waste management market with a revenue share of 34.2% in 2023. The rising urbanization & industrialization is facilitating the construction and renovation projects in Asia Pacific at a rapid rate, which is contributing to the large production of construction and demolition waste, consequently requiring waste management services.

b. Some of the key players operating in the construction & demolition waste management market include Veolia Environment S.A., Waste Connections, Clean Harbors, Inc., Remondis, Republic Services, FCC Environment Limited, WM Intellectual Property Holdings, LLC, and Kiverco, Daiseki Co., Ltd.

b. The key factors that are driving the construction & demolition waste management market include the rising regulatory compliance, increasing construction & demolition projects, and growing environmental concerns over the pollution caused by waste.

b. The global construction & demolition waste management market size was estimated at USD 209.5 billion in 2023 and is expected to be USD 221.38 billion in 2024.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.