- Home

- »

- Biotechnology

- »

-

Consumer Genomics Market Size And Share Report, 2030GVR Report cover

![Consumer Genomics Market Size, Share & Trends Report]()

Consumer Genomics Market Size, Share & Trends Analysis Report By Application (Genetic Relatedness, Ancestry, Diagnostics, Sports Nutrition & Health), By Region (North America, Europe), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-987-6

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Consumer Genomics Market Size & Trends

The global consumer genomics market size was estimated at USD 1.23 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 24.8% from 2023 to 2030. There has been a rising demand for direct-to-consumer genetic testing in recent years. These tests typically analyze an individual's DNA to provide information about health risks, genetic traits, and ancestry. As the field of consumer genomics expands, an increasing number of companies are offering genetic testing directly to consumers. However, it's crucial to thoroughly evaluate the quality and credibility of these services before pursuing any testing, as there is currently limited regulation of direct-to-consumer genetic testing companies.

Since the COVID-19 pandemic, there has been a heightened public concern about health, prompting an increased interest in cutting-edge approaches like consumer genomics. This growing awareness of health issues and the role of genetics has contributed to the sustained growth of the market. One key factor driving this growth is the rising focus on DNA-based research and development (R&D) efforts, particularly in the realm of bioinformatics, for the creation of diagnostic tools and efficient therapies, including those related to COVID-19

The expansion of the market is primarily propelled by several factors, including a surge in consumer and physician interest in direct-to-consumer (DTC) kits, advancements in technology, the increasing range of consumer genomics applications, supportive governmental policies, and the growing trend of personalized genomics. For instance, the prevalence of DTC tests saw a notable increase in 2022, as individuals could purchase them without requiring a doctor's prescription, making them more accessible and convenient for the general population.

The expansion of the application areas for direct-to-consumer (DTC) genetic tests is a significant driver of the market. Genetic testing encompasses a wide array of services, including ancestry identification, race determination, and the exploration of family connections. These diverse applications have led to increased adoption in clinical practices. Furthermore, robust consumer genetics tests find applications in clinical, genealogical, and forensic domains. Many companies offer DTC tests that are adaptable for ongoing research, sports, nutrition, and various other fields.

Market expansion is expected to be further supported by significant product innovation and collaborations among key industry players. For instance, in July 2022, 1health.io Inc. significantly expanded its testing capabilities in both the clinical and direct-to-consumer sectors. In addition, the company partnered with Apollo Health Group to extend the clinical market for Apollo's specialized, high-performing Next-Generation Sequencing (NGS) assays, including pharmacogenetics screenings (PGx) and hereditary cancer genetic screenings (CGx). These advancements are contributing to the market's growth.

Companies such as 23andMe, bio.logis Genetic Information Management (GIM) GmbH and DNA Testing Centers of Canada offer carrier screening test kits for various genetic conditions in clinical settings. Similarly, My Gene Diet, Smart DNA, and Halo Health International provide personalized diet services and meal plans that are tailored to an individual's genetic profile. The trend of direct-to-consumer (DTC) personalized genomic testing continues to gain momentum, driven by the affordability of these tests, with prices ranging from as low as USD 100 to over USD 2000, depending on the complexity and scope of the tests.

Application Insights

The genetic relatedness segment held the largest revenue share of 19.82% in 2022. This area involves the most common type of paternal testing. The rise in the adoption of paternity testing, maternity testing, and prenatal paternity testing drives revenue generation in the market. Paternity testing kits can be easily ordered online; however, these tests are not always legal. Conversely, a significant number of customers are adopting DTC genetic testing to gain information about their hereditary traits and to identify unknown relatives and long-distance cousins.

According to a research paper released by the University of Cambridge in November 2021, genome sequencing from a single blood test detects 31% more cases of unusual genetic disorders than standard testing. In addition, cancer screening has made substantial use of genetic relatedness. The rising prevalence of cancers in the world is anticipated to fuel the market. For instance, the American Cancer Society predicted 1,918,030 new cases of cancer in the country in 2022. According to the International Agency for Research on Cancer (IARC), the incidence of undiagnosed cancer is projected to rise to 30.2 million by 2040. Therefore, genetic testing helps provide information about the risk factors linked to the development of cancer in the future and whether cancer runs in the family.

Companies such as FamilyTree DNA; AncestryDNA; 23andMe, Inc.; MyHeritage; and others offer various paternal and maternal tests. These tests help gather information about genetic relations and ancestry at a low cost. DTC tests are considered powerful tools for identifying similar inheritance patterns among individuals and tracing relatives back to known people. Test Country, Gensys, Genetic Profiles, and many other companies offer the most common type of paternal testing. Some of these companies also provide non-consensual (infidelity) testing along with paternal testing.

The lifestyle, wellness, & nutrition segment is expected to grow at the fastest CAGR in the coming years. Several companies such as My Gene Diet (Natures Remedies Ltd); Pathway Genomics; Helix; Toolbox Genomics; and others offer nutrigenetic testing services, including tests related to fitness, diet, wellness, and nutrition plans. Some of these companies are also engaged in offering customized services related to diet, meals, and food supplement plans. Nutrition and lifestyle-based genetic tests are considered promising and are widely available to assist with diet and lifestyle plans.

Regional Insights

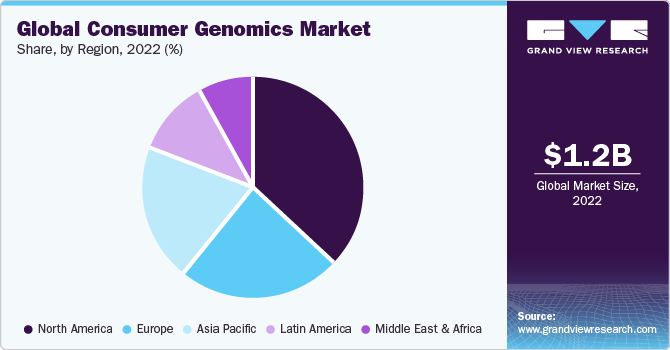

North America dominated the market and accounted for the largest revenue share of 36.6% in 2022. High patient awareness levels, high per capita healthcare spending, and a high prevalence of the target disorders all favor the expansion of the market. The biggest reason for mortality and disability in the U.S. each year is chronic diseases, according to data on chronic diseases updated by the Centers for Disease Control and Prevention in July 2022. The expansion of consumer genomics in the country is supported by the increased incidence of chronic diseases.

This major market share can also be attributed to the early commercialization of genomics in North America as well as the presence of a substantial number of key players dealing with DTC tests. The local presence of key DTC players and the high awareness of at-home testing among the U.S. population reinforce the dominant position of the U.S. in the global market.

In Canada, an increase in government initiatives to strengthen genomics projects is expected to further enhance Canada's expertise in DTC genetics. The Canadian Medical Association (CMA) supports public knowledge and education, helping to increase patient awareness about the potential advantages and limitations of DTC genetic testing. Furthermore, CMA is actively engaged in training healthcare providers to keep them updated with the rapid advancements in molecular genetics.

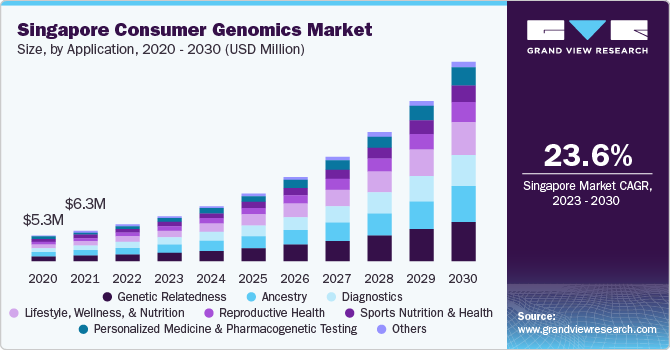

In Asia Pacific, the market for consumer genomics is estimated to witness the fastest CAGR of 25.4% during the forecast period. This region exhibits high growth potential due to increasing awareness of DTC genetics and the availability of funding for long-term research initiatives. The entry of new market participants is also contributing to the regional market's growth. For example, Prenetics Limited, a consumer genomics company based in Hong Kong, markets its offerings in the East and Southeast Asian markets. Similarly, Xcode Life is an India-based consumer genomics company targeting the Indian market.

Key Companies & Market Share Insights

The market is highly competitive, with a large number of manufacturers accounting for a majority of the market share. Product launches, approvals, strategic acquisitions, and innovations are just a few of the important business strategies used by market participants to maintain and grow their global reach. For instance, in May 2023, Grifols launched the AlphaIDAt Home by which the American consumers can now self-screen for genetic COPD.

Key Consumer Genomics Companies:

- Ancestry

- Gene By Gene, Ltd. (FamilyTree DNA)

- 23andMe, Inc.

- Color Health, Inc

- Myriad Genetics, Inc

- Mapmygenome

- Positive Biosciences, Ltd

- Futura Genetics

- Helix OpCo LLC

- MyHeritage Ltd.

- Pathway Genomics

- Veritas

- Amgen, Inc.

- Xcode Life

- Diagnomics, Inc.

- Toolbox Genomics

- SomaLogic, Inc.

- inui Health (formerly Scanadu)

- AgeCurve

- QuickCheck Health

- Biomeb

- Metabolomic Discoveries GmbH

- Illumina, Inc.

Consumer Genomics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.52 billion

Revenue forecast in 2030

USD 7.20 billion

Growth rate

CAGR of 24.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; Switzerland; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Ancestry; Gene By Gene, Ltd. (FamilyTree DNA); 23andMe,Inc.; Color Genomics,Inc; Myriad Genetics,Inc; Mapmygenome; Positive Biosciences, Ltd; Futura Genetics; Helix OpCo LLC; MyHeritage Ltd.; Pathway Genomics; Veritas; Amgen, Inc.; Xcode Life; Diagnomics, Inc.; Toolbox Genomics; SomaLogic, Inc.; inui Health (formerly Scanadu); AgeCurve; QuickCheck Health; Biomeb; Metabolomic Discoveries GmbH; Illumina, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Content Delivery Network Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global consumer genomics market report based on application, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Genetic Relatedness

-

Ancestry

-

Lifestyle, Wellness, & Nutrition

-

Diagnostics

-

Sports Nutrition & Health

-

Reproductive Health

-

Personalized Medicine & Pharmacogenetic testing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Switzerland

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global consumer genomics market size was estimated at USD 1.23 billion in 2022 and is expected to reach USD 1.52 billion in 2023.

b. The global consumer genomics market is expected to grow at a compound annual growth rate of 24.8% from 2023 to 2030 to reach USD 7.20 billion by 2030.

b. The genetic relatedness segment led the global consumer genomics market and accounted for the largest revenue share of 19.8% in 2022.

b. Some key players operating in the consumer genomics market include 23andMe, Inc.; Ancestry; Color Genomics, Inc.; Helix OpCo LLC; Gene By Gene, Ltd. (FamilyTree DNA); Mapmygenome; Positive Biosciences, Ltd.; Futura Genetics; MyHeritage Ltd.; Pathway Genomics; Xcode Life; Diagnomics, Inc.; and Toolbox Genomics.

b. Key factors that are driving the consumer genomics market growth include a rise in the interest of consumers & physicians in DTC kits & consequent rise in sales of DNA test kits, increase in access to DTC services due to reducing the cost of genotyping, expansion in applications of DTC genetics, significant investments & initiatives by companies to maintain their competitive edge in the market, and growing trend of personalized genomics.

b. North America dominated the consumer genomics market with a share of 36.56% in 2022. This can be attributed to the early commercialization of genomics in North America as well as the presence of a substantial number of key players dealing with consumer genetic tests.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."