- Home

- »

- Next Generation Technologies

- »

-

Contact Center Analytics Market Size, Industry Report, 2030GVR Report cover

![Contact Center Analytics Market Size, Share & Trends Report]()

Contact Center Analytics Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Service), By Deployment, By Enterprise Size, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-075-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Contact Center Analytics Market Summary

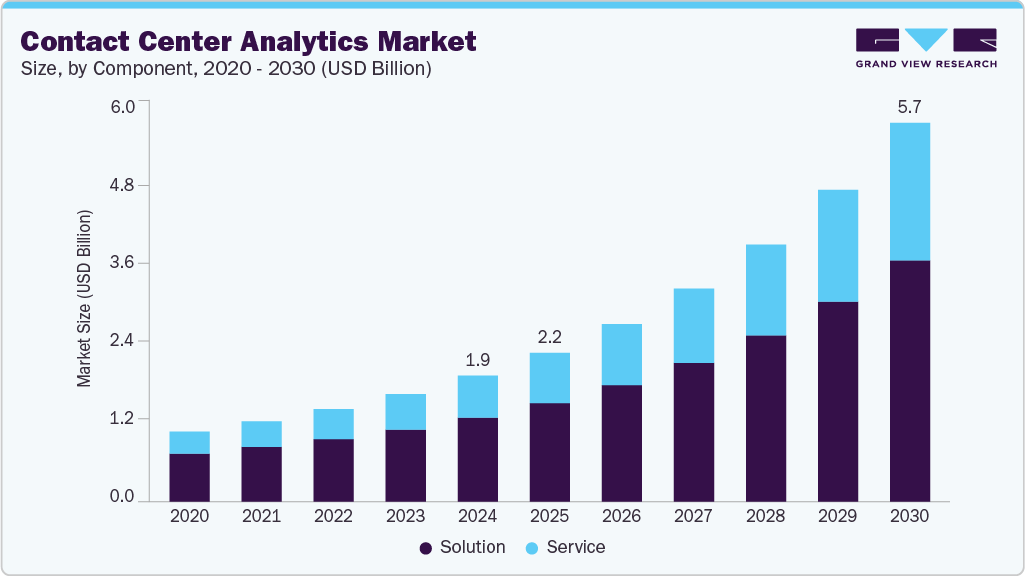

The global contact center analytics market size is estimated at USD 1.91 billion in 2024 and is projected to reach USD 5.75 billion by 2030, growing at a CAGR of 20.5% from 2025 to 2030. The high demand for analytics among contact centers can be attributed to the benefits it offers, such as improved service quality and the ability to monitor service metrics from employee performance, call times, customer satisfaction, and efficiency.

Key Market Trends & Insights

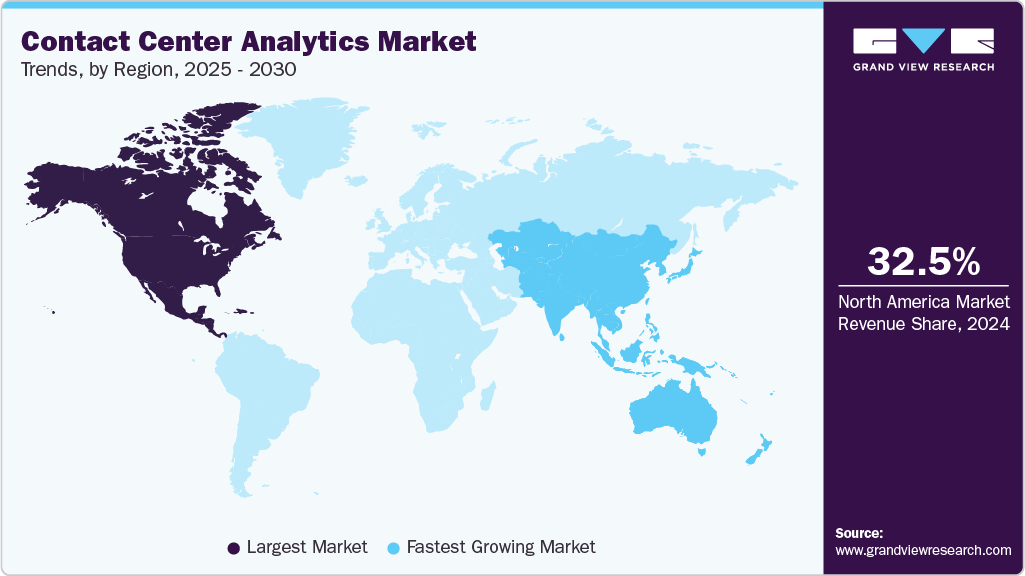

- North America dominated the market with the largest revenue share of 32.50% in 2024.

- The U.S. contact center analytics industry held a dominant position in 2024.

- Based on component, the solutions segment accounted for the largest share of 66.6% in 2024.

- Based on service, the integration & deployment segment accounted for the largest revenue share of 39.1% in 2024.

- Based on solutions, the speech analytics segment accounted for the largest share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.91 Billion

- 2030 Projected Market Size: USD 5.75 Billion

- CAGR (2025-2030): 20.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The growing use of social media platforms is also one of the major factors creating the demand for contact center analytics. Customer feedback posted on social media platforms through blogs, posts, and forums is analyzed using contact center analytics solutions, allowing companies to analyze social media content on a real-time basis. The widespread adoption of the Industrial Internet of Things (IIoT) and automation in the mining sector drives the growth of the market. IIoT integrates sensors, connected devices, and software to collect and analyze real-time data across mining equipment and facilities. This enhances visibility and enables mining companies to take proactive actions, such as scheduling maintenance before a machine fails or redirecting equipment to high-yield zones.

Component Insights

The solutions segment accounted for the largest share of 66.6% in 2024. Rising demand for enhanced customer experience drives growth of the segment. Modern businesses increasingly recognize the importance of delivering superior customer experiences as a key differentiator. Contact center analytics solutions enable organizations to capture and analyze vast volumes of customer interaction data across channels such as voice, chat, email, and social media. By leveraging these insights, companies can understand customer sentiment, preferences, and pain points, enabling personalized service delivery and faster issue resolution.

The service segment is expected to grow at the fastest CAGR during the forecast period. Growing demand for managed services and support fuels growth of the services segment. Many businesses, particularly small and medium enterprises, lack in-house expertise or IT resources to manage advanced analytics platforms. By outsourcing third-party providers, they can maintain high system performance, access the latest updates, and receive 24/7 technical support, all while controlling costs.

Solutions Insights

The speech analytics segment accounted for the largest share in 2024. The capability of speech analytics solutions to improve agent performance and goal attainment, and reduce agent churn, among other benefits, is expected to drive the segment growth. These solutions collect insights into the performance of contact centers and other functioning areas within a business. These solutions analyze recorded conversations and help agents identify the solution to resolve customer issues. Moreover, increasing focus on customer satisfaction, coupled with the growing significance of real-time speech analytics solutions is further expected to fuel the segment growth.

The performance analytics segment is expected to grow at a significant CAGR over the forecast period. Contact centers are increasingly adopting these solutions for capabilities, such as allowing agents to handle multiple communication channels like messaging, emails, and phone calls at the same time. The integration of multiple communication channels into a single system allows agents to maintain a consistent record of their communications regardless of the channel format. Moreover, these solutions allow agents to automatically draw data from any number of sources and help reduce response time with their customers.

Service Insights

The integration & deployment segment accounted for the largest revenue share of 39.1% in 2024. Integration & deployment services are required to ensure that the new systems are in-line with the existing systems of various departments. The high demand for contact center analytics integration & deployment services can be attributed to the fact that they allow businesses to gain unique access to analytics and customer data by integrating advanced technologies in their operations. Moreover, integration & deployment services focus on regulatory compliance and data privacy needs, thereby generating growth opportunities for the segment.

The managed services segment is estimated to register the fastest CAGR of 26.3% over the forecast period. Managed services allow businesses to focus on improving operational efficiency, technology effectiveness, and creating a cohesive customer experience. These services offer contact centers with risk mitigation, secured integrity of customer data, and intellectual property-based tools. In addition, managed services offer a comprehensive set of automated support solutions, which include monitoring of networks, customer databases, servers, and applications.

Deployment Insights

The on-premise segment held the largest market share in 2024. Organizations demand on-premises deployment as it offers easy customization of software as per their need. Contact center solutions deployed on-premise are managed and owned by the organization’s telephony group or the internal IT department. On-premise solutions are widely preferred by businesses with specific business continuity requirements and data privacy needs.

The hosted segment is expected to grow at the fastest CAGR during the forecast period due to the growing adoption of work-from-home models among contact centers across the globe. A number of organizations prefer the hosted deployment method as it is completely hosted on a vendor’s server and can only be accessed by authorized individuals. The vendor is responsible for software upgrades and maintenance. Hosted deployment enables businesses to manage the technical and operational needs of their contact centers but restricts them from managing the infrastructure.

Enterprise Size Insights

The large enterprise segment dominated the market in 2024. The high call volume experienced by large enterprises is one of the major factors driving the demand for contact center analytics. In large enterprises, customer data is distributed across all the channels. Analytics solutions allow agents to filter the data as per the customer’s requirement and deliver the required information on time.

The SMEs are projected to grow at the fastest CAGR over the forecast period. With the increased adoption of new communication technologies and devices, customer expectations are rapidly growing and evolving. To overcome these challenges, several SMEs are focusing on adopting contact center analytics solutions to provide enhanced customer service. This factor is expected to drive the segment growth over the forecast period. At the same time, benefits offered by these solutions, such as the ease of tracking customer data, are also driving the growth of this segment.

Application Insights

The customer experience management segment dominated the market in 2024. The segment growth can be attributed to the benefits offered by the contact center analytics to customer experience management processes, such as reduced customer churn rate, improved crisis management, and lower marketing costs. Customer experience management processes aggregate customer feedback, transactions, interactions, and agent data, which enable businesses to analyze the report for customer experience and agent performance. Customer experience management solutions also help enterprises analyze customer data from multiple channels and generate insights to improve contact center operations.

The workforce optimization segment is projected to grow at the fastest CAGR over the forecast period. The workforce optimization process enhances the efficiency and quality of contact center agents by ensuring that they are monitored, trained, and motivated. These solutions help agents effectively monitor & evaluate customer calls and help improve employee performance across all communication channels by efficiently scheduling responses.

End Use Insights

The IT & telecom segment held a significant share in the market in 2024. Contact center analytics solutions are widely adopted in the IT & telecom industry owing to their extensive business process automation capabilities. In addition, these solutions allow IT & telecom agents to manage all inbound customer interactions and drive end-to-end service request management. Furthermore, these solutions offer a range of benefits, such as better customer satisfaction, operations cost savings, and business intelligence. These solutions are also used by IT & telecom companies to identify factors impacting their customer experience.

The consumer goods & retail segment is expected to expand at the fastest CAGR of 25.1% over the forecast period. Contact center analytics solutions are widely adopted in the consumer goods & retail industry as they help quickly review customer requirements and resolve queries by offering relevant information. These solutions allow agents to deliver fast and consistent support that effectively guides customer interactions. In the consumer goods & retail industry, these solutions allow agents to track key deal participants, historical activities, competitive information, and complete order management. Consumer goods & retail companies also adopt contact center analytics for providing personalized experience to their customers.

Regional Insights

North America dominated the market with the largest revenue share of 32.50% in 2024, driven by widespread digital transformation, early adoption of advanced customer engagement technologies, and a strong ecosystem of cloud infrastructure providers. Enterprises across industries in the region prioritize enhancing customer experience, operational efficiency, and omnichannel analytics integration, creating sustained demand for sophisticated analytics tools and services. The presence of major technology vendors and a highly competitive customer service landscape further propel market maturity.

U.S. Contact Center Analytics Market Trends

The U.S. contact center analytics industry held a dominant position in 2024. U.S. enterprises are heavily investing in AI-powered analytics, real-time speech and text analytics, and predictive modeling to deliver personalized and proactive customer support. The strong presence of Fortune 500 companies with large-scale contact center operations, along with a growing focus on customer retention and brand loyalty, is driving the adoption of advanced analytics solutions.

Europe Contact Center Analytics Market Trends

The Europe contact center analytics market was identified as a lucrative region in 2024. A surge in demand for customer-centric service models, digital engagement, and regulatory compliance across industries supports the growth in the region. Organizations are increasingly turning to analytics to streamline workflows, gain actionable customer insights, and maintain service quality while optimizing costs.

The UK contact center analytics market is expected to grow rapidly in the coming years. The companies in the region are prioritizing the deployment of analytics solutions to enhance customer satisfaction, manage agent performance, and ensure compliance with both domestic and EU regulations. The country's strong fintech, e-commerce, and telecommunications sectors drive demand as they seek to leverage predictive and sentiment analytics for competitive differentiation.

Asia Pacific Contact Center Analytics Market Trends

The Asia Pacific contact center analytics industry is expected to grow at the fastest CAGR of 22.9% over the forecast period. The growth in the region is attributed to rapid digitization, rising internet penetration, and the expansion of customer service hubs across developing economies. Businesses in the region are increasingly embracing cloud-native analytics platforms to modernize customer engagement, support multilingual operations, and improve first-call resolution rates.

The contact center analytics market in Japan is expected to grow rapidly in the coming years due to the country’s technological advancement, customer service culture, and focus on process efficiency. Japanese organizations are deploying analytics to understand customer behavior better, reduce operational costs, and ensure consistent service quality.

The China contact center analytics market held a substantial market share in 2024. The growth in the region is fueled by its booming e-commerce industry, expanding digital economy, and rising consumer expectations. Chinese companies are leveraging analytics to improve service personalization, track customer journeys, and gain competitive insights across massive user bases. The market is characterized by strong investments in AI, voice recognition, and real-time analytics by domestic tech giants and multinational corporations.

Key Contract Center Analytics Company Insights

Some of the key companies in the contact center analytics market Five9, Inc., Genesys, Genpact Ltd., Cisco Systems, Inc., Oracle, and others. Organizations are focusing on increasing the customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Genesys is a provider of contact center analytics solutions, offering comprehensive cloud-based solutions designed to enhance customer experience (CX) across multiple communication channels such as phone, email, chat, text, and social media. Its Genesys Cloud Contact Center platform integrates advanced analytics and reporting capabilities that provide real-time alerts, live streaming data, and AI-driven insights to monitor queue activity, agent performance, and customer interactions. These analytics tools enable businesses to optimize resources, improve agent productivity, and deliver personalized, seamless customer journeys by aggregating data from various sources, including CRM systems such as Salesforce and Zendesk.

-

Genpact Ltd is an advanced technology services and solutions provider that leverages AI, analytics, and data-driven insights to transform customer experience and business operations. In the contact center analytics market, Genpact offers an AI-powered platform, Cora ContactUs.ai, which delivers personalized customer interactions by providing a unified view of customer data and enabling predictive, proactive service. The platform’s modular, scalable framework helps businesses reduce hold times, minimize repetition, and enhance agent satisfaction while aligning investments with critical business outcomes through an outcome-based model.

Key Contact Center Analytics Companies:

The following are the leading companies in the contact center analytics market. These companies collectively hold the largest market share and dictate industry trends.

- 8x8, Inc.

- CallMiner

- Cisco Systems, Inc.

- Enghouse Interactive

- Five9, Inc.

- Genesys

- Genpact Ltd.

- Mitel Networks Corp.

- NICE

- Oracle

Recent Developments

-

In March 2023, Avaya partnered with Alcatel-Lucent Enterprise (ALE), to expand the reach of Avaya's OneCloud CCaas (Contact Center as a Service) composable solutions to ALE's worldwide customer base. Additionally, as part of the collaboration, ALE's digital networking solutions were made accessible to Avaya customers on a global scale.

-

In March 2022, Avaya partnered with Alcatel-Lucent Enterprise (ALE), to expand the reach of Avaya's OneCloud CCaas (Contact Center as a Service) composable solutions to ALE's worldwide customer base. In addition, as part of the collaboration, ALE's digital networking solutions were made accessible to Avaya customers on a global scale.

Contact Center Analytics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.26 billion

Revenue forecast in 2030

USD 5.75 billion

Growth rate

CAGR of 20.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

8x8, Inc.; CallMiner; Cisco Systems, Inc.; Enghouse Interactive; Five9, Inc.; Genesys.; Genpact Ltd.; Mitel Networks Corp.; NICE; Oracle

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Contract Center Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global contact center analytics market report based on component, deployment, enterprise size, application, end use, and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Cross-Channel Analytics

-

Performance Analytics

-

Predictive Analytics

-

Speech Analytics

-

Text Analytics

-

-

Service

-

Integration & Deployment

-

Support & Maintenance

-

Training & Consulting

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hosted

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automatic Call Distributor

-

Customer Experience Management

-

Log Management

-

Real-Time Monitoring & Reporting

-

Risk & Compliance Management

-

Workforce Optimization

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Consumer Goods & Retail

-

Government

-

Healthcare

-

IT & Telecom

-

Travel & Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.