- Home

- »

- Advanced Interior Materials

- »

-

Container Glass Market Size & Share Report, 2021-2028GVR Report cover

![Container Glass Market Size, Share & Trends Report]()

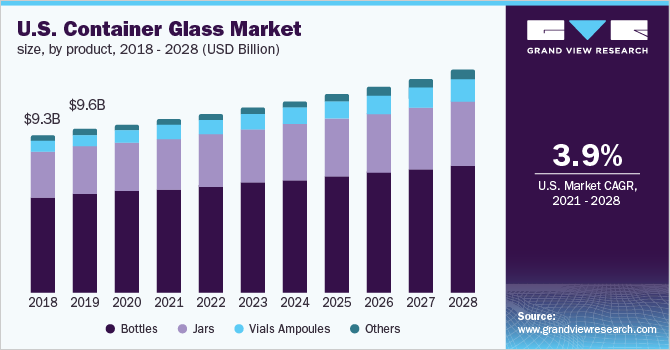

Container Glass Market (2021 - 2028) Size, Share & Trends Analysis Report By Product (Bottles, Jars, Vials And Ampoules), By End User (Pharmaceutical Industry, Chemical Industry, Consumer Application), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-813-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2019

- Forecast Period: 2021 - 2028

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

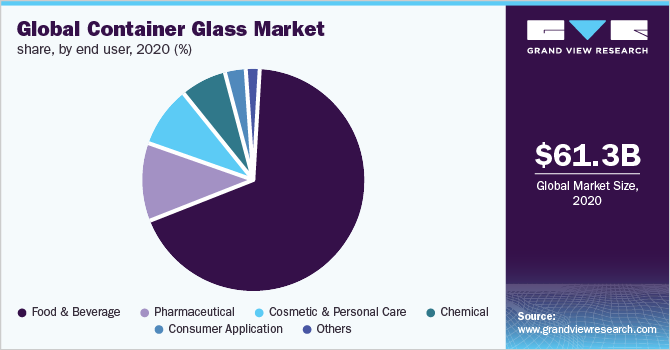

The global container glass market size was valued at USD 61.3 billion in 2020 and is anticipated to expand at a compounded annual growth rate (CAGR) of 3.7% from 2021 to 2028. The market growth is expected to be driven by the increasing consumption of beverages and the growing demand for vials and ampoules in the pharmaceutical industry. Moreover, the growing demand for premium packaging in the food processing industry is further accelerating market growth.

The container glass market experienced a slight hindrance in its growth in 2020 owing to the outbreak of the Coronavirus pandemic. The shortage of raw material, transportation restrictions, and shut down of industries hampered the production of glass containers in 2020 which resulted in the tight supply of container glass in the end-user industries. However, high demand for container glass from the food and beverage and pharmaceutical industry resulted in remarkable resilience of the market in 2020.

Glass is extensively used for beverage, pharmaceutical, and cosmetics packaging owing to its properties such as inert, recyclable, and reusable. Glass is the most extensively used material for manufacturing vials and ampoules. Due to its inert nature, it can store highly corrosive and chemically unstable compounds. Moreover, glass can store products for the long term compared to other materials such as plastics and metal. It is also approved by FDA as GRAS (Generally Recognized As Safe).

Glass also gives a premium and hygienic look to the packaging. This factor is driving the demand for container glass in the personal care, cosmetics, and fragrance industry. Increasing disposable income and urbanization has inclined consumers towards aesthetics. Glass containers can be customized and printed and used as a decorative product in home décor such as candle glass containers and light sparkling bottles. It is also used as tableware for consumer applications. All these factors are expected to propel the demand for container glass over the forecast period.

Product Insights

The bottles segment led the market and accounted for a revenue share of 60.3% in 2020. The bottle is the most preferred glass packaging format globally. It is extensively used in the packaging of beverages. The increasing consumption of alcoholic beverages globally is the key driving factor for glass bottles.

The vials and ampoules segment is likely to witness a CAGR of 8.4% over the forecast period. Vials and ampoules are used to contain various types of injectable medicines in the pharmaceutical industry. Increasing consumption of insulin, biologics, and vaccine globally is driving the demand for vials and ampoules. In addition, the rise in demand for parenteral packaging owing to the increasing prevalence of chronic diseases such as hypertension, diabetes, and the growing geriatric population is further accelerating the growth of the segment.

End-user Insights

The food and beverage segment led the market and accounted for 68.9% of the global revenue share in 2020. The increasing consumption of alcoholic beverages and soft drinks across the globe is the major factor for container glass market growth. According to The Observatory of Economic Complexity (OEC), the world trade for beer increased by 1.93% between 2018 and 2019. The global beer imports in 2017 were USD 14.4 billion which increased to USD 16.5 billion in 2019.

The pharmaceutical industry segment is likely to witness a CAGR of 6.6% over the forecast period. High demand for parenteral packaging coupled with increasing consumption of medicines globally is driving the pharmaceutical industry glass container market. Vials and ampoules are the largest glass container category of Pharmaceutical Industry packaging globally. Syrups, drops, and suspension, among other medicines, are also offered in the glass bottles in the pharmaceutical industry. Growing demand for pediatrics and geriatrics medicines across the globe is further driving the pharmaceutical industry glass container market.

Regional Insights

The Asia Pacific dominated the market and accounted for a revenue share of33.8% in 2020, on account of several factors, including growing food processing industry, increasing consumption of alcoholic beverages, increasing government initiatives, and support for the development of healthcare and pharmaceutical industry in the region. The countries such as India, China, and Japan are the major contributor to the growth of the regional market. According to the Packaging Machinery Manufacturers Institute (PMMI), glass bottles accounted for approximately 16% of the packaging market in the Asia Pacific. The growth of the market is also driven by high demand for fast-moving consumer goods in the region.

In Europe, the market is expected to witness a CAGR of 3.3% over the forecast period. The presence of huge food and beverage industry in the region is the major factor for the market growth. According to European Commission (EC) and FoodDrinkEurope, the food and beverage export of Europe have doubled in the last 10 years. In 2019, the European Union (EU) exports reached over USD 130 billion.

High consumption of beer in the U.S. is the key driving factor for the container glass market. The U.S. is the second-largest consumer in the world followed by China. It alone accounts for almost 13% of the global beer consumption. In addition, the presence of huge pharmaceutical and beverage companies in the U.S. is another major factor for market growth.

In the Middle East and Africa, the market is expected to witness a CAGR of 3.0% over the forecast period owing to the increasing disposable income and growing number of ex-pats in the countries such as Saudi Arabia and the United Arab Emirates (UAE). According to the World Bank, the urban population in UAE increased from 84.4% in 2011 to 86.3% in 2017. The presence of a large urban population in the UAE and Saudi Arabia is another major factor for market growth.

Key Companies & Market Share Insights

The competition among players is based on numerous parameters including product offerings, quality, corporate reputation, and price. Distribution network expansion, product capacity expansion, joint venture, mergers, and acquisitions are some of the key strategies being adopted by the players operating in the container glass market to strengthen their position in the market and gain a higher market share. For instance, in May 2021, Nipro Corporation acquired all shares of Piramidad.o.o., a pharmaceutical industry glass container manufacturing company based in Croatia. Some of the prominent players in the container glass market include:

-

Ardagh Group

-

Gerresheimar AG

-

Borosil

-

Schott AG

-

Stevanato Group

-

Piramal Glass Private Limited

-

Corning Incorporated

-

Unitrade FZE

-

Saverglass SAS

-

O-I Glass, Inc.

-

Vitro

-

Frigoglass SAIC

-

Amcor plc

-

SGD SA

-

Owens-Illinois

Container Glass Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 63.3 billion

Revenue forecast in 2028

USD 82.2 billion

Growth Rate

CAGR of 3.7% from 2021 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-user, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; U.K.; Italy; China; Japan; India; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Ardagh Group; Gerresheimar AG; Borosil; Schott AG; Stevanato Group; Piramal Glass Private Limited; Corning Incorporated; Unitrade FZE; Saverglass SAS; O-I Glass, Inc.; Vitro; Frigoglass SAIC; Amcor plc; SGD SA; and Owens-Illinois

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global container glass market report based on product, end-user, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2028)

-

Bottles

-

Jars

-

Vials & Ampoules

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2028)

-

Food & Beverage Industry

-

Pharmaceutical Industry

-

Cosmetics & Personal Care Industry

-

Chemical Industry

-

Consumer Application

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global container glass market size was estimated at USD 61.3 billion in 2020 and is expected to reach USD 63.3 billion in 2021

b. The container glass market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.7% from 2021 to 2028 to reach USD 82.2 billion by 2028

b. Asia Pacific dominated the container glass market with a revenue share of 33.8% in 2020, on account of several factors including growing food processing industry, and increasing consumption of alcoholic beverages in the region. Increasing government initiatives and support for the development of healthcare and pharmaceutical industry, and consumer’s increasing spending on carbonated drinks is expected to drive the market growth over the forecast period.

b. Some of the key players operating in the container glass market include Ardagh Group, Gerresheimar AG, Borosil, Schott AG, Stevanato Group, Piramal Glass Private Limited, Corning Incorporated, Unitrade FZE, Saverglass SAS, O-I Glass, Inc., Vitro, Frigoglass SAIC, Amcor plc, SGD SA, and Owens-Illinois.

b. The key factors that are driving the container glass market include increasing consumption of beverages, growing demand for vials and ampoules in the pharmaceutical industry, increasing consumer awareness on sustainability and environmental issues, and growing food processing industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.