- Home

- »

- IT Services & Applications

- »

-

Container Orchestration Market Size, Industry Report, 2030GVR Report cover

![Container Orchestration Market Size, Share, & Trends Report]()

Container Orchestration Market (2025 - 2030) Size, Share, & Trends Analysis Report By Type (Platform, Services), By Deployment (On-premises, Cloud), By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-574-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Container Orchestration Market Summary

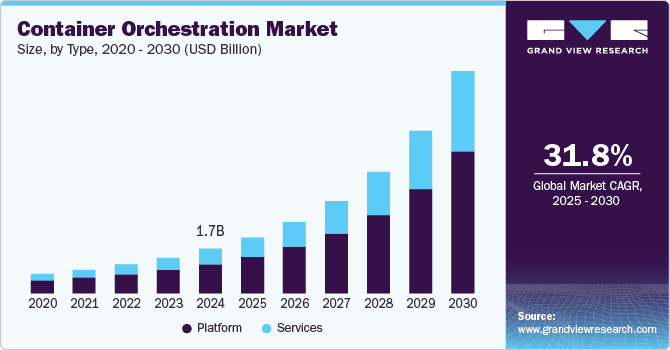

The global container orchestration market size was estimated at USD 1.71 billion in 2024 and is projected to reach USD 8.53 billion by 2030, growing at a CAGR of 31.8% from 2025 to 2030. The increasing adoption of microservices architectures and containerized applications is driving the demand for the market.

Key Market Trends & Insights

- North America container orchestration industry held the major share of over 36.0% of the global market in 2024.

- The container orchestration market in the Asia Pacific is expected to grow at the fastest CAGR of 33.9% from 2025 to 2030.

- Based on type, the platform segment dominated the market with a revenue share of over 66.0% in 2024.

- Based on deployment, the on-premises segment held the largest market share of over 63.0% in 2024.

- Based on enterprise size, the large enterprises segment dominated the market with a revenue share of over 63.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.71 Billion

- 2030 Projected Market Size: USD 8.53 Billion

- CAGR (2025-2030): 31.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Enterprises are moving away from traditional monolithic software designs and embracing microservices, where applications are broken down into smaller, independently deployable services. Containers provide the ideal environment for running these microservices efficiently and consistently across environments.

As the number of containers grows, organizations require tools to manage, deploy, and scale them effectively. This is where container orchestration solutions such as Kubernetes, Docker Swarm, and Apache Mesos become critical, driving demand across industries.

There is a rising demand for scalable and agile DevOps practices. DevOps teams seek tools that enable rapid development, testing, and deployment cycles, which containers support efficiently, driving market growth. However, managing containerized environments manually becomes complex as applications scale. Container orchestration platforms automate the deployment, scaling, and management of containers, making them essential for continuous integration and continuous deployment (CI/CD) pipelines. The synergy between DevOps practices and container orchestration is fueling market expansion, particularly in large enterprises looking to accelerate digital transformation.

The growth of cloud-native technologies is further boosting the market growth. As businesses increasingly adopt hybrid and multi-cloud strategies, the need for consistency in deploying applications across different environments becomes crucial. Orchestration tools offer platform-agnostic capabilities that enable seamless container management across on-premises, public, and private clouds. Cloud service providers such as AWS (EKS), Microsoft Azure (AKS), and Google Cloud (GKE) offer managed Kubernetes services, making it easier for organizations to adopt container orchestration and encourage market growth.

The growing open-source ecosystem and community support around orchestration platforms are also propelling the market growth. Kubernetes, the leading container orchestration tool, is backed by the Cloud Native Computing Foundation (CNCF) and supported by a vast open-source community. This collaborative environment leads to constant innovation, frequent updates, and the development of complementary tools that extend orchestration capabilities. Enterprises are increasingly confident in adopting Kubernetes due to this widespread support, contributing to faster and broader adoption across sectors.

In addition, the demand for multi-tenancy and workload isolation in enterprise IT environments is increasing the importance of container orchestration solutions. These tools allow organizations to manage multiple workloads and user environments on the same infrastructure without compromising performance or security. For businesses running complex applications with multiple users or departments, orchestration offers the ability to allocate resources dynamically and isolate environments securely, helping improve operational efficiency and governance.

Type Insights

The platform segment dominated the market with a revenue share of over 66.0% in 2024. The rapid adoption of DevOps and agile development methodologies is further propelling the demand for orchestration platforms. These platforms integrate seamlessly with CI/CD pipelines and development toolchains, supporting faster release cycles, greater automation, and improved collaboration between development and operations teams. By enabling infrastructure as code and automated container management, orchestration platforms support the core goals of DevOps: speed, reliability, and scalability, thus making them essential for modern software engineering practices.

The services segment is anticipated to grow at the fastest CAGR during the forecast period. The increasing reliance on managed services and support types is driving segment growth. Enterprises are recognizing the benefits of offloading orchestration maintenance, upgrades, and monitoring to managed service providers. These services help reduce the operational burden on internal IT teams, ensure high availability of applications, and provide faster resolution of issues. Managed services also offer scalability, allowing companies to expand their infrastructure and applications without being limited by internal technical constraints.

Deployment Insights

The on-premises segment held the largest market share of over 63.0% in 2024. The growing importance of data localization laws is a significant factor driving the demand for on-premises container orchestration. Many countries now require that specific types of data, such as personal information, financial records, or health data, be stored and processed within national borders. On-premises deployments allow organizations to comply with these legal requirements while retaining the agility of containerized applications. This is especially important for multinational corporations that operate across different jurisdictions with varying data sovereignty rules.

The cloud segment is expected to register the fastest CAGR from 2025 to 2030. The global shift toward DevOps and microservices architecture is accelerating the adoption of cloud-based container orchestration. Cloud platforms offer automation, continuous integration/continuous deployment (CI/CD) pipelines, and monitoring tools that support modern development practices. This fosters innovation, speeds up release cycles, and improves the overall software delivery process, all of which are critical for maintaining competitiveness in today’s fast-paced digital economy.

Enterprise Size Insights

The large enterprises segment dominated the market with a revenue share of over 63.0% in 2024. The drive toward digital transformation and cloud migration drives this segment's growth. Large enterprises are moving legacy applications to containerized environments to modernize their IT stacks and become more agile. Container orchestration platforms are instrumental in managing these transitions, allowing organizations to deploy and manage modern microservices-based applications alongside legacy systems. This hybrid approach supports innovation while preserving existing investments, giving large enterprises a strategic advantage in the competitive landscape.

The small and medium enterprises (SMEs) segment is expected to register the fastest CAGR from 2025 to 2030. The shift toward remote and hybrid work environments has also contributed to the rising demand for container orchestration among SMEs. With distributed teams becoming the norm, SMEs need scalable infrastructure solutions that can support collaborative development, testing, and deployment across various locations. Orchestration platforms facilitate centralized control and automation of applications, enabling seamless updates and monitoring regardless of where team members are located. This operational flexibility aligns with modern workplace needs and supports productivity across geographies.

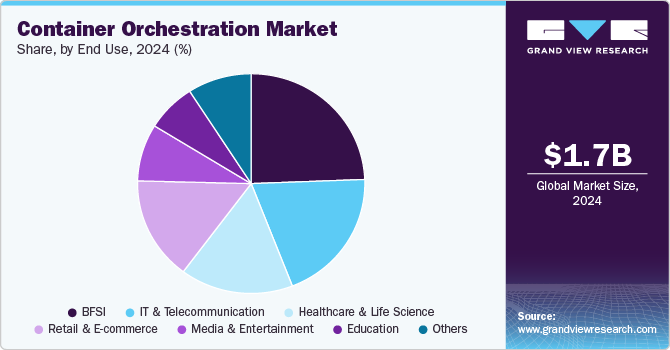

End Use Insights

The BFSI segment held the largest market share of over 24.0% in 2024. The increasing focus on open banking and API ecosystems has accelerated the BFSI industry's container orchestration initiatives. As financial institutions open up their infrastructure to third-party developers through APIs, orchestration becomes essential for managing these dynamic and sometimes ephemeral services. Orchestration platforms provide the necessary tools to handle API traffic, enforce security policies, and scale individual components without disrupting the larger application environment.

The education segment is anticipated to register the fastest CAGR of 34.4% during the forecast period. The expansion of hybrid and remote learning models has significantly impacted the education sector, especially post-pandemic. As schools and universities continue to offer blended learning experiences, they require a flexible and scalable IT infrastructure that can support both in-person and virtual classrooms. Container orchestration platforms enable educational institutions to scale their infrastructure dynamically, ensuring that their online platforms remain available and performant even during peak usage times, such as during exams or high-demand periods.

Regional Insights

North America container orchestration industry held the major share of over 36.0% of the global market in 2024. The expansion of edge computing and the Internet of Things (IoT) is another driver in the region. As North American companies increasingly deploy edge computing solutions to process data closer to where it is generated, container orchestration platforms offer an ideal way to manage and scale applications at the edge. Containers can be deployed across a distributed network of edge devices, and orchestration tools ensure that these containers are managed efficiently, even in environments with limited resources. This is particularly relevant for industries such as manufacturing, transportation, and smart cities, where real-time data processing and low latency are essential.

U.S. Container Orchestration Market Trends

The U.S. container orchestration industry is projected to grow during the forecast period. The increased adoption of Kubernetes in the U.S. has been a game changer in the market. Kubernetes, as an open-source platform, has become the de facto standard for container orchestration thanks to its powerful capabilities and broad community support. Many U.S. organizations are adopting Kubernetes as part of their cloud-native initiatives, enabling them to manage and scale their applications with greater ease. The popularity of Kubernetes is helping fuel the overall growth of the market in the U.S. as businesses of all sizes look to leverage its capabilities to improve the efficiency and performance of their applications.

Europe Container Orchestration Market Trends

The container orchestration industry in Europe is expected to grow at a CAGR of 17.5% from 2025 to 2030. The growth of container-native software solutions is fueling the demand for container orchestration platforms in Europe. As software vendors increasingly develop and release container-native applications, the need for orchestration tools to manage these applications has grown. Container orchestration platforms like Kubernetes enable organizations to efficiently manage these container-native applications, which are designed to run in cloud environments. With more businesses adopting container-native software for flexibility and scalability, the demand for container orchestration solutions that can support these applications is also increasing.

The container orchestration industry in Germany is anticipated to grow during the forecast period. The IoT and Industry 4.0 revolution in Germany is another significant driver for market growth. Germany is a global leader in manufacturing and industrial automation, and the country is at the forefront of Industry 4.0, which emphasizes the integration of IoT devices, artificial intelligence, and automation in manufacturing environments. As the number of IoT devices and connected systems continues to grow, the need for container orchestration tools to manage the deployment, scaling, and monitoring of these complex, distributed systems increases. Container orchestration platforms allow organizations to manage microservices efficiently and containers running at the edge, enabling real-time data processing and enhanced automation in industrial applications.

Asia Pacific Container Orchestration Market Trends

The demand for container orchestration in the Asia Pacific is expected to grow at the fastest CAGR of 33.9% from 2025 to 2030. The growth of e-commerce and digital platforms in the APAC region is driving market growth. The rise in mobile and web applications across APAC is contributing to the expansion of the market. With increasing smartphone penetration and internet usage, particularly in emerging markets like India and Southeast Asia, there has been a surge in mobile and web applications. To deliver high-performance and scalable mobile experiences, businesses are turning to containerization. Container orchestration platforms help developers quickly scale applications in response to user demand, ensuring a seamless user experience. This demand for scalable and high-performing mobile and web applications is expected to drive further growth in the container orchestration industry.

The container orchestration industry in China is projected to grow during the forecast period. The rapid expansion of cloud computing in China is another significant driver of the market. China is one of the largest markets for cloud services globally, with major local cloud providers such as Alibaba Cloud, Tencent Cloud, and Baidu Cloud, alongside international players like AWS, Google Cloud, and Microsoft Azure. The growth of these cloud platforms has resulted in a surge in demand for tools that can manage and orchestrate containerized applications across multi-cloud and hybrid-cloud environments. Container orchestration platforms such as Kubernetes are vital in helping organizations manage containers at scale in cloud environments, making them an essential tool as more companies in China embrace cloud technologies for their operations.

Key Container Orchestration Company Insights

Some of the key companies operating in the market are Amazon Web Services, Inc., and Cisco Systems, Inc., among others.

-

Amazon Web Services, Inc. (AWS), a subsidiary of Amazon.com, is a global cloud computing services company. AWS offers a comprehensive suite of infrastructure services, including computing power, storage options, and networking capabilities, to businesses and developers worldwide. Amazon Elastic Container Service (ECS) is a fully managed container orchestration service that simplifies the deployment and management of containerized applications. ECS integrates seamlessly with other AWS services, providing a secure and scalable environment for running containers.

-

Cisco Systems, Inc. is a global networking hardware, software, and telecommunications equipment provider. Cisco has expanded its portfolio to encompass a wide range of products and services, including cybersecurity solutions, data center infrastructure, and cloud-based technologies. The Cisco Container Platform (CCP) is a turnkey solution that simplifies container orchestration. CCP is built on open-source components, including Kubernetes, Docker, and Contiv, and is designed to operate seamlessly across hyperconverged infrastructure, virtual machines, bare metal, and both public and private clouds.

SUSE S.A. and KubeSphere are some of the emerging market participants in the container orchestration industry.

-

SUSE S.A. is a global provider of enterprise-grade open-source software solutions. The company pioneered the commercialization of Linux with its SUSE Linux Enterprise product line and has since expanded its portfolio to include container management, edge computing, and hybrid cloud solutions. In 2020, SUSE acquired Rancher Labs, a move that significantly strengthened its position in the container orchestration space. This acquisition led to the development of SUSE Rancher, an open-source platform designed to manage Kubernetes clusters across multiple environments, including on-premises, public clouds, and edge locations.

-

KubeSphere is an open-source, enterprise-grade container orchestration platform built on Kubernetes, designed to streamline cloud-native application management. KubeSphere offers a comprehensive solution that integrates DevOps workflows, multi-cluster management, observability, and application lifecycle management into a unified platform. KubeSphere leverages Kubernetes to provide robust container orchestration capabilities. It enhances Kubernetes with a user-friendly graphical interface, simplifying the management of clusters, workloads, and services. The platform supports multi-cloud and hybrid cloud environments, allowing organizations to deploy and manage applications across various infrastructures seamlessly. KubeSphere's architecture is designed to be extensible, enabling integration with third-party tools and services to meet diverse enterprise needs.

Key Container Orchestration Companies:

The following are the leading companies in the container orchestration market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- Docker Inc.

- Intel Corporation

- Microsoft Corporation

- Oracle Corporation

- IBM Corporation

- SUSE S.A.

- KubeSphere

Recent Developments

-

In April 2025, Google Cloud launched the public preview of its Multi-Cluster Orchestrator (MCO), a new service designed to streamline the management of workloads across multiple Kubernetes clusters. MCO enables teams to utilize resources better, enhance application stability, and drive innovation in complex, distributed environments. By introducing a centralized orchestration layer, MCO simplifies the underlying Kubernetes infrastructure and efficiently matches workloads with available capacity across various regions.

-

In February 2025, Hitachi Vantara, a subsidiary of Hitachi, Ltd., launched a new co-engineered solution in partnership with Cisco Systems, Inc., tailored for Red Hat OpenShift. Cisco and Hitachi Adaptive Platforms for Converged Infrastructure combine Cisco’s compute and networking capabilities with Hitachi Vantara’s Virtual Storage Platform arrays, all orchestrated through Red Hat OpenShift container orchestration tools. The solution simplifies container deployment by delivering a pre-validated, enterprise-class infrastructure that enhances application development speed, ensures consistent operations, and improves reliability for latency-sensitive workloads.

Container Orchestration Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.15 billion

Revenue forecast in 2030

USD 8.53 billion

Growth rate

CAGR of 31.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, deployment, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Amazon Web Services, Inc.; Cisco Systems, Inc.; Docker Inc.; Google; Intel Corporation; Microsoft Corporation; Oracle Corporation; IBM Corporation; SUSE S.A.; KubeSphere

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Container Orchestration Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global container orchestration market report based on type, deployment, enterprise size, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Platform

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises (SMEs)

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Healthcare & Life Science

-

IT & Telecommunication

-

Retail & E-commerce

-

Education

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global container orchestration market is expected to grow at a compound annual growth rate of 31.8% from 2025 to 2030 to reach USD 8.53 billion by 2030.

b. The global container orchestration market size was estimated at USD 1.71 billion in 2024 and is expected to reach USD 2.15 billion in 2025.

b. The platform segment accounted for the largest market share of 66.0% in 2024 in the container orchestration market. The rapid adoption of DevOps and agile development methodologies is further propelling the demand for orchestration platforms.

b. The increasing adoption of microservices architectures and containerized applications and The rising demand for scalable and agile DevOps practices. DevOps teams seek tools that enable rapid development, testing, and deployment cycles, which containers support efficiently driving container orchestration market growth.

b. Some key players operating in the market include Amazon Web Services, Inc., Cisco Systems, Inc., Docker Inc., Google, Intel Corporation, Microsoft Corporation, Oracle Corporation, IBM Corporation, SUSE S.A., KubeSphere

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.