- Home

- »

- Digital Media

- »

-

Content Services Platforms Market Size, Share Report, 2030GVR Report cover

![Content Services Platforms Market Size, Share & Trends Report]()

Content Services Platforms Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Solutions, Services), By Enterprise Size, By Deployment (Cloud and On-premises), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-026-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 -2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global content services platforms market size was valued at USD 53.95 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 17.3% from 2023 to 2030. Major drivers such as increasing adoption of social, mobile, analytics, and cloud (SMAC) technologies, the rising demand to optimize business processes and improve content security with automated workflows, and the need for regulatory content management for improved operations are attributed to the growth of the market. In addition, factors such as increasing adoption of content services platforms for managing and retaining digitized content and related metadata and growing awareness regarding the benefits of content services platforms among Enterprises are expected to drive market growth.

The COVID-19 pandemic played a critical role in driving market growth. Increased inclination towards digitization and surged adoption of technologies such as cloud, artificial intelligence, and APIs during the pandemic period are attributed to the growth of market. The growing volumes of digital transactions, the proliferation of smart devices, the continued rollout of 5G networks, and increasing adoption of digital technologies such as robotic process automation, cloud-based systems, and mobile applications, are some of the vital factors driving the market growth.

The market experienced steady growth worldwide as organizations recognized the value of efficient content management and sought solutions to address their evolving needs. Organizations across industries increasingly invested in digital transformation initiatives to improve operational efficiency and agility. CSPs played a vital role in this process by enabling organizations to digitize their content and automate manual processes. Additionally, integrating automation capabilities and AI within content services platforms allows for automated workflows, intelligent content categorization, and advanced analytics, enhancing overall productivity.

Component Insights

In terms of component, the market is segmented into solutions and services. The solutions segment accounted for the largest revenue share of over 60% in 2022 and is expected to continue to dominate the market over the forecast period. The solutions segment encompasses various functionalities, such as workflow automation, document management, records management, content collaboration, and integration with other enterprise systems. These solutions encompass various functionalities that help organizations manage and streamline their content and document-related processes.

The services segment is anticipated to witness the fastest growth rate over the forecast period. Increasing use of content services platforms such as document & records management, workflow management & case management, data capture, information security & governance, content reporting & analytics, and others, owing to their several benefits, are driving the segment growth. Content services platforms provide agile solutions for digital work, reduce content sprawl and information silos, improve security and access, create a better user experience for customers and employees, and boost productivity by making content more easily shared.

Deployment Insights

The cloud segment accounted for a significant revenue share of over 53% in 2022 and is expected to continue to dominate the market over the forecast period. The rise in adoption can be attributed to various features such as automation, stacked content library, image, and video capability, email updates, and link monitoring. Cloud-based content services platforms have gained significant popularity due to their numerous advantages, especially for businesses of all sizes, including SMEs. As technology evolves, cloud-based solutions are expected to remain dominant in content management, offering businesses efficient and flexible ways to manage their content and digital assets.

The on-premises segment is anticipated to witness the fastest growth rate during the forecast period. Compared to cloud deployment, on-premises deployment of content services platforms needs high initial investment by enterprises; however, the incremental costs throughout the ownership are not required. Factors such as incremental cost saving and the increasing need to reduce risks of cyber-attacks & data losses are propelling the segment’s growth.

End-use Insights

Based on the end-use, the global market is segmented into BFSI, government & public sectors, IT & telecommunications, healthcare, retail & consumer goods, and media & entertainment. The IT & telecommunications sector segment held the largest revenue share of 24% in 2022 and is expected to maintain its position over the forecast period. Increasing volumes of data in IT and telecommunications companies are driving the demand for content services platforms in the sector. Leading content service and solution providers such as Microsoft and IBM offer solutions to the telecom industry to streamline operations and business support systems (BSS), empower the telecom workforce, deploy, and optimize next-gen networks, and transform customer experiences.

The government & public sector is expected to witness the fastest CAGR over the forecast period owing to the increasing need for efficient document and information management. Government agencies, public institutions, and other organizations in the public sector deal with vast amounts of information and documents, ranging from citizen records to financial and legal documents. The increasing need to manage and transform large volumes of general public data into digital format is proving challenging for the public and government entities; hence, it is expected to create major growth opportunities for the market in the upcoming years.

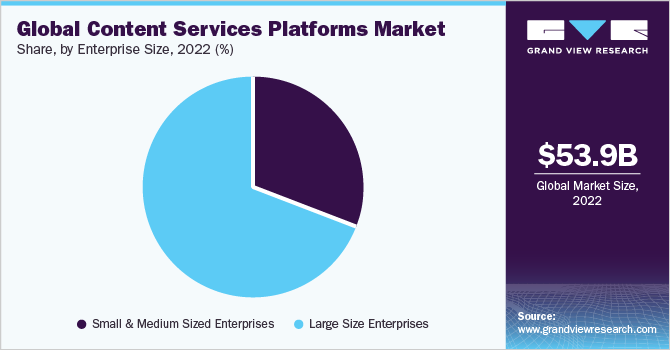

Enterprise Size Insights

The large enterprises segment held the largest revenue share of over 68% in 2022. Large enterprises increasingly use content services platforms to ensure content compliance and governance, enable secure information access, facilitate efficient content extraction, simplify content lifecycle, support hybrid records management, and drive contextual engagement, propelling the segment's growth. For instance, in April 2021, Open Text Corporation, a Canadian company that develops and sells enterprise information management software, announced OpenText Core Case Management and OpenText Core Content, the new content services platform. The new platform empowers clients to securely integrate, collaborate, capture, and manage content and enterprise processes.

On the other hand, the small and medium sized enterprises segment is expected to witness the fastest growth rate during the forecast period. Factors driving the adoption of content services platforms in small & medium sized enterprises are easy installation, low cost, and the high adoption rate of advanced and new technologies. Content services platform offers numerous benefits to small and medium-sized enterprises by improving collaboration, streamlining content management, enhancing security, and providing valuable insights. Implementing a CSP can benefit SMEs to become more efficient, agile, and competitive in today's digital business landscape.

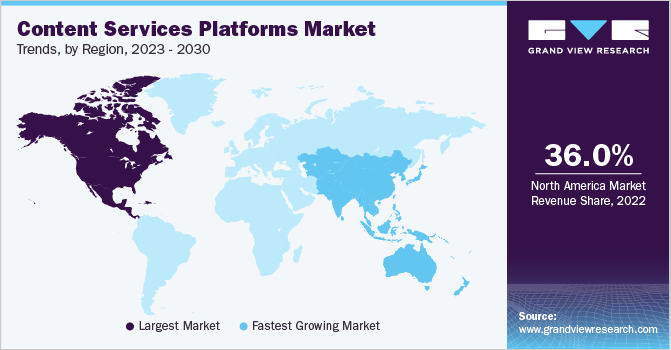

Regional Insights

North America captured the highest market share of over 36% in 2022 and is anticipated to retain its position over the forecast period. The rapid adoption of content services platforms in this region is the major factor behind the market growth. In addition, the vast presence of major market players such as Microsoft (U.S.), Hyland Software, Inc. (U.S.), IBM (U.S.), and Open Text Corporation (Canada) is also boosting the market growth. Content services platforms were widely adopted across various regional industries, including financial services, healthcare, manufacturing, and government. Organizations in these sectors recognized the importance of efficient content management for enhancing productivity and compliance, further driving the market forward.

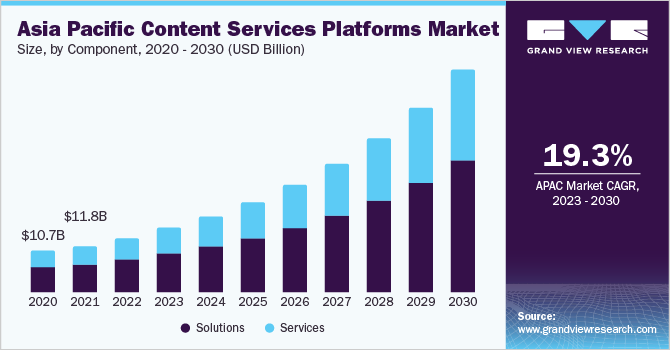

Asia Pacific is anticipated to expand at the fastest CAGR during the forecast period. The increasing adoption of digitization, expanding IT infrastructure, the vast availability of skilled workforce, and rapid growth of the industries such as BFSI, IT & telecommunications, and government in countries such as India, China, and Japan are driving the growth of the content services platforms market in the region. Many organizations in the Asia Pacific region were actively pursuing digital transformation strategies to improve efficiency, productivity, and customer experience. Content services platforms played a crucial role in enabling these initiatives by providing solutions for document management, workflow automation, and collaboration.

Key Companies & Market Share Insights

The market has a fragmented competitive landscape featuring various global and regional players. Leading industry players are undertaking strategies such as product launches, collaborations, and partnerships to survive the highly competitive environment and expand their business footprints. For instance, in May 2023, iCognition launched Ingress, a next-generation content services platform that aims to transform how enterprises manage and secure records, content, and other data. The platform integrates search, security, records and information management, and compliance across various repositories such as SharePoint, Teams, OneDrive, Exchange, and OpenText. Some of the prominent players operating in the global content services platforms market are:

-

IBM Corporation

-

Microsoft

-

Hyland Software, Inc.

-

Open Text Corporation

-

Laserfiche

-

Adobe

-

Oracle

-

M-Files

-

Box

-

Fabasoft International Services GmbH

Content Services Platforms Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 62.56 billion

Revenue forecast in 2030

USD 190.59 billion

Growth Rate

CAGR of 17.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, enterprise size, deployment, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; China; India; Japan; Singapore; Brazil; Mexico; Saudi Arabia; South Africa

Key companies profiled

IBM Corporation; Microsoft; Hyland Software, Inc.; Open Text Corporation; Laserfiche; Adobe; Oracle; M-Files; Box; Fabasoft International Services GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Content Services Platforms Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global content services platforms market report based on component, enterprise size, deployment, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solutions

-

Document & Record Management

-

Workflow Management

-

Information Security & Governance

-

Content Reporting Analytics

-

Case Management

-

Data Capture & Indexing

-

Others

-

-

Services

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Small and Medium Sized Enterprises

-

Large Size Enterprises

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premises

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Government & Public Sector

-

IT & Telecommunication

-

Healthcare

-

Retail & Consumer Goods

-

Media & Entertainment

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global content services platforms market size was estimated at USD 53.95 billion in 2022 and is expected to reach USD 62.55 billion in 2023.

b. The global content services platforms market is expected to grow at a compound annual growth rate of 17.3% from 2023 to 2030 to reach USD 190.59 billion by 2030.

b. North America captured the highest market share of 36.7% in 2022 and is anticipated to retain its position over the forecast period. The rapid adoption of content services platforms in this region is the major factor behind the market growth. In addition, the vast presence of major market players such as Microsoft (U.S.), Hyland Software, Inc. (U.S.), IBM (U.S.), and Open Text Corporation (Canada) is also boosting the content services platforms market growth.

b. Some key players operating in the content services platforms market include IBM Corporation; Microsoft; Hyland Software, Inc.; Open Text Corporation; Laserfiche; Adobe; Oracle; M-Files; Box; Fabasoft International Services GmbH.

b. Key factors driving the market growth include the rise in the use of Social, Mobile, Analytics, and Cloud (SMAC) technologies and the growing proliferation of digital content across the business.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.