- Home

- »

- IT Services & Applications

- »

-

Contract Management Software Market Size Report, 2030GVR Report cover

![Contract Management Software Market Size, Share & Trends Report]()

Contract Management Software Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Business Function, By Deployment Mode, By Organization Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-588-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Contract Management Software Market Summary

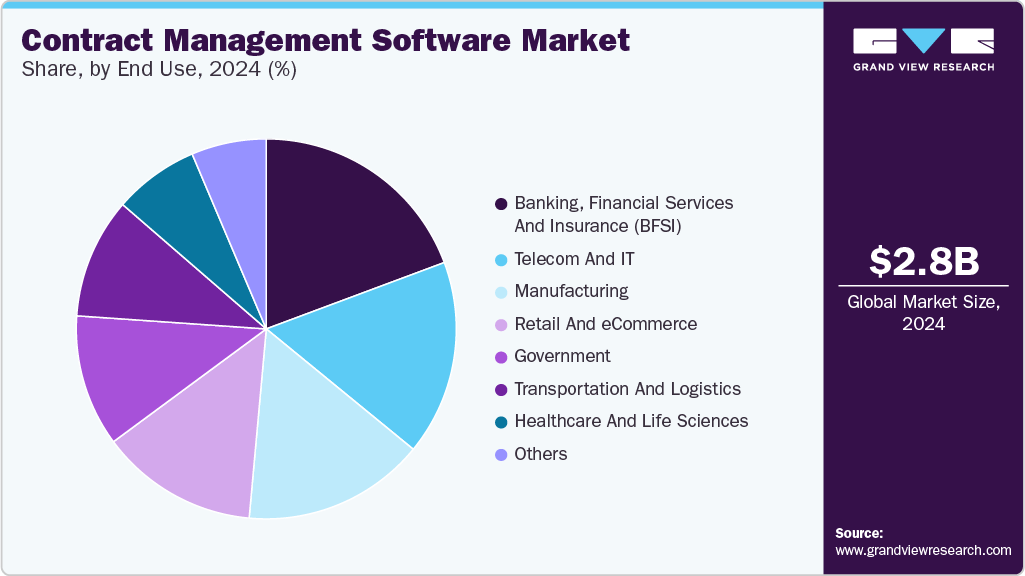

The global contract management software market size was estimated at USD 2.83 billion in 2024 and is projected to reach USD 5.65 billion by 2030, growing at a CAGR of 12.7% from 2025 to 2030. The contract management software industry has evolved into a strategic component of enterprise operations, reflecting its critical role in managing complex agreements, ensuring compliance, and accelerating revenue cycles.

Key Market Trends & Insights

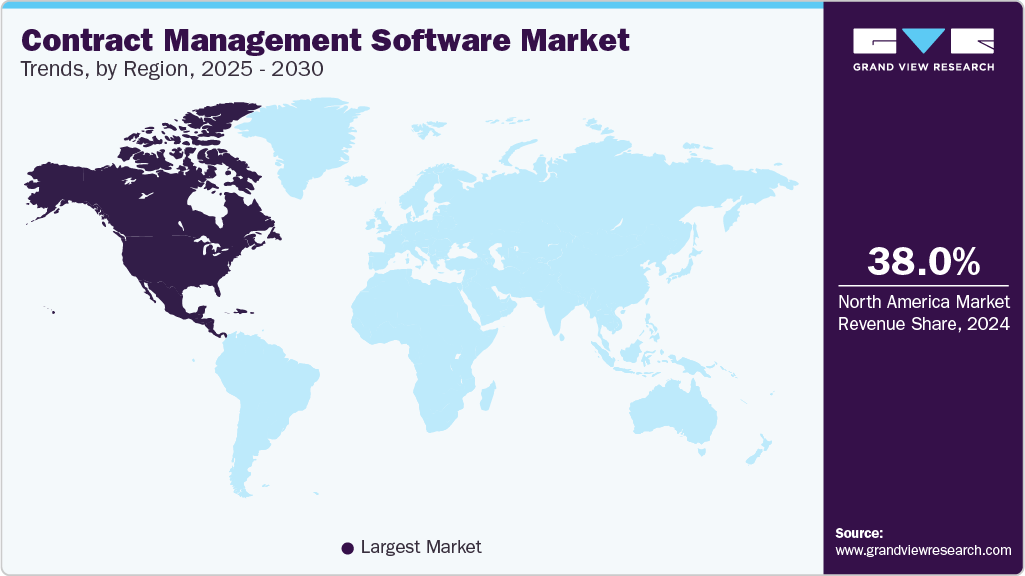

- North America held the significant share of over 38.0% of the contract management software industry in 2024.

- The contract management software industry in the U.S. is expected to grow significantly from 2025 to 2030.

- By component, the software segment accounted for a market share of over 67.0% in 2024.

- By business function, the sales segment is expected to register the fastest CAGR of 13.4% during the forecast period.

- By deployment type, the cloud segment accounted for the largest market share of over 68.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.83 Billion

- 2030 Projected Market Size: USD 5.65 Billion

- CAGR (2025-2030): 12.7%

- North America: Largest market in 2024

Contract Management Software (CMS) enables organizations to automate and streamline the creation, execution, and analysis of contracts across various business functions such as legal, procurement, sales, HR, and finance. As enterprises strive to modernize operations and enhance customer experience, digital transformation has become a strategic priority across industries. Contract management plays a critical role in this evolution, especially in legal, procurement, and compliance functions, where outdated, manual processes often lead to inefficiencies and risk. By implementing contract management software, organizations can automate contract lifecycles, from drafting and negotiation to execution and renewal, helping significantly reduce cycle times. These digital tools help minimize human error, standardize processes, and provide real-time visibility into contract status and obligations.Automated alerts, templates, and approval workflows ensure that compliance is maintained, and contracts do not lapse or violate regulatory terms. Additionally, integrating CMS with ERP and CRM systems enables seamless data flow across departments, contributing to operational agility and strategic decision-making. Ultimately, digitized contract management supports broader transformation goals by improving efficiency, reducing risk, and enabling scalable growth across business functions.

AI and ML are transforming contract management by introducing intelligent automation and data-driven insights. Modern Contract Management Software leverages these technologies to extract key terms, identify risky clauses, and suggest optimal language during drafting. Natural Language Processing (NLP) enables automated review of large contract volumes, saving legal teams significant time. Machine learning models can analyze contract performance, flag anomalies, and even predict renewal or cancellation risks based on historical trends. These capabilities not only improve accuracy but also enhance risk mitigation and decision-making.

Natural Language Processing (NLP) holds significant potential in the contract management software industry by transforming how contracts are created and understood. NLP enables machines to comprehend and interpret human language, including complex legal terminology. By leveraging NLP algorithms, contract management software can analyze legal text, extract key clauses and terms, and offer intelligent, real-time suggestions during contract drafting. This not only streamlines the authoring process but also enhances accuracy, consistency, and overall efficiency in managing legal documents.

The future of the contract management software industry is bright, characterized by accelerated adoption, technological innovation, and global market expansion. Contract Management Software (CMS) will be integrated with enterprise systems like ERP, CRM, procurement, HRMS, and project management platforms. This convergence will streamline workflows, enabling end-to-end automation-from contract creation and approval to execution, payment, and compliance tracking. It will help enhance data consistency, reduce manual intervention, and provide real-time visibility across departments. This seamless integration positions CMS as a core component of the enterprise digital ecosystem.

Component Insights

The software segment accounted for a market share of over 67.0% in 2024. The demand for automation in contract management is rising as organizations seek to eliminate manual, time-consuming processes prone to errors and delays. Automating contract workflows, such as approvals, clause selection, alerts, and renewals, reduces cycle times, enhances accuracy, and improves operational efficiency. Features like auto-reminders, clause libraries, and integrated e-signatures are central to this shift, enabling faster, more consistent contract execution. Simultaneously, the rise of remote and hybrid work models has amplified the need for secure, cloud-based contract management solutions. These platforms allow distributed teams-across legal, procurement, HR, and sales-to access, review, and collaborate on contracts in real time, from any location. Together, automation and remote accessibility are reshaping contract management into a more agile, efficient, and scalable business function.

The services segment is anticipated to grow at a significant CAGR during the forecast period. Ongoing support and maintenance are vital for ensuring the smooth operation, security, and scalability of Contract Management Software. As organizations rely heavily on these systems for critical legal and business processes, they require regular updates, bug fixes, and technical assistance to address performance issues. Vendors play a key role by offering timely support, system enhancements, and security patches. This continuous engagement not only ensures optimal system functionality but also drives recurring revenue for service providers through annual support contracts and service-level agreements.

Business Function Insights

The legal segment accounted for the largest market share in 2024. As businesses expand, the volume and complexity of contracts grow, requiring legal teams to manage a wider array of agreements. Contract Management Software (CMS) helps streamline the creation, review, approval, and management of these contracts, reducing errors and missed deadlines by providing a centralized, efficient system. Additionally, CMS tools offer enhanced risk mitigation and visibility. Legal teams need to track contract terms, risks, and obligations to protect the organization from potential legal and financial exposure. CMS platforms enable real-time monitoring of key milestones, deadlines, and deliverables, empowering legal professionals to address issues proactively, ensure compliance, and enforce contract terms effectively, minimizing risk and avoiding penalties.

The sales segment is expected to register the fastest CAGR of 13.4% during the forecast period. Contract management software enhances sales cycle efficiency by automating key tasks such as contract approvals, routing, and document tracking. It offers real-time collaboration features, allowing multiple stakeholders to review and make changes simultaneously, which speeds up decision-making. With automated workflows, contracts are quickly routed to the right people for review and signature, minimizing delays. This streamlined process eliminates bottlenecks, reduces manual tasks, and accelerates the entire sales cycle, enabling sales teams to close deals faster and more efficiently.

Deployment Type Insights

The cloud segment accounted for the largest market share of over 68.0% in 2024. Cloud-based CMS offers significant advantages in terms of scalability and flexibility. These platforms allow businesses to easily adjust their contract management processes based on changing needs, whether managing a few contracts or thousands across multiple regions. This scalability eliminates the need for substantial infrastructure investments, making cloud solutions ideal for organizations of all sizes. Additionally, cloud CMS solutions ensure businesses are always using the latest software version. Automatic updates keep the system up to date with new features, security patches, and regulatory changes, reducing the burden on IT teams. This continuous maintenance not only improves functionality but also ensures compliance with evolving legal and industry standards, minimizing the risk of relying on outdated or non-compliant systems.

The on-premises segment is expected to grow at a CAGR of 10.8% during the forecast period. For businesses with dedicated IT teams, on-premises CMS platforms provide greater oversight and control. The in-house IT team can directly manage system performance, security updates, and integrations, ensuring that the CMS aligns with organizational goals. This hands-on approach allows for faster troubleshooting, more efficient support, and a higher level of customization to meet specific internal needs. Similarly, on-premises CMS solutions allow businesses to ensure that their contract management practices meet these stringent regulatory demands, providing peace of mind and minimizing the risk of non-compliance.

Organization Size Insights

The large enterprises segment accounted for the largest share of the contract management software market in 2024. Large enterprises handle a vast volume and complexity of contracts across various departments, regions, and vendors. CMS platforms provide the necessary tools to create, track, and manage these agreements efficiently, helping organizations stay organized, compliant, and reduce the risks associated with handling numerous contracts. These platforms allow businesses to manage contracts at scale, improving workflow automation, reducing manual errors, and ensuring consistency. Additionally, large organizations with decentralized business units benefit from centralized contract management systems. A unified CMS platform ensures that all contracts are stored, accessed, and tracked in one place. This centralization simplifies collaboration across legal, procurement, sales, and other teams, ensuring consistent compliance, faster contract execution, and smoother internal communication across regions and departments.

The SMEs segment is expected to grow at a significant CAGR during the forecast period. As SMEs typically have limited budgets, so cost-effective solutions are crucial. Many CMS providers offer scalable, subscription-based models that cater to smaller businesses, providing advanced contract management features at affordable rates. These models eliminate the high upfront costs associated with on-premises systems, allowing SMEs to streamline contract processes without significant financial investment. This flexibility makes it easier for SMEs to adopt efficient contract management tools, enhancing productivity while staying within budget constraints.

End Use Insights

The BFSI segment accounted for the largest market share in 2024. BFSI organizations operate in highly regulated environments, where non-compliance can result in significant penalties and reputational harm. CMS platforms help mitigate these risks by ensuring that contracts are consistently aligned with industry regulations. Features like automated compliance tracking, audit trails, and real-time alerts ensure that companies remain updated on regulatory changes, minimizing the likelihood of compliance issues. Additionally, CMS solutions offer improved contract visibility and transparency. By providing real-time access to contract data, stakeholders can easily monitor key terms, obligations, performance, and renewal dates. This enhanced visibility supports better decision-making, helps mitigate risks associated with missed deadlines, and improves governance, ultimately fostering more strategic planning and compliance in BFSI operations.

The manufacturing segment is expected to grow at a significant CAGR during the forecast period. Manufacturing companies often face complex supplier and vendor agreements that involve various terms, payment schedules, delivery conditions, and performance benchmarks. CMS platforms help manage these complexities by tracking and monitoring all contract terms, reducing the risks of delays, non-compliance, and missed deadlines. This ensures smooth supply chain operations. Additionally, effective contract management is vital for optimizing supply chain efficiency. CMS solutions help track contracts with suppliers, logistics, and service providers, ensuring all obligations are met on time and within budget. Automated workflows and real-time monitoring prevent disruptions, streamline operations, and enhance overall performance, contributing to more efficient and cost-effective supply chain management.

Regional Insights

North America held the significant share of over 38.0% of the contract management software industry in 2024. North America, benefits from a well-established digital infrastructure and a strong culture of technological innovation. Enterprises across various industries are increasingly adopting automation tools, including contract management software, to streamline operations and enhance productivity. This digital maturity enables quicker adoption of advanced CMS features like AI and analytics, helping organizations reduce legal risks, ensure compliance, and improve overall contract lifecycle efficiency.

U.S. Contract Management Software Market Trends

The contract management software industry in the U.S. is expected to grow significantly from 2025 to 2030. Organizations in the U.S. are leading adopters of enterprise software solutions to optimize workflows. The growing need to automate and digitize contract-related processes is driving demand for CMS platforms, especially in legal, procurement, and sales functions.

Europe Contract Management Software Market Trends

The contract management software industryin Europe is expected to grow at a CAGR of 12.8% from 2025 to 2030. Across Europe, both governments and private enterprises are prioritizing digital transformation as a core strategy for improving efficiency and competitiveness. As part of this shift, contract lifecycle automation, electronic signatures, and cloud-based contract management systems are being widely adopted. These technologies streamline administrative workflows, reduce human error, and accelerate contract execution. In particular, the move to cloud-based platforms allows for greater accessibility, collaboration, and scalability. This widespread push toward modernization is fueling significant growth in the adoption of Contract Management Software across diverse industries throughout the European Union.

The UK contract management software market is expected to grow rapidly in the coming years. UK businesses are rapidly embracing digital transformation initiatives, with a notable shift towards cloud-based Contract Lifecycle Management (CLM) solutions. The rise in remote work has further emphasized the need for digital contract management tools that offer accessibility, scalability, and real-time collaboration capabilities. This trend is evident as over 60% of UK businesses have upgraded their contract management systems to enhance productivity and compliance.

The contract management software market in Germany held a substantial market share in 2024. The German government's focus on Industry 4.0 has accelerated digital transformation across various sectors. This initiative promotes the integration of digital technologies into manufacturing and other industries, leading to increased adoption of CMS platforms that facilitate automation and data-driven decision-making.

Asia Pacific Contract Management Software Market Trends

The contract management software industryin Asia Pacific is expected to grow at the highest CAGR of 13.9% from 2025 to 2030. Accelerated digital transformation across the Asia Pacific region is significantly driving the adoption of cloud-based Contract Management Software (CMS). Governments and enterprises in countries such as China, Japan, India, and Singapore are prioritizing digital initiatives to modernize operations, improve transparency, and enhance compliance. This push toward digitization is encouraging organizations to shift from manual and paper-based contract processes to automated, scalable cloud solutions. The increasing need for remote accessibility, data security, and operational agility makes CMS a vital tool in APAC’s broader digital modernization strategies across both public and private sectors.

The China contract management software market held a substantial market share in 2024. China's burgeoning SME sector is increasingly recognizing the benefits of CMS platforms in enhancing operational efficiency and reducing manual errors. The availability of cost-effective, scalable solutions tailored to the needs of smaller businesses is facilitating this adoption, enabling SMEs to compete more effectively in the market.

The contract management software market in Japanheld a substantial market share in 2024. The incorporation of artificial intelligence (AI) and machine learning (ML) into CMS platforms is revolutionizing contract management in Japan. These technologies enable automated contract analysis, risk assessment, and intelligent clause recognition, leading to improved decision-making and operational efficiency. Japan's world-class infrastructure facilitates the implementation of such advanced technologies, further driving the adoption of CMS solutions.

The India contract management software market is growing as enterprises are increasingly investing in digital tools to streamline operations, enhance efficiency, and maintain competitiveness in a rapidly evolving business landscape. This shift is particularly notable in sectors such as banking, financial services, insurance (BFSI), manufacturing, and information technology, where contract management is integral to supply chain and procurement processes.

Key Contract Management Software Company Insights

The key players in the global contract management software marketinclude Agiloft, Conga, ContractWorks, Docusign, GEP Worldwide, Icertis, Ironclad, Jaggaer, SAP SE, Zycus, Onit, Inc, IBM Corporation, Zoho Corporation Pvt. Ltd, Zluri, and Complinity Technologies Private Limited. The companies are focusing on various strategic initiatives, including new Software development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In April 2025, Ironclad introduced a new capability called Obligation Management, enabling enterprises to systematically track critical contract obligations and milestones. This feature aims to help organizations recapture millions in lost contract value by ensuring compliance and timely execution of contractual commitments, thereby reducing risks and enhancing operational efficiency.

-

In January 2025, Agiloft announced the acquisition of Screens, a generative AI contract review and redlining platform that utilizes expert-created and auto-generated playbooks to streamline contract evaluations. This acquisition enhances Agiloft’s Data-first Agreement Platform by standardizing contract review processes, promoting consistency, and unlocking the value of contract data through a global community of legal professionals.

-

In November 2023, Onit introduced a generative AI-powered contract management software, Onit Catalyst for Contracts, designed to enhance contract lifecycle processes. This solution leverages large language models to provide dynamic contract insights and facilitate seamless Microsoft Word integration. By automating tasks such as drafting, reviewing, and redlining contracts, it aims to improve efficiency and reduce manual effort for legal teams. The integration with Microsoft Word ensures a familiar user interface, promoting ease of adoption and workflow continuity.

-

In July 2023, Zluri secured USD 20 million in Series B funding, led by Lightspeed Venture Partners, with participation from MassMutual Ventures, Endiya Partners, and Kalaari Capital. This investment brings Zluri's total funding to USD 32 million since 2020. The company plans to enhance its generative AI capabilities, particularly through its new product, CoPilot, aimed at improving enterprise SaaS operations (SaaSOps) with no-code workflows and identity governance tools.

Key Contract Management Software Companies:

The following are the leading companies in the contract management software market. These companies collectively hold the largest market share and dictate industry trends.

- Agiloft

- Conga

- ContractWorks

- Docusign

- GEP Worldwide

- Icertis

- Ironclad

- Onit, Inc.

- SAP SE

- Zycus

- Jaggaer

- Aavenir

- IBM Corporation

- Zoho Corporation Pvt. Ltd

- Zluri

- Complinity Technologies Private Limited

Contract Management Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.11 billion

Market size forecast in 2030

USD 5.65 billion

Growth rate

CAGR of 12.7% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Market Size in USD million/billion and CAGR from 2025 to 2030

Report coverage

Market Size forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, business function, deployment mode, organization size, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico UK, Germany, France, China, India, Japan, Australia, South Korea, Brazil, UAE, Saudi Arabia, and South Africa

Key companies profiled

Agiloft, Conga, ContractWorks, Docusign, GEP Worldwide, Icertis, Ironclad, Onit, Inc., SAP SE, Zycus, Jaggaer, Aavenir; IBM Corporation, Zoho Corporation Pvt. Ltd, Zluri, Complinity Technologies Private Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Contract Management Software Market Report Segmentation

This report forecasts market Size growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the contract management software marketreport based on component, business function, deployment mode, organization size, end use, and region:

-

Component Outlook (Market Size, USD Billion, 2018 - 2030)

-

Software

-

Services

-

-

Business Function Outlook (Market Size, USD Billion, 2018 - 2030)

-

Legal

-

Sales

-

Procurement

-

Others

-

-

Deployment Mode Outlook (Market Size, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Organization Size Outlook (Market Size, USD Billion, 2018 - 2030)

-

SMEs

-

Large enterprises

-

-

End Use Outlook (Market Size, USD Billion, 2018 - 2030)

-

Government

-

Retail and eCommerce

-

Healthcare and Life Sciences

-

Banking, Financial Services, and Insurance (BFSI)

-

IT and Telecommunications

-

Transportation and Logistics

-

Manufacturing

-

Others

-

-

Regional Outlook (Market Size, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global contract management software market size was estimated at USD 2.83 billion in 2024 and is expected to reach USD 3.11 billion in 2025.

b. The global contract management software market is expected to grow at a compound annual growth rate of 12.7% from 2025 to 2030 to reach USD 5.65 billion by 2030.

b. The software segment accounted for a market share of over 67.0% in 2024. The demand for automation in contract management is rising as organizations seek to eliminate manual, time-consuming processes prone to errors and delays. Automating contract workflows—such as approvals, clause selection, alerts, and renewals—reduces cycle times, enhances accuracy, and improves operational efficiency. Features like auto-reminders, clause libraries, and integrated e-signatures are central to this shift, enabling faster, more consistent contract execution.

b. Some of the companies operating in contract management software market include Agiloft, Conga, ContractWorks, Docusign, GEP Worldwide, Icertis, Ironclad, Onit, Inc, SAP SE, Zycus, Jaggaer, IBM Corporation, Zoho Corporation Pvt. Ltd, Zluri, Complinity Technologies Private Limited

b. The contract management software market has evolved into a strategic component of enterprise operations, reflecting its critical role in managing complex agreements, ensuring compliance, and accelerating revenue cycles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.