- Home

- »

- Agrochemicals & Fertilizers

- »

-

Copper Fungicides Market Size, Share & Trends Report 2030GVR Report cover

![Copper Fungicides Market Size, Share & Trends Report]()

Copper Fungicides Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Copper Oxychloride, Copper Hydroxide, Cuprous Oxide), By Application (Fruits & Vegetables, Cereals & Grains), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-029-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Copper Fungicides Market Size & Trends

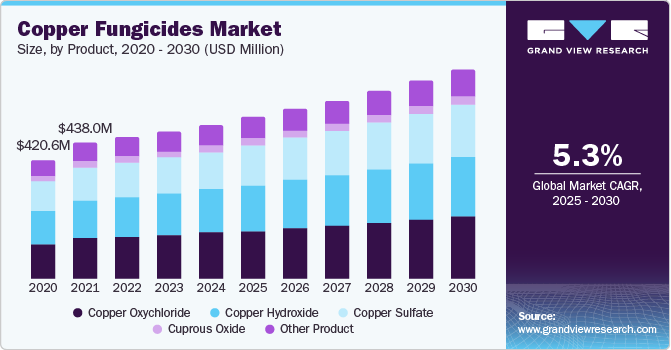

The global copper fungicides market size was estimated at USD 478.38 million in 2024 and is projected to reach USD 648.19 million by 2030, at a CAGR of 5.3% from 2025 to 2030. The increase in fungal diseases among plants can be attributed to several factors, including changes in global climatic conditions, the emergence of invasive fungal species, and the growing need for stronger fungal resistance in crops. Fungi are the largest group of plant pathogens responsible for many serious plant diseases, particularly vegetables. Familiar sources of fungal infections in plants include seeds, soil, weeds, crop debris, and neighboring crops.

Controlling fungal diseases that affect plants is crucial for meeting the increasing global food demand driven by a growing population. The United Nations projects that the worldwide population may reach 9.7 billion by 2050. According to the Harvard Business Review, food demand worldwide is expected to rise by approximately 98% by the same year. The Food and Agriculture Organization estimates that 2050 the demand for cereals will reach 3 billion tons. This demand includes both animal feed and food for people. These factors are expected to significantly boost product demand to increase crop yields in the coming years.

Organic plant growers often rely on copper fungicides because they are the only organic products effective against plant diseases like downy mildew and late blight. These diseases can devastate crops, making the control of diseases through copper fungicides essential for both conventional and organic farming worldwide. This necessity is driven by high crop demand in the region, which is influenced by a growing population and the limited expansion of arable land.

Stringent regulations and a growing focus on sustainable development have resulted in a constant decline in chemical production in the European Union. This factor, coupled with relatively higher prices in the EU and the U.S., has provided a competitive advantage to the Asia Pacific countries, including China, Japan, South Korea, India, and Taiwan, due to the abundant availability of raw materials and economical prices.

Some major raw materials used to produce copper fungicides include sodium chloride, sodium hydroxide, sulfuric acid, copper oxide, and others. Sodium hydroxide is the most widely used strong alkali in various industries. The electrolytic dissociation of sodium chloride produces it. Also, it is more soluble compared to sodium chloride. However, copper hydroxide and copper oxychloride being the most widely used copper fungicides, the demand for their raw materials, including sodium chloride, copper chloride, and sodium hydroxide, is expected to rise, which is likely to fuel their prices in the coming years.

Drivers, Opportunities & Restraints

Fungi constitute the highest number of plant pathogens and cause numerous serious diseases in plants. Fungi cause the majority of diseases in vegetables worldwide. Various sources of fungal infections in plants are soil, seed, crop debris, weeds, and nearby crops. Water splashes, wind, animal movement, soil, seedlings, machines, etc., spread fungi. Some of the prevalent foliar diseases caused by fungi are powdery mildews, downy mildews, and white blisters.

Unlike other agrochemicals, evidence exists that copper fungicides can have a long-term effect on a wide range of soil biota. Effects can occur even at a low concentration of copper and impact several soil processes such as bioturbation, earthworm activity, and microbial activity. Copper residues are expected to remain indefinitely in soil, thereby influencing its overall health.

The shrinkage of cultivable land owing to its usage for non-agricultural purposes, such as the construction of buildings, roads, railways, etc., is predicted to generate the requirement for high crop productivity and minimize the occurrence of crop-related diseases to improve agricultural yields per hectare worldwide. This is expected to be a market growth opportunity in the coming years.

Product Insights

The copper oxychloride compounds segment accounted for the largest revenue market share of 30.3% in 2024 and is expected to continue to dominate the industry over the forecast period. This is owing to its broad range of properties, which control fungal and bacterial diseases through contact action. Furthermore, it has low aqueous solubility and low volatility. Copper itself cannot break down in the environment because it is a heavy metal, which makes it an effective fungicide. It is moderately toxic to mammals and most biodiversity. Its fine particles stick to the leaves and hinder the growth of the fungus.

Copper hydroxide fungicide is a major copper fungicide used to protect dozens of vegetables, fruit, and nut crops against many fungal infections. Bayer AG, a prominent manufacturer of Copper Fungicides, produces copper hydroxide under the brand “Blue Shield. " This product protects the crop against peppery leaf spots, downy mildew, black rot, and ring spots in pears, apples, and citrus fruit, along with anthracnose and bacterial black spots in mangoes.

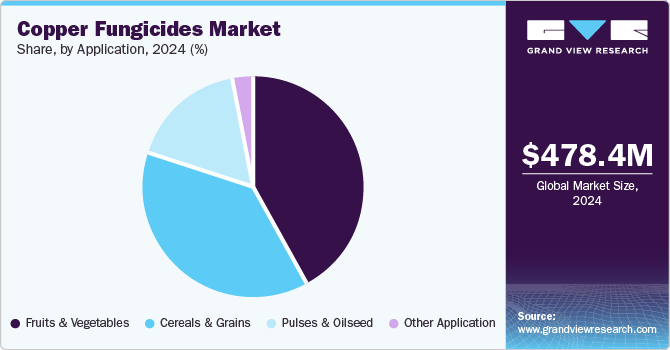

Application Insights

The fruit & vegetables segment dominated the end-use segment with a revenue market share of 41.82% during the forecast period. Increasing health consciousness among consumers and the growing demand for fresh fruits and vegetables worldwide is expected to boost segment growth. Furthermore, fruit and vegetable production is rising at a high pace, which is expected to drive the copper fungicide market. This is attributed to the increasing consumption of vegetarian foods globally. Globally, growing health awareness among consumers is driving the demand for fruits & vegetables, which, in turn, is expected to propel the copper fungicide market growth.

Oilseeds and pulses include various types of seeds, such as sunflower seeds, soybeans, and leguminous seeds (pulses). The increasing focus of farmers on oilseed production is expected to drive the copper fungicide market. Soybeans are commonly used oilseeds. China is the world's major producer of soybeans. In terms of rapeseed production, Europe, India, and Ontario are the top producers, while China leads peanut production, and Ukraine leads sunflower production. Rising demand for these oilseeds and pulses is expected to positively influence the demand for copper fungicides in the above regions.

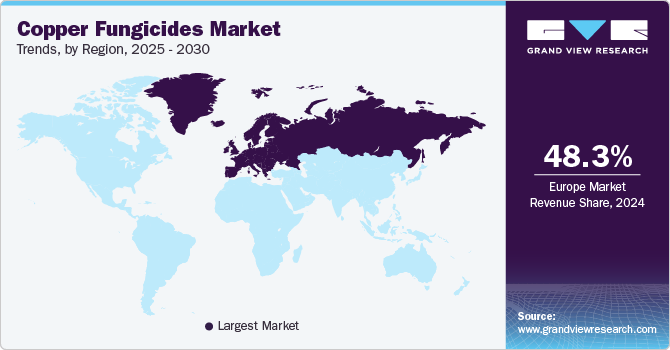

Regional Insights

The copper fungicides market in North America is expected to grow significantly over the forecast period. North America is among the largest crop producers in the world, mainly responsible for producing corn, soybeans, oats, barley, etc. The increasing share of North America in global agricultural production is mainly driven by the flourishing agricultural sector in the U.S. Canada and Mexico are also witnessing surging crop yields, which contribute to the growth of the agricultural market in North America. Increasing agricultural activities in the region due to rising food requirements have fueled the demand for crop protection chemicals such as copper fungicides in North America.

U.S. Copper Fungicides Market Trends

The U.S. copper fungicides market is expected to grow significantly over the forecast period. This growth is attributable to the increasing crop production capacity of the U.S., which was at an all-time high with 177.0 bushels per acre registered in 2021. This was 5.6 bushels higher than 171.4 bushels per acre recorded in the country in 2020. The U.S. witnessed its highest soybean production in 2021, with over 4.44 billion bushels, registering a hike of approximately 5.0% in soybean production compared with that of 2020. Nearly 21 states across the U.S. produced an all-time high of soybeans in 2021.

Europe Copper Fungicides Market Trends

Europe copper fungicides market dominated the market in 2024 as they are the leading producer of copper fungicides in the world. Copper fungicides were discovered in the region and have been used as fungicides in this geography since then. Most key copper fungicide manufacturers are in Europe due to the easy and adequate availability of raw materials such as copper sulfate required for developing these chemicals. Some other copper-based chemicals produced in this region are copper oxychloride, copper hydroxide, and cuprous oxide. The flourishing market for grapes in Europe owing to surging production and consumption of wine is estimated to fuel the growth of the market for copper fungicides in the region in the foreseeable period.

Asia Pacific Copper Fungicides Market Trends

The copper fungicides market in Asia Pacific is expected to grow at a significant CAGR during the forecast period. Agriculture is a primary sector in several countries in Asia Pacific, including India, Bangladesh, and Sri Lanka. The flourishing agriculture sector in these countries is expected to drive the consumption of copper fungicides in the region. Moreover, China and India being powerhouses in terms of the production of crops such as rice, wheat, and cotton, have emerged as global export hubs for rice, wheat, and cotton. It is expected that the consumption of pesticides will increase exponentially in Asia Pacific in the coming years, thereby leading to market growth in the region.

Latin America Copper Fungicides Market Trends

The copper fungicides market in Latin America is among the key producers of bananas, sugar, coffee, cocoa, wheat, and corn. Brazil, Argentina, and Colombia are the major contributors to the growth of agricultural production in Latin America. The region represents immense growth potential for crop protection chemicals such as copper fungicides due to rising crop cultivation driven by increasing demand for food.

Middle East & Africa Copper Fungicides Market Trends

The copper fungicides market in MEA is expected to grow significantly due to the rising input costs for agricultural production and limited water availability, which pose major threats to crop cultivation in the Middle East. The U.S. Department of Agriculture (USDA) estimates that wheat production in the region is expected to deteriorate further in the coming years with the limited availability of water in the Middle East. The region accounts for a share of 5.0% of the global wheat production yearly. It mainly relies on wheat imports and other crops to cater to domestic requirements. In addition, the Middle East has the most water scarcity in the world.

Key Copper Fungicides Company Insights

Some of the key players operating in the market include UPL Limited India, Albaugh, LLC, and Bayer AG.

-

Albaugh LLC is a global business offering an ever-expanding portfolio of crop protection products in the key agricultural regions of North America, Latin America, Europe, Middle East & Africa, and Asia Pacific. Albaugh LLC is a manufacturer and formulator of agricultural crop protection products based in Ankeny, Iowa. The company's core product portfolio is based on five key active ingredients, offering herbicides, fungicides, insecticides, seed treatments, and plant growth regulators to help farmers with crop protection requirements.

-

Nufarm is a global agricultural products manufacturer. The company develops, manufactures, and sells crop protection products, including insecticides, fungicides, and herbicides. It is also an expert in seed technologies and crop protection solutions. The company’s crop protection solutions protect crops against pests, weeds, and diseases. Its product portfolio includes seed treatments, herbicides, fungicides, insecticides, and plant growth regulators. Key crop chemicals are related to cereals, corn, soybean, pasture, turf, ornamentals, trees, nuts, vines, and vegetables.

Key Copper Fungicides Companies:

The following are the leading companies in the copper fungicides market. These companies collectively hold the largest market share and dictate industry trends.

- UPL Limited India

- Albaugh, LLC

- Nufarm

- Certis USA LLC

- Bayer AG

- Isagro S.p.A.

- Nordox AS

- ADAMA

- Quimetal

- Cosaco

- Cinkara Celje dd

- Corteva

Recent Developments

-

In March 2023, Corteva Agriscience announced the commercial launch of Adavel Active. This innovative fungicide has recently obtained product registrations in Australia, Canada, and South Korea. Adavel Active is distinguished by its unique mode of action, which protects against various diseases that can significantly impact crop yields.

Copper Fungicides Report Scope

Report Attribute

Details

Market size value in 2025

USD 501.17 million

Revenue forecast in 2030

USD 648.19 million

Growth rate

CAGR of 5.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in tons, revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

UPL Limited India; Albaugh, LLC; Nufarm; Certis USA LLC; Bayer AG; Isagro S.p.A.; Nordox AS; ADAMA; Quimetal; Cosaco; Cinkara Celje dd; Corteva

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Copper Fungicides Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global copper fungicides market report by product, application, and region:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Copper Oxychloride

-

Copper Hydroxide

-

Cuprous Oxide

-

Copper Sulfate

-

Other Product

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Fruits & Vegetables

-

Cereals & Grains

-

Pulses & Oilseed

-

Other Application

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the copper fungicide market growth include factors such as the change in global climatic conditions, the emergence of invasive fungal species, and the need for strong fungal resistance in crops

b. Some key players operating in the copper fungicide market include UPL Limited India; Albaugh, LLC; Nufarm; Certis USA LLC; Bayer AG; Isagro S.p.A.; Nordox AS; ADAMA; Quimetal; Cosaco; Cinkara Celje dd; Corteva

b. The copper oxychloride compounds segment accounted for the largest revenue market share of 30.3% in 2024 and is expected to continue to dominate the industry over the forecast period.

b. The global copper fungicide market size was estimated at USD 478.38 million in 2024 and is expected to reach USD 501.17 million in 2025

b. The copper fungicide market is expected to grow at a compound annual growth rate of 5.3% from 2024 to 2030 to reach USD 648.19 million by 2030

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.