Coronary Heart Disease Diagnostic Imaging Device Market Size, Share & Trends Analysis Report By Modality (Computed Tomography, X-rays, Ultrasound, Magnetic Resonance Imaging, Nuclear Medicine), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-924-2

- Number of Report Pages: 190

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

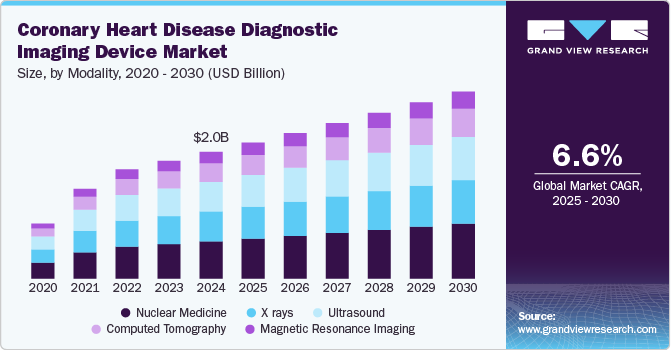

The global coronary heart disease diagnostic imaging device market size was estimated at USD 2.0 billion in 2024 and is projected to grow at a CAGR of 6.6% from 2025 to 2030. Several key drivers, including the increasing prevalence of coronary artery diseases and the rising adoption of early diagnostic techniques, significantly influence the coronary heart disease diagnostic market. As lifestyle changes, urbanization, and an aging population contribute to a higher incidence of cardiovascular conditions, healthcare systems must enhance their diagnostic capabilities. According to statistics from the Centers for Disease Control and Prevention (CDC), in the U.S., an individual succumbs to cardiovascular disease approximately every 33 seconds.

One of the foremost drivers is the rising prevalence of coronary heart disease globally. According to the World Health Organization (WHO), cardiovascular diseases are responsible for approximately 32% of all deaths worldwide, with CHD being a leading cause. The increasing incidence rates can be attributed to lifestyle factors such as poor diet, lack of physical activity, and smoking, which further amplify the need for advanced diagnostic imaging devices to facilitate early detection and treatment.

The growing geriatric population is another critical driver influencing this market segment. The aging demographic is particularly susceptible to cardiovascular diseases due to age-related physiological changes and comorbidities. According to a report from the United Nations (UN), by 2050, there will be approximately 2 billion individuals aged 60 years or older globally. This demographic shift necessitates increased healthcare services focused on managing chronic conditions such as CHD, thereby propelling demand for diagnostic imaging devices designed specifically for older patients who may require more frequent monitoring and intervention.

Advancements in imaging technologies also significantly contribute to market growth. Innovations such as cardiac MRI, CT angiography, and echocardiography have improved diagnostic accuracy and patient outcomes. Technological advancements enhance the precision of diagnoses and reduce procedural times and patient discomfort. As healthcare providers increasingly adopt these cutting-edge technologies, they drive demand for sophisticated imaging devices tailored to diagnose CHD effectively.

Market Concentration & Characteristics

The degree of innovation in the market is high. The market is marked by considerable innovation, propelled by advancements in technology such as computed tomography (CT), magnetic resonance imaging (MRI), and nuclear medicine. For instance, the emergence of 64-slice cardiac CT technology enhanced the ability to identify lesions that block more than 50% of the lumen, demonstrating high sensitivity, specificity, and predictive accuracy.

The level of merger and acquisition (M&A) activities in the market is moderate. The market merger and acquisition (M&A) activities were robust as companies sought to consolidate resources, expand product portfolios, and enhance technological capabilities. For instance, in May 2022, GE Healthcare acquired Zionexa, a company specializing in molecular imaging technologies that can aid cardiovascular diagnostics. This acquisition reflects a strategic move to integrate innovative imaging solutions into GE’s existing portfolio while addressing the growing need for comprehensive cardiovascular care.

The U.S. Food and Drug Administration (FDA) implemented stringent guidelines for the approval of new diagnostic devices, which can delay market entry but ultimately ensure higher standards of patient care. For instance, in September 2023, the FDA’s Breakthrough Devices Program expedited the review process for innovative technologies that offer significant advantages over existing options; this was instrumental for companies developing novel imaging solutions, such as advanced cardiac PET scans that promise improved patient outcomes.

Product expansion in the market is high. Manufacturers are increasingly focusing on developing portable and user-friendly diagnostic devices that can be utilized in various settings beyond traditional hospitals, such as outpatient clinics or home care environments. For instance, in October 2023, Philips launched its handheld ultrasound device designed specifically for cardiac assessments; this product allows healthcare providers to perform quick evaluations at the point of care, improving patient access to timely diagnostics.

Regional expansion in market is moderate. Companies are strategically entering Asia-Pacific and Latin America markets to tap into this growth potential. For instance, in August 2022, Wipro GE Healthcare partnered with Boston Scientific to enhance cardiac care in India. This collaboration aims to provide comprehensive interventional cardiac care solutions, improving patient access to treatment and addressing the country's significant burden of cardiovascular diseases.

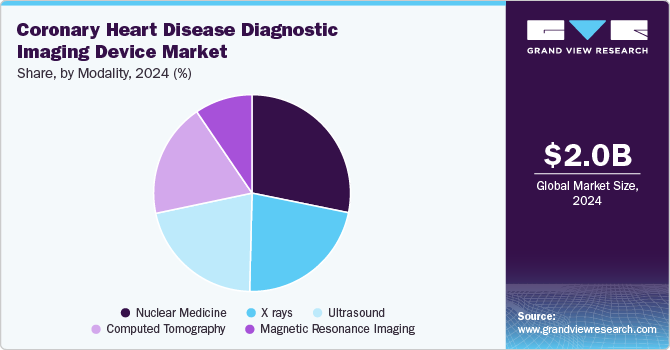

Modality Insights

Based on modality, the nuclear medicine segment led the market with the largest revenue share of 28.19% in 2024. This segment is driven by the increasing prevalence of cardiovascular diseases, the need for early diagnosis, and the growing adoption of advanced imaging technologies. Nuclear imaging techniques such as single-photon emission computed tomography (SPECT) and positron emission tomography (PET) are widely used for diagnosing coronary artery disease by assessing myocardial blood flow, metabolism, and viability. The non-invasive nature of nuclear imaging procedures makes them preferable for patients with suspected or known coronary heart disease, contributing to the segment’s growth.

The computed tomography (CT) segment is anticipated to experience at the fastest CAGR during the forecast period. Advancements in CT technology, such as developing multi-slice and dual-source CT scanners, drive the market growth. These significantly improved image quality and reduced scan times, making it easier for healthcare providers to diagnose coronary artery disease (CAD) accurately and efficiently. In addition, the increasing prevalence of coronary heart disease globally has led to a higher demand for practical diagnostic tools; CT angiography has emerged as a non-invasive method that provides detailed images of blood vessels and helps assess coronary artery blockages.

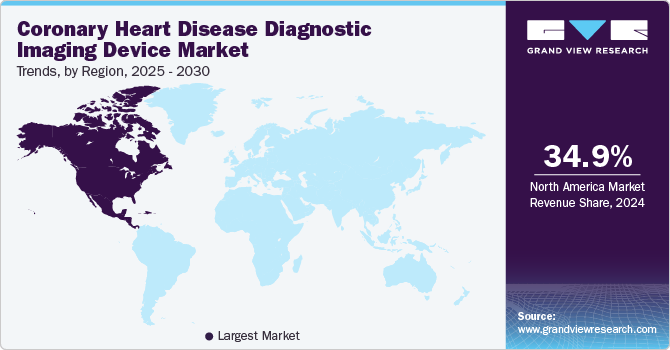

Regional Insights

The North America coronary heart disease diagnostic imaging device market dominated the market with the largest revenue share of 34.9% in 2024, driven by the high prevalence of cardiovascular diseases and the need for early diagnosis. The region is home to many leading medical device manufacturers, such as GE Healthcare and Siemens Healthineers, who are continuously innovating and launching new products. The market in North America is also influenced by the high adoption rates of advanced imaging technologies, such as CT and MRI, for diagnosing coronary artery diseases (CAD). For instance, in September 2023, Forum Health Fond du Lac launched a new scanning technology known as the Multifunction Cardiogram (MCG) scan, which aims to detect early indicators of heart disease.

U.S. Coronary Heart Disease Diagnostic Imaging Device Market Trends

The coronary heart disease diagnostic imaging device market in U.S. is characterized by a strong focus on research and development, leading to advanced technologies for early detection and precise diagnosis of heart conditions. The country’s robust healthcare infrastructure and high healthcare expenditure contribute to the rapid adoption of advanced imaging devices. For instance, in November 2022, Fujifilm Healthcare Americas Corporation launched the SCENARIA View Focus Edition Computed Tomography (CT) system in the United States.

Europe Coronary Heart Disease Diagnostic Imaging Device Market Trends

The coronary heart disease diagnostic imaging device market in Europe is influenced by stringent regulatory standards set by organizations such as the European Medicines Agency (EMA) and the European Society of Cardiology (ESC). These regulations ensure patient safety and product quality but can pose challenges for market players regarding compliance costs and time-to-market for new devices. Cultural factors such as an aging population and increasing awareness about preventive healthcare drive the demand for advanced diagnostic imaging solutions in Europe.

The UK coronary heart disease diagnostic imaging device market reflects a mix of public and private healthcare systems, impacting access to innovative technologies for diagnosing heart conditions. Economic factors such as budget constraints within the National Health Service (NHS) influence procurement decisions, potentially limiting the widespread adoption of expensive imaging devices. However, initiatives promoting early screening and diagnosis of cardiovascular diseases contribute to market growth in the UK.

The coronary heart disease diagnostic imaging device market in France benefits from a well-established healthcare system that prioritizes cardiovascular health through comprehensive screening programs and treatment protocols. The country’s emphasis on preventive care aligns with the growing trend towards early detection of heart diseases using advanced imaging technologies. Regulatory frameworks by agencies, including Agence Nationale de Sécurité du Médicament et des Produits de Santé (ANSM), ensure that diagnostic devices meet stringent quality standards before entering the market.

Asia Pacific Coronary Heart Disease Diagnostic Imaging Device Market Trends

The coronary heart disease diagnostic imaging device market in Asia Pacific is expected to witness at a significant CAGR during the forecast period, due to the increasing prevalence of cardiovascular diseases and the rising geriatric population. Japan, China, and India are driving this growth with advancements in healthcare infrastructure and technology adoption. The demand for non-invasive diagnostic imaging devices is rising in countries such as South Korea and Australia. In addition, the growing awareness about early diagnosis and treatment of heart diseases is fueling market expansion in this region.

The China coronary heart disease diagnostic imaging device market is anticipated to grow at a rapid CAGR during the forecast period, driven by a large patient pool, improving healthcare infrastructure, and increasing disposable income. The Chinese government’s initiatives to enhance healthcare services and promote preventive care also contribute to market development. Moreover, the country’s focus on technological advancements in medical imaging devices and the presence of key market players are further boosting the market growth in China.

The coronary heart disease diagnostic imaging device market in India is driven by the high prevalence of cardiovascular diseases and the need for affordable and accessible diagnostic solutions. The country faces unique challenges, such as a large population living in rural areas with limited access to healthcare facilities and a shortage of skilled healthcare professionals. The market in India is also influenced by the increasing adoption of telemedicine and mobile health technologies to reach underserved populations.

Latin America Coronary Heart Disease Diagnostic Imaging Device Market Trends

The coronary heart disease diagnostic imaging devices market in Latin American region is anticipated to witness at a significant CAGR during the forecast period, due to an aging population, changing lifestyles leading to increased cardiovascular risk factors and improving healthcare infrastructure. Countries including Brazil, Mexico, and Argentina are vital contributors to this growth, focusing on early detection and management of heart diseases. Cultural factors such as a preference for non-invasive diagnostic procedures influence market trends in Latin America.

The Brazil coronary heart disease diagnostic imaging device market is anticipated to experience at a steady CAGR during the forecast period, supported by a growing elderly population, increasing awareness about cardiovascular health, and advancements in medical technology. The Brazilian regulatory environment shapes market dynamics by ensuring product quality standards and safety measures. Economic factors such as rising healthcare expenditure and investments in healthcare infrastructure are driving market expansion in Brazil.

Middle East & Africa Coronary Heart Disease Diagnostic Imaging Device Market Trends

The coronary heart disease diagnostic imaging device market in the Middle East and Africa is anticipated to witness at a significant CAGR during the forecast period, due to several factors. Technological advancements in imaging modalities such as CT scans, MRI, and nuclear imaging have improved the accuracy and efficiency of diagnosing coronary heart disease. Moreover, the growing awareness among healthcare providers and patients regarding early detection and treatment of cardiovascular conditions is further fueling the adoption of these diagnostic devices in the Middle East and Africa.

The Saudi Arabia coronary heart disease diagnostic imaging device market is anticipated to grow at the fastest CAGR during the forecast period. In Saudi Arabia, several unique factors influence the market growth. One significant factor is the country's stringent regulatory environment governing medical devices. The Saudi Food and Drug Authority (SFDA) ensures that all medical devices meet strict quality standards before being marketed or used in healthcare facilities. This regulatory oversight contributes to maintaining high patient safety and quality assurance levels in the diagnostic imaging device market. In addition, cultural factors such as a preference for advanced healthcare technologies and a growing emphasis on preventive care drive the demand for state-of-the-art imaging devices for diagnosing coronary heart disease in Saudi Arabia.

Key Coronary Heart Disease Diagnostic Imaging Device Company Insights

The key players are developing advanced colposcopies to meet the growing prevalence of cervical cancer. Moreover, regional & service portfolio expansions and mergers & acquisitions are critical strategic undertakings adopted by these players. Market players invest heavily in emerging markets to increase their global footprint and lead the market.

Key Coronary Heart Disease Diagnostic Imaging Device Companies:

The following are the leading companies in the coronary heart disease diagnostic imaging device market. These companies collectively hold the largest market share and dictate industry trends.

- Canon

- Esaote SPA

- FUJIFILM Holdings Corporation

- GE Healthcare

- Hitachi Medical Corporation

- Koninkilijhe Phillips N.V.

- SAMSUNG

- Siemens Healthineers AG

- Ziehm Imaging GmbH

View a comprehensive list of companies in the Coronary Heart Disease Diagnostic Imaging Device Market

Recent Developments

-

In May 2024, GE HealthCare partnered with Medis Medical Imaging to enhance non-invasive coronary assessments. This collaboration aims to improve coronary artery disease (CAD) diagnosis and treatment by integrating advanced imaging technologies with innovative software solutions

-

In September 2023, Martini Hospital in Groningen, Netherlands, launched a pioneering continuous remote cardiac monitoring service using Philips' ePatch and AI-driven cardiology analytics. This innovative solution replaces traditional Holter monitors, offering a more convenient and efficient method for patient monitoring

-

In January 2023, Cleerly announced the introduction of Cleerly ISCHEMIA. This innovative product has recently obtained clearance from the U.S. Food and Drug Administration (FDA) under the 510(k) medical device approval process

Coronary Heart Disease Diagnostic Imaging Device Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.15 billion |

|

Revenue forecast in 2030 |

USD 2.96 billion |

|

Growth rate |

CAGR of 6.6% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Modality, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait |

|

Key companies profiled |

Canon; Esaote SPA; FUJIFILM Holdings Corporation; GE Healthcare; Hitachi Medical Corporation; Koninkilijhe Phillips N.V.; SAMSUNG; Siemens Healthineers AG; Ziehm Imaging GmbH |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Coronary Heart Disease Diagnostic Imaging Device Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global coronary heart disease diagnostic imaging device market report based on modality, and region.

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Computed Tomography

-

X rays

-

Ultrasound

-

Magnetic Resonance Imaging

-

Nuclear Medicine

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global coronary heart disease diagnostic imaging devices market is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2030 to reach USD 2.96 billion by 2030.

b. The global coronary heart disease diagnostic imaging devices market size was estimated at USD 2.00 billion in 2024 and is expected to reach USD 2.15 billion in 2025.

b. Nuclear Medicine accounted for the largest share of 29.27% in 2024 within the modality segment. Factors such as non-invasiveness, clarity of image, accurate detection of disease even at a nascent stage, and increasing adoption among end-users, influence the market growth.

b. Some of the key players operating in the coronary heart disease diagnostic imaging devices market include GE Healthcare, Fujifilm, Siemens Healthineers, Toshiba, Hitachi, Koninklijke Phillips, Canon Medical, and Analogic Corp.

b. Factors such as a rise in cardiovascular diseases, increased need for non-invasive diagnostic techniques, rise in geriatric population, increased risk of coronary artery diseases (CAD) due to increased prevalence of obesity, and are expected to boost the coronary heart disease diagnostic imaging devices market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."