- Home

- »

- Healthcare IT

- »

-

Meditation Management Apps Market, Industry Report, 2033GVR Report cover

![Meditation Management Apps Market Size, Share & Trends Report]()

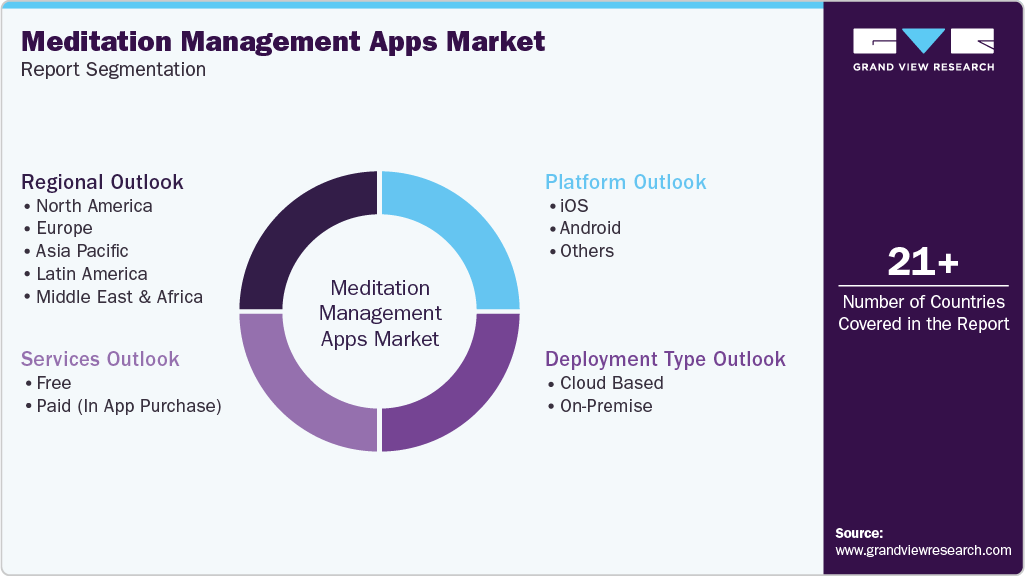

Meditation Management Apps Market (2026 - 2033) Size, Share & Trends Analysis Report By Platform (iOS, Android), By Deployment Type (Cloud-Based, On-Premise), By Service (Free, Paid), By Region (North America, Europe, APAC), And Segment Forecasts

- Report ID: GVR-4-68040-181-9

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Meditation Management Apps Market Summary

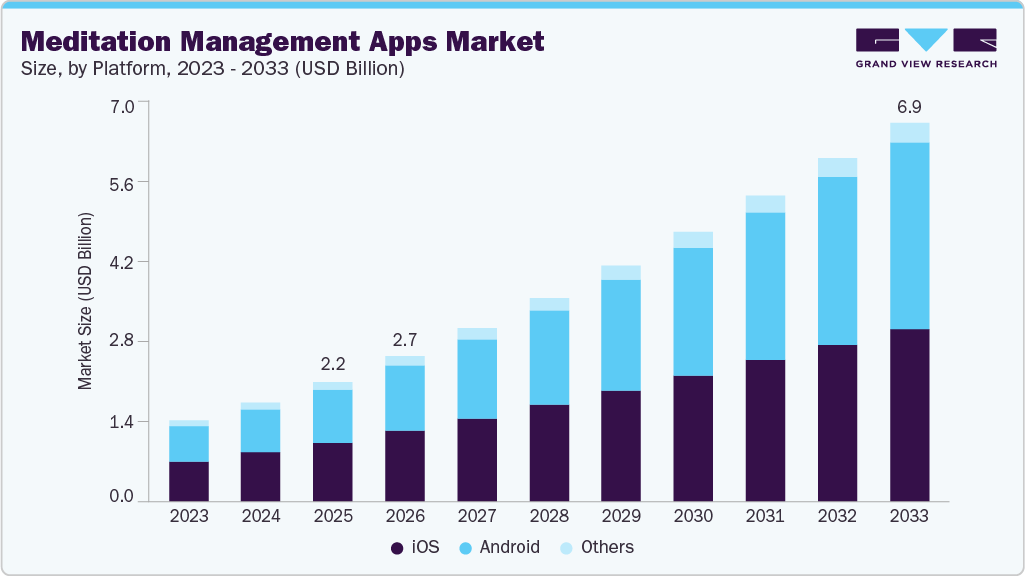

The global meditation management apps market size was estimated at USD 2.20 billion in 2025 and is projected to reach USD 6.99 billion by 2033, growing at a CAGR of 14.67% from 2026 to 2033. Factors such as an increased number of individuals suffering from stress, anxiety, and depression, government initiatives that promote meditation and yoga, rising use of smartphones and tablets, and growing awareness regarding mental health drive market growth.

Key Market Trends & Insights

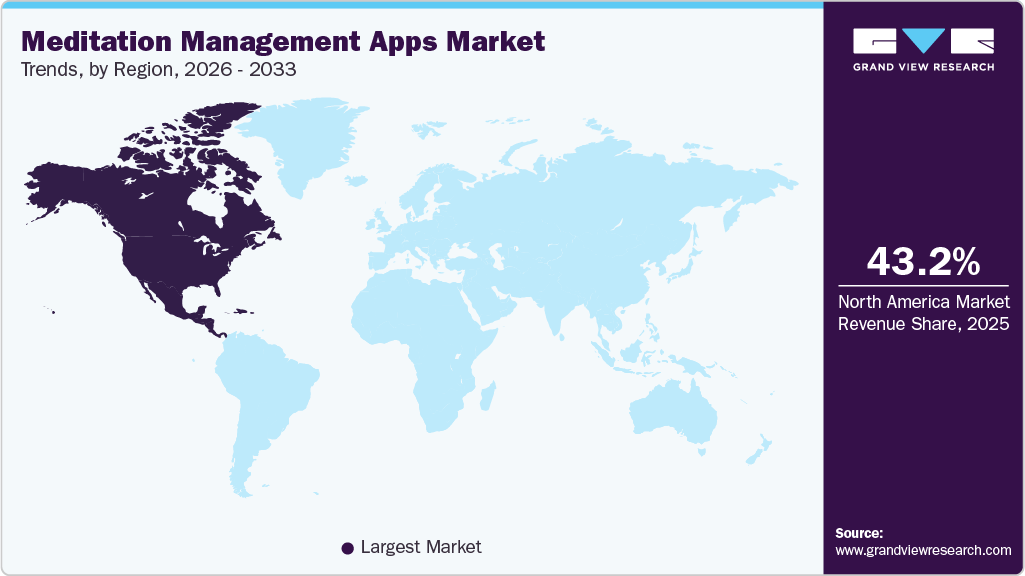

- North America dominated the market and accounted for 43.22% revenue share in 2025.

- The U.S. meditation management apps market accounted for the largest share in North America in 2025.

- Based on the platform, the iOS segment held the largest share in 2025.

- Based on the deployment type, the cloud-based deployment type segment held the largest share in 2025.

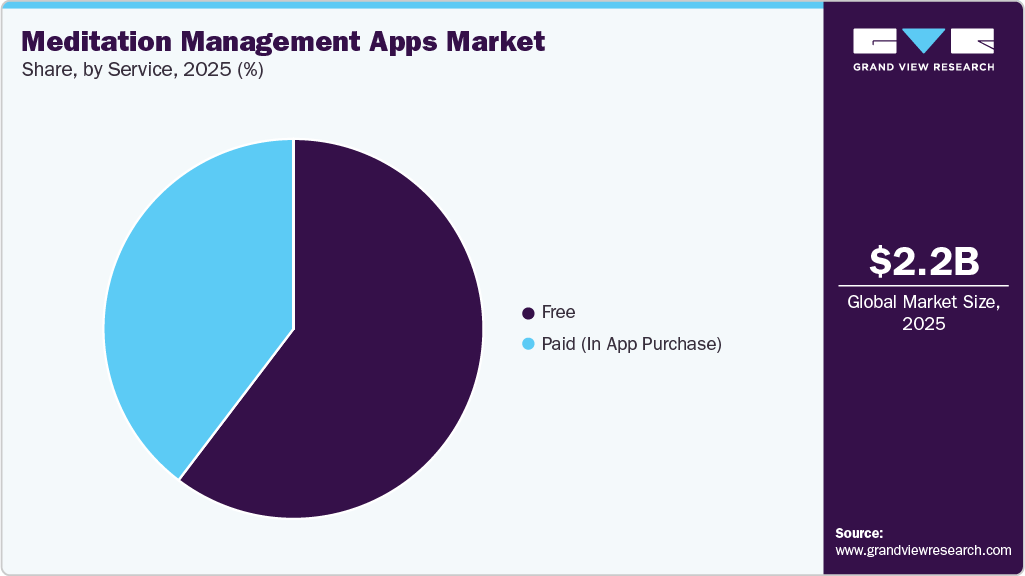

- Based on service, the free services segment held the largest share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2.20 Billion

- 2033 Projected Market Size: USD 6.99 Billion

- CAGR (2026-2033): 14.67%

- North America: Largest market in 2025

These applications guide breathing techniques, visualization exercises, and relaxation of muscles and the body. The growing awareness of mental health and overall well-being is one of the major driver for meditation apps, as modern lifestyles marked by stress, long work hours, and digital overload have contributed to rising rates of anxiety, depression, and sleep disorders worldwide. For instance, in March 2023, according to the World Health Organization (WHO), around 280 million people across the globe suffered from depression, and it remains one of the leading mental health conditions contributing to disability and reduced daily functioning. Meditation apps such as Calm and Headspace, provide guided mindfulness exercises that help manage stress, improve sleep, and enhance emotional resilience.

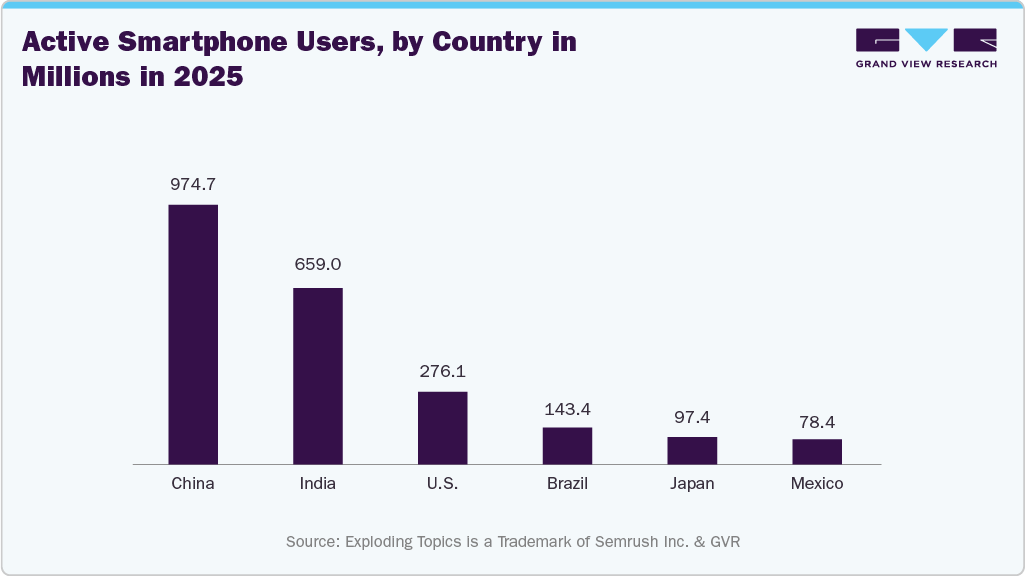

The growing use of smartphones is driving the growth of the meditation management app market. According to the Kepios. article published, in October 2025, the number of people using the internet worldwide reached about 6.04 billion, representing nearly 73.2 % of the global population, reflecting continued growth in online connectivity across regions. With mobile devices serving as the primary access point to the internet for most users, digital applications, including meditation, health, and elder care apps can scale rapidly in this favorable environment. Mobile-first behavior is shaping how people engage with information, services, and wellness tools, and as more users come online across demographics, the potential reach of technology-based health and well-being solutions continues to expand.

Digital platforms and global campaigns are expanding access to meditation and mindfulness practices through technology, helping millions adopt these techniques in their daily lives. For instance, in December 2025, the United Nations formally declared World Meditation Day, an international observance held annually on December 21, recognizing meditation’s role in promoting mental health and wellbeing and encouraging digital and community program around the world. This combination of government policy support and digital adoption of meditation platforms reflects a growing global emphasis on integrating holistic wellness practices into public health strategies.

Advances in technology are enabling meditation apps to offer highly personalized and interactive wellness experiences. By leveraging AI and machine learning, these apps can assess user behavior, mood, goals, and engagement patterns to provide content tailored to individual needs. For example, apps can recommend short stress-relief sessions during work hours or longer guided meditations before sleep based on usage history. Wearable integration with smartwatches and fitness trackers enables apps to monitor physiological indicators such as heart rate variability, stress levels, and sleep quality, adapting sessions in real-time to optimize outcomes. Virtual reality (VR) and immersive environments create a more experiential form of meditation, transporting users to calming virtual settings like beaches or forests, appealing especially to younger, tech-savvy audiences.

Corporate wellness initiatives are increasingly incorporating meditation apps to support employee well-being. Companies recognize that stress reduction and mindfulness can improve productivity, reduce burnout, and lower absenteeism. Partnerships between app providers and corporate wellness programs are expanding, with apps offering enterprise packages, analytics dashboards, and content tailored for employees. Tech firms such as Google and Salesforce have integrated mindfulness and meditation programs into their wellness strategies, demonstrating ROI through higher employee satisfaction and retention.

Market Concentration & Characteristics

The meditation management apps market is characterized by high innovation, by rapid digitalization, widespread smartphone adoption, and integration with emerging technologies such as AI, virtual reality (VR), and wearable sensors. Many apps are pushing the boundaries of traditional meditation by adding features identical to personalized guidance, mood‑adaptive sessions, and immersive experiences. For instance, in March 2024, Headspace launched Headspace XR, a virtual reality mindfulness experience on Meta Quest that combines guided meditations with immersive environments to enhance user engagement and mind‑body connection, reflecting the market’s shift toward more interactive and tech‑driven meditation formats.

The meditation management apps market is characterized by the moderate merger and acquisition (M&A) activity. This is due to several factors, including the desire to gain access to new technologies and the need to consolidate in a rapidly growing market. For instance, in March 2023, the acquisition of the meditation and mindfulness app Simple Habit by wellness marketplace Ingenio allowed Simple Habit’s large library of guided meditations and wellness content to be integrated into a broader holistic wellness platform while expanding its user base and distribution.

The relatively low level of formal regulatory oversight for meditation management applications can restrain market growth, as many such apps are treated more similar wellness tools than regulated digital health products. This creates uncertainty around data protection, privacy, and safety standards, especially when sensitive personal and mental well‑being information is collected, shared, or stored. For instance, in April 2025, an iOS meditation app called 7 Minute Chi Meditate & Move exposed over 100,000 users’ personal details due to a publicly misconfigured database, highlighting serious vulnerabilities in data security and the potential for misuse or phishing attacks when apps lack strong regulatory requirements for user data protection.

Key players in the market adopt a geographical expansion strategy to increase their reach in the market. In addition, this strategy includes adding new features to existing solutions, creating opportunities for companies focused on developing meditation management apps.

Platform Insights

Based on platform type, the iOS segment dominated the market, accounting for about 48.76% of revenue in 2025. This growth can be attributed to the increasing adoption of iOS among consumers. For instance, according to data published by BankMyCell.com, iOS's market share in the U.S. increased from 58.1% in 2023 to 61.45% in 2024. This rising trend in iOS adoption, combined with the segment’s strong ecosystem of app quality, security, and integration with other Apple services, demonstrates the iOS segment’s continued dominance and significant role in driving revenue growth for meditation management apps over the forecast period.

The android segment is anticipated to grow at the fastest CAGR during the forecast period, driven by rising adoption and the cost-effective nature of Android-based smartphones. According to the Commandlinux article published in December 2025, Android is the world’s most widely used mobile operating system, with estimates showing that it commands more than 72.77% of the global smartphone OS (Operating System) market share in 2025, translating to nearly 3.9 billion active devices worldwide a figure that underscores its vast user base and reach. This extensive adoption creates significant opportunities for meditation app developers to expand user engagement and market penetration across regions where Android is dominant.

Deployment Type Insights

By deployment type, the Cloud-based segment dominated the market, accounting for over 59.62% of revenue in 2025, and is expected to register the fastest CAGR during the forecast period. Key factors driving market growth include the scalable online infrastructure that enables real-time updates, personalized experiences, and seamless cross-device access. Users’ rising demand for instant, adaptive, and synchronized wellness tools makes cloud solutions essential for enhancing engagement, retention, and service expansion. For instance, in February 2025, RelaxFrens, an AI-powered meditation app, began generating personalized sessions in real time using cloud-hosted machine learning, allowing continuous content updates and improved user experiences worldwide.

The on- premise segment is anticipated to grow at the significant CAGR during the forecast period, due to growing adoption among enterprises and organizations that prioritize data security, privacy, and internal control. Companies are increasingly deploying meditation and wellness platforms within their own IT infrastructure to ensure sensitive employee or patient data remains secure, while still providing personalized wellness content For instance, in November 2025, Meditopia for Work has been implemented by several corporate wellness programs, allowing employees to access mindfulness and meditation resources through secure, internal portals, ensuring compliance with company data policies and offering tailored experiences for workforce well-being.

Service Insights

Based on the service, the free segment dominated the market, accounting for over 60.34% of revenue in 2025, owing to users increasingly seek accessible wellness solutions without subscription barriers. Many apps offer generous free content, such as guided meditations, timers, and community features that attract a broad base of users and introduce them to mindfulness practices without upfront cost. For instance, in November 2024, Insight Timer, which provides access to over 150,000 guided meditations and community sessions at no cost, was one of the most widely used free meditation platforms globally, and was appealing to both beginners and seasoned practitioners. This trend helps users adopt regular mindfulness habits without financial commitment, allows developers to grow active user communities, and then optionally convert engaged users to paid or premium tiers.

The paid (in-app purchase) segment is anticipated to grow at the fastest CAGR over the forecast period. The paid service segment remains a primary revenue driver for meditation management apps, as users increasingly subscribe to or purchase premium content to access advanced features, expert-led sessions, and structured mindfulness programs. Many apps use in-app purchases to unlock complete content libraries, exclusive guided meditations, and tailored wellness plans that go beyond basic free offerings. For instance, Happier Meditation (formerly Ten Percent Happier) offers a range of in-app purchase options, including annual memberships and premium subscriptions that provide access to over 500 guided meditation sessions and personalized practice plans designed to address stress, anxiety, and sleep challenges. Such monetization strategies reflect users’ willingness to pay for more profound, expert-driven experiences, and they help app developers sustain ongoing content creation and feature enhancements through subscription and premium purchase revenue.

Regional Insights

North America dominated the meditation management apps market with a revenue share of 43.22% in 2025, driven by high awareness of mental health, strong digital adoption, and increasing integration of mindfulness tools into everyday life and workplaces. In the U.S. especially, employers are widely incorporating digital meditation platforms into their corporate wellness and employee benefits programs to address stress, burnout, and work engagement. For instance, a 2025 study of more than 1,400 employees using Headspace’s digital mindfulness programs reported significant improvements in perceived stress (27% reduction), anxiety (37% reduction), depression (32% reduction), and overall workplace engagement, highlighting how workplace adoption is strengthening demand for meditation apps in the region.

U.S. Meditation Management Apps Market Trends

The U.S. dominated the meditation management apps market in the North America region in 2025, owing to rising stress levels, widespread smartphone use, and increasing integration of digital wellness into everyday life and employee benefits, fueling demand. In the U.S., major health insurers are now partnering with meditation platforms to expand access through employer and healthcare plans, reflecting broader acceptance of digital mindfulness as part of preventative care. For instance, in November 2025, Headspace partnered with Cigna Healthcare in late 2025 to launch Headspace for Cigna Healthcare, making its meditation, sleep, stress reduction, and mental wellness tools available at no cost to more than 7 million Cigna members through employer benefit offerings starting January 1, 2026, with custom content designed to support everyday mental health challenges.

Europe Meditation Management Apps Market Trends

The meditation management apps market in Europe is expected to grow significantly over the forecast period. Meditation management apps are seeing increasing adoption as awareness of mental health and digital well-being grows. Users in markets such as Germany, the UK, and France are increasingly using mindfulness apps for stress management, while employers and insurers are incorporating these tools into workplace wellness and preventive healthcare programs. For instance, the German meditation app 7Mind, which has become widely adopted across multiple European countries, even offers free access to members of major health insurance providers such as Barmer, allowing users to access over 1,000 guided mindfulness exercises and relaxation sessions to improve stress resilience and sleep quality. Such initiatives reflect how localized content, cultural relevance, and partnerships with healthcare organizations are helping drive adoption and engagement across Europe, making meditation apps more accessible to diverse audiences.

The meditation management apps industry in France is expected to grow significantly during the forecast period. In France, meditation management apps are gaining wider adoption as mental health awareness grows and users seek digital tools for stress relief and well‑being. Local apps such as Petit BamBou, a French‑developed mindfulness and meditation platform with over 11 million users worldwide, offer culturally relevant guided sessions, breathing exercises, and relaxation programs tailored to French speakers and international audiences alike. Such homegrown solutions, alongside global players, reflect the increasing integration of meditation practices into daily life and wellness routines across France.

The UK meditation management app industryis expected to grow significantly during the forecast period. Meditation apps are gaining popularity in the UK as mental health awareness and digital wellness adoption grow. For instance, in April 2025, Headspace launched its AI companion Ebb for UK users, offering personalized guidance and mindfulness support based on users’ emotions. This trend reflects the increasing demand for adaptive, AI-enhanced mental wellness tools that fit into busy lifestyles while promoting stress reduction and emotional well-being.

Asia Pacific Meditation Management Apps Market Trends

Asia Pacific is anticipated to witness significant growth in the meditation management apps market, driven by rising demand for connected devices and the adoption of smartphones. Moreover, countries in the region, such as India, Thailand, and South Korea, are adopting digital health technologies to improve outcomes and streamline healthcare delivery. Thus, such initiatives are projected to boost the adoption of meditation management apps over the forecast period.

The India meditation management apps market is anticipated to grow significantly during the forecast period. In India, meditation management apps are achieving rapid popularity as more users embrace digital wellness tools to manage stress, improve mental balance, and enhance daily well‑being. For instance, in March 2025, the launch of Miracle of Mind, a free meditation app developed by Isha Foundation, which recorded over 1 million downloads within the first 15 hours of release, outperformed other major apps in growth speed.¹ The app blends guided meditation with AI personalization and supports multiple languages, making mindfulness practices accessible to a broad audience across India and beyond. This surge reflects growing interest in mobile meditation solutions that are culturally relevant, easy to use, and free at the point of access, helping drive broader adoption across diverse age groups and regions.

Japan meditation management apps market is anticipated to register considerable growth during the forecast period. In Japan, meditation and mindfulness apps are gaining traction as smartphone adoption rises and more people seek digital tools for stress reduction and emotional well-being amid demanding work cultures. Local users increasingly turn to both global platforms and Japan focused solutions that offer culturally tailored content and easy daily use. For instance, in August 2025, the Japanese mindfulness app Upmind, which analyzes metrics such as heart rate variability to provide personalized mental health recommendations, has reached over 1.5 million downloads and expanded through partnerships, including its 2024 selection for the UTokyo Innovation Platform (UTokyo IPC) acceleration program. This reflects growing interest in apps that combine traditional mindfulness approaches with data-driven personalization and practical tools for managing stress and daily emotional health.

Latin America Meditation Management Apps Market Trends

The Latin America meditation management apps industry is anticipated to witness considerable growth over the forecast period. Increasing smartphone penetration, rising awareness of mental health, and the growing adoption of digital wellness tools in daily routines are driving market the growth. Users are increasingly seeking apps that provide guided meditation, stress reduction, and mindfulness support, while expanding internet access and improvements in mobile infrastructure across countries such as Brazil and Argentina are enabling wider adoption.

Brazil anesthesia video laryngoscope industry is anticipated to register considerable growth during the forecast period. Factors such as rising mental health awareness, government initiatives promoting wellness, and growing smartphone adoption are boosting market growth. In addition, initiatives by app developers to localize content in Portuguese, integrate culturally relevant mindfulness programs, and strengthen digital distribution networks are helping attract and retain users across the country.

Middle East & Africa Meditation Management Apps Market Trends

The Middle East and Africa meditation management apps market is anticipated to grow significantly over the forecast period. The Increasing interest in mental health solutions, rising smartphone and internet adoption, and the growing demand for accessible and user-friendly mindfulness tools are driving adoption. Moreover, partnerships between app developers and wellness programs, along with initiatives to educate users about digital mental health solutions, are enhancing familiarity and trust, supporting broader adoption of meditation management apps in both urban and semi urban areas across the region.

South Africa meditation management apps industry is anticipated to register considerable growth during the forecast period. In South Africa, meditation and mental well‑being apps are increasingly gaining visibility as digital wellness tools become more accepted for stress management and emotional support. Growing smartphone usage and rising awareness of mental health have encouraged both international and local meditation solutions to reach broader audiences. For instance, in June 2025, is TikTok’s rollout of a built‑in guided meditation feature across Sub‑Saharan Africa, including South Africa, which introduces users to mindfulness and sleep‑focused meditations directly within the platform and supports mental health awareness through partnerships with local organizations.¹ This reflects a broader movement toward integrating meditation content into popular digital platforms and everyday mobile experiences, helping reach users who might not otherwise download standalone apps.

Key Meditation Management Apps Company Insights:

Key participants in the meditation management apps industry are focusing on devising innovative business growth strategies, such as expanding their product portfolios, focusing on partnerships and collaborations, and engaging in mergers and acquisitions, as well as expanding their business footprints.

Key Meditation Management Apps Companies:

The following key companies have been profiled for this study on the meditation management apps market.

- InnerExplorer

- Calm.

- Headspace Inc.

- MindApps.

- Breethe.

- Meditation Moments.

- Simple Habit

- Ten Percent Happier

- Aura Health

- Meditopia

Recent Developments

-

In December 2025, Seoul National University launched the “SNU Healthing U” health app, a mobile platform for walking, nutrition, and meditation through a points‑based system for faculty.

-

In January 2025, Hilton Hotels partnered with Calm, integrating Calm’s guided meditations, sleep stories, soundscapes, and mindfulness exercises into Hilton’s Connected Room Experience. This collaboration provides guests with in‑room access to premium relaxation and meditation content, expanding meditation app reach into the hospitality sector.

-

In November 2024, Mindbloom and the meditation app Happier announced a partnership to combine ketamine therapy programs with mindfulness content. Under this collaboration, Mindbloom clients receive free access to Happier’s guided meditations, while Happier users gain discounted access to Mindbloom’s mood‑focused therapy pathways, creating a holistic experience that blends traditional meditation with therapeutic support for anxiety, depression, PTSD, and self‑love.

-

In March 2024, Headspace launched Headspace XR, a next-generation mindfulness and meditation platform that integrates fully immersive virtual reality (VR) and mixed reality (MR) experiences.

-

In September 2023, Headspace Inc. and One Medical, a U.S.-based in-office and virtual primary care provider, entered a strategic partnership. Under this partnership, the two companies would focus on devising solutions to reduce anxiety and spread awareness towards preventive health screenings.

Meditation Management Apps Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 2.68 billion

Revenue forecast in 2033

USD 6.99 billion

Growth rate

CAGR of 14.67% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, deployment type, services, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Norway; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; UAE; Kuwait

Key companies profiled

InnerExplorer;;Calm.;;Headspace Inc.; MindApps.;; Breethe.;;Meditation Moments.;;Simple Habit; Ten Percent Happier; Aura Health; Meditopia

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Meditation Management Apps Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global meditation management apps market report based on platform, deployment type, services, and region.

-

Platform Outlook (Revenue, USD Million, 2021 - 2033)

-

iOS

-

Android

-

Others

-

-

Deployment Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud Based

-

On-Premise

-

-

Services Outlook (Revenue, USD Million, 2021 - 2033)

-

Free

-

Paid (In App Purchase)

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the meditation management apps market include InnerExplorer; Calm.; Headspace Inc.; MindApps.; Breethe.; Meditation Moments.; Simple Habit; Ten Percent Happier; Aura Health; Meditopia

b. Key factors that are driving the market growth include factors such as an increased number of individuals suffering from stress, anxiety, and depression, government initiatives that promote meditation and yoga, rising use of smartphones and tablets, and growing awareness regarding mental health drive market growth.

b. The global meditation management apps market size was estimated at USD 2.20 billion in 2025 and is expected to reach USD 2.68 billion in 2026.

b. The global meditation management apps market is expected to grow at a compound annual growth rate of 14.67% from 2026 to 2033 to reach USD 6.99 billion by 2033.

b. North America dominated the meditation management apps market with a share of 43.22% in 2025. Factors such as developments in coverage networks, growing adoption of smartphones, and growing internet and social media penetration fuel the market growth in this region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.