- Home

- »

- Medical Devices

- »

-

COVID-19 Vaccine Packaging And Delivery Devices Market, 2030GVR Report cover

![COVID-19 Vaccine Packaging And Delivery Devices Market Size, Share & Trends Report]()

COVID-19 Vaccine Packaging And Delivery Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Syringes, Vials), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-4-68039-411-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

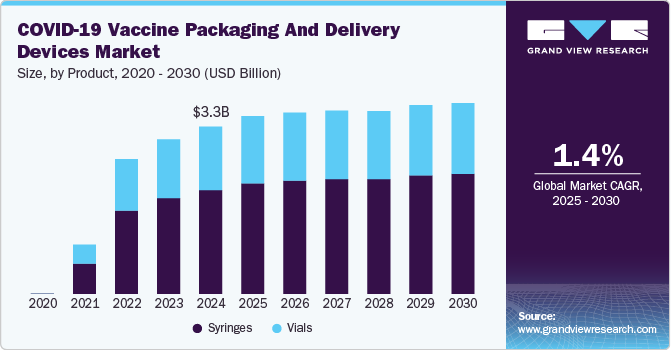

The global COVID-19 vaccine packaging and delivery devices market size was estimated at USD 3.27 billion in 2024 and is projected to grow at a CAGR of 1.4% from 2025 to 2030. COVID-19 vaccines, like many other pharmaceutical liquid formulations, are packaged in multidose glass vials. To prevent wastage, appropriate packaging is essential for distribution. The rapid rollouts, increased production capacity, and a large number of vaccines nearing the end of clinical trials are key factors driving the market growth for COVID-19 vaccine packaging and delivery devices. By April 2021, over 50% of the U.S. population aged 65 and older had received their full vaccination.

Manufacturers are increasing their production capacity to meet rising global demand, which is expected to drive the need for more packaging materials. For example, AstraZeneca partnered with IDT Biologika in February 2021 to establish a new manufacturing site in Germany. The rapid mutation of the virus into more infectious strains is likely to further accelerate the demand for vaccines, fueling market growth.

Increased investment in research and development to enhance packaging materials' strength and chemical inertness is expected to drive growth in the COVID-19 vaccine packaging and delivery devices industry. For example, Corning Incorporated has developed the “Valor” glass vial, which offers advantages over traditional borosilicate vials, including better resistance to delamination and breakage, along with reduced particulate generation. This innovative solution helps improve vaccine safety and packaging performance, contributing to the overall demand for superior packaging materials in the vaccine industry.

As of March 2021, over 270 million COVID-19 vaccine doses were administered globally, with the United States contributing around 30% of the total doses. This massive global vaccination effort has led to the rapid scaling of vaccine production and packaging capabilities, further intensifying the market for packaging materials. In response to this surge in demand, key players in the packaging industry are investing heavily in research and development to produce high-quality packaging materials that maintain vaccine efficacy and minimize potential contamination risks.

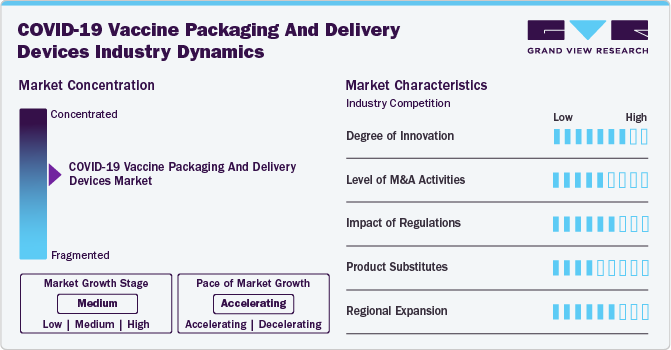

Market Concentration & Characteristics

The COVID-19 vaccine packaging and delivery devices industry is concentrated among a few key global players due to the high specialization and demand for safe, effective packaging. The market is shaped by stringent regulations, technological advancements in vaccine storage, and the ongoing expansion of production capacity. Companies like Pfizer, Moderna, and AstraZeneca, along with packaging firms, are central to this supply chain. The industry is characterized by innovations in packaging solutions, such as temperature-controlled vials and pre-filled syringes, to ensure the integrity and effectiveness of vaccines during global distribution.

The COVID-19 vaccine packaging and delivery devices industry has seen significant innovation, particularly with COVAXIN, India's first COVID-19 vaccine. Developed by Bharat Biotech in partnership with ICMR and NIV, COVAXIN uses an inactivated SARS-CoV-2 strain produced in a high-containment BSL-3 facility. After successful preclinical trials, it received approval from the Drug Controller General of India for Phase I and II trials in July 2020.

Regulations significantly impact the COVID-19 vaccine packaging and delivery devices industry, ensuring safety, quality, and efficacy. The FDA's approval of vaccines like Novavax's NVX-CoV2705 in September 2024 through emergency use authorization (EUA) demonstrates how regulatory bodies ensure rapid but safe vaccine deployment during global health crises. Such regulations are essential for maintaining public trust and ensuring vaccine packaging, delivery mechanisms, and overall distribution meet strict standards for effectiveness and safety. This process fosters efficient global vaccination efforts while safeguarding public health.

Mergers and acquisitions (M&A) in the COVID-19 vaccine packaging and delivery devices industry are rapidly increasing as companies aim to bolster their technological capabilities and market reach. For instance, WuXi Biologics successfully acquired Bayer's biologics and COVID-19 vaccine facility in Wuppertal, Germany, on April 2021. The site, one of Germany's largest vaccine production facilities, will be used to produce substances for COVID-19 vaccines and other biologics. WuXi plans to invest further in processing equipment at the facility.

In the COVID-19 vaccine packaging and delivery devices industry, glass vials, traditionally used for vaccine storage, are facing a supply shortage. As a result, substitutes such as plastic vials coated with organosilica nanolayers are being explored. These treated plastic vials offer advantages, including shatter resistance and mechanical strength, making them viable alternatives to glass vials. In addition, innovations in packaging materials and delivery systems continue to evolve, ensuring the efficient distribution and storage of COVID-19 vaccines globally.

Regional Expansion: The COVID-19 pandemic highlighted the risks of relying on external vaccine supplies, prompting low- and middle-income countries (LMICs) to focus on developing their vaccine manufacturing capabilities. The African Union, with support from the Gavi Vaccine Alliance's USD 1.8 billion investment, aims to increase vaccine production in Africa. India's experience as a major vaccine producer offers valuable insights to support this regional expansion.

Product Insights

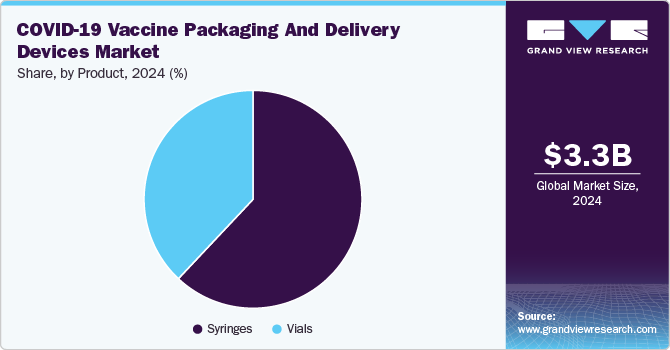

The syringes segment led the market with the largest revenue share of 62.04% in 2024 and is anticipated to register at the fastest CAGR over the forecast period. The segment is further divided into empty and prefilled syringes. The average volume of a single COVID-19 dose is estimated to be 0.5 ml. Therefore, 1.0 ml of sterile empty syringes are preferred. In addition, some vaccine candidates require to be reconstituted with diluent solutions before administration. In such cases, an additional empty syringe (2/3 ml) is required. Pfizer developed a vaccine that needs to be reconstituted with saline; thereby, the pace of the roll-out program is expected to significantly influence the segment.

Vials are typically made of plastic or glass, with glass being preferred for COVID-19 vaccine storage due to its chemical stability. However, the demand for glass vials has created a supply gap, leading to increased interest in plastic vials. Companies like SiO2 Materials Science have developed plastic vials coated with organosilica, making them durable and shatterproof, presenting a potential alternative to glass vials.

The prefilled syringes segment is anticipated to witness at the fastest CAGR during the forecast period. To vaccinate the 7.0 billion world population in a shorter time is a tedious process with the established logistic network. The presence of distribution constraints associated with current COVID-19 packaging systems is expected to increase the preference for prefilled syringes. For instance, In December 2020, BD invested USD 1.2 billion to expand its manufacturing capacity of pre-filled syringes.

Regional Insights

The COVID-19 vaccine packaging and delivery devices market in North America is anticipated to grow at the fastest CAGR during the forecast period. As of March 5, 2021, CDC data shows that 15.9% of the U.S. population had received one dose of the COVID-19 vaccine, while 8.1% were fully vaccinated. In addition, various government initiatives, including Operation Warp Speed (OWS), the Biomedical Advanced Research and Development Authority (BARDA), and the Defense Production Act (DPA), are expected to accelerate vaccine production and distribution, thereby boosting demand for packaging materials.

U.S. COVID-19 Vaccine Packaging And Delivery Devices Market Trends

The COVID-19 vaccine packaging and delivery devices market in the U.S. accounted for a significant share in North America in 2024. From May 2021 to February 2024, the U.S. donated over 693 million vaccine doses to 117 countries and regions, partnering with organizations like COVAX, Caricom, and AVAT, as well as through bilateral agreements.

Asia Pacific COVID-19 Vaccine Packaging And Delivery Devices Market Trends

Asia Pacific dominated the COVID-19 vaccine packaging and delivery devices market with the largest revenue share of 33.39% in 2024, driven by the region's large-scale vaccination campaigns. With diverse vaccine approvals and rapid distribution, countries in the region are leveraging advanced packaging solutions to ensure efficient delivery. Key factors include innovations in cold-chain technology, local vaccine production, and collaborations with global health organizations to expand access. These trends reflect the region's efforts to meet vaccination demands, improve storage, and support future public health initiatives across diverse, large populations. This market is expected to expand further as countries continue managing COVID-19 and preparing for future health challenges.

The Japan COVID-19 vaccine packaging and delivery devices market is expected to grow at the fastest CAGR during the forecast period. New developments, such as Moderna's updated Spikevax vaccine formulation, received approval from Japan's Ministry of Health, Labour and Welfare (MHLW) in August 2024. This updated vaccine targets the SARS-CoV-2 variant JN.1, further advancing Japan's vaccination efforts.

The COVID-19 vaccine packaging and delivery devices market in China is set for growth, with eight vaccines approved and 35 in clinical trials. Sinovac and Sinopharm lead vaccine production, with Sinovac supplying 848 million doses to 48 countries, while Sinopharm has donated 103 million doses to 79 countries, according to December 2022 data.

The India COVID-19 vaccine packaging and delivery devices market is experiencing significant growth, fueled by substantial financial support. In November 2021, the Asian Development Bank approved a USD1.5 billion loan, alongside an additional USD 500 million from the Asian Infrastructure Investment Bank, to secure 667 million doses, aiding India's vaccination efforts for 317 million people. This funding supports the country's large-scale vaccination campaign and enhances its ability to deliver vaccines efficiently to the population.

Europe COVID-19 Vaccine Packaging And Delivery Devices Market Trends

The COVID-19 vaccine packaging and delivery devices market in Europe accounted for the second-largest revenue share in 2024. The region has robust vaccine production and packaging facilities. The growing concern in EU member states to keep the vaccination rate at par with countries such as the UK and the U.S. is one of the key factors expected to boost market growth. For instance, in February 2021, BioNTech, a German vaccine procedure, started production of the COVID-19 vaccine at its new production site in Germany to boost the supply to the EU.

The UK COVID-19 vaccine packaging and delivery devices market is expected to grow at the fastest CAGR during the forecast period. As immunity from earlier vaccinations begins to diminish in the autumn, the NHS offers a free booster for those at higher risk. Vaccines continue to protect against severe illness, with data showing a 45% reduction in hospital admissions for vaccinated individuals. Protection lasts about four months.

The COVID-19 vaccine packaging and delivery devices market in France is anticipated to expand at a significant CAGR during the forecast period. In February 2022, France and the WHO signed an agreement to bolster health systems to combat COVID-19. The partnership emphasizes pandemic preparedness, vaccine distribution, and healthcare infrastructure, especially in low-income countries.

The Germany COVID-19 vaccine packaging and delivery devices market is expected to grow at a significant CAGR during the forecast period, due to the country’s significant support for global vaccination efforts. Germany has contributed 3.21 billion to the ACT-Accelerator, with most of its donations directed through COVAX. Since August 2021, it has donated approximately 119 million doses to over 146 countries.

Latin America COVID-19 Vaccine Packaging And Delivery Devices Trends

The COVID-19 vaccine packaging and delivery devices market in Latin America is growing rapidly, driven by widespread vaccine distribution. Nearly 1.3 billion doses were administered across the region. Vaccines are estimated to have saved between 610,000 and 2.61 million lives in 17 countries within the first 1.5 years, as per research from Yale University, Brazil, and PAHO, published in September 2024. This growth reflects the region’s robust vaccination efforts and underscores the importance of efficient vaccine delivery and packaging systems.

The Saudi Arabia COVID-19 vaccine packaging and delivery devices market is expected to grow at the fastest CAGR during the forecast period. In February 2021, the SFDA authorized the AstraZeneca COVID-19 vaccine, developed with Oxford University. The approval followed a comprehensive review of the vaccine's safety, efficacy, and quality, ensuring its stability for the country's vaccination efforts.

Key COVID-19 Vaccine Packaging And Delivery Devices Company Insights

The competitive scenario in the COVID-19 vaccine packaging and delivery devices industry is highly competitive, with key players such as BD, B. Braun Melsungen AG; and Hindustan Syringes & Medical Devices Ltd. holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key COVID-19 Vaccine Packaging And Delivery Devices Companies:

The following are the leading companies in the COVID-19 vaccine packaging and delivery devices market. These companies collectively hold the largest market share and dictate industry trends.

- BD

- B. Braun Melsungen AG

- Hindustan Syringes & Medical Devices Ltd.

- Terumo

- NIPRO Medical Corporation

- SCHOTT AG

- Gerresheimer AG

- Cardinal Health

Recent Developments

-

In November 2024,preclinical studies demonstrated that redesigned lipid packaging for mRNA vaccines outperformed the current industry standard. It showed improved delivery efficiency for both a COVID-19 mRNA vaccine and an mRNA therapeutic for a rare hereditary disease, accelerating their development by enhancing stability and effectiveness during storage and transport.

-

In October 2024, CDC Director Mandy Cohen endorsed updated guidelines from the CDC Advisory Committee on Immunization Practices (ACIP). The recommendations advise individuals aged 65+ and those severely immunocompromised to receive a second dose of the 2024-2025 COVID-19 vaccine six months after the first. Flexibility for additional doses is allowed for immunocompromised individuals, based on healthcare provider consultation. These recommendations aim to protect at-risk groups and clarify vaccine dosing for immunocompromised patients.

-

In October 2024, the WHO Technical Advisory Group on COVID-19 Vaccine Composition (TAG-CO-VAC) continued monitoring the evolution of SARS-CoV-2 variants and vaccine performance. They plan to advise vaccine manufacturers on future updates based on ongoing data and will meet in December 2024 to make further recommendations.

COVID-19 Vaccine Packaging And Delivery Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.47 billion

Revenue forecast in 2030

USD 3.73 billion

Growth rate

CAGR of 1.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

BD; B. Braun Melsungen AG; Hindustan Syringes & Medical Devices Ltd; Terumo; NIPRO Medical Corporation; SCHOTT AG; Gerresheimer AG; Cardinal Health

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global COVID-19 Vaccine Packaging And Delivery Devices Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global COVID-19 vaccine packaging and delivery devices market report based on the product, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Vials

-

Glass

-

Plastic

-

-

Syringes

-

Empty

-

Prefilled

-

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global COVID-19 vaccine packaging and delivery devices market size was estimated at USD 3.27 billion in 2024 and is expected to reach USD 3.47 billion in 2025.

b. The global COVID-19 vaccine packaging and delivery devices market is expected to grow at a compound annual growth rate of 1.4% from 2025 to 2030 to reach USD 3.73 billion by 2030.

b. The syringes segment dominated the global COVID-19 vaccine packaging & delivery devices market and held the largest revenue share of 62.0% in 2024.

Which region accounted for the largest COVID-19 vaccine packaging and delivery devices market share?b. North America dominated the COVID-19 vaccine packaging & delivery devices market with a share of 26.8% in 2024. This is attributable to the domicile presence of key vaccine suppliers coupled with growing public awareness to get vaccinated.

b. Some key players operating in the COVID-19 vaccine packaging & delivery devices market include BD, B. Braun Melsungen AG, and NIPRO Medical Corporation Hindustan Syringes & Medical Devices Ltd, Terumo, Gerresheimer AG, SCHOTT AG, and Cardinal Health.

b. Key factors driving the COVID-19 vaccine packaging & delivery devices market growth include increasing funding & investment in COVID-19 vaccine research, growing vaccine production capacity, rising demand for vaccines, especially in APAC countries, and increasing public trust in approved vaccines.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.