- Home

- »

- Medical Devices

- »

-

Cranial Implants Market Size & Share, Industry Report, 2030GVR Report cover

![Cranial Implants Market Size, Share & Trends Report]()

Cranial Implants Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Customized, Non-Customized), By Material (Polymer, Ceramic, Metal), By End Use (Hospital, Neurosurgery Centers) and Segment Forecasts

- Report ID: GVR-3-68038-124-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cranial Implants Market Size & Trends

The global cranial implants market sizewas valued at USD 1.43 billion in 2024 and is expected to grow at a CAGR of 6.5% from 2025 to 2030. The rising prevalence of traumatic injuries and wounds and the increasing number of road accidents are factors driving the market.

Key Highlights:

- The North America cranial implants market held the largest revenue share of 36.7% of the cranial implants industry in 2024.

- The U.S. cranial implants market held the largest revenue share of 79.4% in 2024, demonstrating its dominance within the regional landscape.

- By product, the customized product segment dominated the market with a 87.9% share in 2024.

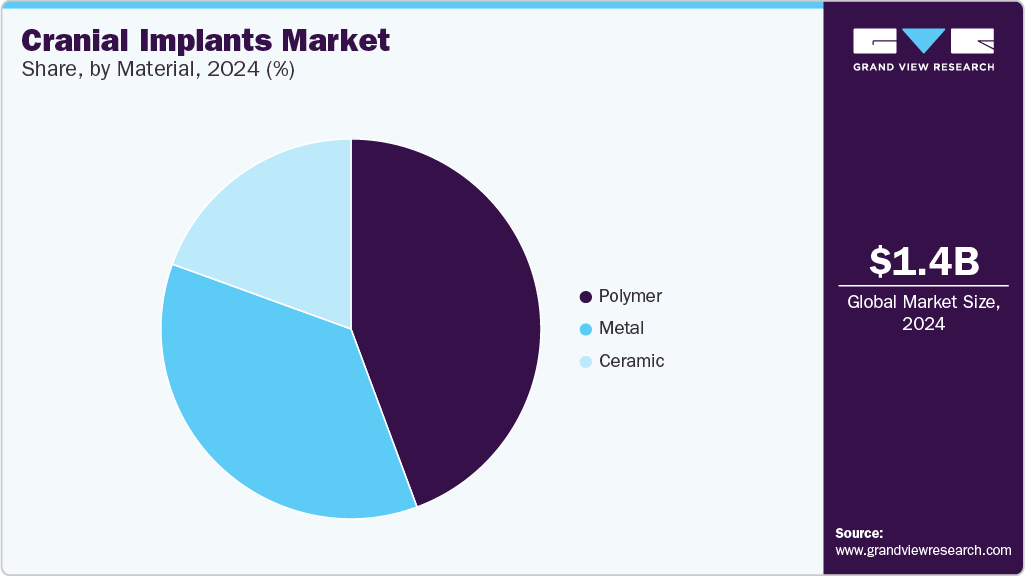

- By material, the polymer segment is dominated the market in 2024. PEEK polymer is a commonly used material for cranial implants.

- By end use, the neurosurgery centers segment is expected to register the fastest CAGR during the forecast period.

The cranial implants market is expanding significantly due to a rise in head injuries worldwide. More accidents, falls, and assaults are leading to greater demand for solutions that repair and protect the skull. These implants, made from materials like titanium, polymers, and ceramics, are vital in neurosurgery for fixing defects, providing structural support, and protecting the brain.

The increasing number of road accidents and the widespread occurrence of Traumatic Brain Injury (TBI) are key factors driving this market growth. For instance, a World Health Organization report from December 2023 indicates that approximately 1.19 million people died in road accidents. Furthermore, data from BRAIN-AMN published in November 2022 shows that 69 million individuals globally are affected by TBI. These increasing instances of brain injuries are fueling the growth of the cranial implants market.

Market Concentration & Characteristics

The industry growth stage is medium, and the pace of growth is accelerating. Even though the market is not booming, it exhibits steady, healthy growth. The market is driven by a combination of factors, including the rising incidence of TBIs due to accidents and falls and an increasing demand for reconstructive surgeries following tumor resections. According to a study published in the American Journal of Preventive Medicine, in April 2025, the global incidence & prevalence of traumatic brain injury in 2021 were 20.84 million and 37.93 million, respectively. Such instances directly contribute to the demand for cranial implants for skull repair.

Initially, the adoption of cranial implants was somewhat limited by factors such as the complexity of procedures, the availability of skilled neurosurgeons, and the cost of implants. However, several trends contribute to an accelerated growth rate. Technological advancements, particularly in 3D printing and CAD/CAM technologies, enable the creation of customized, patient-specific implants. This personalization leads to better surgical outcomes, reduced complications, and increased patient satisfaction, thereby driving adoption. For instance, in April 2025, restor3d, a U.S. medical technology company, raised USD 38 million funding to advance the development of fully 3D printed implant systems, underscoring the increasing investment and focus on innovative solutions within this sector.

The cranial implants market is moderately concentrated. A few major companies, including B. Braun SE; Johnson & Johnson Services, Inc.; Stryker; and Zimmer Biomet, hold a significant market share. However, many smaller, specialized companies also operate within the cranial implants industry. This market structure exists because producing cranial implants requires complying with stringent regulatory approvals and significant research investment, which limits new players' entry. While large players have a strong presence, the market includes numerous smaller firms with specialized offerings.

The cranial implants market demonstrates a high degree of innovation, particularly in the development and adoption of advanced materials and personalized designs. For instance, Stryker, a medical device manufacturing company, offers customized Polyetheretherketone (PEEK) implants. These patient-specific devices are precisely engineered to match individual cranial defects, facilitating an optimized surgical fit and potentially improving patient outcomes.

The level of Merger and Acquisition (M&A) activities in the market is medium. While there are no frequent large-scale consolidations, strategic acquisitions of smaller, specialized companies or technology providers occur as major players aim to expand their product portfolios and technological capabilities. In September 2022, Brainlab a medical technology company, strategically expanded its neurosurgery portfolio through the acquisition of Dr. Langer Medical GmbH, a firm specializing in neuromonitoring solutions. This acquisition will likely foster market growth by integrating advanced neuromonitoring with Brainlab's neurosurgical solutions, potentially leading to safer and more precise cranial procedures, thus increasing adoption.

In terms of regional expansion, North America cranial implants industry currently represents a substantial portion of the market, and other regions also demonstrate increasing activity. As per Orthopedics This Week, in January 2022, Kelyniam Global, Inc. entered into a licensing agreement with Fin-ceramica faenza spa to retail its hydroxyapatite cranial implant, marketed as CustomizedBone Service, within the U.S. This strategic partnership signifies efforts to broaden the availability of specific cranial implant technologies within established markets.

Product Insights

The customized product segment dominated the market with a 87.9% share in 2024. This dominance is significantly influenced by the increasing incidence of road accidents, leading to a rise in traumatic brain injuries. Given the unique skull structure and contour of each individual, surgeons increasingly favor customized cranial implant solutions for optimal patient outcomes, thereby fueling market growth. Customized implants offer substantial advantages in reconstructive surgery, primarily due to their improved fit and accuracy. Using advanced imaging technologies like MRI and CT scans, these implants are precisely engineered to conform to the specific anatomical structure of each patient. This demand for patient-specific solutions is a key driver in the cranial implants market. Companies offering customized solutions for cranial implants include Stryker, which offers CMF PEEK customized implants and 3D Systems VSP solutions. Companies are also involved in innovating advanced solutions, such as 3D Systems, Inc., which received FDA approval in April 2024 and a 510(K) clearance for a 3D-printed customized cranial implant solution. These innovations drive segment growth.

The non-customized segment is expected to register the fastest CAGR during the forecast period. The segment encompasses standardized implant designs intended for general application in cranial reconstruction procedures. These implants are pre-shaped and available in various sizes and materials, offering surgeons readily available solutions for repairing cranial defects resulting from trauma, surgery, or congenital anomalies. Some key players offering non-customized cranial implants include Stryker; Johnson & Johnson Services, Inc.; B. Braun SE; and Zimmer Biomet. These companies offer diverse portfolios of standard cranial plates, meshes, and pre-formed implants made from various biocompatible materials such as titanium, polymers (like PEEK), and ceramics.

Material Insights

The polymer segment is dominated the market in 2024. PEEK polymer is a commonly used material for cranial implants. This material is preferred for reconstructing significant cranial defects with a customized inlay implant. It offers biocompatibility, can be modified for interoperability, and is compatible with CT scans, MRI scans, and radiation therapy. Some companies offering PEEK implants for cranial procedures are Xilloc Medical Int B.V., Johnson & Johnson Services, Inc., and Stryker.

The ceramic segment is expected to register the fastest CAGR during the forecast period. The material's ultrasound compatibility is one of the primary factors driving this segment, as it is used for treating brain tumors. According to the University of Gothenburg in October 2020, bioceramic implants have been proven to stimulate the regeneration of the skull bone. Such advancements are expected to drive the segment growth.

End Use Insights

The hospital segment dominated the cranial implants industry and accounted for a XX% share in 2024. The high number of cranial implant procedures carried out in hospitals due to the availability of skilled neurosurgeons accounts for the high segment share. Hospitals have neurology departments dedicated to providing neurological treatments. In addition, the hospitals are medically fully equipped with advanced technologies and professional teams to consult in complex situations. Most diagnostic tests, such as CT and MRI, are performed in hospitals, offering integrated healthcare under one roof, which boosts the segment growth.

The neurosurgery centers segment is expected to register the fastest CAGR during the forecast period. The rising incidence of TBIs and the high adoption of cranial implants are factors expected to drive the segment. Neurosurgery centers offer personalized treatment, enhancing a patient’s experience. The centers are dedicated to offering neurological solutions to both children and adults, providing consolidated care under one roof, boosting the segment growth.

Regional Insights

The North America cranial implants market held the largest revenue share of 36.7% of the cranial implants industry in 2024. This dominance can be attributed to the region's well-developed healthcare infrastructure and the increasing need for advanced neurosurgical procedures. A significant factor fueling this market expansion is the rising incidence of TBIs. According to data published by Brain Injury Canada in June 2024, it was estimated that approximately 165,000 individuals in Canada suffer TBI annually. The substantial number of TBI cases directly contributes to the growing adoption of cranial implants as a crucial intervention in treatment and rehabilitation, thereby driving the market growth in North America. The sophisticated healthcare systems in the region ensure better access to these advanced medical devices and procedures for a larger patient population affected by cranial injuries.

U.S. Cranial Implants Market Trends

The U.S. cranial implants market held the largest revenue share of 79.4% in 2024, demonstrating its dominance within the regional landscape. The increasing incidence of TBI is significantly propelling market expansion. According to Brain Injury Association of America, the U.S. witnesses 2.9 million TBI-related emergency department visits annually. Cranial implants are essential for addressing skull fractures and defects resulting from these injuries, as well as for reconstructive procedures following neurosurgical treatments. Therefore, the high volume of TBI cases serves as a primary catalyst for the demand and expansion of the cranial implants market within the country, requiring sophisticated medical solutions and fostering a strong market environment.

Europe Cranial Implants Market Trends

Europe cranial implants market accounted for a significant share in 2024. According to the European Union (EU) data published in February 2024, more than one-fifth of the population is aged 65 years and above, accounting for 21.3% of the total population in the region. According to the National Library of Medicine report published in September 2022, nearly 7.7 million people are living with TBI-related disabilities. Such rising prevalence is encouraging companies to offer innovative cranial implant solutions, boosting the market growth in the region.

Germany cranial implants market is expected to grow due to the increasing incidence of TBI, which is the primary market driver. At the same time, the rising geriatric population is the secondary market driver. According to Rehacare, an international trade fair for rehabilitation, in July 2021, older individuals are more susceptible to TBIs due to falls. Hence, various companies are involved in innovating advanced solutions in the cranial implants market. Some key players driving the market are evonos GmbH & Co. KG, 3di GmbH, and KLS Martin Group.

Asia Pacific Cranial Implants Market Trends

Asia Pacific cranial implants market is estimated to register the fastest CAGR of 7.9% over the forecast period. Increasing road accidents, causing TBIs, and rising prevalence of brain tumors are primary market drivers. Other factors driving the market include a growing geriatric population, which is more susceptible to falls. According to the Connectivity Traumatic Brain Injury Australia, up to 200,000 Australians suffer from TBIs each year. Such instances encourage companies to innovate and develop advanced solutions, driving the regional market.

The Indian cranial implants market is experiencing growth propelled by the increasing incidence of road accidents and a high prevalence of TBIs. Data from the Indian Head Injury Foundation indicates that India records the highest number of head injuries globally, resulting in over 100,000 fatalities, and approximately 1 million individuals suffer serious head injuries annually. These circumstances are driving the adoption of cranial implants as a necessary medical intervention, thereby contributing to the expansion of the market in India.

China cranial implants market accounted for the largest share in the Asia Pacific cranial implants industry in 2024. This growth is majorly driven by the increasing prevalence of TBI due to rising road accidents and other incidents, as well as a growing geriatric population, which is more susceptible to falls. Furthermore, the advancements in healthcare infrastructure across China and increasing healthcare expenditure contribute to the greater adoption of cranial implant procedures.

Key Cranial Implants Company Insights

Some companies in the cranial implants market include B. Braun SE; Johnson & Johnson Services, Inc.; Stryker; evonos GmbH & Co. KG; Kelyniam Global Inc.; and Acumed LLC. Key companies are involved in strategic initiatives such as new product launches, collaboration with institutions and other industries, and establishing partnerships.

-

B. Braun SE is a Germany-based medical and pharmaceutical devices company that offers a comprehensive portfolio of over 5,000 healthcare products. The company provides solutions relevant to the cranial implants market within this extensive range, specifically within its neurosurgery division. Its offerings in neurosurgery include cranial fixation, CranioFix and Neuro Plating System. This positions B. Braun SE as a significant participant in the broader neurosurgical and cranial implant landscape.

-

Johnson & Johnson Services, Inc. is a global healthcare company offering a wide range of products such as feminine hygiene, baby care, beauty, and over-the-counter products. In addition, the company also provides products for cranial implants such as MatrixNEURO system, MatrixNEURO Preformed Mesh, and cranial tube clamps.

Key Cranial Implants Companies:

The following are the leading companies in the cranial implants market. These companies collectively hold the largest market share and dictate industry trends.

- B. Braun SE

- Johnson & Johnson Services Inc.

- Stryker

- Zimmer Biomet

- Acumed LLC

- evonos GmbH & Co. KG

- Medartis AG

- Renishaw plc.

- Kelyniam Global

- Anatomics Pty Ltd

Recent Developments

-

In August 2024, Longeviti Neuro Solutions, a neurotechnology company headquartered in Maryland, was granted a U.S. patent for its innovative translucent prosthetic cranial implant designed for application in neurosurgical procedures. This implant allows real-time, noninvasive brain monitoring and direct communication between the brain and external devices, significantly improving surgical outcomes and reducing monitoring costs and time worldwide.

-

In April 2024, Kelyniam Global, a medical device manufacturing business, and Fin-ceramica Faenza s.p.a. received 510(k) clearance from the FDA for the NEOS Surgery Cranial LOOP fixation system, which can be utilized with Finceramica’s CustomizedBone hydroxyapatite cranial implant. This system, made from a biocompatible polymer, allows fast and secure bone flap fixation after craniotomies, supports clear post-operative imaging, and is suitable for both adults and children as young as seven years old due to its low infection risk and bone-like properties.

-

In October 2023, 3D Systems, Inc. produced patient-specific (customized) 3D-printed cranial implant using point-of-care technologies at University Hospital Basel. These 3D-printed implants enable precise, customized treatment and highlight the growing importance of additive manufacturing in the expanding cranial implants market, expected to exceed $2 billion by 2030.

Cranial Implants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.52 billion

Revenue forecast in 2030

USD 2.09 billion

Growth rate

CAGR of 6.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

May 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, material, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

B. Braun SE, Johnson & Johnson Services, Inc., Stryker, Zimmer Biomet, Acumed LLC, evonos GmbH & Co. KG, Medartis AG, Renishaw plc., Kelyniam Global Inc., Anatomics Pty Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cranial Implants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels as well as provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the cranial implants market report on the basis of product, material, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Customized

-

Non-Customized

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Polymer

-

Ceramic

-

Metal

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Neurosurgery Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.