- Home

- »

- Network Security

- »

-

Critical Infrastructure Protection Market Size Report, 2033GVR Report cover

![Critical Infrastructure Protection Market Size, Share, & Trends Report]()

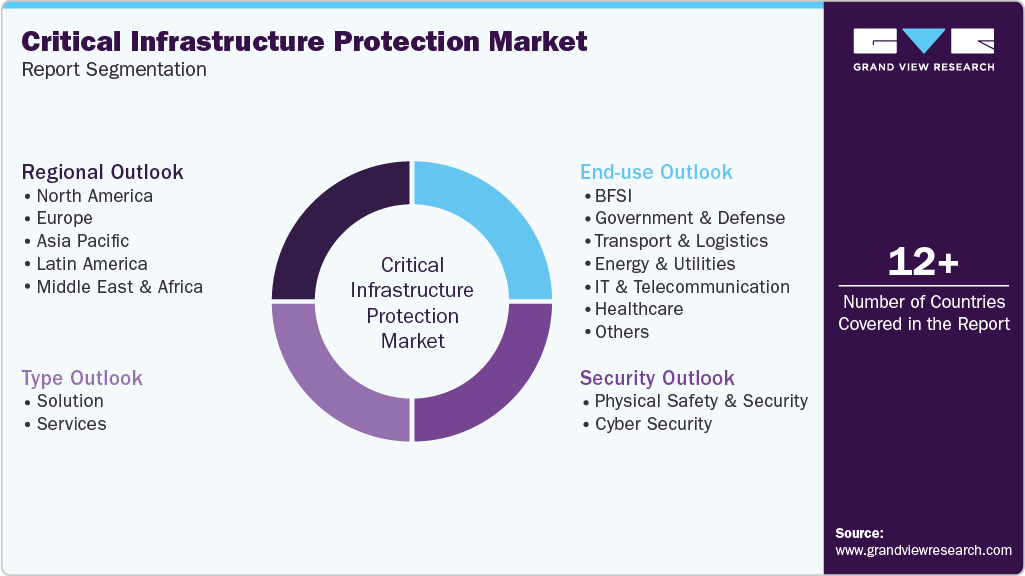

Critical Infrastructure Protection Market (2025 - 2033) Size, Share, & Trends Analysis Report By Type (Solution, Services), By Security (Physical Safety and Security, Cyber Security), By End Use (BFSI, Government & Defense), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-377-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Critical Infrastructure Protection Market Summary

The global critical infrastructure protection market size was estimated at USD 145.59 billion in 2024 and is projected to reach USD 229.11 billion by 2033, growing at a CAGR of 5.4% from 2025 to 2033. Growing cyber insurance adoption and board-level focus on operational resilience contribute to the critical infrastructure protection industry growth.

Key Market Trends & Insights

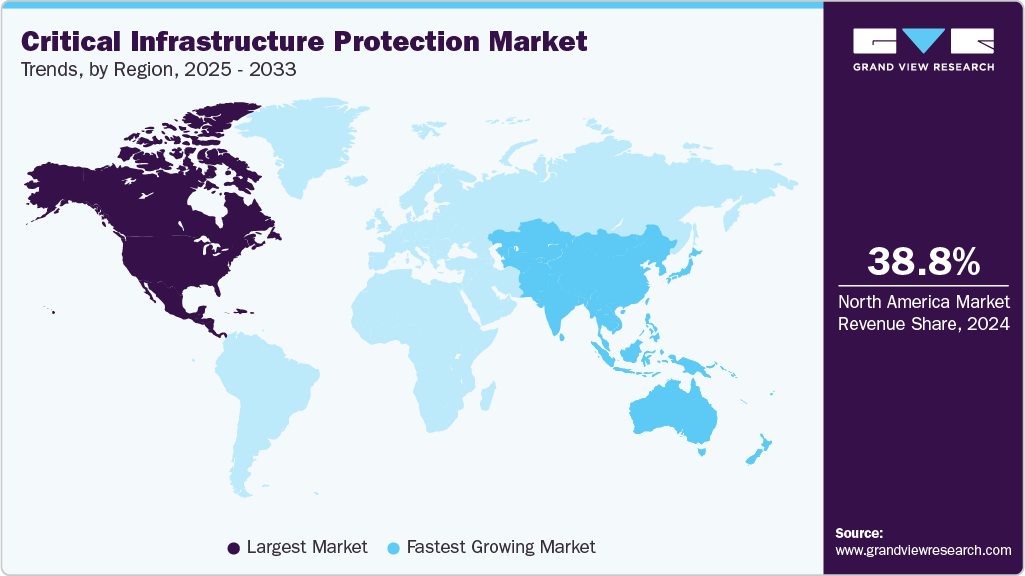

- North America held 38.8% revenue share of the global critical infrastructure protection industry in 2024.

- By type, solution segment held the largest revenue share of 72.5% in 2024.

- By security, the physical safety and security segment held the largest revenue share in 2024.

- By end use, the BFSI segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 145.59 Billion

- 2033 Projected Market Size: USD 229.11 Billion

- CAGR (2025-2033): 5.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Rising concerns about cyber threats have encouraged multiple businesses to adopt critical infrastructure protection solutions and services. In addition, government initiatives have been fostering collaborative efforts to strengthen cybersecurity. The increasing number of cyber threats and frauds committed with the help of computing technology has created an alarming situation for numerous businesses that heavily rely on data transfer and the use of remote networks. For instance, according to the Federal Bureau of Investigation, the 2024 Internet Crime Report compiles data from 859,532 suspected internet crime complaints, revealing reported losses of over USD 16 billion, marking a 33% increase compared to 2023.The growing digitalization and interconnectivity of operational technology (OT) and information technology (IT) in critical sectors is driving market growth. Industrial control systems (ICS), Physical Safety and Security networks, and IoT devices are essential types of power plants, airports, and manufacturing facilities. While these systems enhance efficiency and real-time decision-making, they also broaden the attack surface. The convergence of OT and IT has made traditional perimeter defenses obsolete, prompting operators to adopt more advanced, layered security models. This has accelerated the demand for CIP solutions that offer intrusion detection, asset visibility, anomaly detection, and secure remote access tailored to industrial environments.

The implementation of strict government regulations and compliance mandates is also a significant force driving the CIP market. National cybersecurity policies in countries such as the United States (e.g., CISA guidelines), the United Kingdom (NIS Regulations), and India (CERT-In directives) require critical infrastructure operators to adopt robust protection frameworks. These regulations often include mandatory risk assessments, incident reporting, and minimum security controls. As a result, organizations are compelled to invest in advanced security technologies, risk management platforms, and compliance-driven solutions to meet regulatory requirements and avoid penalties.

Furthermore, the rising adoption of cloud, edge computing, and 5G networks in critical sectors is creating new vulnerabilities that demand updated protection strategies. As more critical infrastructure systems migrate to the cloud or adopt edge-based architectures for real-time processing, there is a growing need for cloud-native security platforms, secure network segmentation, and zero-trust architectures. These trends are prompting both public and private entities to partner with technology vendors and managed security providers to implement scalable, real-time, and policy-driven protection strategies, ensuring the resilience and continuity of essential services in an increasingly complex threat landscape.

Type Insights

The solution segment dominated the market with a market share of 72.5% in 2024. The growth of this segment is attributed to the rising digitization across different private and government organizations in multiple industries, growing dependability on computing technology, and inclination towards the installation of robust protection solutions to avoid future threats of cybercrimes and data breaches. The need for software and hardware solutions is rising as it provides a holistic approach to securing critical infrastructure and effectively safeguarding against cyber threats. This segment helps users address diverse cybersecurity requirements.

The services segment is projected to be the fastest-growing segment from 2025 to 2033. The increase in demand for infrastructure security and services is providing a combination of information, disaster recovery, and physical infrastructure protection with cyber and incident management to ensure resilience to cyber threats. The service segment ensures prevention, response, preparedness, and recovery from cyber fraud. These factors have contributed to the growth of this segment in recent years.

Security Insights

The physical safety and security segment dominated the market in 2024. The growing occurrence of cyberfraud and attacks primarily drives the growth of this segment. Frauds and crimes committed through modern infrastructures have developed an increasing need for physical safety and security of multiple related dynamics. This segment includes physical identity and access control systems, perimeter intrusion detection systems, video surveillance systems, and screening and scanning. The physical safety and security solution protects property and people from threats and ensures that critical infrastructures function uninterruptedly.

The cybersecurity segment is projected to be the fastest-growing segment from 2025 to 2033. This segment is divided into encryption, network access controls and firewalls, threat intelligence, and others. The increase in smart devices with IoT and advanced technologies has amplified the risk of cyber threats. The critical infrastructures include banking & finance, defense & national security, healthcare, water, food & grocery products, and distribution networks, data & cloud, space technology, transport, communication, and others. Innovations like AI, big data analytics, and machine learning have played a crucial role in the growth of this segment in recent years.

End Use Insights

The BFSI segment dominated the market in 2024. In recent years, multiple cyberattacks and data breaches related to stock exchanges, private organizations, insurance agencies, financial trusts, banks, and cryptocurrency platforms have been recorded worldwide. The economic expansion, which involves innovation such as financial inclusion initiatives, payment banks, and fintech advancements, has accelerated the credit cycles and economic development linked to each other. This segment makes it convenient for users to purchase and install critical infrastructure protection in their businesses. Cyber or physical attacks on critical infrastructures related to banking, finance services, and insurance could cripple communities and nations. This has led to an inevitable need for enhanced security solutions and protocols in this sector.

The oil & gas segment is projected to be the fastest-growing segment from 2025 to 2033. Oil and gas activities, such as refining, drilling, and distribution, are complex and widespread, often covering large geographic areas. These tasks depend on advanced operational technology (OT) systems to streamline control machinery and guarantee efficient resource management and procedures. The vulnerability of sites and operations related to the oil and gas industry to physical as well as cyber-attacks has developed the need for developing protection solutions for the prevention of damaging incidences. High susceptibility to exploitation, the interdependent nature of operations, a lack of skilled professionals in terms of cybersecurity, rising cases of intrusion, and the growing need for security and monitoring are expected to drive an upsurge in demand for critical infrastructure protection solutions in the oil and gas industry during the forecast period.

Regional Insights

North America critical infrastructure protection industry dominated the global market with a revenue share of 38.8% in 2024. Multiple attempts to gain access to control systems and critical infrastructure networks related to different industries in the region, such as food & agriculture, healthcare, oil & gas, water, and wastewater management, are expected to lead to an increase in demand for this regional market in the approaching years. The history of cyberattacks on critical infrastructure networks related to countries such as the U.S. and Canada has encouraged nations and businesses to adopt or develop effective critical infrastructure protection solutions.

U.S. Critical Infrastructure Protection Market Trends

The U.S. critical infrastructure protection industry is projected to grow during the forecast period. The emphasis on public-private partnerships as a national strategy is propelling the growth of the critical infrastructure protection industry. The U.S. government recognizes that nearly 85% of critical infrastructure is privately owned and has launched initiatives to enhance collaboration, intelligence sharing, and coordinated response among federal agencies, private companies, and technology vendors. Programs such as the National Risk Management Center (NRMC) and sector-specific Information Sharing and Analysis Centers (ISACs) are playing a central role in aligning standards, sharing real-time threat information, and driving the adoption of best practices.

Asia Pacific Critical Infrastructure Protection Market Trends

The Asia Pacific critical infrastructure protection market is expected to be the fastest-growing segment, with a CAGR of 6.7% over the forecast period. The rapid expansion of manufacturing and industrial automation in the Asia Pacific is driving market growth. As the region cements its position as the global manufacturing hub, particularly for electronics, automotive, pharmaceuticals, and heavy machinery, there is an urgent need to secure supply chains, production lines, and logistics networks. The use of robotics, cloud-connected sensors, and predictive analytics in factories enhances efficiency but also introduces multiple entry points for cyber threats. To mitigate these risks, industrial firms are investing in security frameworks that offer real-time monitoring, anomaly detection, secure firmware updates, and endpoint protection across all industrial assets.

The critical infrastructure protection industry in India is projected to grow during the forecast period. Increasing digital transformation activities by the public and private sector companies, unprecedented growth in online transactions, increasing adoption of smartphone technology, alignment of multiple departments of government authority with the Digital India initiative implemented by the Government in the country, and a growing threat of cyberattacks are anticipated to drive growth for this market.

Europe Critical Infrastructure Protection Market Trends

The critical infrastructure protection industry in Europe is expected to grow during the forecast period. The growth of this market is primarily influenced by the growing digital transformational activities adopted by the business and authorities in the region. According to the Council of the EU and the European Council, ransomware attacks and distributed denial of service (DDoS) have troubled Europe in recent years. The region experiences nearly 10 terabytes of data theft every month.

The critical infrastructure protection industry in the UK is projected to grow during the forecast period. This is attributed to multiple factors, such as growing digitization trends, increasing dependence of critical infrastructures on computing and network technologies, a growing number of cyberattack incidences related to private organizations, the BFSI sector, and the telecommunication industry. The history of cybercrimes and identified potential threats has encouraged authorities and businesses to increase investments in critical infrastructure protection services and solutions.

Key Critical Infrastructure Protection Company Insights

Some of the key companies operating in the marke include BAE Systems and Lockheed Martin Corporation, among others.

-

BAE Systems is a multinational company specializing in defense, aerospace, and security. Within its broader architecture, BAE Systems maintains a specialized division, BAE Systems Applied Intelligence, rebranded as BAE Systems Digital Intelligence that focuses on safeguarding critical infrastructure and mission-critical systems. This unit delivers a full suite of cyber and technological solutions, including threat intelligence, incident response, managed detection, and industrial control-system protection.

-

Lockheed Martin Corporation is a preeminent aerospace, defense, and security organization. Within the critical infrastructure protection, Lockheed Martin plays a critical role by blending cutting-edge cyber technologies, battle-management systems, and industrial-control solutions. Its Rotary and Mission Systems division offers advanced C4ISR capabilities, including radar sensors and communication networks vital for maintaining situational awareness across military, energy, and transportation grids.

Module X Solutions and OPSWAT Inc. are some of the emerging market participants in the critical infrastructure protection industry.

-

Module X Solutions is a privately held engineering and manufacturing firm specializing in modular protective structures for critical infrastructure. The company designs, engineers, and installs modular systems capable of safeguarding key government, utility, and defense sector facilities. These units are specifically built to withstand a wide range of threats, including explosions, ballistic attacks, electromagnetic interference, forced entry, fires, and chemical releases, making them suitable for sensitive environments like command centers, SCIFs, and secure telecommunication hubs.

-

OPSWAT Inc. is a cybersecurity firm. It specializes in protecting critical infrastructure through solutions tailored to both IT and operational technology (OT) environments. OPSWAT’s offerings include two major platforms: MetaDefender, which secures file transfers by dissecting and rebuilding content to remove threats, and MetaAccess, which governs device access via posture checks and vulnerability assessments. Together, they enable secure workflows for email, file sharing, cloud uploads, removable media, and remote devices, crucial for organizations with air-gapped or hybrid IT/OT systems.

Key Critical Infrastructure Protection Companies:

The following are the leading companies in the critical infrastructure protection market. These companies collectively hold the largest market share and dictate industry trends.

- BAE Systems

- Lockheed Martin Corporation

- Honeywell International Inc.

- Thales

- Raytheon Technologies Corporation

- Airbus

- Booz Allen Hamilton Inc.

- Hexagon AB

- TYCO International

- General Dynamics Corporation

- Johnson Controls Inc.

- Axis Communications AB

- Module X Solutions

- Exiger

- OPSWAT Inc.

Recent Developments

-

In July 2025, Booz Allen Hamilton announced a strategic investment in Corsha through its corporate venture capital arm, Booz Allen Ventures. This investment aims to accelerate the adoption of cutting-edge technologies to strengthen U.S. defenses against the growing frequency and sophistication of cyberattacks. Corsha employs advanced behavioral analytics to identify unusual activity and detect potential threats, effectively preventing adversaries from gaining access to American operational technology (OT), particularly within domestic defense manufacturing and other critical infrastructure sectors.

-

In May 2025, Honeywell International Inc. partnered with Nutanix to provide a modern, secure, and scalable infrastructure for Honeywell’s Integrated Control and Safety System (ICSS). This collaboration is designed to help organizations across critical industries accelerate their digital transformation while improving operational efficiency, strengthening cybersecurity, and boosting system resilience. Through this partnership, Honeywell will integrate Nutanix’s leading hybrid cloud platform with its Experion Process Knowledge System (PKS) and other advanced control technologies.

-

In November 2024, National Highways partnered with BAE Systems, allocating up to USD 21.8 million to implement a cyber-first, resilient approach across all major projects and programmes within the UK’s road network. Under the new three-year contract, BAE Systems will deliver support in key areas such as cybersecurity and data protection, information security analysis, and the delivery of cyber threat intelligence services.

Critical Infrastructure Protection Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 150.99 billion

Revenue forecast in 2033

USD 229.11 billion

Growth rate

CAGR of 5.4% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, security, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

BAE Systems; Lockheed Martin Corporation; Honeywell International Inc.; Thales; Raytheon Technologies Corporation; Airbus; Booz Allen Hamilton Inc.; Hexagon AB; TYCO International; General Dynamics Corporation; Johnson Controls Inc.; Axis Communications AB; Module X Solutions; Exiger; OPSWAT Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Critical Infrastructure Protection Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the critical infrastructure protection market report based on type, security, end use, and region.

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Solution

-

Services

-

-

Security Outlook (Revenue, USD Billion, 2021 - 2033)

-

Physical Safety and Security

-

Physical Identity and Access Control Systems

-

Perimeter Intrusion Detection Systems

-

Video Surveillance Systems

-

Screening and Scanning

-

Others

-

-

Cyber Security

-

Identity & Access Management (IAM)

-

Network Security

-

Risk & Compliance Management

-

Application Security

-

Endpoint Security

-

Security Information and Event Management (SIEM)

-

Cloud Security

-

Data Loss Prevention (DLP)

-

Web Security

-

Threat Intelligence & Incident Response

-

Encryption and Tokenization

-

Others

-

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

BFSI

-

Government & Defense

-

Transport & Logistics

-

Energy and Utilities

-

IT & Telecommunication

-

Healthcare

-

Oil & Gas

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global critical infrastructure protection market size was estimated at USD 145.60 billion in 2024 and is expected to reach USD 151.00 billion in 2025.

b. The global critical infrastructure protection market is expected to grow at a compound annual growth rate of 5.4% from 2025 to 2033 to reach USD 229.11 billion by 2033.

b. The solution segment dominated the critical infrastructure protection market with a market share of 72.5% in 2024. The growth of this segment is attributed to the rising digitization across different private and government organizations in multiple industries, growing dependability on computing technology, and inclination towards the installation of robust protection solutions to avoid future threats of cybercrimes and data breaches.

b. Some key players operating in the market include BAE Systems, Lockheed Martin Corporation, Honeywell International Inc., Thales, Raytheon Technologies Corporation, Airbus, Booz Allen Hamilton Inc., Hexagon AB, TYCO International, General Dynamics Corporation, Johnson Controls Inc., Axis Communications AB, Module X Solutions, Exiger, OPSWAT Inc.

b. Factors such as the growing cyber insurance adoption and board-level focus on operational resilience are the key factors driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.